Insurance Fraud Detection Market Report

Published Date: 31 January 2026 | Report Code: insurance-fraud-detection

Insurance Fraud Detection Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive overview of the Insurance Fraud Detection market from 2023 to 2033, analyzing market trends, size, segmentation, and key players to offer valuable insights for stakeholders.

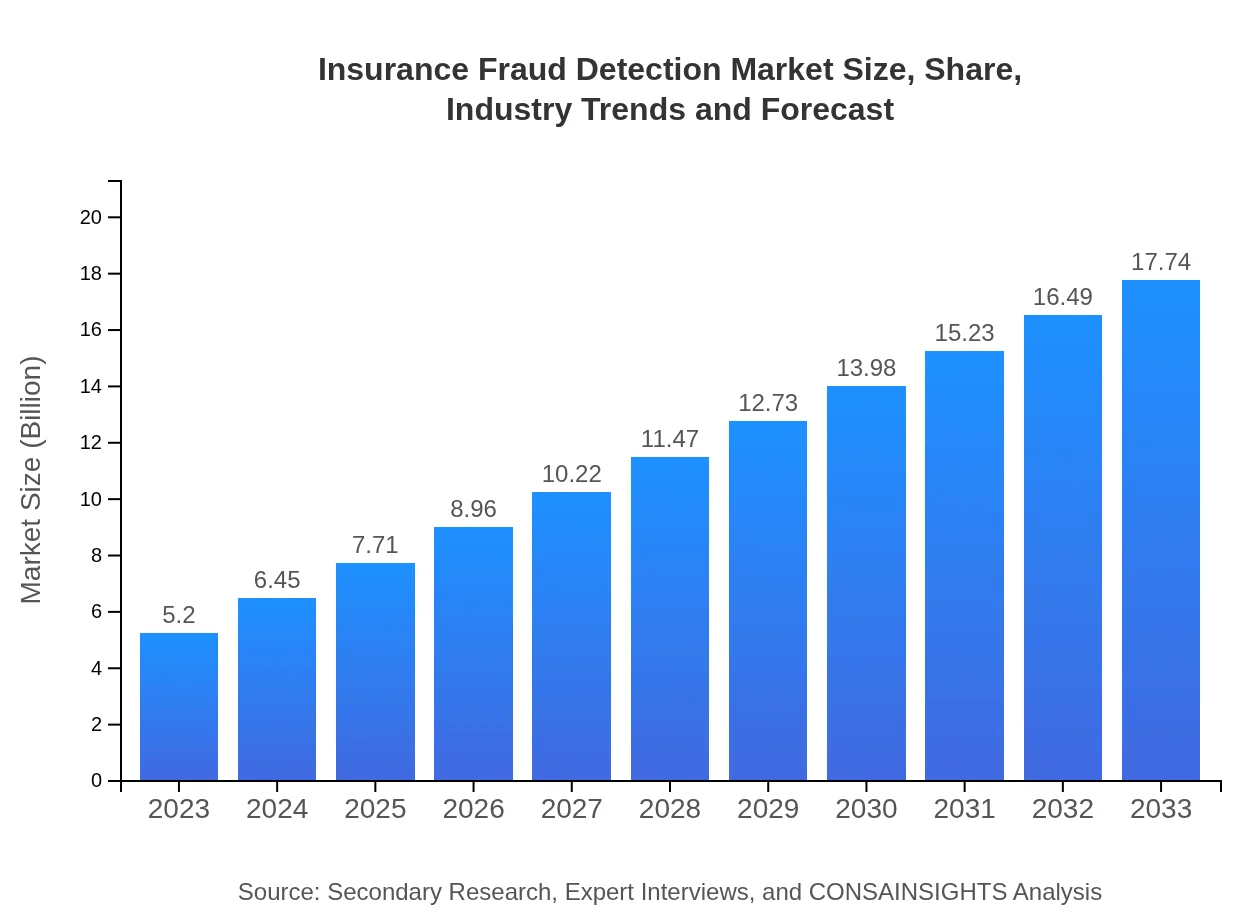

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 12.5% |

| 2033 Market Size | $17.74 Billion |

| Top Companies | SAS Institute Inc., FICO (Fair Isaac Corporation), Experian PLC, LexisNexis Risk Solutions, IBM Corporation |

| Last Modified Date | 31 January 2026 |

Insurance Fraud Detection Market Overview

Customize Insurance Fraud Detection Market Report market research report

- ✔ Get in-depth analysis of Insurance Fraud Detection market size, growth, and forecasts.

