Integrated Radar And Camera Market Report

Published Date: 31 January 2026 | Report Code: integrated-radar-and-camera

Integrated Radar And Camera Market Size, Share, Industry Trends and Forecast to 2033

This report presents a comprehensive analysis of the Integrated Radar And Camera market from 2023 to 2033, covering market size, growth trends, regional dynamics, industry segmentation, and key players. Insights provided aid in understanding the evolving landscape and future prospects.

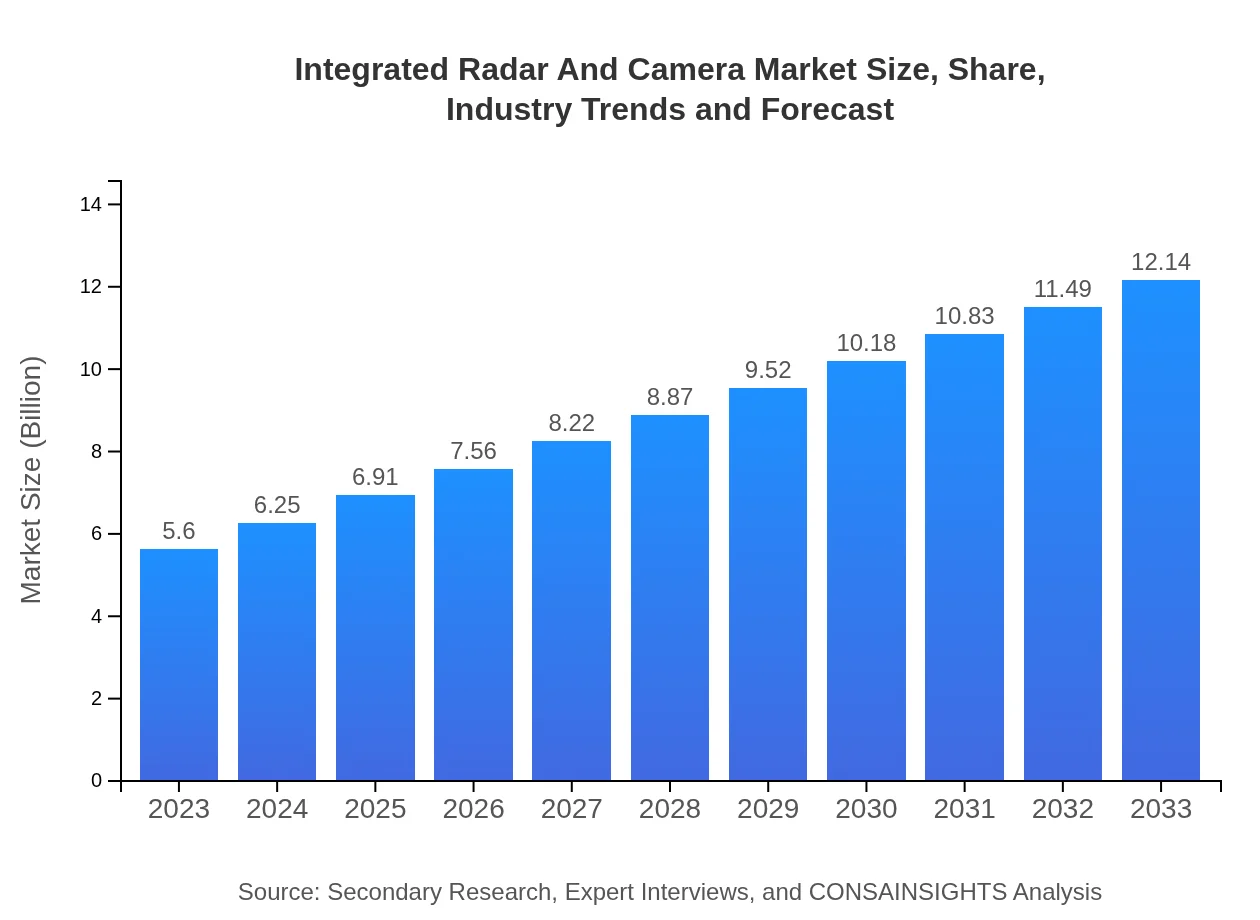

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $12.14 Billion |

| Top Companies | Bosch, Daimler AG, Continental AG, Valeo |

| Last Modified Date | 31 January 2026 |

Integrated Radar And Camera Market Overview

Customize Integrated Radar And Camera Market Report market research report

- ✔ Get in-depth analysis of Integrated Radar And Camera market size, growth, and forecasts.

