Insulin Delivery Devices Market Report

Published Date: 31 January 2026 | Report Code: insulin-delivery-devices

Insulin Delivery Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Insulin Delivery Devices market from 2023 to 2033, offering insights on market dynamics, size, segmentation, technology advancements, regional analyses, and future trends crucial for stakeholders and industry participants.

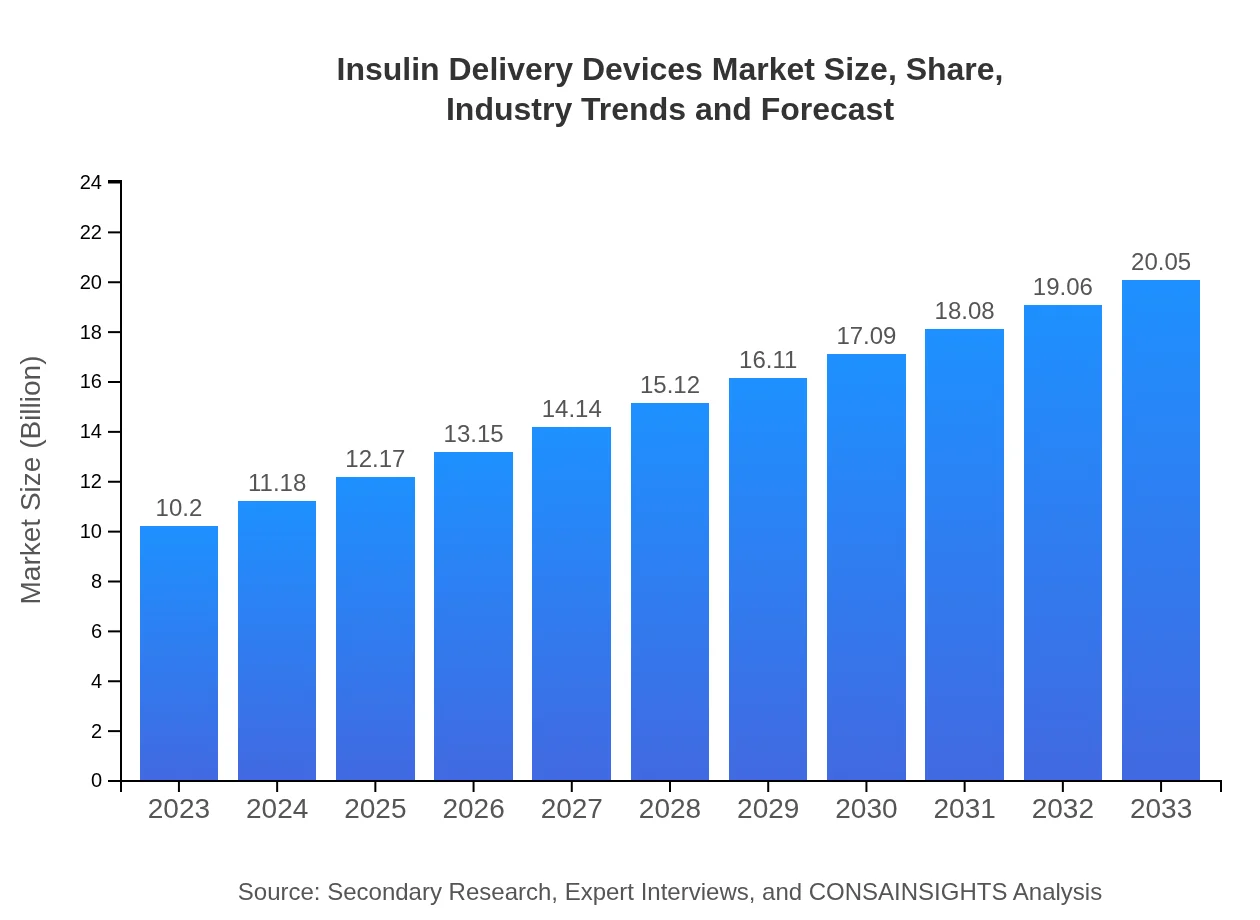

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $20.05 Billion |

| Top Companies | Medtronic , Abbott Laboratories, Roche Diabetes Care, Novo Nordisk |

| Last Modified Date | 31 January 2026 |

Insulin Delivery Devices Market Overview

Customize Insulin Delivery Devices Market Report market research report

- ✔ Get in-depth analysis of Insulin Delivery Devices market size, growth, and forecasts.

