Insurance Analytics Market Report

Published Date: 24 January 2026 | Report Code: insurance-analytics

Insurance Analytics Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive market report provides an in-depth analysis of the Insurance Analytics market, covering insights about market trends, growth drivers, and forecasts for 2023 to 2033. The report includes a detailed assessment of market size, segments, and regional dynamics.

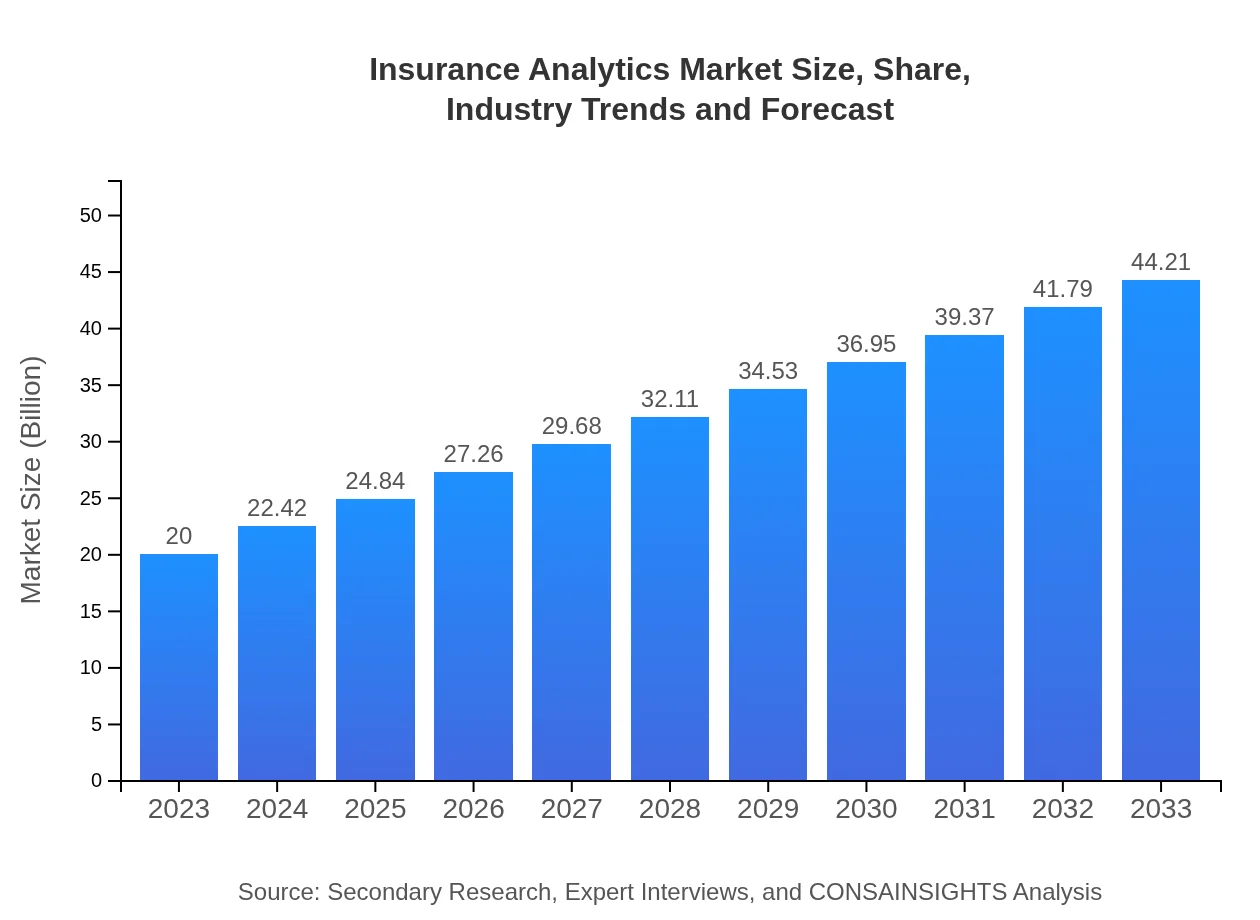

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $20.00 Billion |

| CAGR (2023-2033) | 8.0% |

| 2033 Market Size | $44.21 Billion |

| Top Companies | IBM, SAS, Oracle, Tableau |

| Last Modified Date | 24 January 2026 |

Insurance Analytics Market Overview

Customize Insurance Analytics Market Report market research report

- ✔ Get in-depth analysis of Insurance Analytics market size, growth, and forecasts.

