Inulin Market Report

Published Date: 31 January 2026 | Report Code: inulin

Inulin Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the inulin market, including market size, growth trends, and forecasts from 2023 to 2033. It explores regional dynamics, industry analysis, market segmentation, key players, and future trends impacting the inulin industry.

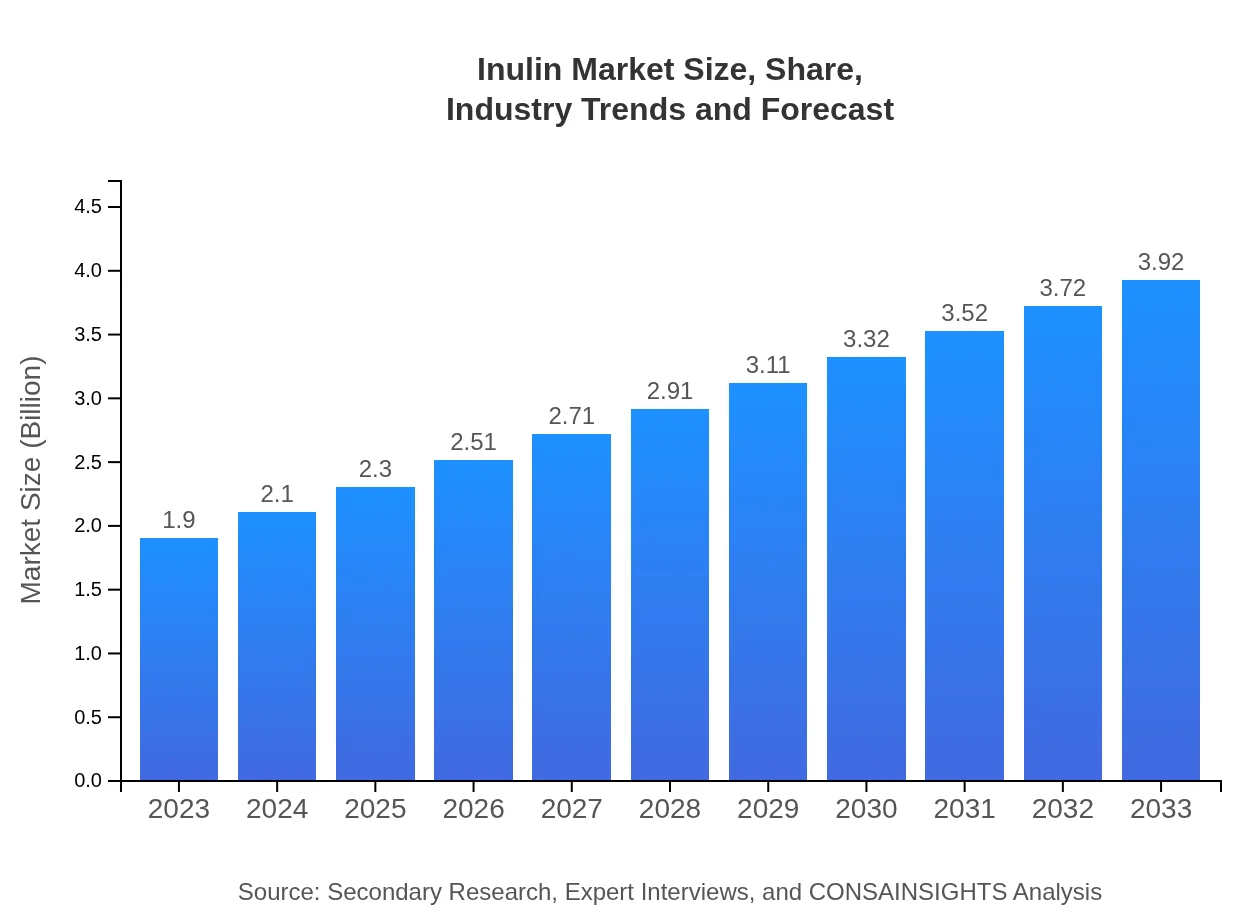

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.90 Billion |

| CAGR (2023-2033) | 7.3% |

| 2033 Market Size | $3.92 Billion |

| Top Companies | Orafti S.A., Sensus (Beneo), DuPont Nutrition & Biosciences, Frutarom (Irfat) |

| Last Modified Date | 31 January 2026 |

Inulin Market Overview

Customize Inulin Market Report market research report

- ✔ Get in-depth analysis of Inulin market size, growth, and forecasts.

