Intelligence Surveillance And Reconnaissance Market Report

Published Date: 03 February 2026 | Report Code: intelligence-surveillance-and-reconnaissance

Intelligence Surveillance And Reconnaissance Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Intelligence Surveillance and Reconnaissance (ISR) market from 2023 to 2033. It includes insights into market size, growth rates, industry challenges, segmentation, regional performance, and key players in the industry.

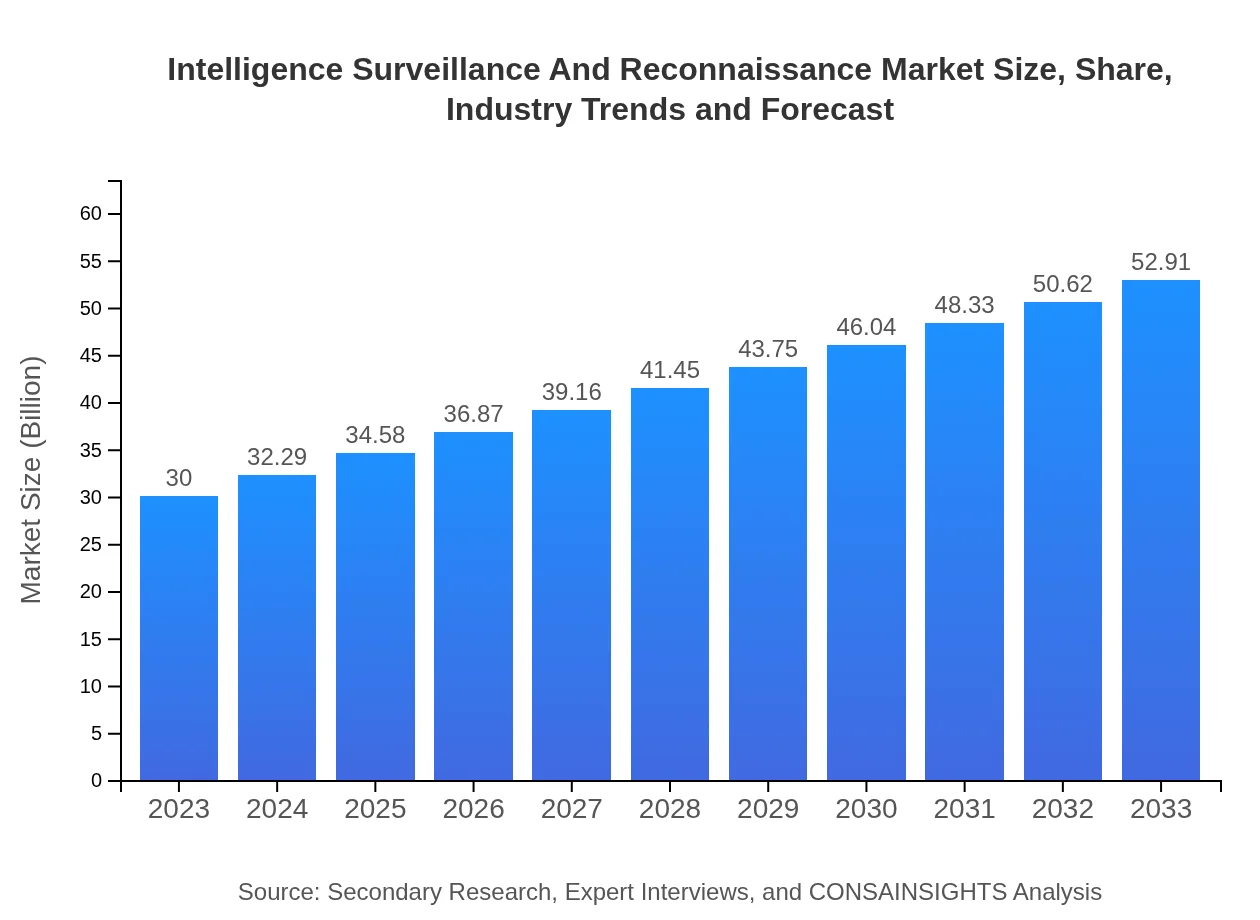

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $30.00 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $52.91 Billion |

| Top Companies | Lockheed Martin, Northrop Grumman, General Dynamics, BAE Systems |

| Last Modified Date | 03 February 2026 |

Intelligence Surveillance And Reconnaissance Market Overview

Customize Intelligence Surveillance And Reconnaissance Market Report market research report

- ✔ Get in-depth analysis of Intelligence Surveillance And Reconnaissance market size, growth, and forecasts.

