Internal Security Market Report

Published Date: 03 February 2026 | Report Code: internal-security

Internal Security Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the internal security market, covering market size, growth trends, technology innovations, and regional insights from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

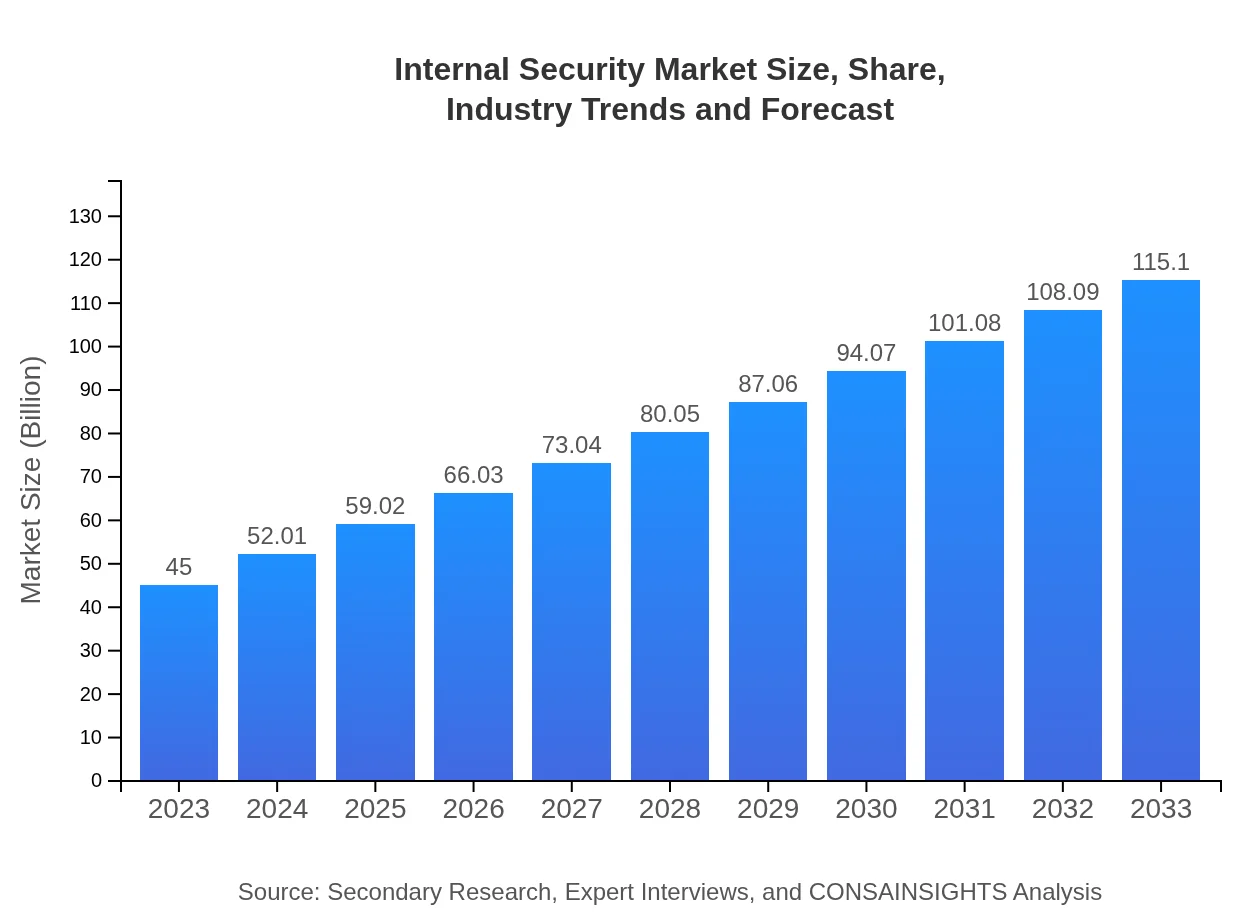

| 2023 Market Size | $45.00 Billion |

| CAGR (2023-2033) | 9.5% |

| 2033 Market Size | $115.10 Billion |

| Top Companies | IBM, Cisco Systems, McAfee, Palo Alto Networks, ADT |

| Last Modified Date | 03 February 2026 |

Internal Security Market Overview

Customize Internal Security Market Report market research report

- ✔ Get in-depth analysis of Internal Security market size, growth, and forecasts.