- ✔ Understand Insulin Delivery Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Insulin Delivery Devices

What is the Market Size & CAGR of Insulin Delivery Devices market in 2033?

Insulin Delivery Devices Industry Analysis

Insulin Delivery Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Insulin Delivery Devices Market Analysis Report by Region

Europe Insulin Delivery Devices Market Report:

In Europe, the market is expected to rise from USD 2.47 billion in 2023 to USD 4.86 billion by 2033. Innovative healthcare solutions, favorable reimbursement policies, and increasing healthcare expenditure drive the adoption of insulin delivery devices in this region.Asia Pacific Insulin Delivery Devices Market Report:

In Asia Pacific, the insulin delivery devices market is expected to grow from USD 2.05 billion in 2023 to USD 4.03 billion by 2033, driven by rising diabetes cases and the increasing adoption of technologically advanced devices. Countries such as China and India are significant contributors due to their large populations and growing healthcare infrastructure.North America Insulin Delivery Devices Market Report:

North America holds a substantial market share, with a projection to grow from USD 3.82 billion in 2023 to USD 7.51 billion by 2033. Factors such as advanced healthcare systems, high diabetes prevalence, and strong presence of key market players facilitate this growth.South America Insulin Delivery Devices Market Report:

The South American market is projected to expand from USD 0.78 billion in 2023 to USD 1.53 billion by 2033. The growth is supported by increased healthcare investments and awareness about diabetes management, along with the rising prevalence of diabetes in the region.Middle East & Africa Insulin Delivery Devices Market Report:

The Middle East and Africa market will see growth from USD 1.08 billion in 2023 to USD 2.11 billion by 2033, supported by investments in healthcare infrastructure and growing awareness of diabetes management among patients and healthcare providers.Tell us your focus area and get a customized research report.

