Intermodal Freight Transportation Market Report

Published Date: 31 January 2026 | Report Code: intermodal-freight-transportation

Intermodal Freight Transportation Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the intermodal freight transportation market, examining its current state, segmentation, and growth potential up to 2033. Key insights include market size, CAGR, regional performance, and trends shaping the industry.

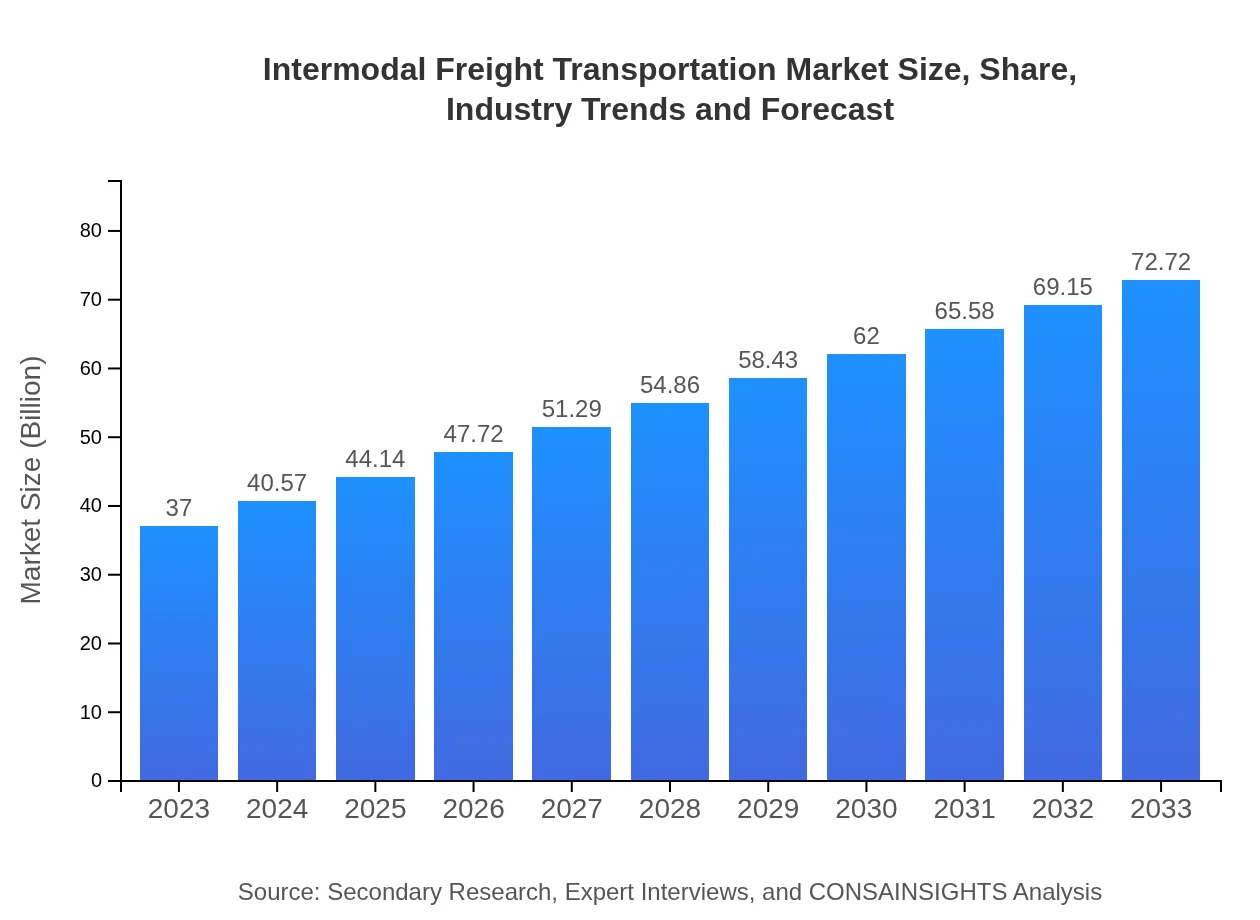

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $37.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $72.72 Billion |

| Top Companies | Maersk, CSX Transportation, DB Schenker, XPO Logistics |

| Last Modified Date | 31 January 2026 |

Intermodal Freight Transportation Market Overview

Customize Intermodal Freight Transportation Market Report market research report

- ✔ Get in-depth analysis of Intermodal Freight Transportation market size, growth, and forecasts.

