Insulin Market Report

Published Date: 31 January 2026 | Report Code: insulin

Insulin Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Insulin market, exploring key insights from 2023 to 2033. It covers market size, growth forecasts, segmentation, industry analysis, technological advancements, and regional insights, aimed at identifying trends and opportunities within this vital healthcare segment.

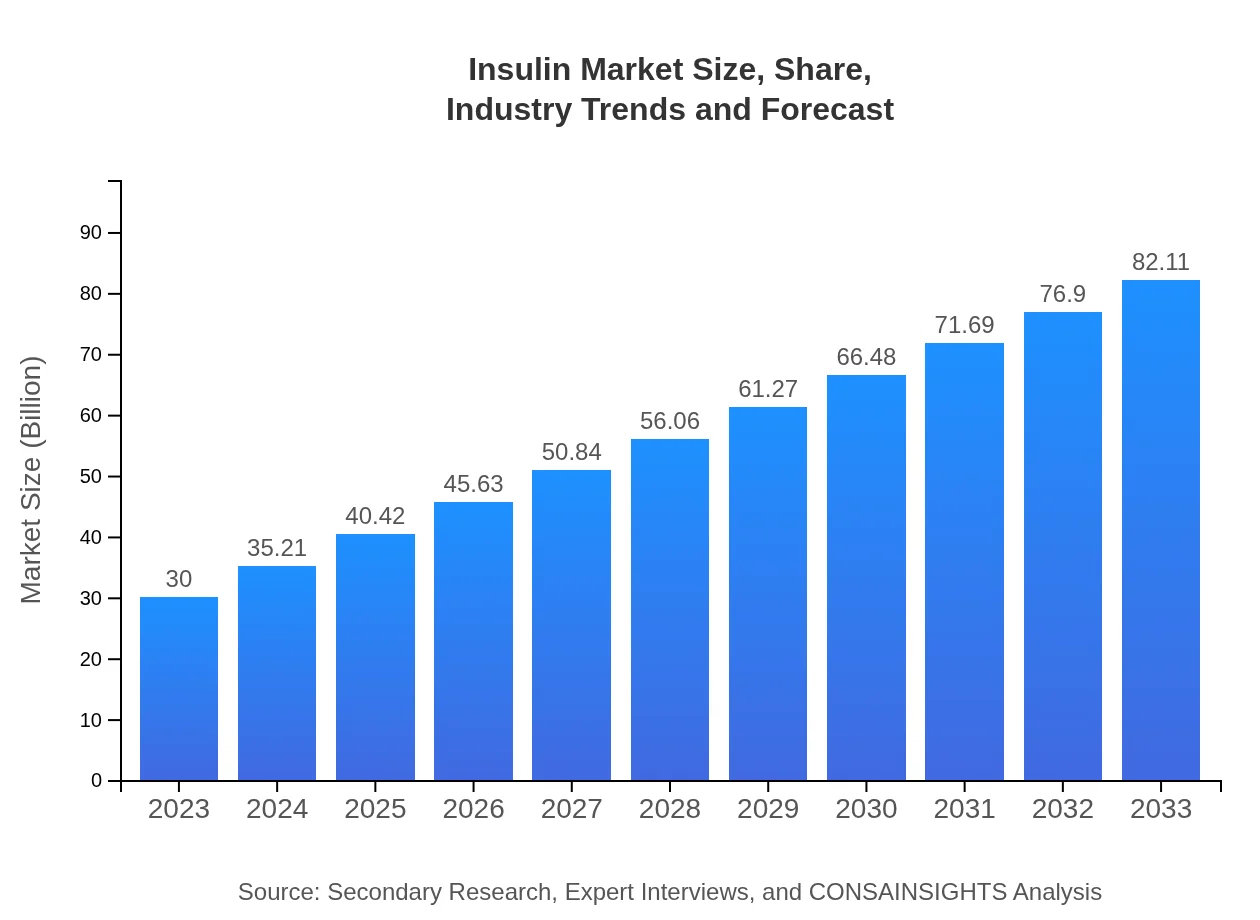

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $30.00 Billion |

| CAGR (2023-2033) | 10.2% |

| 2033 Market Size | $82.11 Billion |

| Top Companies | Novo Nordisk, Sanofi, Boehringer Ingelheim, Bristol-Myers Squibb |

| Last Modified Date | 31 January 2026 |

Insulin Market Overview

Customize Insulin Market Report market research report

- ✔ Get in-depth analysis of Insulin market size, growth, and forecasts.