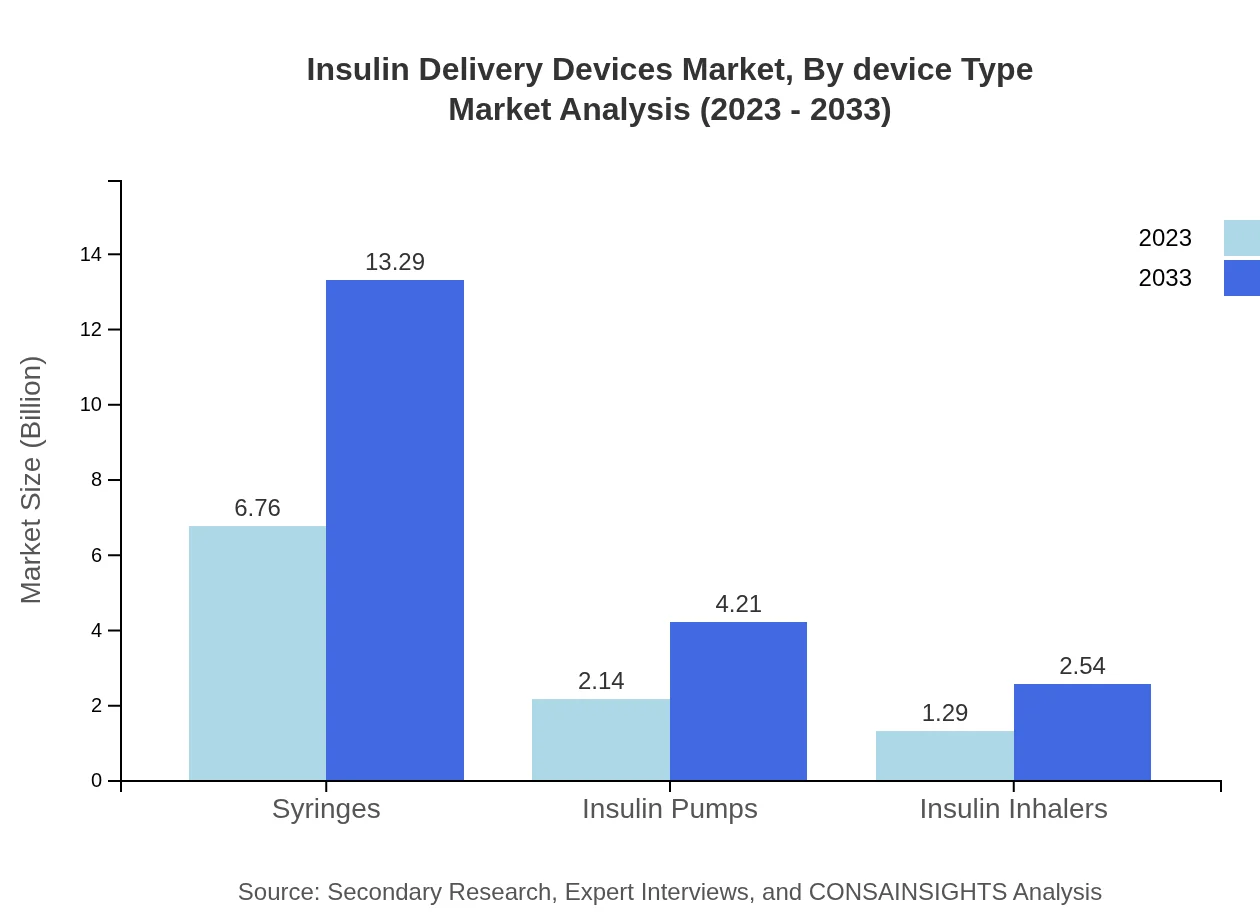

Insulin Delivery Devices Market Analysis By Device Type

The primary market segment for insulin delivery devices includes syringes, insulin pens, insulin pumps, and inhalers. Syringes dominate the market, representing a significant share of 66.31% in 2023, with a corresponding market size of USD 6.76 billion. Insulin pens follow, with a solid foothold facilitated by growing patient preference due to convenience and accuracy. Insulin pumps and inhalers are gaining traction as they offer sophisticated features like continuous monitoring, although they account for a smaller segment relative to conventional methods.