- ✔ Understand Insurance Fraud Detection's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Insurance Fraud Detection

What is the Market Size & CAGR of Insurance Fraud Detection market in 2033?

Insurance Fraud Detection Industry Analysis

Insurance Fraud Detection Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Insurance Fraud Detection Market Analysis Report by Region

Europe Insurance Fraud Detection Market Report:

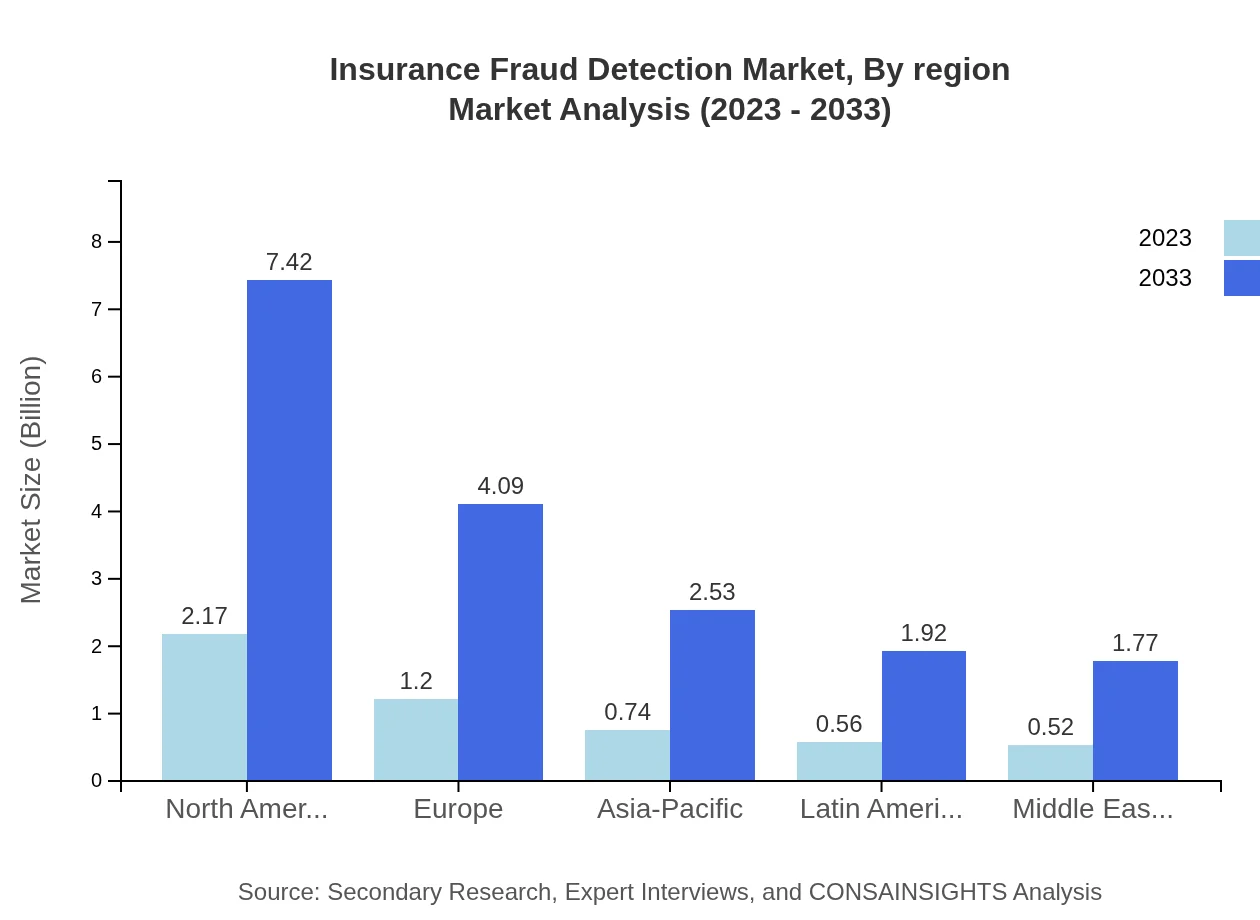

The European market for Insurance Fraud Detection is expected to experience growth from USD 1.90 billion in 2023 to USD 6.49 billion by 2033, driven by stringent regulations and increasing fraud incidents. Insurers are prioritizing the integration of cutting-edge technologies to enhance their fraud detection capabilities.Asia Pacific Insurance Fraud Detection Market Report:

