Insurtech Market Report

Published Date: 24 January 2026 | Report Code: insurtech

Insurtech Market Size, Share, Industry Trends and Forecast to 2033

This report offers extensive insights into the Insurtech market, including analysis of its size, projections for growth through 2033, and industry trends. It covers market segmentation, regional insights, product performance, and leading companies.

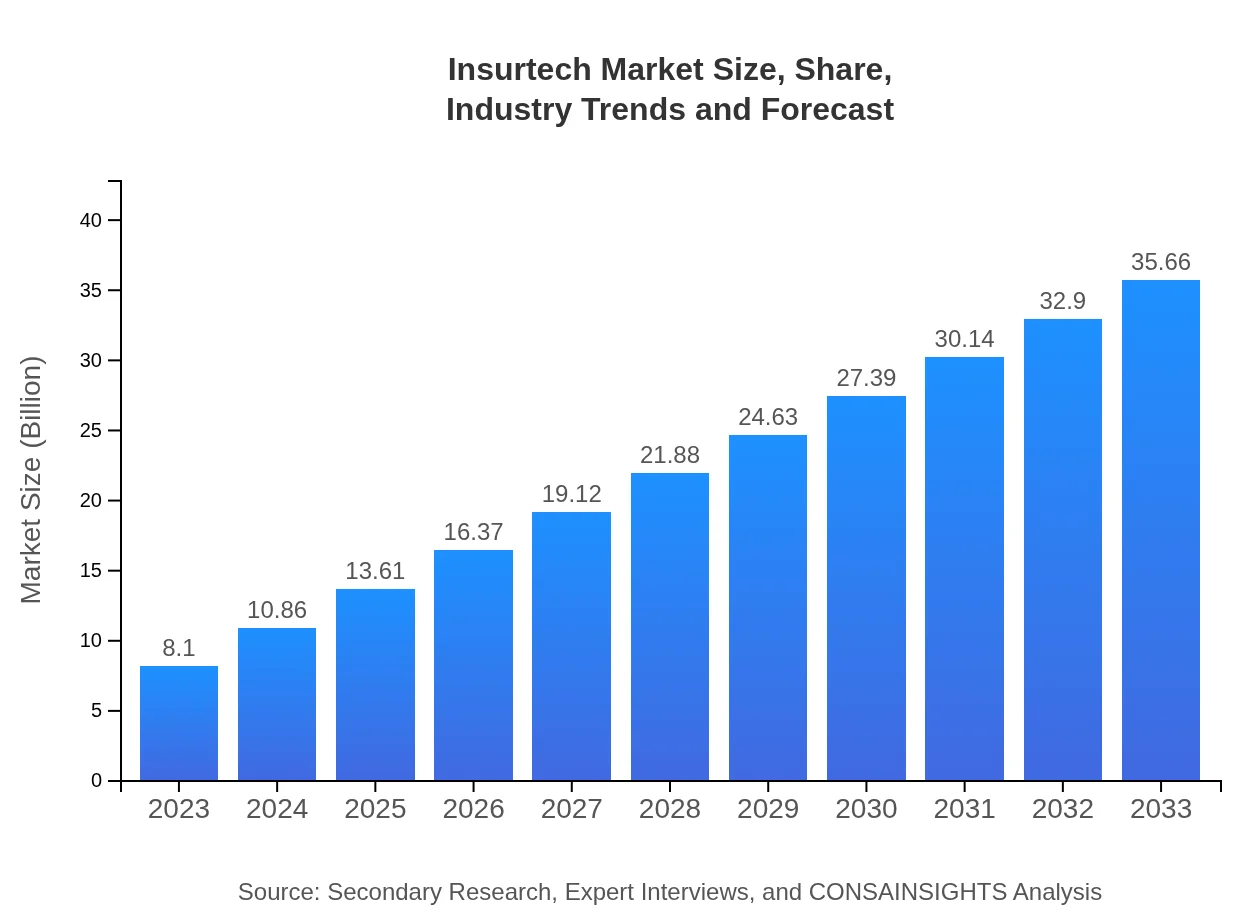

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.10 Billion |

| CAGR (2023-2033) | 15.2% |

| 2033 Market Size | $35.66 Billion |

| Top Companies | Lemonade, Oscar Health, Zego, Root Insurance |

| Last Modified Date | 24 January 2026 |

Insurtech Market Overview

Customize Insurtech Market Report market research report

- ✔ Get in-depth analysis of Insurtech market size, growth, and forecasts.

