Insurance Third Party Administrators Market Report

Published Date: 24 January 2026 | Report Code: insurance-third-party-administrators

Insurance Third Party Administrators Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Insurance Third Party Administrators market. It includes insights on market size, growth forecasts, segmentation, and detailed regional analyses for the period 2023-2033.

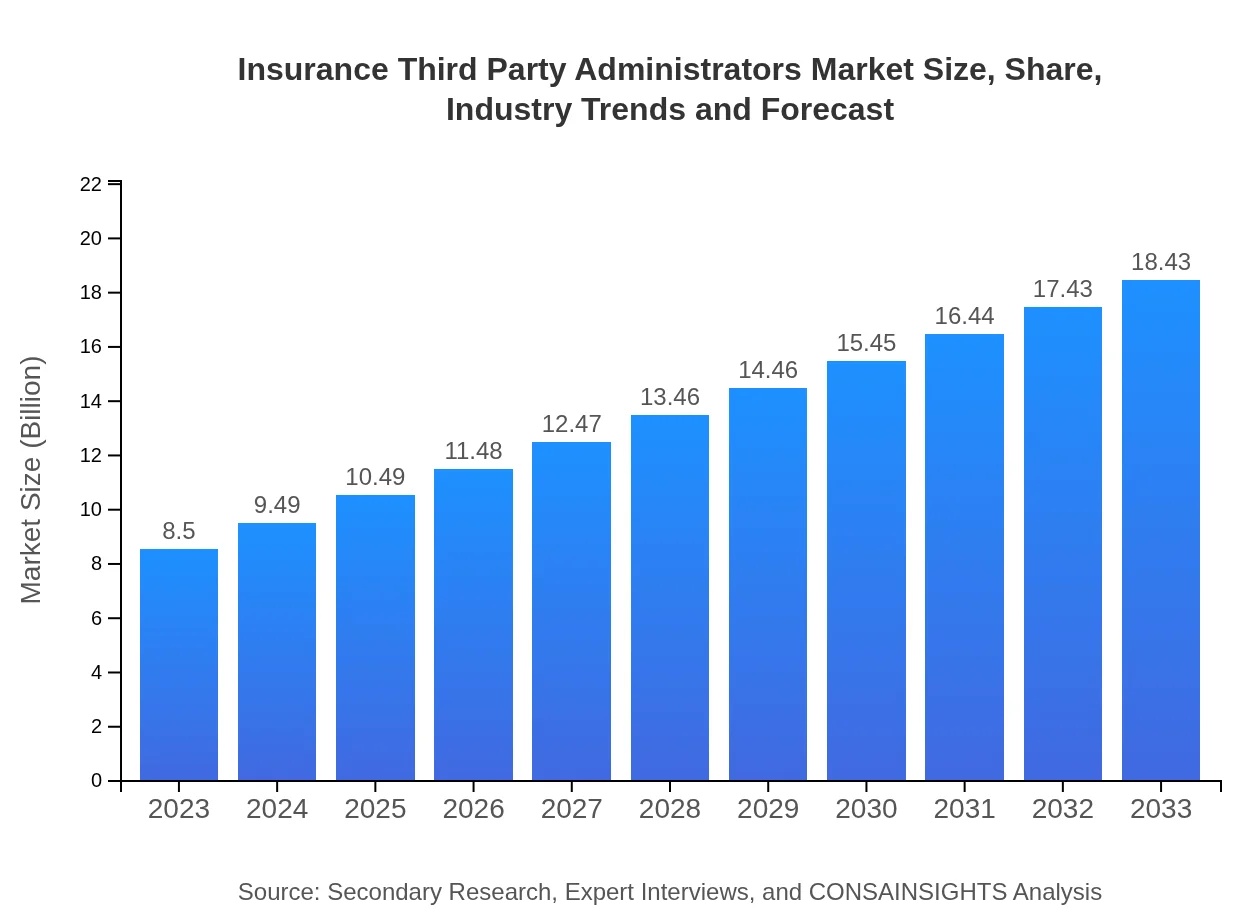

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.50 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $18.43 Billion |

| Top Companies | Sedgwick Claims Management Services, Crawford & Company, Willis Towers Watson, Genpact |

| Last Modified Date | 24 January 2026 |

Insurance Third Party Administrators Market Overview

Customize Insurance Third Party Administrators Market Report market research report

- ✔ Get in-depth analysis of Insurance Third Party Administrators market size, growth, and forecasts.

