Insulation Products Market Report

Published Date: 22 January 2026 | Report Code: insulation-products

Insulation Products Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Insulation Products market, encompassing insights into market trends, size, and growth forecasts from 2023 to 2033. The report covers various segments, regional dynamics, and key industry players, offering valuable data for stakeholders and decision-makers.

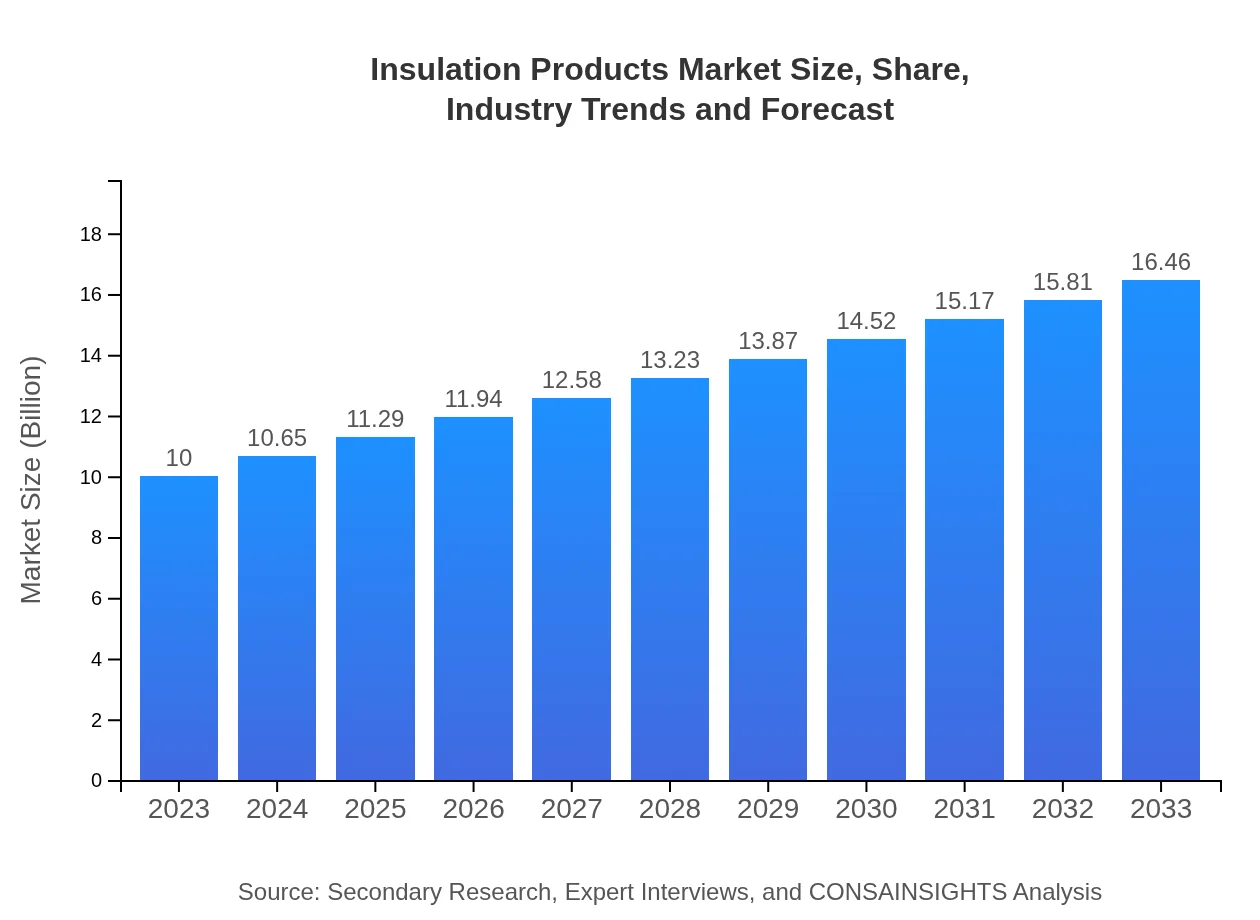

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $16.46 Billion |

| Top Companies | Owens Corning, Saint-Gobain, Rockwool International |

| Last Modified Date | 22 January 2026 |

Insulation Products Market Overview

Customize Insulation Products Market Report market research report

- ✔ Get in-depth analysis of Insulation Products market size, growth, and forecasts.