- ✔ Understand Intermodal Freight Transportation's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Intermodal Freight Transportation

What is the Market Size & CAGR of Intermodal Freight Transportation market in 2023 and 2033?

Intermodal Freight Transportation Industry Analysis

Intermodal Freight Transportation Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Intermodal Freight Transportation Market Analysis Report by Region

Europe Intermodal Freight Transportation Market Report:

Europe's intermodal market stands at $12.65 billion in 2023 and is expected to almost double to $24.87 billion by 2033. Regulatory frameworks promoting sustainability and burgeoning e-commerce activities are critical factors influencing this growth.Asia Pacific Intermodal Freight Transportation Market Report:

The Asia Pacific region held a market size of $6.77 billion in 2023, expected to grow to $13.32 billion by 2033. Growth drivers include rapid urbanization, increasing export and import activities, and expansion in logistics infrastructure.North America Intermodal Freight Transportation Market Report:

North America has a significant role in the market, with a size of $12.18 billion in 2023 and estimated to reach $23.93 billion by 2033. The region’s advanced infrastructure and high demand for efficient logistics services contribute to this growth.South America Intermodal Freight Transportation Market Report:

In South America, the intermodal freight transportation market is projected to grow from $0.60 billion in 2023 to $1.19 billion by 2033. This growth is driven by investments in logistics networks and improving trade relations among countries.Middle East & Africa Intermodal Freight Transportation Market Report:

The Middle East and Africa region exhibits growth potential, moving from a market size of $4.79 billion in 2023 to $9.42 billion by 2033. Increased investments in freight corridors and logistics infrastructure are paving the way for the market expansion.Tell us your focus area and get a customized research report.