- ✔ Understand Insurance Third Party Administrators's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Insurance Third Party Administrators

What is the Market Size & CAGR of Insurance Third Party Administrators market in 2023?

Insurance Third Party Administrators Industry Analysis

Insurance Third Party Administrators Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Insurance Third Party Administrators Market Analysis Report by Region

Europe Insurance Third Party Administrators Market Report:

The European market for Insurance TPAs is valued at $2.06 billion in 2023 and is expected to grow to $4.48 billion by 2033. The region’s growth is mainly attributed to stringent regulations concerning claims processing and customer protection measures.Asia Pacific Insurance Third Party Administrators Market Report:

In 2023, the Asia Pacific market for Insurance TPAs is valued at $1.80 billion and is projected to grow to $3.91 billion by 2033, exhibiting strong growth driven by increasing outsourcing trends in countries like India and China, where insurance penetration is on the rise.North America Insurance Third Party Administrators Market Report:

North America holds a significant share of the market, valued at $3.09 billion in 2023 and projected to reach $6.71 billion by 2033. The region's growth is driven by advancements in technology and the strong demand for efficient claims management processes.South America Insurance Third Party Administrators Market Report:

The South American market for Insurance TPAs was valued at $0.53 billion in 2023 and is expected to reach $1.14 billion by 2033, fueled by growing awareness of risk management and the need for cost-effective administration among insurers.Middle East & Africa Insurance Third Party Administrators Market Report:

In the Middle East and Africa, the TPA market stands at $1.01 billion in 2023 and is projected to develop to $2.19 billion by 2033, driven by increasing investments in healthcare and insurance sectors.Tell us your focus area and get a customized research report.