- ✔ Understand Intelligence Surveillance And Reconnaissance's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Intelligence Surveillance And Reconnaissance

What is the Market Size & CAGR of Intelligence Surveillance And Reconnaissance market in 2023?

Intelligence Surveillance And Reconnaissance Industry Analysis

Intelligence Surveillance And Reconnaissance Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Intelligence Surveillance And Reconnaissance Market Analysis Report by Region

Europe Intelligence Surveillance And Reconnaissance Market Report:

In Europe, the ISR market is projected to expand from $7.39 billion in 2023 to $13.03 billion by 2033. Increased concerns about terrorism and the need for enhanced surveillance capabilities are significant factors driving this growth.Asia Pacific Intelligence Surveillance And Reconnaissance Market Report:

In the Asia Pacific region, the ISR market is projected to grow from $6.43 billion in 2023 to approximately $11.33 billion by 2033. The increase is attributed to the rising investment in defense capabilities by countries such as China and India, as well as heightened geopolitical tensions.North America Intelligence Surveillance And Reconnaissance Market Report:

The North American market remains the largest, with an estimated value of $11.11 billion in 2023, soaring to $19.59 billion by 2033. The U.S. military’s continued investment in advanced ISR technologies and strategic initiatives to enhance national security are key contributors.South America Intelligence Surveillance And Reconnaissance Market Report:

Latin America, although smaller in size, is expected to see growth from $1.04 billion in 2023 to $1.84 billion by 2033. This growth is driven by governments seeking improved border security and counter-terrorism efforts.Middle East & Africa Intelligence Surveillance And Reconnaissance Market Report:

The Middle East and Africa region is anticipated to grow from $4.04 billion in 2023 to $7.12 billion by 2033, driven by military modernization programs and counter-terrorism strategies deployed by several countries.Tell us your focus area and get a customized research report.