- ✔ Understand Insulation Products's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Insulation Products

What is the Market Size & CAGR of Insulation Products market in 2023?

Insulation Products Industry Analysis

Insulation Products Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Insulation Products Market Analysis Report by Region

Europe Insulation Products Market Report:

Europe's market was $3.31 billion in 2023 and is expected to expand to $5.45 billion by 2033. Rising environmental concerns and the European Union's regulations on energy efficiency significantly drive this region's growth.Asia Pacific Insulation Products Market Report:

In the Asia Pacific region, the market was valued at $1.92 billion in 2023 and is expected to reach $3.16 billion by 2033, fueled by rapid urbanization, increased infrastructure development, and rising energy efficiency standards.North America Insulation Products Market Report:

The North American market in 2023 was valued at $3.23 billion, projected to grow to $5.32 billion by 2033. High demand for insulation from the residential sector and stringent energy codes are key growth drivers.South America Insulation Products Market Report:

The South American market for insulation products was valued at $0.62 billion in 2023 and is projected to grow to $1.03 billion by 2033, supported by the growth in construction activities and government incentives for energy-efficient buildings.Middle East & Africa Insulation Products Market Report:

In the Middle East and Africa, the market for Insulation Products is anticipated to rise from $0.91 billion in 2023 to $1.50 billion by 2033, driven mainly by construction projects in urban areas and increasing awareness of energy conservation.Tell us your focus area and get a customized research report.