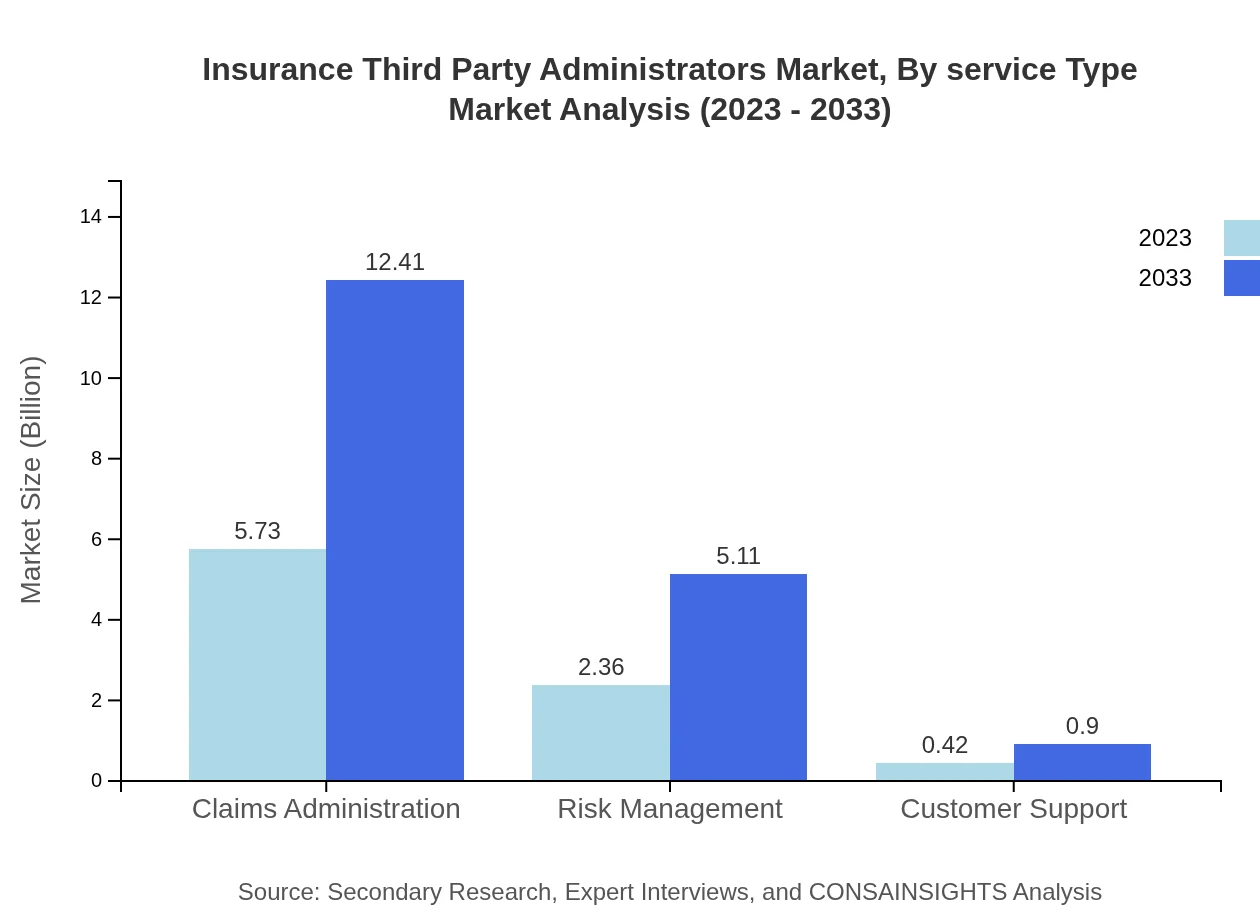

Insurance Third Party Administrators Market Analysis By Service Type

The market size by service type indicates health insurance dominates with a valuation of $4.63 billion in 2023, expected to grow to $10.03 billion by 2033, holding a share of 54.44%. Auto insurance follows at $1.98 billion, expected to reach $4.29 billion, while life insurance and property casualty insurance stand at $0.95 billion, growing to $2.05 billion and $0.95 billion to $2.06 billion respectively. These segments indicate robust growth due to increased insurance awareness and demand for efficient claims processing solutions.