- ✔ Understand Insurance Analytics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Insurance Analytics

What is the Market Size & CAGR of Insurance Analytics market in 2023?

Insurance Analytics Industry Analysis

Insurance Analytics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Insurance Analytics Market Analysis Report by Region

Europe Insurance Analytics Market Report:

The European market for Insurance Analytics is expected to expand from USD 4.97 billion in 2023 to USD 10.98 billion by 2033, as businesses leverage analytics for compliance and operational efficiency amidst stringent regulations.Asia Pacific Insurance Analytics Market Report:

In the Asia Pacific region, the Insurance Analytics market is expected to grow from USD 3.86 billion in 2023 to USD 8.52 billion by 2033, driven by significant technological advancements and increasing insurance penetration in developing economies.North America Insurance Analytics Market Report:

North America is anticipated to maintain a dominant position in the market, with its size growing from USD 7.02 billion in 2023 to USD 15.53 billion in 2033, largely due to heightened investments in technology and data analytics by insurance providers.South America Insurance Analytics Market Report:

The South American market is projected to escalate from USD 1.87 billion in 2023 to USD 4.14 billion by 2033, influenced by a growing recognition of analytics in enhancing customer service and compliance.Middle East & Africa Insurance Analytics Market Report:

In the Middle East and Africa, the market's growth from USD 2.28 billion in 2023 to USD 5.04 billion by 2033 signifies the rising acknowledgment of data analytics and its potential to transform insurance operations in the region.Tell us your focus area and get a customized research report.

