Insulin Pens Market Report

Published Date: 31 January 2026 | Report Code: insulin-pens

Insulin Pens Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Insulin Pens market, highlighting market size, trends, technological advancements, and forecasts from 2023 to 2033. It covers various segments, regional insights, and profiles of key market players, aiming to inform stakeholders for strategic decision-making.

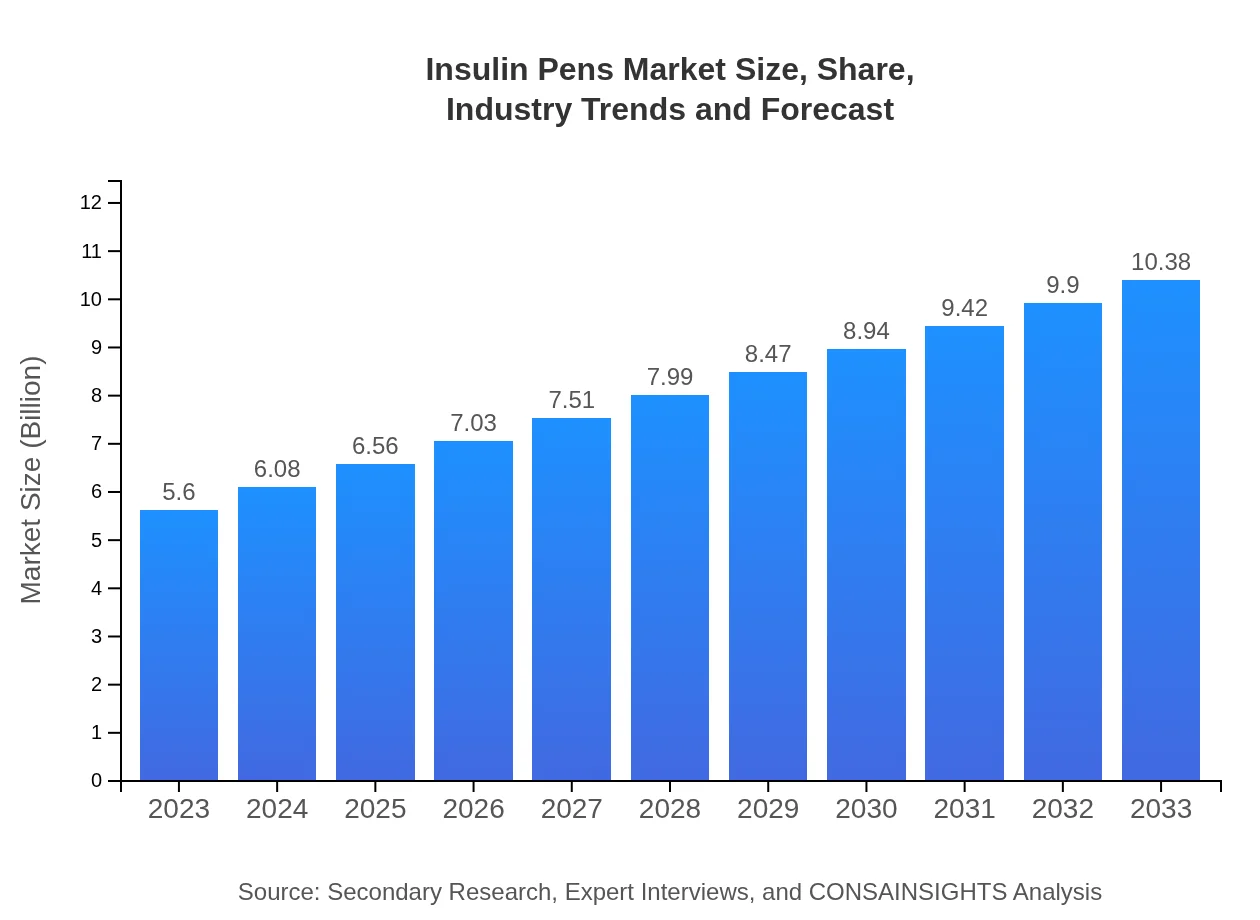

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $10.38 Billion |

| Top Companies | Novo Nordisk, Sanofi, Boehringer Ingelheim, Eli Lilly, Roche |

| Last Modified Date | 31 January 2026 |

Insulin Pens Market Overview

Customize Insulin Pens Market Report market research report

- ✔ Get in-depth analysis of Insulin Pens market size, growth, and forecasts.