- ✔ Understand Integrated Radar And Camera's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Integrated Radar And Camera

What is the Market Size & CAGR of Integrated Radar And Camera market in 2033?

Integrated Radar And Camera Industry Analysis

Integrated Radar And Camera Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Integrated Radar And Camera Market Analysis Report by Region

Europe Integrated Radar And Camera Market Report:

In Europe, the market size is expected to grow from $1.75 billion in 2023 to $3.79 billion in 2033, driven by regulatory pushes towards road safety and strong demand for automated solutions in vehicles. The region's focus on electric vehicles and autonomous technology further boosts adoption.Asia Pacific Integrated Radar And Camera Market Report:

The Asia Pacific region is expected to witness substantial growth, driven by increasing automotive production and rising technological advancements. With a market size projected to grow from $0.89 billion in 2023 to $1.92 billion in 2033, notable investments in smart city initiatives and IoT technology in countries like China and Japan bolster the growth of Integrated Radar and Camera solutions.North America Integrated Radar And Camera Market Report:

North America leads the market with a size projected to increase from $2.13 billion in 2023 to $4.61 billion in 2033. The region benefits from stringent safety regulations, a robust automotive sector, and high investments in R&D for advanced driver-assistance systems. The presence of key market players also contributes to the region’s dominance.South America Integrated Radar And Camera Market Report:

In South America, the market size is expected to evolve from $0.41 billion in 2023 to $0.89 billion in 2033, propelled by growing demand for safety and surveillance applications. The implementation of modern infrastructure projects will further drive the integration of these technologies into various sectors.Middle East & Africa Integrated Radar And Camera Market Report:

The Middle East and Africa show promise with an expected increase in market size from $0.43 billion in 2023 to $0.93 billion in 2033, fueled by advancements in defense technologies and the adoption of smart surveillance systems in urban areas.Tell us your focus area and get a customized research report.

