Inventory Tank Gauging System Market Report

Published Date: 31 January 2026 | Report Code: inventory-tank-gauging-system

Inventory Tank Gauging System Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report provides crucial insights into the Inventory Tank Gauging System market from 2023 to 2033, encompassing market trends, size, analysis by region and segmentation, as well as projections for growth and challenges ahead.

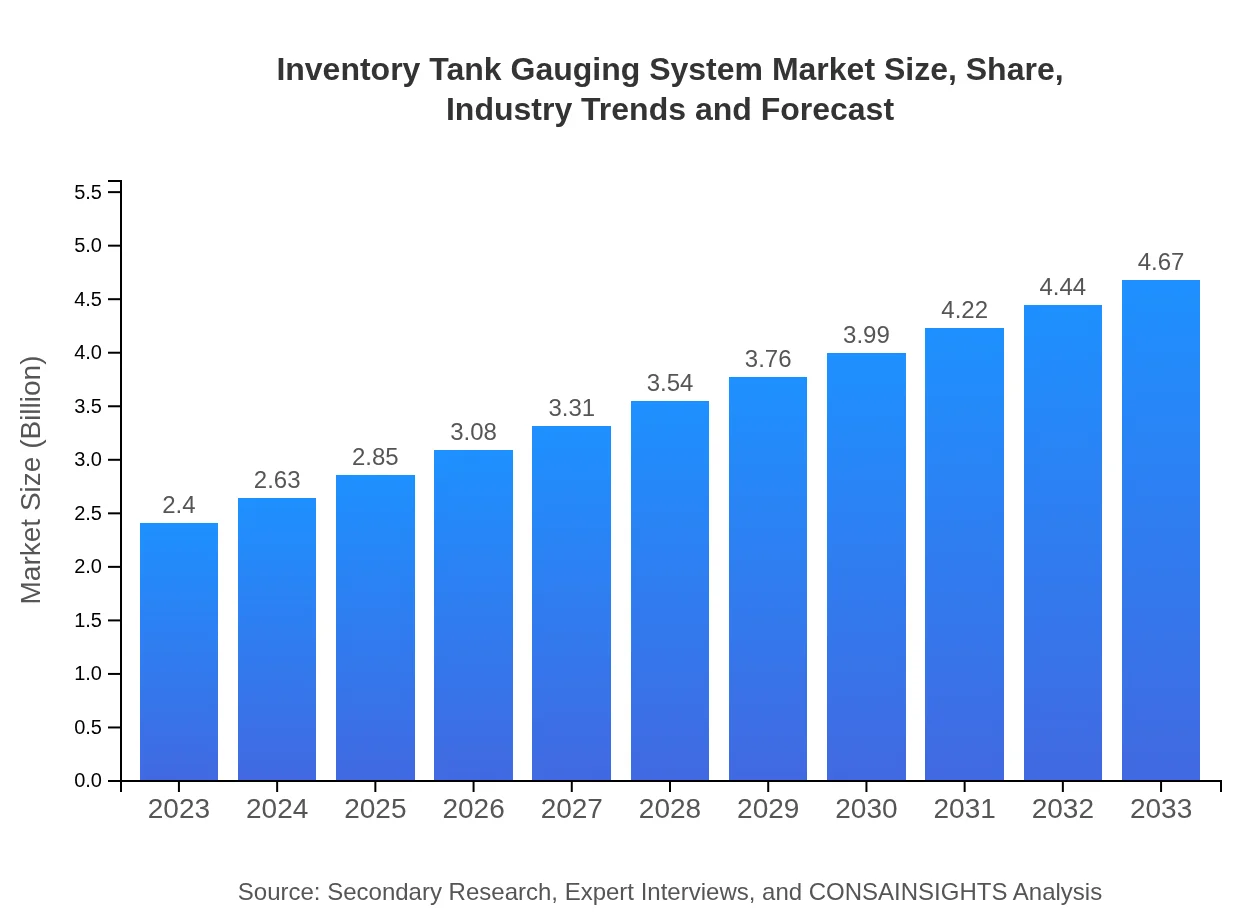

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.40 Billion |

| CAGR (2023-2033) | 6.7% |

| 2033 Market Size | $4.67 Billion |

| Top Companies | Emerson Electric Co., Honeywell International Inc., KROHNE Group, VEGA Grieshaber KG |

| Last Modified Date | 31 January 2026 |

Inventory Tank Gauging System Market Overview

Customize Inventory Tank Gauging System Market Report market research report

- ✔ Get in-depth analysis of Inventory Tank Gauging System market size, growth, and forecasts.

- ✔ Understand Inventory Tank Gauging System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Inventory Tank Gauging System

What is the Market Size & CAGR of Inventory Tank Gauging System market in 2023?

