Instrumentation Valves And Fittings Market Report

Published Date: 22 January 2026 | Report Code: instrumentation-valves-and-fittings

Instrumentation Valves And Fittings Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Instrumentation Valves and Fittings market, covering insights about market size, growth forecasts, trends, and competitive dynamics for the period 2023 to 2033.

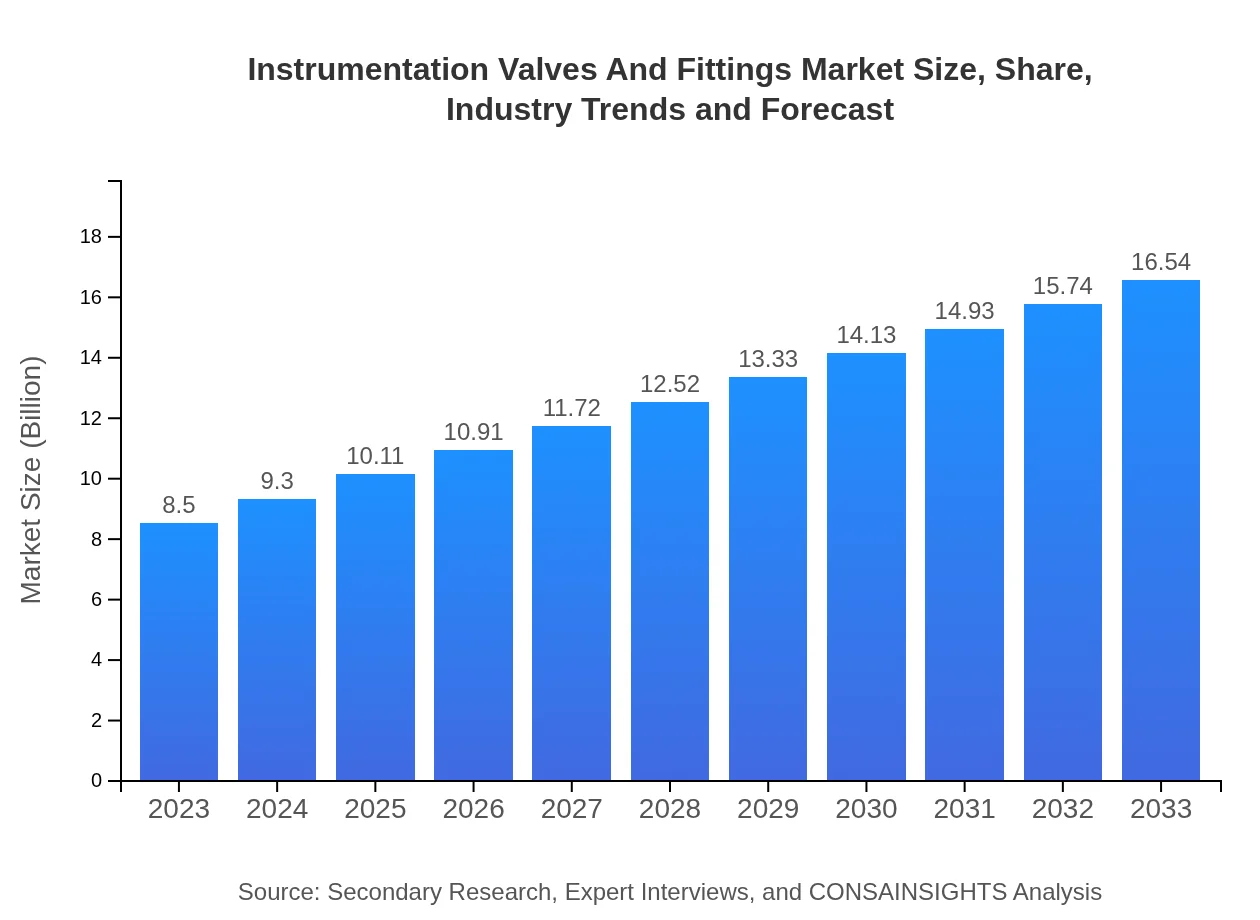

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.50 Billion |

| CAGR (2023-2033) | 6.7% |

| 2033 Market Size | $16.54 Billion |

| Top Companies | Emerson Electric Co., ValvTechnologies, Inc., Flowserve Corporation, Parker Hannifin Corporation |

| Last Modified Date | 22 January 2026 |

Instrumentation Valves And Fittings Market Overview

Customize Instrumentation Valves And Fittings Market Report market research report

- ✔ Get in-depth analysis of Instrumentation Valves And Fittings market size, growth, and forecasts.

