Integrated Passive Devices Market Report

Published Date: 31 January 2026 | Report Code: integrated-passive-devices

Integrated Passive Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the Integrated Passive Devices market, including market size, segmentation, regional insights, industry trends, and future forecasts from 2023 to 2033.

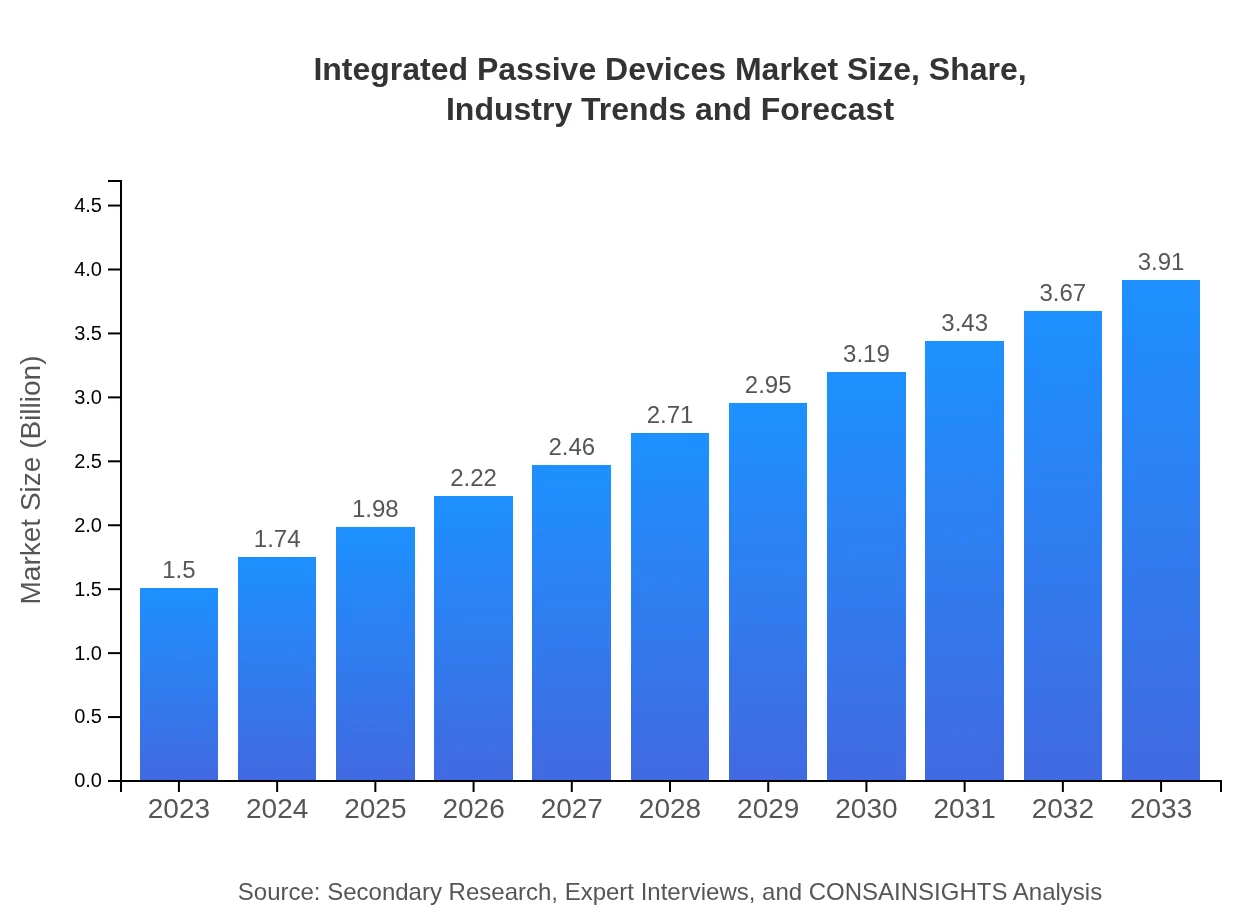

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 9.7% |

| 2033 Market Size | $3.91 Billion |

| Top Companies | AVX Corporation, Murata Manufacturing Co., Ltd., Taiyo Yuden Co., Ltd., TDK Corporation |

| Last Modified Date | 31 January 2026 |

Integrated Passive Devices Market Overview

Customize Integrated Passive Devices Market Report market research report

- ✔ Get in-depth analysis of Integrated Passive Devices market size, growth, and forecasts.

