Inspection Machines Market Report

Published Date: 22 January 2026 | Report Code: inspection-machines

Inspection Machines Market Size, Share, Industry Trends and Forecast to 2033

This report explores the Inspection Machines market, providing insights into market size, segmentation, and trends from 2023 to 2033. It highlights growth drivers, challenges, and forecasts to assist stakeholders in strategic decision-making.

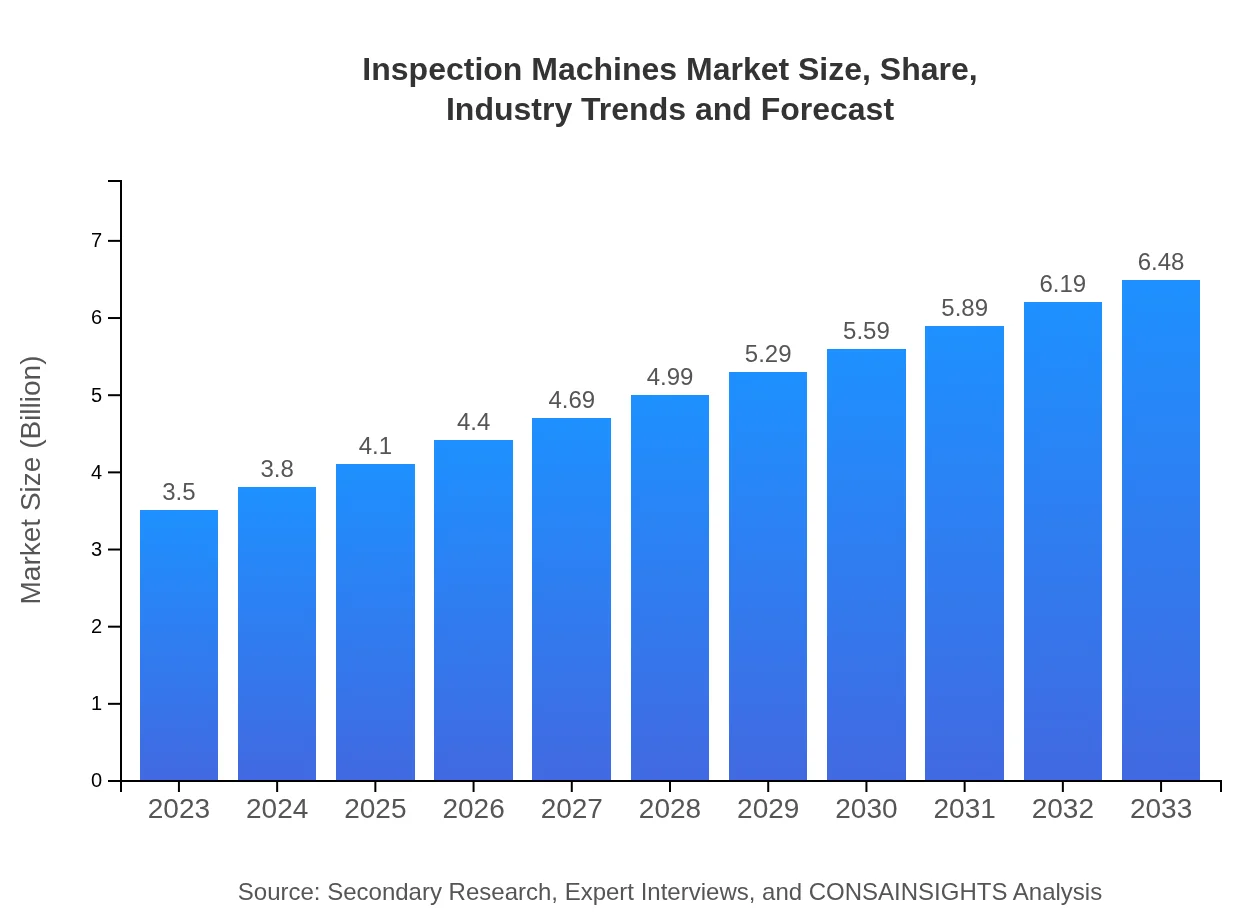

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $6.48 Billion |

| Top Companies | Mettler Toledo, Cognex Corporation, KRONOS, Leica Microsystems |

| Last Modified Date | 22 January 2026 |

Inspection Machines Market Overview

Customize Inspection Machines Market Report market research report

- ✔ Get in-depth analysis of Inspection Machines market size, growth, and forecasts.

