Integrated Operating Room Market Report

Published Date: 31 January 2026 | Report Code: integrated-operating-room

Integrated Operating Room Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Integrated Operating Room market, detailing market size, trends, and forecasts from 2023 to 2033. It encompasses insights on regional performance, segmentation by products and technologies, and identifies prominent market players.

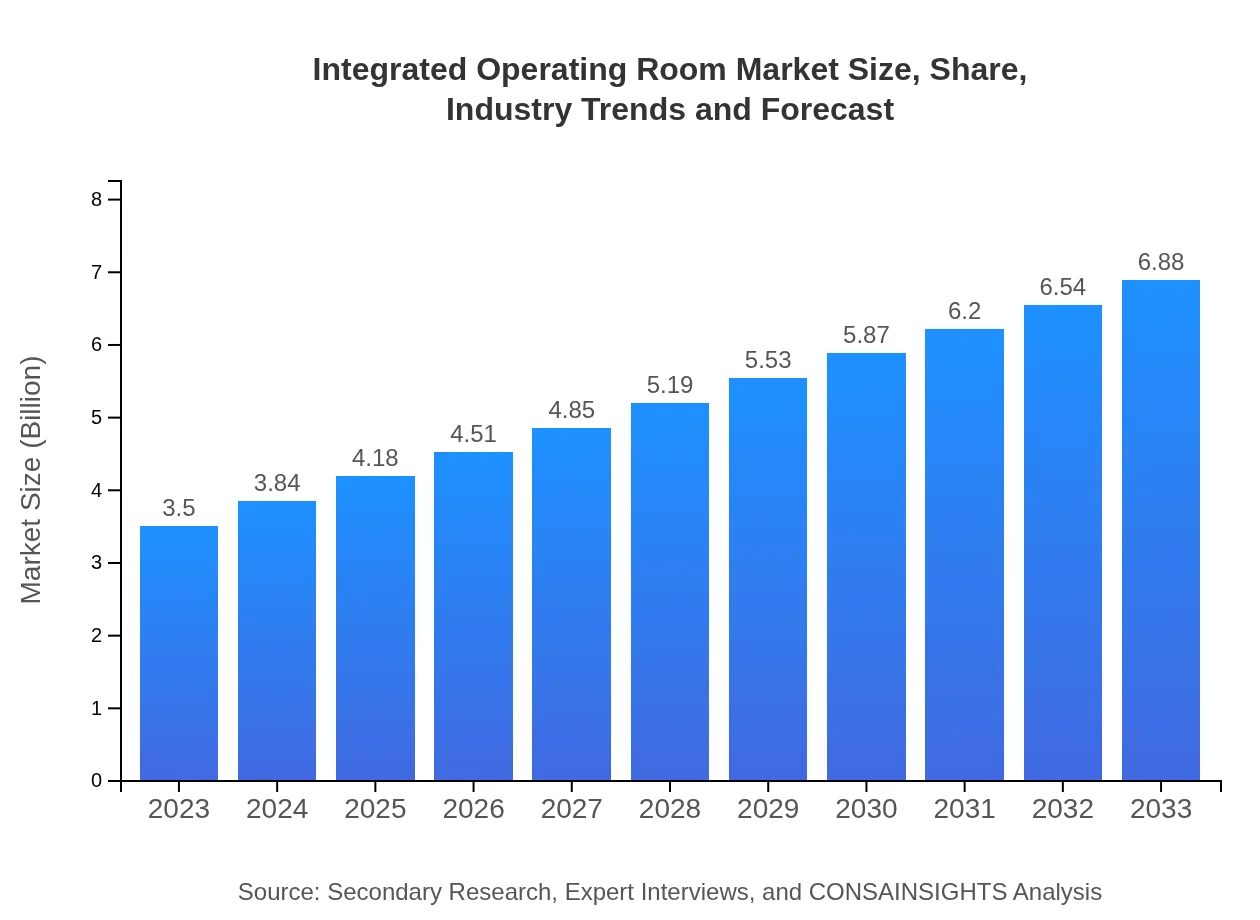

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $6.88 Billion |

| Top Companies | Siemens Healthineers, GE Healthcare, Medtronic , Stryker Corporation, Philips Healthcare |

| Last Modified Date | 31 January 2026 |

Integrated Operating Room Market Overview

Customize Integrated Operating Room Market Report market research report

- ✔ Get in-depth analysis of Integrated Operating Room market size, growth, and forecasts.

