Insurance Telematics Market Report

Published Date: 31 January 2026 | Report Code: insurance-telematics

Insurance Telematics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Insurance Telematics market, covering industry trends, segmentation, regional insights, market size forecasts from 2023 to 2033, and key players impacting the landscape.

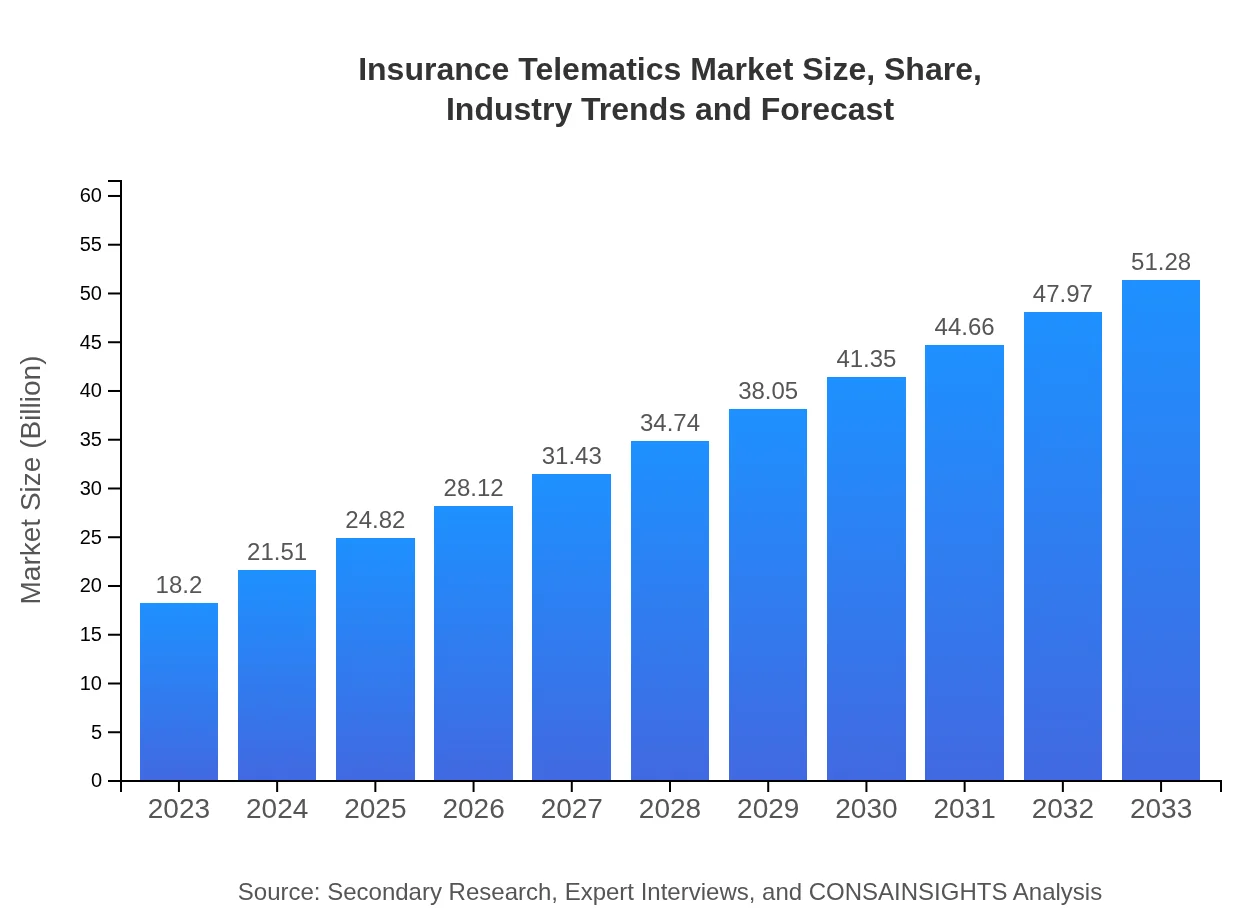

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $18.20 Billion |

| CAGR (2023-2033) | 10.5% |

| 2033 Market Size | $51.28 Billion |

| Top Companies | Verisk Analytics, Octo Telematics, Allstate Insurance, Liberty Mutual |

| Last Modified Date | 31 January 2026 |

Insurance Telematics Market Overview

Customize Insurance Telematics Market Report market research report

- ✔ Get in-depth analysis of Insurance Telematics market size, growth, and forecasts.