- ✔ Understand Internal Security's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Internal Security

What is the Market Size & CAGR of Internal Security market in 2033?

Internal Security Industry Analysis

Internal Security Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Internal Security Market Analysis Report by Region

Europe Internal Security Market Report:

Europe's internal security market is forecasted to expand from $14.81 billion in 2023 to $37.89 billion by 2033. The regulatory landscape around data protection and privacy such as GDPR necessitates robust security systems, thereby driving market growth. Concurrently, the escalation of terrorism and violent incidents pushes both public and private sectors to enhance their security frameworks.Asia Pacific Internal Security Market Report:

In the Asia Pacific region, the internal security market is projected to grow from $8.51 billion in 2023 to $21.78 billion by 2033. The rapid urbanization and increasing crime rates are motivating governments and private sectors to invest in advanced security solutions, particularly in countries like China and India. The proliferation of smart city initiatives is expected to further drive the market as local authorities seek improved safety measures.North America Internal Security Market Report:

North America holds a commanding position in the internal security market, expected to grow from $15.68 billion in 2023 to $40.11 billion by 2033. The growing reliance on digital infrastructures increases vulnerability to cyber-attacks, thus prompting companies to invest heavily in security technologies. Additionally, government initiatives emphasizing national security and disaster preparedness will further escalate market demand.South America Internal Security Market Report:

South America's internal security market, valued at $0.51 billion in 2023, is anticipated to reach $1.30 billion by 2033. Political instability and increasing criminal activities, especially in urban areas, are driving demand for enhanced security frameworks. Governments are focusing on investments in security technologies to mitigate risks and improve public safety.Middle East & Africa Internal Security Market Report:

The Middle East and Africa market is expected to grow from $5.48 billion in 2023 to $14.02 billion by 2033, influenced by geopolitical tensions and rising crime rates. Nations within this region are prioritizing internal security as a key component of their public policies, leading to increased spending on security technologies and collaborative defense initiatives.Tell us your focus area and get a customized research report.