- ✔ Understand Inspection Machines's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Inspection Machines

What is the Market Size & CAGR of Inspection Machines market in 2023?

Inspection Machines Industry Analysis

Inspection Machines Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Inspection Machines Market Analysis Report by Region

Europe Inspection Machines Market Report:

Europe's Inspection Machines market is set to increase from $1.10 billion in 2023 to $2.04 billion by 2033. The region's growth stems from a mature manufacturing base and a strong focus on innovation and quality assurance.Asia Pacific Inspection Machines Market Report:

The Asia Pacific region is anticipated to witness significant growth, with the market expected to rise from $0.61 billion in 2023 to $1.13 billion by 2033. Factors driving this growth include increasing manufacturing activities, technological adoption, and a focus on quality standards in countries like China and India.North America Inspection Machines Market Report:

North America, a frontrunner in the Inspection Machines market, is expected to grow from $1.34 billion in 2023 to $2.48 billion by 2033. The region benefits from advanced technology integration and stringent regulatory requirements across industries.South America Inspection Machines Market Report:

In South America, the market for Inspection Machines is projected to grow from $0.27 billion in 2023 to $0.50 billion by 2033. This growth is supported by the expansion of manufacturing sectors and rising investments in food and beverage safety.Middle East & Africa Inspection Machines Market Report:

The Middle East and Africa market is projected to grow from $0.18 billion in 2023 to $0.33 billion by 2033, driven by increasing investments in consumer goods and food safety standards.Tell us your focus area and get a customized research report.