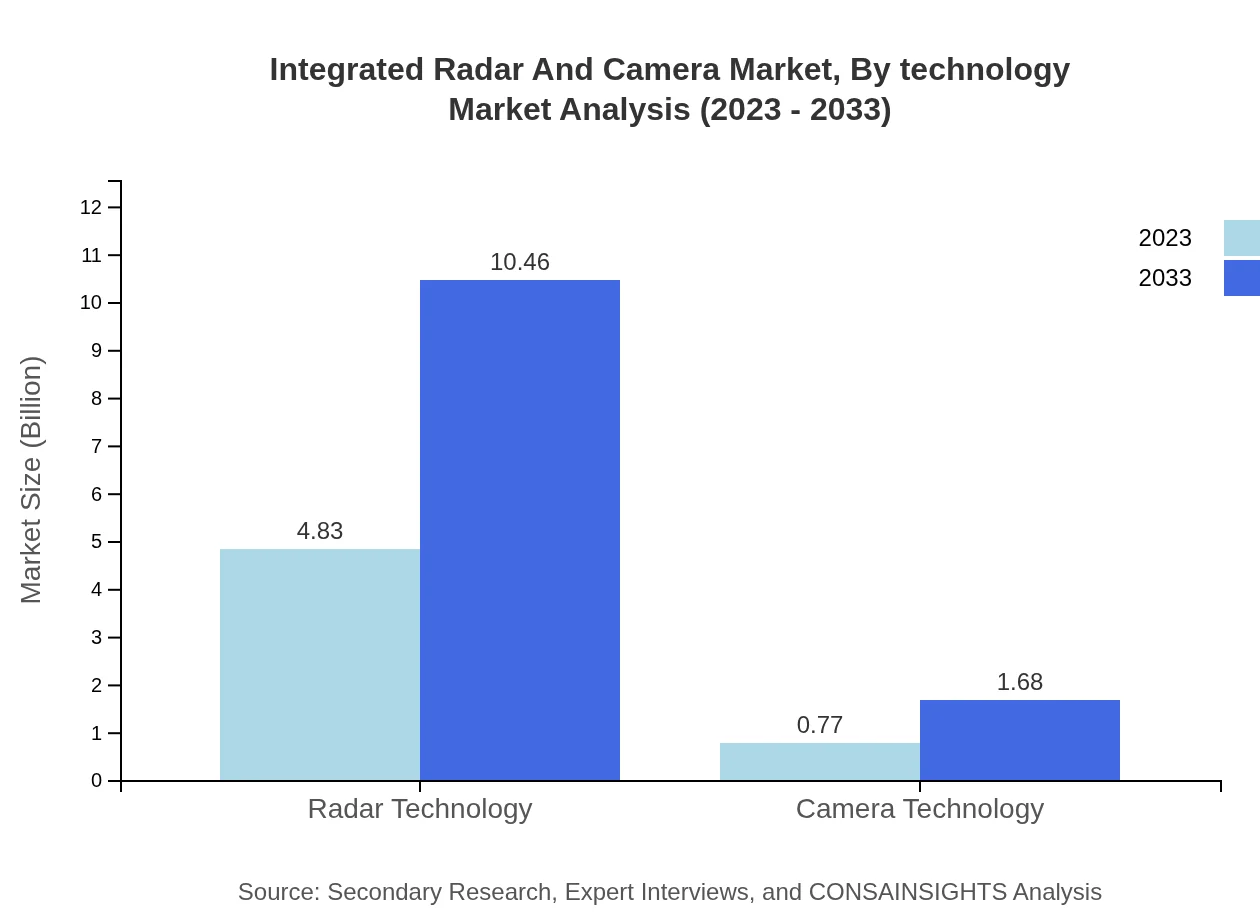

Integrated Radar And Camera Market Analysis By Technology

The Integrated Radar and Camera market is categorized into Radar Technology and Camera Technology. The Radar Technology segment is the leader, accounting for $4.83 billion in size in 2023, expected to rise to $10.46 billion by 2033, representing a stable 86.18% market share. This is driven by its pivotal role in autonomous driving and defense applications. The Camera Technology segment, while smaller at $0.77 billion currently with a forecasted increase to $1.68 billion, accounts for 13.82% of the market.