- ✔ Understand Instrumentation Valves And Fittings's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Instrumentation Valves And Fittings

What is the Market Size & CAGR of Instrumentation Valves And Fittings market in 2023?

Instrumentation Valves And Fittings Industry Analysis

Instrumentation Valves And Fittings Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Instrumentation Valves And Fittings Market Analysis Report by Region

Europe Instrumentation Valves And Fittings Market Report:

Europe is set for significant growth, with market value anticipated to rise from USD 2.35 billion in 2023 to USD 4.58 billion in 2033. The region’s focus on sustainable practices and innovations in instrumentation technology supports this upward trend.Asia Pacific Instrumentation Valves And Fittings Market Report:

The Asia Pacific region is projected to demonstrate significant growth, with market size expected to rise from USD 1.60 billion in 2023 to USD 3.12 billion in 2033. This growth is attributed to rapid industrialization, rising energy demands, and increased investment in infrastructure projects in countries like China and India.North America Instrumentation Valves And Fittings Market Report:

With a market size projected to grow from USD 3.28 billion in 2023 to USD 6.39 billion in 2033, North America remains a major player due to the significant presence of key players and continuous investments in upgrading aging infrastructure, particularly in the oil and gas industry.South America Instrumentation Valves And Fittings Market Report:

In South America, the market is estimated to grow from USD 0.59 billion in 2023 to USD 1.15 billion in 2033. Factors driving this growth include the expansion of the oil and gas sector and an increasing focus on water treatment facilities, especially in Brazil and Argentina.Middle East & Africa Instrumentation Valves And Fittings Market Report:

The Middle East and Africa region is also witnessing growth, with expected increases from USD 0.67 billion in 2023 to USD 1.31 billion in 2033, driven primarily by ongoing oil and gas projects and the need for efficient water treatment systems.Tell us your focus area and get a customized research report.

