Intravenous Product Packaging Market Report

Published Date: 31 January 2026 | Report Code: intravenous-product-packaging

Intravenous Product Packaging Market Size, Share, Industry Trends and Forecast to 2033

This report provides a detailed analysis of the Intravenous Product Packaging market, covering current trends, market dynamics, segmentation, and forecasts from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

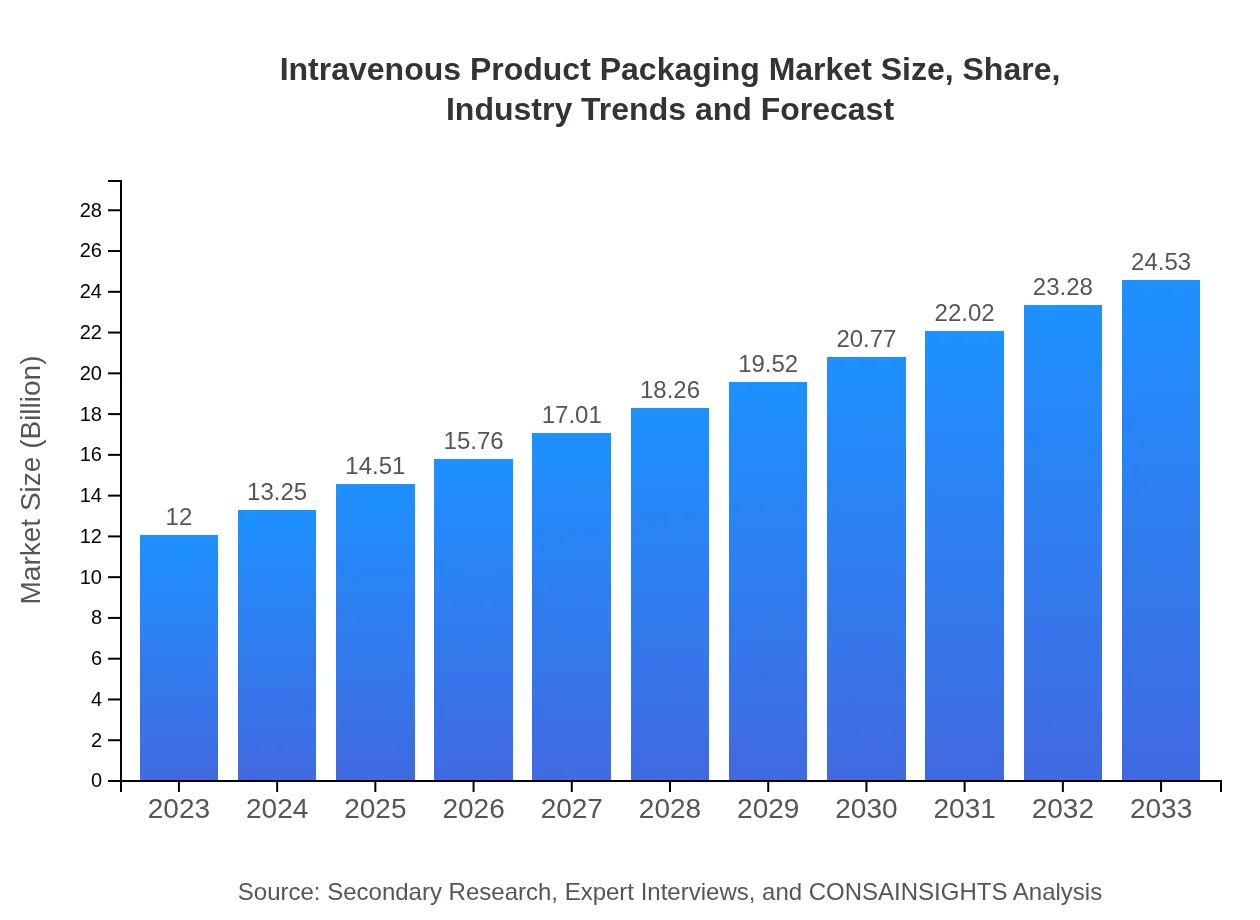

| 2023 Market Size | $12.00 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $24.53 Billion |

| Top Companies | Becton, Dickinson and Company, Vygon, Fresenius Kabi, Terumo Corporation |

| Last Modified Date | 31 January 2026 |

Intravenous Product Packaging Market Overview

Customize Intravenous Product Packaging Market Report market research report

- ✔ Get in-depth analysis of Intravenous Product Packaging market size, growth, and forecasts.