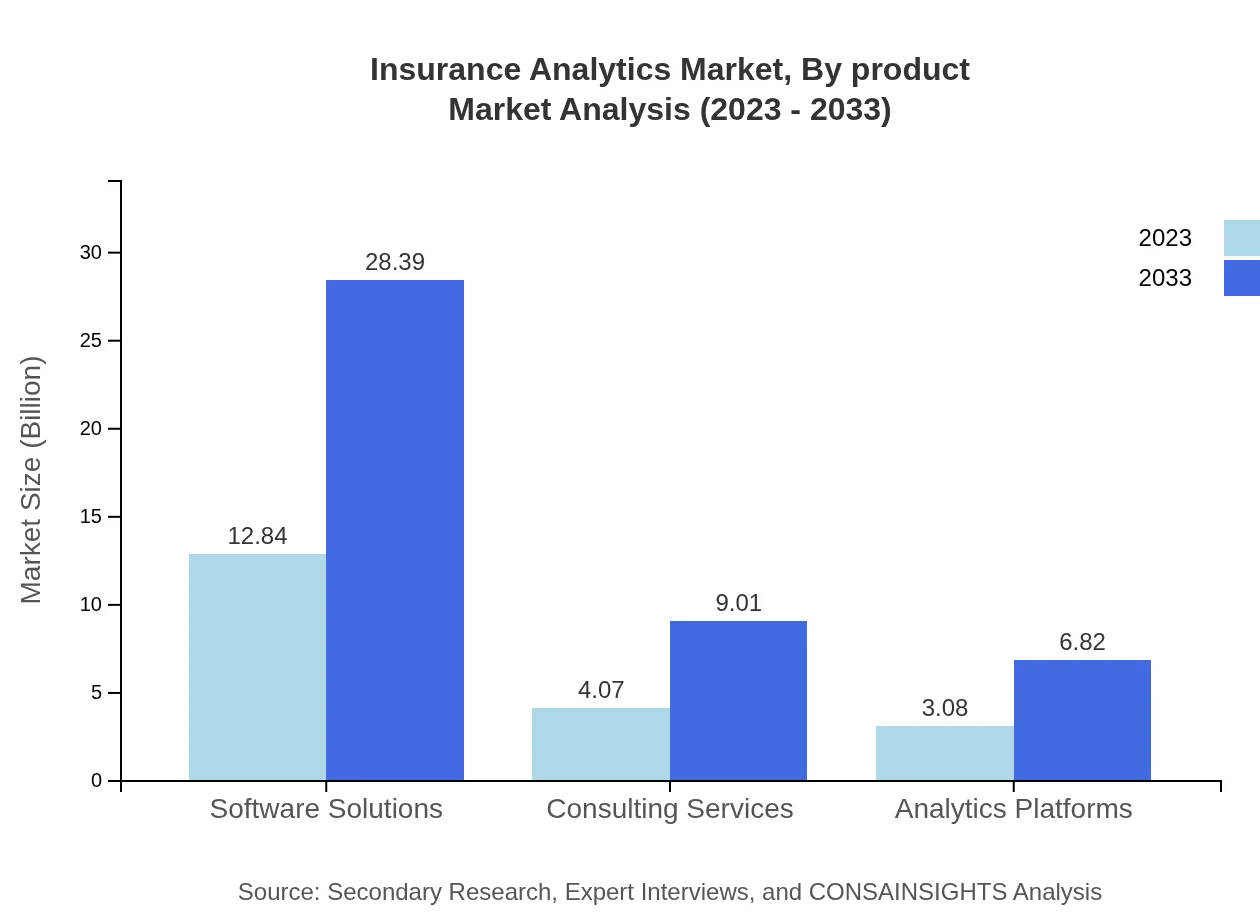

Insurance Analytics Market Analysis By Product

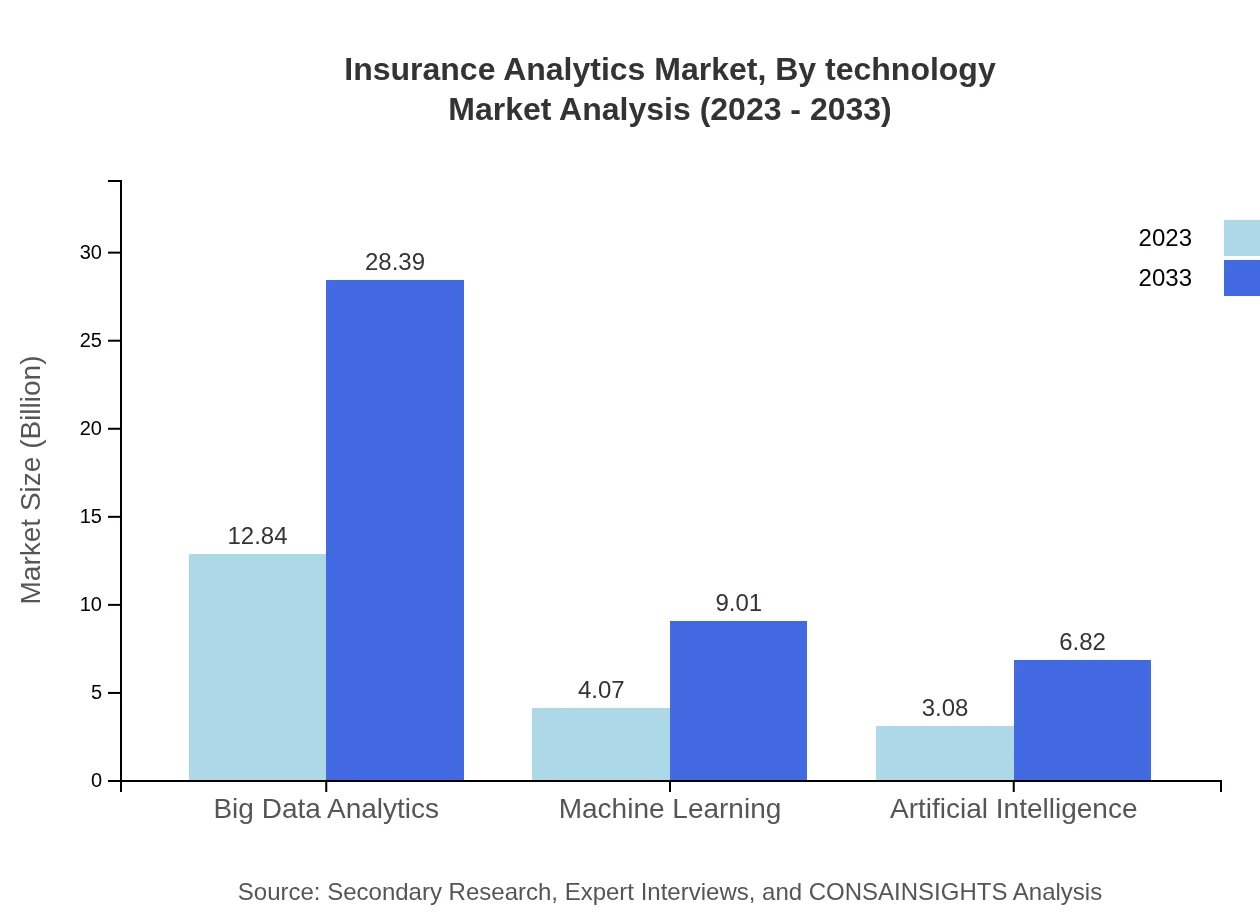

The Software Solutions segment is the largest, expected to expand significantly from USD 12.84 billion in 2023 to USD 28.39 billion by 2033, maintaining a 64.21% market share. Consulting Services and Analytics Platforms are also crucial, with their market sizes projected to reach USD 9.01 billion and USD 6.82 billion, respectively.