The Asia Pacific region is poised for substantial growth in the Insurance Fraud Detection market, anticipated to reach USD 3.32 billion by 2033 from USD 0.97 billion in 2023. With the rapid digitalization of insurance services and increasing mobile data usage, insurers are actively looking to implement robust fraud detection measures. Governments are also emphasizing regulations that encourage insurance transparency and fraud prevention.North America Insurance Fraud Detection Market Report:

North America leads the Insurance Fraud Detection market, projected to reach USD 5.92 billion by 2033 from USD 1.73 billion in 2023. Heavy investments by insurance giants in advanced technologies, particularly AI and predictive analytics, have established a robust infrastructure for fraud detection and prevention.South America Insurance Fraud Detection Market Report:

In South America, the market for Insurance Fraud Detection is expected to grow modestly, reaching USD 0.05 billion by 2033 from USD 0.02 billion in 2023. Limited technological adoption in some areas presents challenges, but growing awareness of fraud risks is prompting a shift toward advanced detection technologies.Middle East & Africa Insurance Fraud Detection Market Report:

In the Middle East and Africa, the market is projected to grow from USD 0.58 billion in 2023 to USD 1.96 billion by 2033. Rising insurance penetration rates and increased regulatory scrutiny are expected to boost demand for comprehensive fraud detection solutions.Tell us your focus area and get a customized research report.

