Insurance Bpo Services Market Report

Published Date: 24 January 2026 | Report Code: insurance-bpo-services

Insurance Bpo Services Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Insurance BPO Services market, covering insights from 2023 to 2033. It encompasses market size, growth rates, regional analysis, industry trends, and forecasts that help stakeholders make informed decisions.

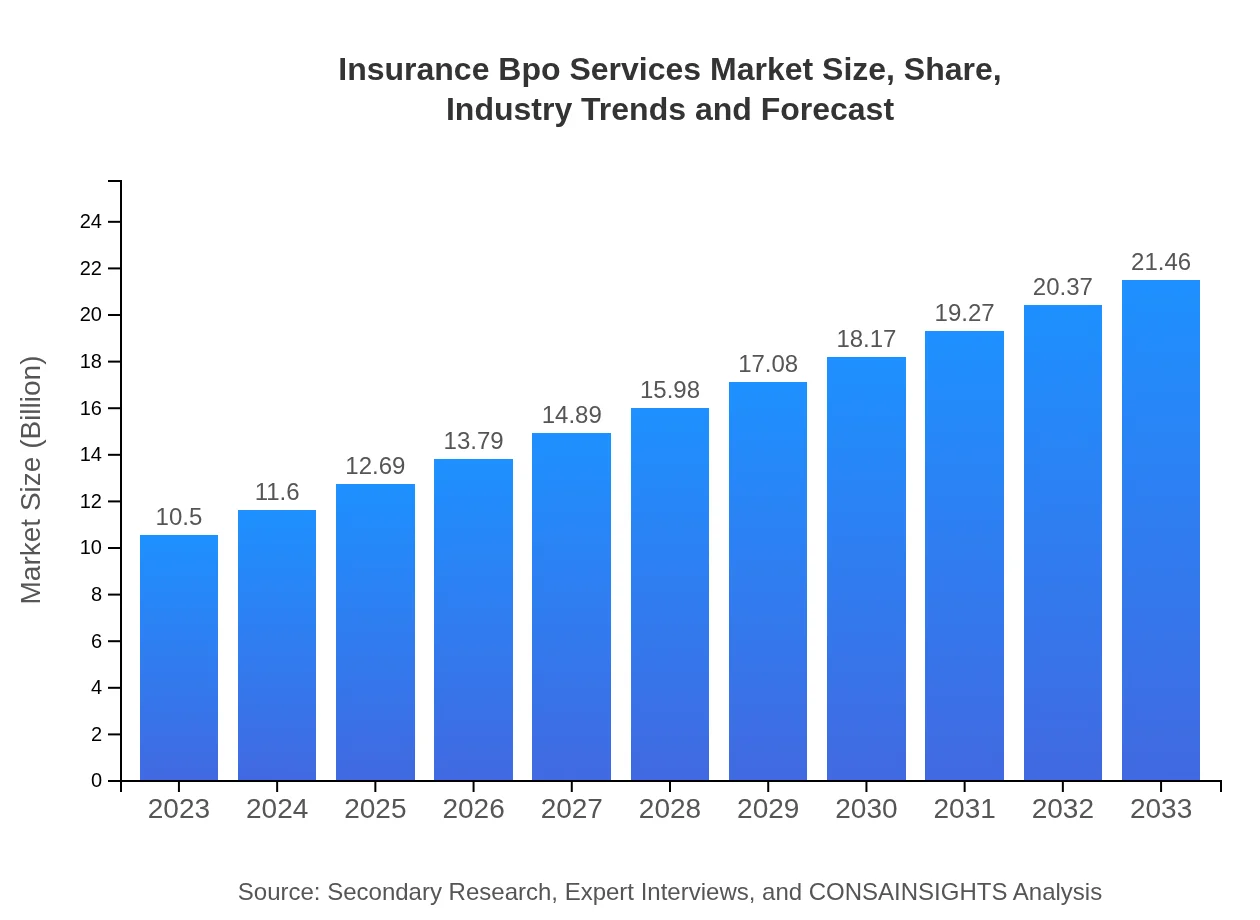

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $21.46 Billion |

| Top Companies | Cognizant, Genpact, TCS (Tata Consultancy Services), Wipro, Infosys |

| Last Modified Date | 24 January 2026 |

Insurance Bpo Services Market Overview

Customize Insurance Bpo Services Market Report market research report

- ✔ Get in-depth analysis of Insurance Bpo Services market size, growth, and forecasts.

