Integrated Food Ingredients Market Report

Published Date: 31 January 2026 | Report Code: integrated-food-ingredients

Integrated Food Ingredients Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Integrated Food Ingredients market, examining trends, forecasts, and regional dynamics from 2023 to 2033. It delivers critical data on market size, growth rates, industry analysis, segmentation, and competitive landscape.

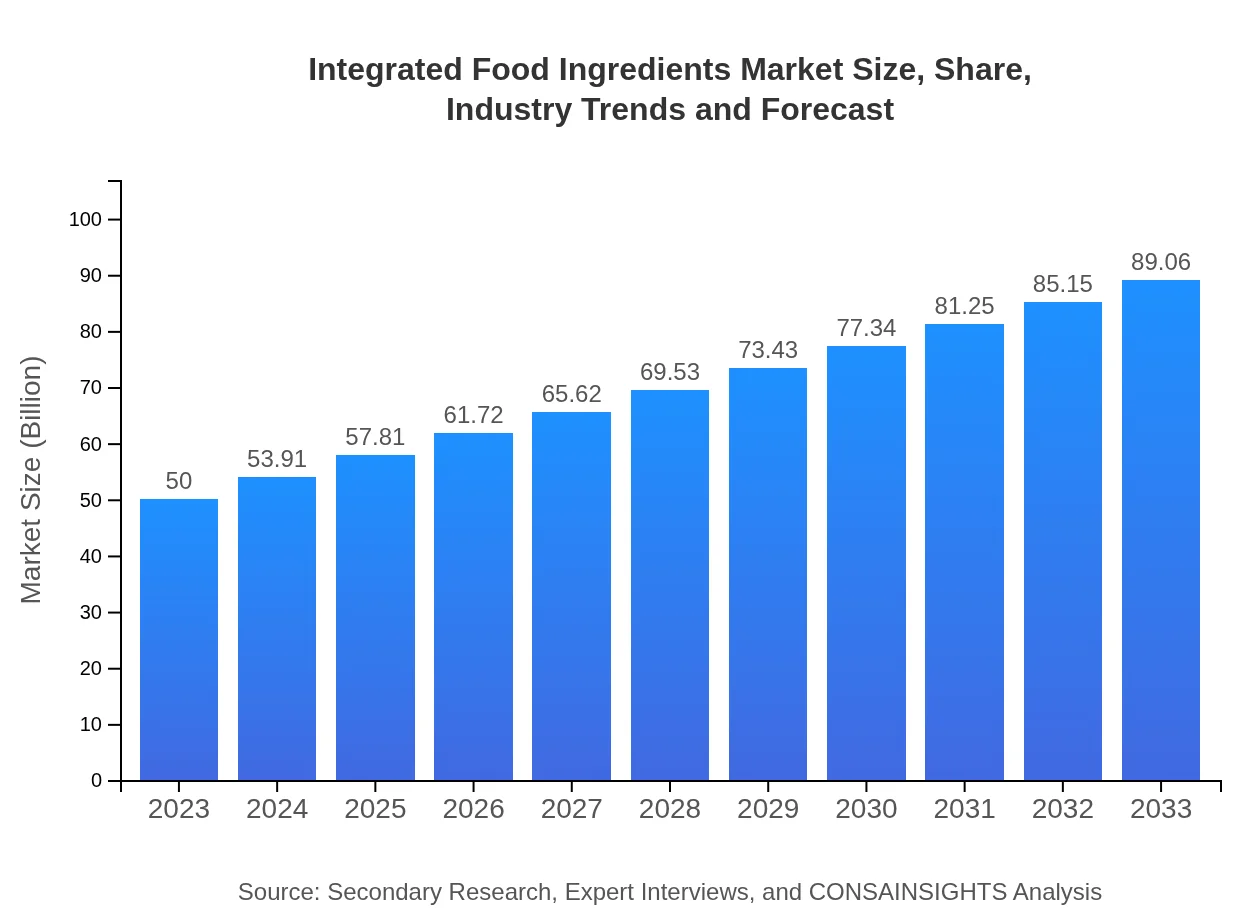

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $50.00 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $89.06 Billion |

| Top Companies | DuPont de Nemours, Inc., Cargill, Incorporated, Kerry Group PLC, ADM (Archer Daniels Midland Company), BASF SE |

| Last Modified Date | 31 January 2026 |

Integrated Food Ingredients Market Overview

Customize Integrated Food Ingredients Market Report market research report

- ✔ Get in-depth analysis of Integrated Food Ingredients market size, growth, and forecasts.