- ✔ Understand Insulin's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Insulin

What is the Market Size & CAGR of Insulin market in 2023?

Insulin Industry Analysis

Insulin Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Insulin Market Analysis Report by Region

Europe Insulin Market Report:

Europe's insulin market is witnessing robust growth with an estimated size of $10.08 billion in 2023, anticipated to grow to $27.58 billion by 2033. Innovative treatment options and a strong regulatory framework are key growth factors.Asia Pacific Insulin Market Report:

The Asia Pacific region is projected to witness significant growth, with the market valued at $5.46 billion in 2023, projected to grow to $14.94 billion by 2033. This expansion is due to increasing diabetes prevalence and improving healthcare infrastructure.North America Insulin Market Report:

North America holds one of the largest shares in the Insulin market, with a size of $10.72 billion in 2023, projected to reach $29.35 billion by 2033. The dominant position is attributed to advanced healthcare systems, high healthcare expenditure, and increased diabetes awareness.South America Insulin Market Report:

The South American market for insulin is expected to experience steady growth. With a market size of $1.00 billion in 2023, expectations suggest it may rise to $2.74 billion by 2033, bolstered by increasing awareness and access to diabetes medications.Middle East & Africa Insulin Market Report:

The Middle East and Africa are expected to see gradual market progression, with an insulin market size of $2.74 billion in 2023, growing to $7.50 billion by 2033, driven by increasing healthcare investments and rising diabetes incidence.Tell us your focus area and get a customized research report.