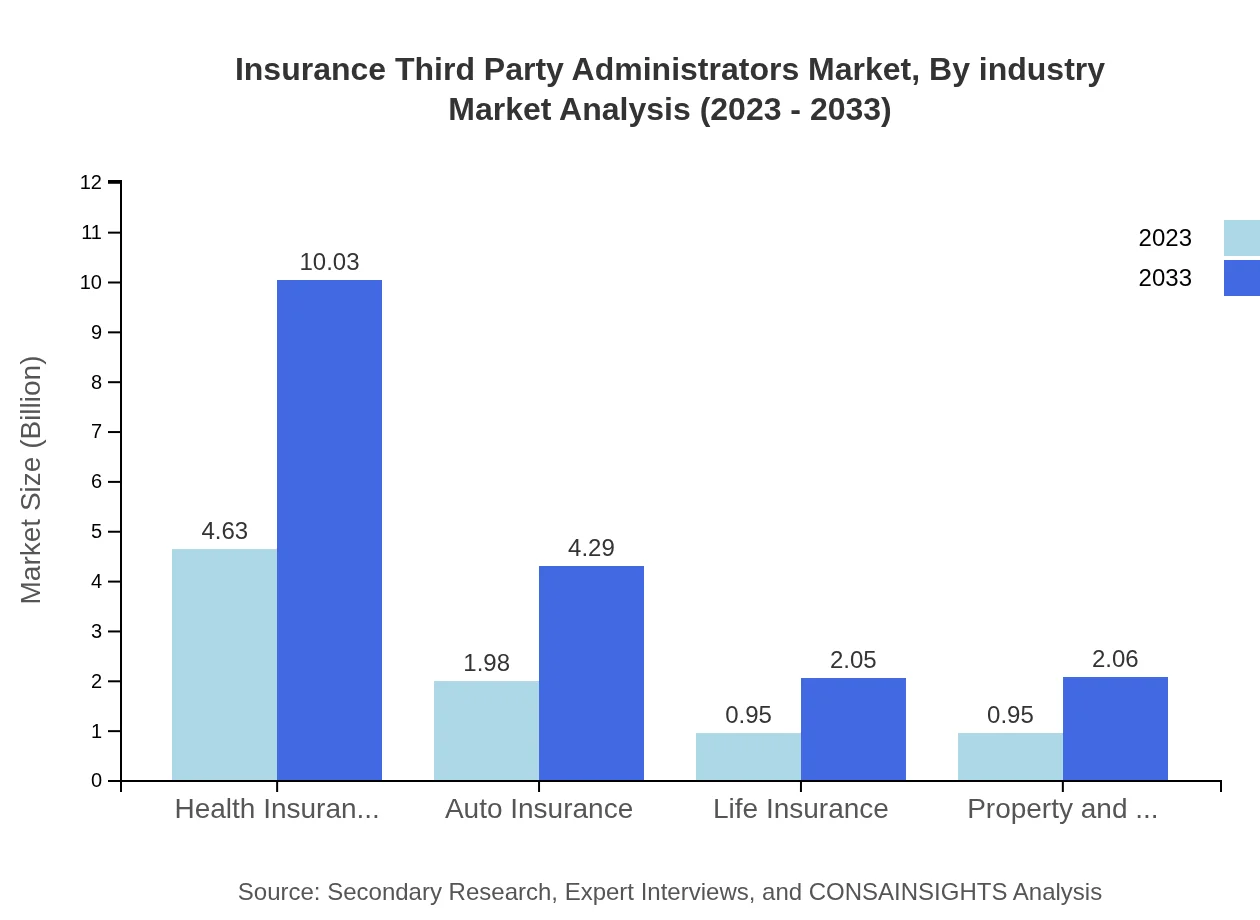

Insurance Third Party Administrators Market Analysis By Industry

The healthcare sector significantly utilizes TPAs for managing health insurance claims, evidenced by the increasing market size from $5.73 billion in 2023 to $12.41 billion by 2033. Similarly, the insurance company segment shows growth from $5.73 billion to $12.41 billion, highlighting the essential role of TPAs in ensuring operational efficiency across multiple insurance domains.

