Intrusion Detection And Prevention Systems Market Report

Published Date: 31 January 2026 | Report Code: intrusion-detection-and-prevention-systems

Intrusion Detection And Prevention Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Intrusion Detection and Prevention Systems market, including trends, regional insights, and industry forecasts spanning from 2023 to 2033. Key data on market size, growth, and technological advancements are dissected to provide stakeholders with actionable insights.

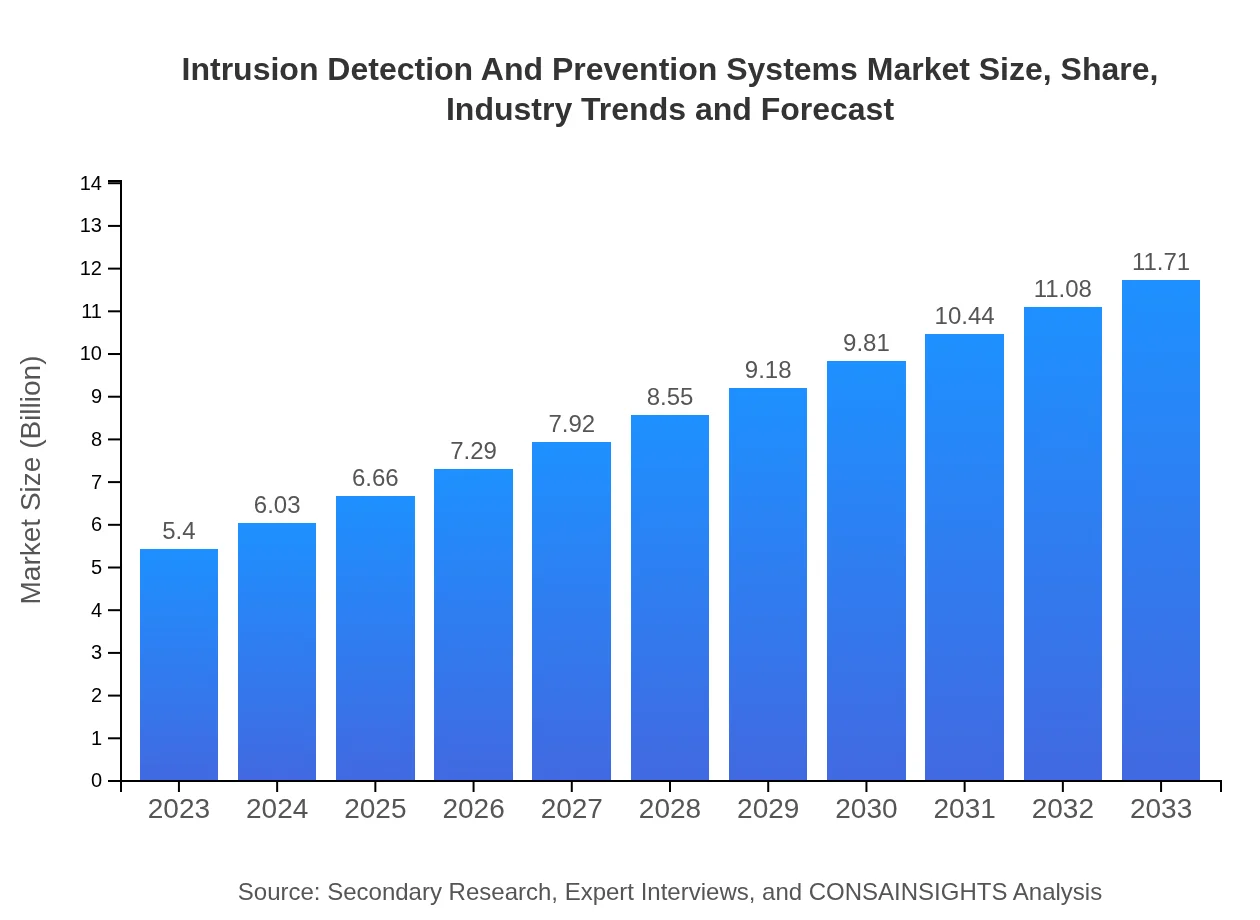

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.40 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $11.71 Billion |

| Top Companies | Cisco Systems, Inc., Palo Alto Networks, Fortinet, Inc., McAfee Corp. |

| Last Modified Date | 31 January 2026 |

Intrusion Detection And Prevention Systems Market Overview

Customize Intrusion Detection And Prevention Systems Market Report market research report

- ✔ Get in-depth analysis of Intrusion Detection And Prevention Systems market size, growth, and forecasts.