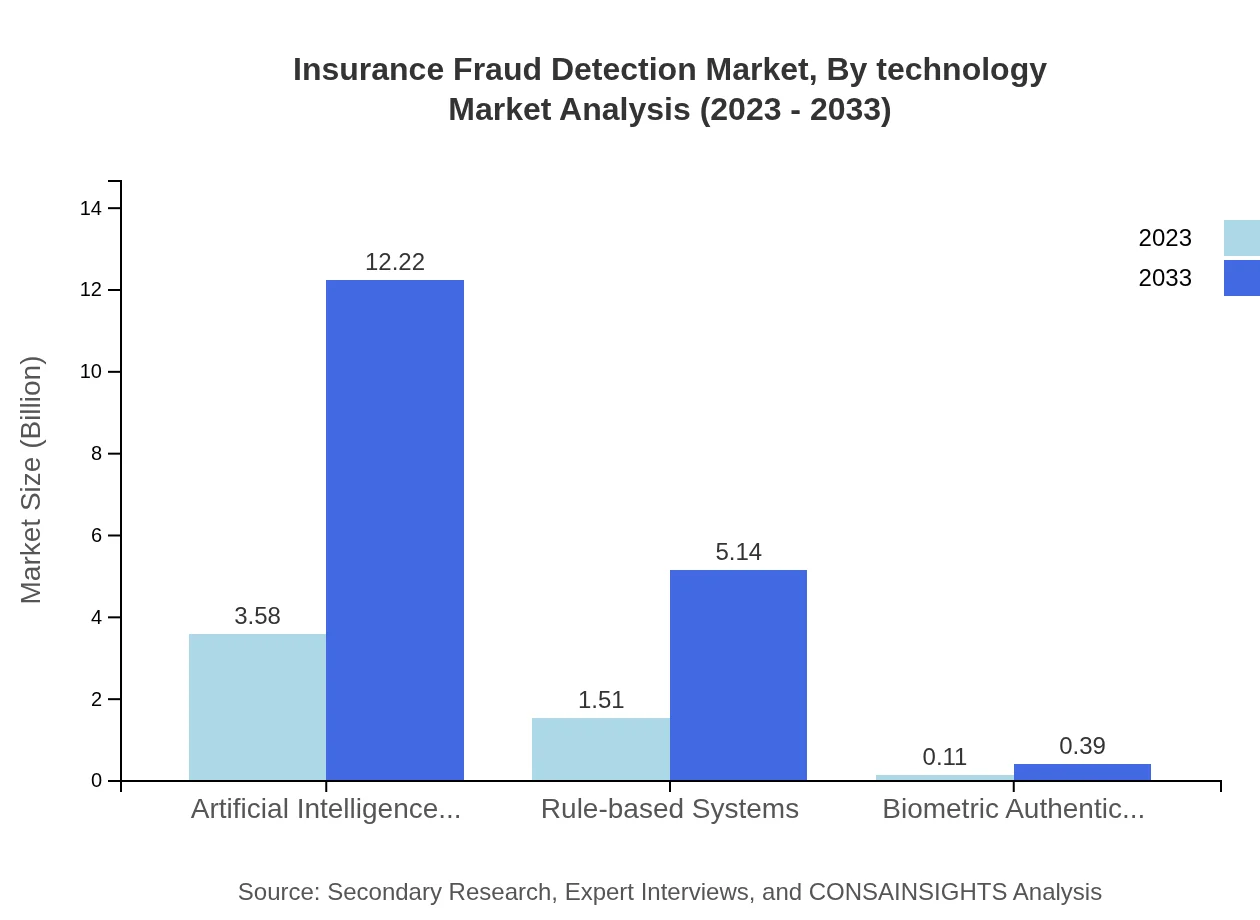

Insurance Fraud Detection Market Analysis By Technology

In the Insurance Fraud Detection Market, Artificial Intelligence & Machine Learning hold the largest market share, projected to grow from USD 3.58 billion in 2023 to USD 12.22 billion in 2033. Additionally, Rule-based Systems and Biometric Authentication are expected to contribute significantly, reflecting evolving needs for varied detection techniques.