- ✔ Understand Integrated Passive Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Integrated Passive Devices

What is the Market Size & CAGR of Integrated Passive Devices market in 2023?

Integrated Passive Devices Industry Analysis

Integrated Passive Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Integrated Passive Devices Market Analysis Report by Region

Europe Integrated Passive Devices Market Report:

Europe is also poised for strong growth, anticipated to rise from $0.48 billion in 2023 to $1.26 billion by 2033. The rising demand for integration in consumer and industrial electronics, along with stringent regulations driving energy-efficient solutions, will contribute to this trend.Asia Pacific Integrated Passive Devices Market Report:

The Asia Pacific region is expected to witness substantial growth, with the market valued at $0.29 billion in 2023 and projected to increase to $0.75 billion by 2033. The rise in electronic manufacturing, driven by countries like China, Japan, and South Korea, combined with the growing telecommunications sector, will be key growth factors.North America Integrated Passive Devices Market Report:

North America holds a significant share, with the market size projected to grow from $0.50 billion in 2023 to $1.31 billion by 2033. The region's robust technological innovation, coupled with the increasing demand for IPDs in industries such as automotive and consumer electronics, is expected to fuel this growth.South America Integrated Passive Devices Market Report:

In South America, the Integrated Passive Devices market is expected to grow from $0.10 billion in 2023 to $0.27 billion by 2033. The growth is largely attributed to the expansion of the consumer electronics market and increasing investments in telecommunications infrastructure in countries like Brazil and Argentina.Middle East & Africa Integrated Passive Devices Market Report:

The Integrated Passive Devices market in the Middle East and Africa is projected to grow from $0.12 billion in 2023 to $0.32 billion by 2033, spurred by advancements in telecommunications and the increasing prevalence of smart technologies in the region.Tell us your focus area and get a customized research report.