- ✔ Understand Insurance Telematics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Insurance Telematics

What is the Market Size & CAGR of Insurance Telematics market in 2023?

Insurance Telematics Industry Analysis

Insurance Telematics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Insurance Telematics Market Analysis Report by Region

Europe Insurance Telematics Market Report:

By 2023, Europe is expected to hold a substantial market value of $4.92 billion, reaching approximately $13.86 billion by 2033. The emphasis on sustainable transport solutions and stringent regulatory frameworks endorsing telematics will offer significant growth opportunities.Asia Pacific Insurance Telematics Market Report:

In 2023, the Asia Pacific Insurance Telematics market is valued at $3.85 billion and is expected to grow to $10.85 billion by 2033. The rapid urbanization and increasing safety regulations in countries like India and China drive the demand for telematics solutions, alongside a growing middle-class population open to opting for innovative insurance solutions.North America Insurance Telematics Market Report:

In North America, the market is anticipated to grow from $6.28 billion in 2023 to $17.70 billion by 2033. Dominated by high consumer awareness and a large number of service-oriented companies implementing telematics, this region is at the forefront of innovation and adoption of telematics-based insurance.South America Insurance Telematics Market Report:

The South American Insurance Telematics market was valued at $0.83 billion in 2023 and is projected to reach $2.34 billion by 2033. As the region develops technologically and regulatory models evolve, the demand for personalized insurance products is expected to burgeon, assisted by government initiatives towards vehicle safety improvements.Middle East & Africa Insurance Telematics Market Report:

The Middle East and Africa market, valued at $2.31 billion in 2023, is projected to grow to $6.52 billion by 2033. The growing emphasis on vehicle safety and the adoption of smart fleet management systems portends significant growth for insurance telematics in this burgeoning market.Tell us your focus area and get a customized research report.

