Internet Of Things In Banking Market Report

Published Date: 31 January 2026 | Report Code: internet-of-things-in-banking

Internet Of Things In Banking Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Internet of Things in Banking market, focusing on trends, growth factors, and regional insights for the period 2023 to 2033, including detailed data on market size and CAGR.

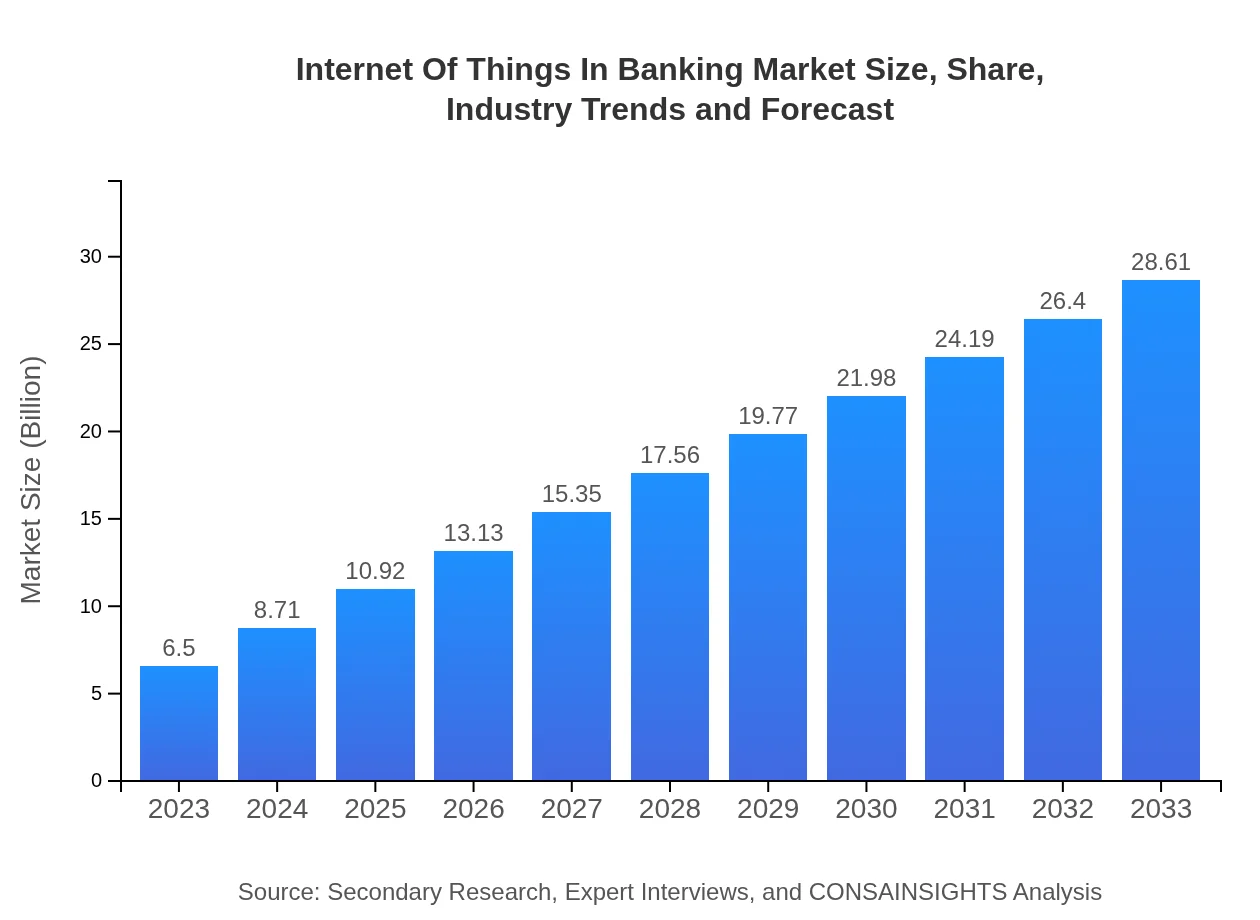

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.50 Billion |

| CAGR (2023-2033) | 15.2% |

| 2033 Market Size | $28.61 Billion |

| Top Companies | IBM, Cisco Systems, Oracle, SAP, Microsoft |

| Last Modified Date | 31 January 2026 |

Internet Of Things In Banking Market Overview

Customize Internet Of Things In Banking Market Report market research report

- ✔ Get in-depth analysis of Internet Of Things In Banking market size, growth, and forecasts.