- ✔ Understand Intravenous Product Packaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Intravenous Product Packaging

What is the Market Size & CAGR of Intravenous Product Packaging market in 2033?

Intravenous Product Packaging Industry Analysis

Intravenous Product Packaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Intravenous Product Packaging Market Analysis Report by Region

Europe Intravenous Product Packaging Market Report:

Europe is expected to experience significant growth in the Intravenous Product Packaging market, rising from 3.22 billion USD in 2023 to 6.59 billion USD by 2033. The demand for standardized and safe drug delivery mechanisms, along with stringent regulatory requirements, drives innovations in packaging solutions. The focus on green and sustainable packaging is also a growing trend in the region.Asia Pacific Intravenous Product Packaging Market Report:

The Asia Pacific region is witnessing rapid growth in the Intravenous Product Packaging market, with a projected market size of 5.32 billion USD by 2033, up from 2.60 billion USD in 2023. This growth is driven by increasing healthcare expenditures, expanding hospital networks, and a rising aging population requiring sophisticated medical solutions. Additionally, investments in healthcare infrastructure and innovation present opportunities for manufacturers.North America Intravenous Product Packaging Market Report:

North America dominates the Intravenous Product Packaging market with a size of 4.14 billion USD in 2023, expected to reach 8.46 billion USD by 2033. Advancements in healthcare technology, coupled with a high number of surgical procedures and a focus on patient safety, are key drivers. The presence of leading pharmaceutical companies and strong regulatory frameworks further strengthen the market here.South America Intravenous Product Packaging Market Report:

In South America, the Intravenous Product Packaging market is expected to grow from 0.83 billion USD in 2023 to 1.70 billion USD by 2033. Factors contributing to this growth include increasing access to healthcare, rising chronic disease prevalence, and a focus on improving healthcare standards. Strategies to enhance supply chain efficiency and regulatory compliance are also vital.Middle East & Africa Intravenous Product Packaging Market Report:

The Middle East and Africa region is projected to grow from 1.21 billion USD in 2023 to 2.47 billion USD by 2033, driven by healthcare improvements and rising investments from government and private sectors. Initiatives to enhance healthcare infrastructure and affordability of intravenous therapies foster industry growth in this region.Tell us your focus area and get a customized research report.