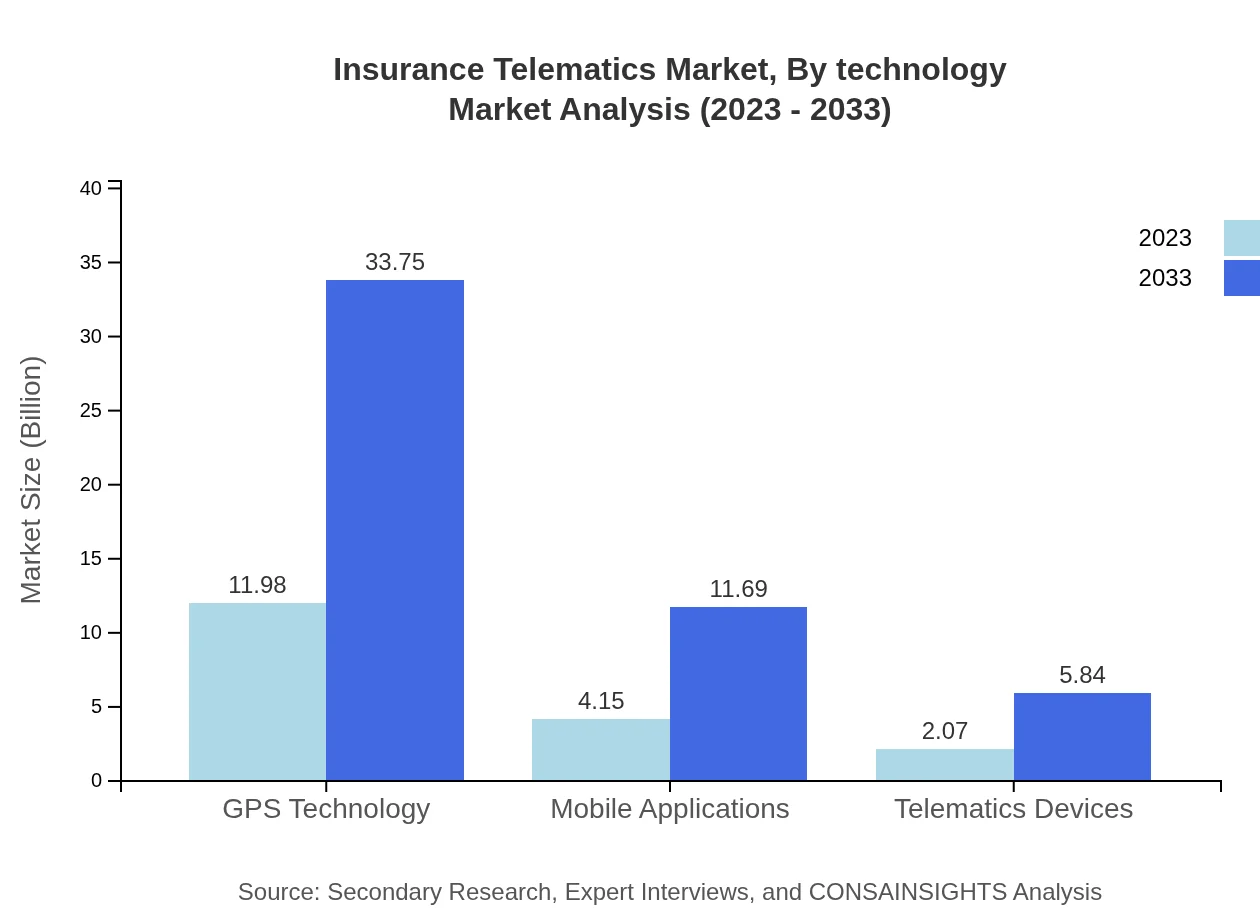

Insurance Telematics Market Analysis By Technology

The Insurance Telematics market demonstrates a significant focus on technology segments such as GPS Technology ($11.98 billion in 2023), Real-time Analytics ($14.60 billion), and associated devices transforming insurance premium structures and consumer engagement through comprehensive data analysis techniques.