- ✔ Understand Insurtech's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Insurtech

What is the Market Size & CAGR of the Insurtech market in 2023?

Insurtech Industry Analysis

Insurtech Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Insurtech Market Analysis Report by Region

Europe Insurtech Market Report:

The European Insurtech market is anticipated to experience significant growth from $2.72 billion in 2023 to $11.96 billion by 2033, propelled by advancements in fintech and regulatory support for digital transformation.Asia Pacific Insurtech Market Report:

The Asia Pacific Insurtech market, valued at $1.42 billion in 2023, is expected to reach $6.24 billion by 2033, reflecting rapid digital adoption and a growing middle class. Countries like China and India lead in technological advancements, fostering a strong growth environment.North America Insurtech Market Report:

North America stands as a leader in the Insurtech market with a size of $2.93 billion in 2023, projected to grow to $12.91 billion by 2033. The region's established insurance landscape and high technological adoption rates fuel its growth.South America Insurtech Market Report:

In South America, the Insurtech market was valued at $0.64 billion in 2023 and is projected to grow to $2.83 billion by 2033. The region is witnessing increased investments in technology to address gaps in traditional insurance services.Middle East & Africa Insurtech Market Report:

The Middle East and Africa region's Insurtech market is currently valued at $0.39 billion in 2023, with a forecast of $1.72 billion by 2033. The region is gradually embracing technology-driven insurance solutions amidst evolving consumer needs.Tell us your focus area and get a customized research report.