Inventory Tank Gauging System Industry Analysis

Inventory Tank Gauging System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Inventory Tank Gauging System Market Analysis Report by Region

Europe Inventory Tank Gauging System Market Report:

Europe demonstrates a market movement from $0.74 billion in 2023 to $1.44 billion in 2033. The drive for environmental compliance and sustainability in industries has been a primary factor, bolstered by technological innovations.Asia Pacific Inventory Tank Gauging System Market Report:

In the Asia-Pacific region, the Inventory Tank Gauging System market is expected to grow from $0.48 billion in 2023 to $0.94 billion in 2033. The rapid industrialization and rising demand from end-user industries like oil and gas and chemicals drive this growth, alongside increasing investments in infrastructure.North America Inventory Tank Gauging System Market Report:

In North America, the market size is estimated to increase from $0.79 billion in 2023 to $1.54 billion in 2033. This growth is attributed to the region's advanced technological infrastructure and stringent safety regulations that boost demand for reliable tank gauging solutions.South America Inventory Tank Gauging System Market Report:

The South American market is projected to expand from $0.16 billion in 2023 to $0.32 billion by 2033, reflecting a growing focus on modernizing inventory management in sectors including food and beverage and chemical production.Middle East & Africa Inventory Tank Gauging System Market Report:

The inventory tank gauging system market in the Middle East and Africa is anticipated to grow from $0.22 billion in 2023 to $0.43 billion in 2033, supported by an upsurge in the oil and gas industry and increasing regulatory frameworks requiring precise inventory control.Tell us your focus area and get a customized research report.