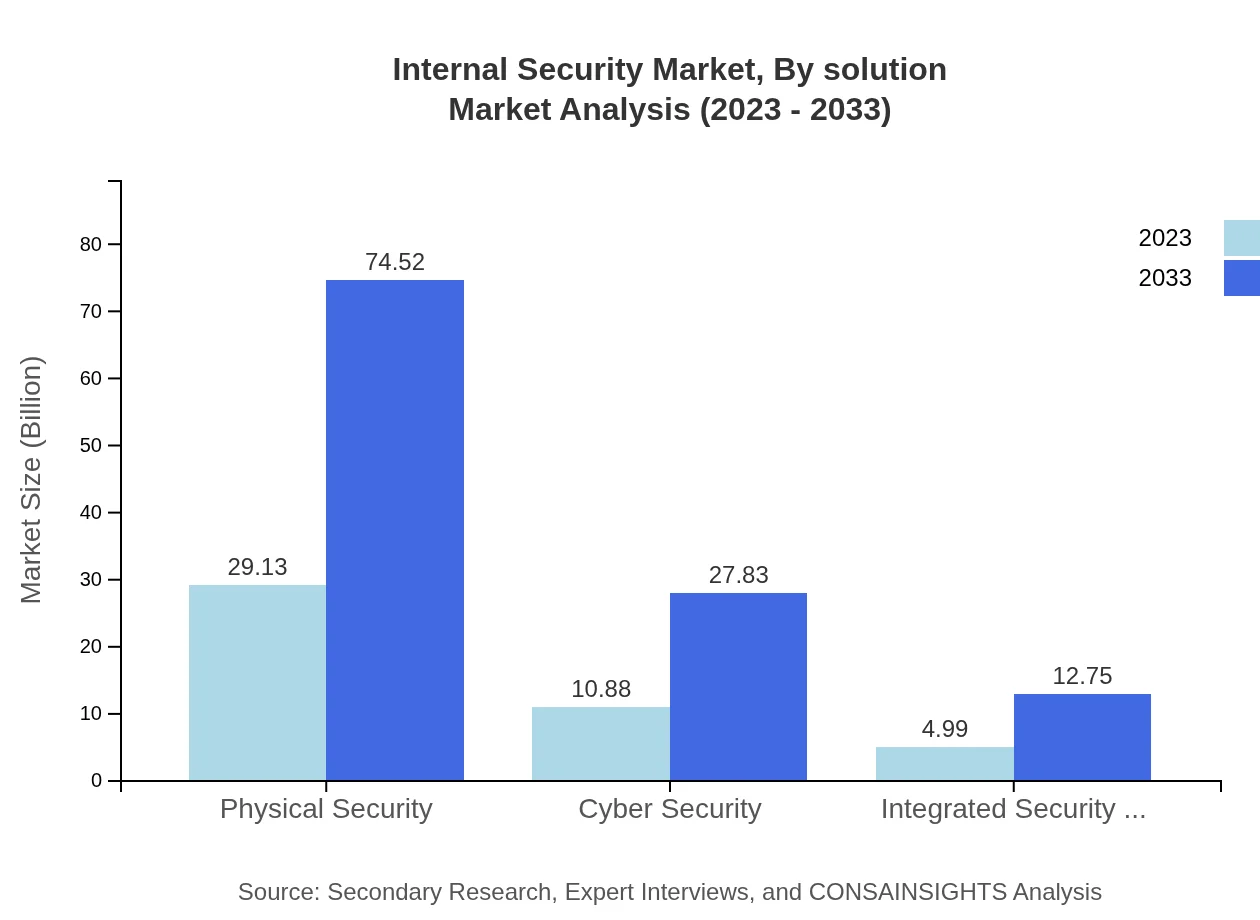

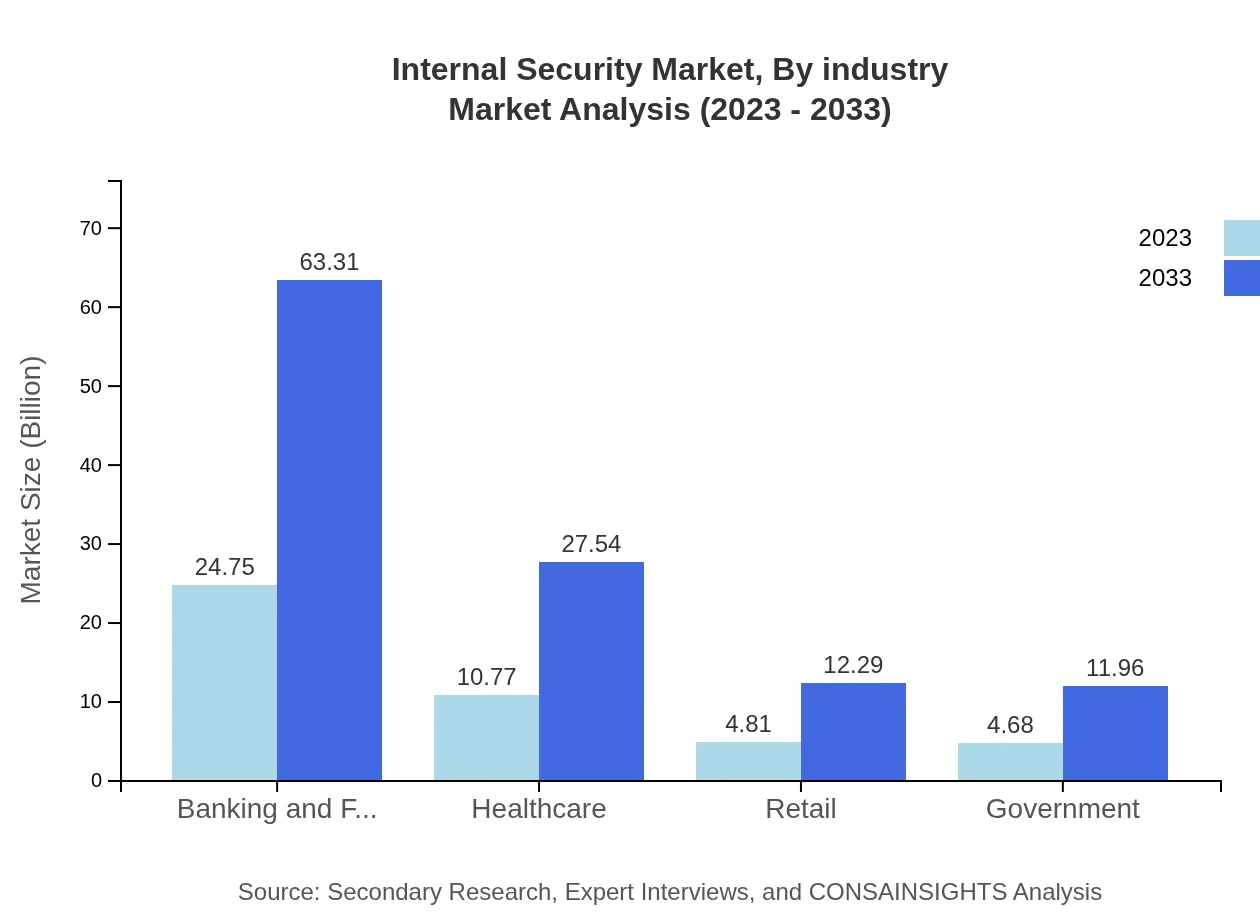

Internal Security Market Analysis By Solution

In 2023, the Banking and Finance sector leads the market segment, valued at $24.75 billion, and is expected to grow to $63.31 billion by 2033. This segment covers security solutions such as transaction monitoring, fraud detection, and compliance services, vital due to stringent regulatory requirements. The healthcare segment, growing from $10.77 billion to $27.54 billion, is underpinned by the need to protect sensitive patient data. Retail also shows promise, with growth from $4.81 billion to $12.29 billion, as businesses strengthen their defenses against theft and fraud through improved internal security measures.