- ✔ Understand Insurance Bpo Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Insurance Bpo Services

What is the Market Size & CAGR of Insurance Bpo Services market in 2023?

Insurance Bpo Services Industry Analysis

Insurance Bpo Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Insurance Bpo Services Market Analysis Report by Region

Europe Insurance Bpo Services Market Report:

The European market size stands at approximately $3.03 billion in 2023 and is projected to grow to $6.20 billion by 2033. Europe is characterized by an increasing focus on regulatory compliance and digitalization, which is pushing insurers to outsource more business processes.Asia Pacific Insurance Bpo Services Market Report:

The Asia Pacific region holds a significant share of the Insurance BPO Services market, with a market size of $1.98 billion in 2023, projected to grow to $4.05 billion by 2033. Key markets like India and China are leveraging their skilled workforce and cost advantages to attract global insurance companies seeking BPO solutions.North America Insurance Bpo Services Market Report:

North America represents the largest market for Insurance BPO Services, valued at approximately $3.92 billion in 2023. This market is anticipated to expand to $8.00 billion by 2033. The U.S. remains at the forefront due to its high insurance expenditure and increasing adoption of advanced technological solutions in BPO.South America Insurance Bpo Services Market Report:

In South America, the market for Insurance BPO Services is estimated to be $0.63 billion in 2023, with expectations of reaching $1.28 billion by 2033. Brazil and Argentina are leading the way, driven by increasing foreign investments and the demand for cost-effective operational solutions.Middle East & Africa Insurance Bpo Services Market Report:

The Middle East and Africa market is forecasted to grow from $0.94 billion in 2023 to approximately $1.93 billion by 2033. Economic diversification and the implementation of digital technologies are encouraging insurers in this region to adopt BPO services.Tell us your focus area and get a customized research report.