- ✔ Understand Intrusion Detection And Prevention Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Intrusion Detection And Prevention Systems

What is the Market Size & CAGR of Intrusion Detection And Prevention Systems market in 2023?

Intrusion Detection And Prevention Systems Industry Analysis

Intrusion Detection And Prevention Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Intrusion Detection And Prevention Systems Market Analysis Report by Region

Europe Intrusion Detection And Prevention Systems Market Report:

Europe’s IDPS market is set to grow from $1.39 billion in 2023 to $3.01 billion by 2033. Stringent data privacy regulations such as GDPR push organizations to enforce robust cybersecurity measures. The region is also witnessing an increase in collaborative defense strategies among firms.Asia Pacific Intrusion Detection And Prevention Systems Market Report:

The Asia Pacific region is gaining momentum in the IDPS market, projected to grow from $1.18 billion in 2023 to $2.56 billion by 2033. Increasing cyber threats, coupled with significant investments in digital transformation strategies, drive demand in this region. Countries like China and India show strong growth as enterprises bolster their cybersecurity infrastructures.North America Intrusion Detection And Prevention Systems Market Report:

In North America, the market is anticipated to expand from $1.88 billion in 2023 to $4.08 billion by 2033. The increased implementation of regulatory frameworks and a high concentration of cybersecurity firms contribute to this growth. North America shows strength in innovation, with advancements in technology enhancing IDPS functionalities.South America Intrusion Detection And Prevention Systems Market Report:

South America’s IDPS market size is expected to rise from $0.39 billion in 2023 to $0.84 billion by 2033. Growing awareness regarding cybersecurity due to increasing cyberattacks will boost adoption rates. However, the market is also challenged by budget constraints in many organizations.Middle East & Africa Intrusion Detection And Prevention Systems Market Report:

The Middle East and Africa region's IDPS market is expected to grow from $0.56 billion in 2023 to $1.21 billion by 2033. Driven by rapid digital transformation and rising governmental support for cybersecurity initiatives, the region is gradually recognizing the importance of intrusion detection technologies.Tell us your focus area and get a customized research report.