- ✔ Understand Integrated Food Ingredients's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Integrated Food Ingredients

What is the Market Size & CAGR of Integrated Food Ingredients market in 2023?

Integrated Food Ingredients Industry Analysis

Integrated Food Ingredients Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Integrated Food Ingredients Market Analysis Report by Region

Europe Integrated Food Ingredients Market Report:

Europe, with a market value of $13.67 billion in 2023, is expected to reach $24.35 billion by 2033. This region is characterized by stringent food safety regulations, pushing manufacturers towards the integration of high-quality food ingredients. Rising awareness about health benefits linked to natural ingredients is also shaping consumer choices.Asia Pacific Integrated Food Ingredients Market Report:

The Asia Pacific region's Integrated Food Ingredients market is anticipated to grow from $10.16 billion in 2023 to approximately $18.11 billion by 2033. Increasing urbanization, a rising middle-class population, and evolving dietary habits are driving demand. Consumer trends towards health and wellness are prompting manufacturers to introduce innovative ingredient solutions tailored for this dynamic market.North America Integrated Food Ingredients Market Report:

The North American market stands as a significant player, with its size projected to leap from $18.63 billion in 2023 to $33.18 billion by 2033. The region's growth is attributed to technological advances in food processing and rising consumer preferences for organic and functional foods. Regulatory frameworks further support innovations that prioritize health and sustainability.South America Integrated Food Ingredients Market Report:

In South America, the market for Integrated Food Ingredients is expected to expand from $2.74 billion in 2023 to around $4.88 billion by 2033. This growth is propelled by a heightened interest in natural ingredients and cleaner labels. As food safety regulations increase, local manufacturers are seeking integrated solutions to enhance product quality and safety.Middle East & Africa Integrated Food Ingredients Market Report:

The Middle East and Africa market is predicted to experience growth from $4.79 billion in 2023 to $8.54 billion by 2033. Increasing population movements towards urban settings and heightened demand for convenience foods and beverages are key factors driving this growth. Manufacturers are adapting by incorporating indigenous ingredients into their products.Tell us your focus area and get a customized research report.