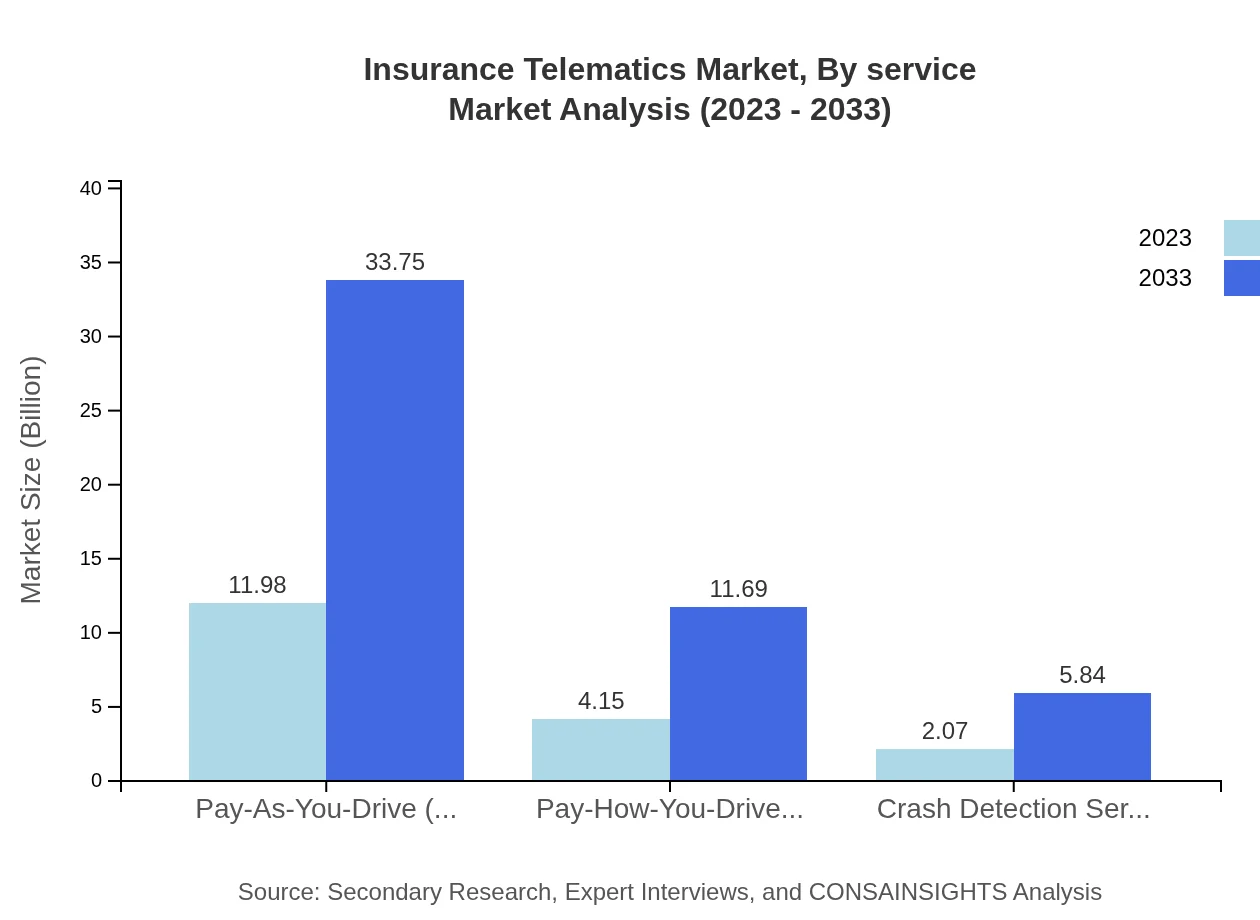

Insurance Telematics Market Analysis By Service

Service segments include Pay-As-You-Drive (PAYD) which is dominating the market with estimates of $11.98 billion in 2023, and Pay-How-You-Drive (PHYD) valued at $4.15 billion. Both offer pivotal avenues for sustaining consumer-favored insurance products.