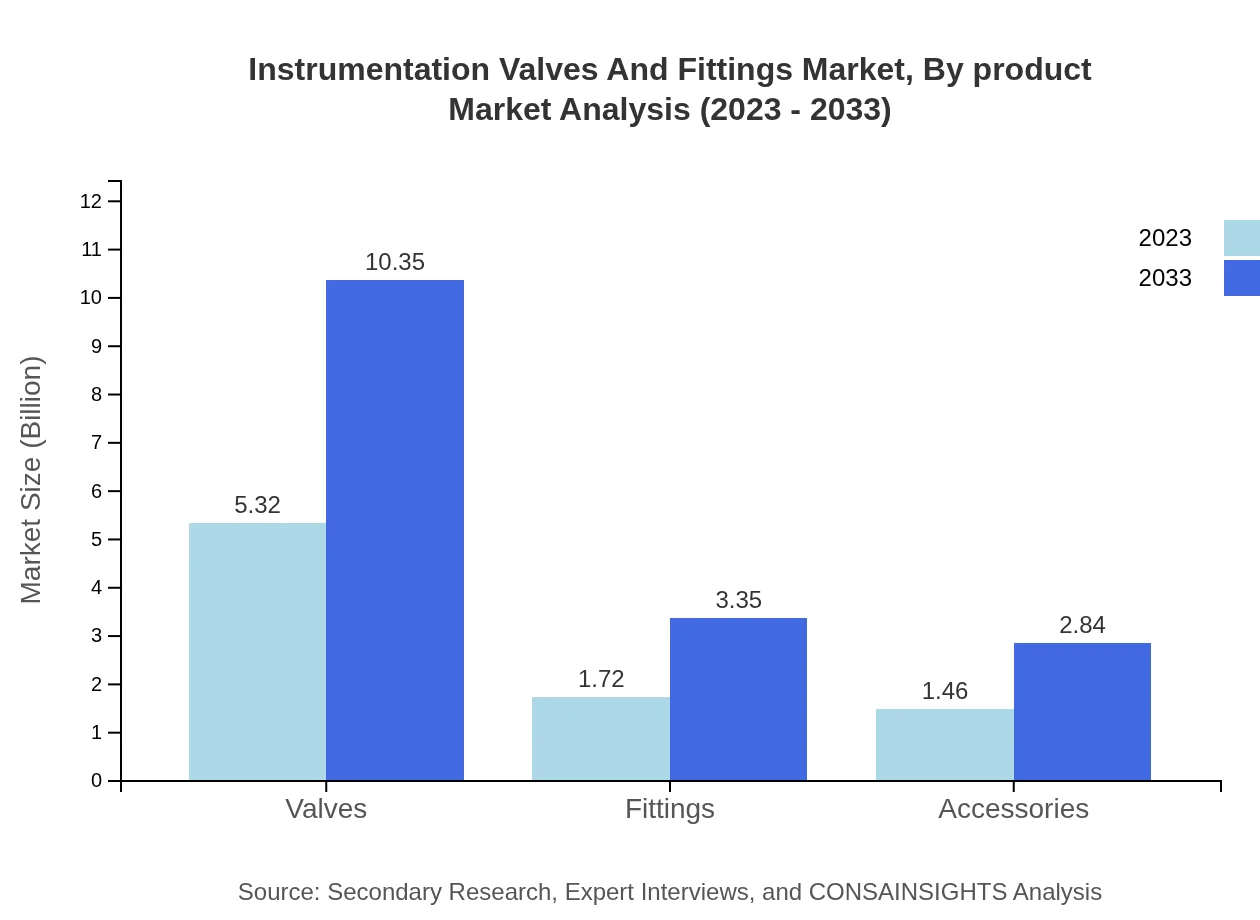

Instrumentation Valves And Fittings Market Analysis By Product

In 2023, the valves segment holds a significant market size of approximately USD 5.32 billion, forecasted to grow to USD 10.35 billion by 2033, reflecting the critical role of valves in controlling flows. Fittings account for a size of USD 1.72 billion in 2023 and are projected to increase to USD 3.35 billion by 2033. Accessories, vital for enhancing operational reliability, are expected to grow from USD 1.46 billion in 2023 to USD 2.84 billion by 2033.