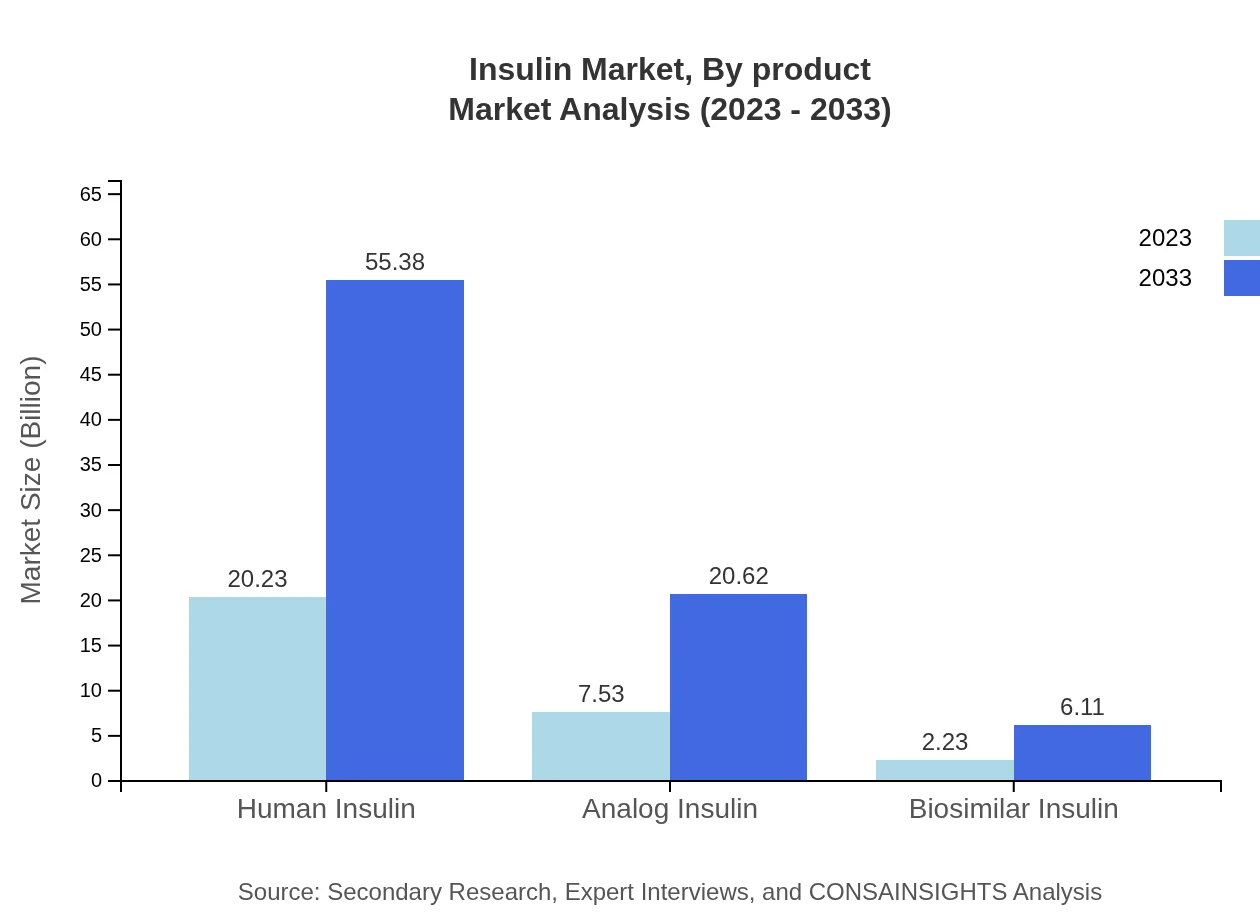

Insulin Market Analysis By Product

The Insulin market, by product type, is dominated by human insulin, which is valued at $20.23 billion in 2023 and is projected to grow to $55.38 billion by 2033. Analog insulin trails with a market size of $7.53 billion in 2023, anticipated to reach $20.62 billion by 2033. Biosimilar insulin, despite being a smaller segment at $2.23 billion in 2023, shows a promising growth trajectory, expected to reach $6.11 billion by 2033, driven by cost-effectiveness and market access.