- ✔ Understand Insulin Pens's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Insulin Pens

What is the Market Size & CAGR of Insulin Pens Market in 2023?

Insulin Pens Industry Analysis

Insulin Pens Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Insulin Pens Market Analysis Report by Region

Europe Insulin Pens Market Report:

The European insulin pens market was valued at $1.38 billion in 2023, with a forecasted growth to $2.57 billion by 2033. The market is driven by substantial investments in healthcare innovation, regulatory support for technological advancements, and increasing patient awareness regarding diabetes management.Asia Pacific Insulin Pens Market Report:

In the Asia Pacific region, the insulin pens market was valued at $1.19 billion in 2023 and is projected to grow to $2.20 billion by 2033. This growth is attributed to the increasing prevalence of diabetes, rising disposable incomes, and advancements in healthcare infrastructure. Countries like India and China are spearheading this growth, focusing on improving diabetes care management.North America Insulin Pens Market Report:

In North America, the market size was $1.80 billion in 2023, anticipated to grow substantially to $3.33 billion by 2033. The U.S. remains the largest market due to high diabetes prevalence and strong access to advanced healthcare technologies, alongside a focus on patient-centric diabetes management solutions.South America Insulin Pens Market Report:

The South American insulin pens market stood at $0.53 billion in 2023 and is expected to reach $0.98 billion by 2033. The market growth is driven by the rising awareness of diabetes management and increasing healthcare expenditure. Brazil and Argentina are the primary markets due to improved access to healthcare technology.Middle East & Africa Insulin Pens Market Report:

The Middle East and Africa saw a market size of $0.70 billion in 2023, projected to rise to $1.30 billion by 2033. The growth is fueled by expanding healthcare infrastructures, increasing disposable income levels, and heightened efforts by governments and organizations to improve diabetes care services in the region.Tell us your focus area and get a customized research report.