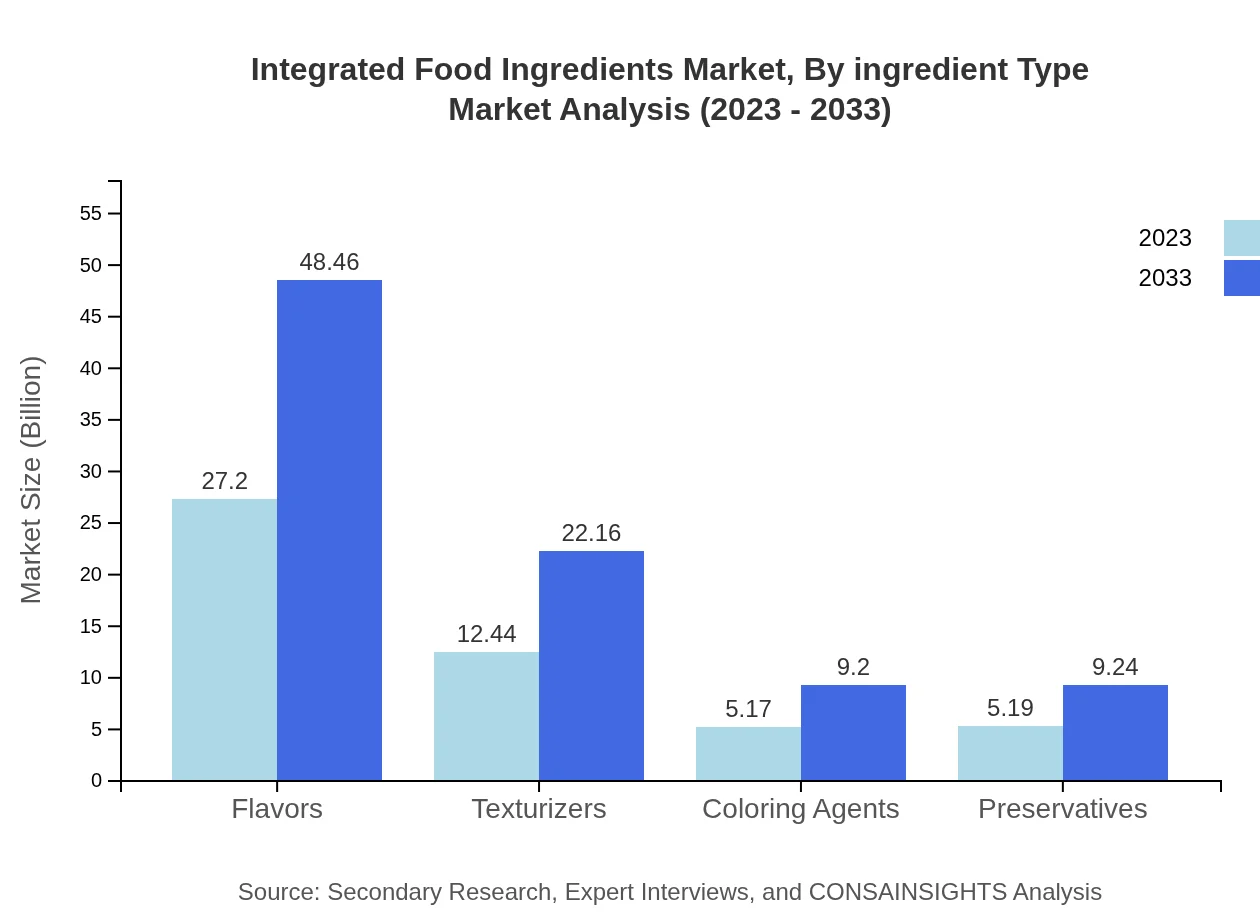

Integrated Food Ingredients Market Analysis By Ingredient Type

The Integrated Food Ingredients market by ingredient type reveals noteworthy trends. Liquids are projected to grow from $27.20 billion in 2023 to $48.46 billion in 2033, holding a market share of 54.41% throughout. Other significant segments include powders growing from $12.44 billion to $22.16 billion (with a 24.88% share) and granular ingredients from $5.17 billion to $9.20 billion (10.33% share). These segments emphasize the versatility of integrated food ingredients across various applications.