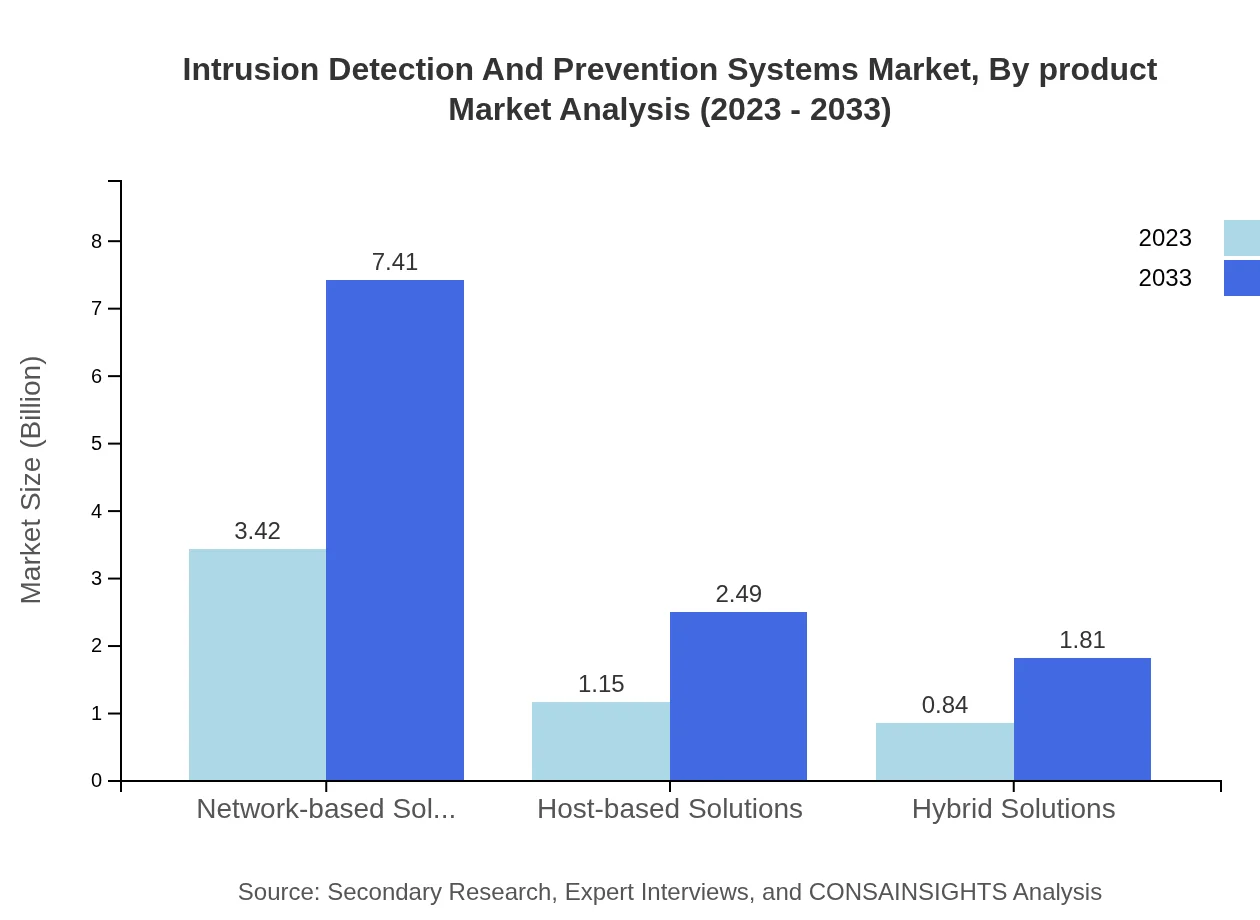

Intrusion Detection And Prevention Systems Market Analysis By Product

The market is segmented into network-based, host-based, and hybrid solutions. In 2023, the network-based solutions are estimated to have a market size of approximately $3.42 billion, followed by host-based solutions at $1.15 billion, and hybrid solutions at $0.84 billion. By 2033, network-based solutions will grow to $7.41 billion, capturing about 63.27% market share, while host-based and hybrid solutions will reach $2.49 billion and $1.81 billion, respectively, retaining their proportions.

Intrusion Detection And Prevention Systems Market Analysis By Technology

The technological advancements shape the IDPS market dynamics. Signature-based detection, with a market size of $3.42 billion in 2023, accounts for 63.27% share, while anomaly-based detection stands at $1.15 billion, representing 21.26%. Both technologies show significant growth potential, with predictions for 2033 estimating sizes of $7.41 billion and $2.49 billion, respectively.