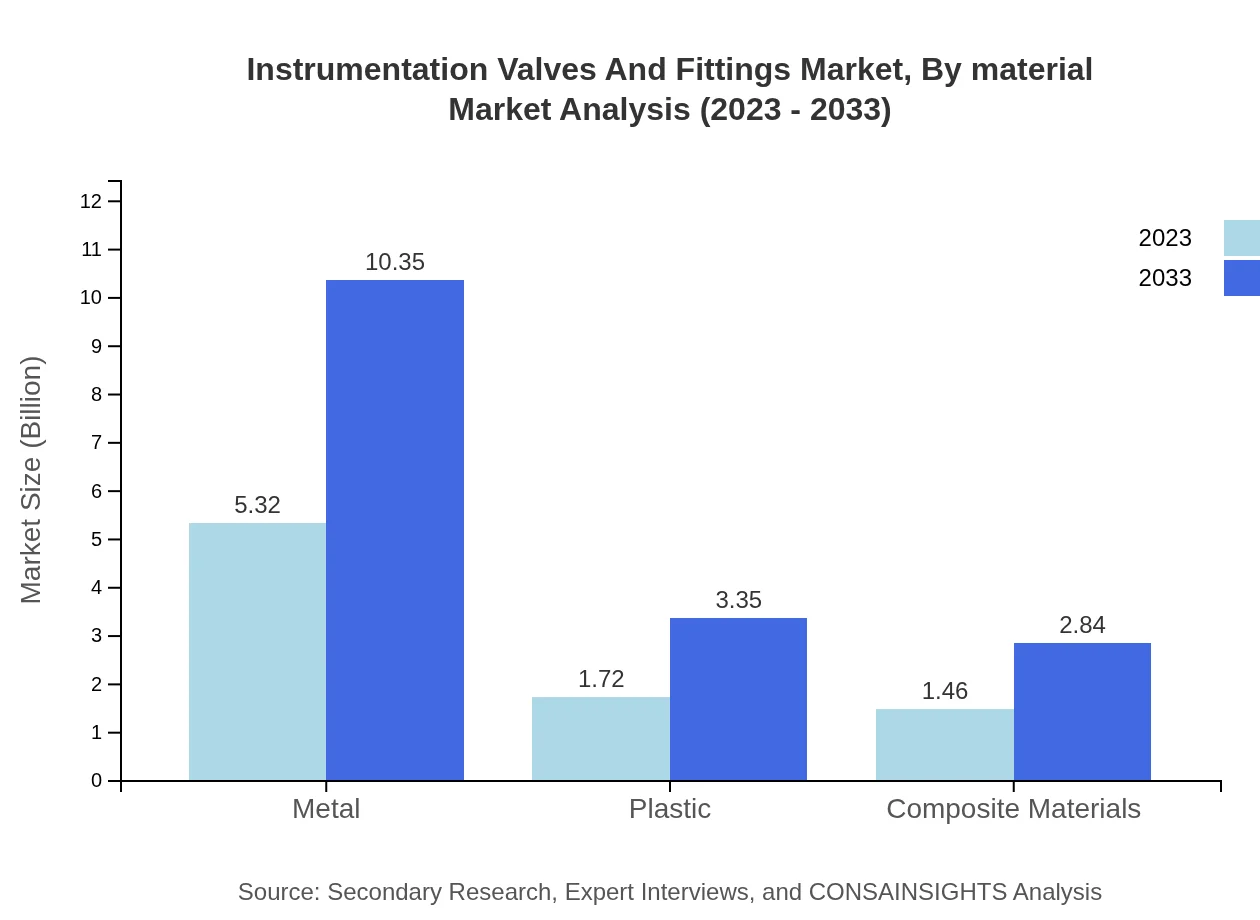

Instrumentation Valves And Fittings Market Analysis By Material

The market's material breakdown indicates that metal components dominate the landscape, with a market size of USD 5.32 billion in 2023, forecasted to grow significantly. Plastic and composite materials hold sizes of USD 1.72 billion and USD 1.46 billion respectively in 2023 and are gaining traction for their lightweight and corrosion-resistant properties.