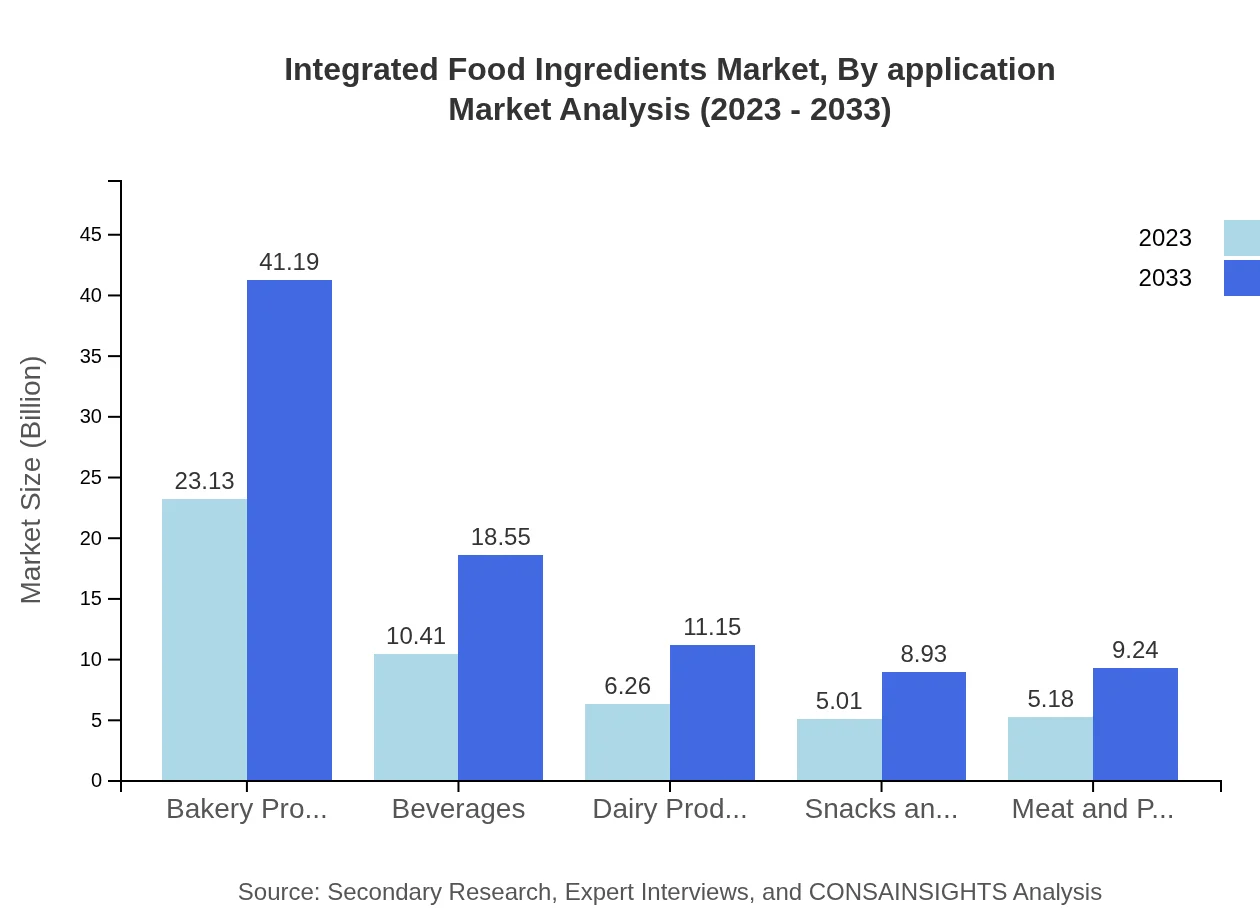

Integrated Food Ingredients Market Analysis By Application

Significant applications of Integrated Food Ingredients include bakery products, projected to escalate from $23.13 billion in 2023 to $41.19 billion in 2033, commanding a 46.25% share. Beverages are also noteworthy, with expected growth from $10.41 billion to $18.55 billion (20.83% share). The evolving needs of consumers for healthy on-the-go options are driving this application segment.