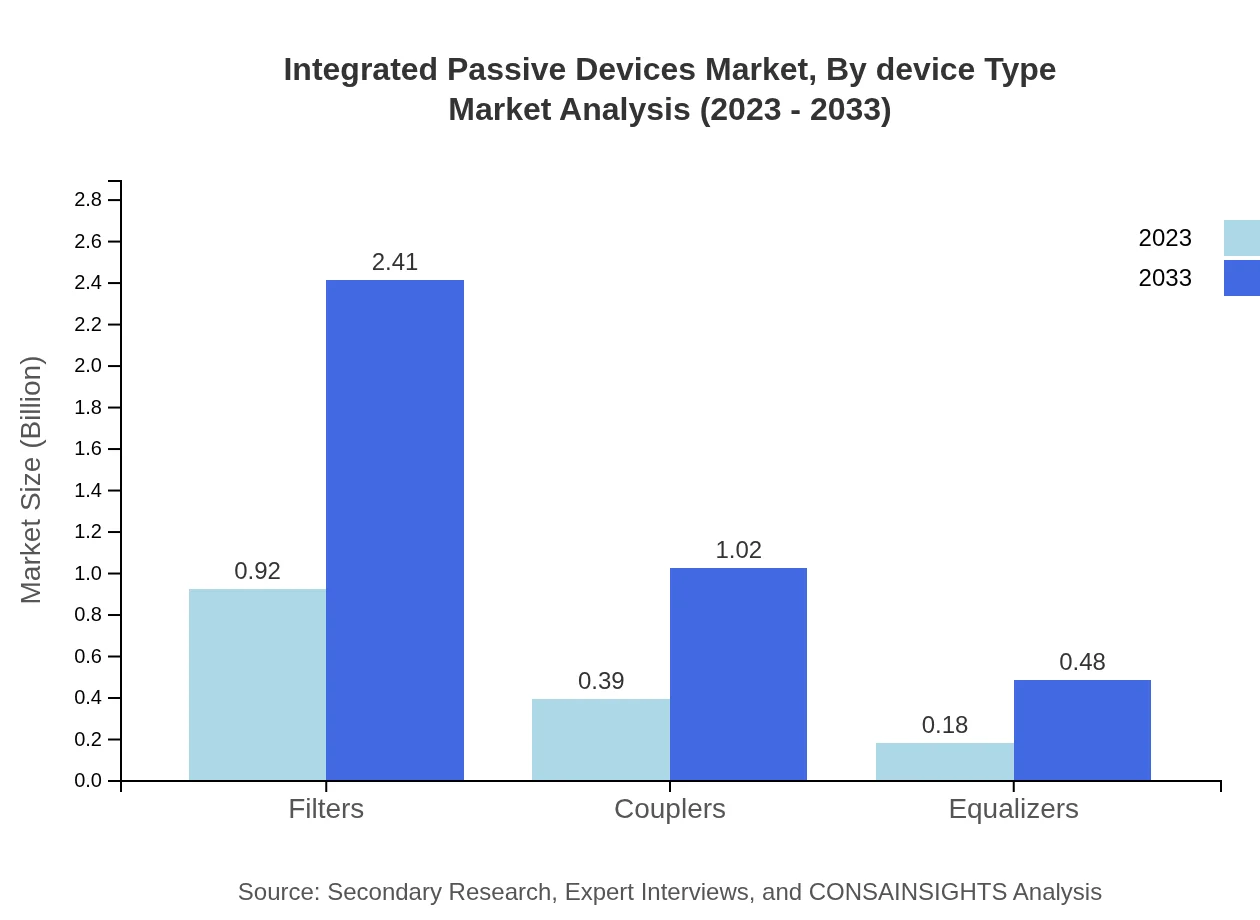

Integrated Passive Devices Market Analysis By Device Type

By device type, filters dominate the market, accounting for $0.92 billion in 2023 and growing to $2.41 billion by 2033. Couplers also show significant growth from $0.39 billion to $1.02 billion during the same period. Equalizers and other passive components maintain relevance, showcasing steady demand.