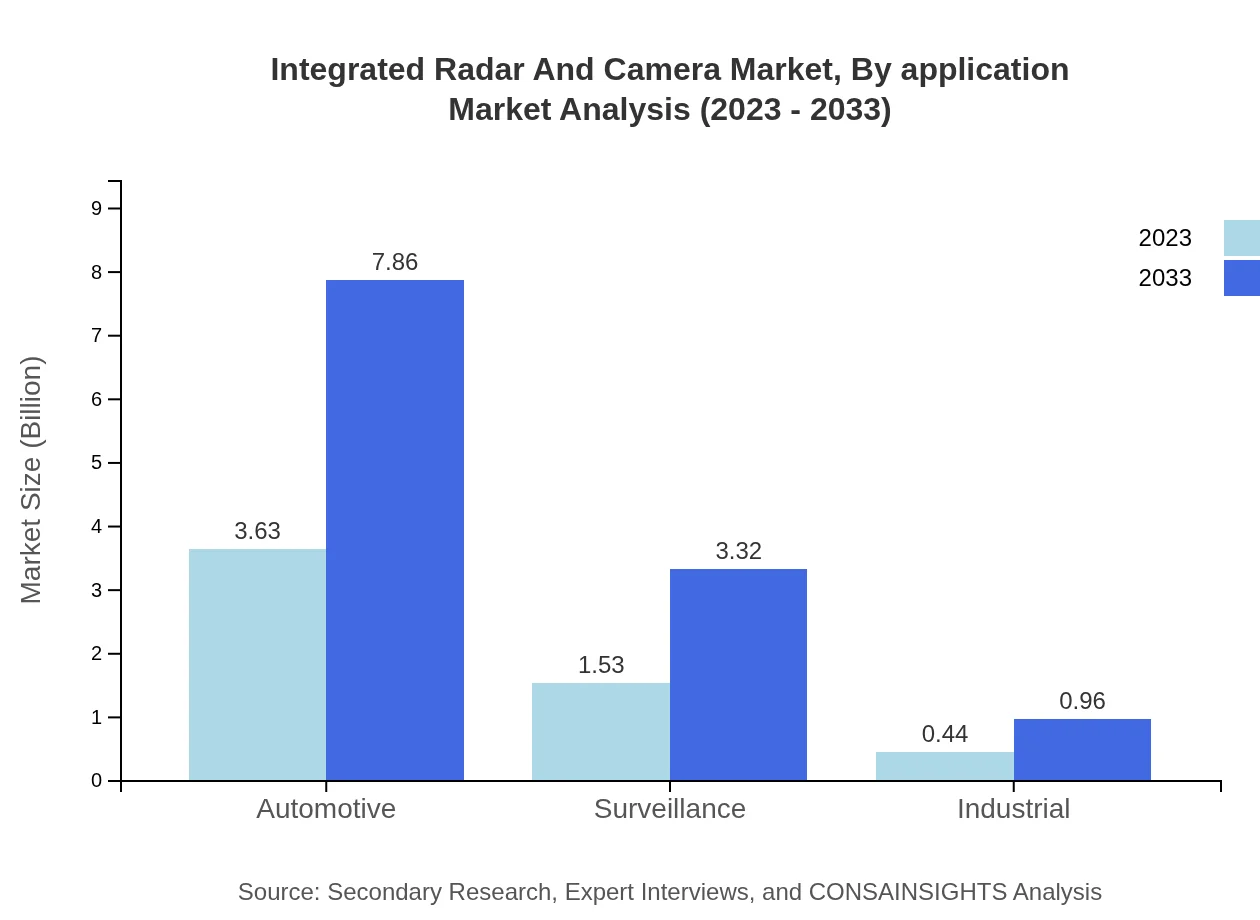

Integrated Radar And Camera Market Analysis By Application

Applications primarily include Transportation, Defense, Consumer Electronics, and Surveillance. The Transportation segment is expected to dominate, growing from $3.63 billion in 2023 to $7.86 billion by 2033 and maintaining a market share of 64.77%. The Defense sector will see growth due to rising global tensions, expanding from $1.53 billion to $3.32 billion, capturing 27.34% of the share. Other segments like Consumer Electronics and Surveillance, although smaller, are growing steadily with significant development prospects.