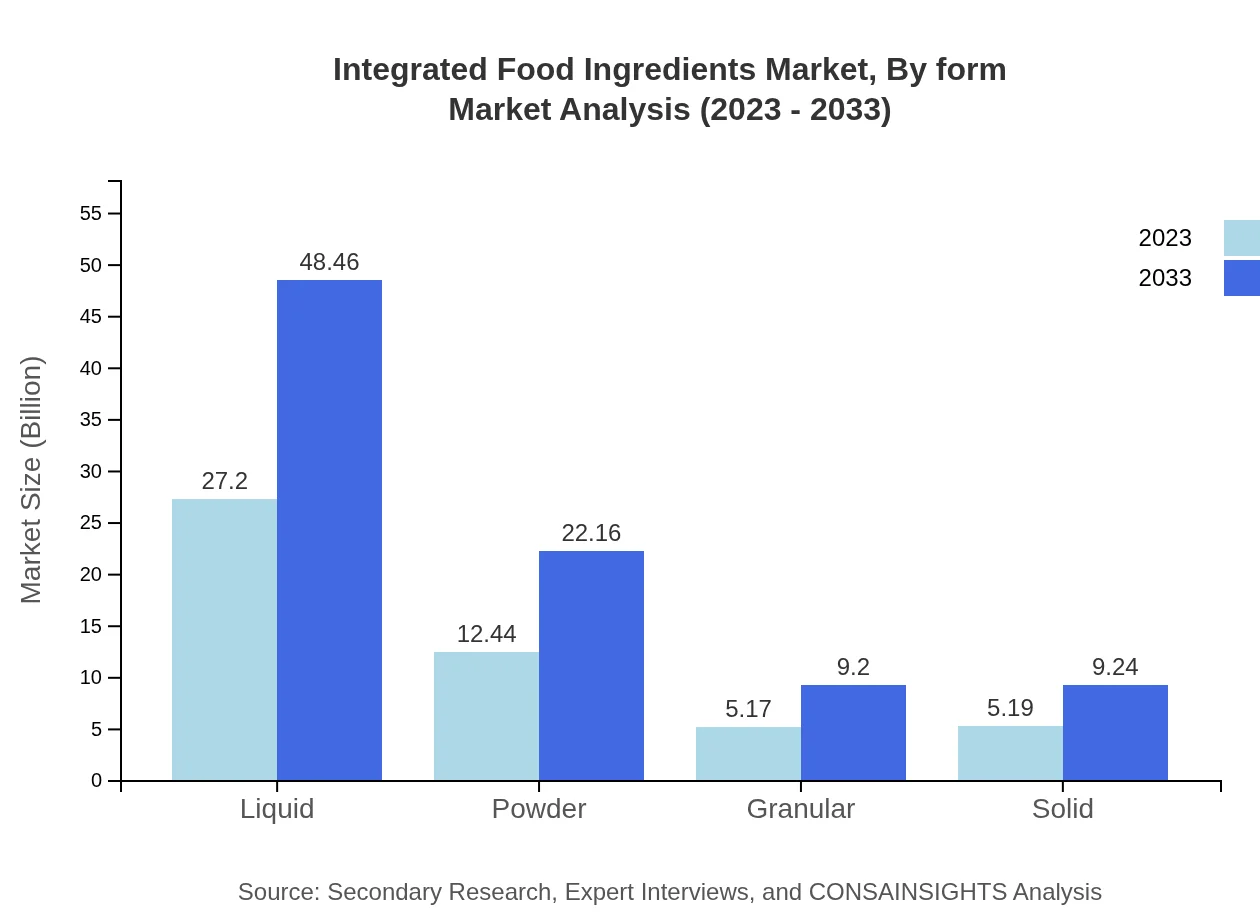

Integrated Food Ingredients Market Analysis By Form

In terms of form, the liquid segment is predominant, expected to progress from $27.20 billion in 2023 to $48.46 billion in 2033. Powders and granular forms follow, reflecting consumer demands for diverse product offerings in food manufacturing. The importance of convenience and ease of use influences consumer preferences.