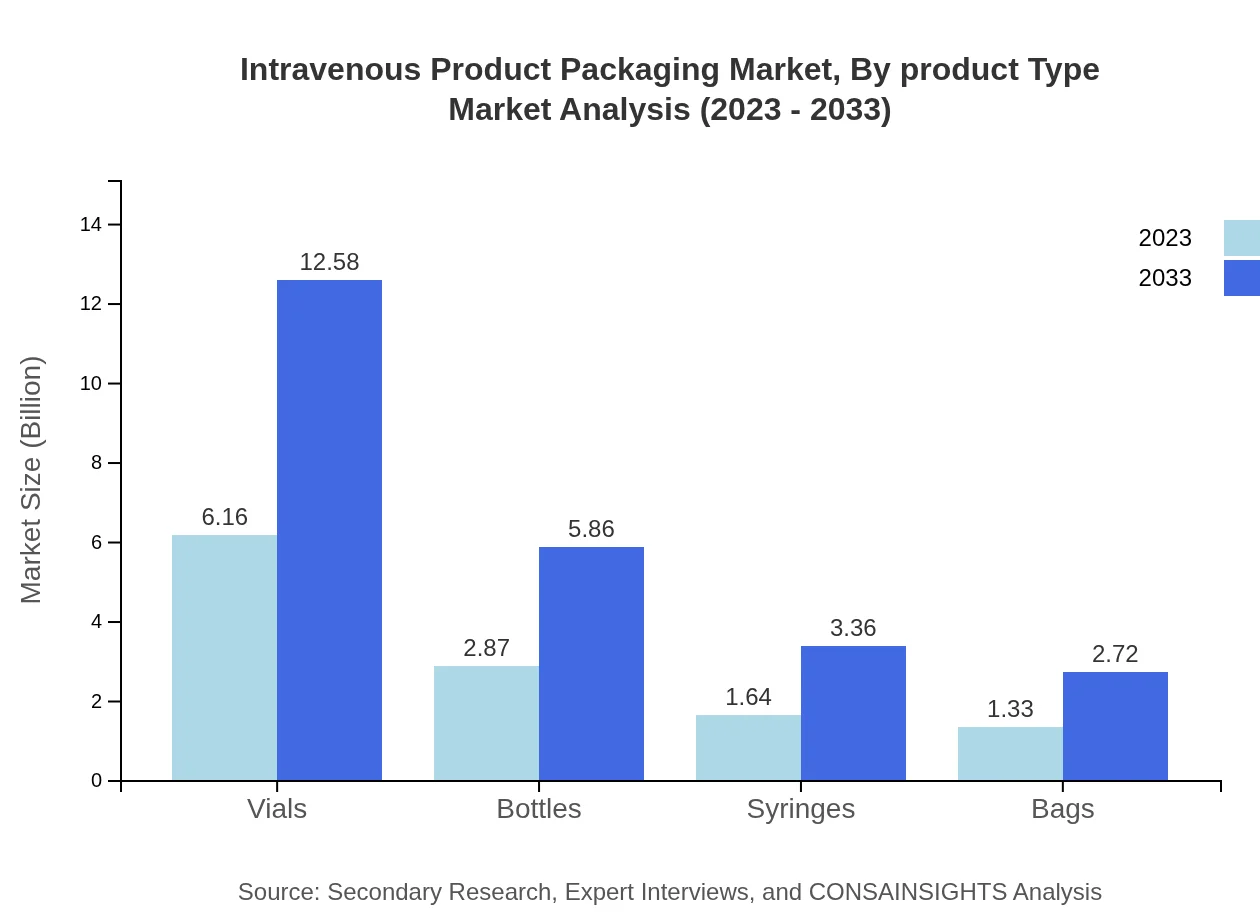

Intravenous Product Packaging Market Analysis By Product Type

The Intravenous Product Packaging market by product type includes vials, bottles, syringes, and bags. Vials hold the largest share with a market size projected at 12.58 billion USD by 2033, reflecting its critical role in medication storage. Bottles and syringes also show robust growth trajectories, propelled by increasing demand in healthcare facilities.

