Integrated Traffic Systems Market Report

Published Date: 31 January 2026 | Report Code: integrated-traffic-systems

Integrated Traffic Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Integrated Traffic Systems market, covering key insights and forecasts from 2023 to 2033. It explores market size, industry trends, technology advancements, and regional analyses, offering valuable data for stakeholders.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

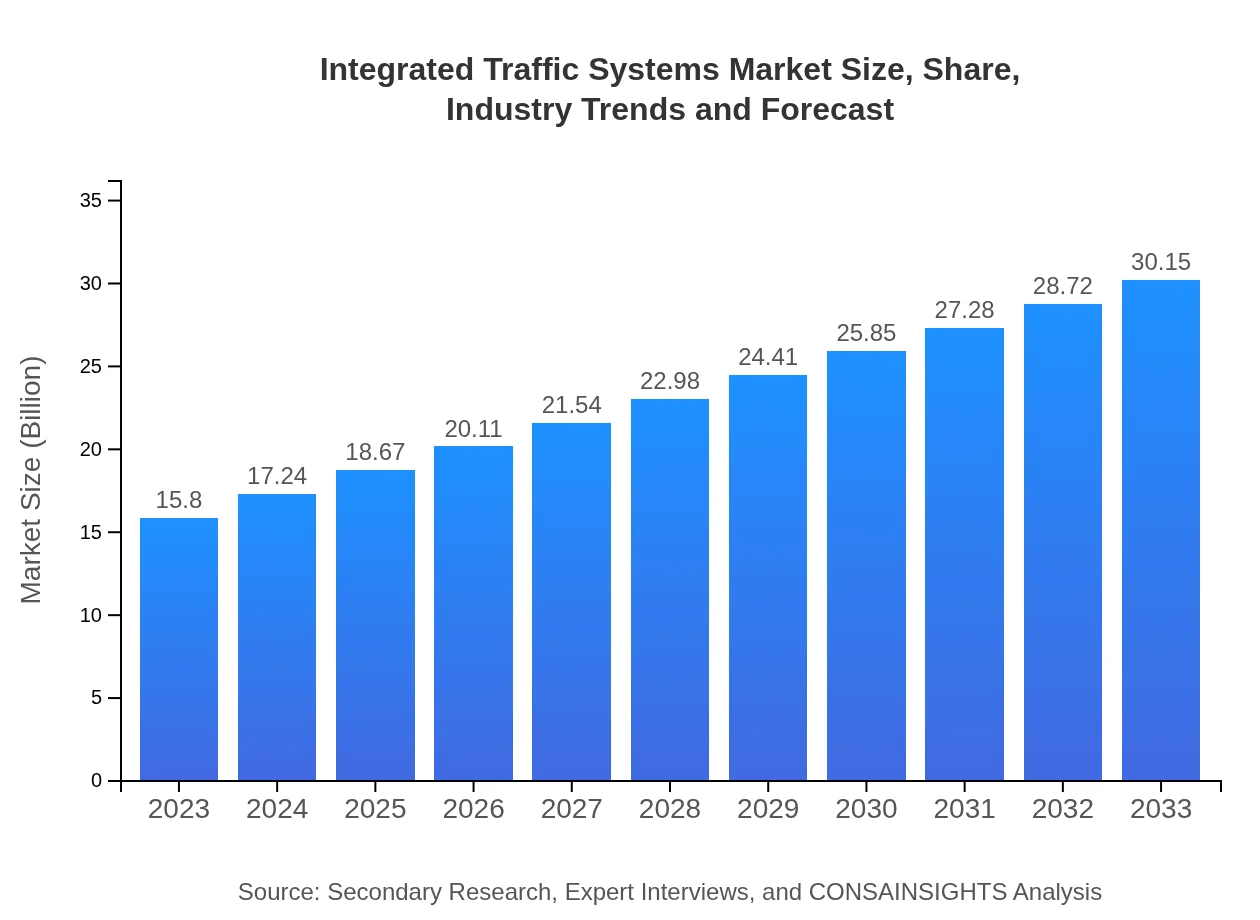

| 2023 Market Size | $15.80 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $30.15 Billion |

| Top Companies | Siemens AG, Cubic Corporation, Kapsch TrafficCom AG, Thales Group, Hewlett Packard Enterprise |

| Last Modified Date | 31 January 2026 |

Integrated Traffic Systems Market Overview

Customize Integrated Traffic Systems Market Report market research report

- ✔ Get in-depth analysis of Integrated Traffic Systems market size, growth, and forecasts.