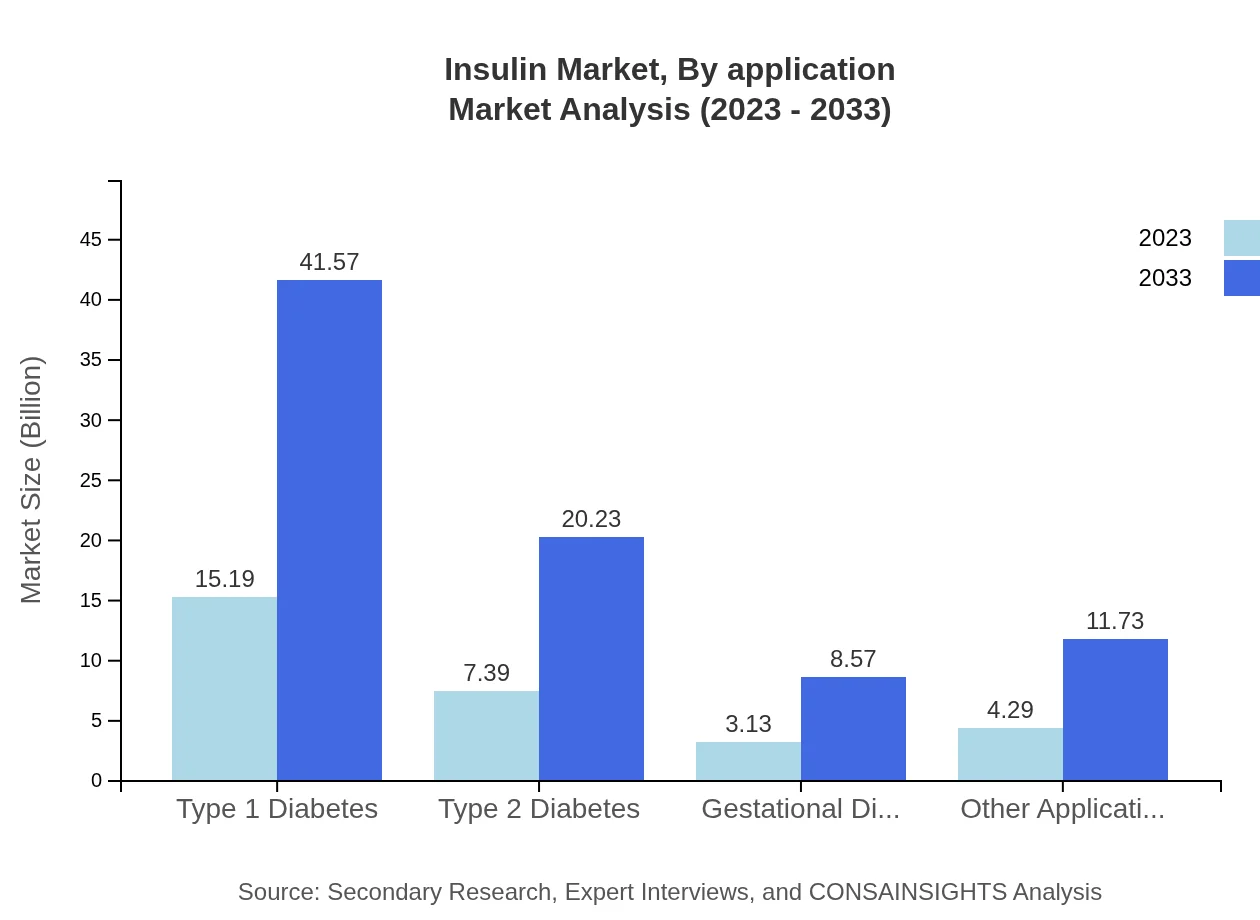

Insulin Market Analysis By Application

The market segmentation by application reveals a clearer picture of insulin consumption. The Type 1 diabetes segment accounts for a significant portion, with a market size of $15.19 billion in 2023 and an expected increase to $41.57 billion by 2033. Type 2 diabetes follows with a market value of $7.39 billion in 2023, growing to $20.23 billion by 2033. Gestational diabetes and other applications remain niche segments but are critical for comprehensive diabetes care systems.