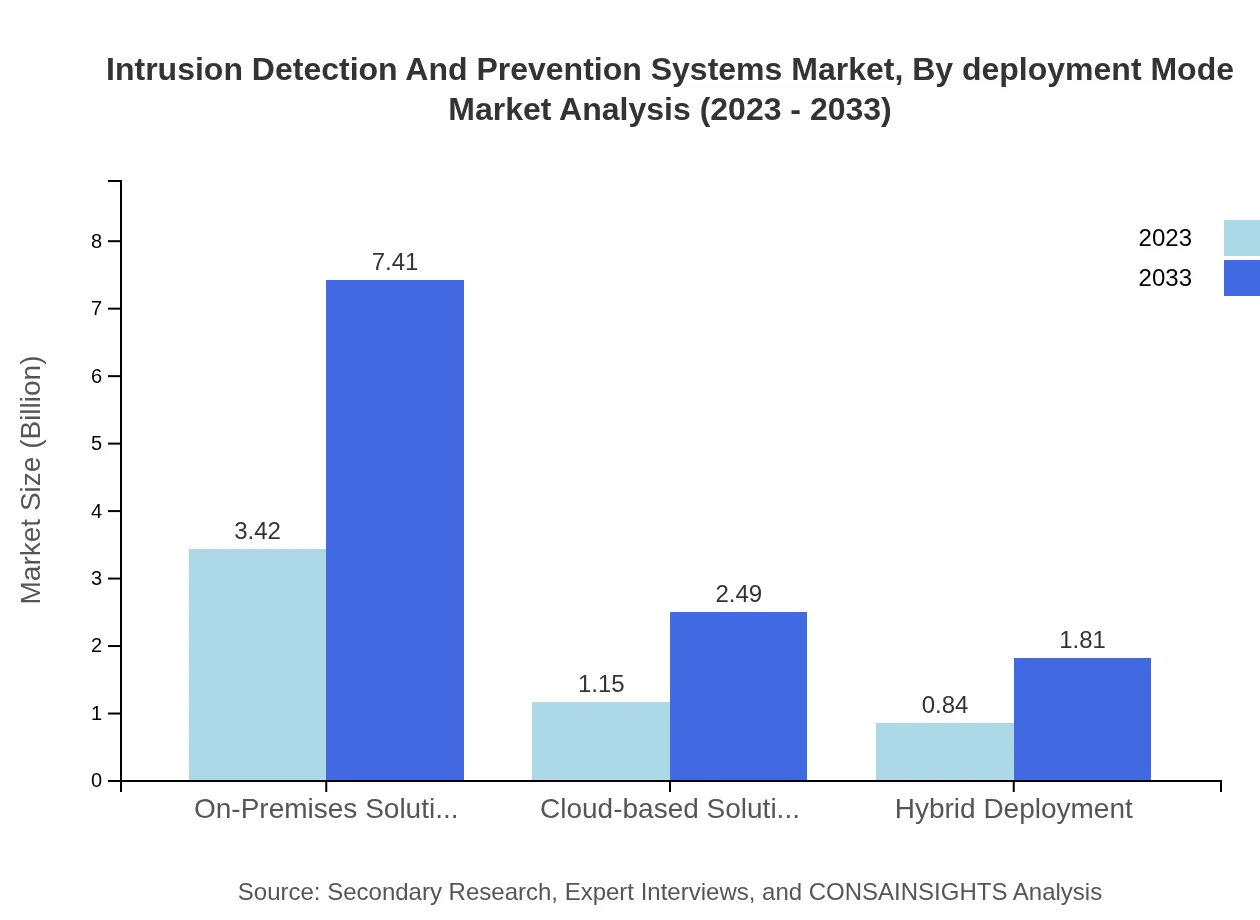

Intrusion Detection And Prevention Systems Market Analysis By Deployment Mode

The deployment mode is critical for IDPS adoption. On-premises solutions dominate the market, valued at $3.42 billion in 2023. By 2033, market growth projects to $7.41 billion, maintaining a steady market share. Conversely, cloud-based solutions start at $1.15 billion, expected to grow to $2.49 billion, reflecting the shift towards flexible deployments.