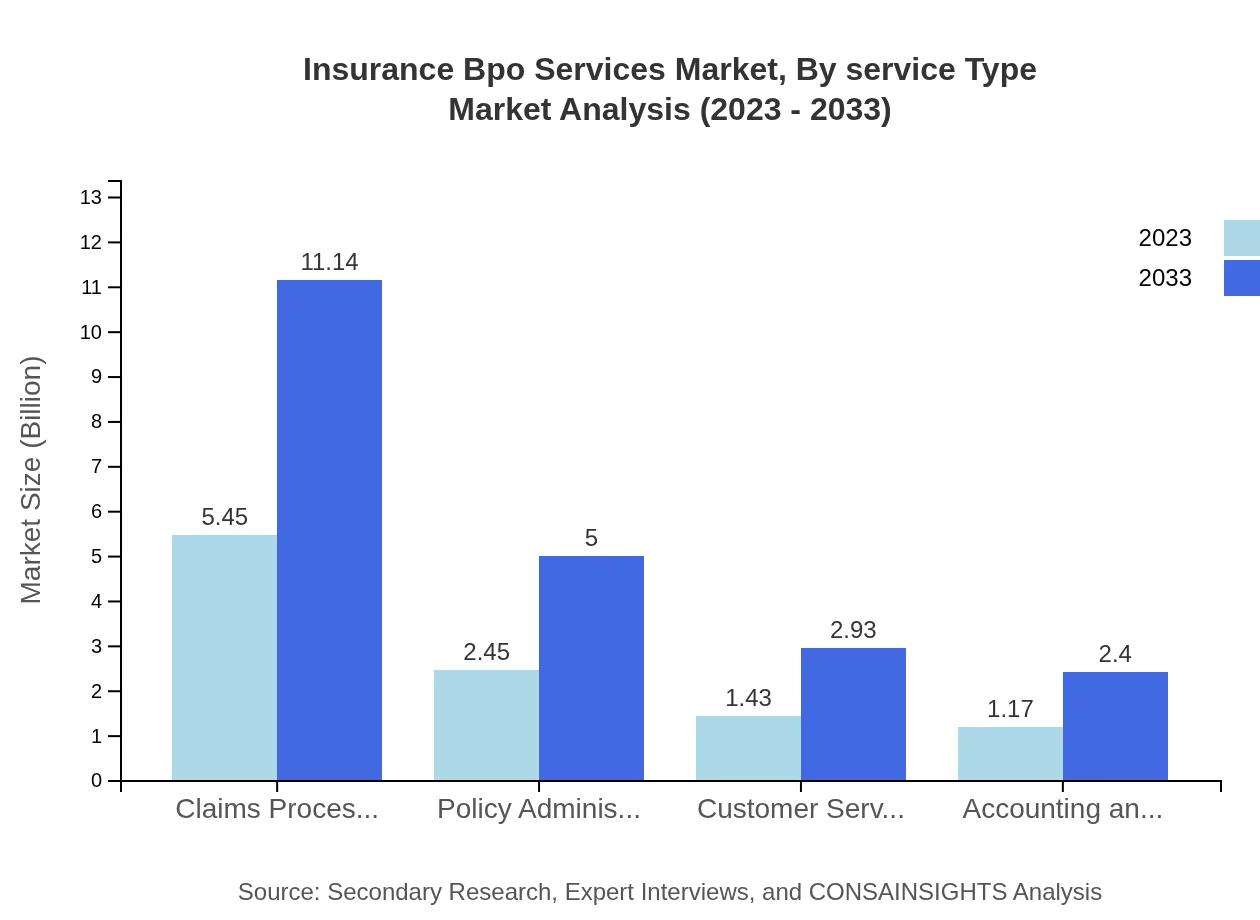

Insurance Bpo Services Market Analysis By Service Type

The service type segment includes: 1. **Claims Processing**: The market size is $5.45 billion in 2023, expected to reach $11.14 billion by 2033, holding a market share of 51.89% in 2023. 2. **Policy Administration**: This segment is valued at $2.45 billion in 2023 and projected to reach $5.00 billion by 2033 (23.31% share). 3. **Customer Service**: Estimated at $1.43 billion in 2023, growing to $2.93 billion by 2033 (13.63% share). 4. **Accounting and Finance**: Valued at $1.17 billion in 2023, this service is projected to reach $2.40 billion (11.17% share).