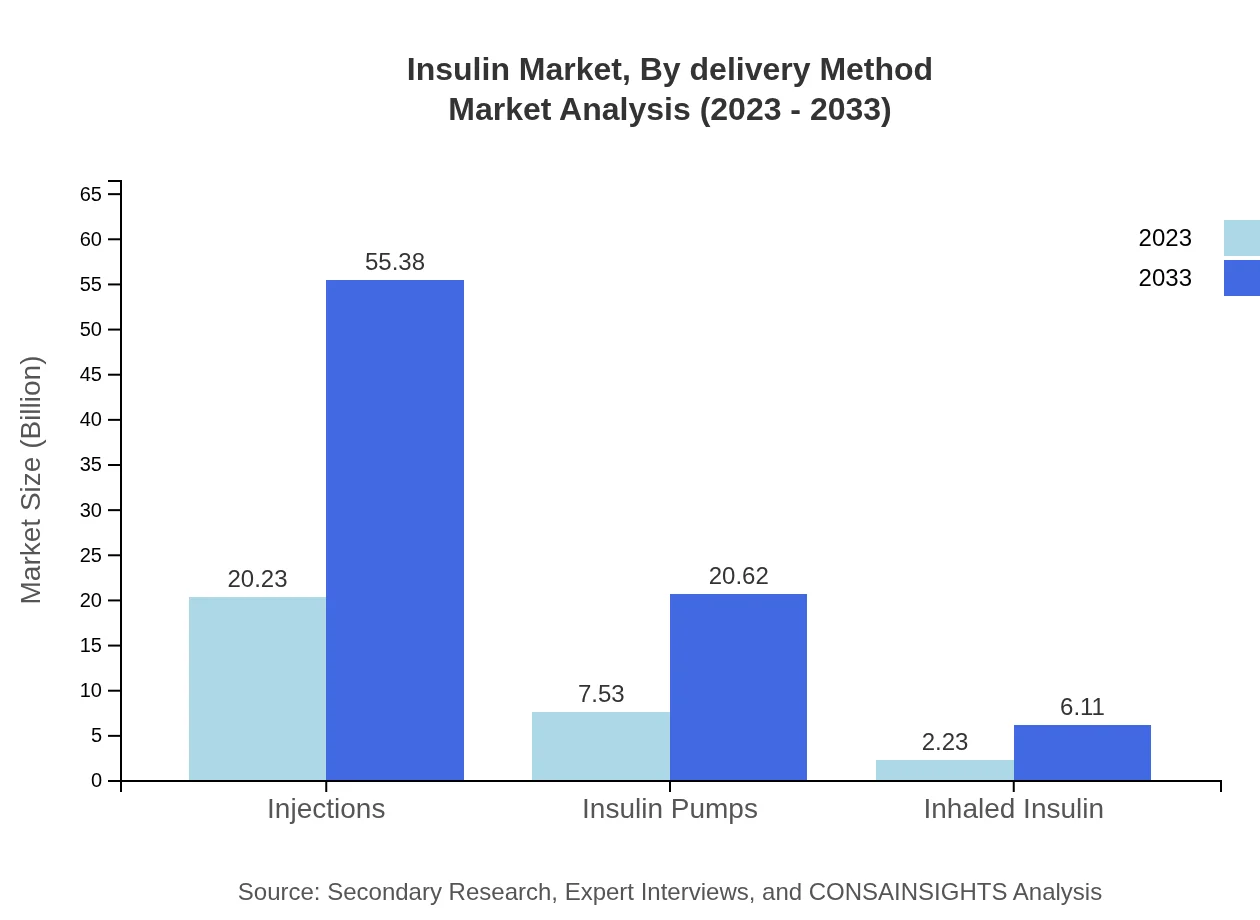

Insulin Market Analysis By Delivery Method

Analysis by delivery method indicates that injections dominate the insulin market with a valuation of $20.23 billion in 2023, expected to escalate to $55.38 billion by 2033. Insulin pumps also exhibit growth, from $7.53 billion in 2023 to $20.62 billion by 2033, showcasing the shift towards more advanced delivery methods. However, inhaled insulin remains a smaller segment, valued at $2.23 billion in 2023, with growth prospects up to $6.11 billion by 2033.