- ✔ Understand Internet Of Things In Banking's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Internet Of Things In Banking

What is the Market Size & CAGR of Internet Of Things In Banking market in 2023?

Internet Of Things In Banking Industry Analysis

Internet Of Things In Banking Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Internet Of Things In Banking Market Analysis Report by Region

Europe Internet Of Things In Banking Market Report:

The European market for IoT in Banking was valued at $2.10 billion in 2023, expected to grow to $9.22 billion by 2033. Regulatory support and the emphasis on improving customer experience are pivotal in driving investments within the region.Asia Pacific Internet Of Things In Banking Market Report:

The Asia Pacific region witnessed substantial growth in the IoT banking market, with a valuation of $1.04 billion in 2023 and forecasted to reach $4.56 billion by 2033. High smartphone penetration and increasing digital banking services drive this growth, alongside supportive government policies aimed at fostering fintech innovation.North America Internet Of Things In Banking Market Report:

North America held a significant position in the IoT banking market with an estimated value of $2.44 billion in 2023 and is expected to reach $10.75 billion by 2033. The presence of leading tech firms and continual investments in smart banking solutions enhance its market strength.South America Internet Of Things In Banking Market Report:

In South America, the IoT in Banking market was valued at $0.18 billion in 2023, projected to rise to $0.81 billion by 2033. The growth is fueled by an increasing inclination towards digital banking solutions among consumers and businesses, despite economic challenges faced by the region.Middle East & Africa Internet Of Things In Banking Market Report:

The Middle East and Africa market is set to expand from $0.74 billion in 2023 to $3.27 billion by 2033, spurred by increasing investment in banking technology and governmental initiatives to promote digital banking and financial inclusion.Tell us your focus area and get a customized research report.