- ✔ Understand Integrated Operating Room's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Integrated Operating Room

What is the Market Size & CAGR of Integrated Operating Room market in 2023?

Integrated Operating Room Industry Analysis

Integrated Operating Room Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Integrated Operating Room Market Analysis Report by Region

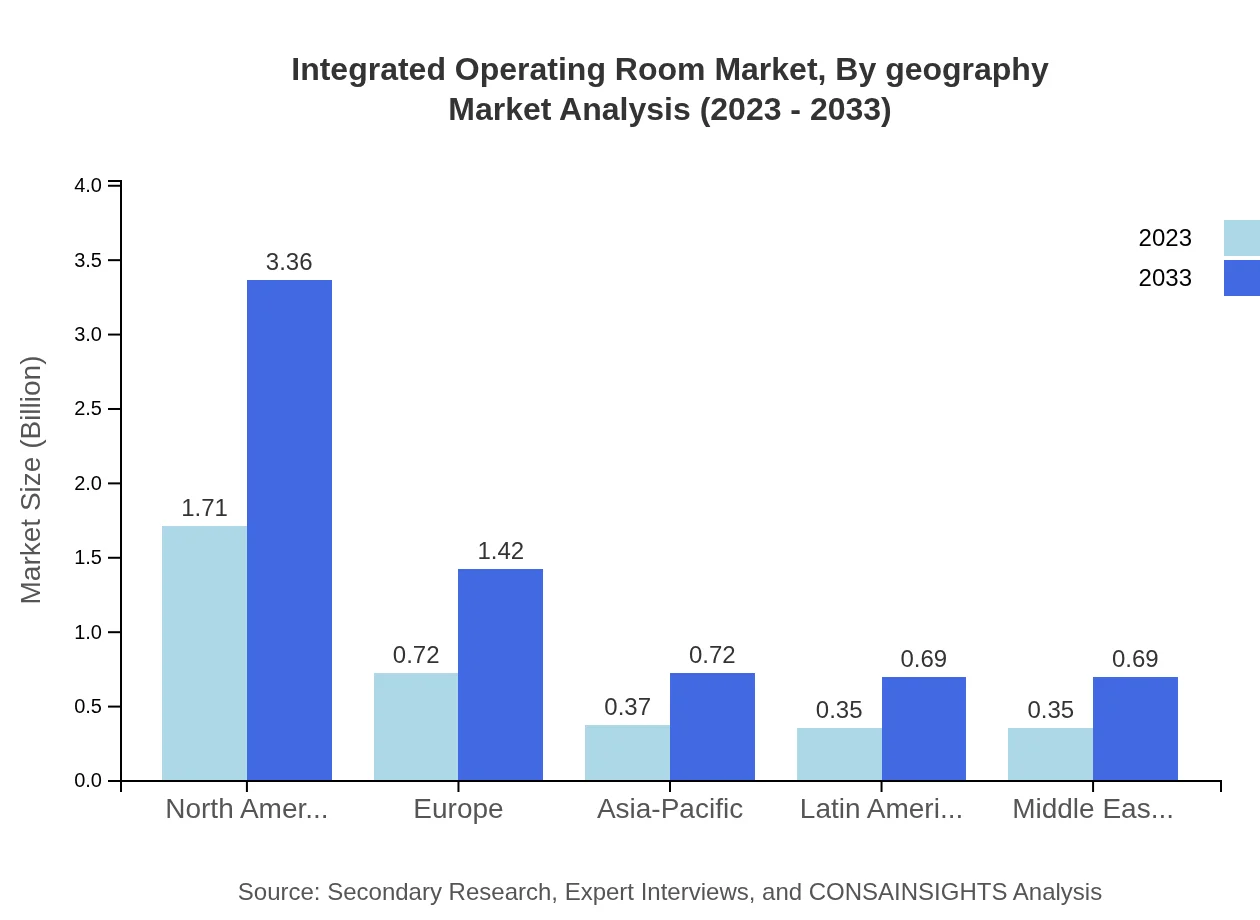

Europe Integrated Operating Room Market Report:

The European market is also on a growth trajectory, projected to reach $2.10 billion by 2033 from $1.07 billion in 2023. Factors contributing to this growth include stringent regulations promoting safety in surgical procedures and extensive research in surgical technologies.Asia Pacific Integrated Operating Room Market Report:

The Asia Pacific region is expected to witness significant growth, with a market size projected to reach $1.20 billion by 2033, up from $0.61 billion in 2023. The driving forces include increasing healthcare infrastructure investments and a rising number of surgical procedures. Countries like China and India are investing heavily in technology to improve healthcare delivery.North America Integrated Operating Room Market Report:

North America holds the largest share of the Integrated Operating Room market, with an expected value of $2.68 billion by 2033, up from $1.36 billion in 2023. The presence of advanced healthcare technologies, coupled with high healthcare expenditure and a significant aging population, underpins its leading market position.South America Integrated Operating Room Market Report:

In South America, the Integrated Operating Room market is estimated to grow from $0.27 billion in 2023 to $0.52 billion by 2033. The region is experiencing gradual improvements in healthcare access, spurred by government initiatives aimed at upgrading hospital facilities and an increase in elective surgeries.Middle East & Africa Integrated Operating Room Market Report:

The Middle East and Africa region is showing gradual growth, with the market expected to grow from $0.19 billion in 2023 to $0.38 billion by 2033. Developments in regional healthcare systems, along with efforts to enhance surgical capabilities, are key growth drivers.Tell us your focus area and get a customized research report.