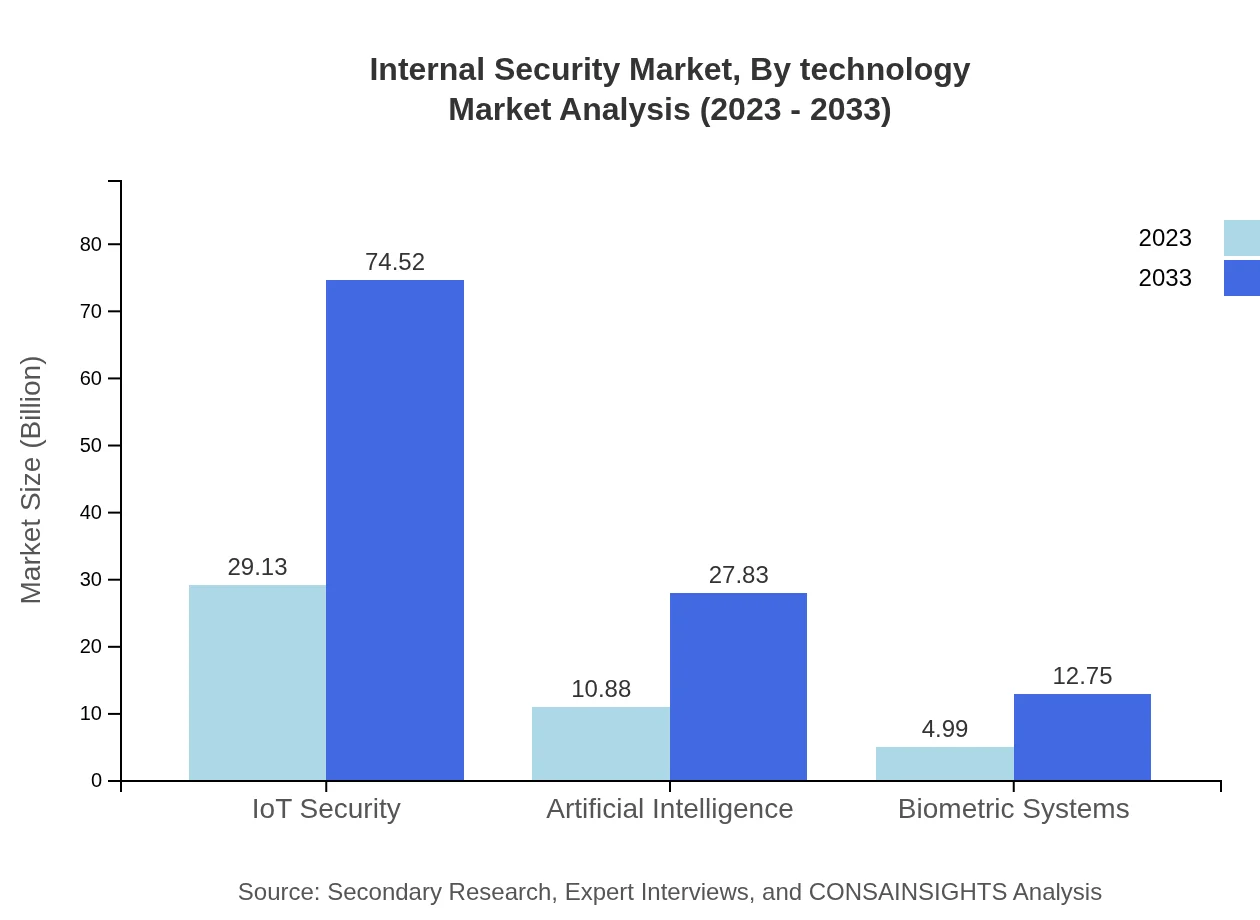

Internal Security Market Analysis By Technology

The technology segment is dominated by Physical Security, which accounts for $29.13 billion in 2023 and is projected to expand to $74.52 billion by 2033. This includes access control systems, surveillance, and alarms. Cyber Security is projected to grow significantly due to rising cyber threats, moving from $10.88 billion to $27.83 billion over the same period. Emerging technologies such as IoT Security and Artificial Intelligence are expected to play critical roles in enhancing security measures across industries.