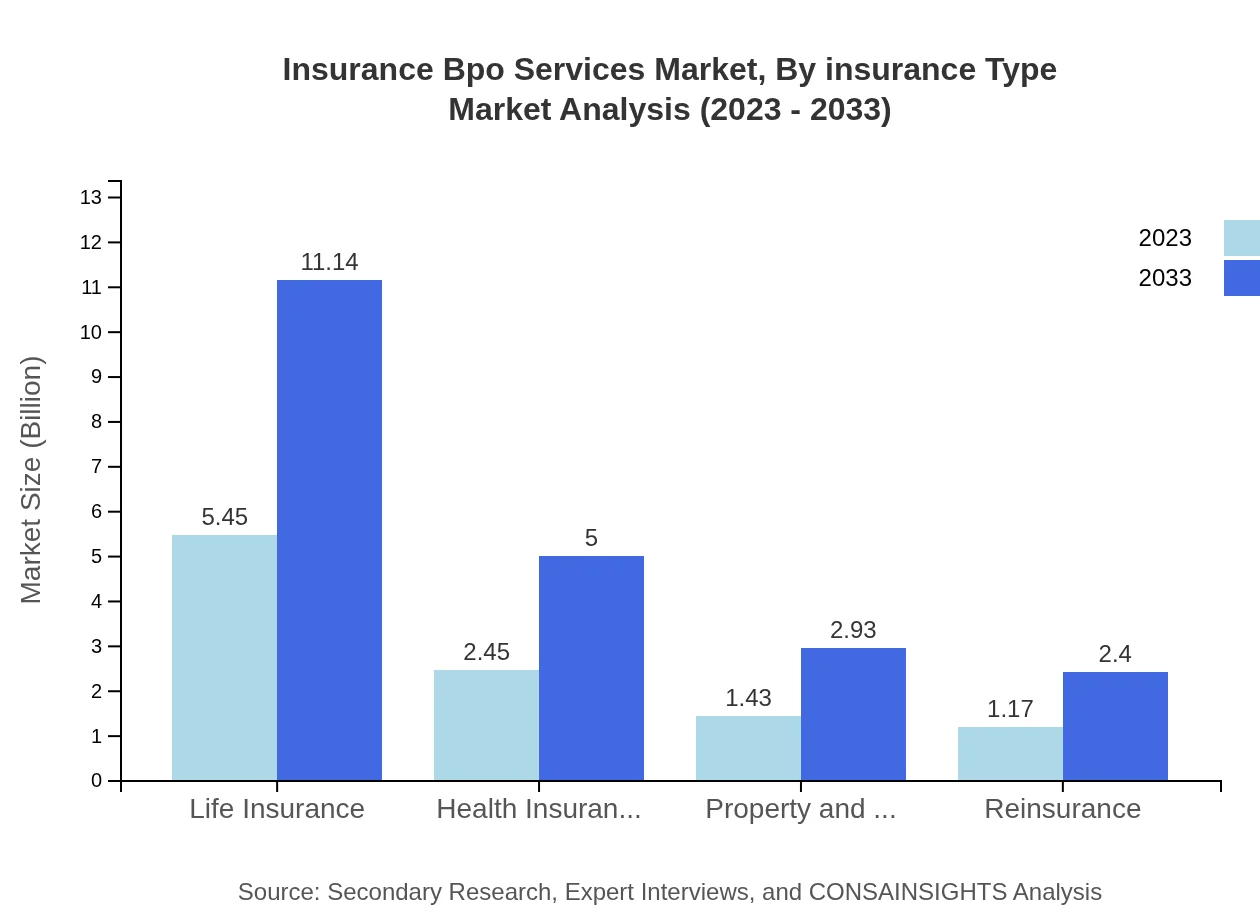

Insurance Bpo Services Market Analysis By Insurance Type

The market also segments by insurance type, including: 1. **Life Insurance**: Valued at $5.45 billion in 2023, growing to $11.14 billion by 2033. 2. **Health Insurance**: Expected to grow from $2.45 billion in 2023 to $5.00 billion by 2033. 3. **Property and Casualty**: Estimated at $1.43 billion in 2023, reaching $2.93 billion by 2033. 4. **Reinsurance**: This segment is expected to grow from $1.17 billion in 2023 to $2.40 billion by 2033.