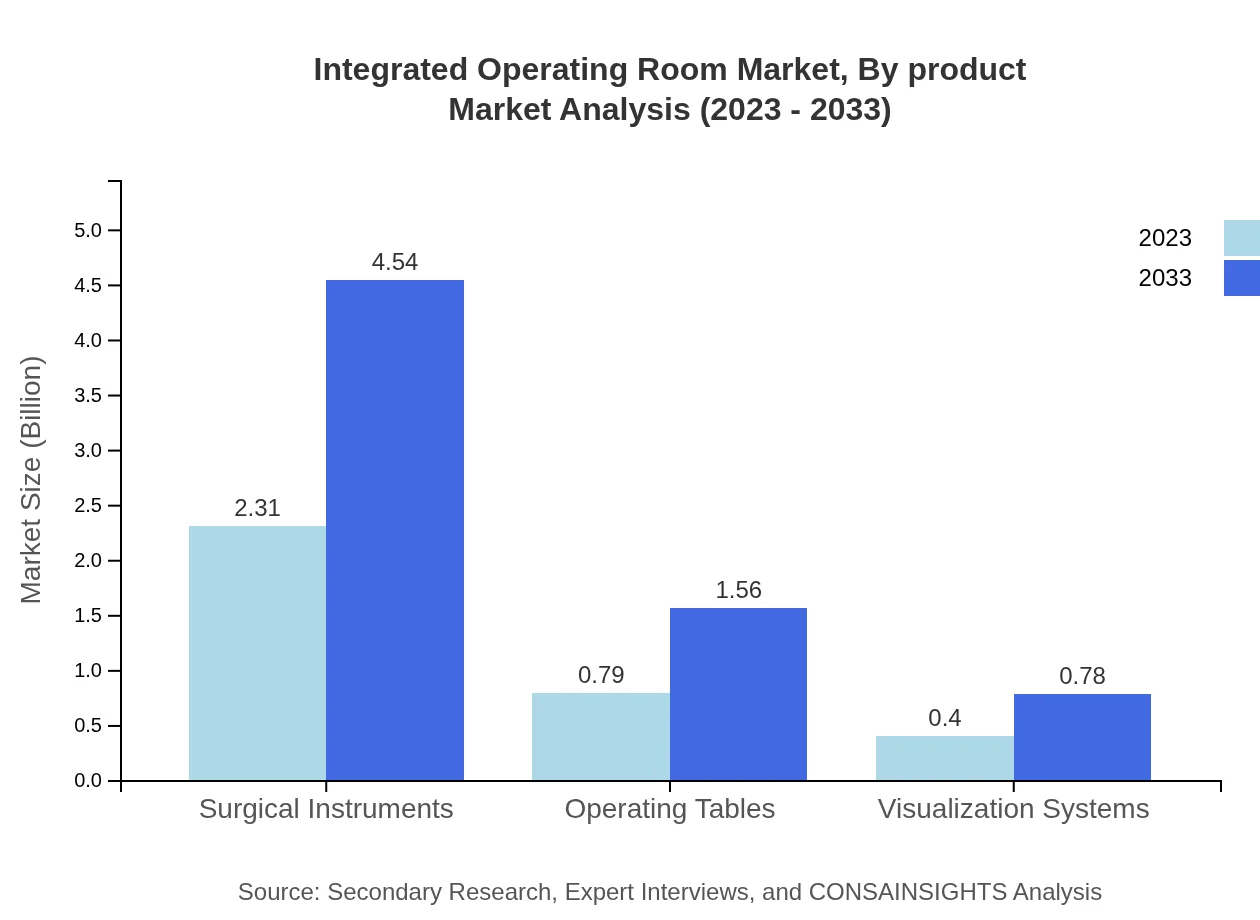

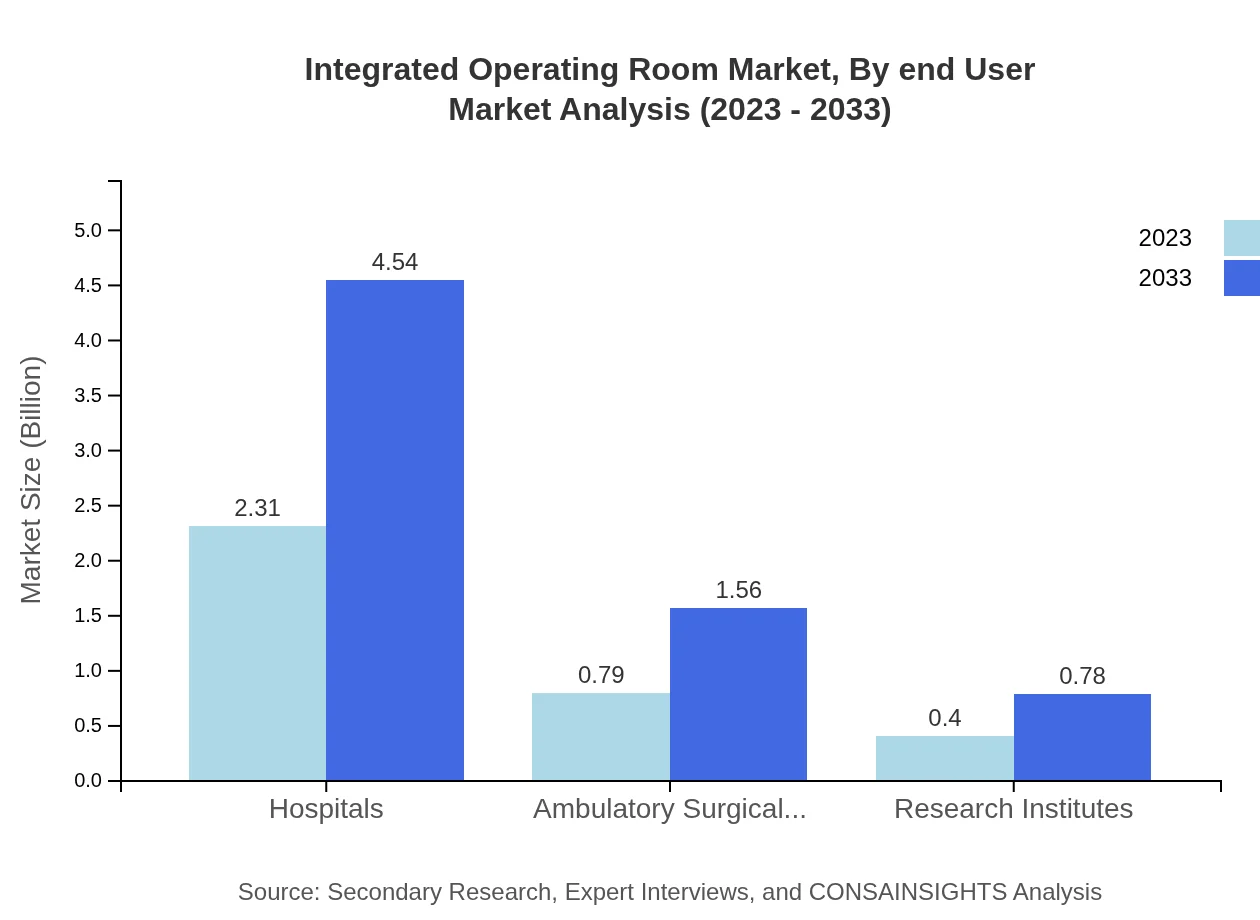

Integrated Operating Room Market Analysis By Product

The market for surgical instruments dominates the Integrated Operating Room sector, projected to reach $4.54 billion by 2033 compared to $2.31 billion in 2023, maintaining a 65.97% market share. Operating tables and visualization systems are also crucial segments, expected to grow to $1.56 billion and $0.78 billion respectively by 2033. The growing reliance on advanced surgical tools emphasizes the need for integrated solutions in the surgical ecosystem.