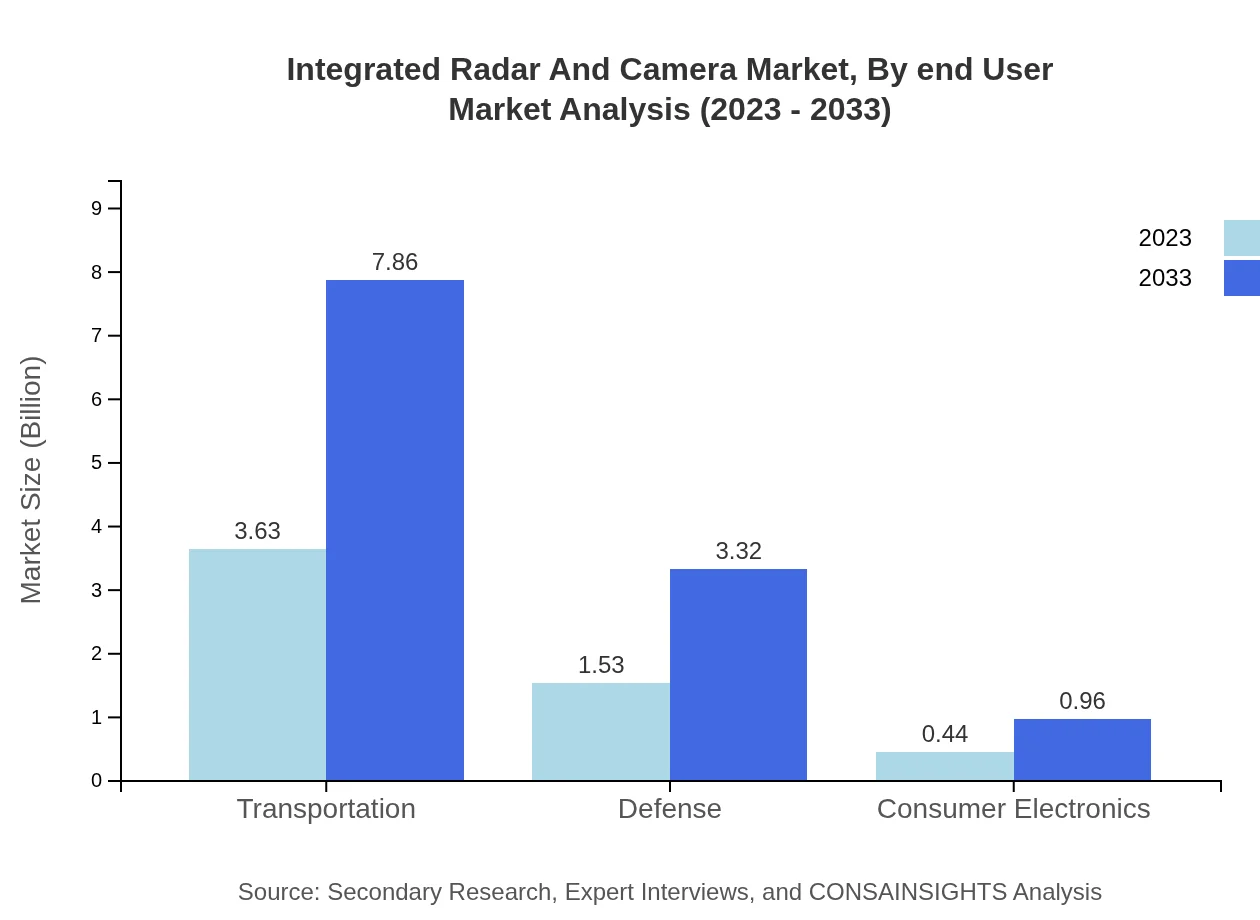

Integrated Radar And Camera Market Analysis By End User

The end-user categories for Integrated Radar and Camera include Automotive, Defense, Industrial, and Consumer Electronics. The Automotive sector is the largest, with a market size of $3.63 billion in 2023 projected to grow to $7.86 billion, comprising 64.77% of the end-user market. Defense shows strong growth potential at $1.53 billion, expected to reach $3.32 billion, making up about 27.34%. Industrial and Consumer Electronics, while smaller, represent emerging markets with growth opportunities.