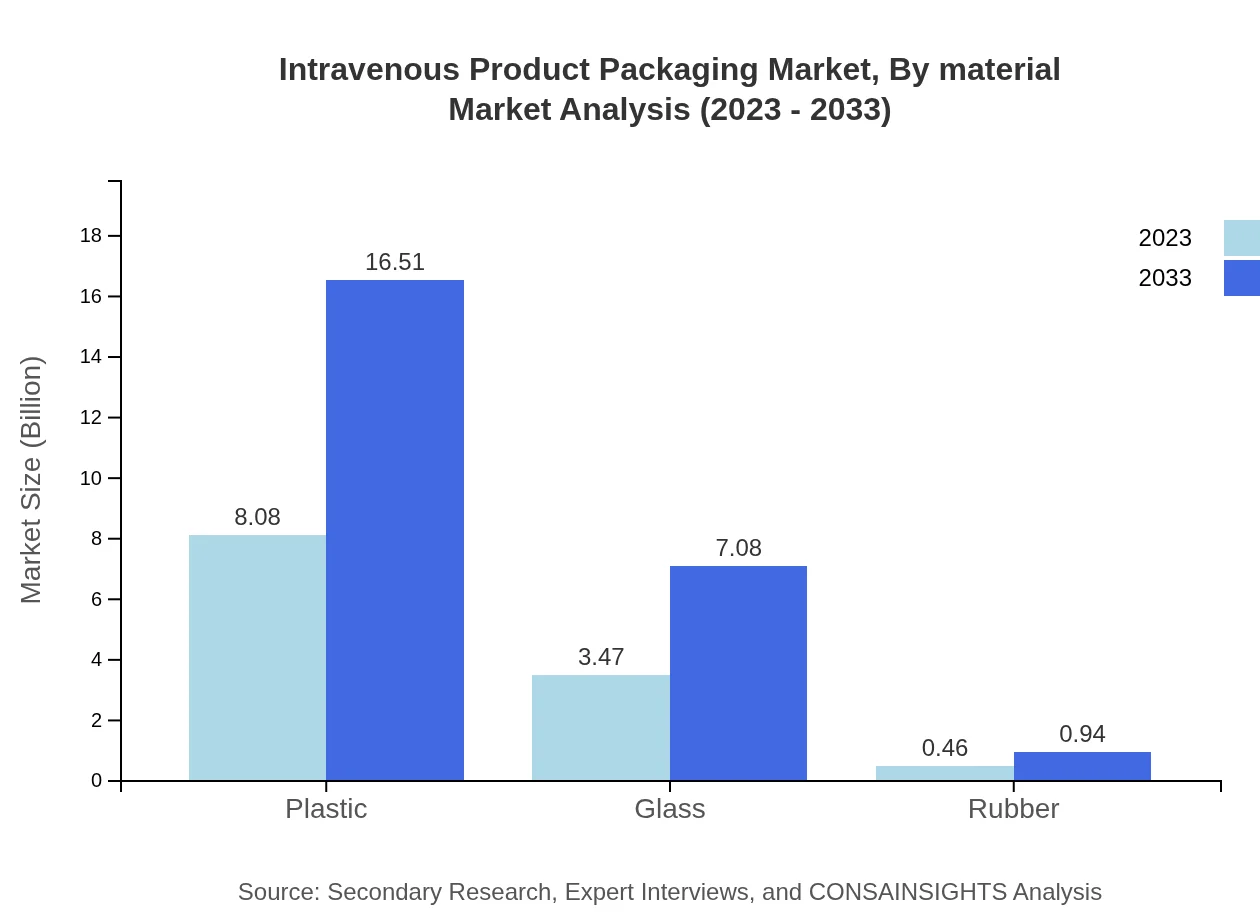

Intravenous Product Packaging Market Analysis By Material

The market segments by material are predominantly plastic, glass, and rubber, with plastic leading the market share at 16.51 billion USD by 2033. Stringent regulations regarding contamination and the affordability of plastic materials drive this trend. Glass packaging is important for its quality assurance, while rubber finds applications primarily in closures.

Intravenous Product Packaging Market Analysis By End User

The end-user segments include hospitals, clinics, ambulatory surgical centers, and pharmacies. Hospitals are the largest segment, anticipated to dominate the market with a share of 51.3% in 2033. The growing need for IV therapies in hospitals propels demand, while clinics and surgical centers also witness growth with rising patient volumes.