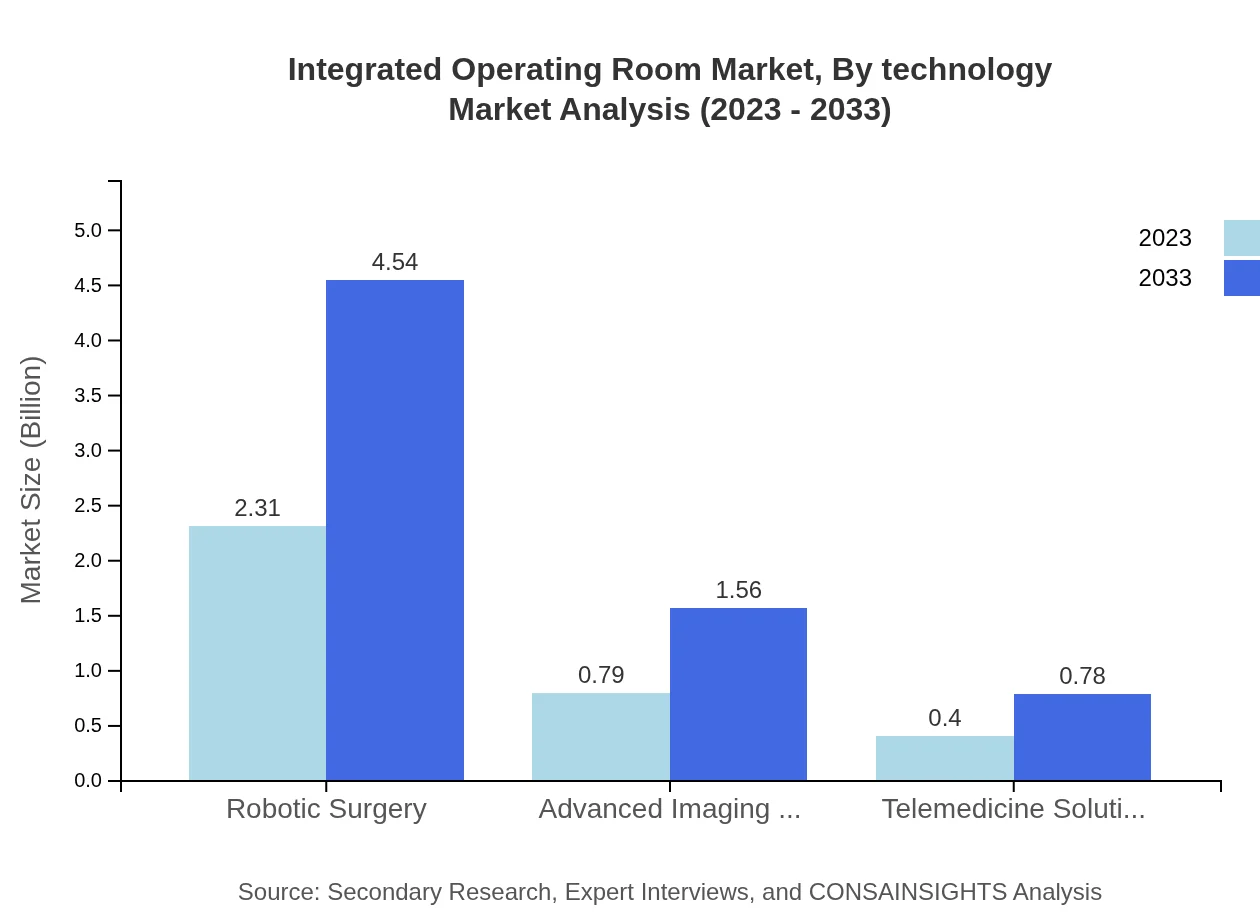

Integrated Operating Room Market Analysis By Technology

Robotic surgery is a prominent technology within the market, with a significant value of $4.54 billion anticipated by 2033, mirroring its current size of $2.31 billion. Advanced imaging technologies are projected to grow substantially, supported by increased adoption of minimally invasive surgical techniques, which require high-definition imaging for precision.