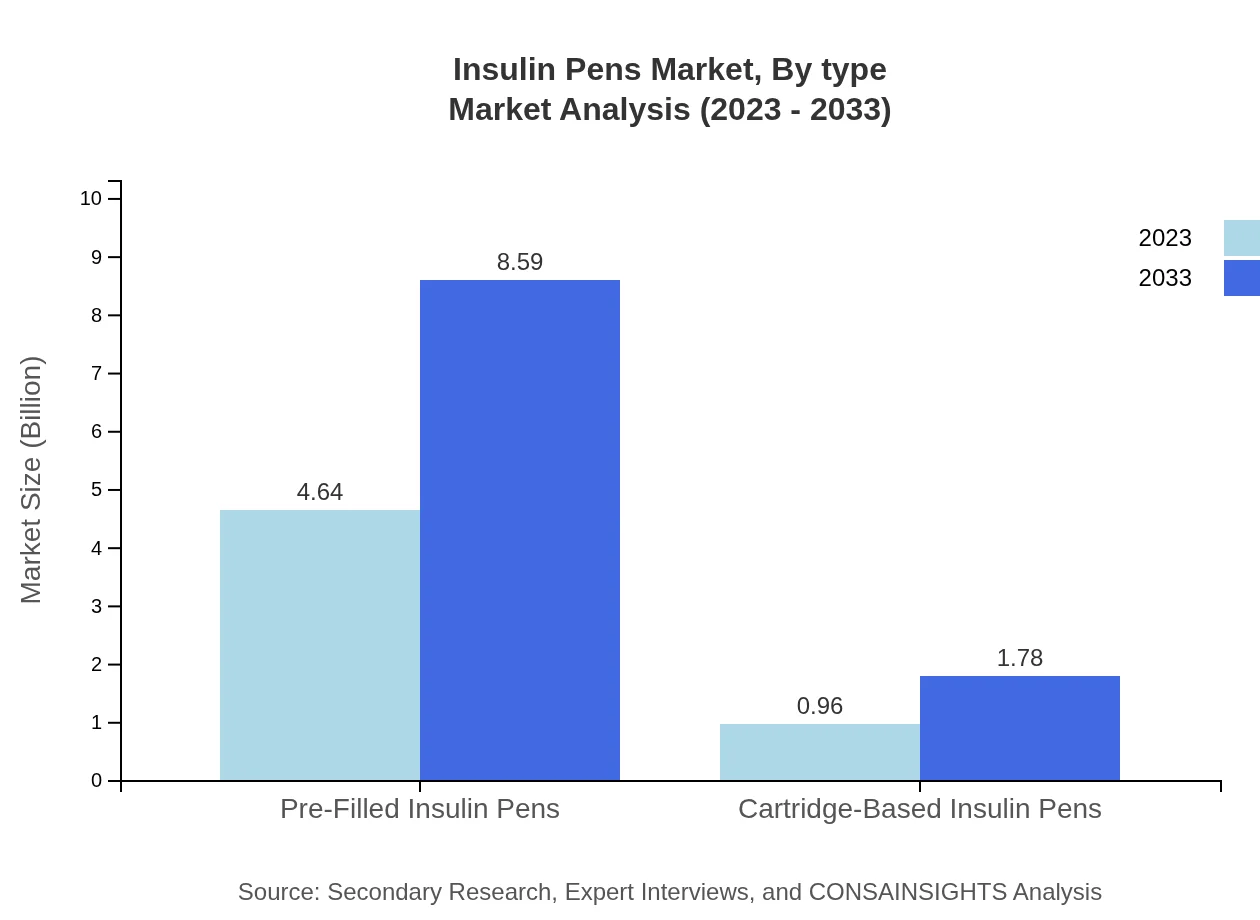

Insulin Pens Market Analysis By Type

The Insulin Pens market is primarily dominated by pre-filled insulin pens, which accounted for $4.64 billion in 2023 and are expected to grow to $8.59 billion by 2033, maintaining an 82.82% market share. Conversely, cartridge-based insulin pens showed a market size of $0.96 billion in 2023 projected to reach $1.78 billion by 2033, holding 17.18% market share.