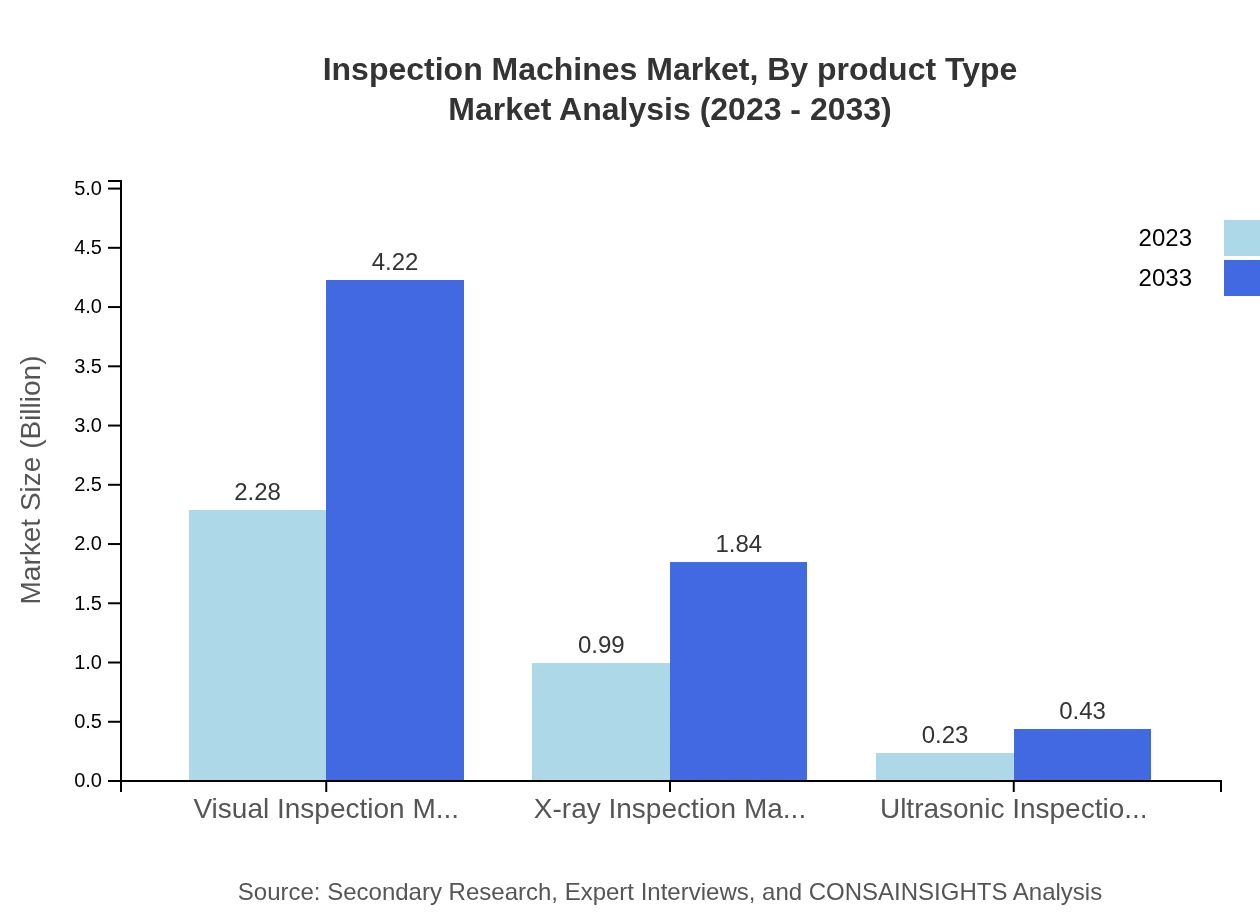

Inspection Machines Market Analysis By Product Type

The analysis reveals that visual inspection machines dominate the market with a size of $2.28 billion in 2023, expected to reach $4.22 billion by 2033, while X-ray inspection machines hold a significant portion as well, starting at $0.99 billion in 2023 and projected to grow to $1.84 billion by 2033. Other noteworthy segments include ultrasonic inspection machines and AI-based inspection systems, highlighting the diversity within product offerings.