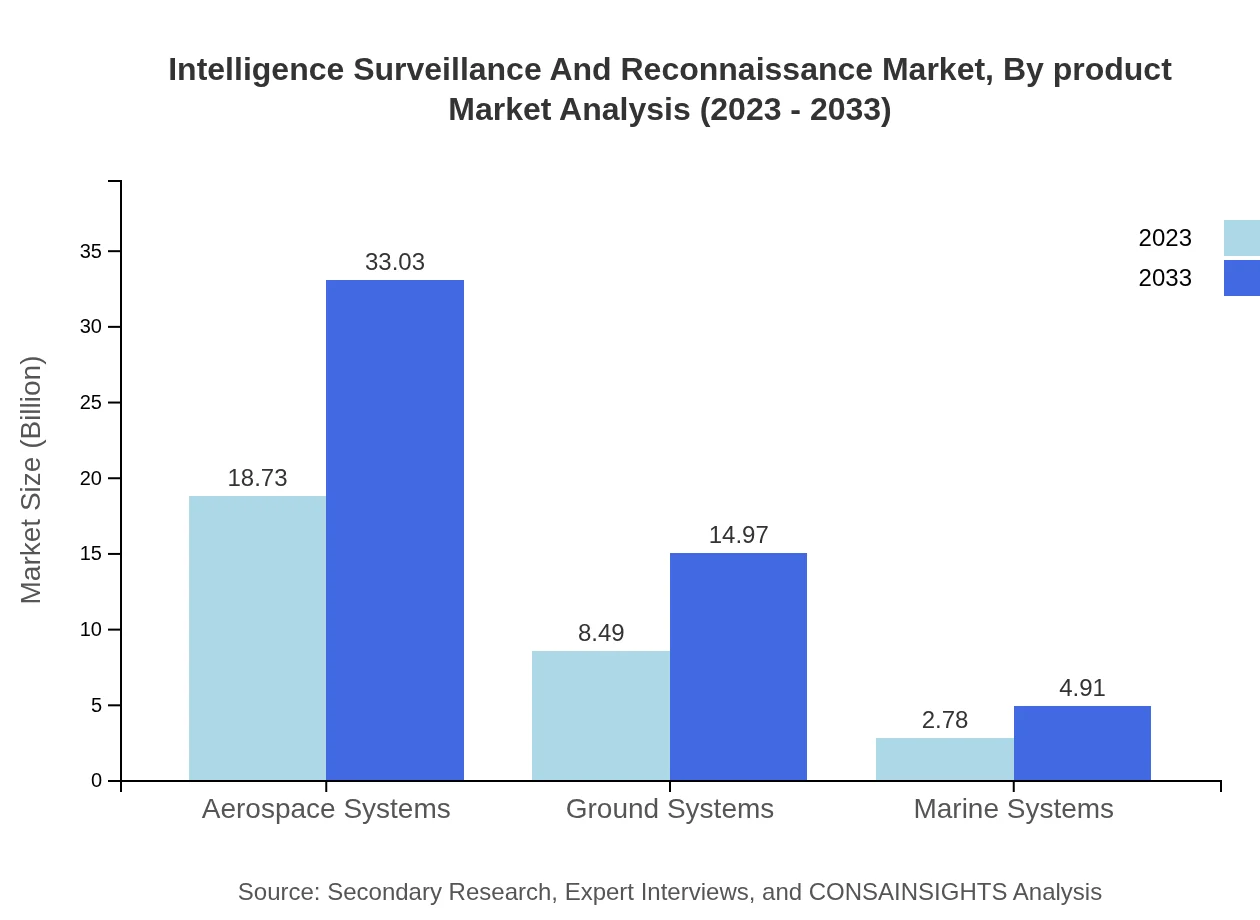

Intelligence Surveillance And Reconnaissance Market Analysis By Product

The ISR market by product encompasses Aerospace Systems, Ground Systems, and Marine Systems. Aerospace Systems, valued at $18.73 billion in 2023, dominate the market with a 62.42% share. Ground Systems follow with $8.49 billion, capturing 28.3%. Marine Systems contribute $2.78 billion and hold a 9.28% market share.