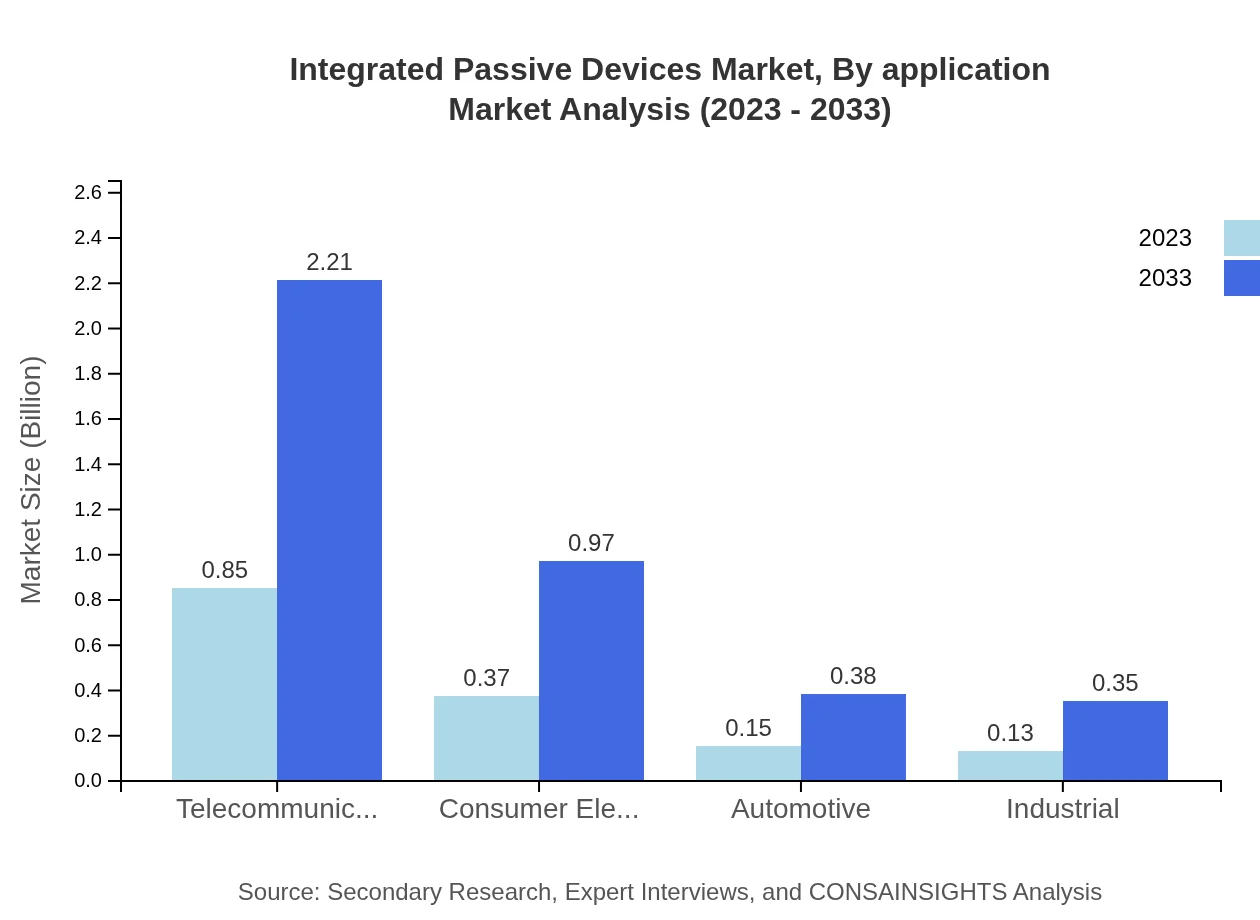

Integrated Passive Devices Market Analysis By Application

In terms of application, telecommunications remains the largest sector, representing a market size of $0.85 billion in 2023 and expected to grow to $2.21 billion by 2033. Consumer electronics and automotive applications follow, indicating healthy growth rates fueled by rising consumer electronic product adoption and vehicle electrification.