- ✔ Understand Integrated Traffic Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Integrated Traffic Systems

What is the Market Size & CAGR of Integrated Traffic Systems market in 2023?

Integrated Traffic Systems Industry Analysis

Integrated Traffic Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Integrated Traffic Systems Market Analysis Report by Region

Europe Integrated Traffic Systems Market Report:

Europe is expected to see strong growth in the Integrated Traffic Systems market, increasing from $5.02 billion in 2023 to $9.57 billion by 2033. The European Union's commitment to sustainable urban mobility and smart city projects significantly drives the demand for ITS solutions. Countries like Germany and the UK are at the forefront, implementing cutting-edge technologies to optimize urban traffic.Asia Pacific Integrated Traffic Systems Market Report:

The Asia Pacific region is witnessing significant growth in the Integrated Traffic Systems market, projected to increase from $2.77 billion in 2023 to $5.29 billion by 2033. Factors contributing to this growth include rapid urbanization, government investments in smart city initiatives, and a surge in vehicle ownership. Countries like China and India are implementing advanced traffic solutions to address congestion and improve safety.North America Integrated Traffic Systems Market Report:

North America remains one of the largest markets for Integrated Traffic Systems, with a size of $5.74 billion in 2023 expected to reach $10.95 billion by 2033. The U.S. and Canada lead in implementing advanced solutions, spurred by government regulations focused on improving mobility and safety. High levels of investment in R&D also foster innovation in the ITS field.South America Integrated Traffic Systems Market Report:

The South American market for Integrated Traffic Systems, though smaller, is expected to grow from $0.23 billion in 2023 to $0.43 billion in 2033. This growth is driven by increasing urban populations and investments in transportation infrastructure. The adoption of ITS is crucial for enhancing road safety and managing the rising traffic volumes experienced in major cities across this region.Middle East & Africa Integrated Traffic Systems Market Report:

The Integrated Traffic Systems market in the Middle East and Africa is anticipated to grow from $2.05 billion in 2023 to $3.91 billion by 2033. Factors such as increased governmental attention to urbanization challenges, traffic congestion, and safety are paving the way for substantial investments in ITS. Countries like UAE and South Africa are leading in adopting advanced traffic management systems.Tell us your focus area and get a customized research report.