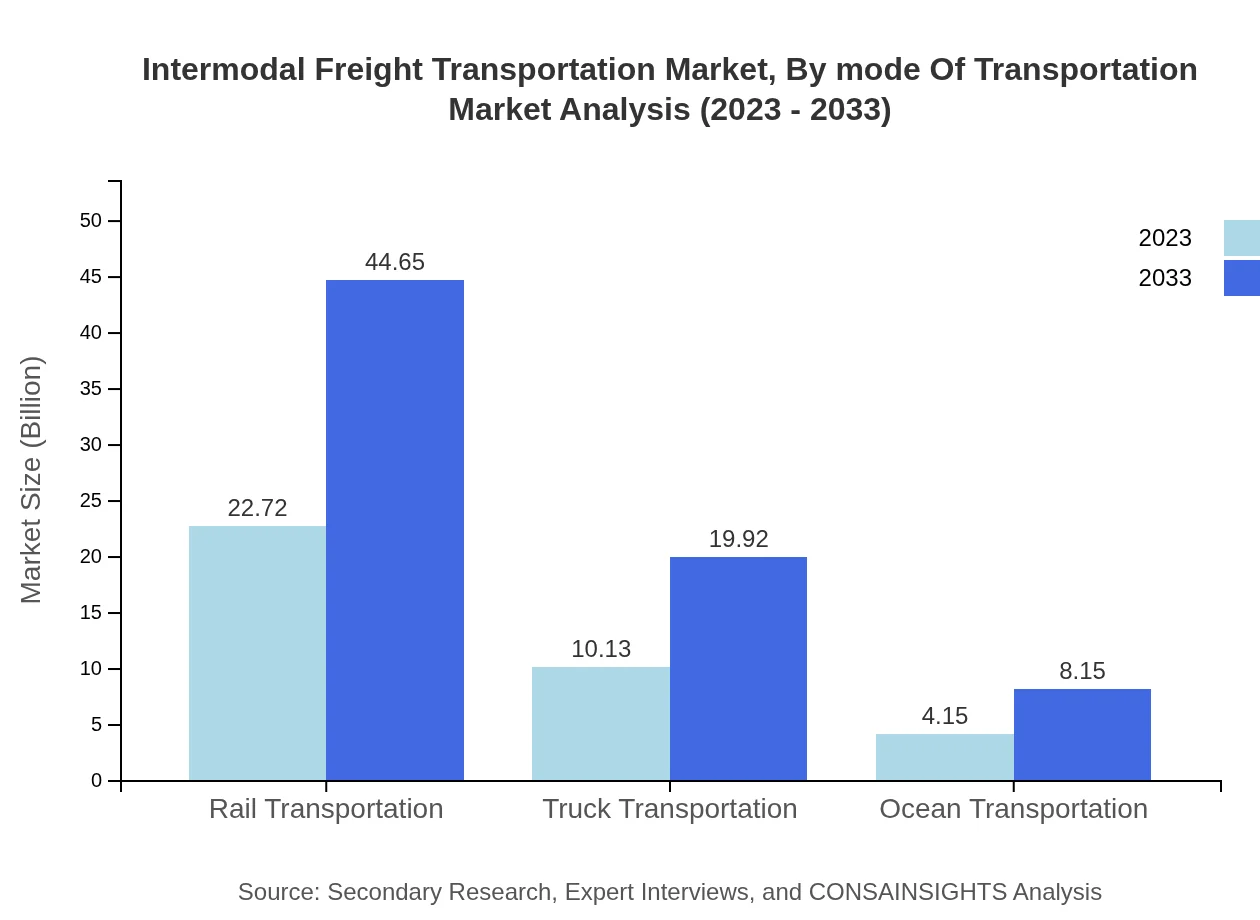

Intermodal Freight Transportation Market Analysis By Mode Of Transportation

The market is segmented into rail, truck, ocean, and air transportation. Rail transportation holds a significant market share due to its cost-effectiveness for long distances and high volumes, while truck transportation is favored for last-mile deliveries. Ocean transportation remains essential for international shipping, particularly in trade-heavy economies, offering a lower cost per ton-mile.

