Integrated Pest Management Market Report

Published Date: 02 February 2026 | Report Code: integrated-pest-management

Integrated Pest Management Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Integrated Pest Management (IPM) market, highlighting current trends, market size forecasts, and regional insights from 2023 to 2033. It aims to offer strategic guidance for stakeholders in the IPM sector.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $16.46 Billion |

| Top Companies | BASF SE, Syngenta AG, Corteva Agriscience, FMC Corporation |

| Last Modified Date | 02 February 2026 |

Integrated Pest Management Market Overview

Customize Integrated Pest Management Market Report market research report

- ✔ Get in-depth analysis of Integrated Pest Management market size, growth, and forecasts.

- ✔ Understand Integrated Pest Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Integrated Pest Management

What is the Market Size & CAGR of Integrated Pest Management market in 2023?

Integrated Pest Management Industry Analysis

Integrated Pest Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

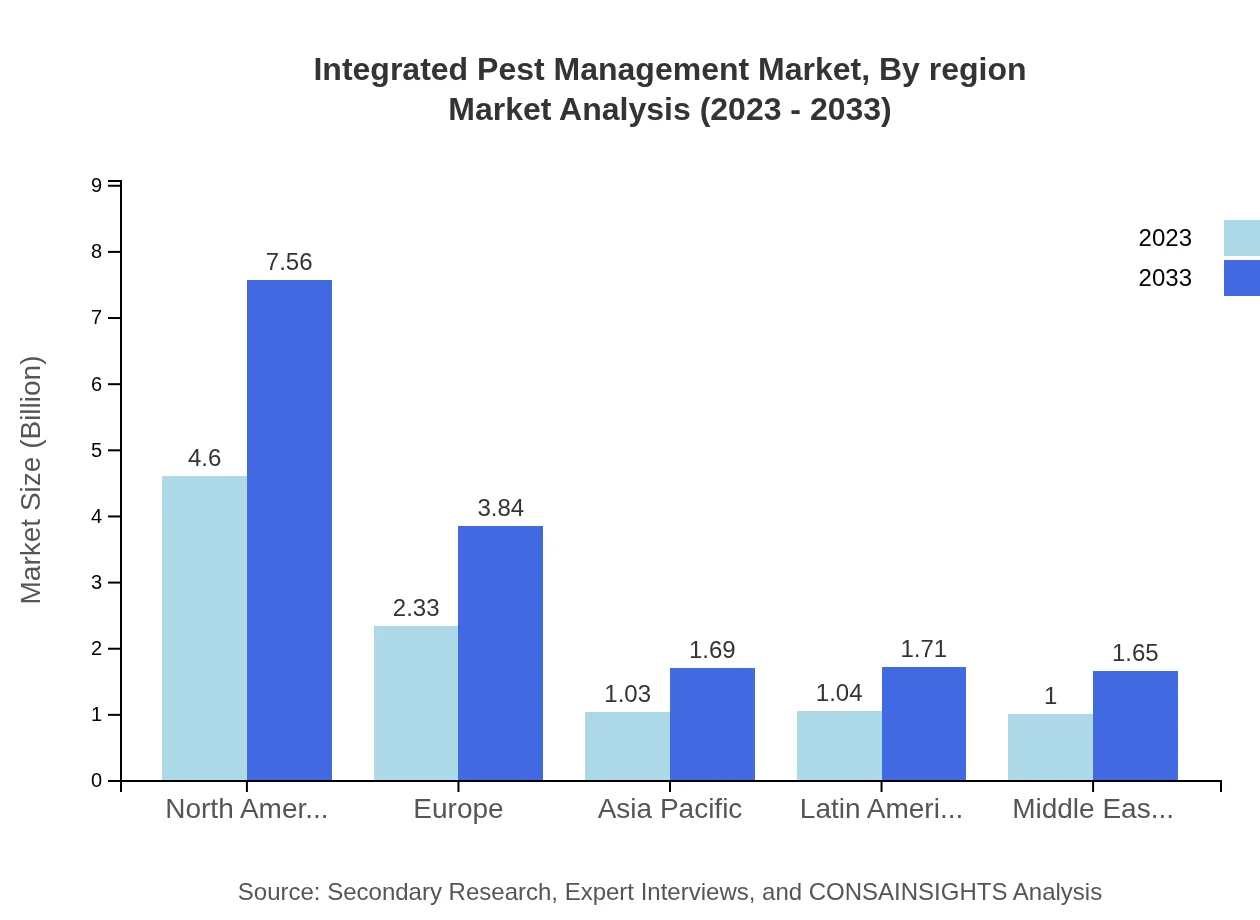

Integrated Pest Management Market Analysis Report by Region

Europe Integrated Pest Management Market Report:

The European IPM market is expected to grow from $3.17 billion in 2023 to $5.23 billion by 2033, driven by stringent EU regulations on pesticide usage and a growing consumer preference for organic produce.Asia Pacific Integrated Pest Management Market Report:

In 2023, the Asia Pacific region's IPM market is valued at $1.91 billion and is expected to reach $3.14 billion by 2033. Enhanced adoption of IPM practices in countries like India and China, driven by government initiatives and rising awareness, will fuel market growth.North America Integrated Pest Management Market Report:

The North American IPM market, valued at $3.42 billion in 2023, will grow to $5.63 billion by 2033. The U.S. leads in this sector due to strong regulations regarding pesticide use, along with an increasing demand for sustainable practices among farmers.South America Integrated Pest Management Market Report:

South America’s IPM market is projected to increase from $0.29 billion in 2023 to $0.48 billion by 2033. This growth is attributed to the rising agricultural sector and organic farming practices, particularly in Brazil and Argentina.Middle East & Africa Integrated Pest Management Market Report:

In the Middle East and Africa, the IPM market's size is anticipated to increase from $1.21 billion in 2023 to $1.99 billion by 2033. The region's focus on improving food security and sustainable agricultural practices will play a significant role in this growth.Tell us your focus area and get a customized research report.

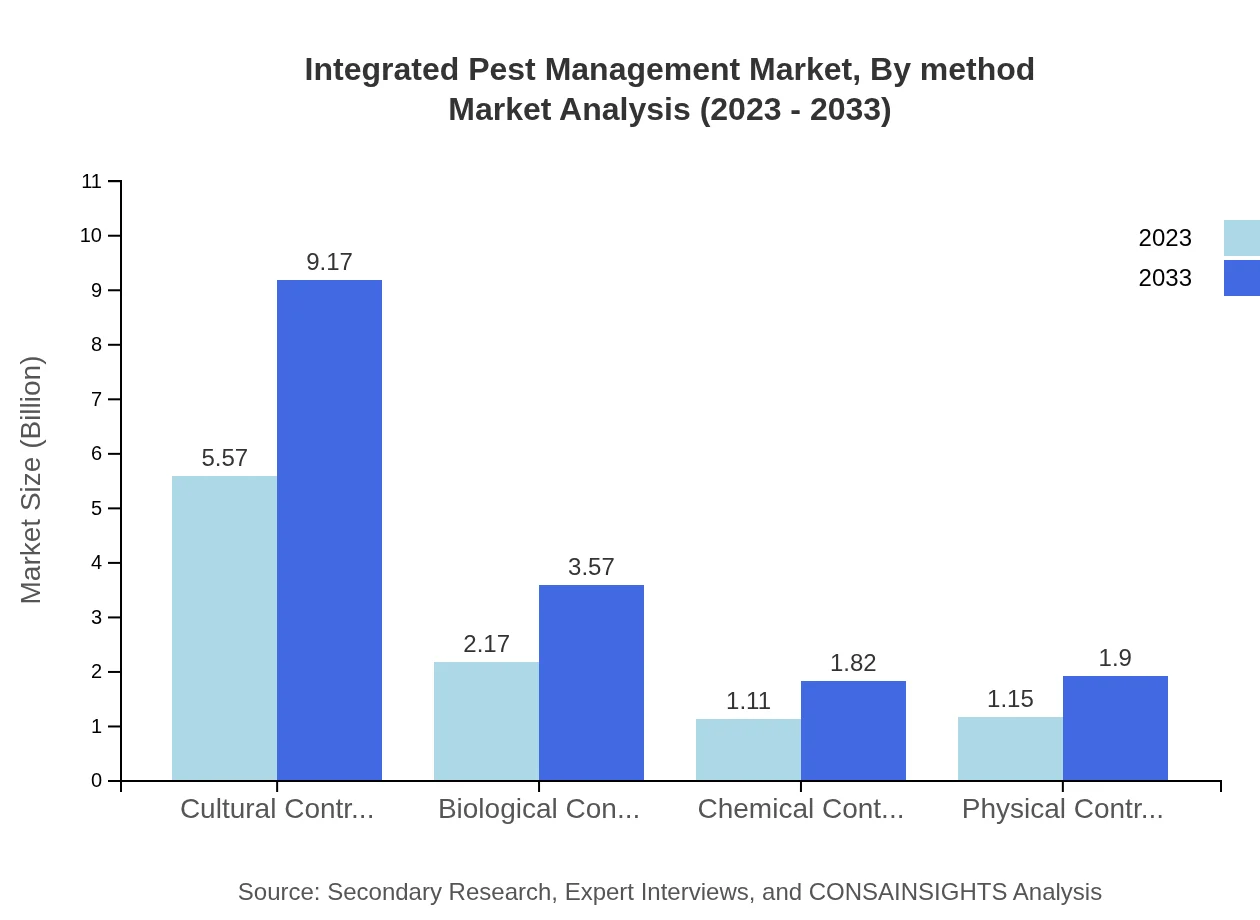

Integrated Pest Management Market Analysis By Method

The IPM market is notably dominated by cultural control methods, projected to grow from $5.57 billion in 2023 to $9.17 billion by 2033. Biological control methods, while smaller, are also gaining traction with growth from $2.17 billion to $3.57 billion. Chemical control methods remain vital, but their market share is decreasing due to increasing sustainability concerns.