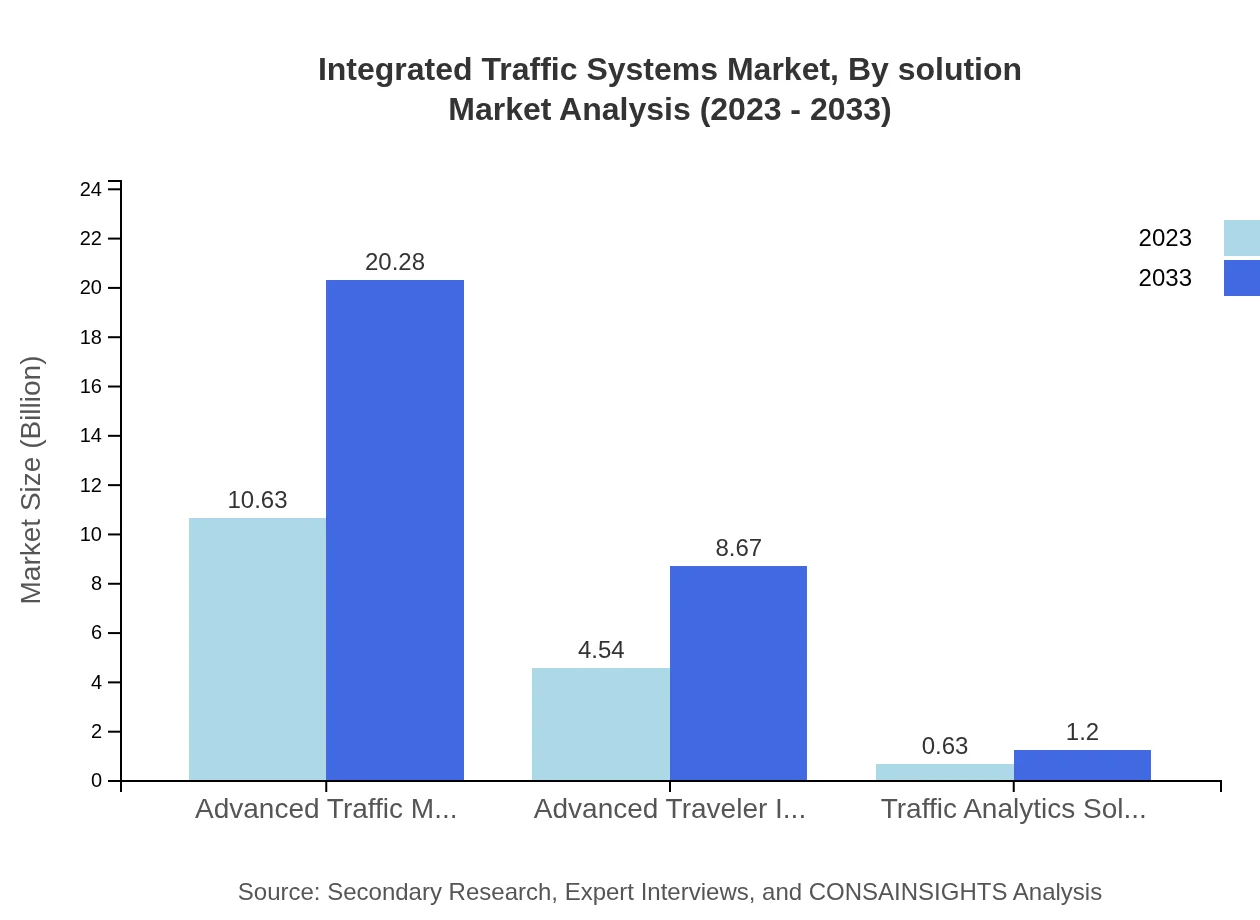

Integrated Traffic Systems Market Analysis By Solution

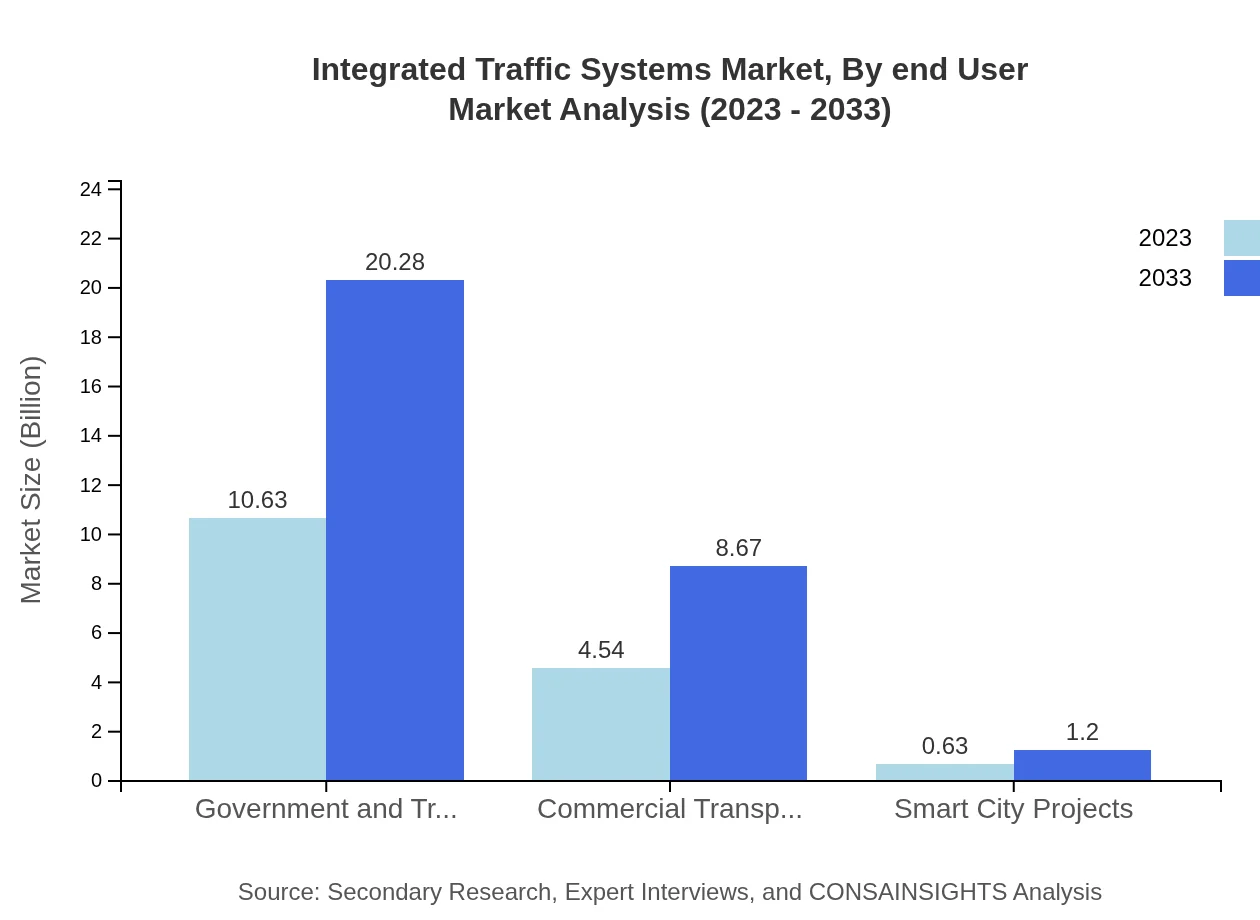

Government and Transport Authorities dominate the segment, holding a market size of $10.63 billion in 2023 and projected to grow to $20.28 billion by 2033. This segment is crucial due to ongoing demand for advanced traffic management solutions. Commercial Transport Companies are another key player, with market sizes anticipated to rise from $4.54 billion to $8.67 billion during the same period, as businesses look to enhance efficiency and reduce operational costs.