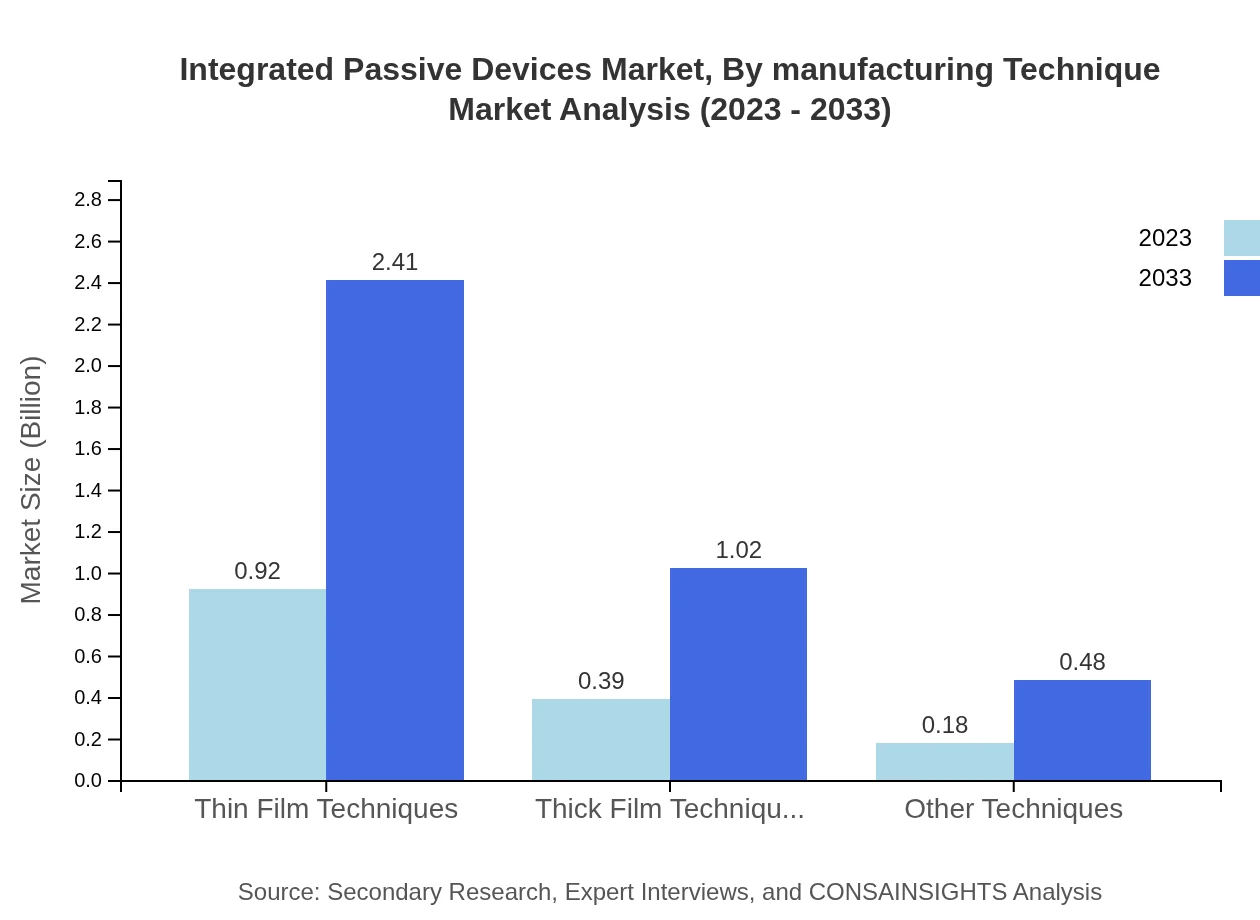

Integrated Passive Devices Market Analysis By Manufacturing Technique

The market segmented by manufacturing technique shows thin film techniques leading with $0.92 billion in 2023 and anticipated growth to $2.41 billion by 2033. Thick film techniques also represent a significant portion, expected to rise from $0.39 billion to $1.02 billion, denoting a strong preference for these methods among manufacturers.