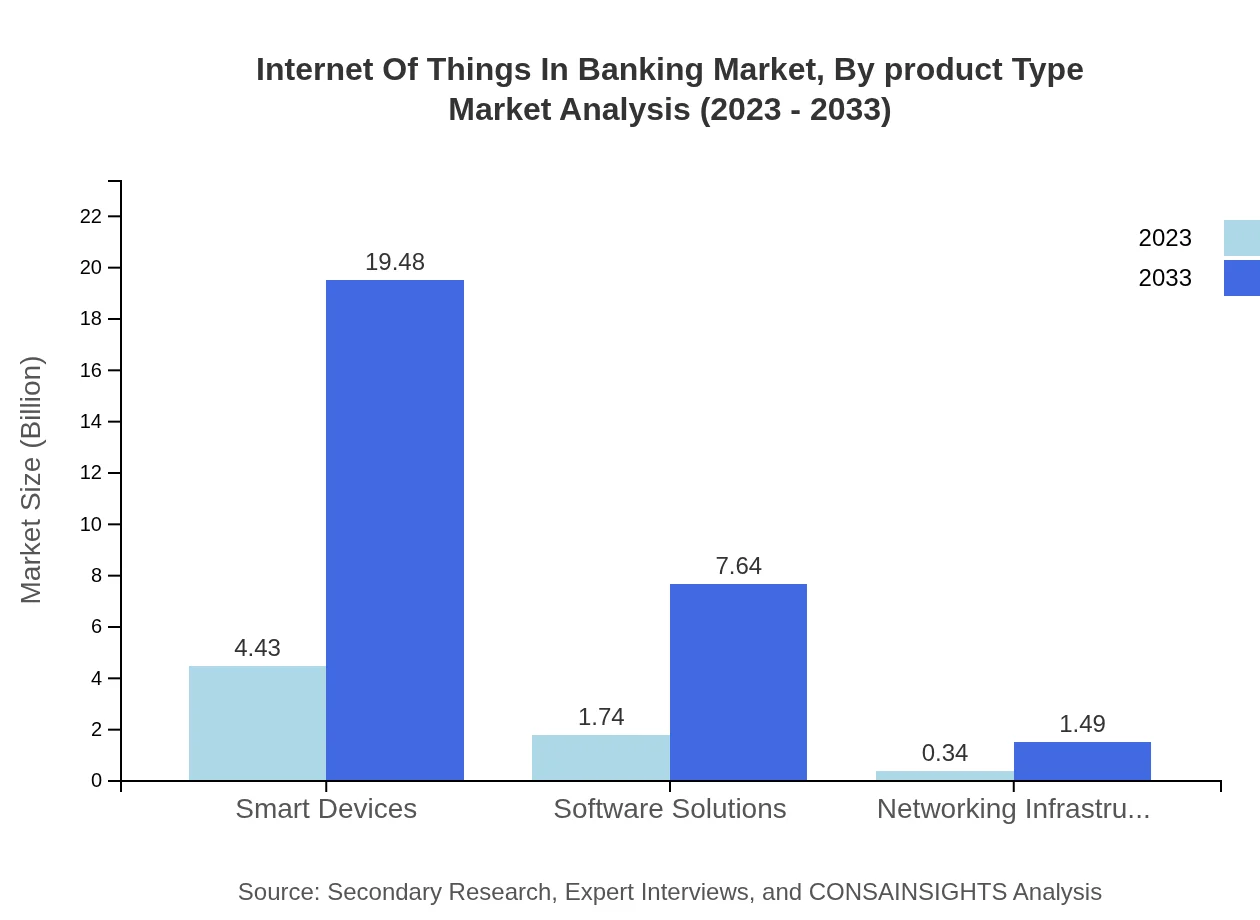

Internet Of Things In Banking Market Analysis By Product Type

The IoT in Banking market by product type includes smart devices, software solutions, and networking infrastructure. Smart devices alone contribute significantly with a market size of $4.43 billion in 2023, expected to reach $19.48 billion by 2033. Meanwhile, software solutions also demonstrate robust growth from $1.74 billion in 2023 to $7.64 billion in 2033.