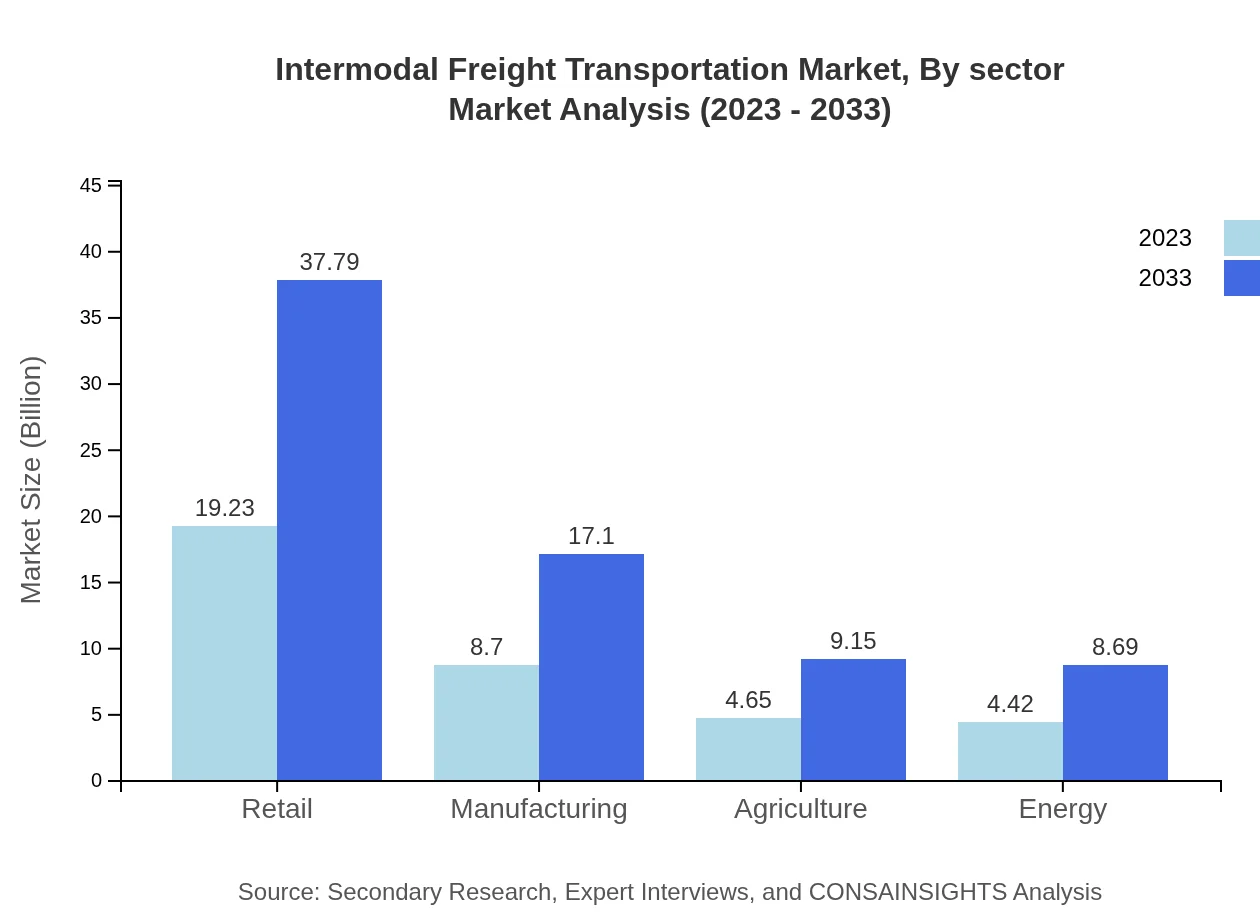

Intermodal Freight Transportation Market Analysis By Sector

Major sectors utilizing intermodal freight include retail, manufacturing, agriculture, and energy. The retail sector leads in market size and share, driven by e-commerce demands and just-in-time delivery needs. Manufacturing and agriculture also rely heavily on intermodal logistics for both raw materials and finished goods transport.