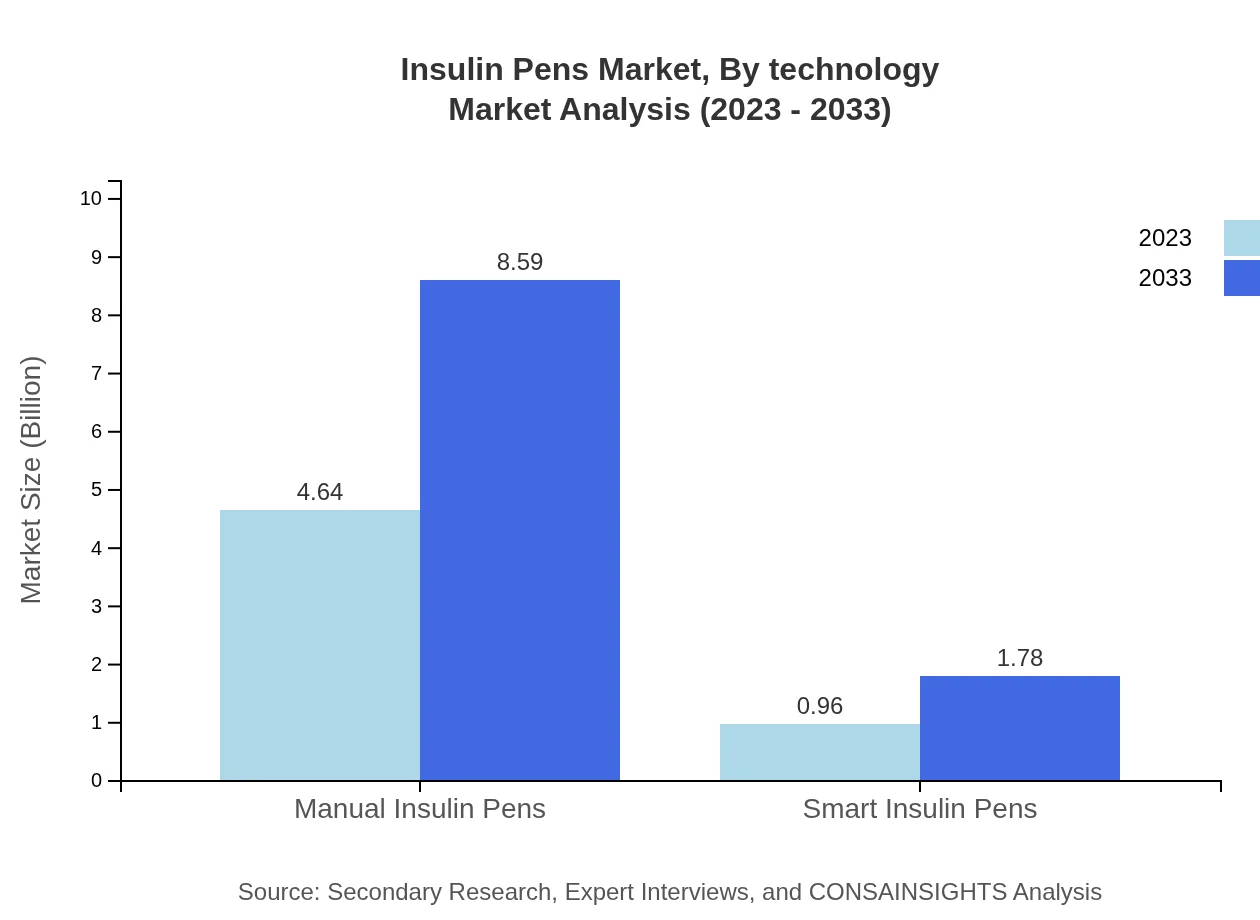

Insulin Pens Market Analysis By Technology

The technology in insulin pens can be categorized into manual and smart types. Manual insulin pens are still prevalent, commanding an $4.64 billion market share currently and expected to rise to $8.59 billion by 2033. Meanwhile, smart insulin pens have emerged to capture the market share with a current size of $0.96 billion, projected to reach $1.78 billion over the next decade.