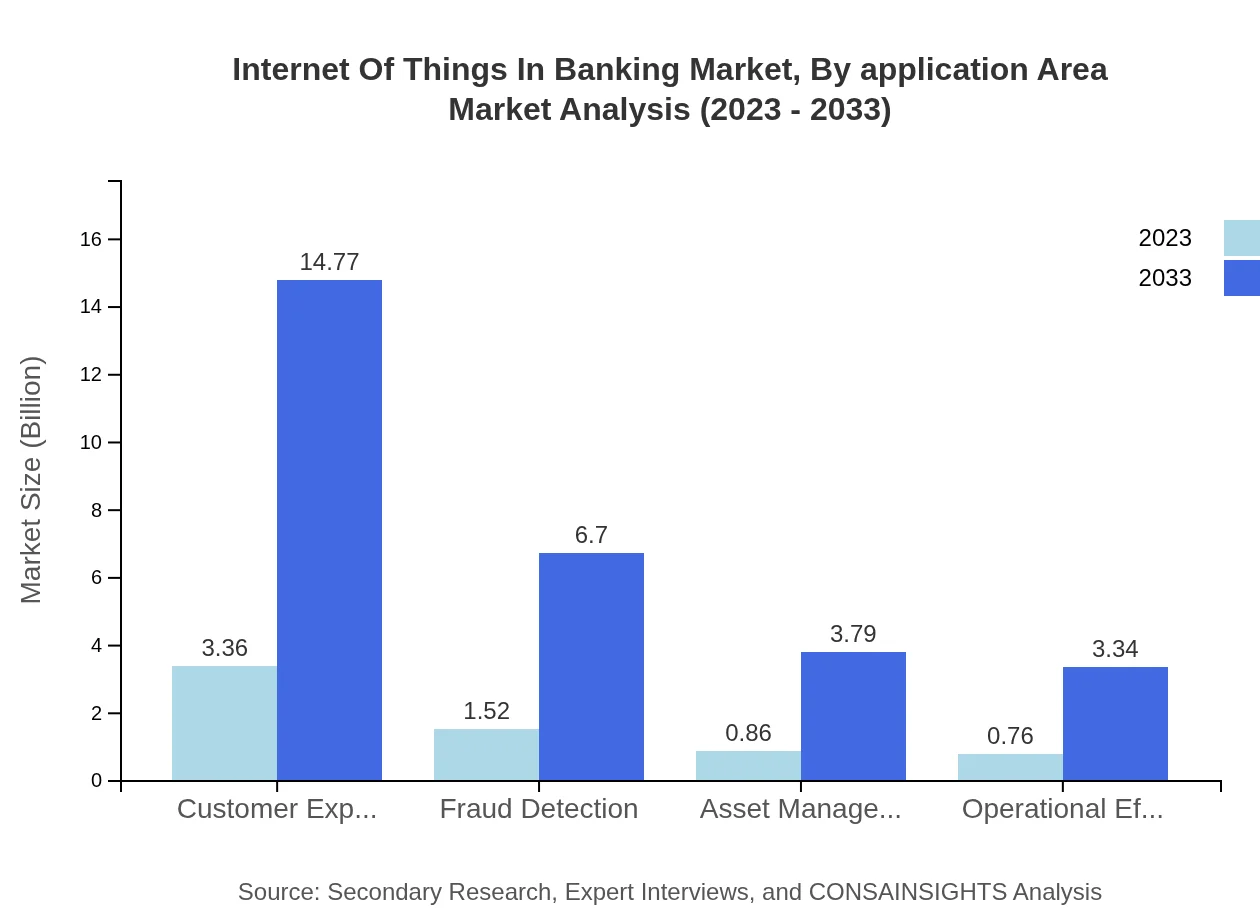

Internet Of Things In Banking Market Analysis By Application Area

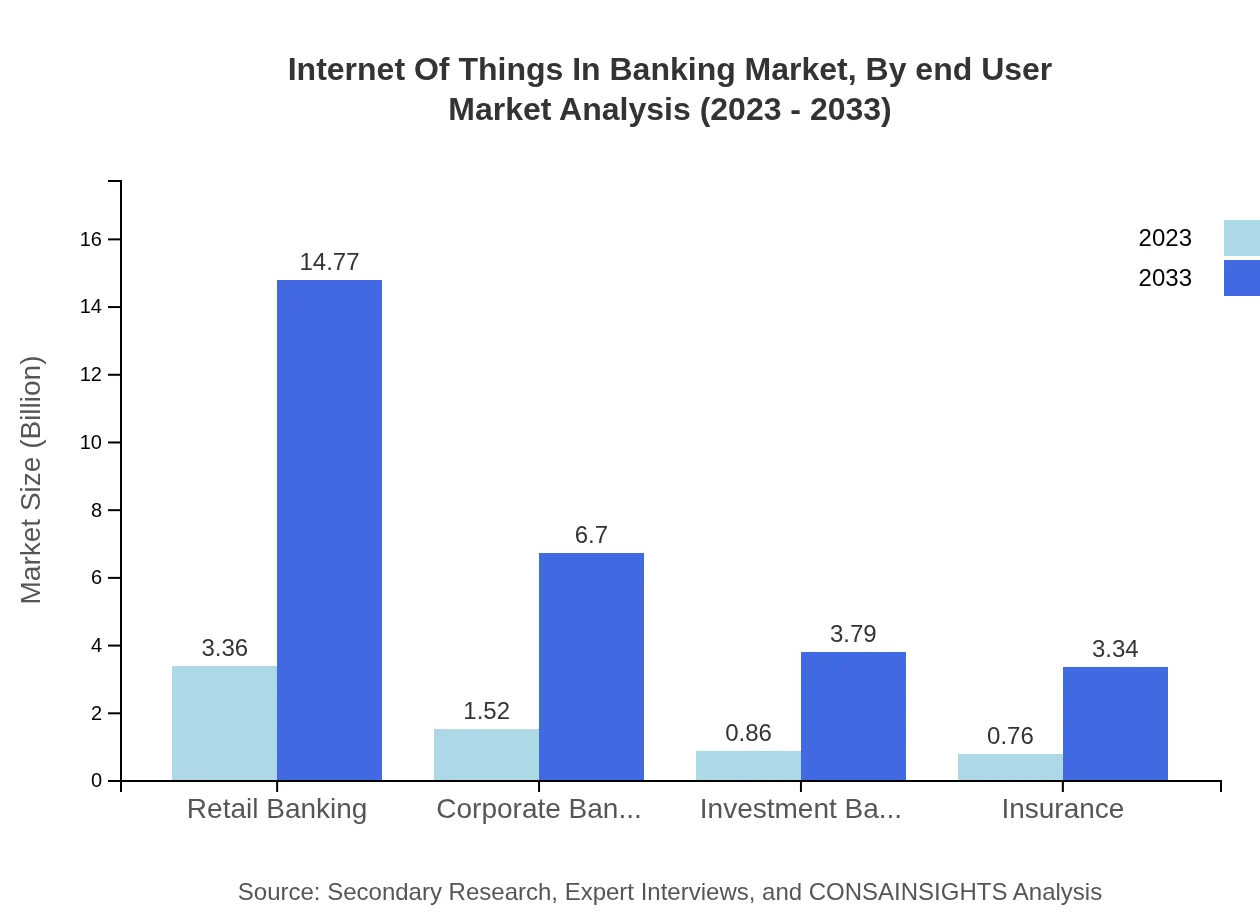

In terms of application areas, the retail banking segment leads with a market size of $3.36 billion in 2023, projected to grow to $14.77 billion by 2033. Corporate banking and investment banking segments are also significant players, with their respective sizes reaching $6.70 billion and $3.79 billion by 2033.