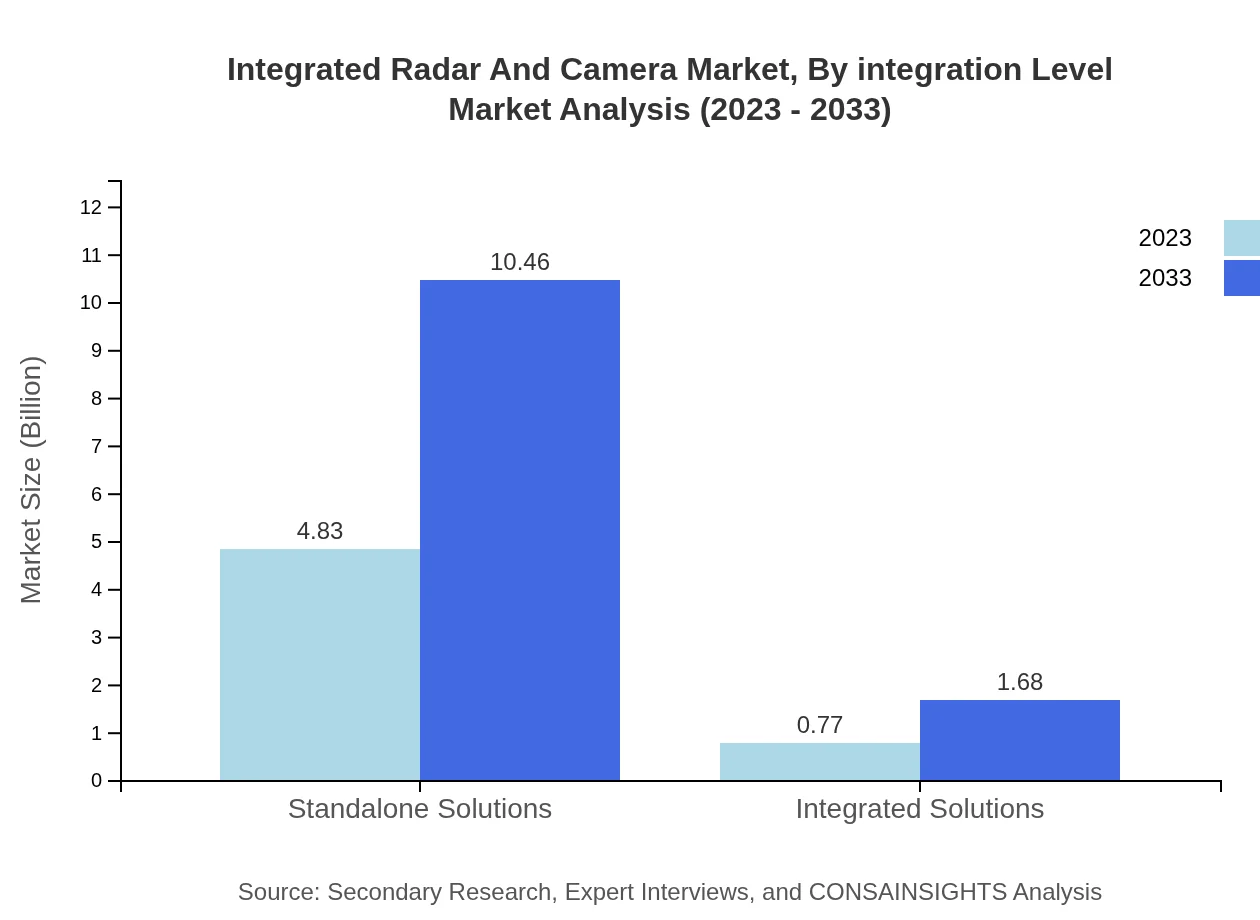

Integrated Radar And Camera Market Analysis By Integration Level

Integration levels differentiate between Standalone Solutions and Integrated Solutions. The Standalone Solutions, which currently have a size of $4.83 billion, are expected to reach $10.46 billion by 2033 with a stable share of 86.18%. Integrated Solutions, currently at $0.77 billion, represent strong potential for growth as industries increasingly demand synergy between radar and camera technologies.