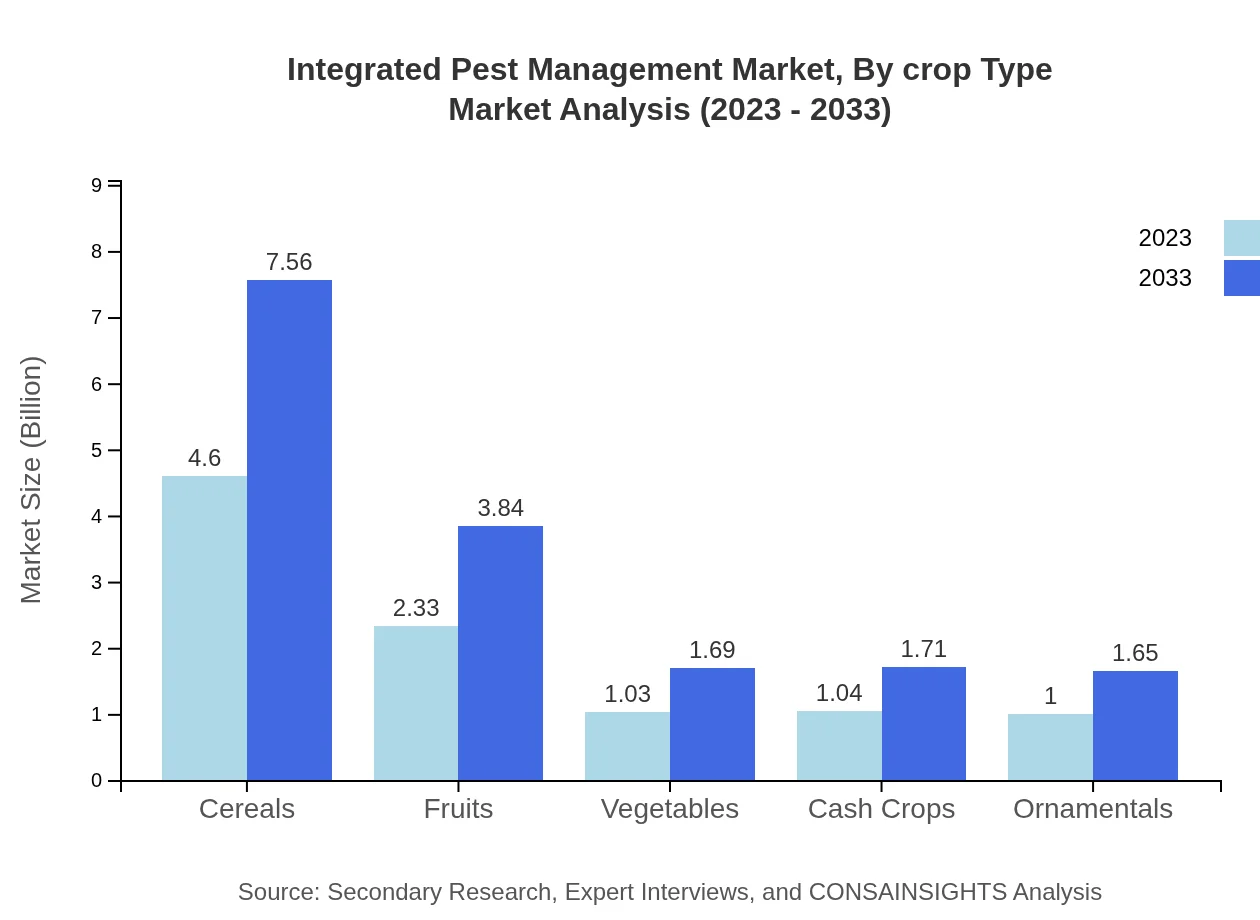

Integrated Pest Management Market Analysis By Crop Type

Cereals are the largest segment within the crop type category, with market values rising from $4.60 billion in 2023 to $7.56 billion by 2033. Fruits and vegetables follow, emphasizing the varying needs for pest management across crop types.