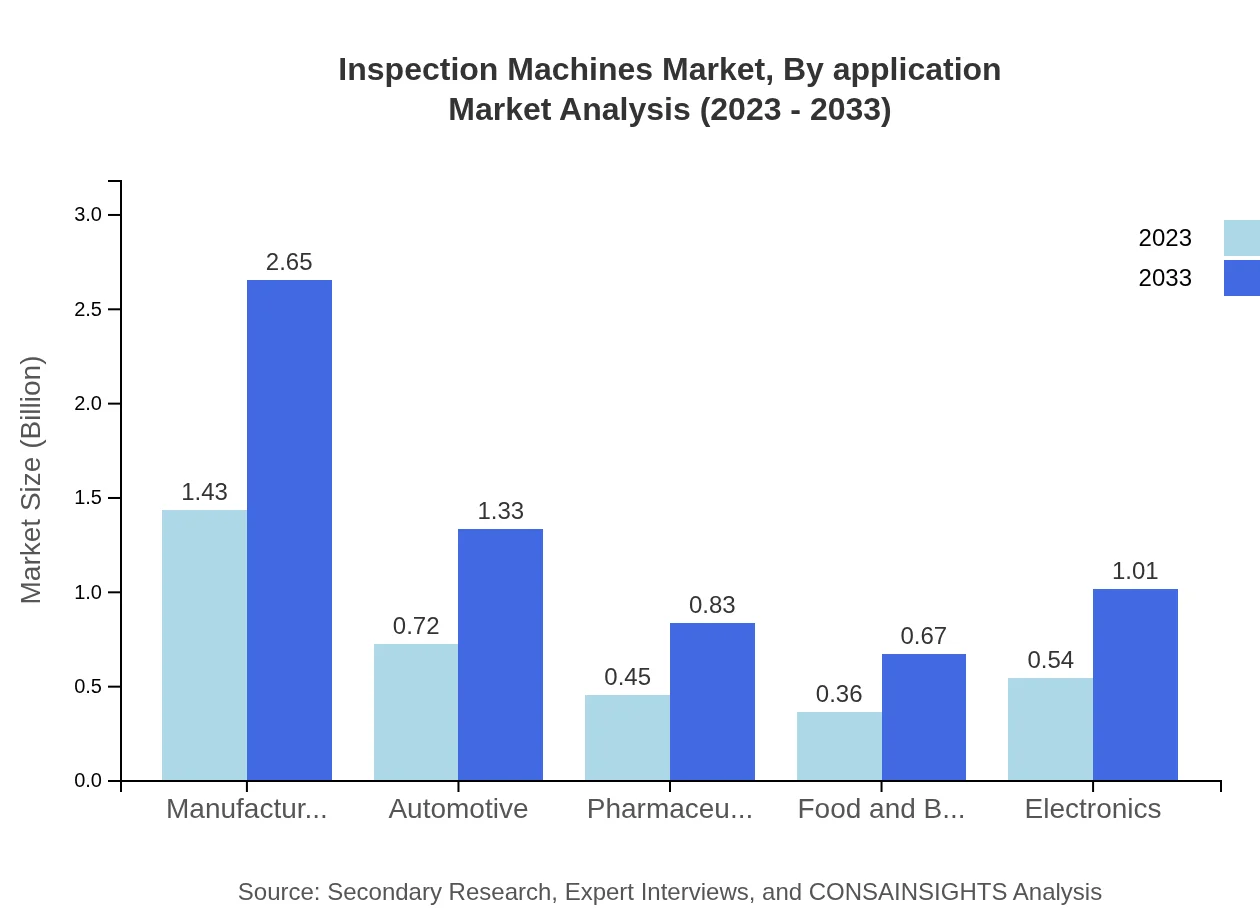

Inspection Machines Market Analysis By Application

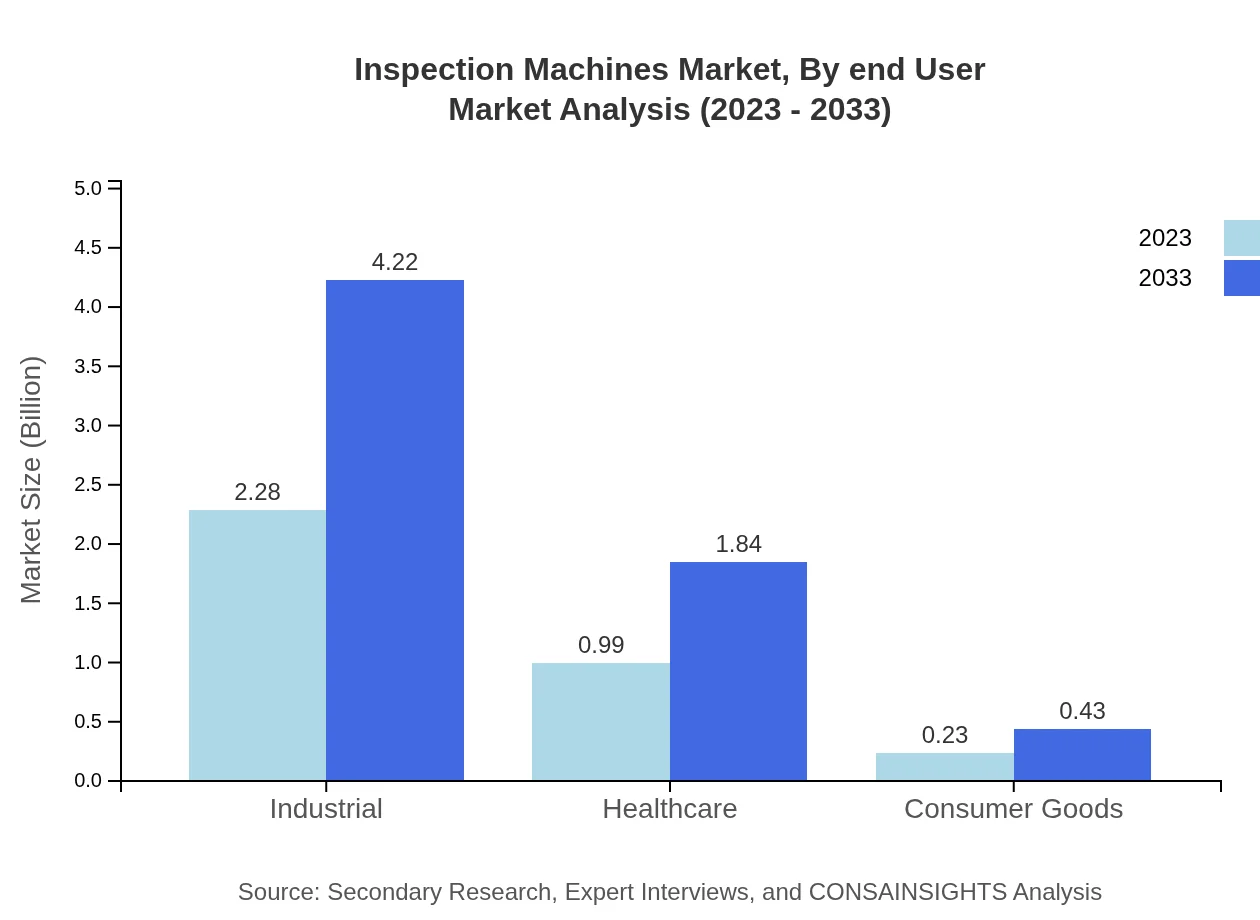

In terms of application, the industrial sector is the largest consumer of inspection machines, accounting for a market size of $2.28 billion in 2023 and expected to rise to $4.22 billion by 2033. The healthcare sector follows with significant growth, moving from $0.99 billion to $1.84 billion, while other sectors like consumer goods and food and beverage also show promising prospects.