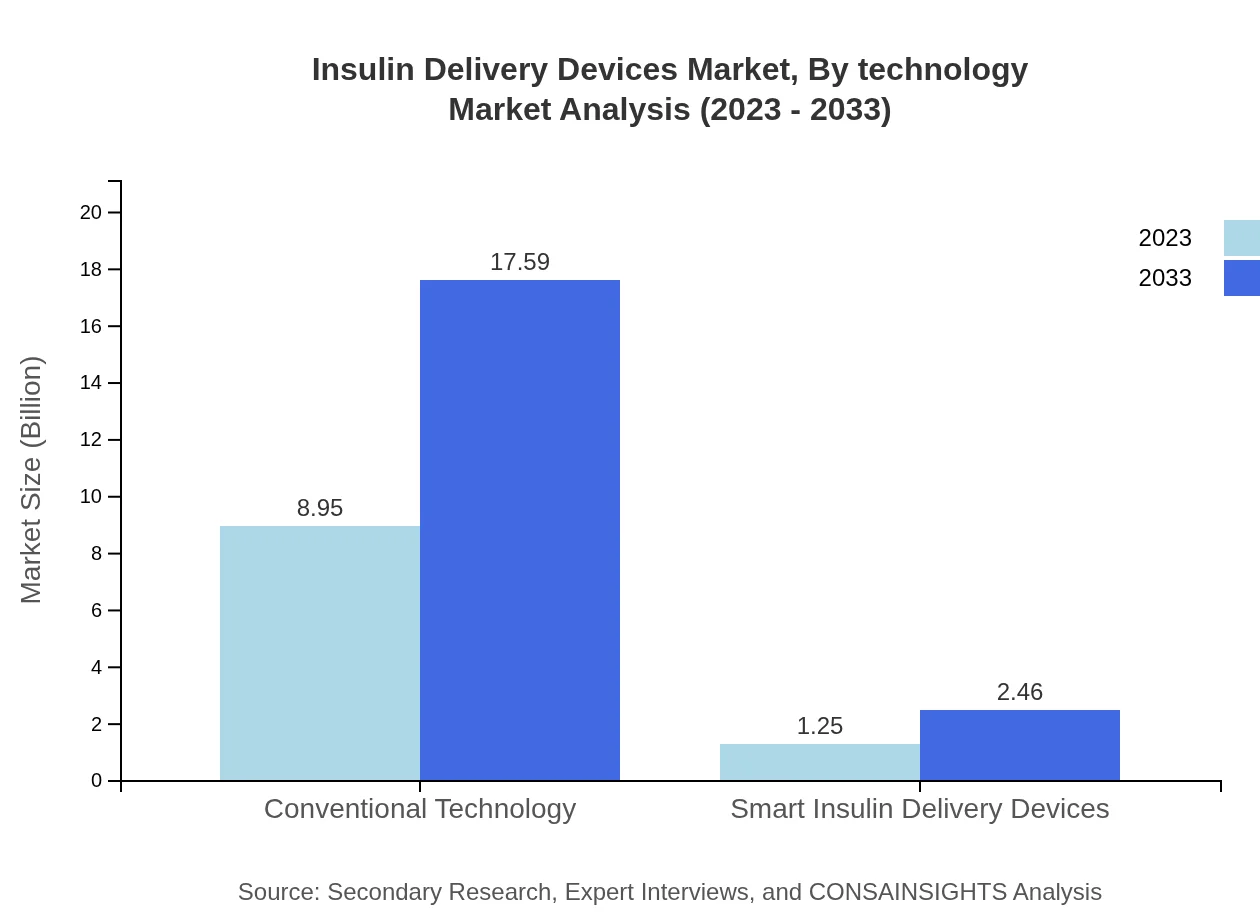

Insulin Delivery Devices Market Analysis By Technology

In terms of technology, the market showcases conventional technology (syringes and pens) leading with an 87.75% market share in 2023, while smart insulin delivery devices are emerging with a significant growth trajectory. Smart devices, such as connected insulin pens and advanced insulin pumps, are becoming increasingly popular due to their ease of use and integration with digital health applications, indicating a shift toward digitization in diabetes management.