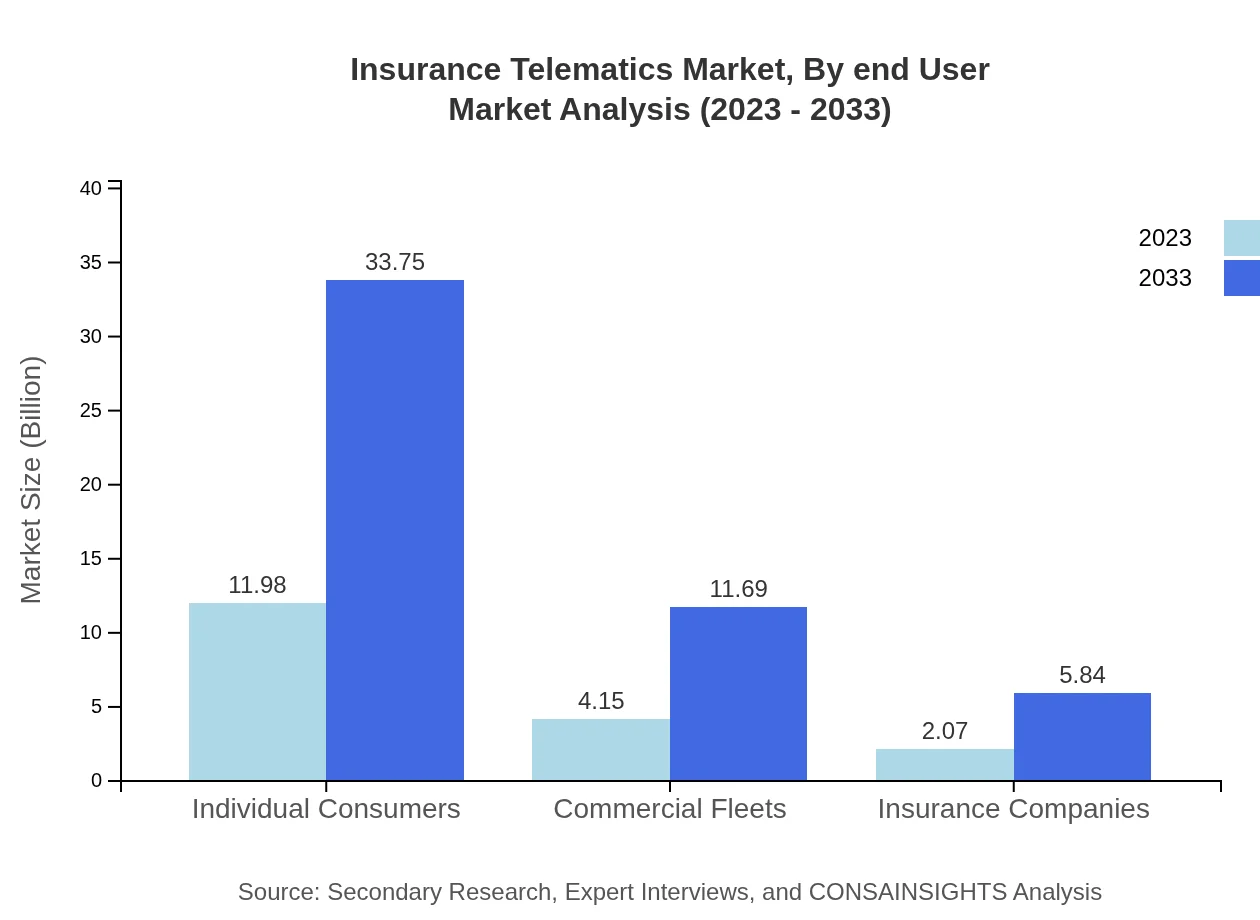

Insurance Telematics Market Analysis By End User

Individual consumers remain the key end-users comprising a significant share of revenues at $11.98 billion in 2023, while commercial fleets are valued at $4.15 billion. This segmentation indicates a broader consumer base embracing telematics-driven insurance solutions.