- ✔ Understand Inulin's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Inulin

What is the Market Size & CAGR of the Inulin market in 2023?

Inulin Industry Analysis

Inulin Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Inulin Market Analysis Report by Region

Europe Inulin Market Report:

The European inulin market is forecasted to grow from $0.47 billion in 2023 to $0.96 billion by 2033, driven by stringent regulations promoting nutritional enrichment in food. The high dietary fiber consumption in countries like Germany, France, and the UK is also supporting this growth.Asia Pacific Inulin Market Report:

The Asia Pacific inulin market is projected to grow from $0.38 billion in 2023 to $0.78 billion by 2033, reflecting increasing demand for healthy food options and a growing awareness of the health benefits of dietary fibers. Additionally, rising disposable incomes and changing dietary habits in countries like India and China are contributing to market growth.North America Inulin Market Report:

North America is a significant market for inulin, projected to grow from $0.71 billion in 2023 to approximately $1.46 billion by 2033. The United States leads this growth due to its strong health and wellness market, increasing demand for functional foods, and high awareness of dietary fibers.South America Inulin Market Report:

In South America, the inulin market is expected to expand from $0.10 billion in 2023 to about $0.21 billion by 2033. The growth is supported by increasing health consciousness and a trend towards organic and healthy food products among consumers, particularly in Brazil and Argentina.Middle East & Africa Inulin Market Report:

The Middle East and Africa inulin market is anticipated to increase from $0.25 billion in 2023 to $0.52 billion by 2033. The rising prevalence of lifestyle-related diseases and an increase in health-oriented food product offerings are key factors contributing to market expansion in this region.Tell us your focus area and get a customized research report.