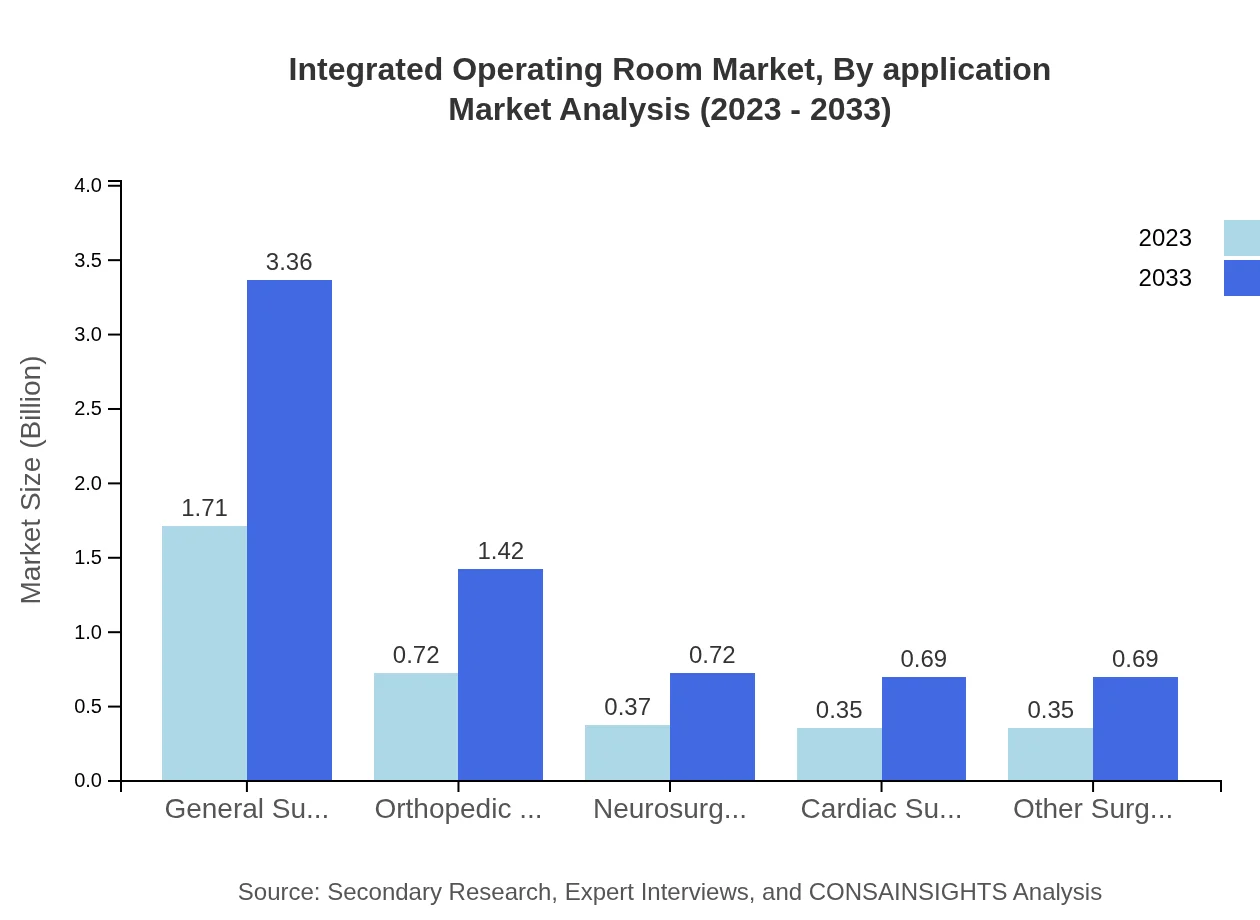

Integrated Operating Room Market Analysis By Application

General surgery accounts for the largest application share of the Integrated Operating Room market, with a projected value of $3.36 billion by 2033. Orthopedic and neurosurgeries are also key contributors, reflecting increasing incidences of related injuries and conditions. The continuous evolution of surgical techniques enhances the value of integrated operating room environments.

Integrated Operating Room Market Analysis By End User

Hospitals remain the primary end-user segment, dominating the market with a share of 65.97% expected by 2033. Ambulatory surgical centers are also becoming increasingly prominent due to the shift towards outpatient surgical procedures, expected to grow to $1.56 billion by 2033.

Integrated Operating Room Market Analysis By Geography

The Integrated Operating Room market shows varying trends across regions, with North America leading in market size due to established healthcare systems. In contrast, Asia-Pacific is rapidly catching up due to modernization efforts in healthcare. Europe remains stable, while Middle Eastern countries are improving their surgical readiness, fostering market growth.

Integrated Operating Room Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Integrated Operating Room Industry

Siemens Healthineers:

A leader in medical technology, Siemens Healthineers provides advanced imaging systems and integrated operating solutions that enhance workflow efficiency and patient safety.GE Healthcare:

GE Healthcare is known for its innovative imaging technologies and solutions designed to improve clinical outcomes in surgical settings.Medtronic :

Medtronic specializes in medical devices linked to surgery and offers integrated solutions for improving surgical outcomes through advanced robotic technology.Stryker Corporation:

Stryker is renowned for its surgical instruments, operating tables, and advanced imaging solutions, focusing on enhancing surgical workflows.Philips Healthcare:

Philips Healthcare leverages advanced technologies in imaging and patient monitoring to enhance surgical precision and improve overall outcomes.We're grateful to work with incredible clients.

FAQs

What is the market size of integrated operating room?

As of 2023, the global integrated operating room market is valued at approximately $3.5 billion and is expected to expand at a CAGR of 6.8% over the next decade, indicating a robust growth trajectory in the surgical sector.

What are the key market players or companies in the integrated operating room industry?

Key players in the integrated operating room industry include major medical equipment manufacturers and technology providers specializing in surgical systems, typically focusing on innovation and integration of advanced technologies to enhance surgical outcomes and efficiency.

What are the primary factors driving the growth in the integrated operating room industry?

Growth is primarily driven by advancements in medical technologies, increasing demand for minimally invasive surgeries, and the need for improved surgical outcomes, prompting hospitals to invest in integrated operating room solutions for efficiency and patient care.

Which region is the fastest Growing in the integrated operating room?

North America is currently the fastest-growing region in the integrated operating room market, expected to grow from $1.36 billion in 2023 to $2.68 billion by 2033, reflecting rising adoption of advanced surgical technologies.

Does ConsaInsights provide customized market report data for the integrated operating room industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the integrated operating room industry, allowing clients to access in-depth insights and analysis relevant to their market segment.

What deliverables can I expect from this integrated operating room market research project?

Deliverables typically include detailed market analysis reports, growth forecasts, competitive landscape assessments, regional insights, and segment-specific data, enhancing decision-making and strategic planning for stakeholders.

What are the market trends of integrated operating room?

Current trends in the integrated operating room market include rising adoption of telemedicine solutions, automation of surgical procedures, and the integration of advanced imaging technologies, reflecting the ongoing evolution in surgical practices.