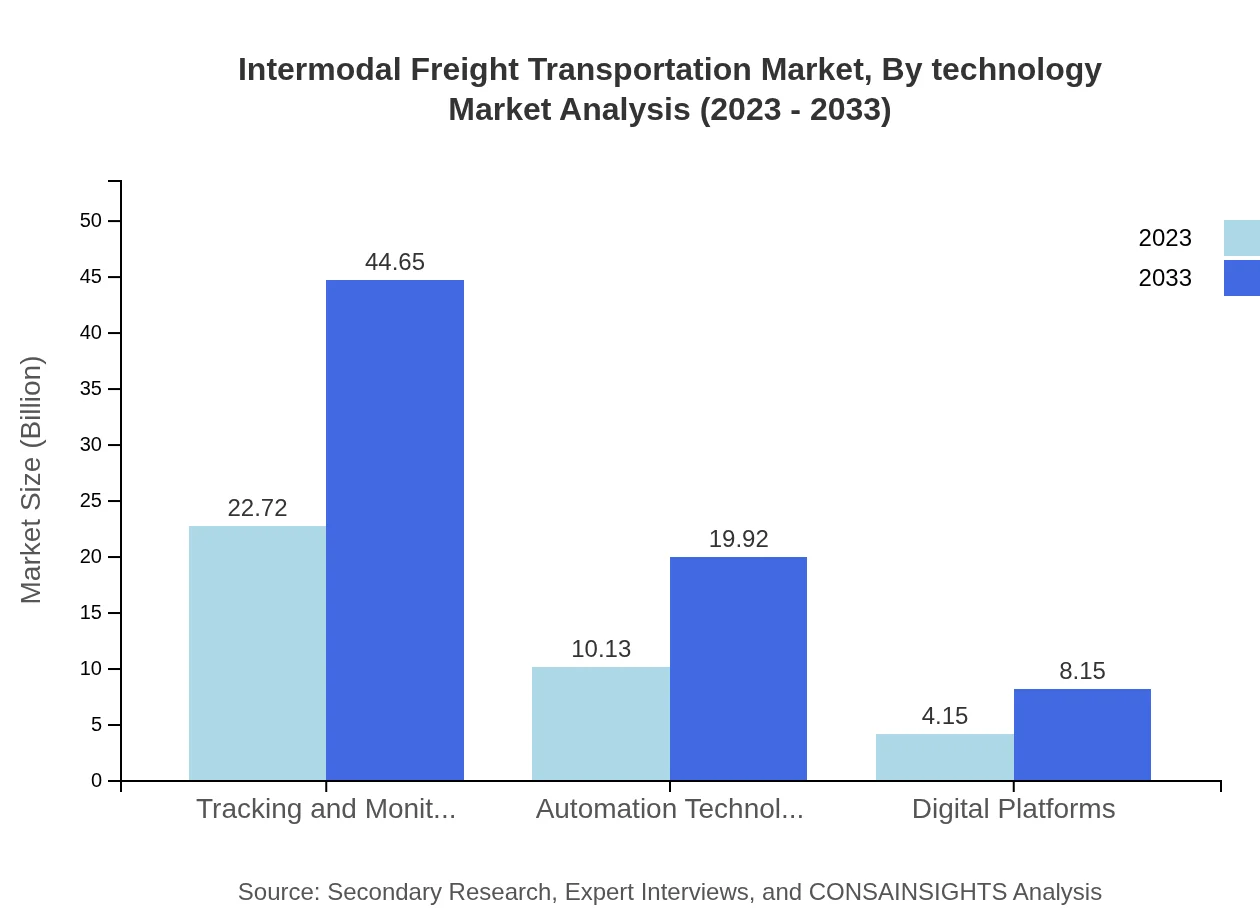

Intermodal Freight Transportation Market Analysis By Technology

Technological advancements are crucial to the intermodal freight transportation industry. Key trends include automation technologies, tracking and monitoring systems, and the use of digital platforms for supply chain management. These technologies enhance efficiency, reduce costs, and provide real-time visibility into shipping processes.

