Intraoperative Imaging Market Report

Published Date: 31 January 2026 | Report Code: intraoperative-imaging

Intraoperative Imaging Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Intraoperative Imaging market from 2023 to 2033. It covers market trends, growth forecasts, and segmentation, along with insights on the competitive landscape and regional developments.

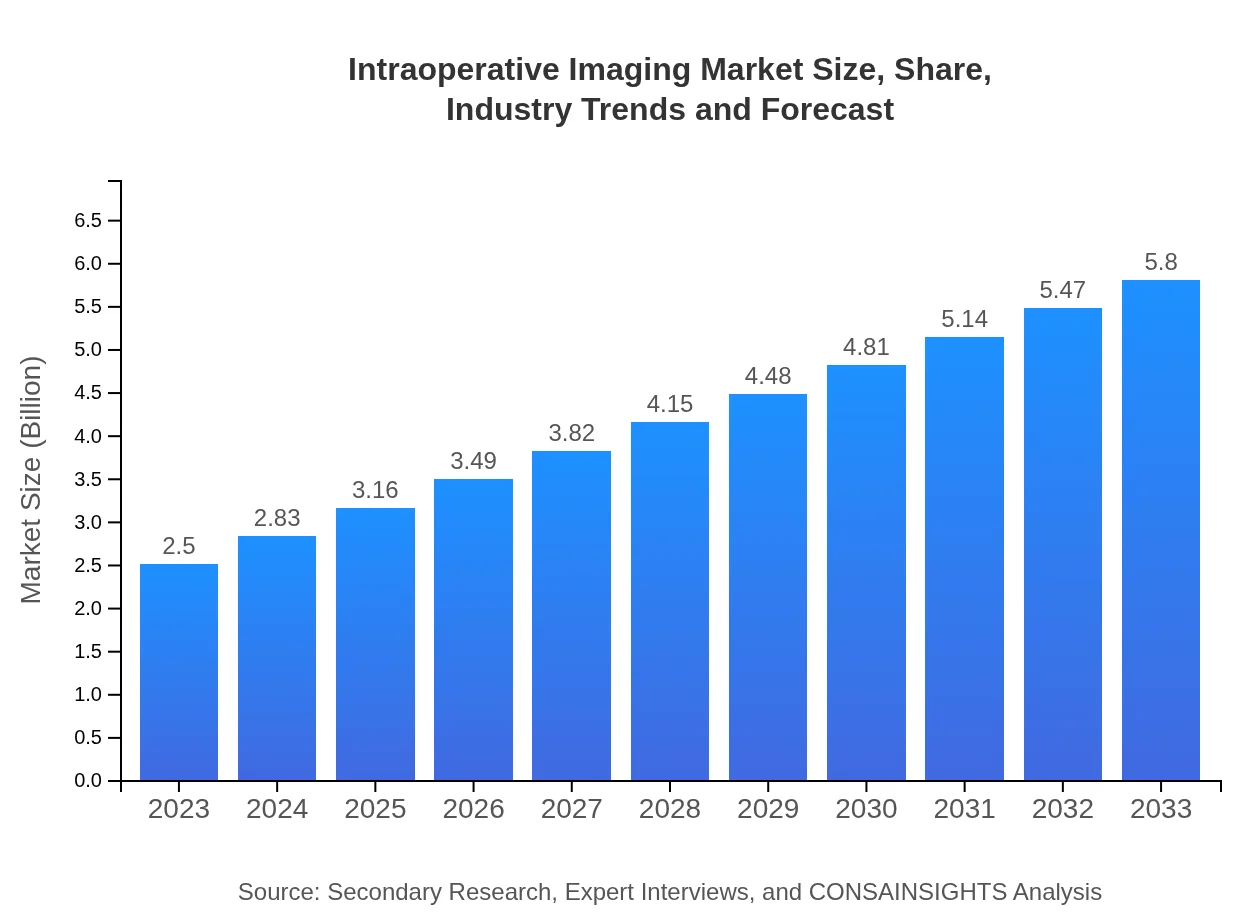

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 8.5% |

| 2033 Market Size | $5.80 Billion |

| Top Companies | GE Healthcare, Philips Healthcare, Siemens Healthineers, Canon Medical Systems |

| Last Modified Date | 31 January 2026 |

Intraoperative Imaging Market Overview

Customize Intraoperative Imaging Market Report market research report

- ✔ Get in-depth analysis of Intraoperative Imaging market size, growth, and forecasts.