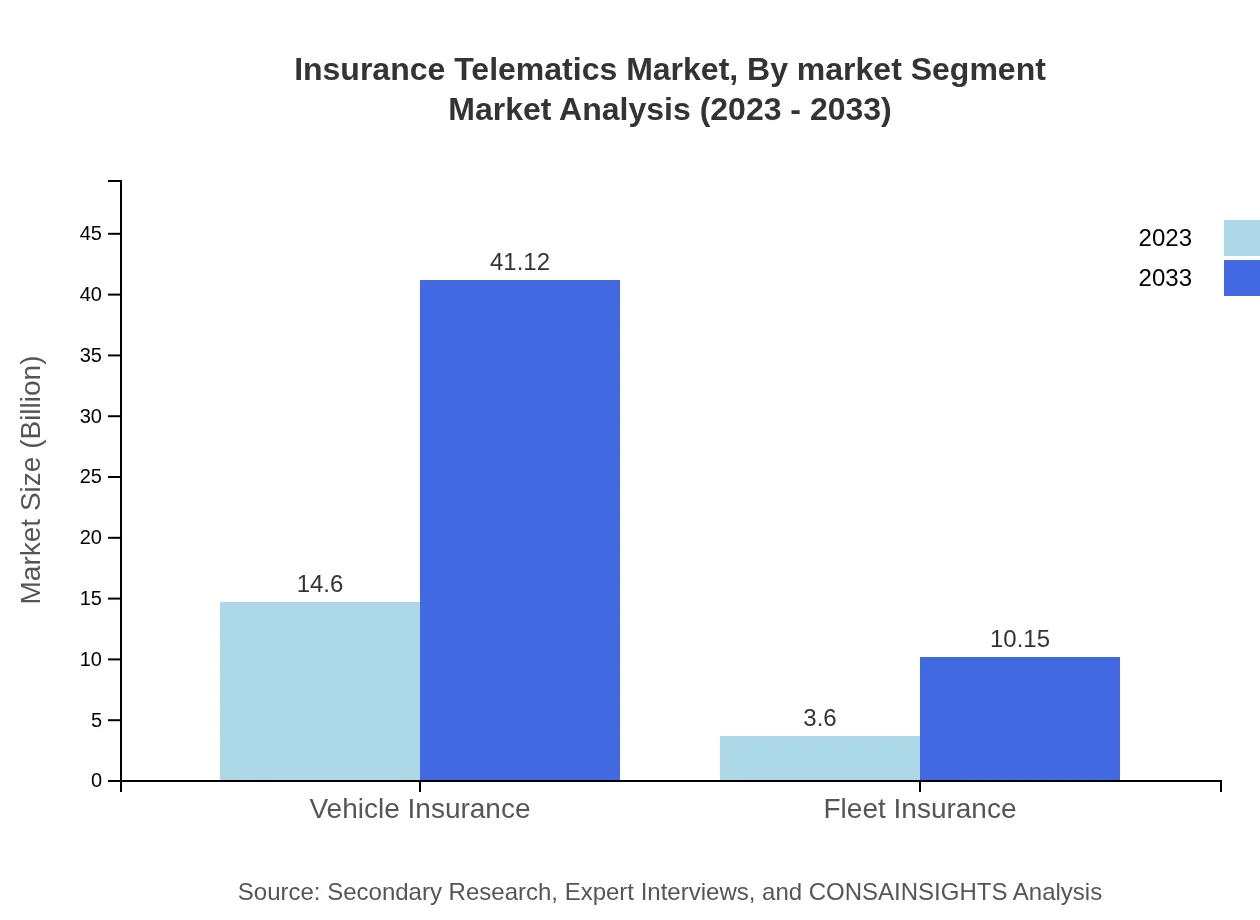

Insurance Telematics Market Analysis By Market Segment

Through individual segments, commercial fleets and insurance companies highlight distinct contributions to the telematics domain. The market dynamics challenge insurers to innovate continuously to meet varying consumer needs and regulatory demands.