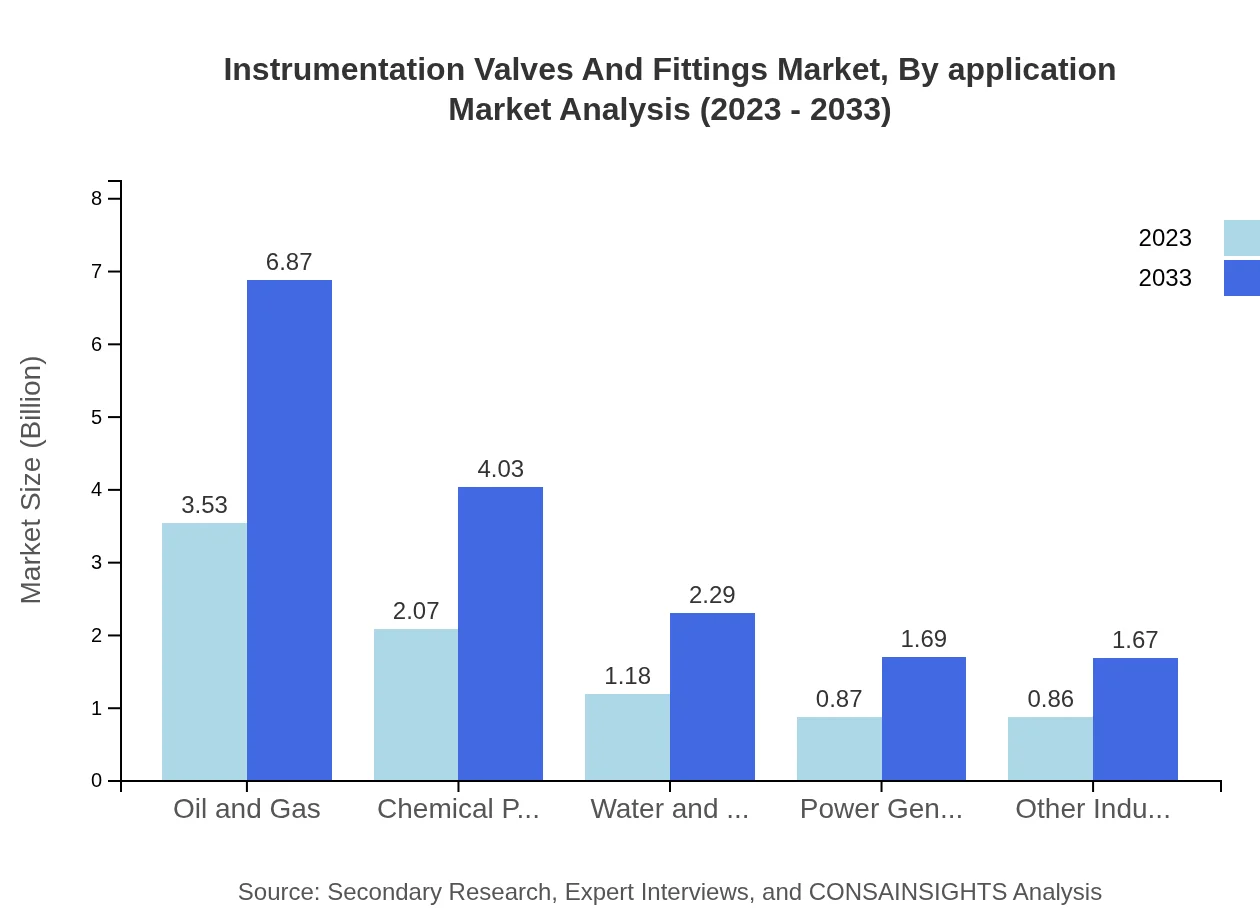

Instrumentation Valves And Fittings Market Analysis By Application

The oil and gas sector is the largest application area, valued at USD 3.53 billion in 2023 and projected to grow to USD 6.87 billion by 2033. Other application segments, such as chemical processing and water treatment, follow closely, reflecting their increasing importance in global industrial processes.