- ✔ Understand Intraoperative Imaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Intraoperative Imaging

What is the Market Size & CAGR of Intraoperative Imaging market in 2033?

Intraoperative Imaging Industry Analysis

Intraoperative Imaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Intraoperative Imaging Market Analysis Report by Region

Europe Intraoperative Imaging Market Report:

Europe’s Intraoperative Imaging market is set to rise from USD 0.84 billion in 2023 to USD 1.94 billion by 2033. The region emphasizes innovative healthcare solutions and regulatory support, aiding rapid advancements in intraoperative imaging technologies.Asia Pacific Intraoperative Imaging Market Report:

In the Asia Pacific region, the Intraoperative Imaging market is anticipated to expand from USD 0.43 billion in 2023 to USD 1.01 billion by 2033, reflecting growing investments in healthcare infrastructure and increasing surgical procedures powered by technological advancements.North America Intraoperative Imaging Market Report:

North America stands as the largest market, expected to grow from USD 0.91 billion in 2023 to USD 2.12 billion in 2033. The region benefits from a well-established healthcare infrastructure, technological adoption, and a strong focus on patient safety, driving the demand for intraoperative imaging.South America Intraoperative Imaging Market Report:

The South American market is projected to experience a modest growth from USD 0.04 billion in 2023 to USD 0.10 billion by 2033. Factors such as the rise in healthcare accessibility and the demand for advanced surgical imaging solutions fuel this growth.Middle East & Africa Intraoperative Imaging Market Report:

The Middle East and Africa market is forecasted to grow from USD 0.27 billion in 2023 to USD 0.63 billion by 2033, driven by increasing medical tourism and investments directed towards modernizing healthcare facilities.Tell us your focus area and get a customized research report.