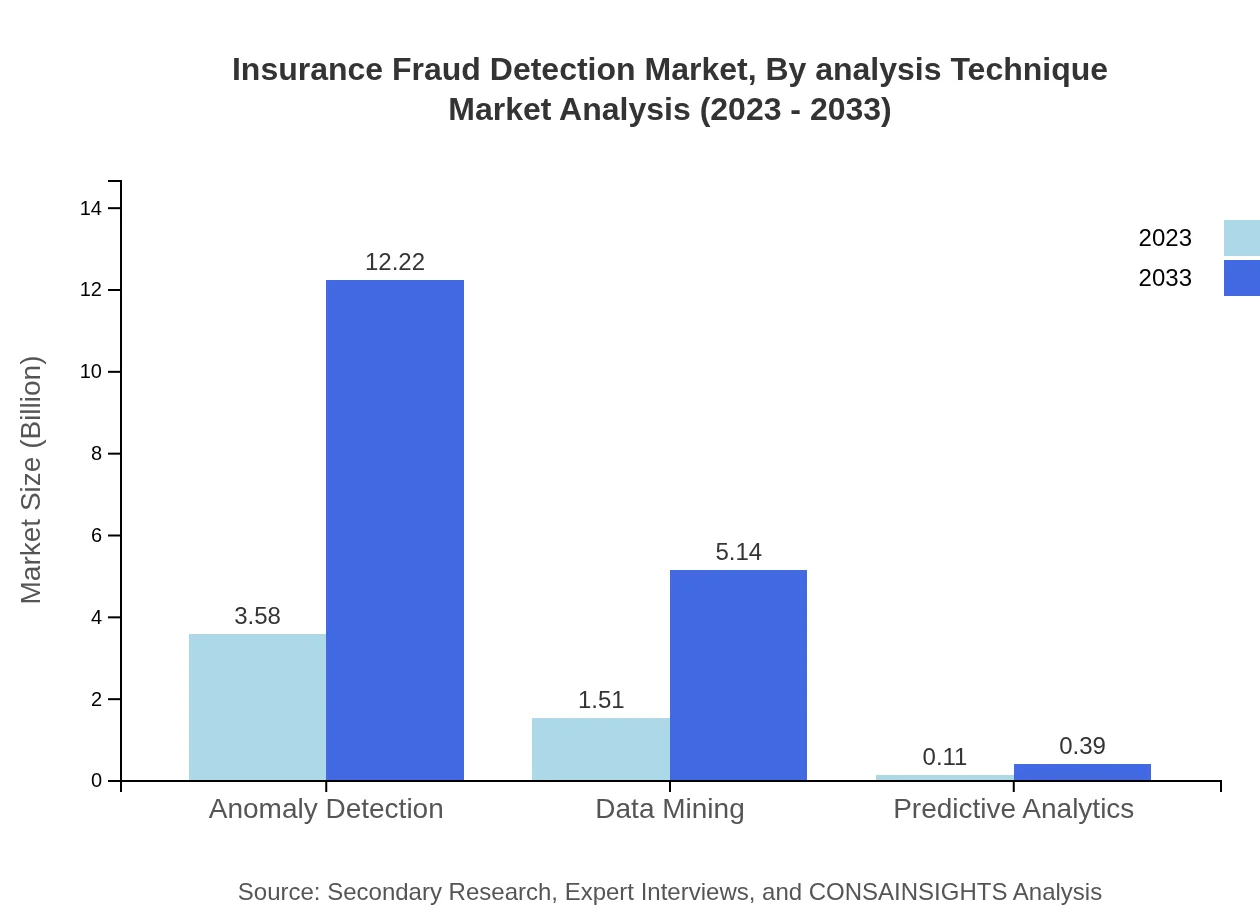

Insurance Fraud Detection Market Analysis By Analysis Technique

Segmented by analysis techniques, Anomaly Detection and Predictive Analytics are prominent, with significant market shares and growing adoption as insurers seek innovative ways to detect fraudulent activities proactively.