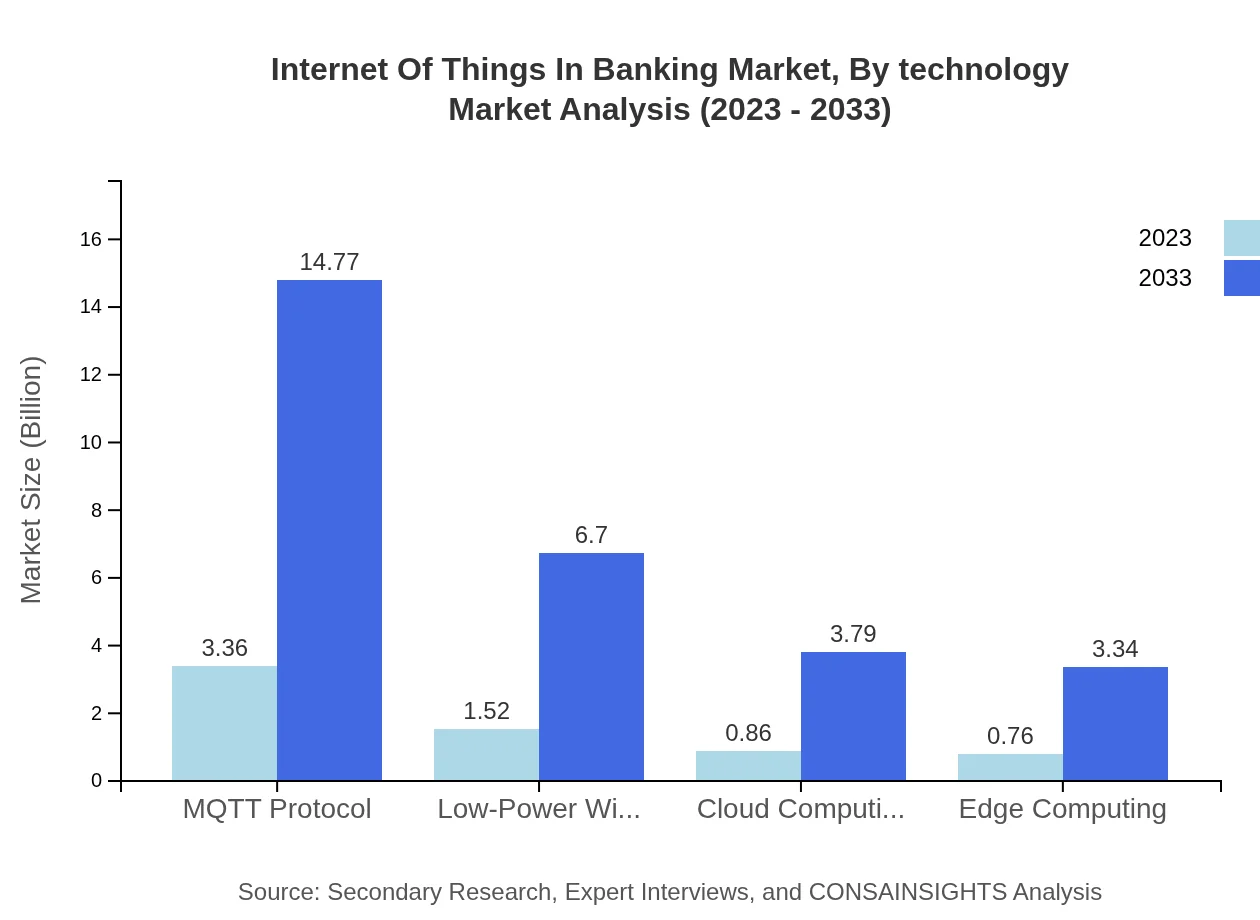

Internet Of Things In Banking Market Analysis By Technology

Technological advancements such as MQTT protocols and LPWAN technologies are pivotal to growth, with the MQTT Protocol market expected to grow from $3.36 billion in 2023 to $14.77 billion by 2033. Innovations in cloud computing signify essential drivers, transitioning banking towards more secure and scalable solutions.

Internet Of Things In Banking Market Analysis By End User

End-users of IoT in banking range from retail customers to businesses requiring corporate financial services. The segmentation emphasizes the necessity of customer experience management, fraud detection, and operational efficiency, which collectively enhance the overall banking experience.

Internet Of Things In Banking Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Internet Of Things In Banking Industry

IBM:

IBM offers IoT solutions that enable banks to improve operations, security, and customer engagement through data-driven insights.Cisco Systems:

Cisco provides networking infrastructure and IoT solutions tailored for financial institutions, enhancing connectivity and scalability.Oracle:

Oracle delivers cloud computing and software solutions that empower banks to leverage IoT technologies for higher efficiency and enhanced customer experience.SAP:

SAP's IoT solutions focus on data integration and operational management, allowing banks to optimize resources and improve financial services.Microsoft:

Microsoft's Azure IoT platform encourages innovation in financial services, helping banks adopt modern technologies for improved service delivery.We're grateful to work with incredible clients.

FAQs

What is the market size of internet Of Things In Banking?

The internet-of-things-in-banking market is projected to grow from $6.5 billion in 2023 to an estimated value driven by a CAGR of 15.2% over the next decade, reaching substantial figures by 2033.

What are the key market players or companies in this internet Of Things In Banking industry?

Key players in the internet-of-things-in-banking space include technology giants, fintech startups, and traditional banks that are adopting IoT solutions to enhance customer experience, operational efficiency, and security.

What are the primary factors driving the growth in the internet Of Things In Banking industry?

Growth in this sector is driven by technological advancements, the need for enhanced security, improved customer experience, regulatory requirements, and the growing demand for efficient banking solutions leveraging IoT technologies.

Which region is the fastest Growing in the internet Of Things In Banking?

Europe is expected to be the fastest-growing region in the IoT banking market, expanding from $2.10 billion in 2023 to $9.22 billion by 2033, showcasing a robust growth trajectory throughout the decade.

Does ConsaInsights provide customized market report data for the internet Of Things In Banking industry?

Yes, ConsaInsights offers customized market report data tailored to the internet-of-things-in-banking industry, allowing clients to gain specific insights based on their unique business needs and requirements.

What deliverables can I expect from this internet Of Things In Banking market research project?

Deliverables for the IoT in banking research project include comprehensive market analysis reports, data visualizations, trend analyses, and strategic recommendations to inform decision-making and investment strategies.

What are the market trends of internet Of Things In Banking?

Trends in the internet-of-things-in-banking market include increased adoption of smart devices, enhancements in fraud detection, customer experience management, and a focus on operational efficiency driven by cloud and edge computing innovations.