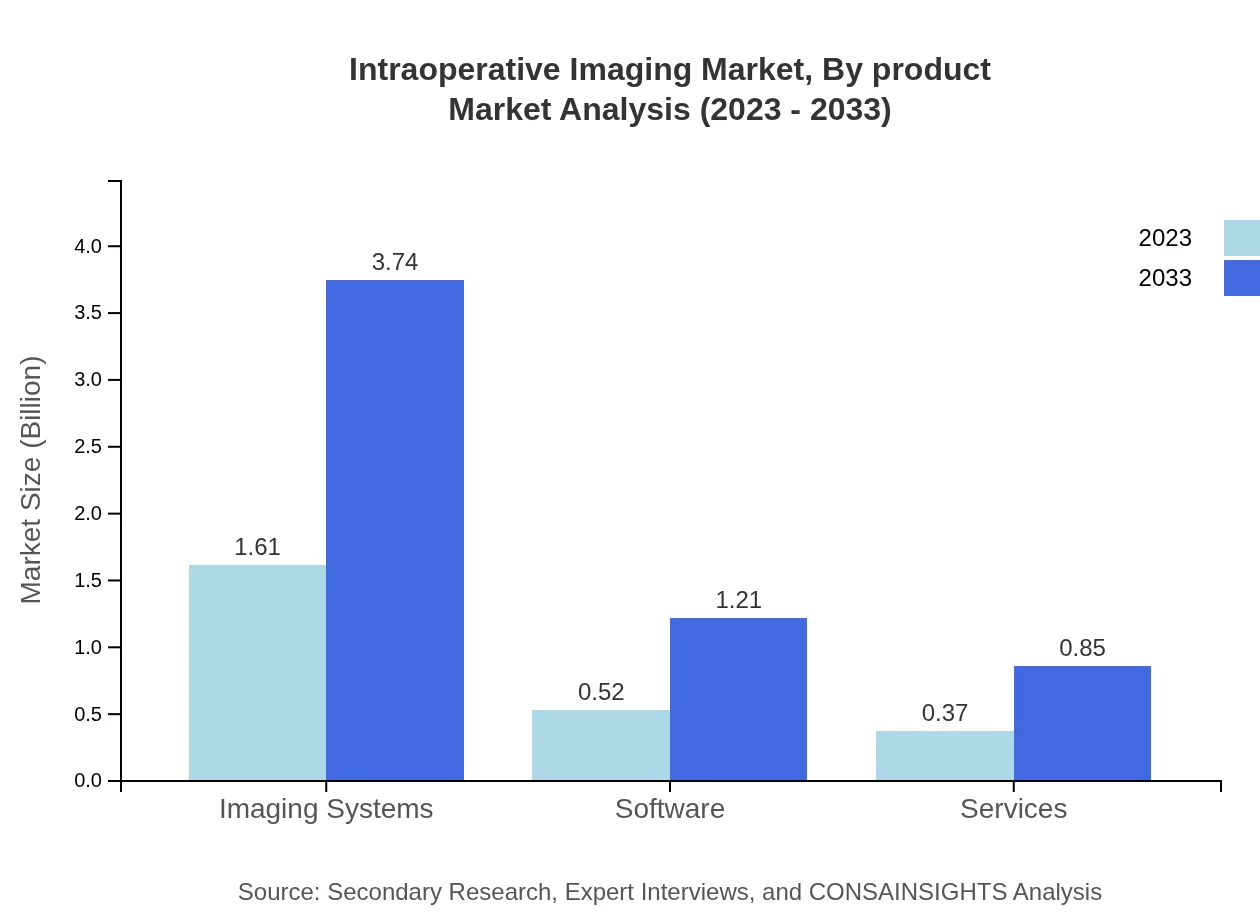

Intraoperative Imaging Market Analysis By Product

The Intraoperative Imaging market, segmented by product, includes imaging systems, software, and services. Imaging systems encompass technologies like CT, MRI, and fluoroscopy, contributing significantly to market growth, with a market size of USD 1.61 billion in 2023 expected to reach USD 3.74 billion by 2033. Software tools for intraoperative imaging play a critical role in enhancing imaging accuracy and workflow efficiency, set to grow from USD 0.52 billion in 2023 to USD 1.21 billion by 2033.