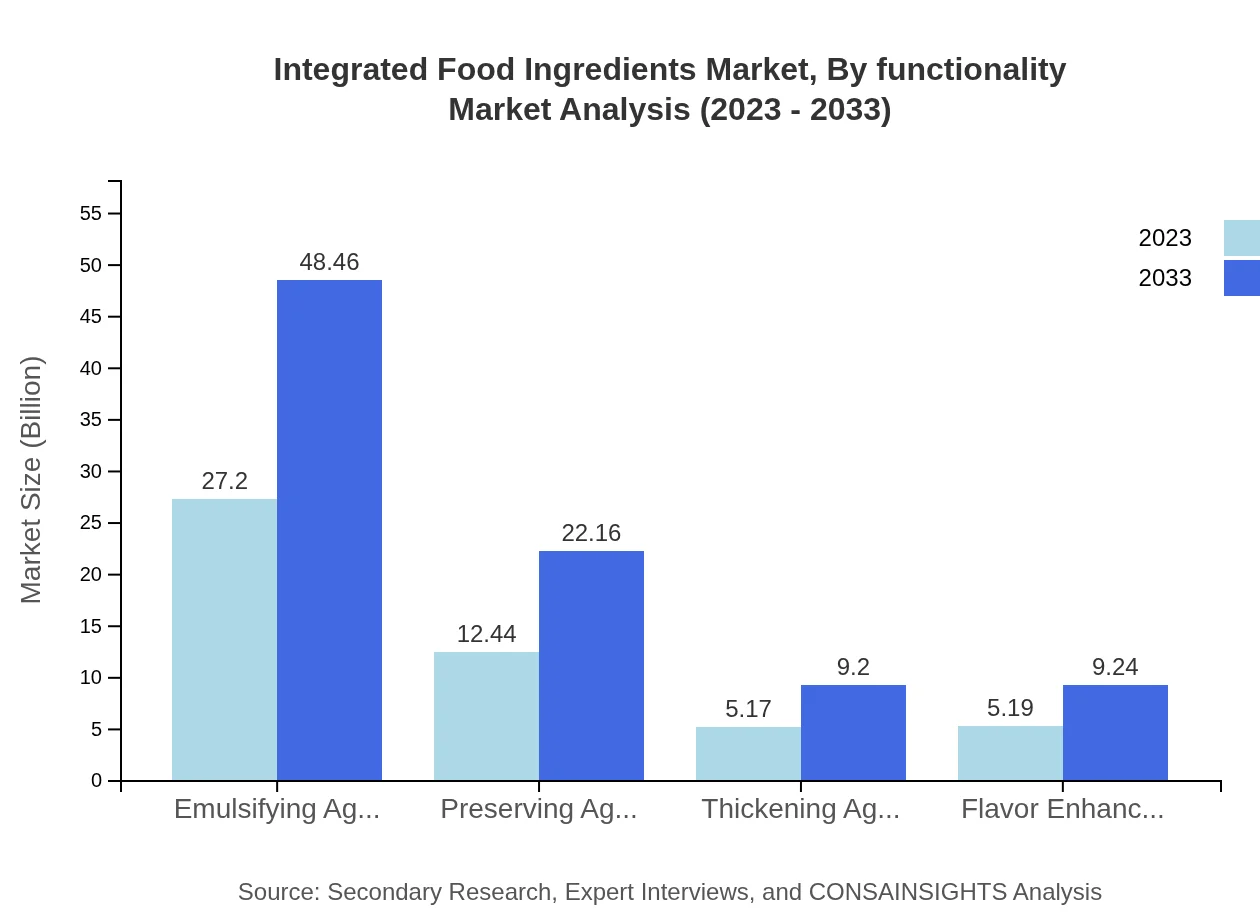

Integrated Food Ingredients Market Analysis By Functionality

Functionality-wise, emulsifying agents dominate the market, anticipated to expand from $27.20 billion in 2023 to $48.46 billion by 2033 (54.41% share), followed closely by preserving agents and thickening agents, highlighting the market's evolving trend towards functional food products.