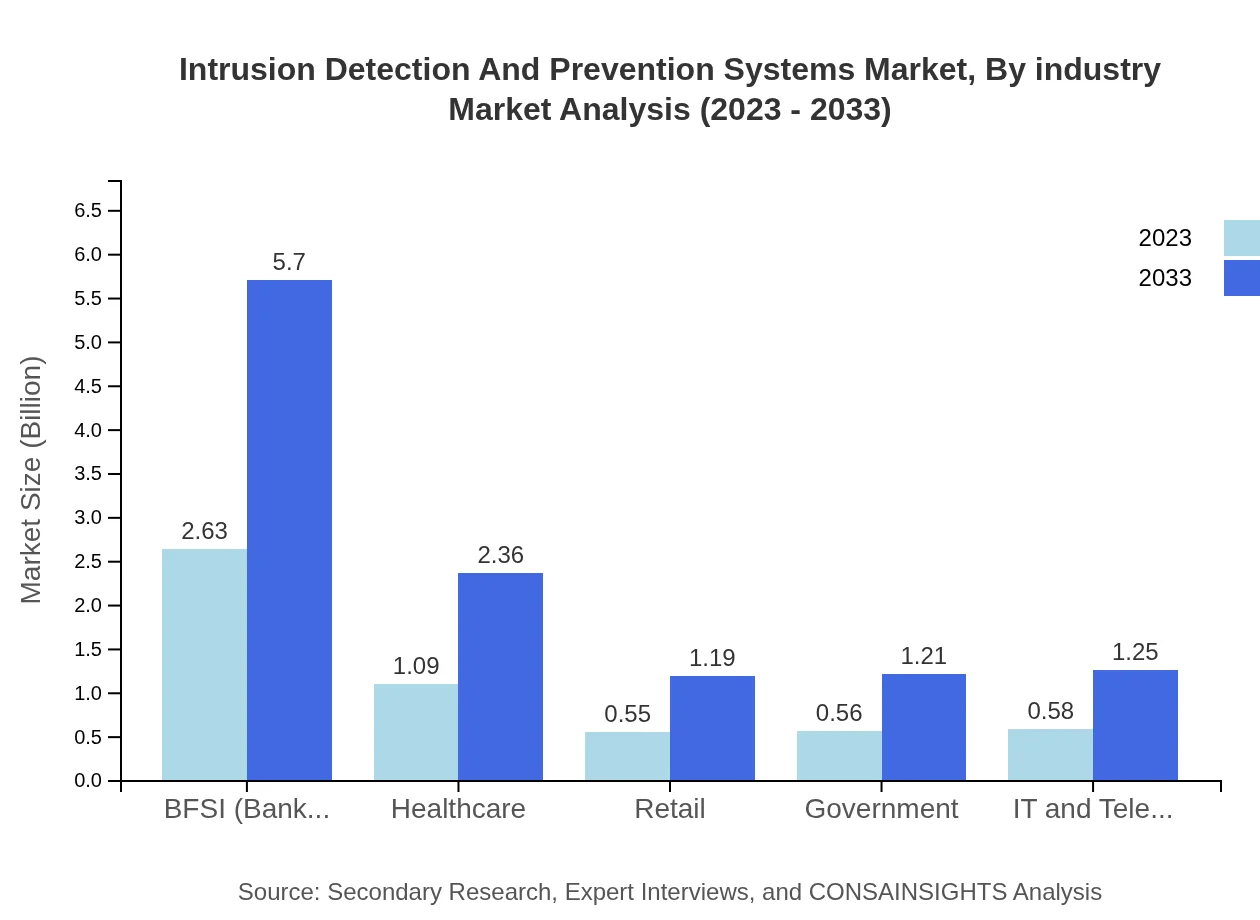

Intrusion Detection And Prevention Systems Market Analysis By Industry

The BFSI sector is the largest contributor to the IDPS market, valued at $2.63 billion in 2023, growing to $5.70 billion by 2033. Additionally, industries such as healthcare and retail are increasingly investing in protection against cyber threats, with projected growth from $1.09 billion and $0.55 billion respectively, indicating a robust demand across multiple sectors.