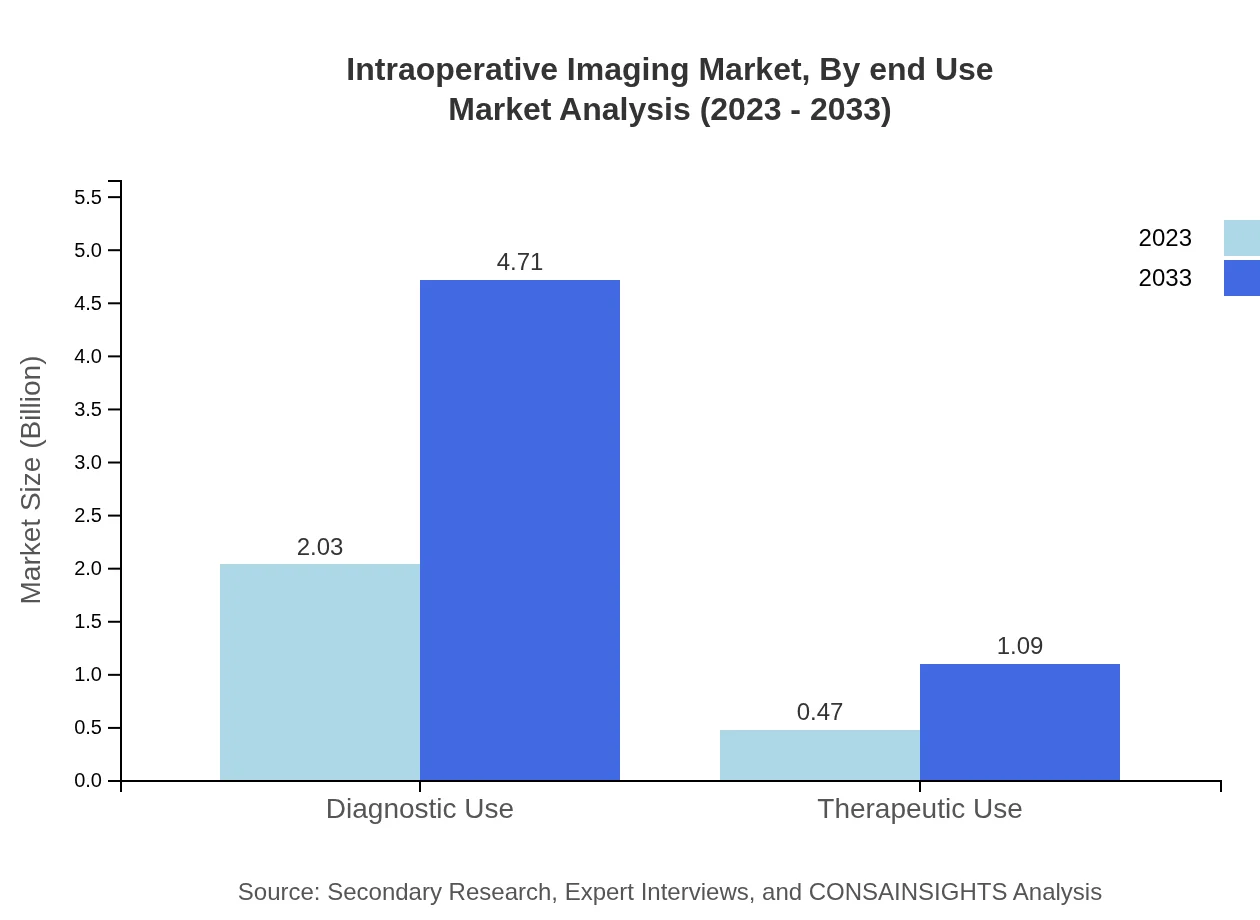

Intraoperative Imaging Market Analysis By Application

The applications of intraoperative imaging are primarily divided into diagnostic and therapeutic uses. The diagnostic applications account for a dominant market share of 81.19%, with a notable growth from USD 2.03 billion in 2023 to USD 4.71 billion by 2033, showcasing the critical role these technologies play in improving surgical outcomes.