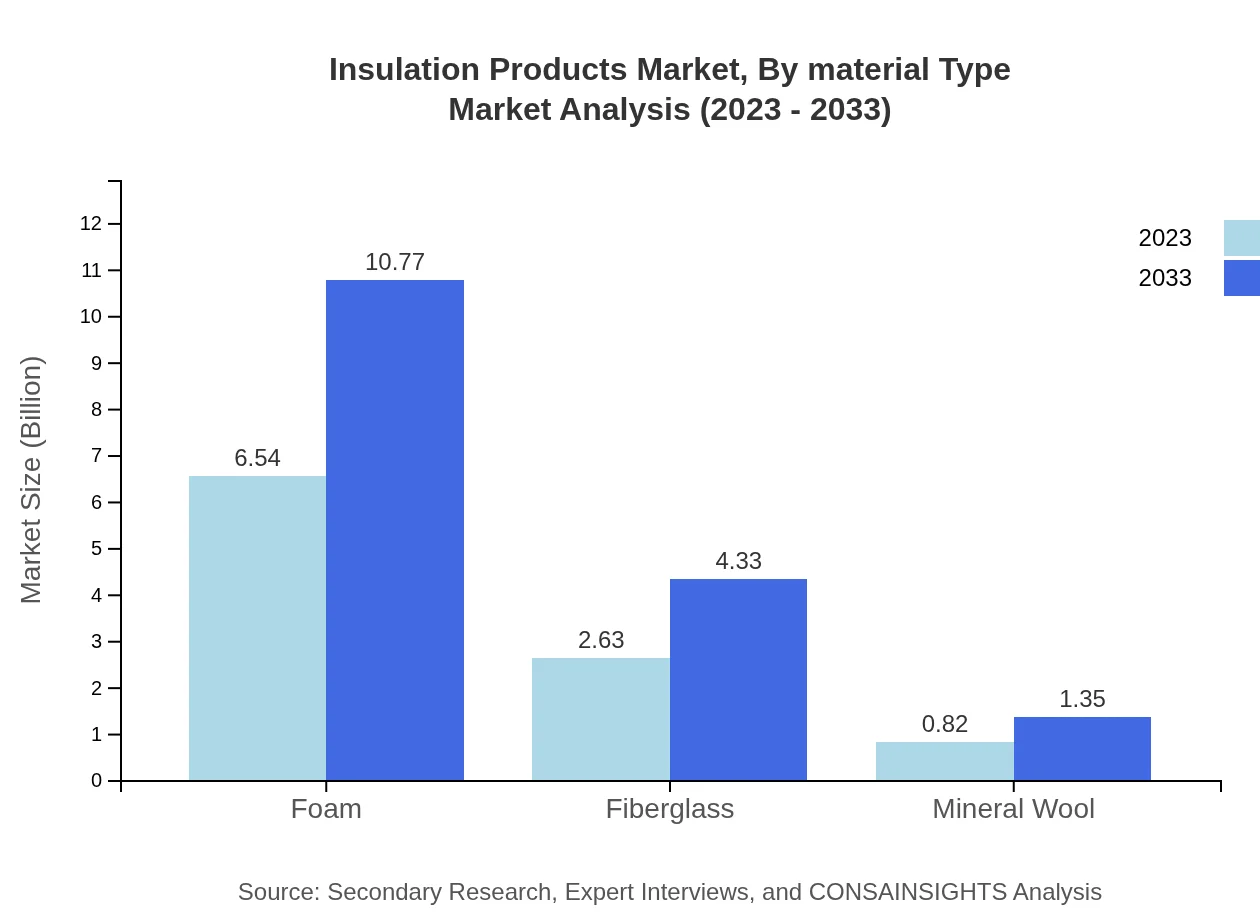

Insulation Products Market Analysis By Material Type

The Insulation Products market is prominently classified by material types, which include: - Foam: Expected to grow from $6.54 billion in 2023 to $10.77 billion in 2033, holding a 65.44% market share; - Fiberglass: Projected to increase from $2.63 billion to $4.33 billion, maintaining a 26.33% market share; - Mineral Wool: Anticipated growth from $0.82 billion to $1.35 billion with an 8.23% market share.