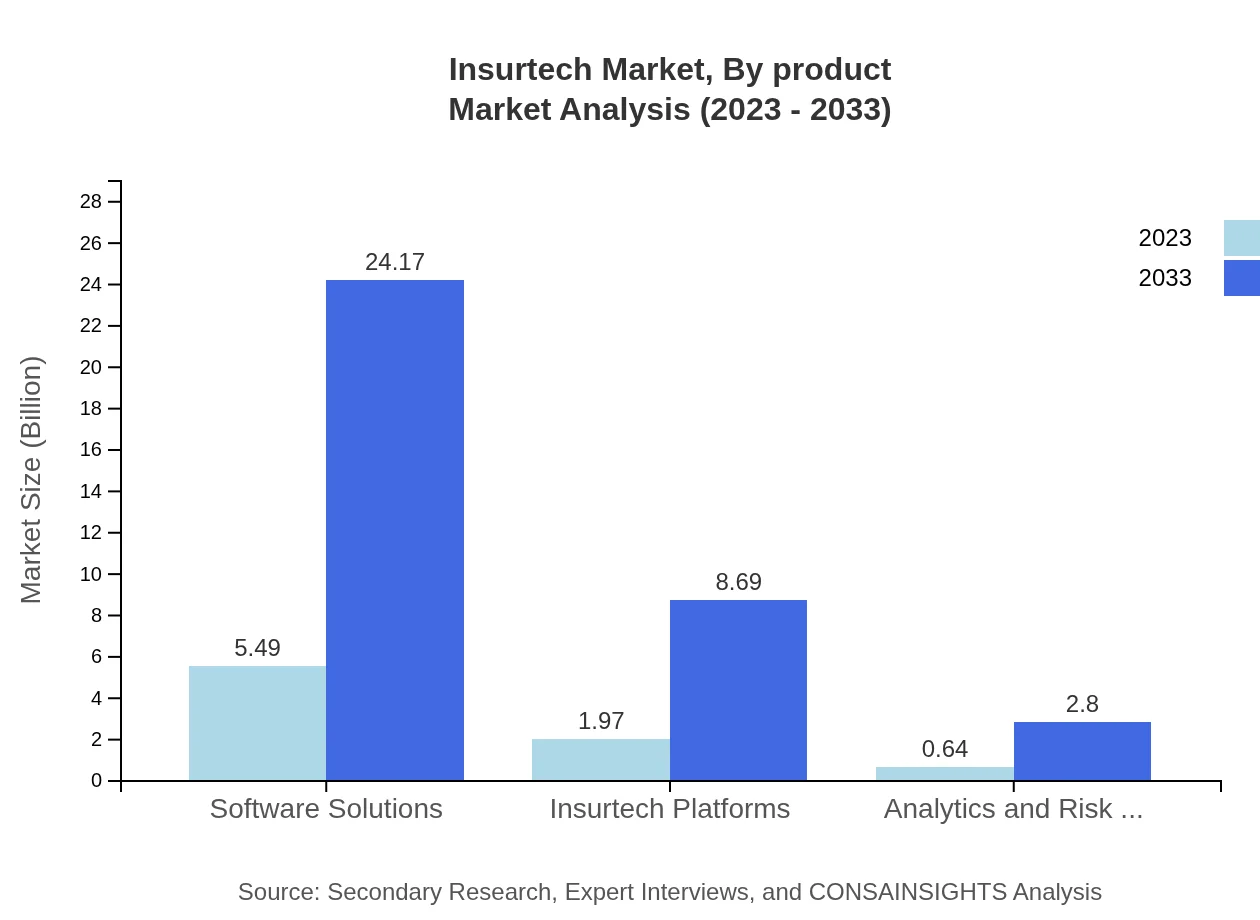

Insurtech Market Analysis By Product

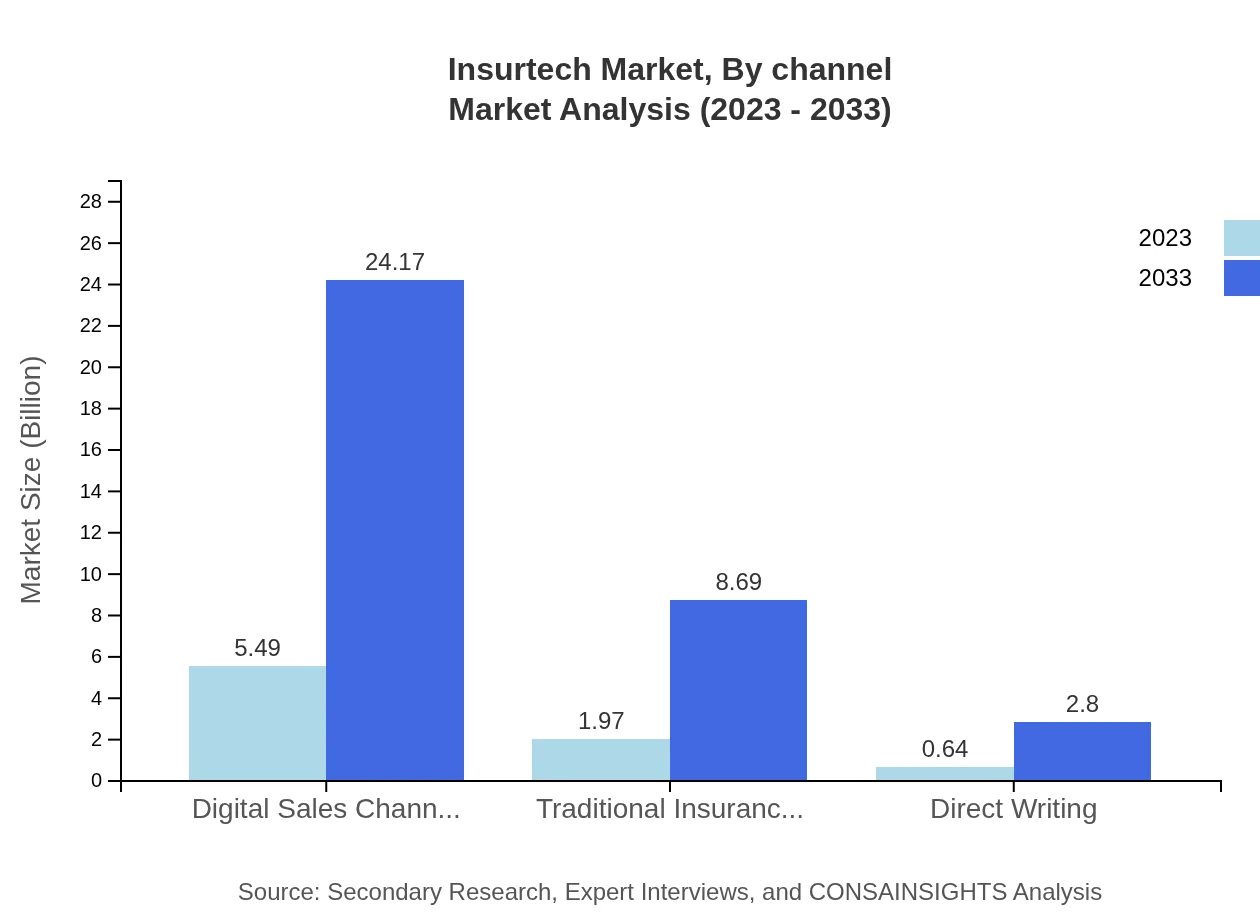

In the Insurtech market, products are increasingly diversified with digital sales channels projected to grow from $5.49 billion in 2023 to $24.17 billion in 2033. Traditional insurance agents are also vital, seeing growth from $1.97 billion to $8.69 billion over the same period.