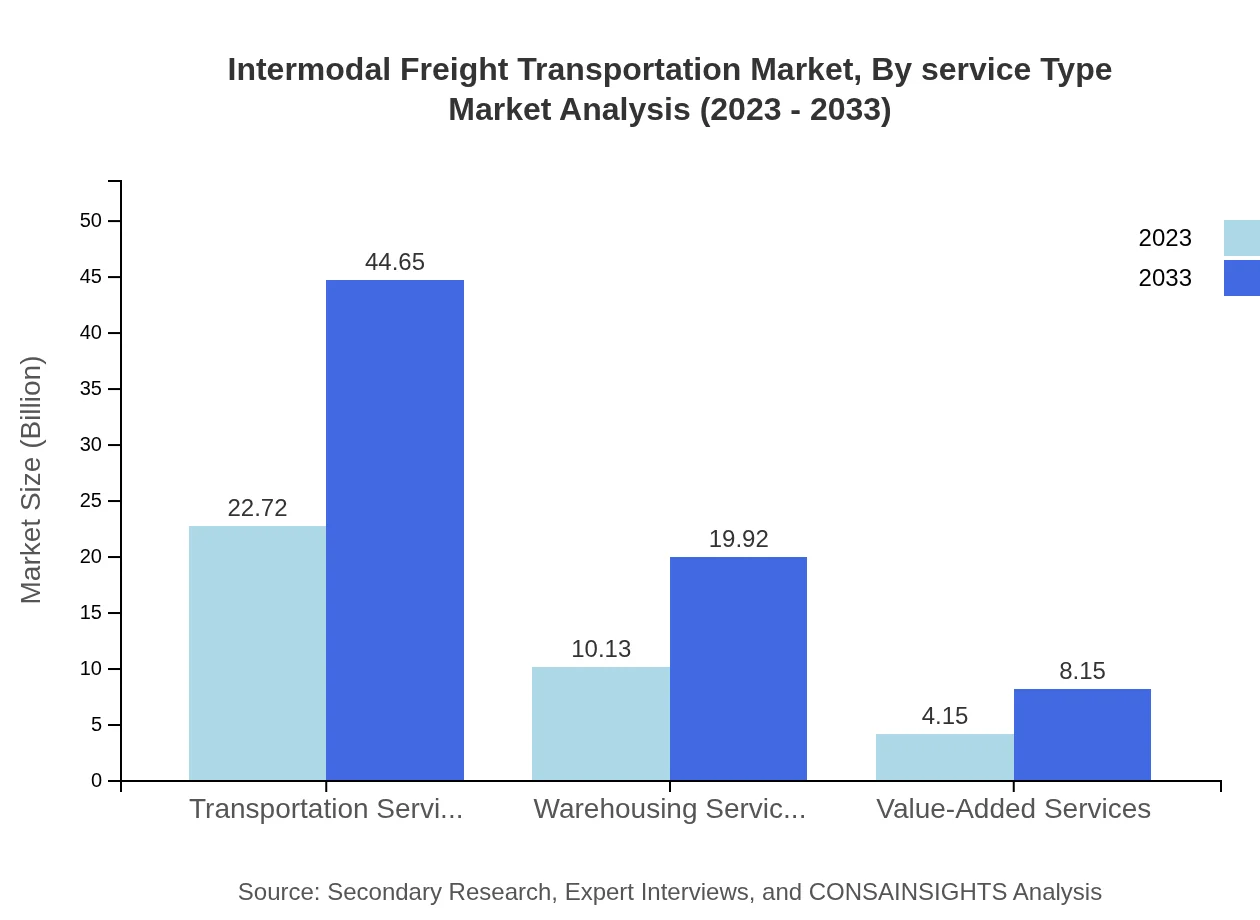

Intermodal Freight Transportation Market Analysis By Service Type

Service types within the intermodal freight market include transportation services, warehousing, and value-added services. Transportation services dominate the market, focusing on creating seamless logistics operations that include packaging, storage, and sorting to fulfill diverse customer needs.