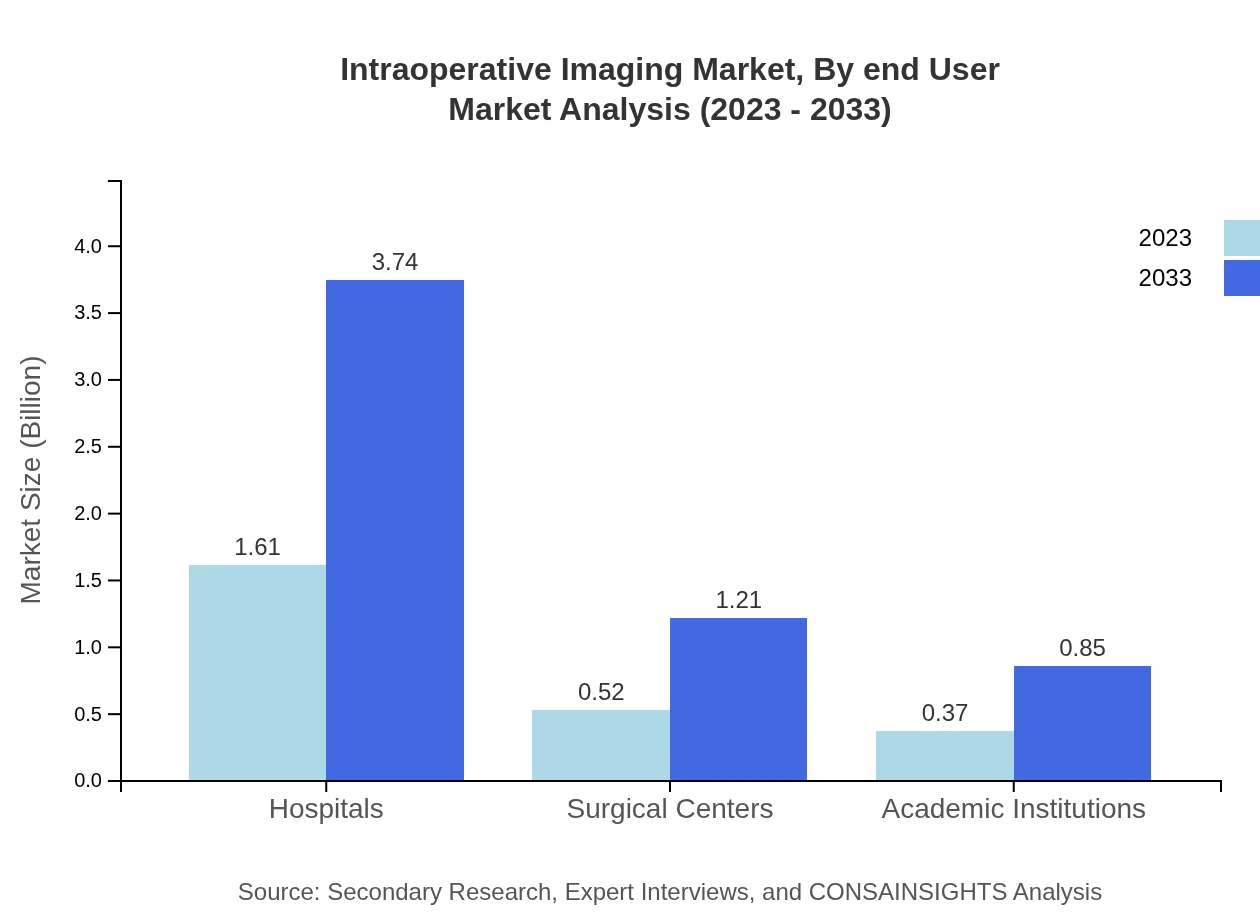

Intraoperative Imaging Market Analysis By End User

By end-user, hospitals account for a significant share of the Intraoperative Imaging market, expected to grow from USD 1.61 billion in 2023 to USD 3.74 billion by 2033. Surgical centers and academic institutions also present growth opportunities, with respective market sizes of USD 0.52 billion and USD 0.37 billion in 2023.