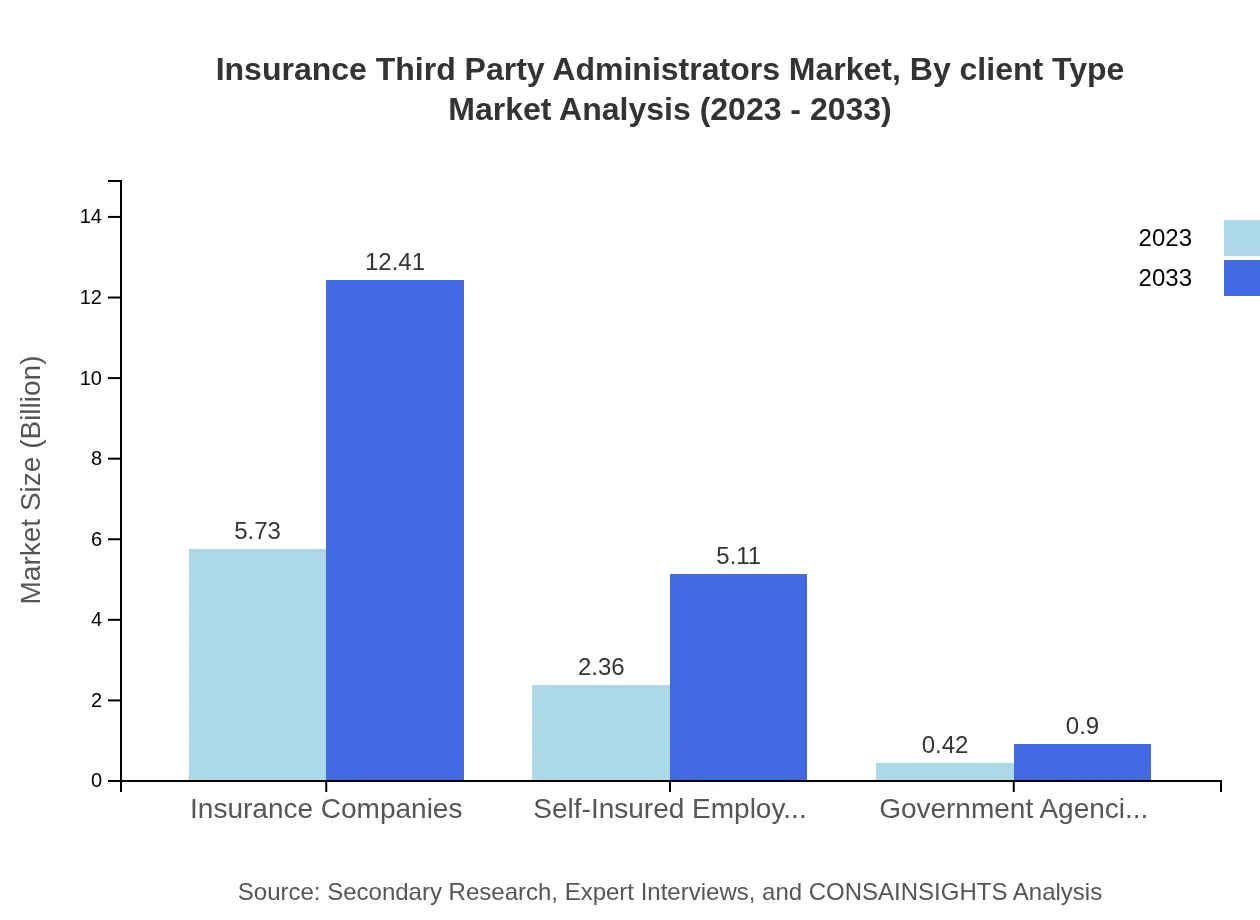

Insurance Third Party Administrators Market Analysis By Client Type

Insurance TPAs cater to various client types including self-insured employers, insurance companies, and government agencies. The market is expected to increase from $2.36 billion in 2023 to $5.11 billion by 2033 for self-insured employers, emphasizing a growing trend where companies prefer outsourcing to improve operational effectiveness.