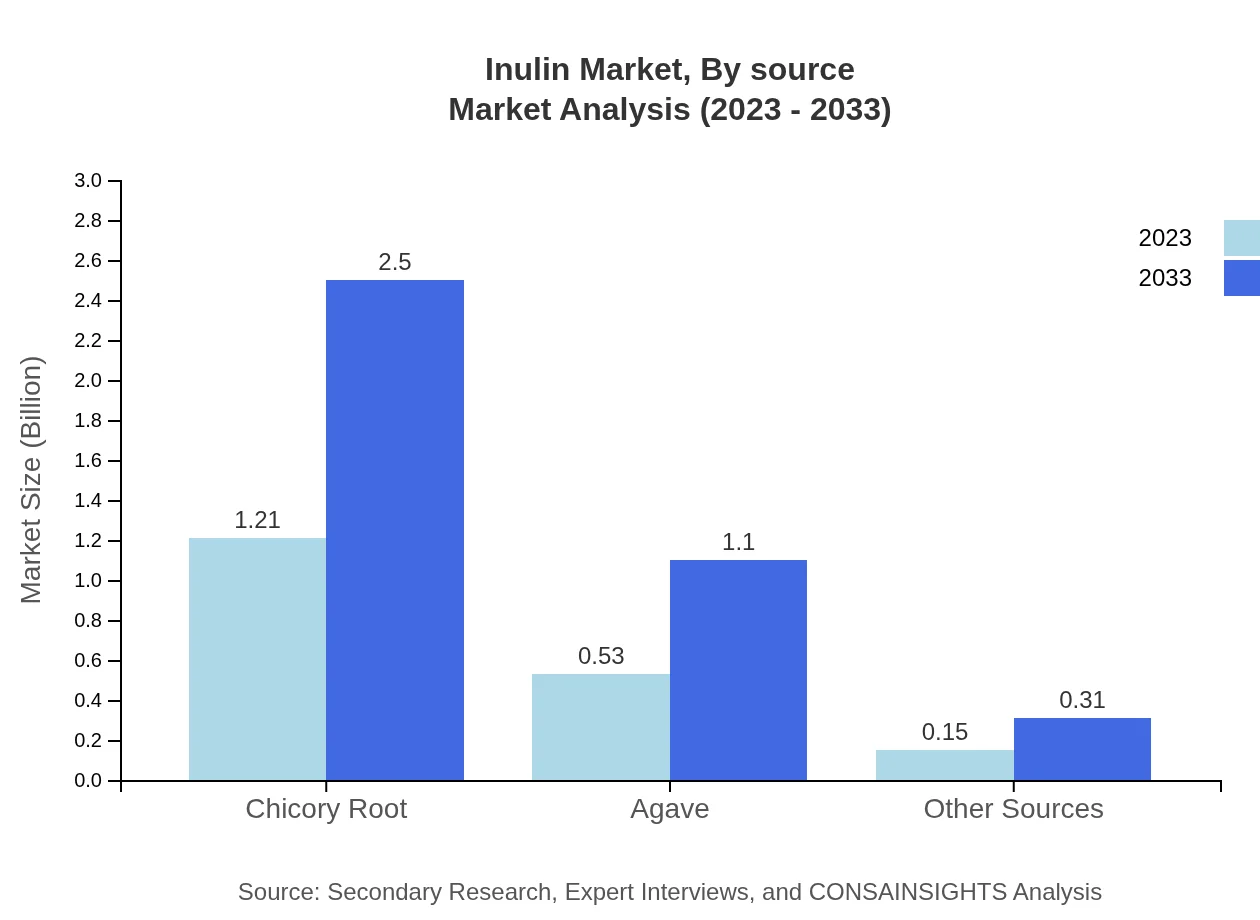

Inulin Market Analysis By Source

In 2023, chicory root dominates the inulin market with a share of 63.85%, valued at $1.21 billion, and is expected to reach $2.50 billion by 2033. Other sources, including agave and other plants, also hold notable shares, with agave projected to grow from $0.53 billion to $1.10 billion during the same period.