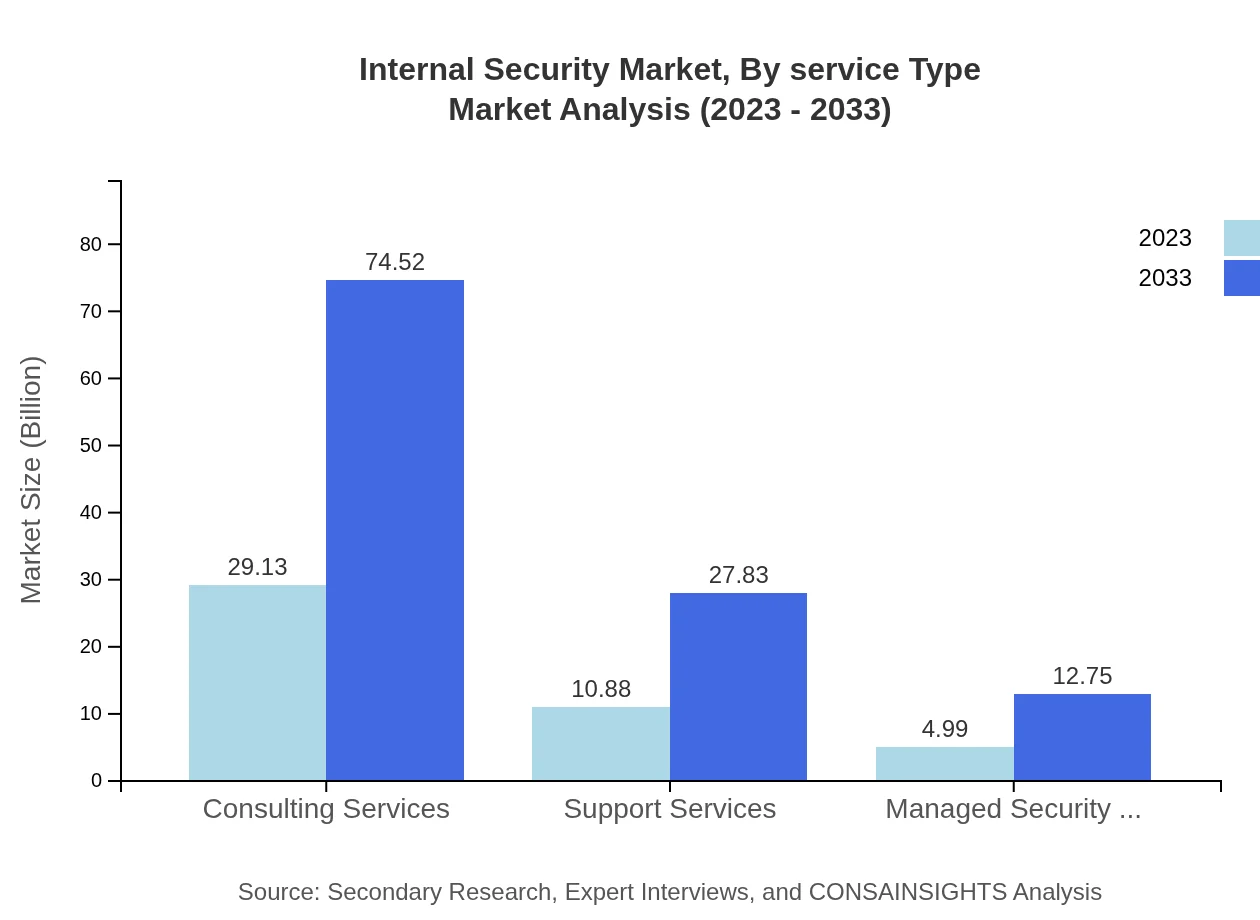

Internal Security Market Analysis By Service Type

Managed Security Services are predicted to grow significantly, growing from $4.99 billion in 2023 to $12.75 billion by 2033. Consulting and support services worth $29.13 billion and $10.88 billion respectively in 2023 are also anticipated to enhance their presence due to increased complexity and necessity of integrated security approaches among businesses of various scales.

Internal Security Market Analysis By Industry

The internal security market is heavily driven by verticals such as Banking and Finance, which maintain a substantial share (55%) owing to strict compliance requirements. The healthcare segment comprises 23.93% of the market and is critical, especially with increasing ransomware attacks on health institutions. Government and retail sectors account for 10.39% and 10.68% respectively, emphasizing the necessity for securing public and commercial spaces.

Internal Security Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Internal Security Industry

IBM:

IBM is a pioneer in cybersecurity solutions, offering advanced analytics and artificial intelligence technologies that fortify internal security frameworks across industries.Cisco Systems:

Cisco provides comprehensive security solutions that encompass network security, threat intelligence, and advanced threat protection, essential for modern enterprises.McAfee:

McAfee specializes in cybersecurity solutions, guiding organizations in protecting their digital assets against evolving cyber threats through innovative tools.Palo Alto Networks:

Palo Alto Networks is recognized for its cutting-edge firewall solutions and AI-driven cybersecurity management, enhancing the internal security capabilities of organizations.ADT :

ADT focuses on physical security and monitoring solutions, providing services that range from residential security systems to enterprise-level monitoring operations.We're grateful to work with incredible clients.

FAQs

What is the market size of internal Security?

The internal security market is valued at approximately $45 billion in 2023, with a projected CAGR of 9.5%. By 2033, the market is expected to significantly grow, indicating robust demand and increasing investments in security solutions.

What are the key market players or companies in the internal Security industry?

Key players in the internal security market include well-known security technology providers, software developers specializing in cybersecurity, and firms offering physical security solutions. Companies are increasingly focusing on advanced AI-driven security systems and IoT security integrations.

What are the primary factors driving the growth in the internal security industry?

Major growth drivers in the internal security industry include rising cyber threats, increasing regulatory compliance requirements, and growing investment in digital transformation. Organizations are prioritizing security measures to protect vital data and infrastructure.

Which region is the fastest Growing in the internal security market?

North America is the fastest-growing region in the internal security market, expected to increase from $15.68 billion in 2023 to $40.11 billion by 2033. Europe's growth also remains notable, transitioning from $14.81 billion to $37.89 billion over the same period.

Does ConsaInsights provide customized market report data for the internal security industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the internal security industry, enabling clients to access detailed insights and analyses that pertain directly to their unique market considerations.

What deliverables can I expect from this internal security market research project?

From this internal security market research project, clients can expect detailed market analyses, trends, and future projections, along with in-depth segment features across various applications and geography, accompanied by visual data representations and strategic recommendations.

What are the market trends of internal security?

Current market trends in internal security include an increased focus on integrated security systems, a rise in cybersecurity investment, and the implementation of AI and IoT solutions. Organizations are shifting towards holistic approaches that combine physical and digital security.