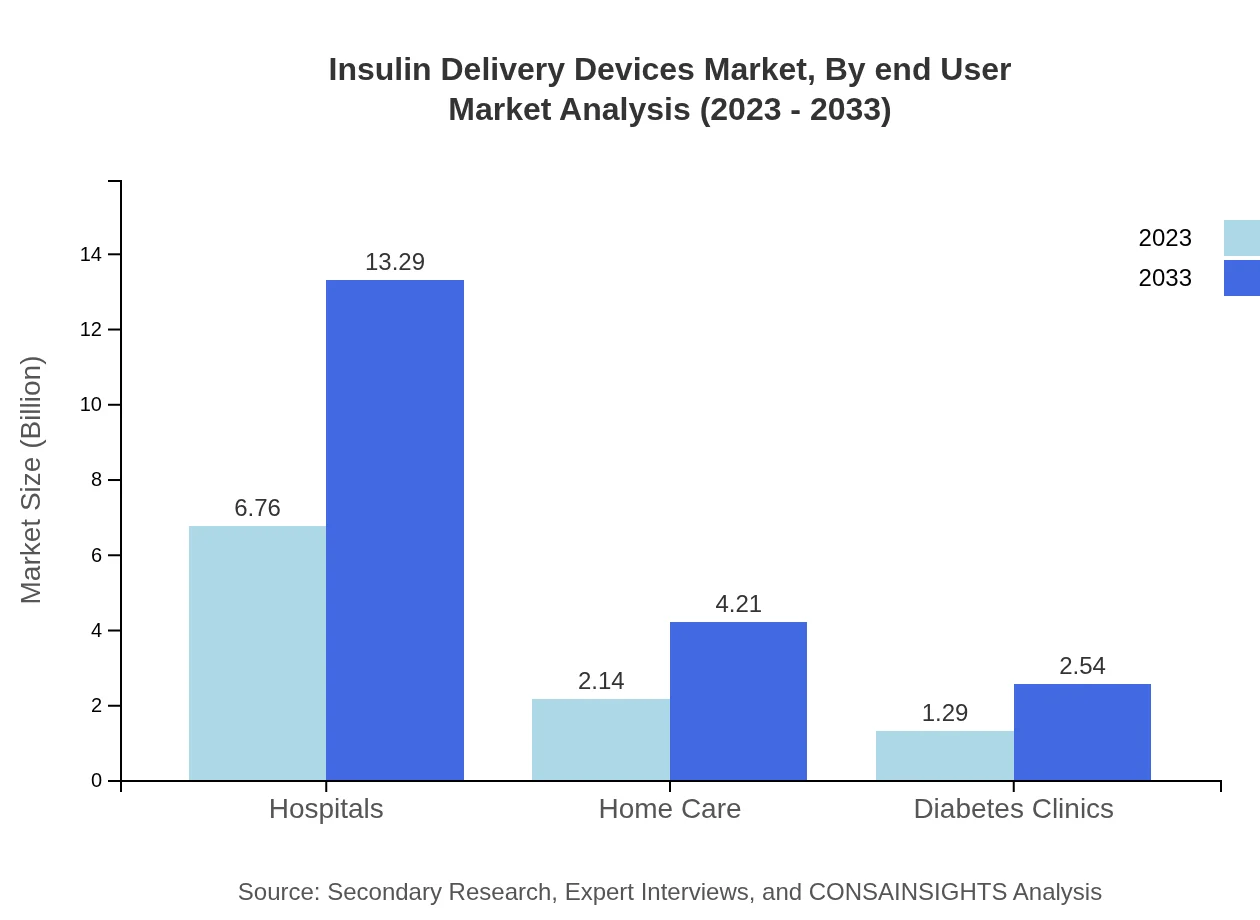

Insulin Delivery Devices Market Analysis By End User

Hospitals represent the largest end-user segment, commanding a market size of USD 6.76 billion with a market share of 66.31% in 2023. The home care segment is witnessing growth as patients prefer administering insulin in their environments, accounting for a market size of USD 2.14 billion. Diabetes clinics also contribute significantly, pushing towards better patient education and hands-on management.