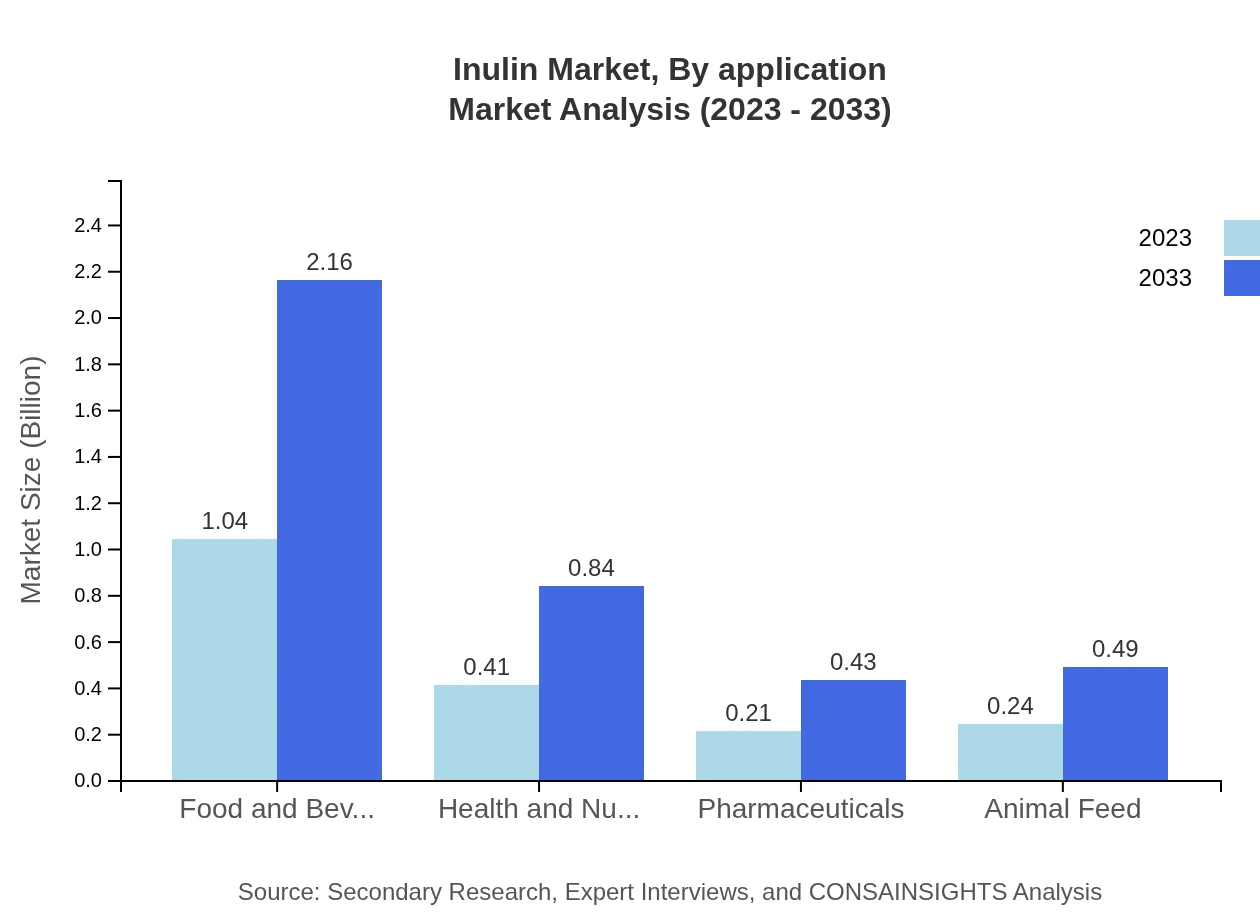

Inulin Market Analysis By Application

The food and beverage sector holds a significant share (54.98%) of the inulin market in 2023, representing $1.04 billion. By 2033, this segment is expected to grow to $2.16 billion. Health and nutrition applications follow, constituting 21.46% of the market.