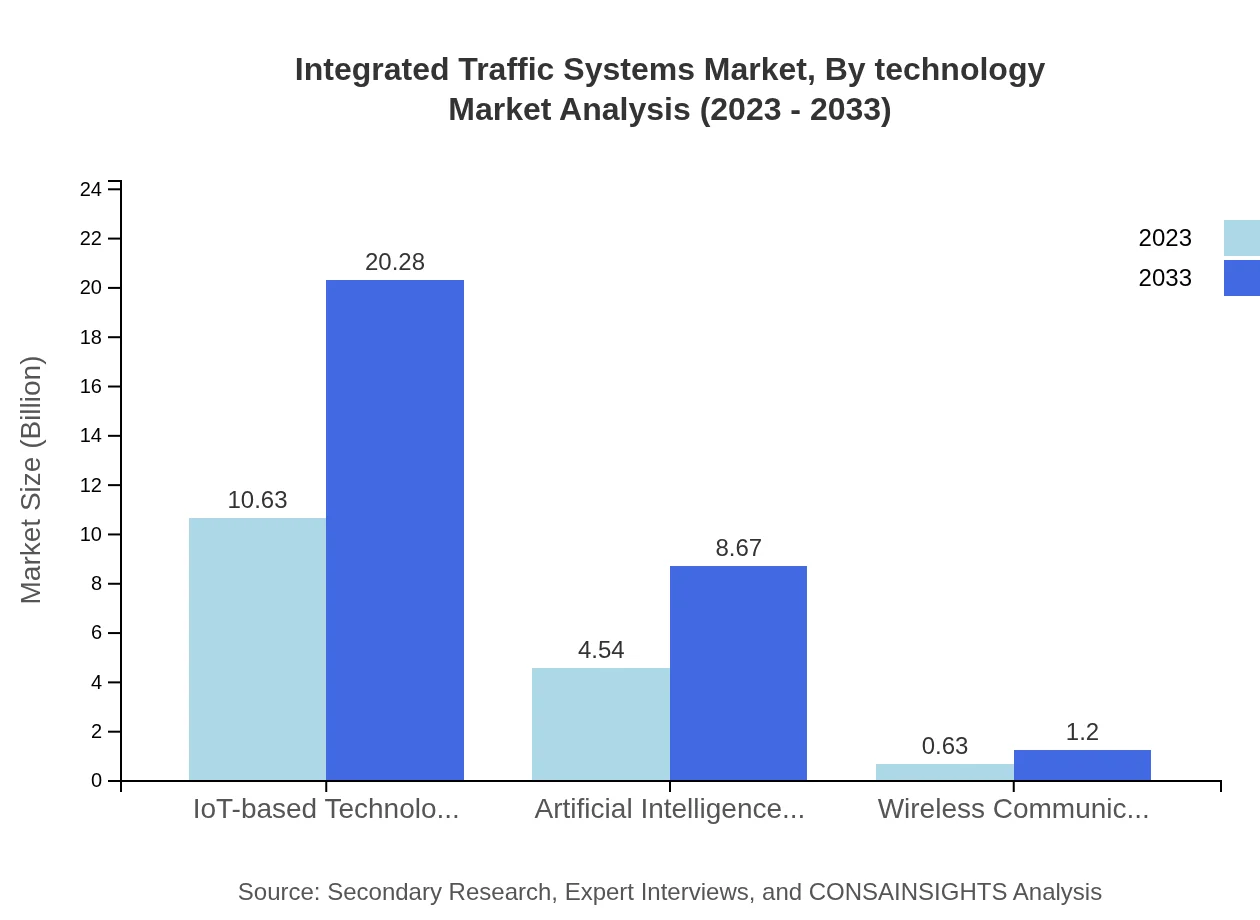

Integrated Traffic Systems Market Analysis By Technology

The market under IoT-based Technologies has a strong presence with $10.63 billion in 2023, expected to reach $20.28 billion by 2033. The integration of AI and other wireless technologies also stands out, with AI Technologies at $4.54 billion growing to $8.67 billion by 2033, signifying the transformative impact of these technologies on traffic management.