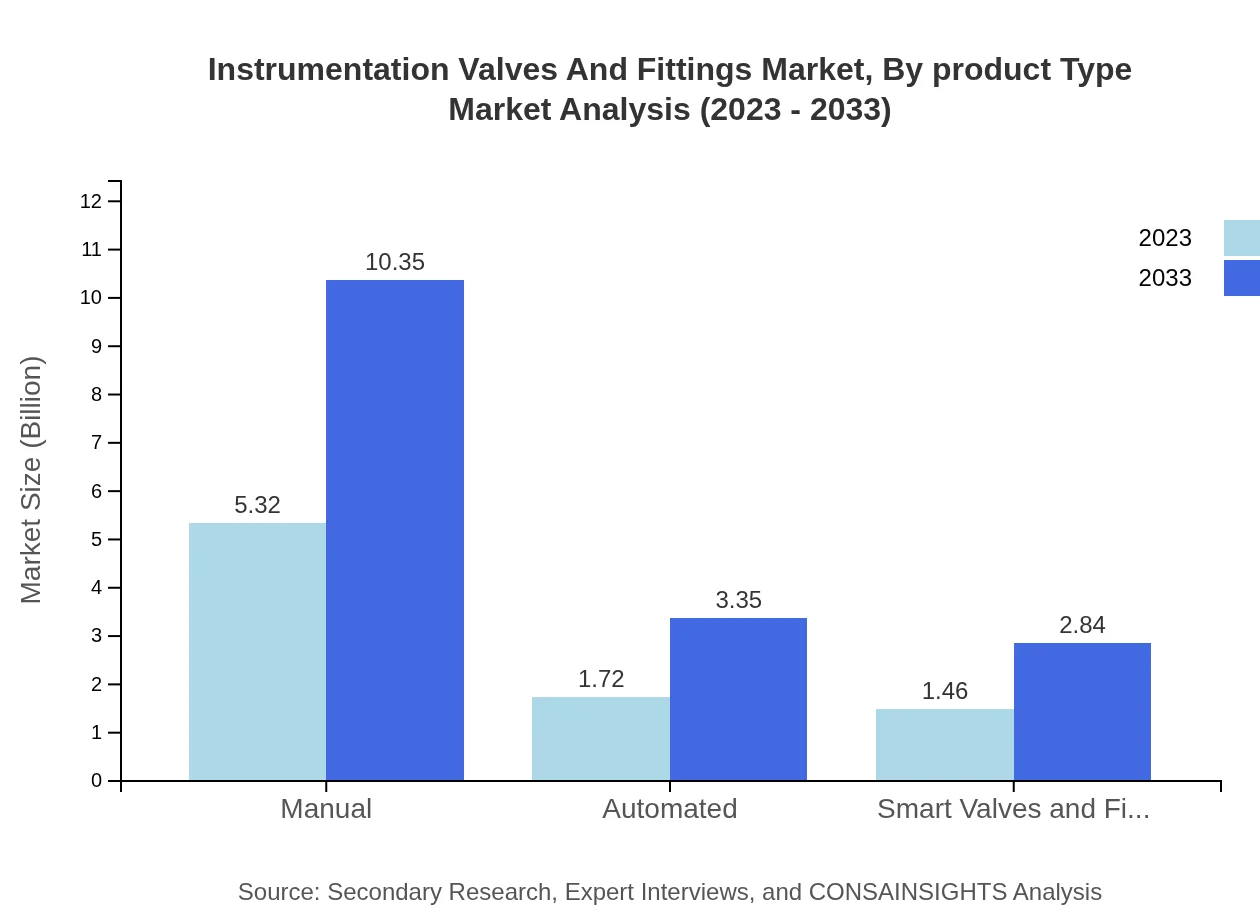

Instrumentation Valves And Fittings Market Analysis By Product Type

Manual and automated product types are vital, with manuals representing a significant share at USD 5.32 billion in 2023 and projected to match in 2033. Automated types are projected to see growth from USD 1.72 billion in 2023 to USD 3.35 billion as the industry shifts towards automation and smart technologies.

Instrumentation Valves And Fittings Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Instrumentation Valves And Fittings Industry

Emerson Electric Co.:

A leading company specializing in automation solutions, Emerson offers a wide range of instrumentation valves and fittings, known for their reliability and performance in critical applications.ValvTechnologies, Inc.:

ValvTechnologies is recognized for its advanced valve technologies and services, especially in industries requiring stringent safety and efficiency standards.Flowserve Corporation:

Flowserve is a global provider of fluid motion and control products and services, including valves and fittings, acknowledged for their quality and durability.Parker Hannifin Corporation:

Parker Hannifin is a global leader in motion and control technologies, offering an extensive range of instrumentation valves and fittings suited for various applications.We're grateful to work with incredible clients.

FAQs

What is the market size of instrumentation Valves And Fittings?

The global instrumentation valves and fittings market is valued at approximately $8.5 billion in 2023, with a projected CAGR of 6.7% from 2023 to 2033, indicating robust growth and expansion opportunities in the sector.

What are the key market players or companies in this instrumentation Valves And Fittings industry?

Key players in the instrumentation valves and fittings industry include major manufacturers and suppliers committed to innovation and quality, contributing to advancements in industrial applications across various sectors.

What are the primary factors driving the growth in the instrumentation Valves And Fittings industry?

Growth in the instrumentation valves and fittings industry is driven by rising industrial automation, increased demand for reliable and efficient systems, and stringent regulatory standards favoring high-quality instrumentation in operations.

Which region is the fastest Growing in the instrumentation Valves And Fittings?

The Asia-Pacific region is the fastest-growing market for instrumentation valves and fittings, projected to expand from $1.60 billion in 2023 to $3.12 billion by 2033, driven by increased industrialization and infrastructure development.

Does ConsaInsights provide customized market report data for the instrumentation Valves And Fittings industry?

Yes, ConsaInsights offers customized market report data tailored to client specifications, ensuring detailed insights and relevant information for businesses in the instrumentation valves and fittings sector.

What deliverables can I expect from this instrumentation Valves And Fittings market research project?

Clients can expect comprehensive market analysis reports, regional insights, competitive landscape evaluations, segment-wise breakdowns, and forecast data over specified timelines, aiding strategic decision-making.

What are the market trends of instrumentation Valves And Fittings?

Current trends in the instrumentation valves and fittings market include the rise of automation and smart technologies, a shift towards sustainable practices, and increased adoption of advanced materials enhancing product performance.