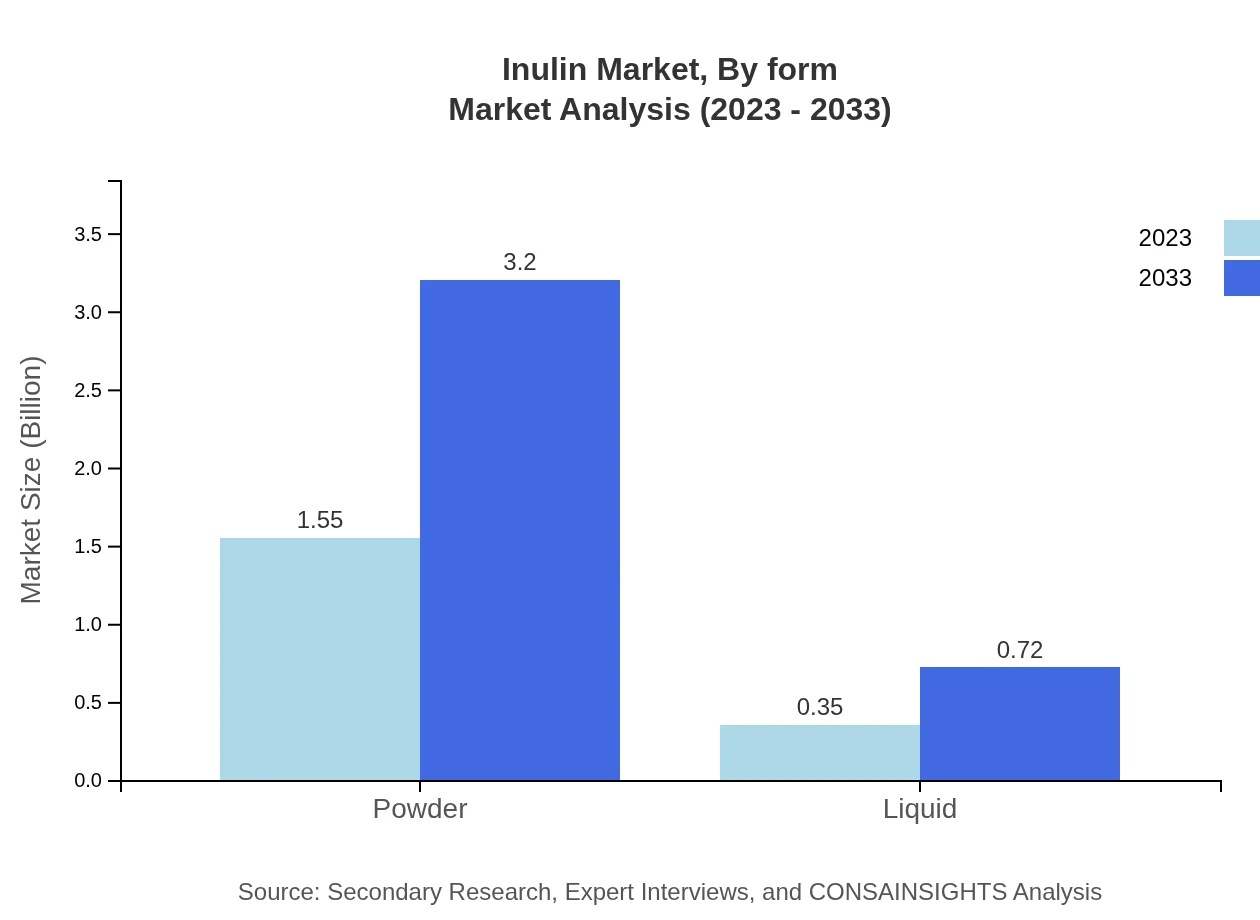

Inulin Market Analysis By Form

The powder form of inulin captures a major share, accounting for 81.53% in 2023, worth $1.55 billion, projected to increase to $3.20 billion by 2033. Liquid forms, although smaller, are expected to see growth due to increasing applications in health drinks.