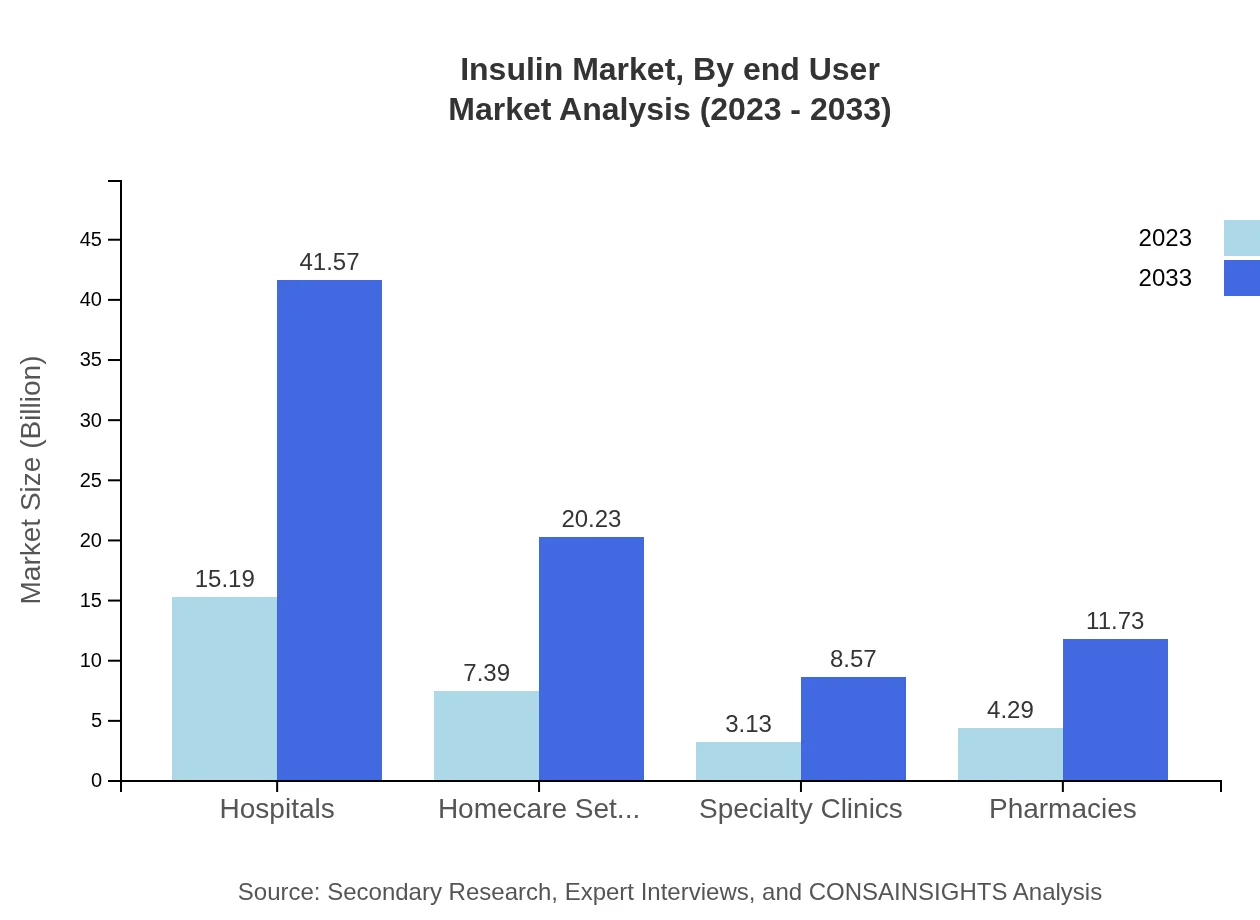

Insulin Market Analysis By End User

Insulin consumption across end-users is primarily driven by hospitals, which represent $15.19 billion in 2023, expected to grow to $41.57 billion by 2033. Homecare settings also play a significant role, with a market value of $7.39 billion in 2023, anticipated to rise to $20.23 billion by the decade's end. Specialty clinics and pharmacies, while smaller, remain essential for patient access and support.