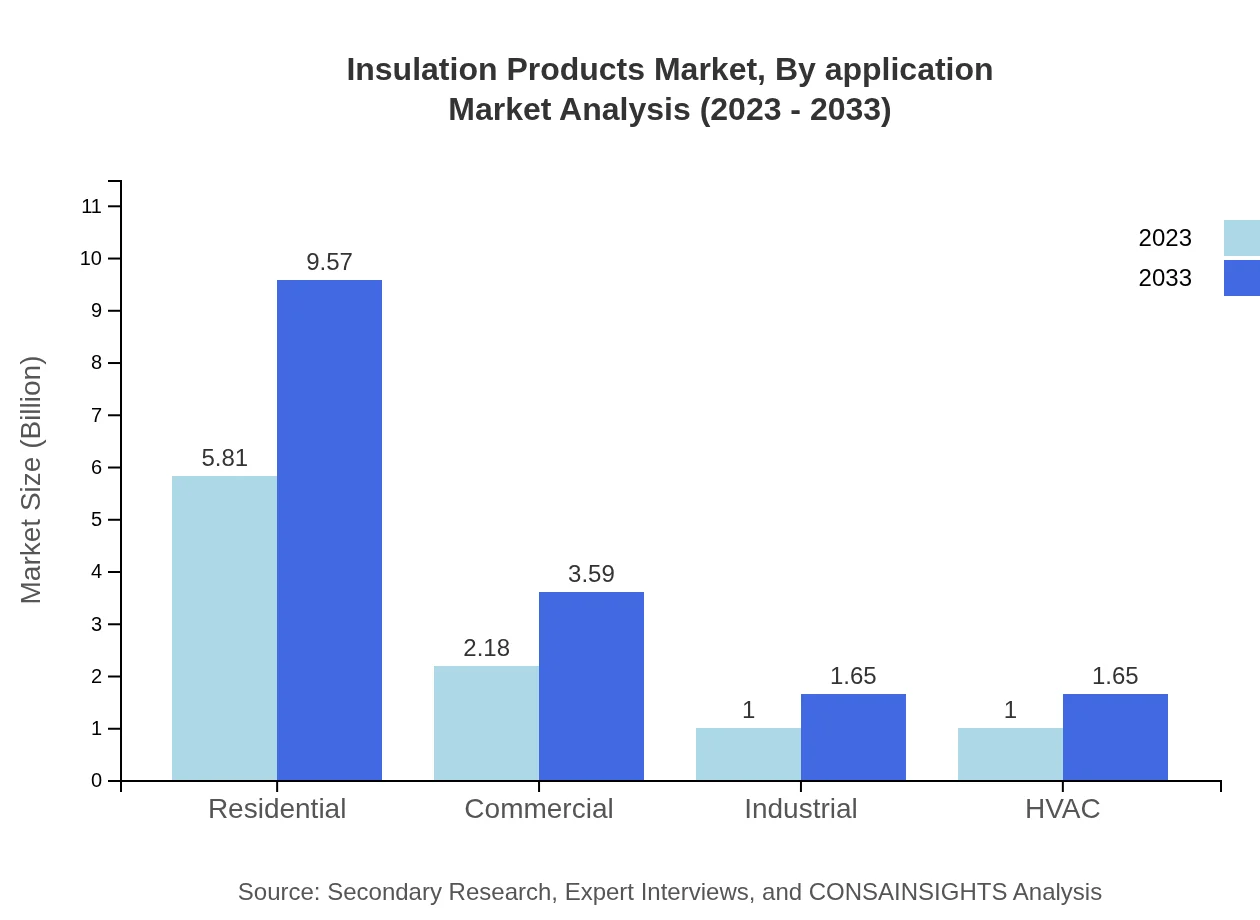

Insulation Products Market Analysis By Application

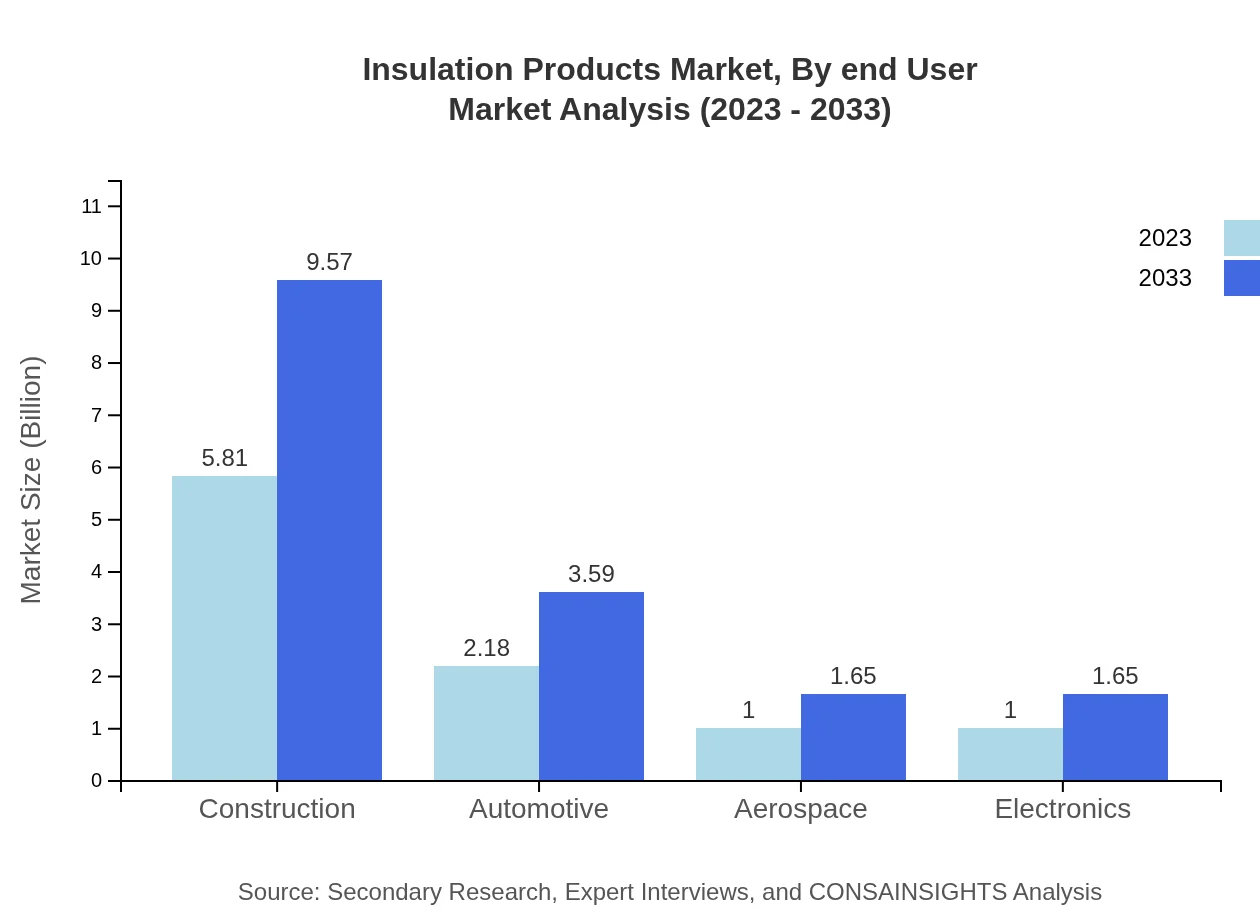

Market segmentation based on application reveals: - Construction: Size anticipated to grow from $5.81 billion in 2023 to $9.57 billion in 2033, holding a steady share of 58.14%; - Automotive: Growth from $2.18 billion to $3.59 billion, maintaining 21.82% share; - Aerospace: Increasing from $1.00 billion to $1.65 billion, accounting for 10.02% share.