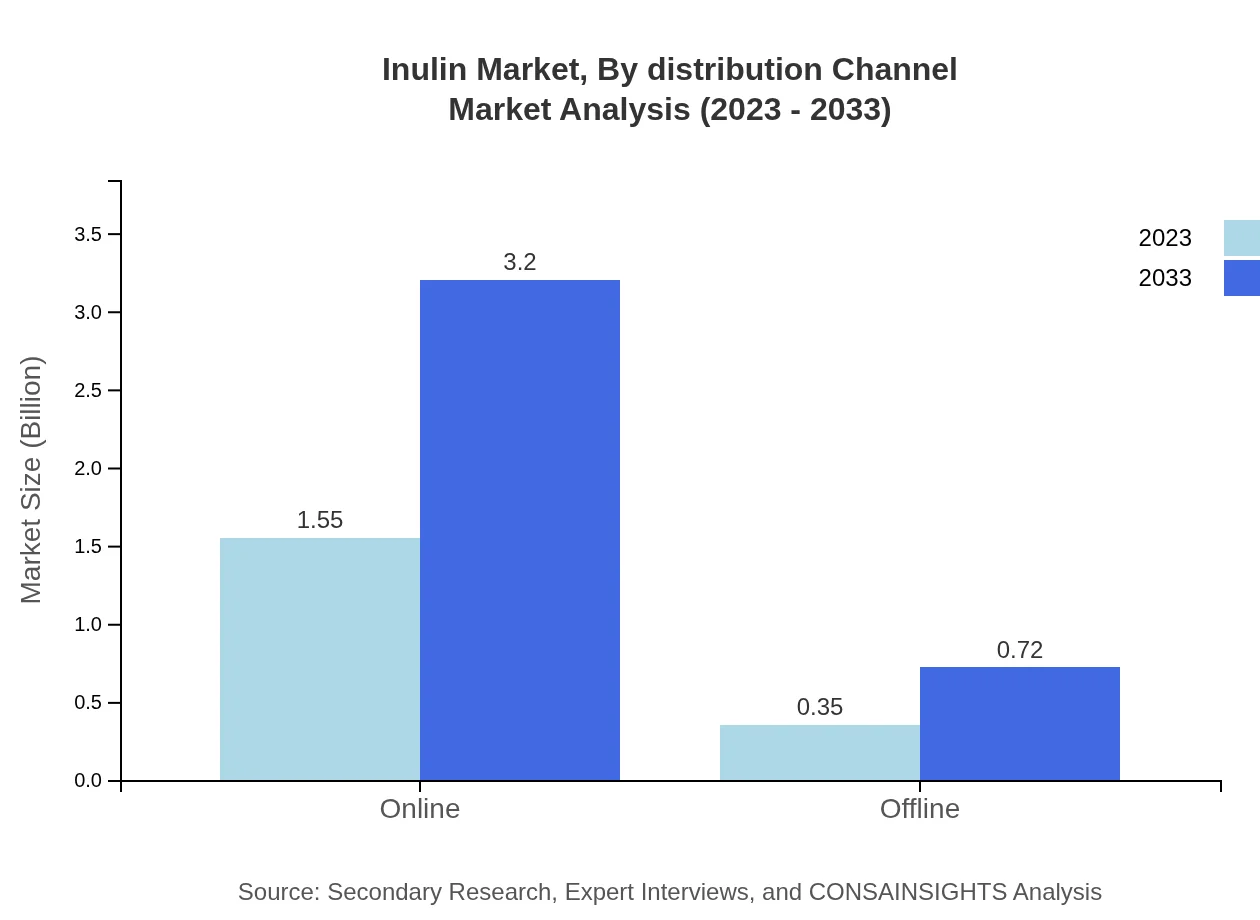

Inulin Market Analysis By Distribution Channel

The online distribution channel is leading the market with 81.53% share in 2023, valued at $1.55 billion. The offline channel holds an 18.47% share. The online channel is expected to grow substantially, driven by increasing e-commerce usage.