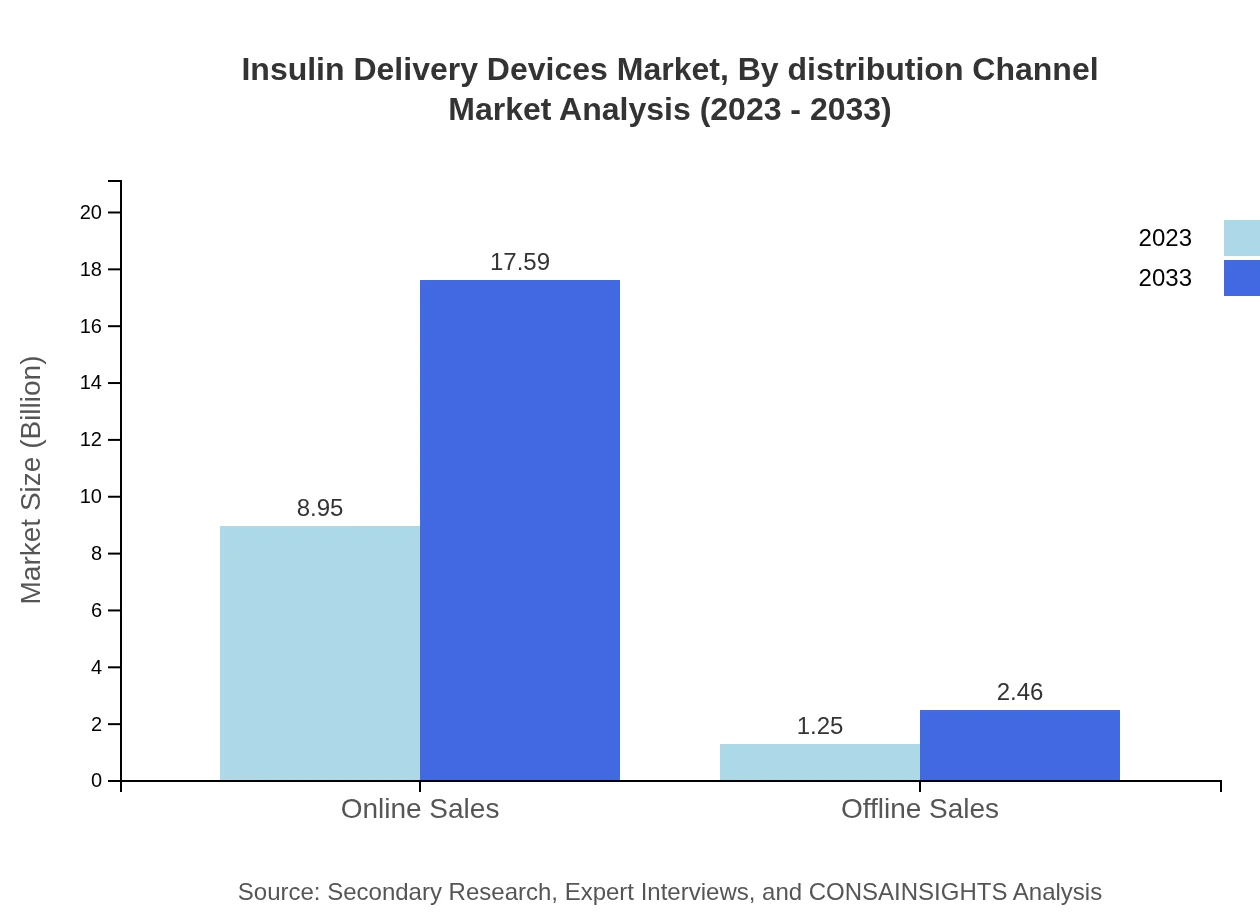

Insulin Delivery Devices Market Analysis By Distribution Channel

Online sales channels are surging, with a market size of USD 8.95 billion and a dominating 87.75% market share in 2023. The preference for online purchases stems from the convenience and availability of diverse products. Offline sales are growing but at a slower pace, offering opportunities for companies to strengthen their physical retail presence.