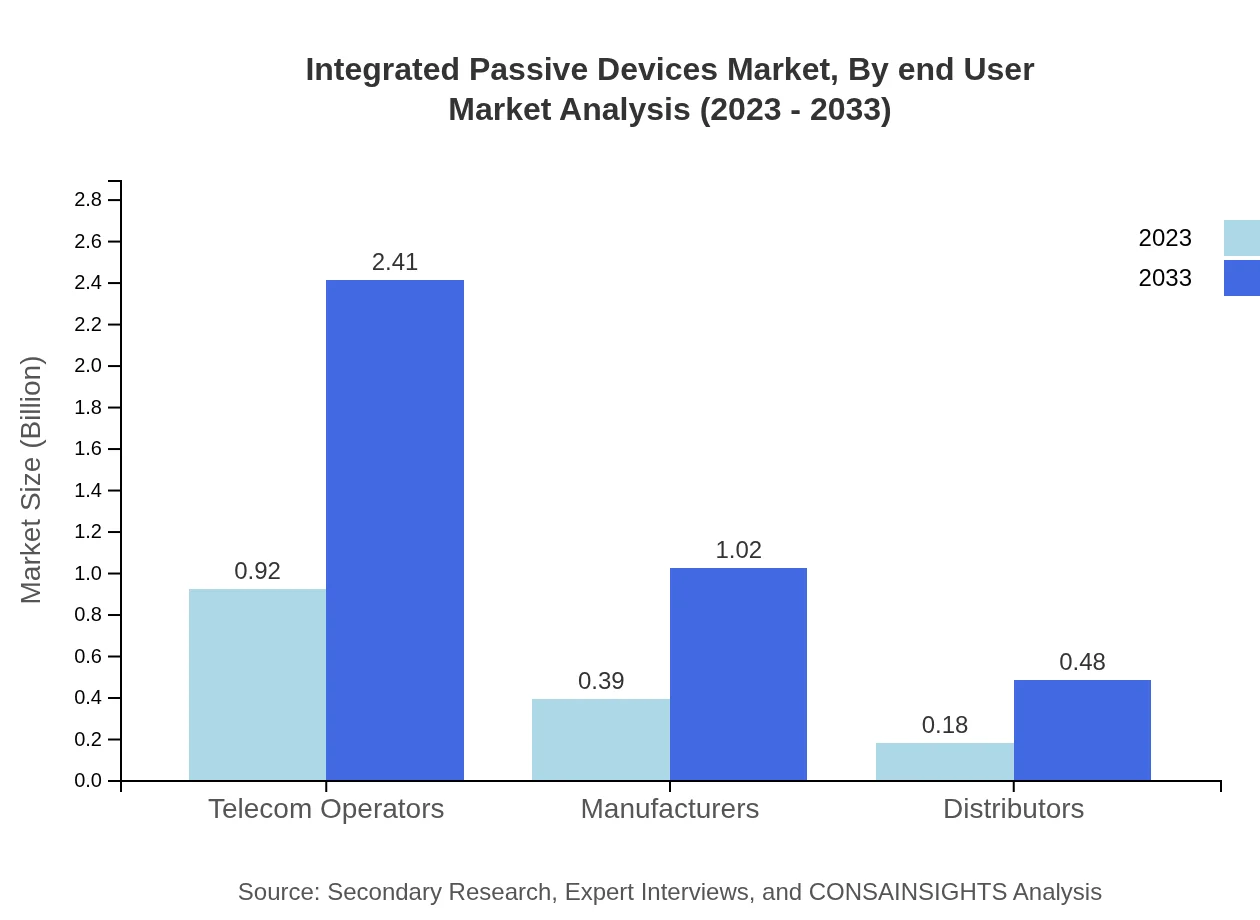

Integrated Passive Devices Market Analysis By End User

Telecommunications is the key end-user segment, accounting for a market size of $0.92 billion in 2023, with growth to $2.41 billion by 2033. Other notable sectors include consumer electronics and automotive industries, where rising demand for integrated solutions drives substantial opportunities.

Integrated Passive Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Integrated Passive Devices Industry

AVX Corporation:

A leading manufacturer of passive components, AVX Corporation specializes in integrated passive devices used across various applications, consistently focusing on innovation and product development.Murata Manufacturing Co., Ltd.:

Murata is a prominent player in the IPD market, known for its high-quality electronic components, continuously working to enhance miniaturization and integration in its product lines.Taiyo Yuden Co., Ltd.:

Taiyo Yuden focuses on developing advanced passive components, leading to significant contributions in the integrated passive devices sector, especially aiming towards IoT applications.TDK Corporation:

TDK is well-recognized for its comprehensive range of passive components and has made significant advancements in the integrated passive devices market, catering to diverse industries.We're grateful to work with incredible clients.

FAQs

What is the market size of integrated Passive Devices?

The integrated passive devices market is currently valued at approximately $1.5 billion in 2023, with a projected CAGR of 9.7% over the next decade, indicating significant growth potential and increasing adoption in various applications.

What are the key market players or companies in this integrated Passive Devices industry?

The integrated passive devices industry comprises noteworthy players such as Texas Instruments, Analog Devices, Vishay Intertechnology, and Murata Manufacturing, who are pioneering innovations and strategic collaborations within this sector.

What are the primary factors driving the growth in the integrated Passive Devices industry?

Key factors driving growth include increasing demand in telecommunications, advancements in consumer electronics, and the push for miniaturization in electronic devices, leading to a greater preference for integrated passive solutions.

Which region is the fastest Growing in the integrated Passive Devices?

The North American region is the fastest-growing for integrated passive devices, projected to expand from $0.50 billion in 2023 to $1.31 billion by 2033, driven by technological advancements and a strong consumer electronics market.

Does ConsaInsights provide customized market report data for the integrated Passive Devices industry?

Yes, ConsaInsights offers tailored market report data for the integrated passive devices industry, allowing clients to gain insights specific to their needs, including focused segments or geographical regions.

What deliverables can I expect from this integrated Passive Devices market research project?

Clients can expect comprehensive deliverables such as detailed market analysis reports, forecasts, segment breakdowns, regional insights, and crucial industry trends that provide a thorough understanding of the integrated passive devices landscape.

What are the market trends of integrated Passive Devices?

Current trends in the integrated passive devices market include increased adoption in automotive applications, growth in 5G infrastructure, and a strong focus on sustainability and energy efficiency in device manufacturing.