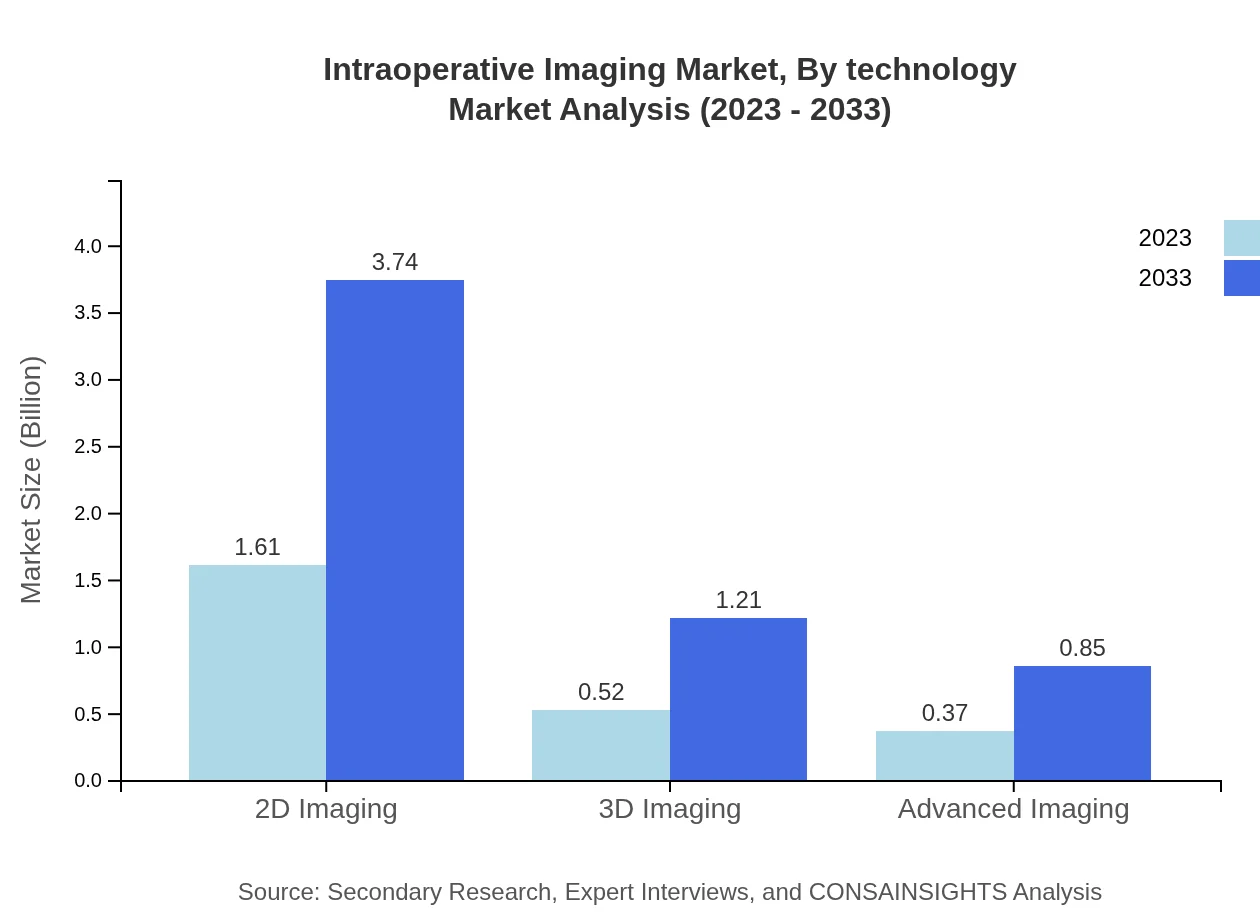

Intraoperative Imaging Market Analysis By Technology

The technology segment includes 2D imaging, 3D imaging, and advanced imaging solutions. 2D imaging dominates the market with a share of 64.48%, projected to expand from USD 1.61 billion in 2023 to USD 3.74 billion by 2033. 3D imaging and advanced technologies are also seeing increased interest, with growing applications in complex surgical cases.