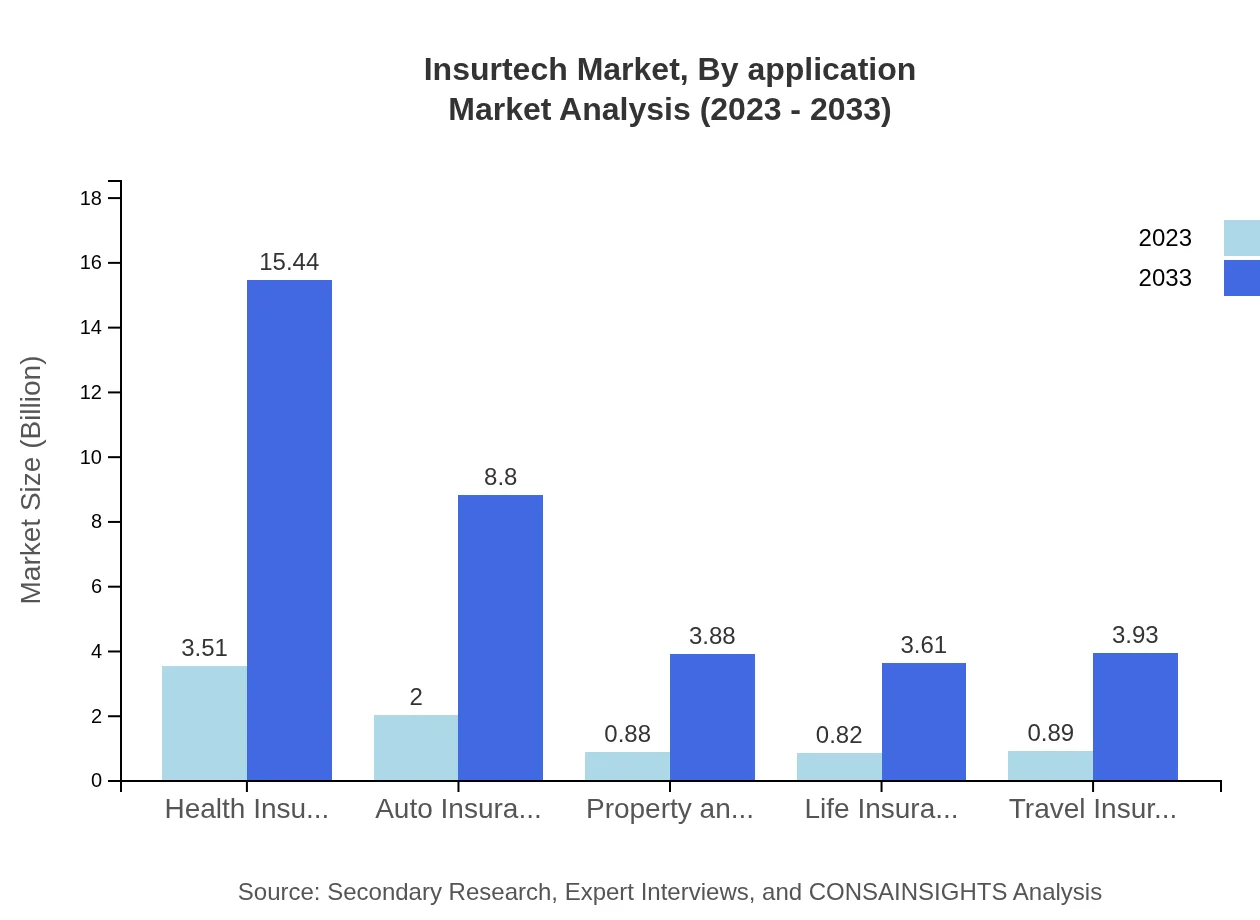

Insurtech Market Analysis By Application

Key application segments include health, auto, and life insurance, with health insurance expected to dominate the market, scaling from $3.51 billion in 2023 to $15.44 billion by 2033. Auto insurance follows with a substantial increase from $2.00 billion to $8.80 billion.