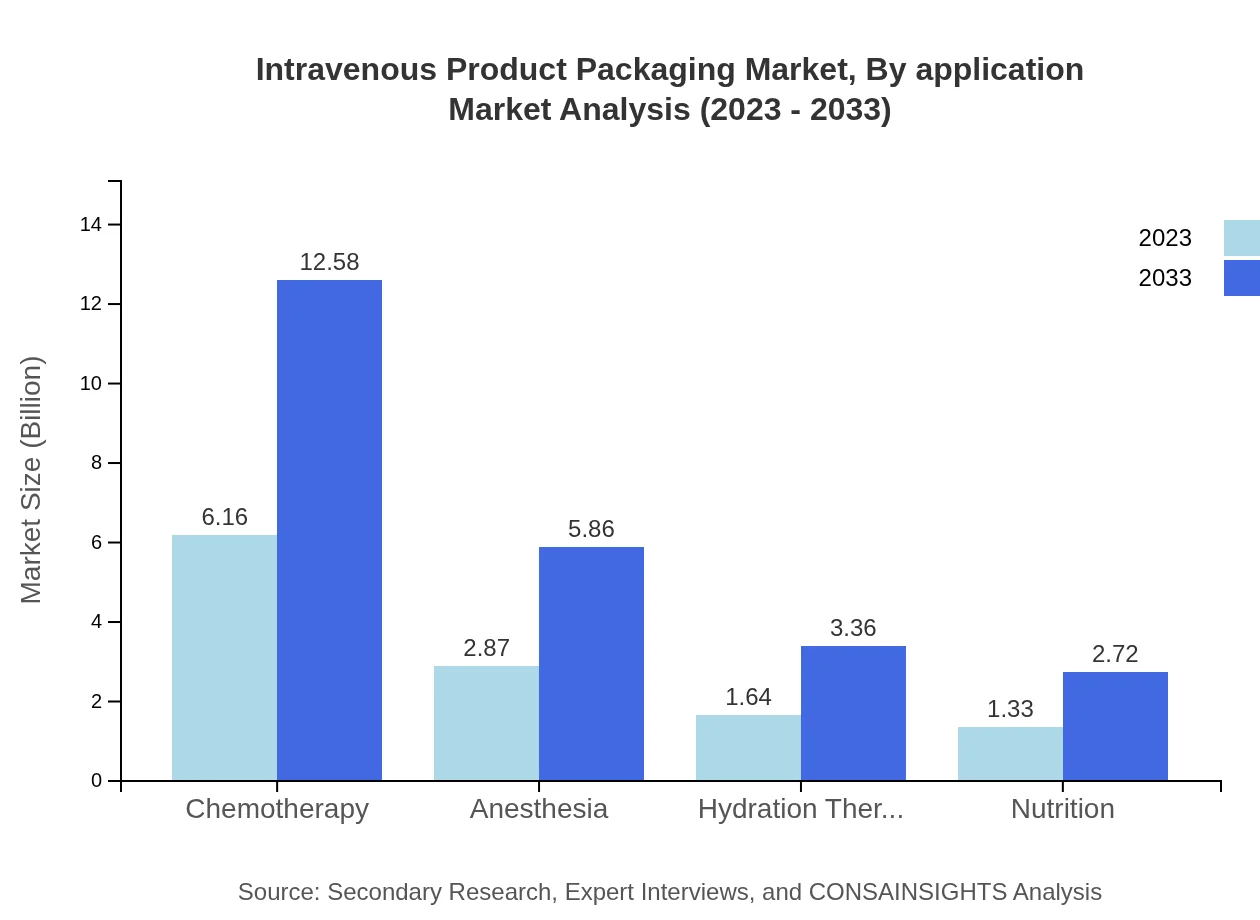

Intravenous Product Packaging Market Analysis By Application

Key applications in this market include chemotherapy, anesthesia, hydration therapy, and nutrition, with chemotherapy leading the application segment at a market share of 51.3% in 2033. The rising incidence of cancer and the corresponding demand for effective drug delivery systems are primary market drivers.

Intravenous Product Packaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Intravenous Product Packaging Industry

Becton, Dickinson and Company:

BD is a leading global medical technology company that manufactures and sells medical devices, instrument systems, and reagents. Their focus on innovation in IV packaging technology enhances patient safety and outcomes.Vygon:

Vygon is a French company specializing in single-use medical devices. With a strong commitment to healthcare quality, Vygon produces advanced IV equipment that meets stringent regulatory standards and local market needs.Fresenius Kabi:

Fresenius Kabi is focused on lifesaving medicines and high-quality medical devices. Their comprehensive range of IV medications and related packaging solutions support the healthcare system globally.Terumo Corporation:

Terumo Corporation offers innovative medical devices and solutions for blood management and drug delivery, including advanced IV packaging products that enhance patient care and safety.We're grateful to work with incredible clients.

FAQs

What is the market size of intravenous Product Packaging?

The intravenous product packaging market size is estimated at $12 billion in 2023, with a projected CAGR of 7.2%, indicating significant growth potential. By 2033, this market is expected to expand, reflecting increased demand and reliance on intravenous therapies in healthcare.

What are the key market players or companies in this intravenous Product Packaging industry?

Key players in the intravenous product packaging industry include major pharmaceutical manufacturers and packaging specialists such as B. Braun Melsungen AG, Baxter International Inc., and Fresenius Kabi. These companies lead with innovative packaging solutions and strong global market presence.

What are the primary factors driving the growth in the intravenous Product Packaging industry?

The growth drivers for the intravenous product packaging industry include the increasing prevalence of chronic diseases, a rise in surgical procedures requiring intravenous therapy, and advancements in packaging technologies that enhance safety and efficiency in drug delivery.

Which region is the fastest Growing in the intravenous Product Packaging?

The fastest-growing region in the intravenous product packaging market is North America, with a market size of $4.14 billion in 2023 projected to grow to $8.46 billion by 2033. Europe and Asia Pacific also show strong growth trajectories due to increasing healthcare expenditures.

Does ConsaInsights provide customized market report data for the intravenous Product Packaging industry?

Yes, ConsaInsights offers customized market report data tailored to the intravenous product packaging industry, allowing stakeholders to gain insights that align with specific business goals and regional market conditions, thus enabling informed decision-making.

What deliverables can I expect from this intravenous Product Packaging market research project?

From the intravenous product packaging market research project, expect comprehensive deliverables including detailed market analysis, segmentation data, competitive landscape insights, forecasts, and strategic recommendations, which can guide business planning and investment strategies.

What are the market trends of intravenous Product Packaging?

Current trends in the intravenous product packaging market include increased adoption of sustainable materials, innovations in container design for better sterility and safety, and a growing focus on automation in packaging processes to enhance efficiency and reduce costs.