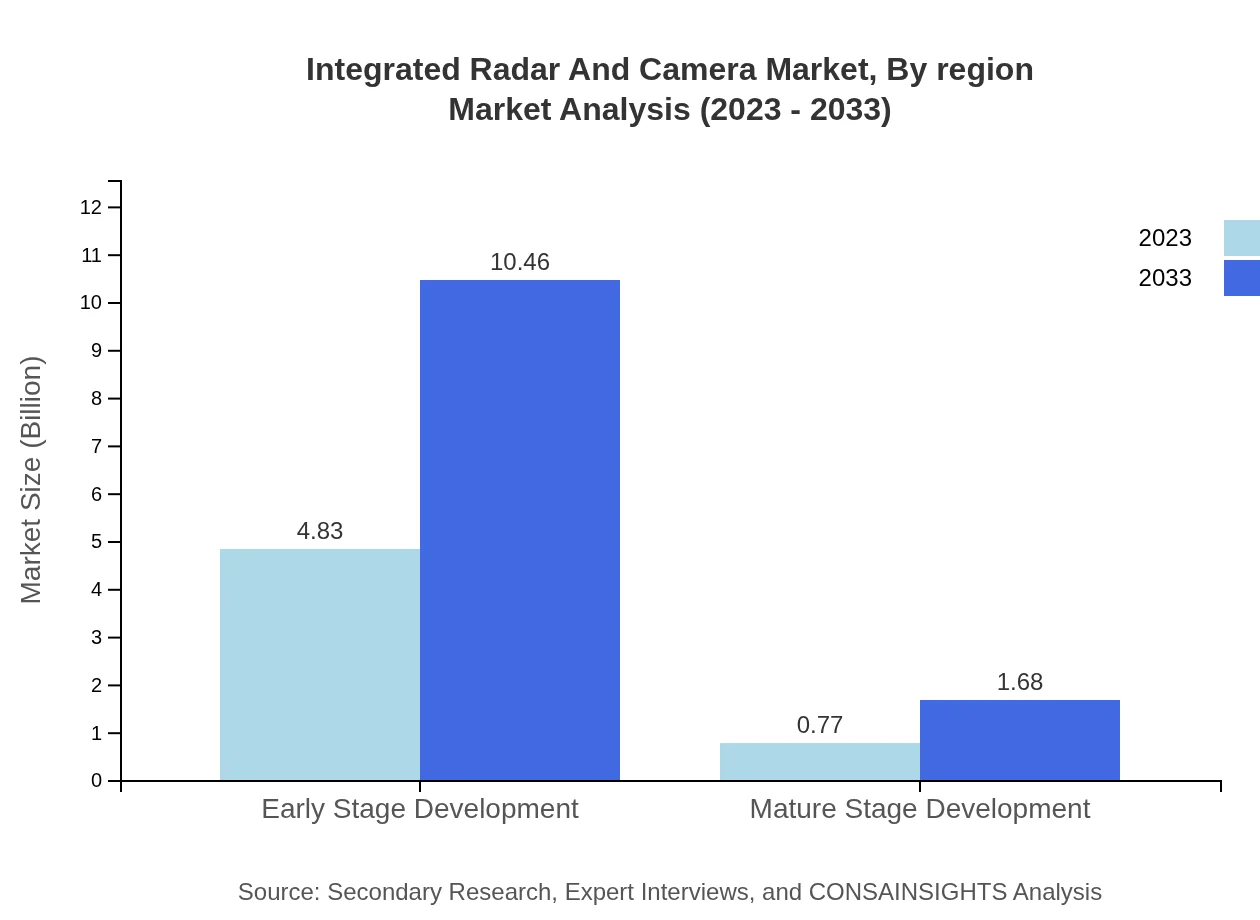

Integrated Radar And Camera Market Analysis By Region

The market development stage is divided into Early Stage Development and Mature Stage Development. The Early Stage segment, valued at $4.83 billion in 2023, is forecasted to grow to $10.46 billion, while maintaining a market share of 86.18%. The Mature Stage segment, although smaller at $0.77 billion, is expected to increase to $1.68 billion by 2033, making up 13.82%.

Integrated Radar And Camera Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Integrated Radar And Camera Industry

Bosch:

A leading automotive supplier, Bosch integrates radar and camera technologies to enhance vehicle safety and provide smart mobility solutions.Daimler AG:

Through its luxury and commercial vehicle offerings, Daimler invests in advanced integrated radar and camera systems for enhanced driving assistance.Continental AG:

A recognized player in automotive technology, Continental leverages radar and camera systems for innovative driver assistance systems.Valeo:

Valeo specializes in smart automotive technologies and integrates radar and camera features for comprehensive safety systems.We're grateful to work with incredible clients.

FAQs

What is the market size of integrated Radar And Camera?

The integrated radar and camera market is projected to grow from $5.6 billion in 2023 to an estimated size by 2033, experiencing a CAGR of 7.8%. This growth reflects an increasing demand across various industries.

What are the key market players or companies in this integrated Radar And Camera industry?

The integrated radar and camera market includes prominent companies such as Bosch, Harman International, Continental AG, and others. These firms are leading innovations, focusing on enhancing product features to cater to automotive and security applications.

What are the primary factors driving the growth in the integrated Radar And Camera industry?

Key factors driving growth include the rising demand for advanced driver assistance systems, increased investments in smart city initiatives, and the growing emphasis on security and surveillance. Technological advancements in sensor integration further contribute to market expansion.

Which region is the fastest Growing in the integrated Radar And Camera?

North America leads the integrated radar and camera market with a projected growth from $2.13 billion in 2023 to $4.61 billion by 2033. Europe follows closely, expanding from $1.75 billion to $3.79 billion during the same period.

Does ConsaInsights provide customized market report data for the integrated Radar And Camera industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the integrated radar and camera industry. Clients can request in-depth analysis and tailored insights to make informed strategic decisions.

What deliverables can I expect from this integrated Radar And Camera market research project?

Deliverables include a comprehensive market analysis report, segmentation insights by region and application, competitive landscape assessments, and trends over the forecast period, ensuring a thorough understanding of the market dynamics.

What are the market trends of integrated Radar And Camera?

Current market trends include the growing integration of radar and camera systems for enhanced imaging and sensing applications, advancements in AI and machine learning for improved analytics, and increasing adoption in the automotive sector for autonomous driving solutions.