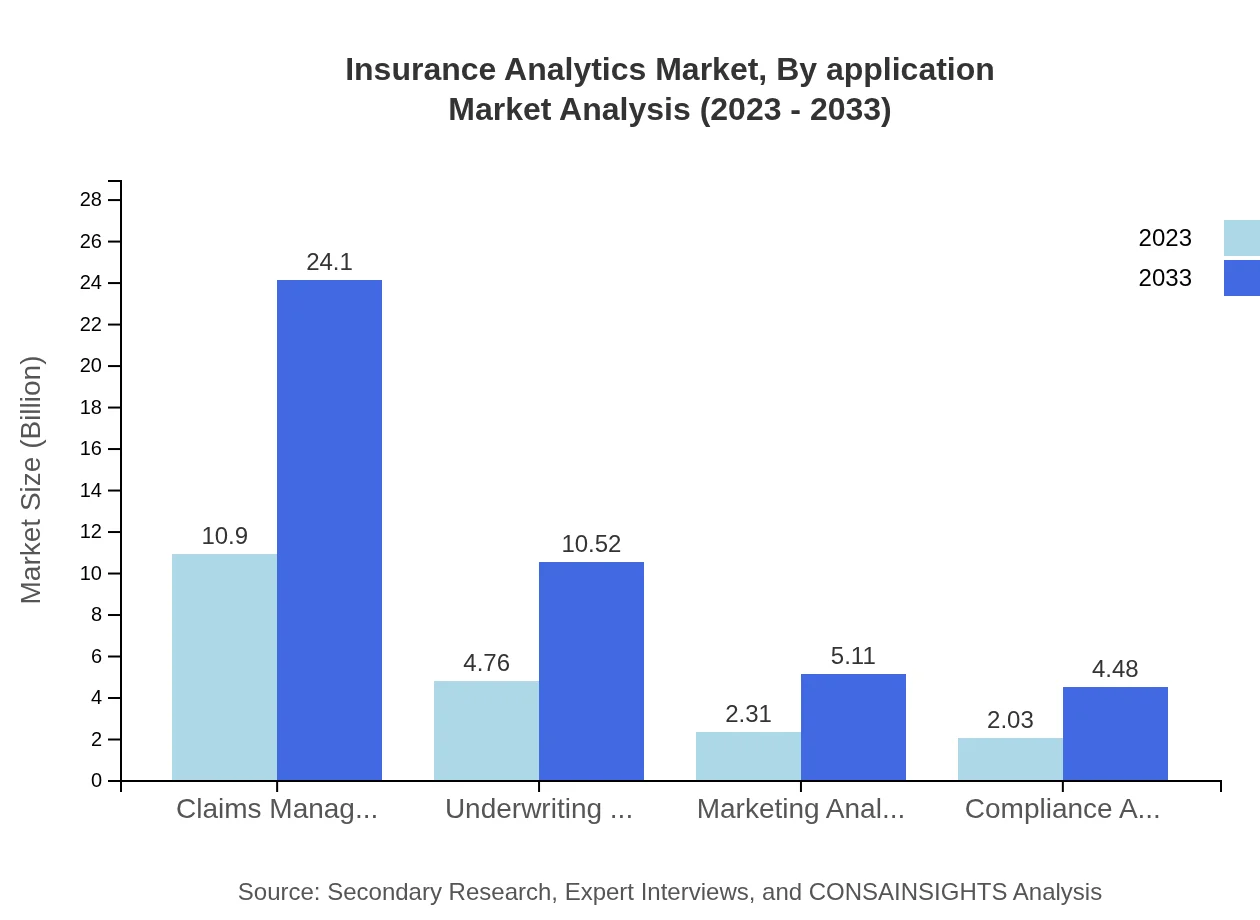

Insurance Analytics Market Analysis By Application

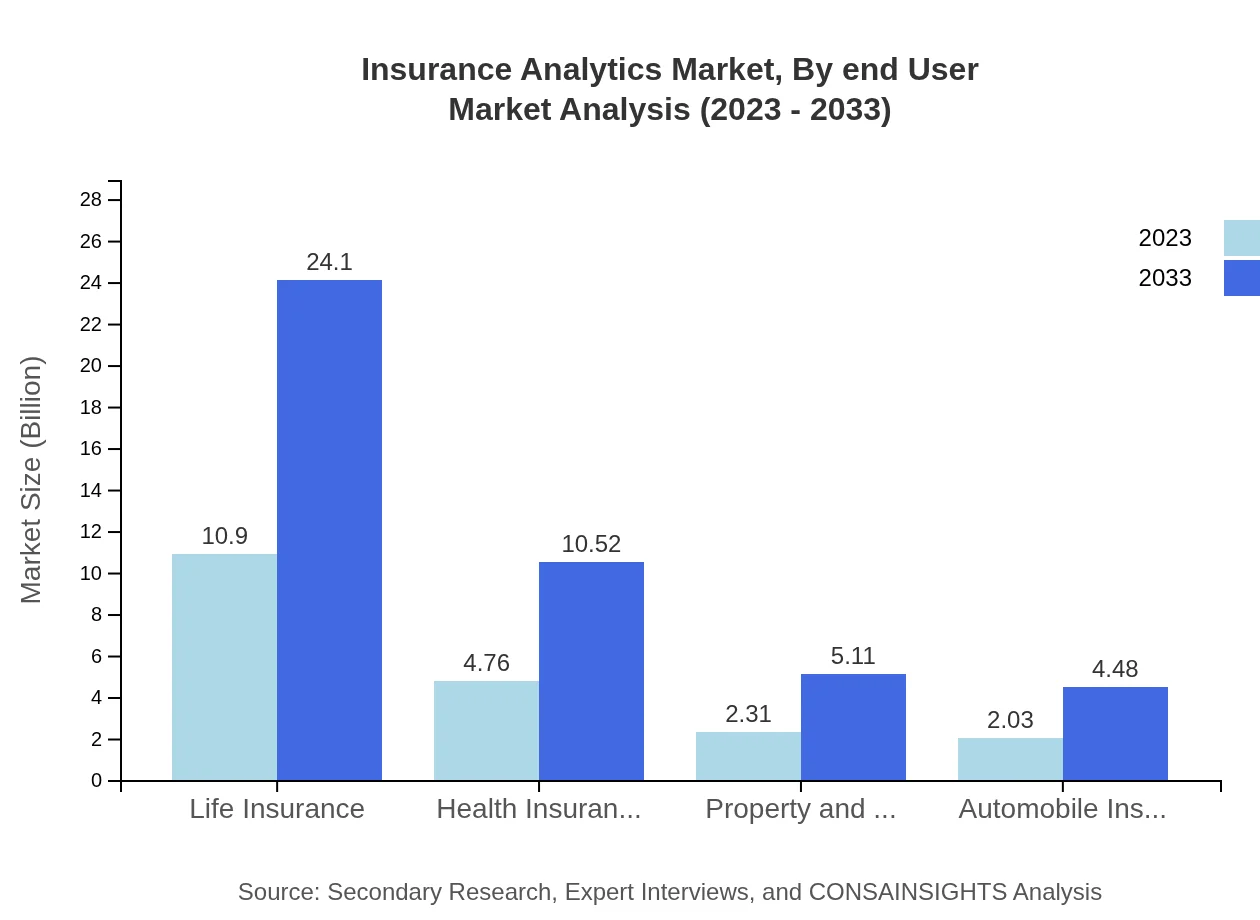

The Life Insurance segment dominates the application landscape, projecting a growth from USD 10.90 billion in 2023 to USD 24.10 billion in 2033, representing a 54.5% market share. Other applications like Health Insurance and Property and Casualty also show significant potential for growth, indicating broader adoption of analytics across various practices.