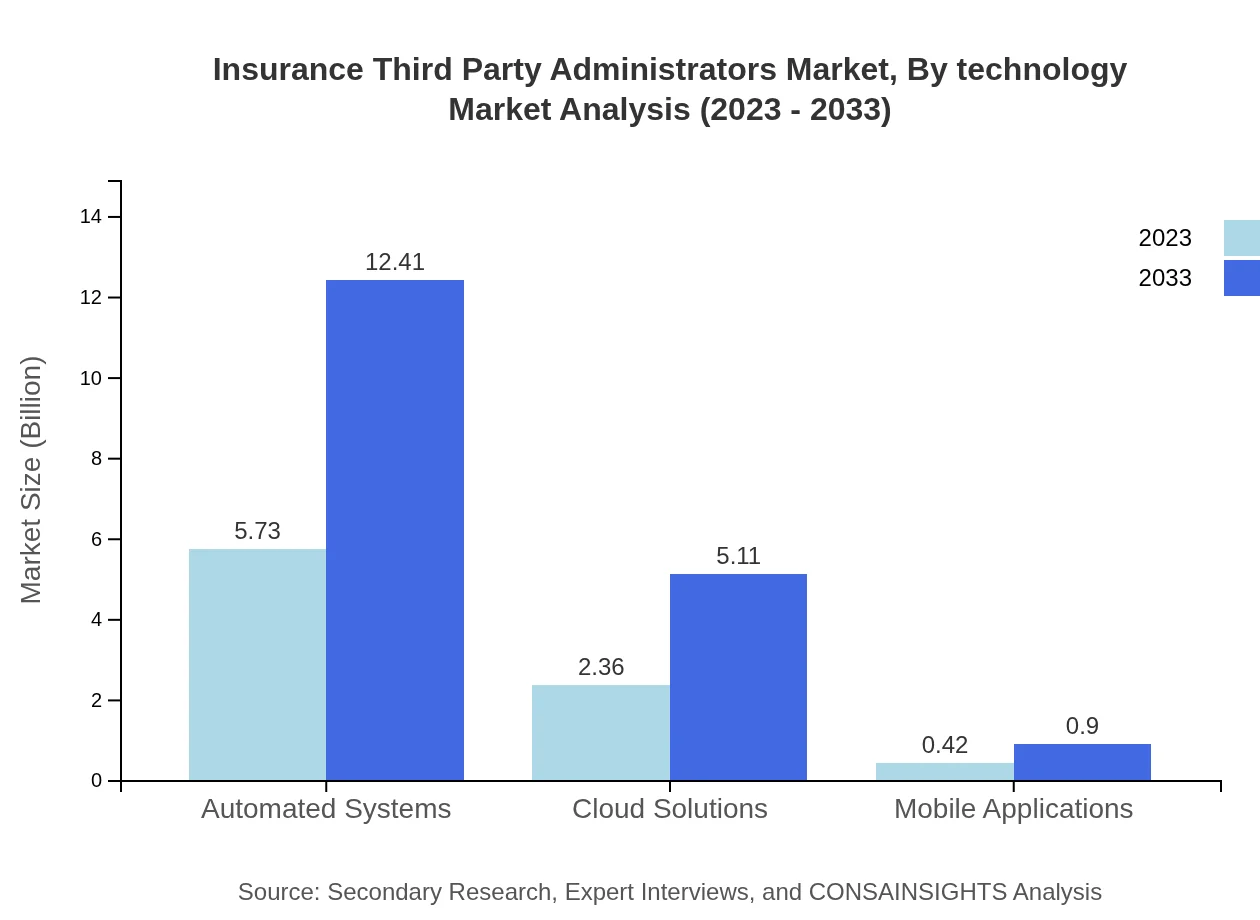

Insurance Third Party Administrators Market Analysis By Technology

The introduction of automated systems is key to transforming the TPA landscape, with a market size of $5.73 billion in 2023 projected to increase to $12.41 billion by 2033. Cloud solutions and mobile applications are gaining traction, encouraging TPAs to adopt technology for better customer interfaces and data management.