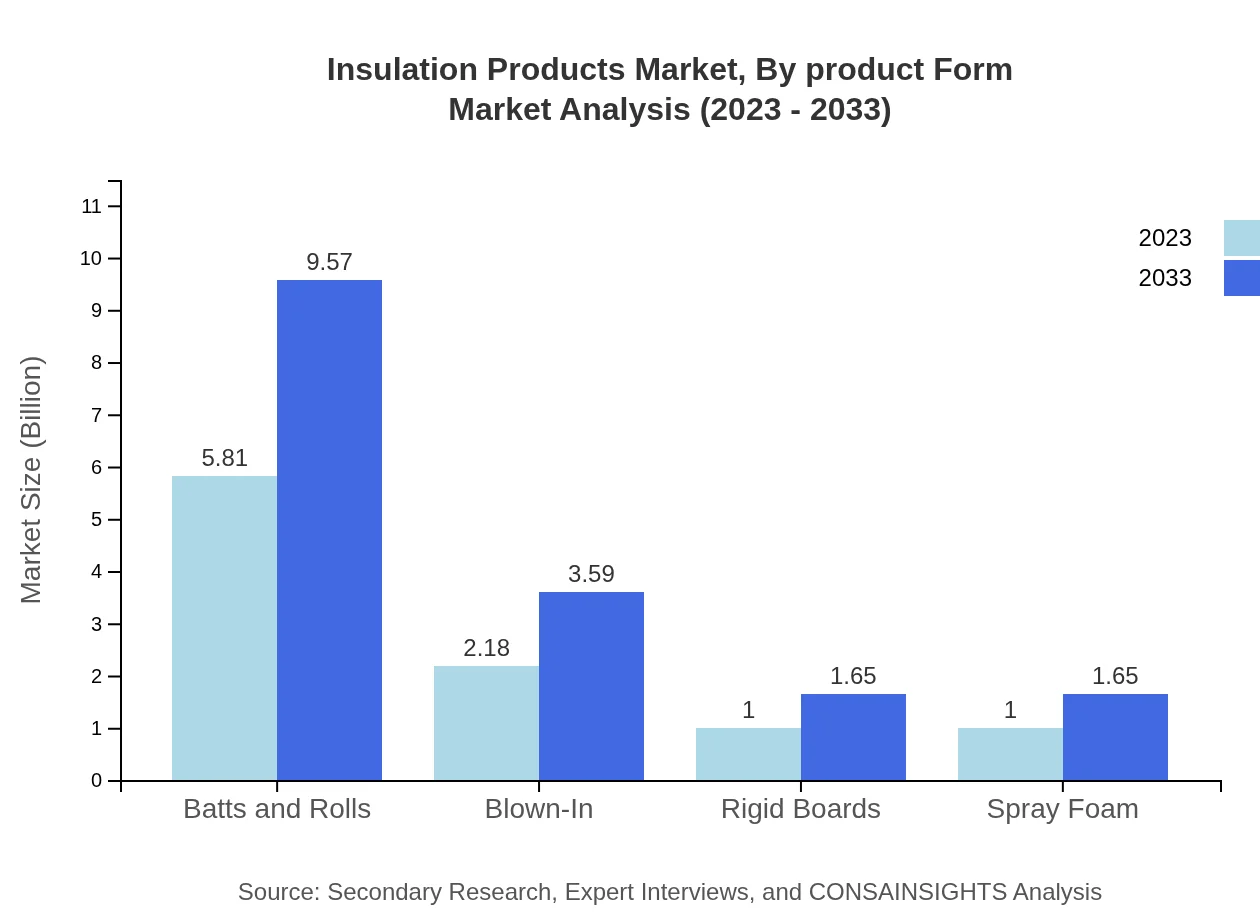

Insulation Products Market Analysis By Product Form

The market exhibits diverse product forms: - Batts and Rolls: Expected to grow from $5.81 billion to $9.57 billion with a 58.14% market share; - Blown-In: Projected from $2.18 billion to $3.59 billion, keeping a 21.82% share; - Rigid Boards: Anticipated growth from $1.00 billion to $1.65 billion representing a 10.02% market share.

Insulation Products Market Analysis By End User

Key end-user segments include: - Residential: From $5.81 billion in 2023 to $9.57 billion by 2033, maintaining a 58.14% share; - Commercial: Growth from $2.18 billion to $3.59 billion, holding a 21.82% share; - HVAC: Anticipated increase from $1.00 billion to $1.65 billion with a 10.02% share.

Insulation Products Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Insulation Products Industry

Owens Corning:

A global leader in insulation, roofing, and fiberglass composites, Owens Corning focuses on sustainability and innovation, providing energy-efficient insulation solutions.Saint-Gobain:

Saint-Gobain manufactures and distributes a wide range of building materials, including advanced insulation products designed to improve energy efficiency and comfort in buildings.Rockwool International:

Specializing in rock-based insulation products, Rockwool focuses on sustainable solutions that improve energy efficiency and fire safety in various applications.We're grateful to work with incredible clients.

FAQs

What is the market size of Insulation Products?

The global insulation products market is projected to reach approximately $10 billion by 2033, growing at a CAGR of 5% from 2023. This growth reflects an increasing demand for energy-efficient materials across various sectors.

What are the key market players or companies in this Insulation Products industry?

Key players in the insulation products market include large corporations such as Owens Corning, Johns Manville, Rockwool International, and Knauf Insulation. These companies are fundamental in driving innovation and sustainability in insulation technologies.

What are the primary factors driving the growth in the Insulation Products industry?

Growth in the insulation products industry is driven by increasing construction activities, rising energy costs, and stringent building regulations aimed at energy efficiency. Additionally, environmental concerns are propelling the demand for sustainable insulation solutions.

Which region is the fastest Growing in the Insulation Products?

The fastest-growing region in the insulation products market is expected to be Europe, where the market is estimated to grow from $3.31 billion in 2023 to $5.45 billion by 2033, reflecting a significant increase in energy-efficient building practices.

Does ConsaInsights provide customized market report data for the Insulation Products industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the insulation products industry. This enables clients to gain insights that align precisely with their business strategies and market requirements.

What deliverables can I expect from this Insulation Products market research project?

From the insulation products market research project, clients can expect comprehensive deliverables including data insights on market size, growth forecasts, competitive analysis, and segmented data by regions and application sectors.

What are the market trends of Insulation Products?

Current market trends indicate a shift towards sustainable insulation materials such as foam and fiberglass, increased adoption of smart insulation technologies, and a rise in energy-efficient construction practices, reflecting broader environmental goals.