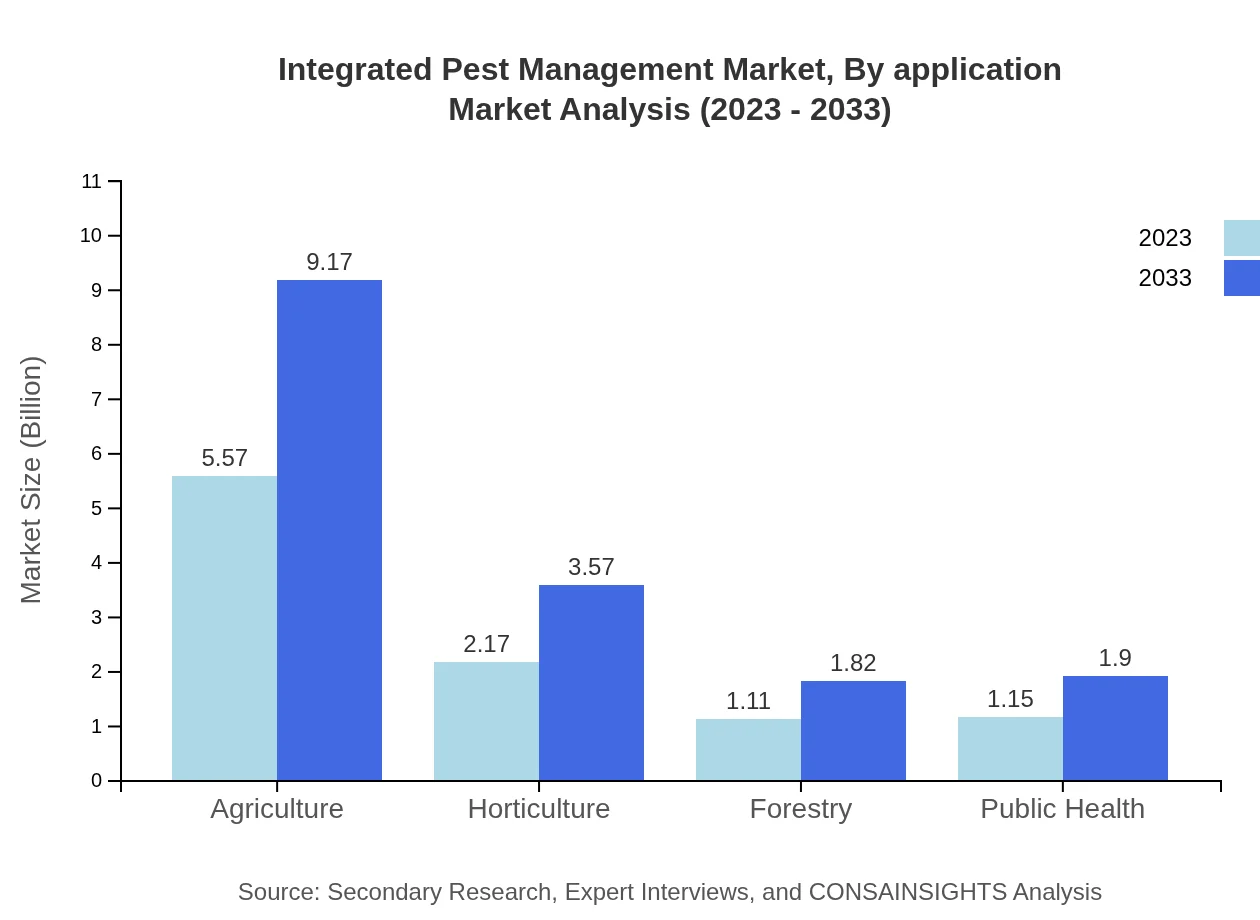

Integrated Pest Management Market Analysis By Application

The agriculture application segment captures the largest share at 55.7% in 2023, reflecting the centrality of pest management to crop production. Horticulture and forestry applications also present significant markets, emphasizing their importance in IPM.

Integrated Pest Management Market Analysis By Region

Regional analyses show varied growth potentials with North America and Europe leading the market. Emerging markets in Asia Pacific and Latin America present new opportunities, driven by shifts towards sustainable agriculture.

Integrated Pest Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Integrated Pest Management Industry

BASF SE:

BASF is a global leader in chemical production, offering innovative pest management solutions including biopesticides that align with IPM strategies.Syngenta AG:

Syngenta focuses on sustainable agriculture, providing a range of IPM solutions. They are dedicated to developing advanced pest control products that minimize environmental impact.Corteva Agriscience:

Corteva specializes in agricultural chemicals and seeds, emphasizing sustainable pest management practices that enhance crop yield while protecting the environment.FMC Corporation:

FMC Corporation provides innovative pest management products and solutions, investing significantly in R&D to develop biopesticides and other environmentally friendly pest control methods.We're grateful to work with incredible clients.

FAQs

What is the market size of Integrated Pest Management?

The Integrated Pest Management (IPM) market is valued at approximately $10 billion in 2023, with a projected growth at a CAGR of 5%. By 2033, it is expected to expand significantly, reflecting increased demand for sustainable pest control solutions.