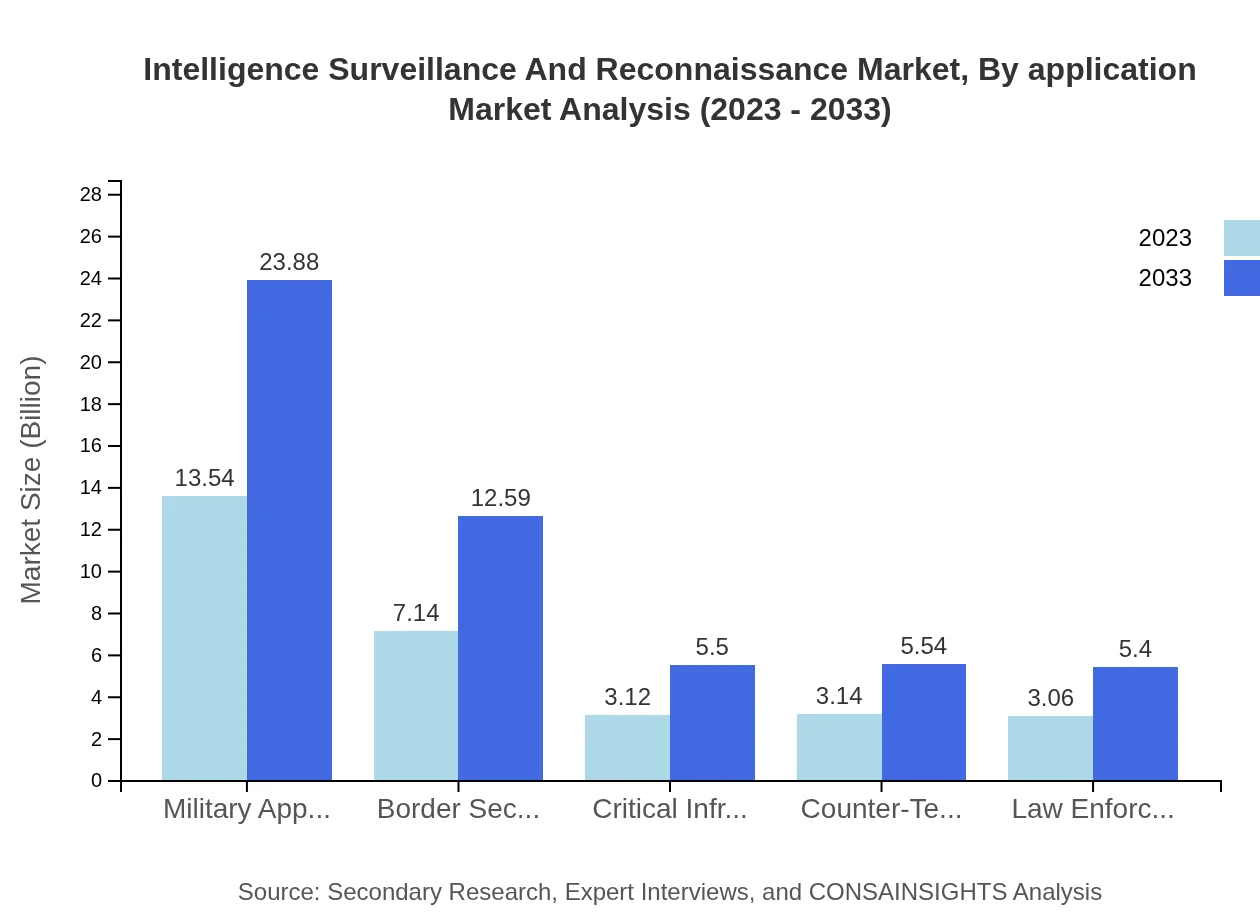

Intelligence Surveillance And Reconnaissance Market Analysis By Application

Applications include Military and Defense, Government Agencies, and Commercial Organizations. Military Applications account for $13.54 billion with a 45.13% share. Government Agencies hold $6.90 billion with a 23% share, while Commercial Organizations contribute $3.41 billion at 11.37%.