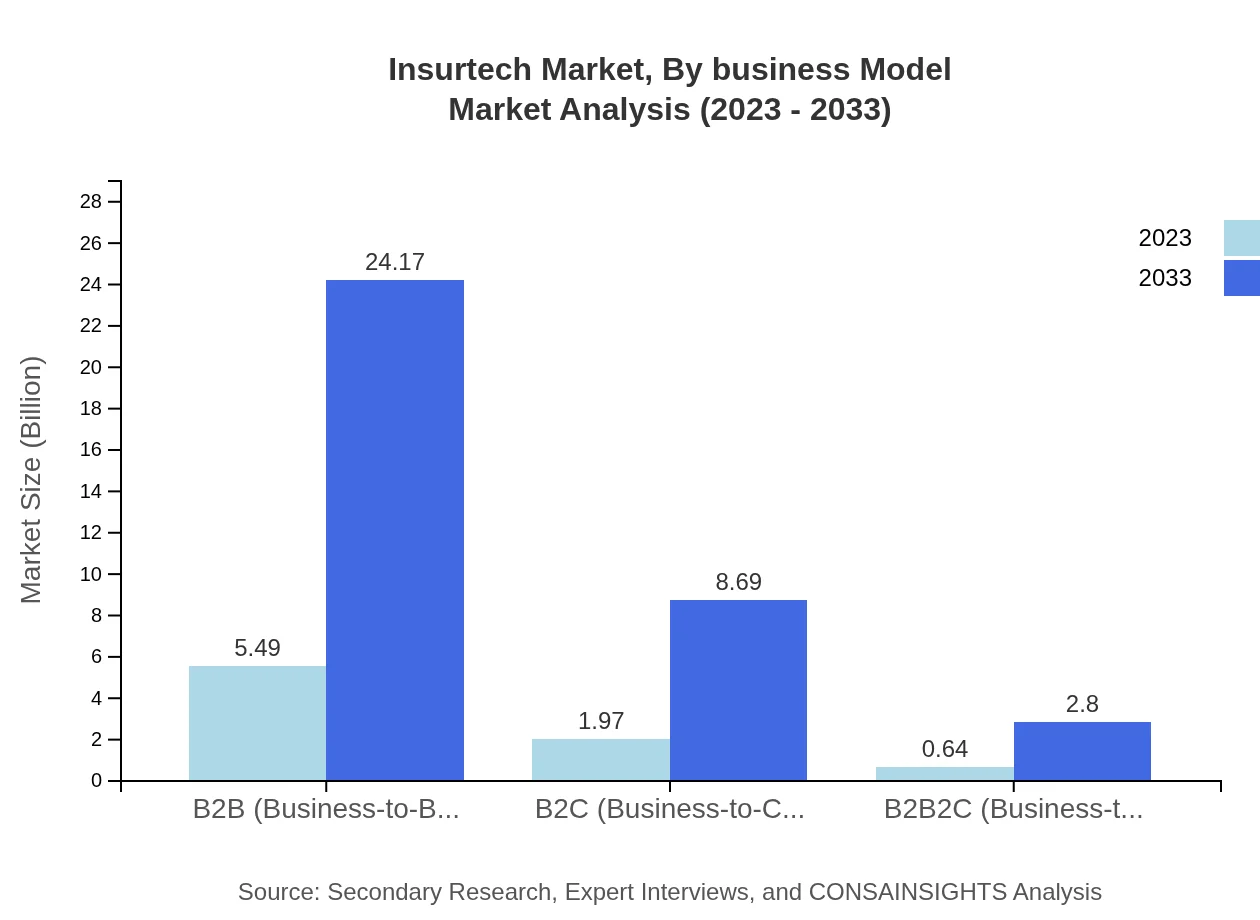

Insurtech Market Analysis By Business Model

The B2B market model leads in revenue generation with a size of $5.49 billion in 2023, anticipated to grow to $24.17 billion by 2033. The B2C model is also significant, moving from $1.97 billion to $8.69 billion, indicating a trend towards personalized insurance services.

Insurtech Market Analysis By Channel

Digital sales channels maintain dominance, envisioned to retain a 67.79% market share through 2023-2033. Traditional agents and direct writing also play important roles, while Insurtech platforms emerge as vital facilitators of distribution.