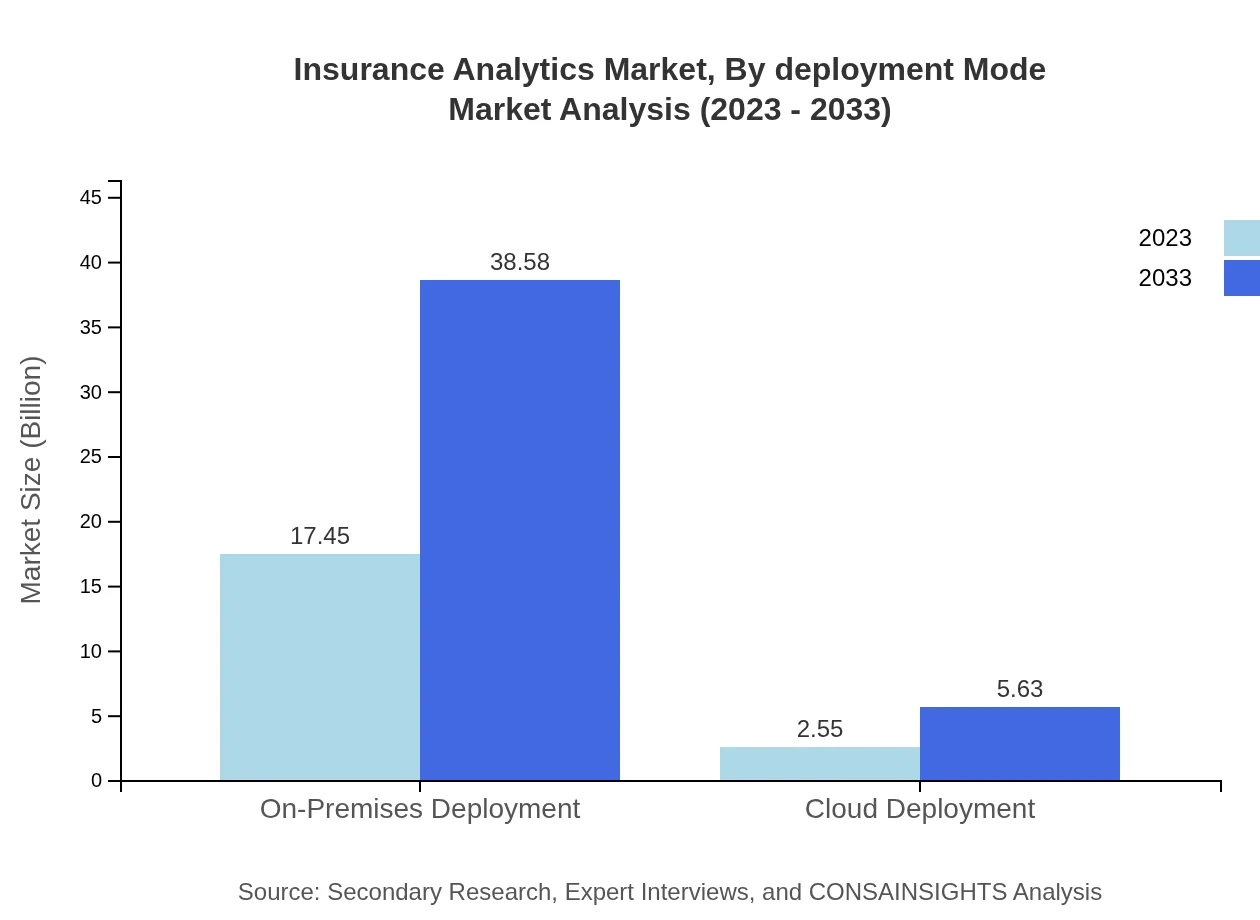

Insurance Analytics Market Analysis By Deployment Mode

The On-Premises Deployment segment is currently leading with its size projected to grow from USD 17.45 billion in 2023 to USD 38.58 billion by 2033, holding an 87.26% share. However, Cloud Deployment is gaining traction, with an expected increase to USD 5.63 billion, indicating a shift towards more flexible and scalable solutions.

Insurance Analytics Market Analysis By End User

The major end-users of Insurance Analytics include large insurance firms and emerging startups that prioritize data analytics to refine their customer engagement strategies, risk management capabilities, and product offerings. The increasing demand for market intelligence tools among underwriters and claims assessors adds significant value to this segment.

Insurance Analytics Market Analysis By Technology

Technological advancements play a pivotal role, with Big Data Analytics holding a significant portion of the market. AI technologies are becoming increasingly integral to the analytics process, evolving the efficiency and effectiveness of insurance operations, including Claims Management and Underwriting Operations.

Insurance Analytics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Insurance Analytics Industry

IBM:

IBM offers comprehensive analytics solutions tailored for the insurance sector, enabling companies to leverage data insights for improved decision-making and streamlined operations.SAS:

SAS provides advanced analytics capabilities that empower insurance firms to manage risks, improve customer interactions, and enhance operational efficiency through data-driven insights.Oracle:

Oracle’s Analytics Cloud provides robust solutions that help insurance providers in managing data for superior market insights and strategic advantages.Tableau:

Tableau specializes in providing visual analytics solutions that enhance the capability of insurance analysts to interpret data for more effective decision-making.We're grateful to work with incredible clients.

FAQs

What is the market size of insurance Analytics?

The global insurance analytics market is valued at approximately $20 billion in 2023, with a compound annual growth rate (CAGR) of 8.0%. By 2033, the market size is projected to reach significant heights, driven by growing data applications within the insurance sector.

What are the key market players or companies in this insurance Analytics industry?

Key players in the insurance analytics market include major technology firms and specialized software providers. Notable companies often lead innovations, driving competition across segments such as software solutions, consulting services, and analytics platforms.

What are the primary factors driving the growth in the insurance Analytics industry?

Factors driving growth in insurance analytics include increased adoption of big data technologies, a focus on risk management, regulatory requirements for data analysis, and the narrowing margins in traditional insurance that prompt agencies to optimize operational efficiency.

Which region is the fastest Growing in the insurance Analytics?

North America is the fastest-growing region in the insurance analytics market, projected to grow from $7.02 billion in 2023 to $15.53 billion by 2033. This growth is due to the rapid adoption of analytics technologies and innovation within the insurance sector.

Does ConsaInsights provide customized market report data for the insurance Analytics industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the insurance analytics industry. Clients can request detailed insights reflecting unique market dynamics and segment-specific analysis.

What deliverables can I expect from this insurance Analytics market research project?

Deliverables from the insurance analytics market research project typically include comprehensive market reports, segmented data analysis, forecasts, competitive landscape assessments, and insights into consumer behavior and market trends.

What are the market trends of insurance Analytics?

Current market trends in insurance analytics include increased integration of machine learning and AI technologies, growing significance of predictive analytics, and a focus on customer-centricity, enhancing personalization in marketing strategies and underwriting.