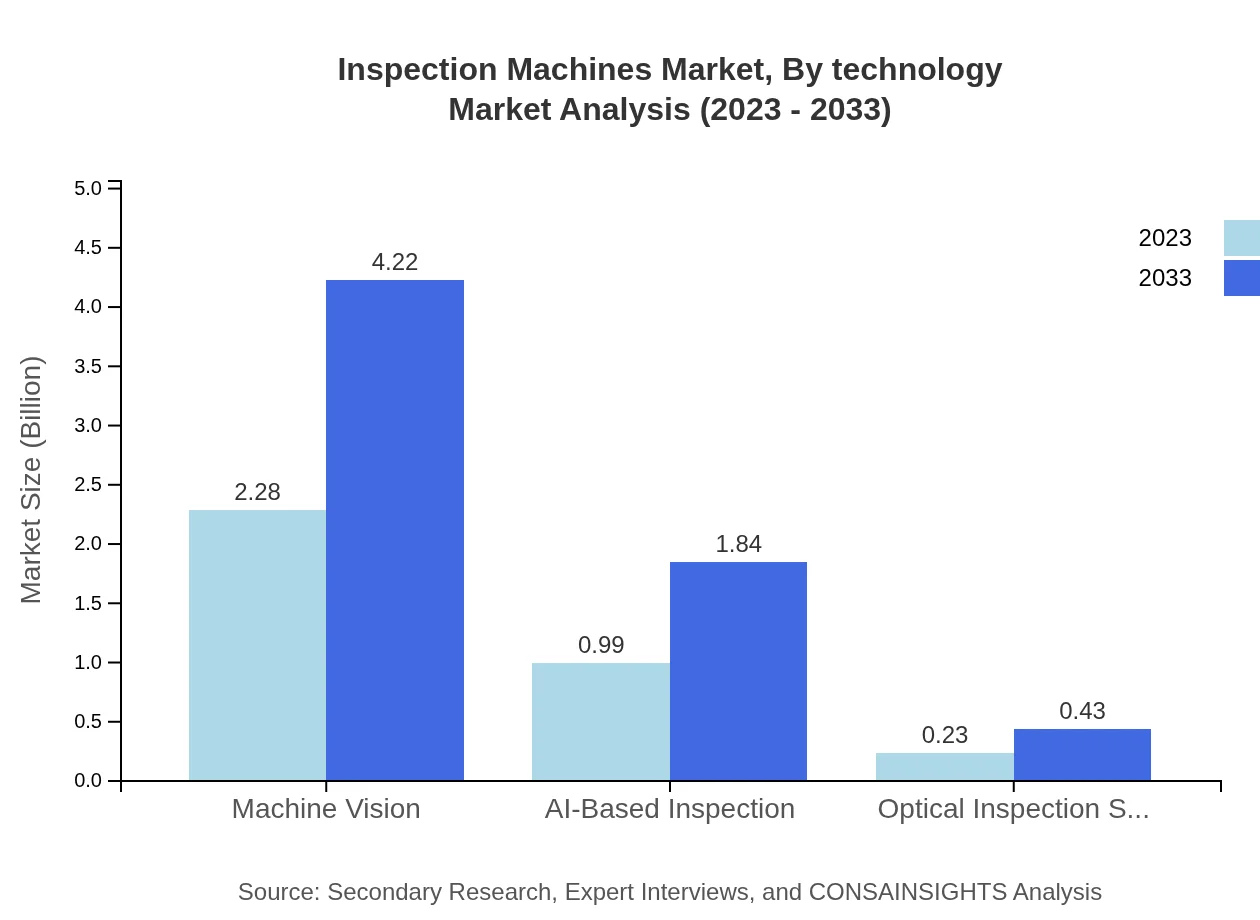

Inspection Machines Market Analysis By Technology

The technological segment showcases a strong preference for machine vision solutions with a substantial share of the market, valuing $2.28 billion in 2023 and expected to double to $4.22 billion by 2033. AI-based technologies also reflect robust growth, indicating a trend towards automation and intelligent quality assurance processes.

Inspection Machines Market Analysis By End User

Major end-user industries include manufacturing, automotive, pharmaceuticals, and food & beverage, with manufacturing leading at a market size of $1.43 billion in 2023, projected to reach $2.65 billion by 2033. Other segments are similarly expanding as industries become more quality-conscious.

Inspection Machines Market Analysis By Geography

Global Inspection Machines Market, By Geography (Not detailed here) Market Analysis (2023 - 2033)

The geographical segmentation of the market is crucial to understanding regional dynamics, with each region employing different strategies to adapt to local demands and regulations.

Inspection Machines Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Inspection Machines Industry

Mettler Toledo:

A leader in precision instruments, Mettler Toledo provides innovative inspection systems that ensure quality control in various industrial applications.Cognex Corporation:

Cognex is renowned for its machine vision technology, offering a range of products that enhance manufacturing processes with advanced inspection capabilities.KRONOS:

KRONOS specializes in integrated inspection systems for manufacturing, focusing on automating quality checks to improve efficiency and reduce downtime.Leica Microsystems:

Known for its optical inspection solutions, Leica Microsystems provides state-of-the-art tools for both industrial and healthcare applications.We're grateful to work with incredible clients.

FAQs

What is the market size of inspection machines?

The inspection machines market is valued at approximately $3.5 billion in 2023, with a compound annual growth rate (CAGR) of 6.2% projected through 2033, allowing for significant expansion and innovation in the sector.

What are the key market players or companies in the inspection machines industry?

Key players in the inspection machines market include companies like ANRITSU CORPORATION, Cognex Corporation, OMROM Corporation, Keyence Corporation, and Siemens AG, which are pivotal in driving technological advancements and market growth.

What are the primary factors driving the growth in the inspection machines industry?

Growth in the inspection machines industry is primarily driven by the increasing demand for quality assurance in manufacturing, rigorous government regulations, the rise in automation technologies, and innovations in AI and machine vision.

Which region is the fastest Growing in the inspection machines?

Asia Pacific is the fastest-growing region in the inspection machines market, projected to grow from $0.61 billion in 2023 to $1.13 billion by 2033, reflecting a strong demand for manufacturing automation and technological advancements.

Does ConsaInsights provide customized market report data for the inspection machines industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the inspection machines industry, providing insights into market size, trends, and competitive landscape.

What deliverables can I expect from this inspection machines market research project?

Deliverables from the inspection machines market research project include comprehensive reports, market forecasts, detailed analysis of market segments, competitive analysis, and insights into regional trends.

What are the market trends of inspection machines?

Current trends in the inspection machines market include the adoption of AI-based technologies, increasing integration of IoT, heightened focus on sustainability, and advancements in optical inspection systems, enhancing overall operational efficiency.