What are the key market players or companies in the Integrated Pest Management industry?

Key players in the Integrated Pest Management industry include Terminix, Rentokil Initial, and Anticimex, along with various local and regional companies that specialize in pest control services and pest management products.

What are the primary factors driving the growth in the Integrated Pest Management industry?

The growth in the IPM sector is primarily driven by increasing awareness of sustainable agriculture, government regulations promoting eco-friendly practices, and the rising incidence of pest-related diseases necessitating effective pest control methods.

Which region is the fastest Growing in the Integrated Pest Management market?

The Asia-Pacific region is currently the fastest-growing market for Integrated Pest Management, with a market size projected to grow from $1.91 billion in 2023 to $3.14 billion by 2033, indicating significant demand for pest management solutions.

Does ConsaInsights provide customized market report data for the Integrated Pest Management industry?

Yes, ConsaInsights offers customized market report data tailored to the Integrated Pest Management industry, enabling stakeholders to obtain specific insights that align with their strategic objectives and requirements.

What deliverables can I expect from this Integrated Pest Management market research project?

Deliverables from the Integrated Pest Management market research project include comprehensive reports, market forecasts, analysis of key players, segmented data, and insights into market trends and consumer behaviors.

What are the market trends of Integrated Pest Management?

Market trends in the Integrated Pest Management space include increasing adoption of digital pest management solutions, greater emphasis on biopesticides, and a shift towards holistic pest control strategies to meet stringent environmental regulations.