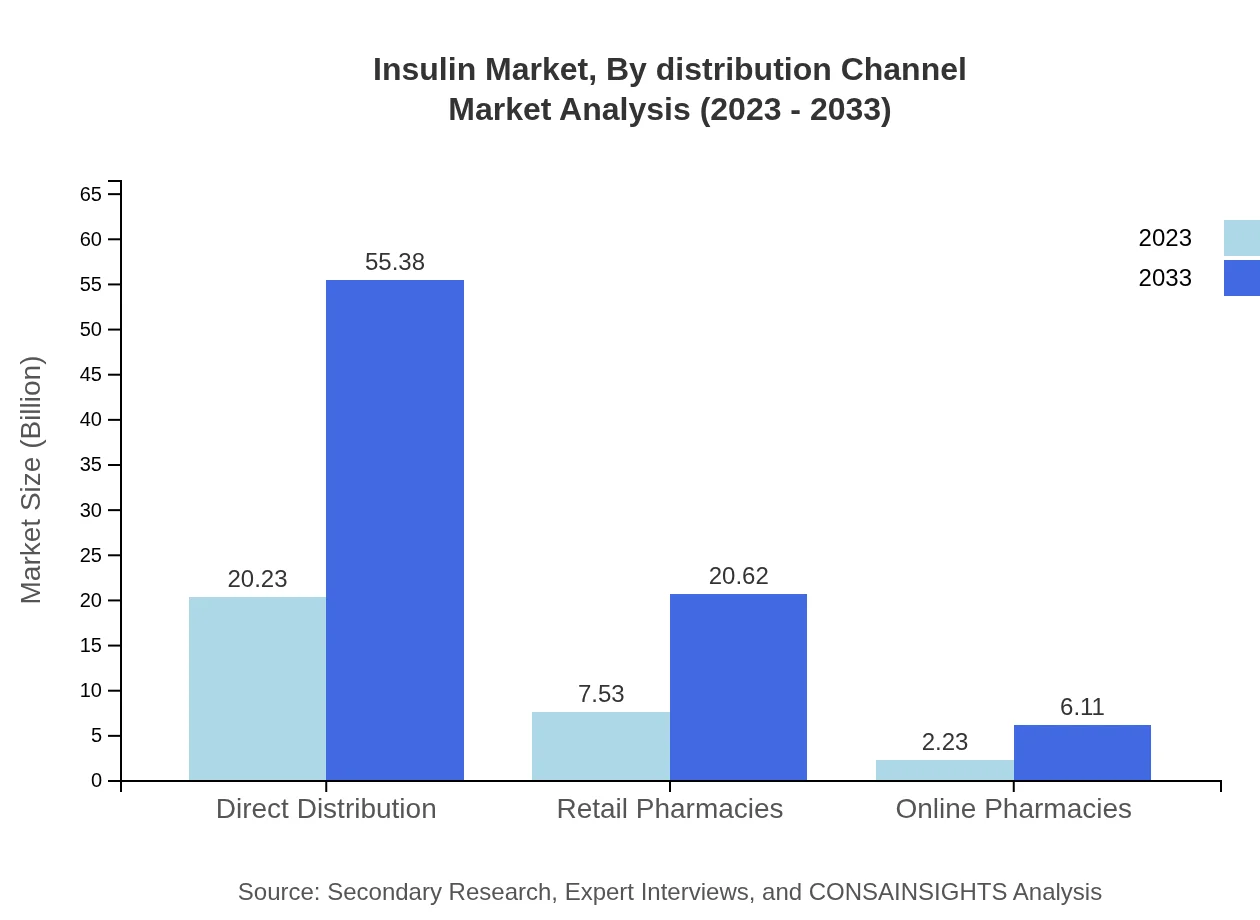

Insulin Market Analysis By Distribution Channel

The insulin market's distribution channels reflect current consumer trends. Direct distribution is the leading channel, garnering $20.23 billion in 2023 and projected to reach $55.38 billion by 2033. Retail pharmacies contribute significantly, starting at $7.53 billion and expected to grow to $20.62 billion, while online pharmacies are gaining traction, with a market size of $2.23 billion, anticipated to rise to $6.11 billion by the end of 2033.

Insulin Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Insulin Industry

Novo Nordisk:

Novo Nordisk is a global leader in diabetes care, known for its extensive range of insulin products, including NovoLog and Levemir. The company invests heavily in diabetes research and innovation.Sanofi:

Sanofi is a prominent player in the insulin market, renowned for its Lantus and Toujeo products. The company focuses on advanced therapies for chronic diabetic conditions.Boehringer Ingelheim:

Boehringer Ingelheim is recognized for its commitment to bringing innovative treatment solutions to diabetes management, with a growing portfolio of biosimilars.Bristol-Myers Squibb:

Bristol-Myers Squibb is dedicated to developing new therapies for chronic diseases, with insulin being a key area of focus, supporting their diverse healthcare portfolio.We're grateful to work with incredible clients.

FAQs

What is the market size of insulin?

The global insulin market is projected to reach approximately $30 Billion by 2033, with a compound annual growth rate (CAGR) of 10.2%. This growth reflects the increasing prevalence of diabetes and advances in insulin delivery methods.

What are the key market players or companies in the insulin industry?

Key players in the insulin market include major pharmaceutical companies such as Novo Nordisk, Sanofi, Eli Lilly and Company, and Boehringer Ingelheim. These companies lead in product development, innovation, and distribution of insulin products.

What are the primary factors driving the growth in the insulin industry?

Significant growth factors in the insulin market include an increase in diabetes prevalence, technological advancements in insulin delivery methods, rising awareness of diabetes management, and a growing aging population prone to Type 2 diabetes.

Which region is the fastest Growing in the insulin market?

The Asia Pacific region is identified as the fastest-growing market for insulin, expanding from $5.46 Billion in 2023 to an expected $14.94 Billion by 2033. This growth is attributed to rising healthcare access and diabetic population growth.

Does ConsaInsights provide customized market report data for the insulin industry?

Yes, ConsaInsights provides customized market report data tailored specifically for the insulin industry. Clients can request personalized insights to suit their particular needs and objectives in market research.

What deliverables can I expect from this insulin market research project?

Deliverables from the insulin market research project typically include a comprehensive market analysis report, segmented data by region and product type, projections for future growth, competitive landscape assessments, and strategic recommendations.

What are the market trends of insulin?

Current market trends in the insulin sector include an increased focus on biosimilar insulin products, a shift toward digital health technologies for diabetes management, and a growing preference for convenient insulin delivery methods like insulin pens and smart pumps.