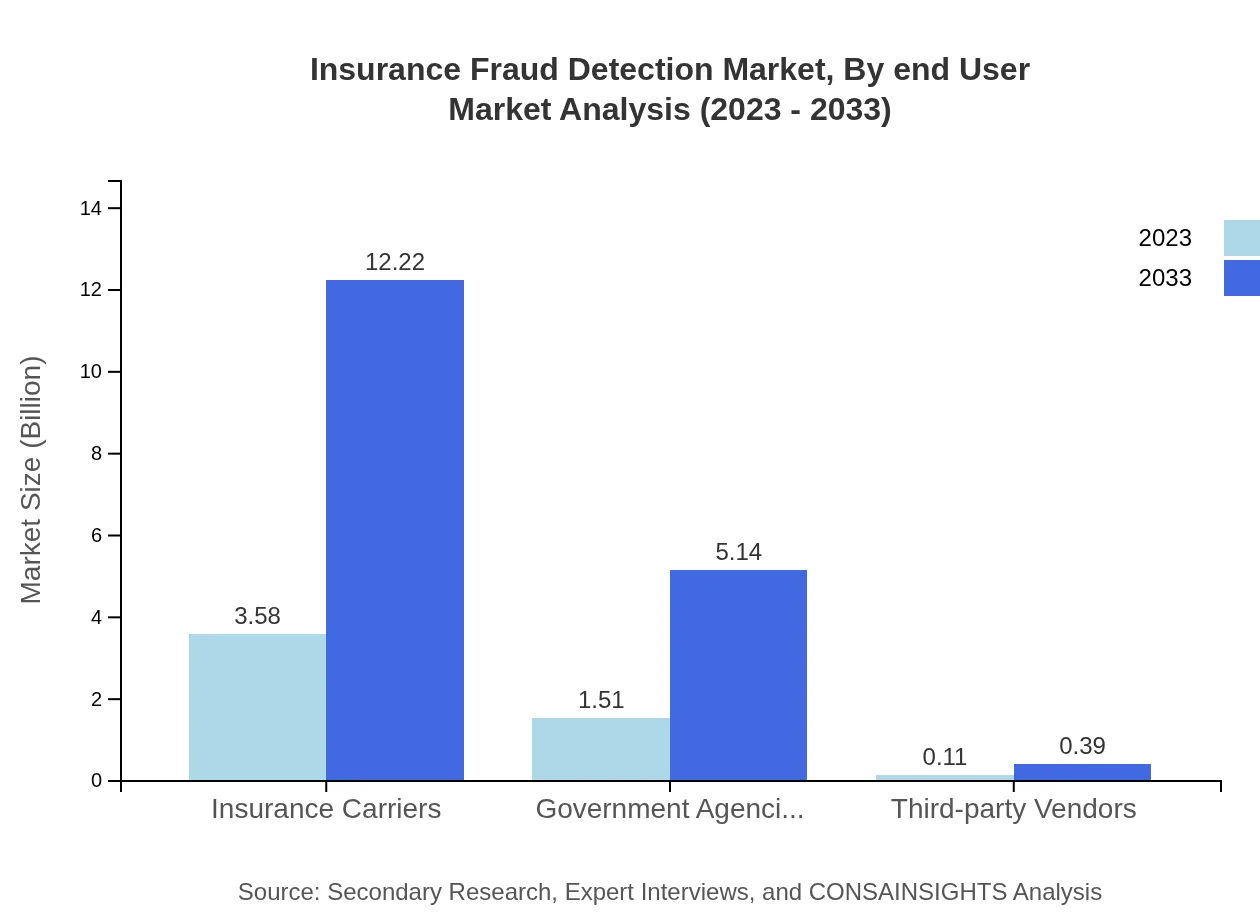

Insurance Fraud Detection Market Analysis By End User

Insurance Carriers dominate the market, accounting for approximately 68.86% of the total market share in 2023. Government Agencies are also notable end-users, focusing on compliance and regulatory requirements against increasing fraudulent activities.