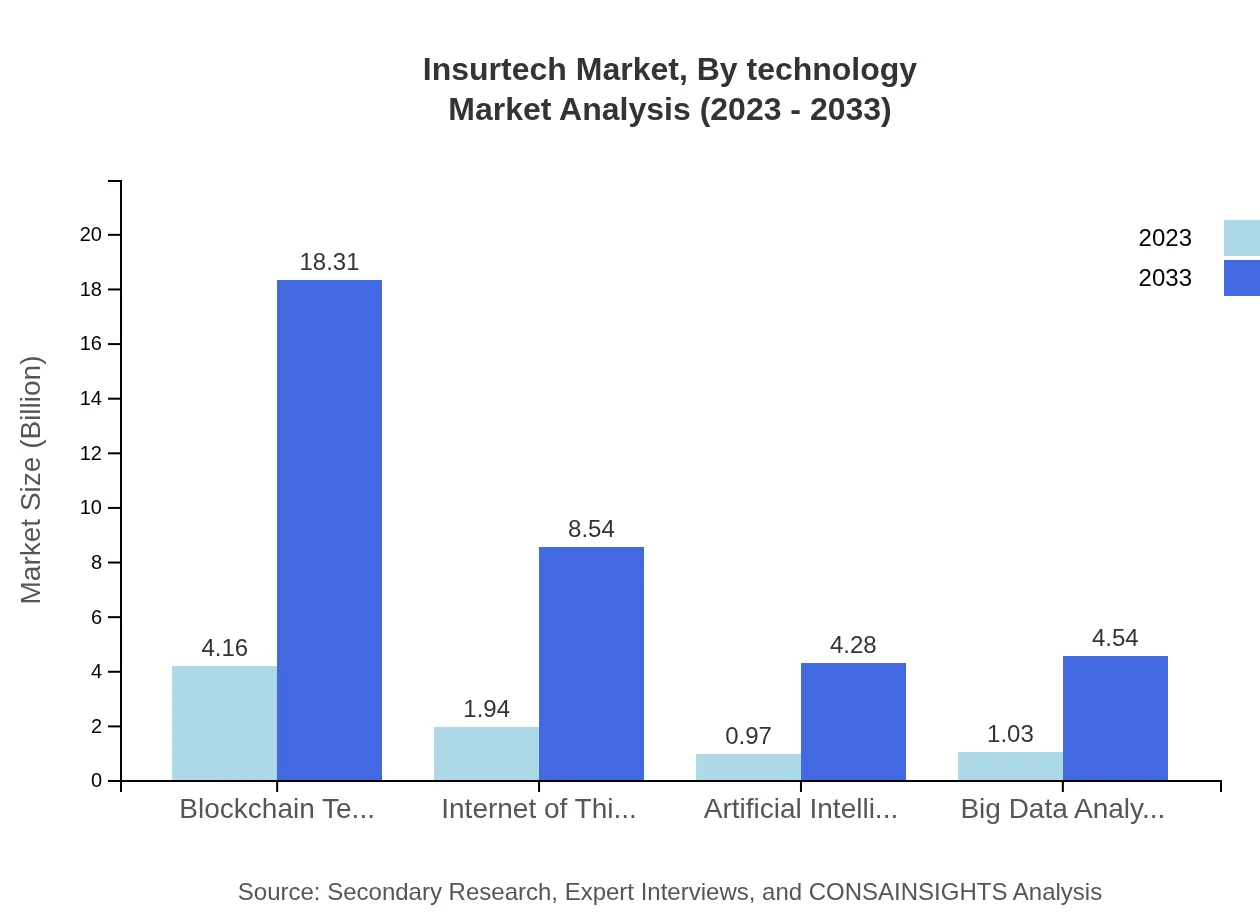

Insurtech Market Analysis By Technology

Technological advancements are reshaping the Insurtech landscape. Blockchain technology is set to grow from $4.16 billion in 2023 to $18.31 billion by 2033, making it a crucial element in enhancing transaction security. AI applications are critical too, projected to rise from $0.97 billion to $4.28 billion.

Insurtech Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Insurtech Industry

Lemonade:

A technology-driven insurance provider offering homeowners and renters insurance with a unique 'give-back' model.Oscar Health:

An innovative health insurance company focused on leveraging technology to simplify healthcare and insurance processes.Zego:

A UK-based company revolutionizing the commercial insurance space with flexible coverage models for businesses.Root Insurance:

Utilizing data and technology to offer personalized auto insurance rates based on driving behaviors.We're grateful to work with incredible clients.

FAQs

What is the market size of insurtech?

The insurtech market is currently valued at $8.1 billion in 2023, with a projected CAGR of 15.2% until 2033. This growth indicates a significant increase in market opportunities, driven by technological advancements and changing consumer behaviors.

What are the key market players or companies in the insurtech industry?

Key players in the insurtech sector include established insurance companies embracing technology, startups innovating in digital solutions, and tech firms providing software platforms. These companies focus on enhancing customer experience through digital integrations.

What are the primary factors driving the growth in the insurtech industry?

Growth in the insurtech industry is primarily driven by advancements in technology, increased demand for personalized insurance products, and the growing trend of digital transformation among consumers, influencing the traditional insurance models significantly.

Which region is the fastest Growing in the insurtech?

The fastest-growing region in the insurtech market is Europe, expected to grow from $2.72 billion in 2023 to $11.96 billion by 2033. Other notable regions include North America and Asia-Pacific, which also show significant growth potential.

Does ConsaInsights provide customized market report data for the insurtech industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the insurtech industry. This customization helps businesses focus on distinct segments or geographic regions for more accurate insights.

What deliverables can I expect from this insurtech market research project?

Deliverables from the insurtech market research project typically include comprehensive reports, detailed analysis of market trends, competitive landscape assessments, and strategic recommendations to help businesses navigate the evolving insurtech landscape.

What are the market trends of insurtech?

Current market trends in insurtech include the rise of digital sales channels, increased adoption of blockchain technology, and a focus on AI-driven analytics for risk assessment, all aimed at enhancing efficiency and customer engagement.