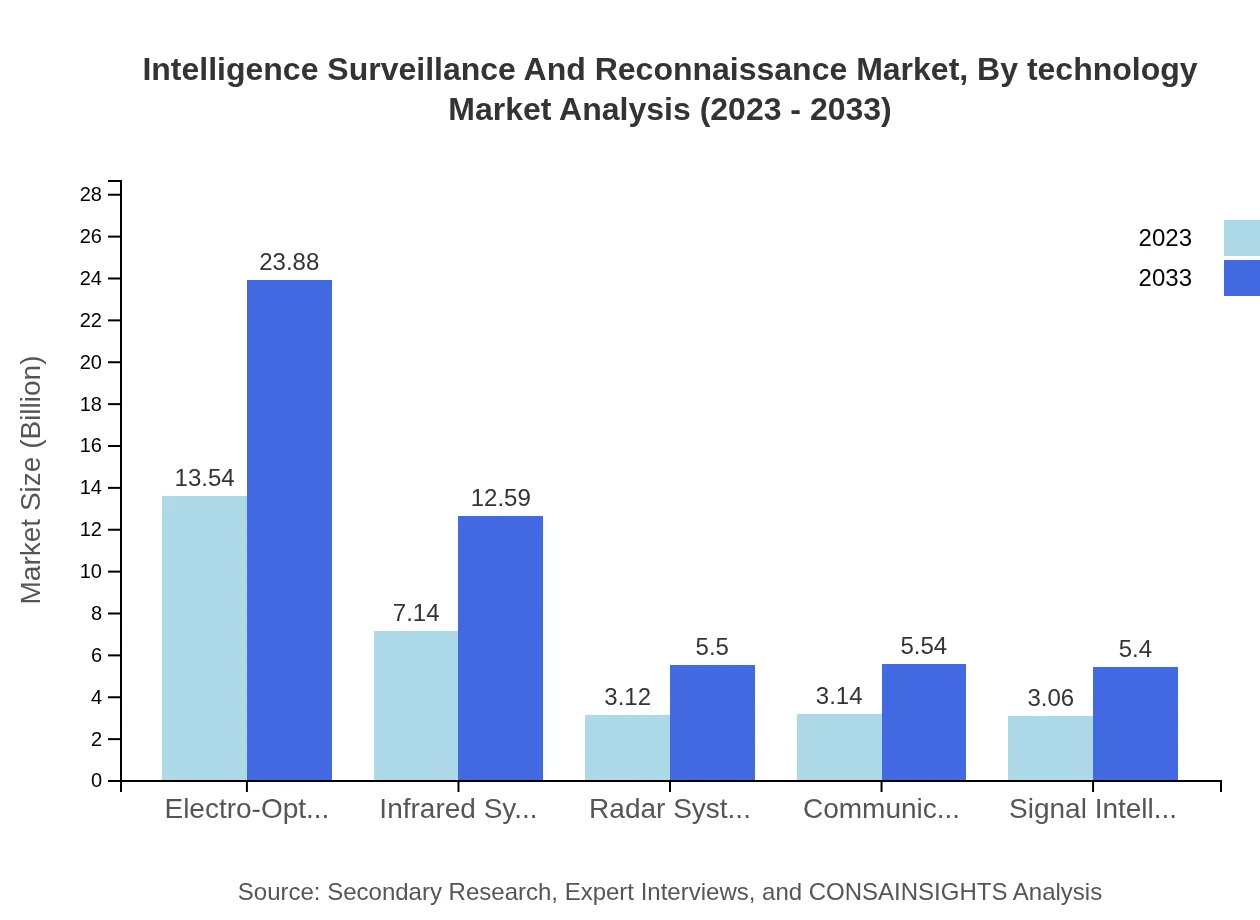

Intelligence Surveillance And Reconnaissance Market Analysis By Technology

Technologies employed in ISR include Electro-Optical Systems, Infrared Systems, and Radar Systems. Electro-Optical Systems lead the market at $13.54 billion, holding 45.13% share. Infrared Systems follow with $7.14 billion at a 23.8% share, and Radar Systems contribute $3.12 billion with 10.39% share.