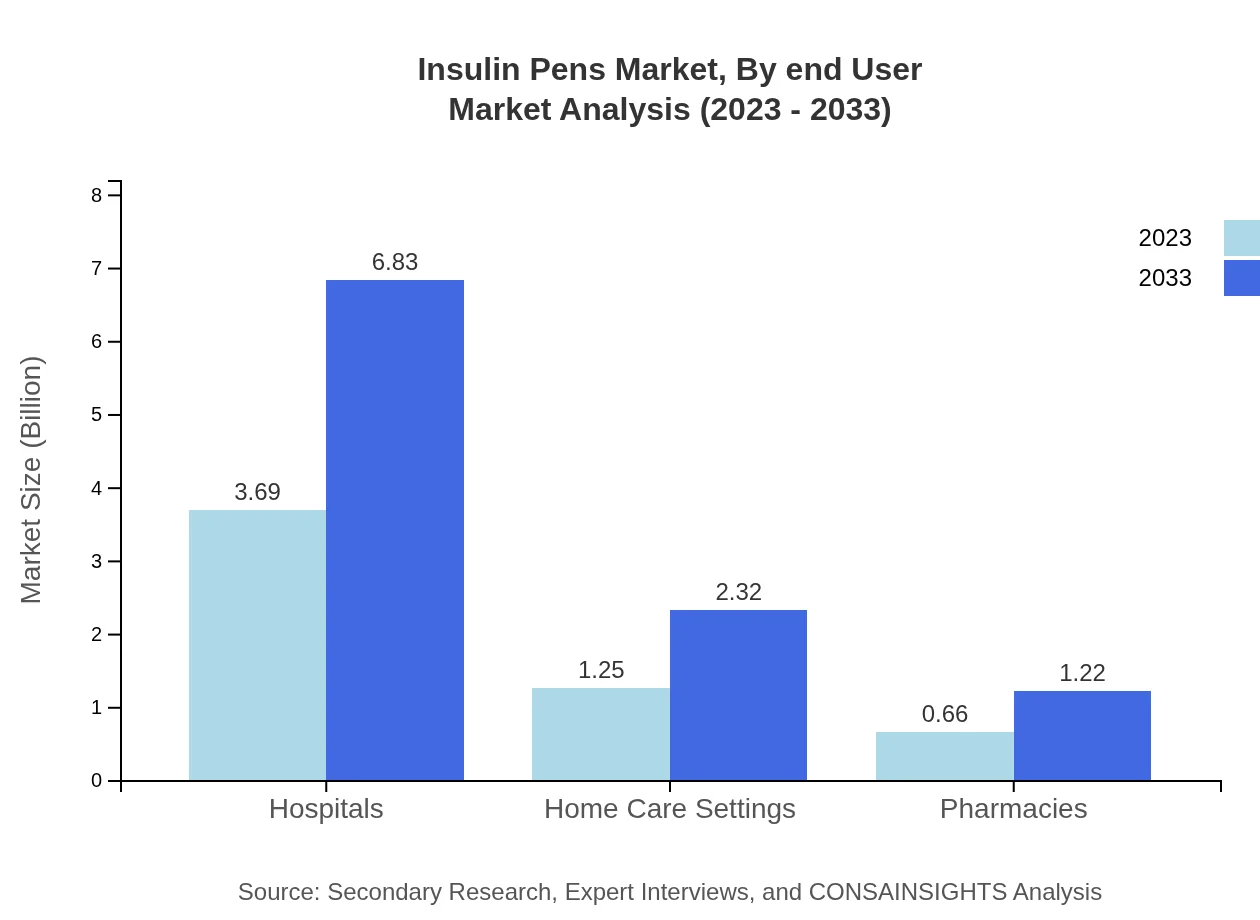

Insulin Pens Market Analysis By End User

Hospitals represent the largest end-user segment, valued at $3.69 billion in 2023 and projected to climb to $6.83 billion by 2033, maintaining a strong 65.84% market share. The home care segment, valued at $1.25 billion in 2023, is expected to grow to $2.32 billion by 2033, constituting 22.4% market share. Pharmacies, including retail and online, collectively account for the remaining market, with online pharmacies expected to capture increasing share as digital healthcare expands.