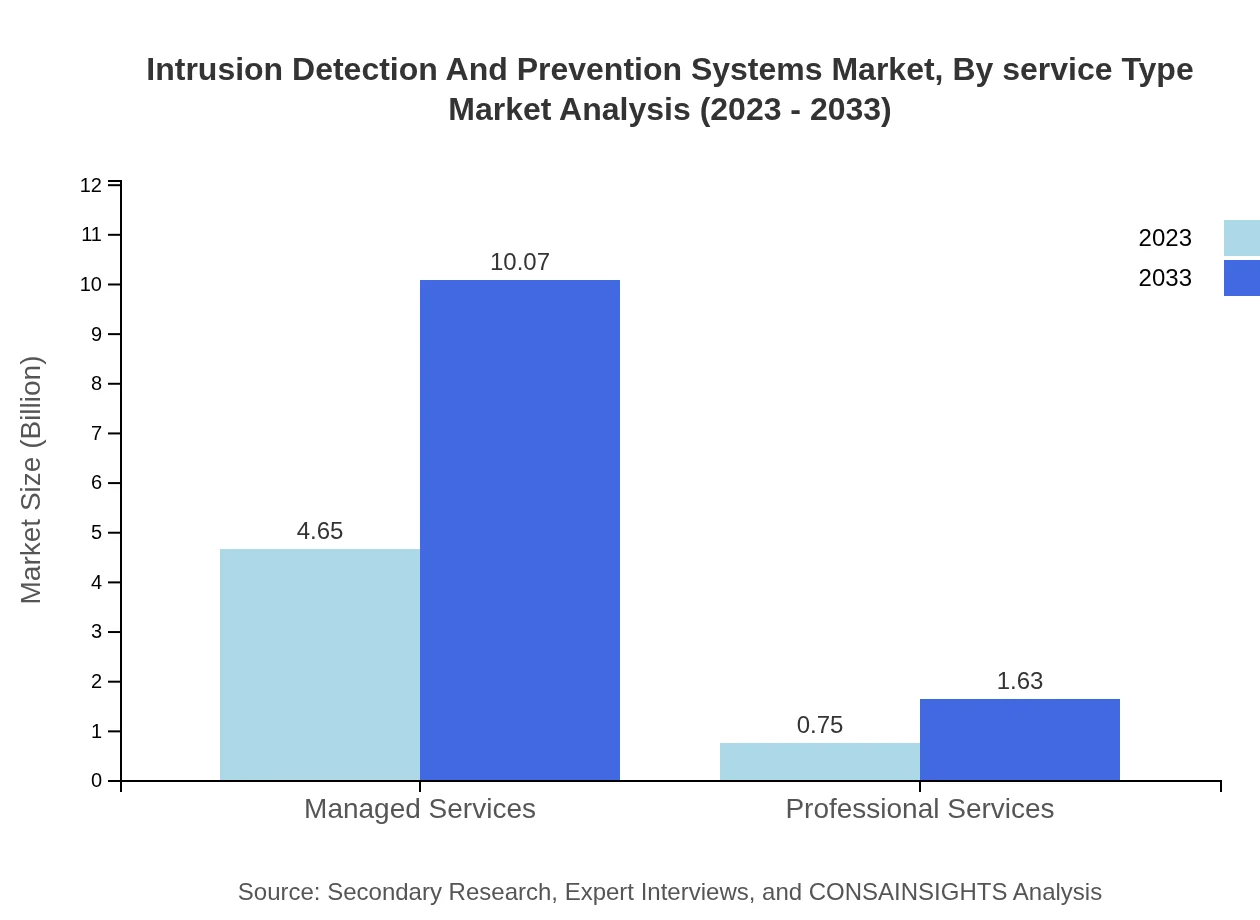

Intrusion Detection And Prevention Systems Market Analysis By Service Type

The market for managed services dominates, reflecting a size of $4.65 billion in 2023, forecasted to grow to $10.07 billion by 2033. This indicates a trend of companies seeking external expertise. Professional services, while smaller, are also projected to expand from $0.75 billion to $1.63 billion, as organizations require actionable insights and support.

Intrusion Detection And Prevention Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Intrusion Detection And Prevention Systems Industry

Cisco Systems, Inc.:

A prominent player offering a robust portfolio of IDPS technologies, Cisco drives innovations in network security frameworks and solutions.Palo Alto Networks:

Renowned for its advanced threat detection capabilities, Palo Alto Networks integrates AI and machine learning in its IDPS offerings.Fortinet, Inc.:

Provides integrated security solutions focusing on intrusion prevention and network security, emphasizing threat intelligence.McAfee Corp.:

Delivers comprehensive security solutions, including IDPS, catering to various industry standards for cyber risk management.We're grateful to work with incredible clients.

FAQs

What is the market size of Intrusion Detection and Prevention Systems?

The Intrusion Detection and Prevention Systems market is projected to reach $5.4 billion by 2033, growing at a CAGR of 7.8%. This growth reflects the increasing focus on cybersecurity across various industries.

What are the key market players or companies in the Intrusion Detection and Prevention Systems industry?

Key players in the Intrusion Detection and Prevention Systems market include industry leaders that focus on innovative security solutions, including software and hardware manufacturers, cybersecurity firms, and managed service providers.

What are the primary factors driving the growth in the Intrusion Detection and Prevention Systems industry?

The growth in the Intrusion Detection and Prevention Systems market is fueled by increasing cyber threats, regulatory compliance requirements, and the rise of IoT devices necessitating enhanced security measures.

Which region is the fastest Growing in Intrusion Detection and Prevention Systems?

The fastest-growing region in the Intrusion Detection and Prevention Systems market is projected to be North America, where market size is expected to grow from $1.88 billion in 2023 to $4.08 billion by 2033.

Does ConsaInsights provide customized market report data for the Intrusion Detection and Prevention Systems industry?

Yes, ConsaInsights offers customized market report data tailored to specific segments within the Intrusion Detection and Prevention Systems industry, helping clients address unique research needs.

What deliverables can I expect from this Intrusion Detection and Prevention Systems market research project?

From this market research project, you can expect comprehensive reports including market size, growth forecasts, analysis by region and segment, competitive landscape, and insights into key market trends.

What are the market trends of Intrusion Detection and Prevention Systems?

Market trends in Intrusion Detection and Prevention Systems include a shift towards managed services, growth in hybrid solutions, and increasing adoption of cloud-based security measures across various sectors.