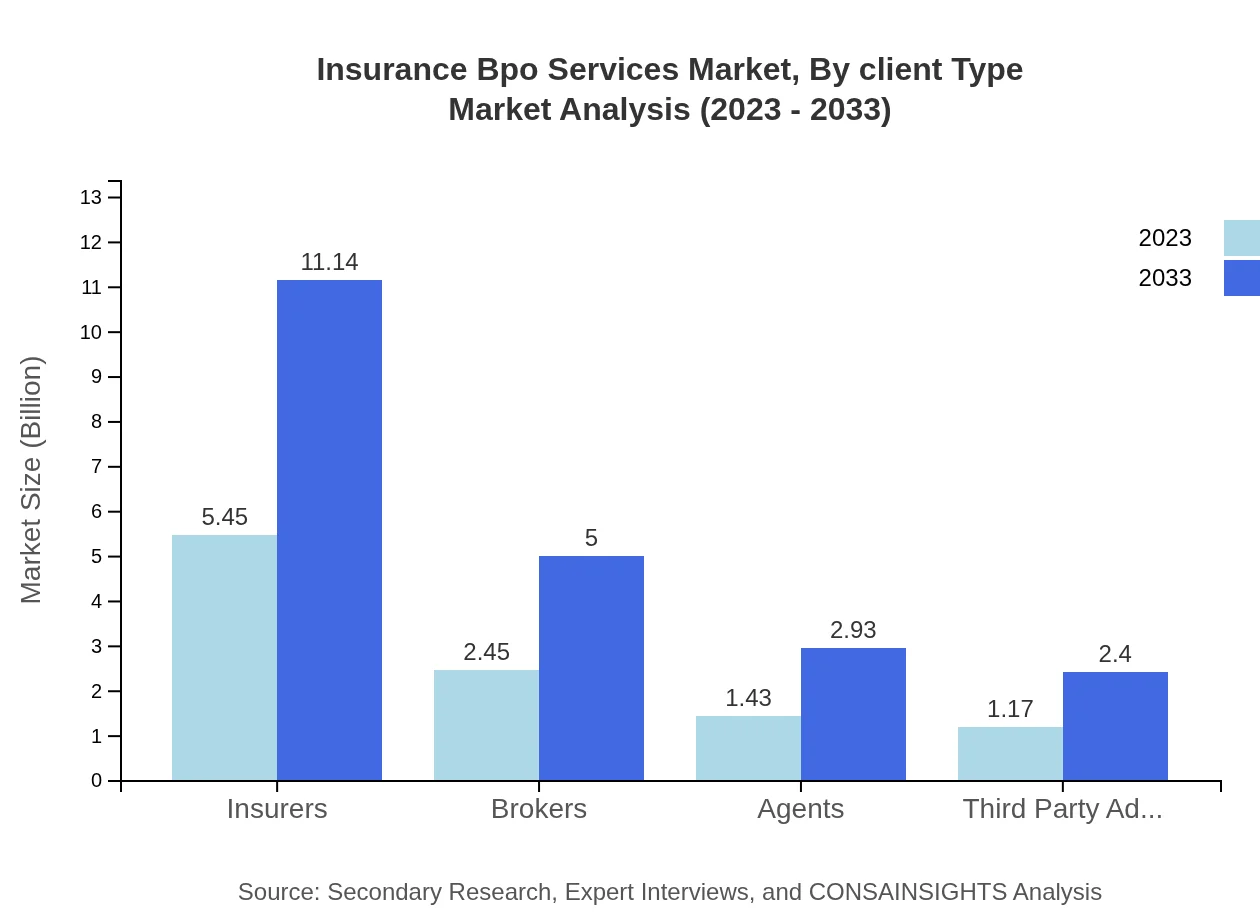

Insurance Bpo Services Market Analysis By Client Type

The client type segmentation shows: 1. **Insurers**: The largest segment with a size of $5.45 billion in 2023, expected to reach $11.14 billion by 2033. 2. **Brokers**: Projected to grow from $2.45 billion in 2023 to $5.00 billion by 2033. 3. **Agents**: Expected to rise from $1.43 billion in 2023 to $2.93 billion by 2033. 4. **Third Party Administrators**: Estimated growth from $1.17 billion in 2023 to $2.40 billion by 2033.