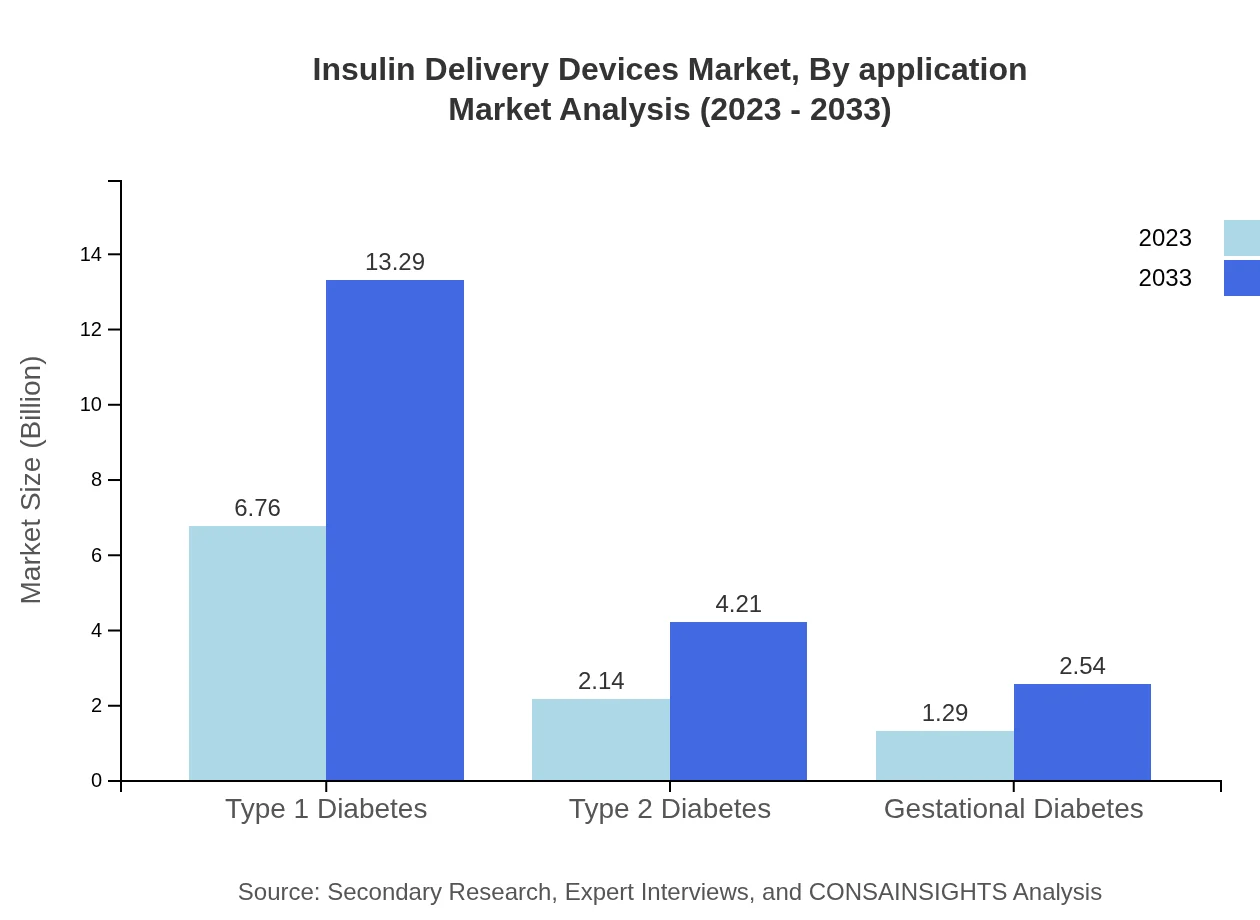

Insulin Delivery Devices Market Analysis By Application

Segmented by application, the primary areas are Type 1 diabetes, Type 2 diabetes, and gestational diabetes. Type 1 diabetes maintains a substantial portion of the market share at 66.31%, with Type 2 diabetes making up 21% as awareness about the condition rises, thereby increasing the demand for effective delivery solutions. Gestational diabetes also presents growth potential, particularly in developed markets.

Insulin Delivery Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Insulin Delivery Devices Industry

Medtronic :

A global leader known for its innovative insulin pumps and continuous glucose monitoring systems, enhancing the quality of diabetes management.Abbott Laboratories:

Specializes in health technology, offering rapid diagnostic tests and smart insulin delivery devices that improve patient care.Roche Diabetes Care:

Provides a range of insulin delivery devices and services aimed at assisting diabetes management through education and product innovation.Novo Nordisk:

A key player in diabetes care that offers insulin products along with delivery systems, focusing on patient-centric solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of insulin Delivery Devices?

The global insulin delivery devices market is projected to reach approximately $10.2 billion in 2023, with a compound annual growth rate (CAGR) of 6.8%, indicating robust growth potential in the coming years.

What are the key market players or companies in this insulin Delivery Devices industry?

Key players in the insulin delivery devices market include industry leaders like Medtronic, Novo Nordisk, and Sanofi, contributing significantly to advancements and innovations in insulin delivery technologies.

What are the primary factors driving the growth in the insulin Delivery Devices industry?

Key growth drivers for the insulin delivery devices market include rising diabetes prevalence, technological advancements in device functionality, and increasing awareness and education regarding diabetes management.

Which region is the fastest Growing in the insulin Delivery Devices?

North America is the fastest-growing region in the insulin delivery devices market, expected to grow from $3.82 billion in 2023 to $7.51 billion by 2033, driven by a high prevalence of diabetes and advanced healthcare infrastructure.

Does ConsaInsights provide customized market report data for the insulin Delivery Devices industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the insulin delivery devices industry, ensuring comprehensive insights and analysis tailored to unique client requirements.

What deliverables can I expect from this insulin Delivery Devices market research project?

Expected deliverables from the insulin delivery devices market research project include detailed market analysis reports, segmentation data, growth forecasts, competitive landscape, and strategic recommendations for market entry and expansion.

What are the market trends of insulin Delivery Devices?

Current trends in the insulin delivery devices market include increased adoption of smart devices, rise in home care solutions, and a shift towards online sales platforms, reflecting changing consumer preferences and technological advancements.