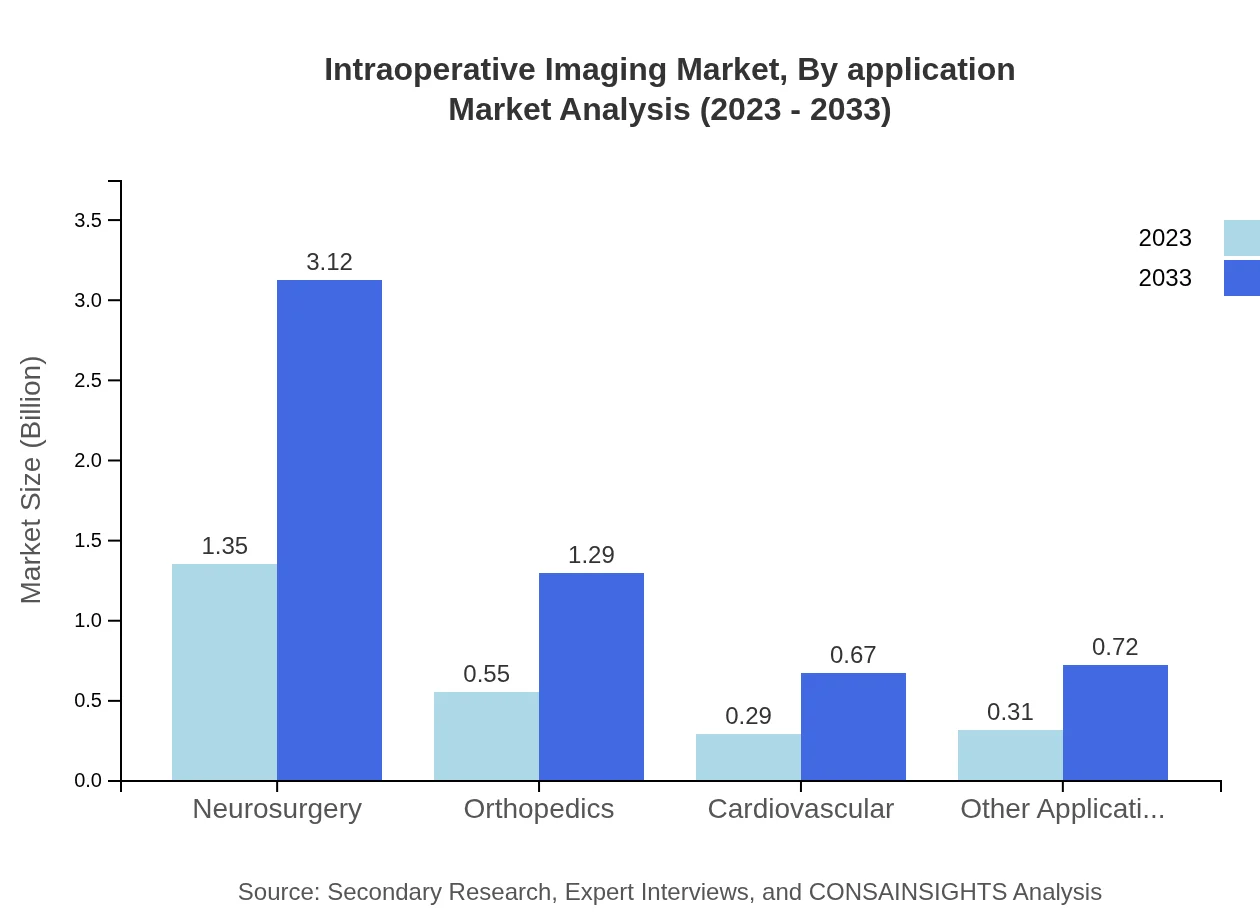

Intraoperative Imaging Market Analysis By End Use

In the end-use category, neurosurgery accounts for the largest share at 53.84%, with a market size growing from USD 1.35 billion in 2023 to USD 3.12 billion by 2033. Other applications in orthopedics and cardiovascular surgery, with respective shares of 22.16% and 11.51%, highlight the diverse applications of intraoperative imaging technologies across various surgical specialties.

Intraoperative Imaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Intraoperative Imaging Industry

GE Healthcare:

A leading global provider of medical imaging equipment and technologies, GE Healthcare focuses on innovative solutions that enhance the quality of imaging and patient care.Philips Healthcare:

Recognized for its advanced imaging systems, Philips Healthcare emphasizes integration and innovation, delivering comprehensive solutions for intraoperative imaging.Siemens Healthineers:

Siemens Healthineers offers a robust portfolio of imaging systems and services designed for various surgical procedures, with an increasing focus on AI-driven diagnostics.Canon Medical Systems:

Canon Medical is committed to providing imaging solutions that enhance patient safety and care, supporting healthcare professionals with advanced imaging technologies.We're grateful to work with incredible clients.

FAQs

What is the market size of intraoperative imaging?

The intraoperative imaging market is valued at $2.5 billion in 2023, with a projected CAGR of 8.5%. Anticipated growth will reach approximately $5.6 billion by 2033, reflecting increasing adoption and technological advancements in the healthcare sector.

What are the key market players or companies in the intraoperative imaging industry?

Key players in the intraoperative imaging market include major companies such as GE Healthcare, Siemens Healthineers, Philips Healthcare, and Canon Medical Systems. These companies drive innovation and technology in imaging solutions used during surgeries.

What are the primary factors driving the growth in the intraoperative imaging industry?

Growth in the intraoperative imaging market is driven by factors such as increased demand for minimally invasive surgeries, advancements in imaging technology, rising awareness about patient safety, and growing investments in healthcare infrastructure.

Which region is the fastest Growing in the intraoperative imaging market?

The fastest-growing region in the intraoperative imaging market is North America, expected to expand from $0.91 billion in 2023 to $2.12 billion by 2033, driven by advanced healthcare facilities and technological adoption.

Does ConsaInsights provide customized market report data for the intraoperative imaging industry?

Yes, ConsaInsights offers customized market report data tailored to the intraoperative imaging industry, enabling clients to receive insights specific to their business needs and strategic objectives.

What deliverables can I expect from this intraoperative imaging market research project?

From the intraoperative imaging market research project, expect deliverables including comprehensive market analysis reports, segmentation data, competitive landscape overview, regional growth insights, and tailored recommendations.

What are the market trends of intraoperative imaging?

Current market trends in intraoperative imaging include increased adoption of 3D imaging and advanced imaging techniques, growing use in neurosurgery, orthopedic and cardiovascular applications, and integration of software solutions for enhanced imaging capabilities.