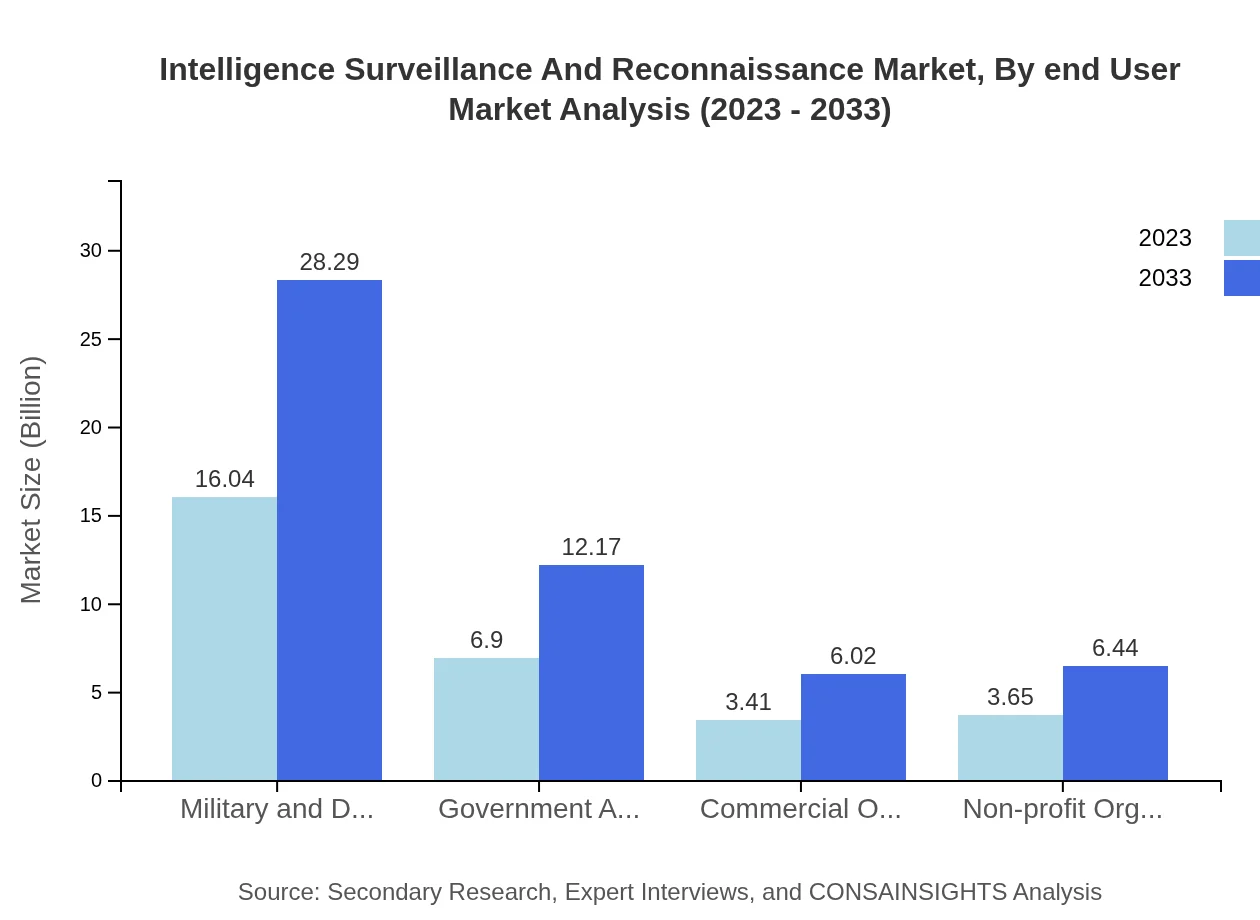

Intelligence Surveillance And Reconnaissance Market Analysis By End User

End-users of ISR technologies are primarily military applications, border security, and government agencies. Military Applications dominate with $13.54 billion and a 45.13% market share, followed by Border Security with $7.14 billion at a 23.8% share.

Intelligence Surveillance And Reconnaissance Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Intelligence Surveillance And Reconnaissance Industry

Lockheed Martin:

A leader in advanced technology solutions for ISR, Lockheed Martin develops UAVs and cutting-edge surveillance technologies aimed at enhancing military operations.Northrop Grumman:

Known for innovative ISR solutions, Northrop Grumman specializes in aerospace and defense technologies with a focus on enhancing national security.General Dynamics:

General Dynamics provides a range of ISR systems, including ground-based and aerial platforms that support military and governmental operations globally.BAE Systems:

BAE Systems offers advanced ISR solutions integrating cyber capabilities with surveillance systems, enhancing data security and operational efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of Intelligence Surveillance and Reconnaissance?

The global Intelligence Surveillance and Reconnaissance market is valued at approximately $30 billion in 2023, with a projected CAGR of 5.7% from 2023 to 2033, marking a significant growth phase in this sector.

What are the key market players or companies in this Intelligence Surveillance and Reconnaissance industry?

Key market players in the Intelligence Surveillance and Reconnaissance industry include major defense contractors such as Lockheed Martin, Northrop Grumman, and Raytheon. These companies lead advancements in technology and provide comprehensive ISR solutions.

What are the primary factors driving the growth in the Intelligence Surveillance and Reconnaissance industry?

The growth in the Intelligence Surveillance and Reconnaissance industry is driven by rising security concerns, technological advancements in sensors and robotics, and increasing defense budgets across nations, leading to greater investment in ISR capabilities.

Which region is the fastest Growing in the Intelligence Surveillance and Reconnaissance?

The fastest-growing region in the Intelligence Surveillance and Reconnaissance market is Europe, expected to grow from $7.39 billion in 2023 to $13.03 billion by 2033, reflecting a strong emphasis on defense and security initiatives.

Does ConsaInsights provide customized market report data for the Intelligence Surveillance and Reconnaissance industry?

Yes, ConsaInsights offers customized market report data, tailoring insights to meet specific client needs within the Intelligence Surveillance and Reconnaissance industry, ensuring relevant market trends and forecasts.

What deliverables can I expect from this Intelligence Surveillance and Reconnaissance market research project?

Clients can expect detailed market analysis reports, including comprehensive data on market size, growth projections, competitive landscape insights, regional analysis, and trends in the Intelligence Surveillance and Reconnaissance sector.

What are the market trends of Intelligence Surveillance and Reconnaissance?

Key trends in the Intelligence Surveillance and Reconnaissance market include the integration of AI for data analysis, growth in unmanned systems, and enhanced cyber surveillance technologies, all catering to evolving security challenges.