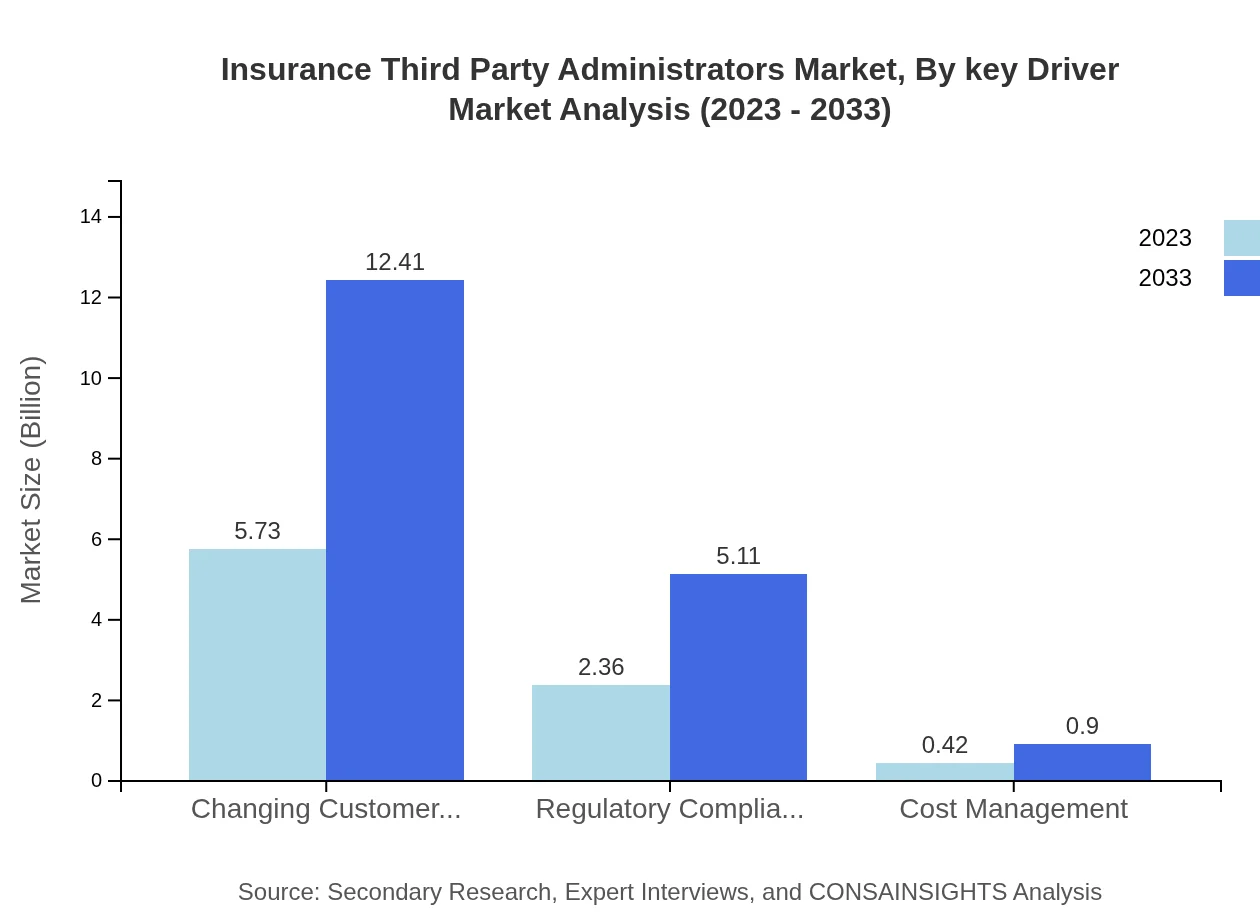

Insurance Third Party Administrators Market Analysis By Key Driver

Cost management remains a significant driver for TPA services, with the market size expected to grow from $0.42 billion in 2023 to $0.90 billion by 2033. Regulatory compliance and changing customer expectations are also pivotal, reflecting the need for TPAs to innovate and adapt to evolving insurance landscapes.

Insurance Third Party Administrators Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Insurance Third Party Administrators Industry

Sedgwick Claims Management Services:

Sedgwick is a leading TPA, providing a broad range of claims management and risk management solutions, known for their advanced technology platforms.Crawford & Company:

Crawford & Company offers comprehensive TPA services globally, focusing on claims services and works with various industries to tailor its solutions.Willis Towers Watson:

This multinational company provides innovative insurance and risk management solutions through its TPA services.Genpact:

Genpact offers TPA solutions focusing on digital transformation, helping insurers streamline their operations and enhance customer experiences.We're grateful to work with incredible clients.

FAQs

What is the market size of insurance third party administrators?

The Insurance Third Party Administrators market is valued at approximately $8.5 billion in 2023, projected to grow at a CAGR of 7.8%. This growth reflects an increasing reliance on third-party services in managing claims and associated administration.

What are the key market players or companies in the insurance third party administrators industry?

The key players in the Insurance Third Party Administrators market include large corporations and specialized firms offering claims management, risk management and administrative services. Notable companies often dominate this market by providing innovative solutions and fostering partnerships.

What are the primary factors driving the growth in the insurance third party administrators industry?

The growth in this industry is primarily driven by increased complexity in insurance claims, rising consumer expectations, technological advancements, and regulatory demands. These factors compel insurance providers to leverage third-party administrators for effective service delivery.

Which region is the fastest Growing in the insurance third party administrators?

The fastest-growing region in the Insurance Third Party Administrators market is Asia Pacific, with market projections rising from $1.80 billion in 2023 to $3.91 billion by 2033. This growth is fueled by burgeoning insurance markets and technological adoption.

Does ConsaInsights provide customized market report data for the insurance third party administrators industry?

Yes, ConsaInsights offers customized market report data tailored specifically to the Insurance Third Party Administrators industry. Clients can request specific insights and data tailored to their needs for a comprehensive view of the market.

What deliverables can I expect from this insurance third party administrators market research project?

From this market research project, you can expect detailed market analysis, segmentation data, regional insights, competitive landscape reports, and projections for future growth, enabling informed decision-making for strategic planning.

What are the market trends of insurance third party administrators?

Key trends in the Insurance Third Party Administrators market include increasing utilization of technology, shifting consumer expectations towards digital services, and greater emphasis on compliance and risk management strategies among providers.