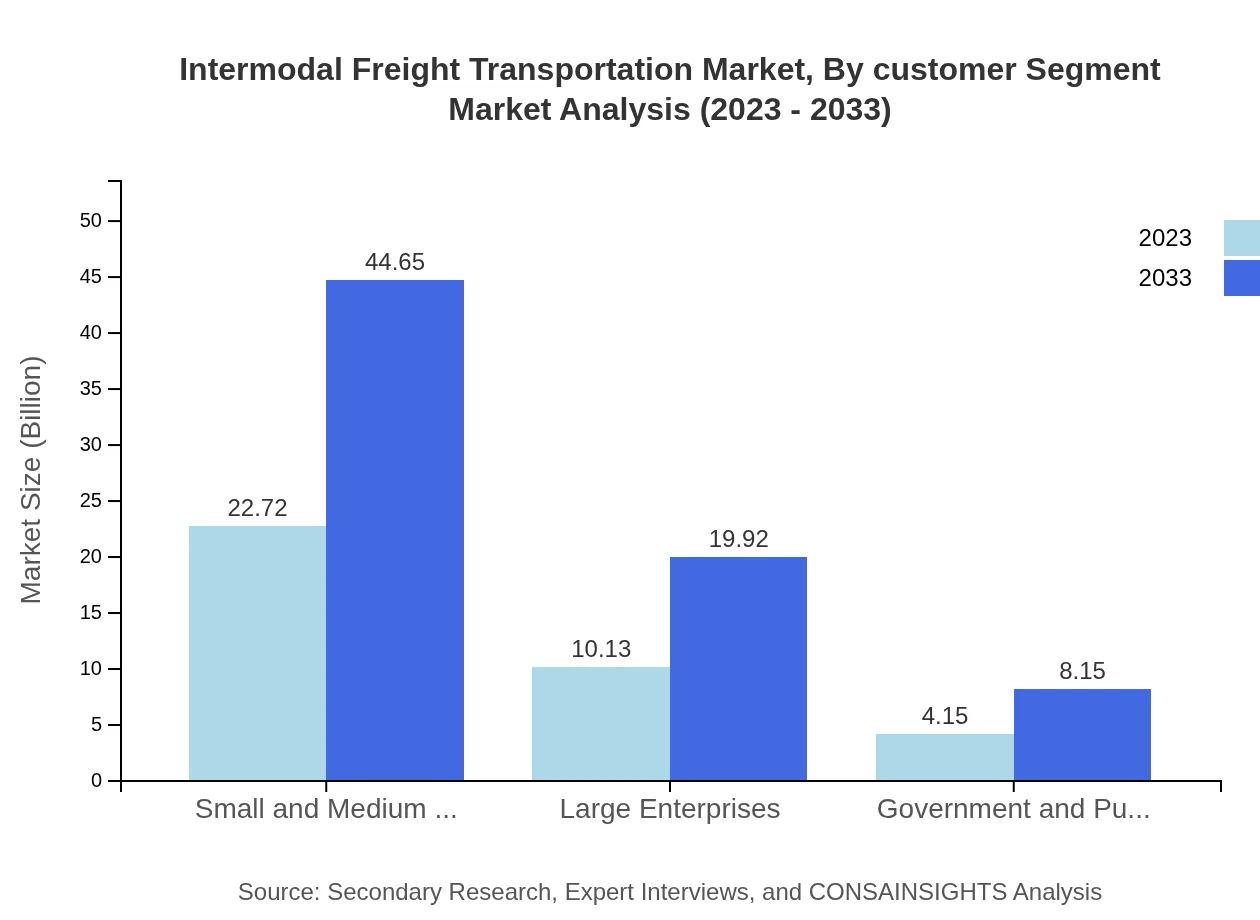

Intermodal Freight Transportation Market Analysis By Customer Segment

The market is segmented by customer types including small and medium enterprises (SMEs), large enterprises, and government entities. SMEs are emerging as a significant market force, driven by growing e-commerce businesses and the need for cost-effective logistics solutions.

Intermodal Freight Transportation Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Intermodal Freight Transportation Industry

Maersk:

A global leader in container shipping and logistics, Maersk provides integrated intermodal transport solutions that connect ports and inland destinations efficiently.CSX Transportation:

CSX is a major North American railroad that offers various intermodal services, contributing significantly to the industry’s growth through rail infrastructure.DB Schenker:

One of the leading providers of supply chain management services, DB Schenker integrates rail, road, ocean, and air transport to provide comprehensive intermodal solutions.XPO Logistics:

XPO Logistics specializes in freight transportation and contract logistics, leveraging advanced technology and a vast network to optimize intermodal logistics.We're grateful to work with incredible clients.

FAQs

What is the market size of Intermodal Freight Transportation?

The Intermodal Freight Transportation market is currently valued at approximately $37 billion, with a projected CAGR of 6.8% from 2023 to 2033. This growth highlights the increasing importance of integrated transport solutions in global trade.

What are the key market players or companies in this Intermodal Freight Transportation industry?

Key players in the Intermodal Freight Transportation industry include established logistics companies such as A.P. Moller-Maersk, Deutsche Bahn, and CSX Corporation. Their continued innovation and service expansions drive competitive dynamics within the market.

What are the primary factors driving the growth in the Intermodal Freight Transportation industry?

Factors fueling growth in the Intermodal Freight Transportation industry include globalization of trade, advancements in technology, and the increasing efficiency of supply chains. Additionally, environmental regulations incentivizing greener transportation methods are spurring demand.

Which region is the fastest Growing in the Intermodal Freight Transportation?

The fastest-growing region for Intermodal Freight Transportation is Europe, projected to grow from $12.65 billion in 2023 to $24.87 billion by 2033. Asia Pacific is also significant, growing from $6.77 billion to $13.32 billion in the same period.

Does ConsaInsights provide customized market report data for the Intermodal Freight Transportation industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the Intermodal Freight Transportation industry. These reports can provide detailed insights, trends, and forecasts according to unique parameters.

What deliverables can I expect from this Intermodal Freight Transportation market research project?

Deliverables from the Intermodal Freight Transportation market research project include comprehensive market reports, regional analyses, competitor benchmarking, and segmented data insights for specific transportation modalities and industry applications.

What are the market trends of Intermodal Freight Transportation?

Current market trends in Intermodal Freight Transportation include digital transformation, increased automation in logistics, and enhanced tracking and monitoring technologies. The sector is also witnessing a shift towards sustainability and cost-effective shipping solutions.