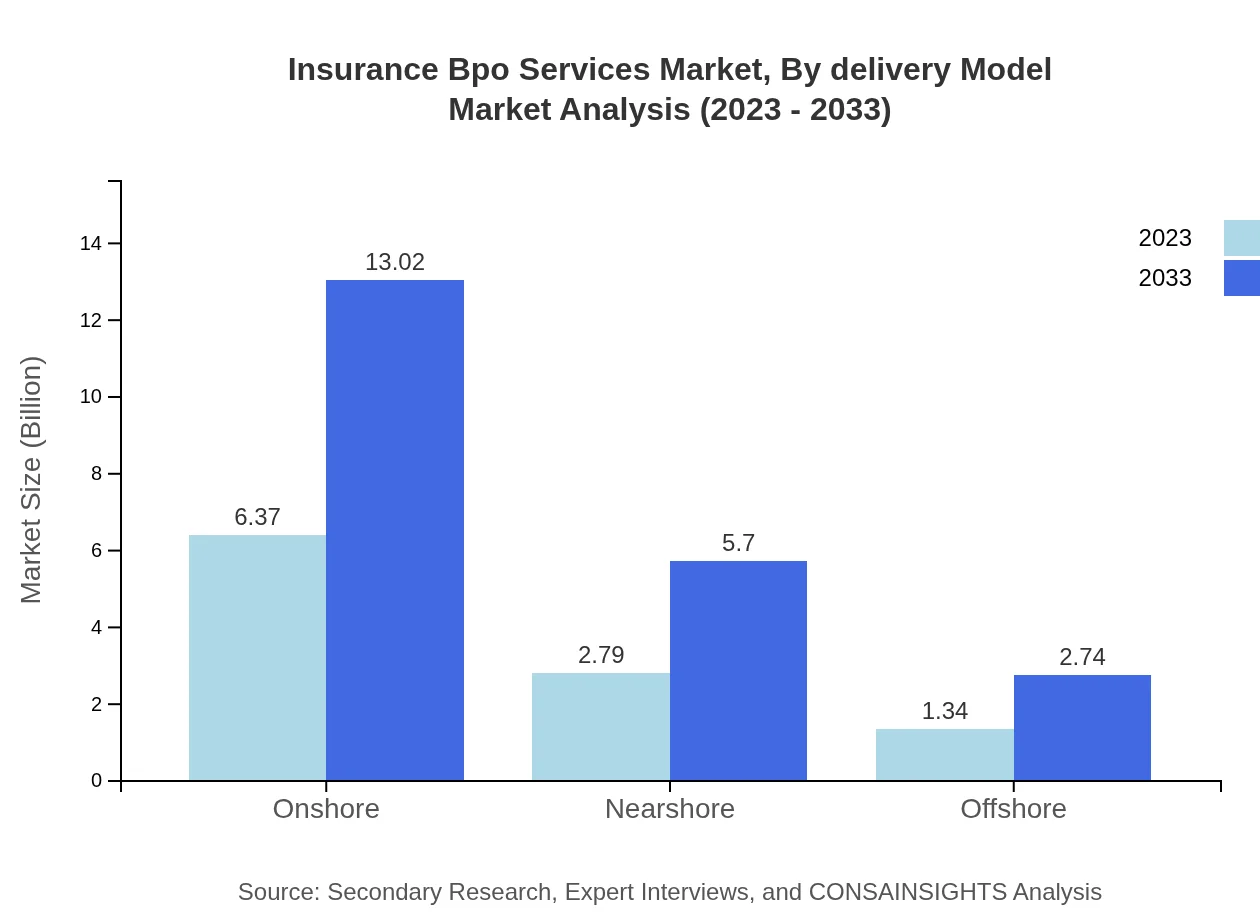

Insurance Bpo Services Market Analysis By Delivery Model

The market segments by delivery model: 1. **Onshore**: Valued at $6.37 billion in 2023, reaching $13.02 billion by 2033. 2. **Nearshore**: Estimated at $2.79 billion in 2023, projected to grow to $5.70 billion by 2033. 3. **Offshore**: Expected growth from $1.34 billion in 2023 to $2.74 billion by 2033.

Insurance Bpo Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Insurance Bpo Services Industry

Cognizant:

Cognizant is a multinational technology company providing IT services, including BPO solutions tailored for the insurance sector. They focus on enhanced customer experiences and operational efficiency.Genpact:

Genpact specializes in digital transformation and offers comprehensive BPO services for insurance businesses enhancing their operational framework and efficiency.TCS (Tata Consultancy Services):

TCS provides global BPO solutions with a strong focus on the insurance domain, helping companies to streamline their operational processes and improve service delivery.Wipro:

Wipro offers innovative BPO solutions for the insurance industry, focusing on improving customer service and optimizing claims processing.Infosys:

Infosys delivers end-to-end BPO services for the insurance sector, focusing on leveraging data analytics and technology to enhance operational processes.We're grateful to work with incredible clients.

FAQs

What is the market size of insurance BPO services?

The global market size for insurance BPO services is estimated at $10.5 billion in 2023, with a robust CAGR of 7.2% projected until 2033, indicating significant growth potential in this sector.

What are the key market players or companies in the insurance BPO services industry?

Key players in the insurance BPO services market include major firms such as Accenture, Cognizant, and Genpact, recognized for providing technological solutions and outsourcing services that enhance efficiency and customer experience.

What are the primary factors driving the growth in the insurance BPO services industry?

The growth in the insurance BPO services sector is driven by technological advancements, increasing demand for operational efficiency, cost reduction strategies, and the need for enhanced customer engagement in a competitive market.

Which region is the fastest Growing in insurance BPO services?

The fastest-growing region in the insurance BPO services market is North America, expected to increase from $3.92 billion in 2023 to $8.00 billion by 2033, indicating strong demand for outsourcing solutions in this area.

Does ConsaInsights provide customized market report data for the insurance BPO services industry?

Yes, ConsaInsights offers customized market report data for the insurance BPO services industry, tailored to specific client needs, including regional insights, segment analysis, and market forecasts.

What deliverables can I expect from this insurance BPO services market research project?

Deliverables from the insurance BPO services market research project typically include detailed market analysis reports, segment breakdowns, forecasts, and strategic recommendations to guide investment and operational decisions.

What are the market trends of insurance BPO services?

Current trends in the insurance BPO services market include increased adoption of AI and automation, a shift toward digital services, and a growing focus on customer experience to meet evolving consumer expectations.