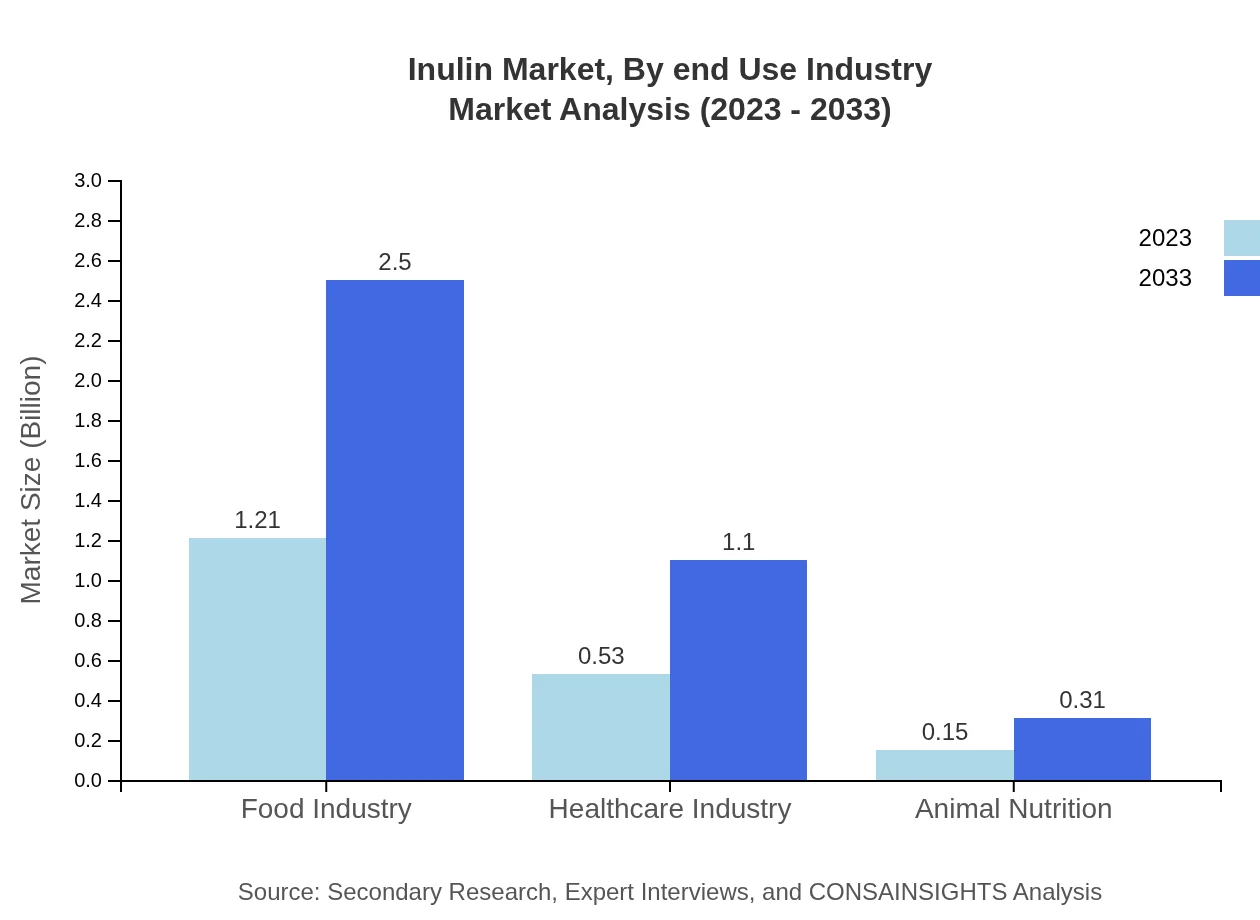

Inulin Market Analysis By End Use Industry

Inulin is widely utilized in the food industry, holding a major share of 63.85% at $1.21 billion in 2023 and projected to reach $2.50 billion by 2033. The healthcare industry also represents a significant segment, with a share of 28.13%.

Inulin Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Inulin Industry

Orafti S.A.:

A pioneer in the production of inulin and oligofructose, Orafti S.A. has vast expertise in the dietary fiber market, offering high-quality inulin derived mainly from chicory root.Sensus (Beneo):

Sensus, part of Beneo, is a global leader in chicory root fibers, providing unique inulin products that cater to the growing demand for natural ingredients in food and beverages.DuPont Nutrition & Biosciences:

DuPont offers a wide range of inulin solutions for food and dietary supplements, focusing on leveraging their extensive R&D capabilities to innovate in the dietary fiber space.Frutarom (Irfat):

Frutarom specializes in the production and supply of inulin, particularly from agave and chicory roots, catering to various applications across the food and health sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of inulin?

The global inulin market is valued at $1.9 billion in 2023 with an expected CAGR of 7.3% through 2033. This growth indicates strong demand across various applications, particularly in food and health sectors.

What are the key market players or companies in the inulin industry?

Leading companies in the inulin market include Cargill, Orafti (Beneo), and FrieslandCampina. These players focus on product innovation and expanding distribution channels to maintain competitiveness in the growing market.

What are the primary factors driving the growth in the inulin industry?

Key drivers include increasing health awareness, demand for dietary fibers, and the rise in functional foods. Additionally, inulin's versatility as a food ingredient spurs market growth across sectors.

Which region is the fastest Growing in the inulin market?

North America is the fastest-growing region, with a market size projected to reach $1.46 billion by 2033. Its growth is fueled by a heightened focus on health and wellness among consumers.

Does ConsaInsights provide customized market report data for the inulin industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the inulin industry, ensuring clients receive relevant data on market trends, forecasts, and competitive analysis.

What deliverables can I expect from this inulin market research project?

Deliverables include comprehensive market analysis, segmentation data, competitive landscape insights, and regional forecasts, providing actionable intelligence for decision-making and strategy development.

What are the market trends of inulin?

Current trends indicate increased consumer preference for natural ingredients, a shift towards plant-based diets, and a focus on health benefits like improved digestion, driving sustained growth in the inulin market.