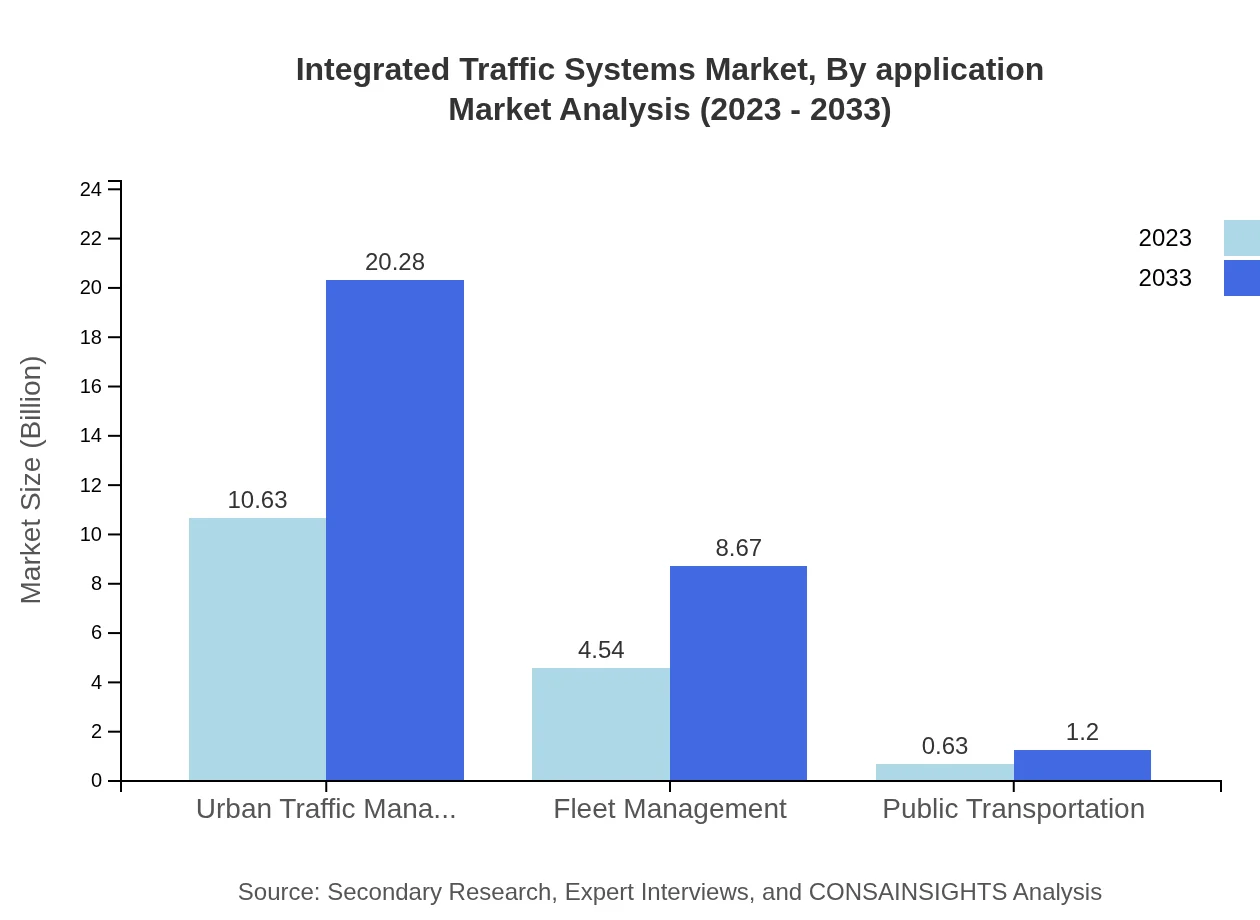

Integrated Traffic Systems Market Analysis By Application

Urban traffic management represents a significant share with an initial market value of $10.63 billion, expected to double by 2033. Fleet Management is also noteworthy, with its market size estimated to rise from $4.54 billion in 2023 to $8.67 billion by the end of the forecast period, emphasizing the growing importance of data-driven solutions in managing vehicle fleets.

Integrated Traffic Systems Market Analysis By End User

The demand from public transportation stands out, predicted to increase from $0.63 billion in 2023 to $1.20 billion in 2033, indicating heightened attention towards sustainable transport solutions. Advanced Traveler Information Systems witness similar growth, signifying the essential role of real-time information in enhancing user experience within integrated systems.

Integrated Traffic Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Integrated Traffic Systems Industry

Siemens AG:

Siemens AG is a global leader in automation and digitalization in the industrial sector, providing innovative solutions for integrated traffic management systems that improve efficiency and safety on roadways.Cubic Corporation:

Cubic Corporation offers advanced solutions in transportation and traffic management, focusing on optimizing urban mobility through innovative technologies such as connected vehicles and real-time analytics.Kapsch TrafficCom AG:

Kapsch TrafficCom specializes in intelligent transportation systems, offering solutions for traffic management, tolling, and urban mobility that integrate cutting-edge technology and data analytics.Thales Group:

Thales Group is a global technology leader providing ITS solutions that enhance safety and security in transportation systems, integrating advanced monitoring and vehicle management technologies.Hewlett Packard Enterprise:

Hewlett Packard Enterprise leverages its IT infrastructure and analytics capabilities to enhance traffic monitoring and management solutions, supporting the deployment of smart city initiatives.We're grateful to work with incredible clients.

FAQs

What is the market size of integrated Traffic Systems?

The Integrated Traffic Systems market is projected to reach a size of $15.8 billion by 2033, with a compound annual growth rate (CAGR) of 6.5% over the forecast period from 2023 to 2033.

What are the key market players or companies in this integrated Traffic Systems industry?

Key players in the integrated traffic systems industry include major technology firms, public transportation entities, and consulting companies specializing in urban planning and infrastructure development.

What are the primary factors driving the growth in the integrated Traffic Systems industry?

Growth is driven by urbanization trends, the adoption of smart city initiatives, and increasing investments in transportation infrastructure aimed at improving traffic management and reducing congestion.

Which region is the fastest Growing in the integrated Traffic Systems?

North America is the fastest-growing region for integrated traffic systems, with its market size projected to expand from $5.74 billion in 2023 to $10.95 billion by 2033, reflecting a strong growth trajectory.

Does ConsaInsights provide customized market report data for the integrated Traffic Systems industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the integrated traffic systems industry, enabling clients to access insights relevant to their strategic goals.

What deliverables can I expect from this integrated Traffic Systems market research project?

Deliverables include comprehensive market analysis reports, regional insights, competitive landscape studies, and strategic recommendations aimed at optimizing market entry and expansion strategies.

What are the market trends of integrated Traffic Systems?

Market trends include rising utilization of AI technologies for traffic prediction, increased investment in IoT-enabled devices, and prioritization of sustainability in traffic management solutions.