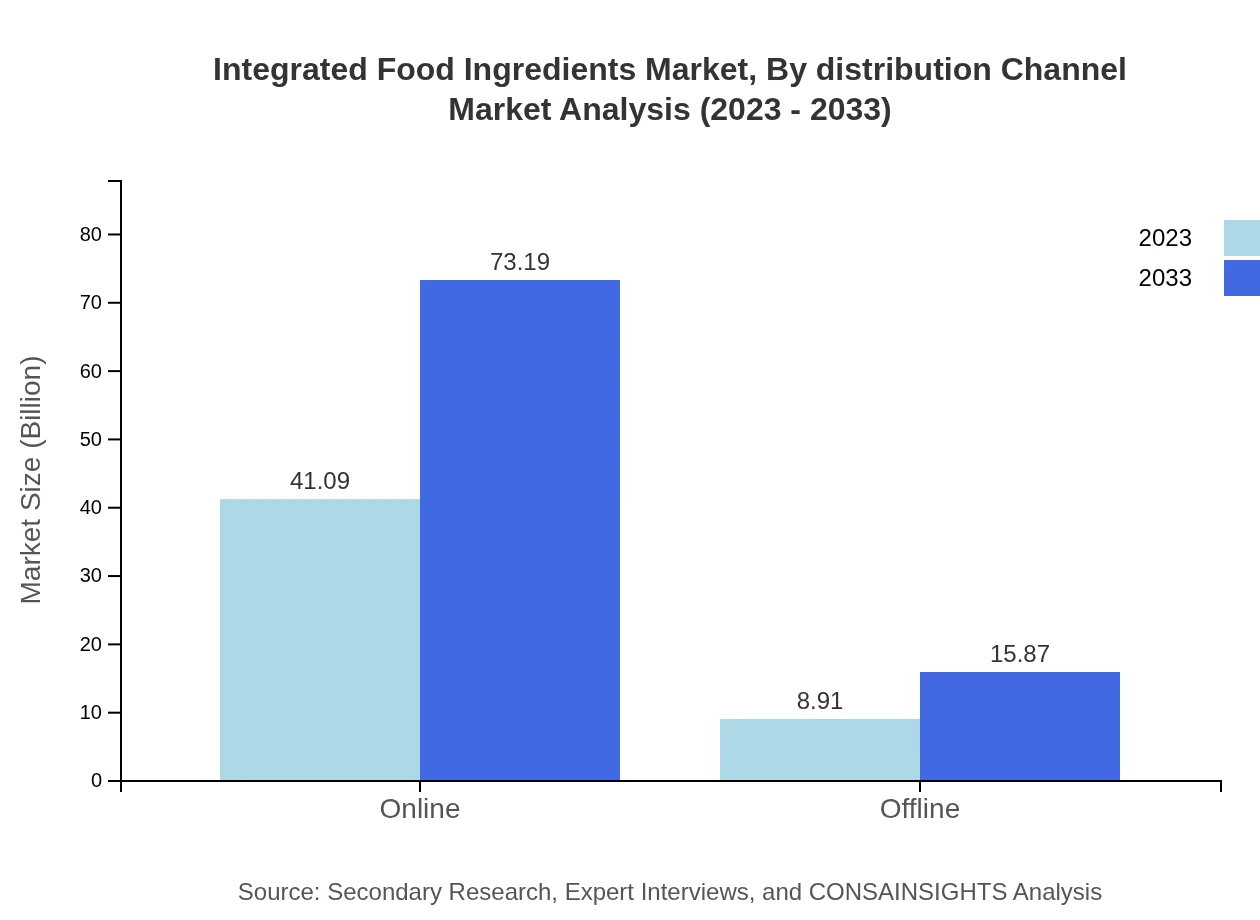

Integrated Food Ingredients Market Analysis By Distribution Channel

Distribution channels are critical in the Integrated Food Ingredients market, with the online segment projected to rise from $41.09 billion in 2023 to $73.19 billion by 2033, showcasing a strong shift towards digitalization. The offline channel remains relevant, growing from $8.91 billion to $15.87 billion, adapting to changing consumer buying behaviors.

Integrated Food Ingredients Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Integrated Food Ingredients Industry

DuPont de Nemours, Inc.:

A global innovation leader in food ingredients and nutrition, DuPont specializes in developing sustainable solutions to enhance food safety and quality.Cargill, Incorporated:

Cargill is a major provider of food and agricultural products, delivering effective solutions in food preservation and ingredient formulation for various applications.Kerry Group PLC:

Focused on innovation in taste and nutrition, Kerry Group offers an extensive range of food ingredients that address health-conscious consumer trends.ADM (Archer Daniels Midland Company):

ADM leverages its vast agricultural resources to deliver top-notch ingredients and solutions for food manufacturers worldwide.BASF SE:

As a leading chemical company, BASF provides high-quality food ingredients that enhance the texture, taste, and nutritional profile of products.We're grateful to work with incredible clients.

FAQs

What is the market size of integrated Food Ingredients?

The global market size of integrated food ingredients is projected to reach approximately $50 billion by 2033, with a steady CAGR of 5.8%. This growth highlights the increasing demand for diverse food products in consumer markets.

What are the key market players or companies in this integrated Food Ingredients industry?

Key players in the integrated food ingredients industry include global giants known for their diverse product offerings and advancements in food technology. Companies focus on innovation and strategic mergers to enhance their market presence.

What are the primary factors driving the growth in the integrated Food Ingredients industry?

Growth drivers include a rise in health-conscious consumers, increasing demand for natural ingredients, and the innovation in food processing technologies. Companies are investing in enhancing food quality and safety to cater to evolving consumer preferences.

Which region is the fastest Growing in the integrated Food Ingredients market?

The fastest-growing region in the integrated food ingredients market is North America, projected to grow from $18.63 billion in 2023 to $33.18 billion by 2033. This growth reflects increasing consumption and innovation in food technology.

Does ConsaInsights provide customized market report data for the integrated Food Ingredients industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the integrated food ingredients industry, ensuring precise insights and actionable information for strategic planning.

What deliverables can I expect from this integrated Food Ingredients market research project?

Deliverables include detailed market analysis reports, regional insights, competitive landscape assessments, and forecasts. Clients receive comprehensive data that supports strategic decision-making and market entry strategies.

What are the market trends of integrated Food Ingredients?

Current trends include increasing demand for clean label products, the rise of plant-based ingredients, and a focus on sustainability. Innovations in processing techniques and flavor enhancement are also key trends shaping the market.