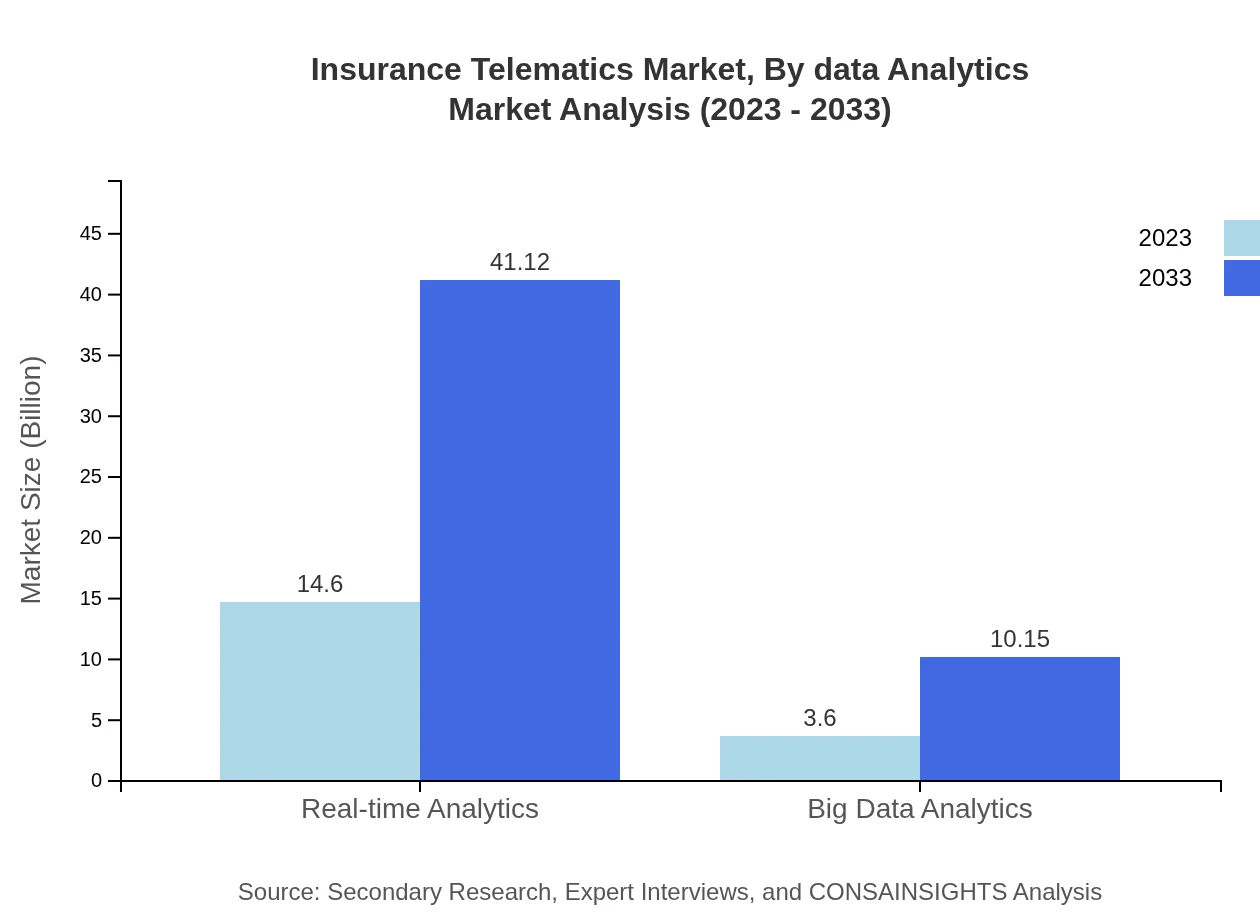

Insurance Telematics Market Analysis By Data Analytics

Data analytics plays a crucial role with categories like Big Data Analytics estimated at $3.60 billion in 2023 and Real-time Analytics leading market dynamics at $14.60 billion. Advanced analytics are transforming risk assessment and lowering operational inefficiencies for insurers.

Insurance Telematics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Insurance Telematics Industry

Verisk Analytics:

A leader in data analytics and predictive modeling solutions, Verisk Analytics provides powerful insights through telematics to insurance companies, enhancing pricing and underwriting processes.Octo Telematics:

Specializes in telematics solutions, Octo uses comprehensive data to tailor insurance policies and enhance road safety for consumers and insurers alike.Allstate Insurance:

As one of the largest insurance providers, Allstate leverages telematics to offer personalized insurance solutions based on real-time driving behaviors.Liberty Mutual:

Liberty Mutual employs advanced telematics to dynamically price vehicle insurance based on users' driving habits, focusing on safety-enhancing technology.We're grateful to work with incredible clients.

FAQs

What is the market size of insurance telematics?

The insurance telematics market is projected to reach approximately $18.2 billion by 2033, growing at a CAGR of 10.5%. This growth indicates substantial investment and interest in telematics technologies within the insurance sector.

What are the key market players or companies in this insurance telematics industry?

Key players include major insurance firms, technology companies specializing in telematics, and automotive manufacturers integrating telematics solutions. Their collaborations drive advancements in data analytics and risk assessment, crucial for competitive advantage.

What are the primary factors driving the growth in the insurance telematics industry?

Growth drivers include increased demand for personalized insurance products, cost reductions through risk assessment, advancements in IoT technology, and consumer preference for usage-based insurance models, fostering innovation in telematics solutions.

Which region is the fastest Growing in the insurance telematics?

The fastest-growing region is North America, projected to grow from $6.28 billion in 2023 to $17.70 billion by 2033. Europe and Asia Pacific are also notable growth regions, reflecting global adoption of telematics.

Does ConsaInsights provide customized market report data for the insurance telematics industry?

Yes, ConsaInsights offers tailored market report solutions to address specific client needs. Clients can request customized data sets focusing on geographical, segment-based, or competitive analyses in the insurance telematics sector.

What deliverables can I expect from this insurance telematics market research project?

Deliverables typically include comprehensive market reports, detailed analysis of market trends, competitive landscape insights, forecasts, and strategic recommendations tailored to your objectives in the insurance telematics market.

What are the market trends of insurance telematics?

Trends include the shift towards real-time data analytics, increased adoption of usage-based insurance models, advancements in AI for risk evaluation, and a growing prominence of mobile applications and telematics devices in enhancing customer engagement.