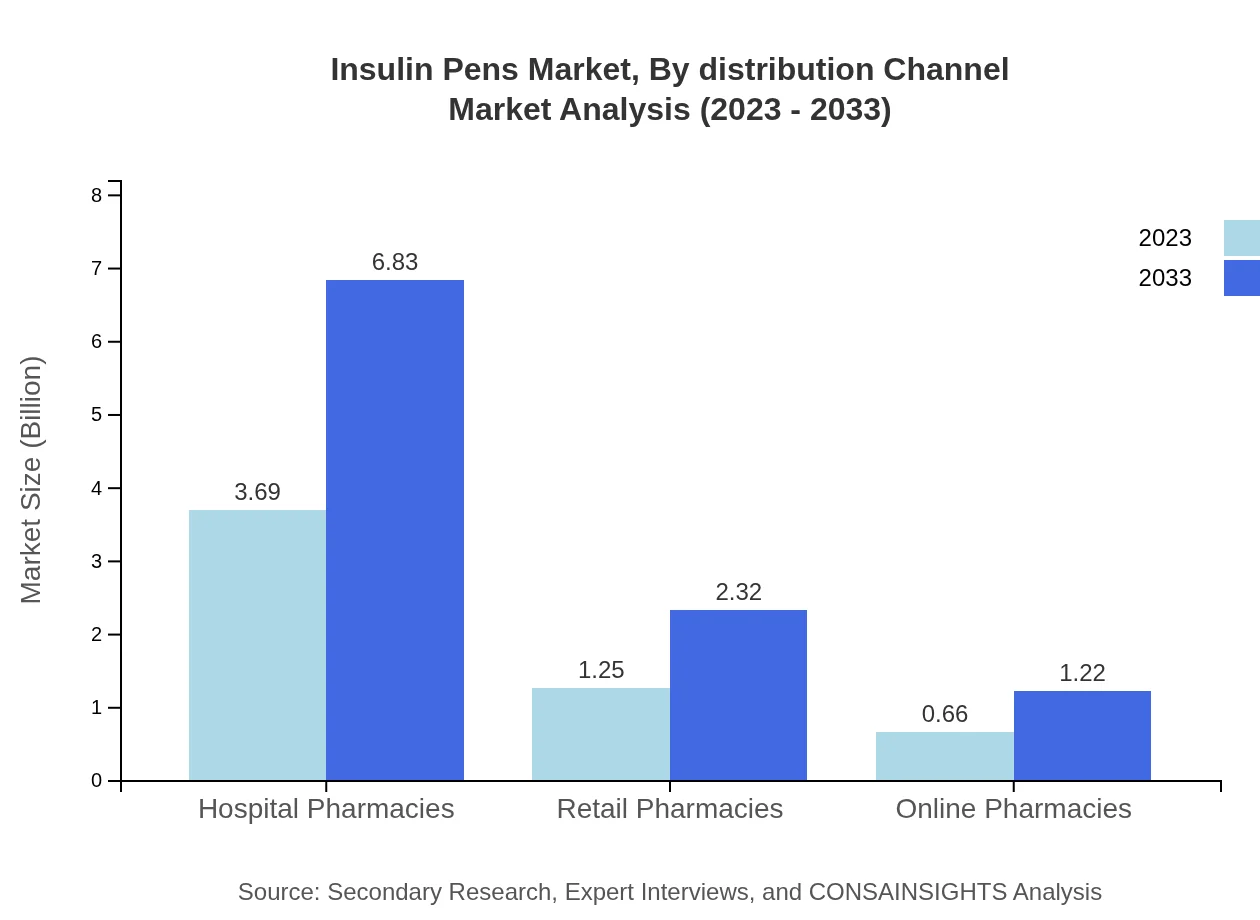

Insulin Pens Market Analysis By Distribution Channel

The distribution segment is divided among hospital pharmacies, retail pharmacies, and online pharmacies. Hospital pharmacies dominate with $3.69 billion in 2023, expected to reach $6.83 billion by 2033. Retail pharmacies encompass a market size of $1.25 billion, and online pharmacies, although smaller, are gaining momentum with a projected growth from $0.66 billion to $1.22 billion over the forecast period.

Insulin Pens Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Insulin Pens Industry

Novo Nordisk:

Novo Nordisk is a global leader in diabetes care, offering a range of insulin pens including the popular FlexPen and Novopen. The company focuses on innovation and patient-centered solutions to improve diabetes management.Sanofi:

Sanofi is known for its advanced insulin delivery devices, including the SoloStar pen, which has gained significant market share due to its ease of use and patient compliance. The company is committed to enhancing the lives of individuals with diabetes through effective solutions.Boehringer Ingelheim:

Boehringer Ingelheim has made substantial advancements in insulin pens, contributing to the development of the Inhaled Insulin delivery system alongside traditional pens, focusing on providing comprehensive diabetes care.Eli Lilly:

Eli Lilly is recognized for its innovative insulin pens such as the KwikPen, which has revolutionized diabetes treatment with its user-friendly design and prefilled options, enhancing patient adherence and satisfaction.Roche:

Roche has a significant presence in the diabetes care market, offering durable insulin pens that cater to various patient needs, including the Accu-Chek range which integrates diagnostics with insulin delivery.We're grateful to work with incredible clients.

FAQs

What is the market size of insulin pens?

The global insulin pens market is valued at approximately $5.6 billion in 2023 and is projected to grow at a CAGR of 6.2% through 2033, indicating a significant demand for advanced diabetes management solutions.

What are the key market players or companies in the insulin pens industry?

Key players in the insulin pens market include major pharmaceutical companies such as Novo Nordisk, Sanofi, Eli Lilly, and Becton, Dickinson and Company, which are instrumental in manufacturing and distributing innovative insulin delivery devices.

What are the primary factors driving the growth in the insulin pens industry?

Growth in the insulin pens market is driven by the rising prevalence of diabetes, advancements in insulin delivery technology, increasing adoption of self-management in diabetes care, and the growing availability of insulin pens in various healthcare settings.

Which region is the fastest Growing in the insulin pens market?

The Asia Pacific region is projected to be the fastest-growing market for insulin pens, with an increase from $1.19 billion in 2023 to $2.20 billion by 2033, reflecting a strong demand for diabetes management solutions.

Does ConsaInsights provide customized market report data for the insulin pens industry?

Yes, ConsaInsights offers customized market report data tailored to clients' specific needs within the insulin pens industry, ensuring that businesses obtain insights relevant to their operational strategies and market focus.

What deliverables can I expect from this insulin pens market research project?

Expect detailed market analysis reports, segment breakdowns by type and region, growth forecasts, competitive landscape assessments, and insights into consumer trends, providing a comprehensive overview of the insulin pens market.

What are the market trends of insulin pens?

Key trends in the insulin pens market include the increasing shift towards pre-filled insulin pens, rising adoption of smart insulin pens, and greater focus on home care settings, enhancing patient convenience and compliance.