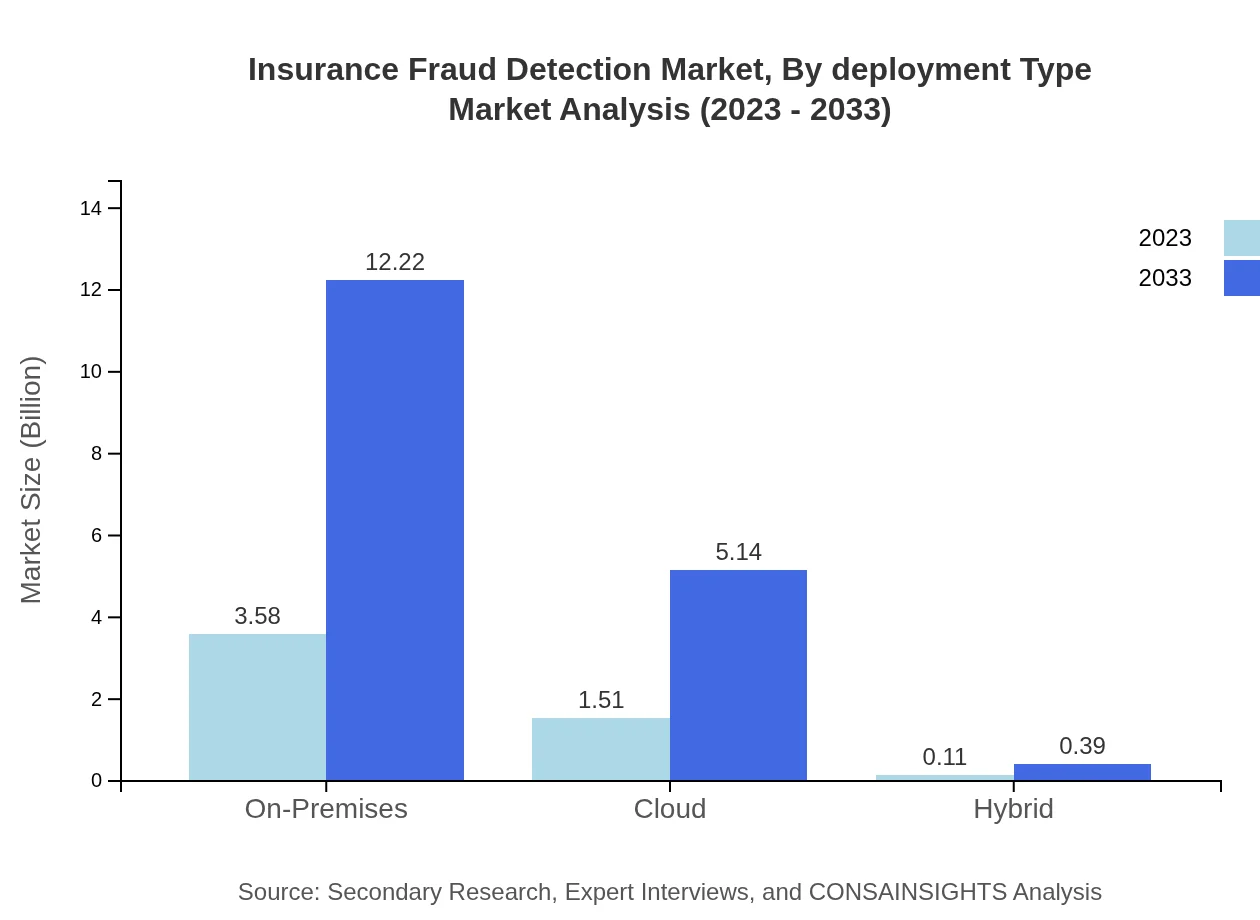

Insurance Fraud Detection Market Analysis By Deployment Type

On-Premises deployment currently accounts for the largest share due to the legacy systems in many insurance companies. However, Cloud-based solutions are witnessing rapid growth, expected to reach USD 5.14 billion by 2033 due to their flexibility and scalability.

Insurance Fraud Detection Market Analysis By Region

Geographically, North America is the largest market, followed by Europe. Each region represents unique challenges and opportunities, influenced by legislation, technological advancements, and market needs.

Insurance Fraud Detection Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Insurance Fraud Detection Industry

SAS Institute Inc.:

A leader in advanced analytics, SAS provides comprehensive solutions for fraud detection and prevention leveraging Artificial Intelligence and machine learning techniques.FICO (Fair Isaac Corporation):

FICO is well-known for its analytics and decision management tools, offering solutions that help insurers detect and manage insurance fraud more effectively.Experian PLC:

Experian offers powerful fraud detection and data verification services to insurers, enhancing their ability to prevent fraudulent claims and ensure compliance.LexisNexis Risk Solutions:

A subsidiary of RELX Group, LexisNexis provides integrated solutions for fraud detection through data analytics and advanced risk management technologies.IBM Corporation:

IBM leverages its Watson technology to offer AI-driven fraud detection solutions, positioning itself as a tech leader in insurance fraud analytics.We're grateful to work with incredible clients.

FAQs

What is the market size of insurance Fraud Detection?

The insurance fraud detection market is currently valued at approximately $5.2 billion in 2023, with a projected CAGR of 12.5% from 2023 to 2033. This growth indicates a robust demand for technologies to combat and prevent insurance fraud, enhancing market viability.

What are the key market players or companies in this insurance Fraud Detection industry?

Key players in the insurance fraud detection market include prominent insurance carriers, government agencies, and third-party vendors specializing in financial technology solutions. Their collective innovations drive competition and improve the overall effectiveness of fraud detection measures across the industry.

What are the primary factors driving the growth in the insurance Fraud Detection industry?

Factors driving growth include the increasing prevalence of insurance fraud, regulatory requirements for stricter compliance, advancements in artificial intelligence, and machine learning technologies. High financial losses due to fraudulent claims push businesses to invest in sophisticated fraud detection tools.

Which region is the fastest Growing in the insurance Fraud Detection?

The fastest-growing region for insurance fraud detection is Europe, with the market size projected to grow from $1.90 billion in 2023 to $6.49 billion by 2033. Other regions such as Asia-Pacific are also experiencing significant growth due to increasing digitalization.

Does ConsaInsights provide customized market report data for the insurance Fraud Detection industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the insurance fraud detection industry. This customization allows clients to gain deep insights and make informed decisions based on relevant market trends and metrics.

What deliverables can I expect from this insurance Fraud Detection market research project?

Clients can expect comprehensive market analysis reports that include market size, growth forecasts, competitive landscape assessments, regional insights, and segment analysis. These deliverables facilitate strategic planning and help identify key opportunities in the insurance landscape.

What are the market trends of insurance Fraud Detection?

Current trends in the insurance fraud detection market include heightened adoption of AI and machine learning for predictive analytics, increased reliance on data mining techniques, and enhanced collaboration between insurers and technology firms to improve fraud detection capabilities.