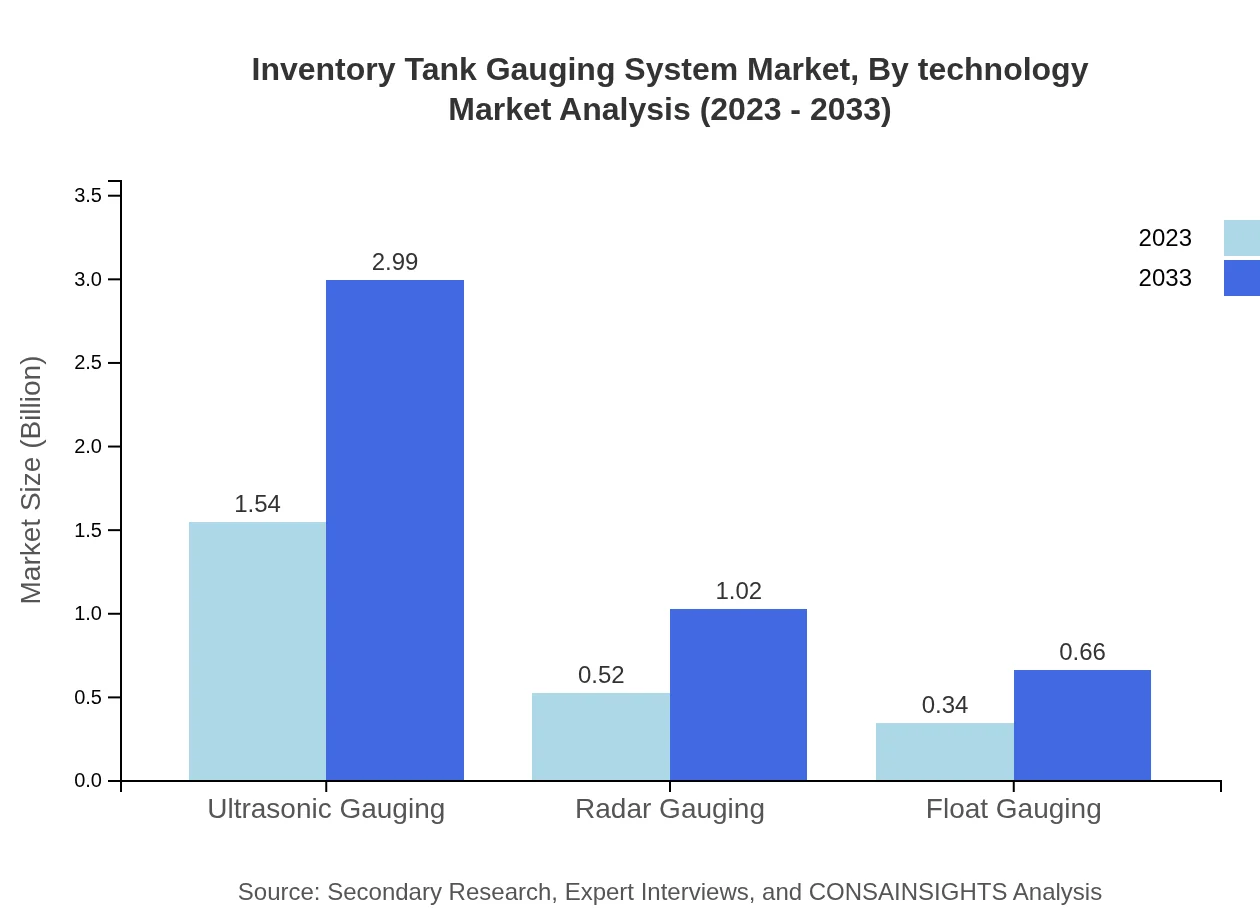

Inventory Tank Gauging System Market Analysis By Technology

This segment includes different technologies such as Ultrasonic Gauging, Radar Gauging, and Float Gauging. Ultrasonic Gauging leads this segment with a market size of $1.54 billion in 2023 projected to grow to $2.99 billion by 2033, due to its high accuracy and reliability. Radar Gauging and Float Gauging are also gaining traction, reflecting a substantial share in the inventory tank gauging market.

Inventory Tank Gauging System Market Analysis By Application

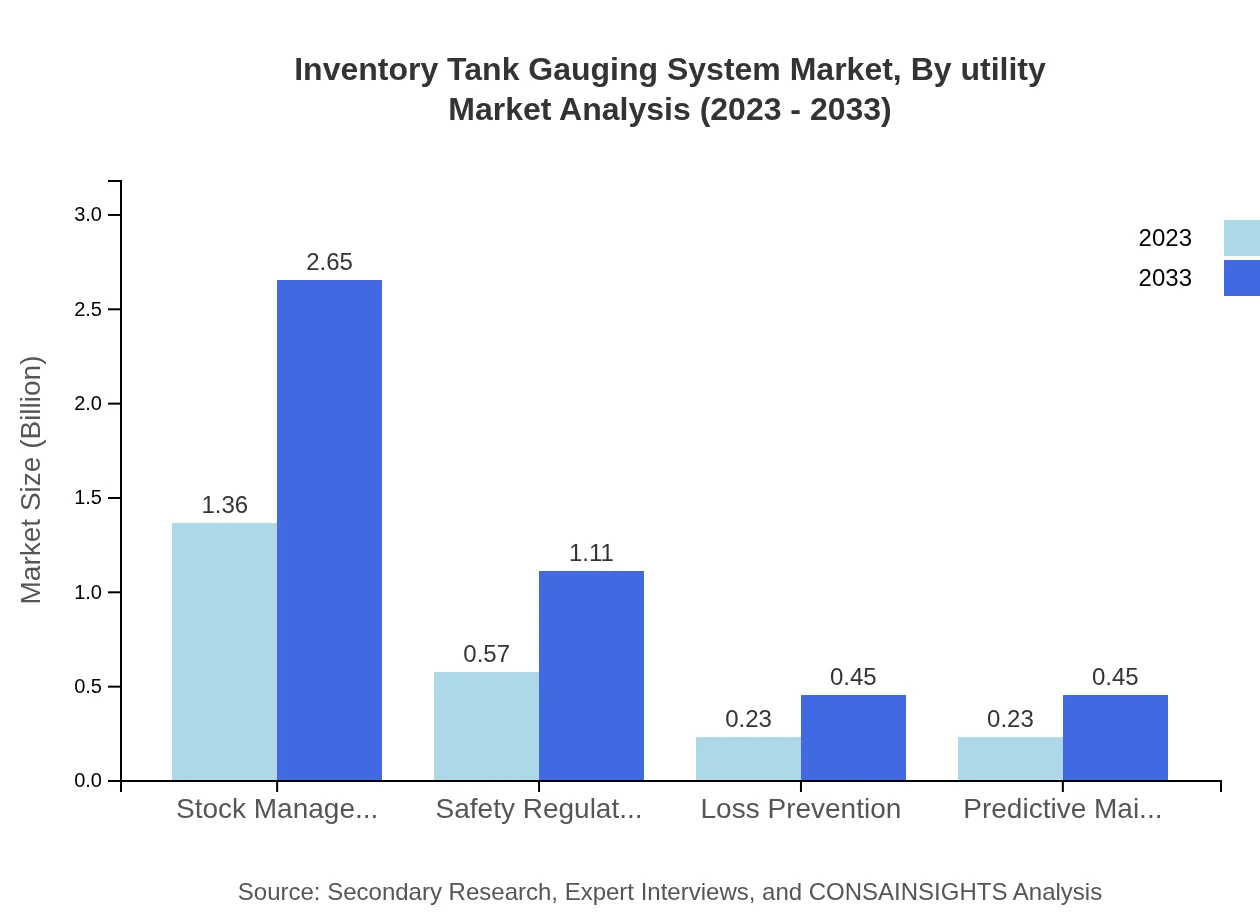

Applications of these systems are seen prominently in Stock Management, Safety Regulation Compliance, Loss Prevention, and Predictive Maintenance. Stock Management holds a significant share starting at $1.36 billion in 2023, anticipated to reach $2.65 billion by 2033. This highlights the role of accurate inventory tracking across various industries.

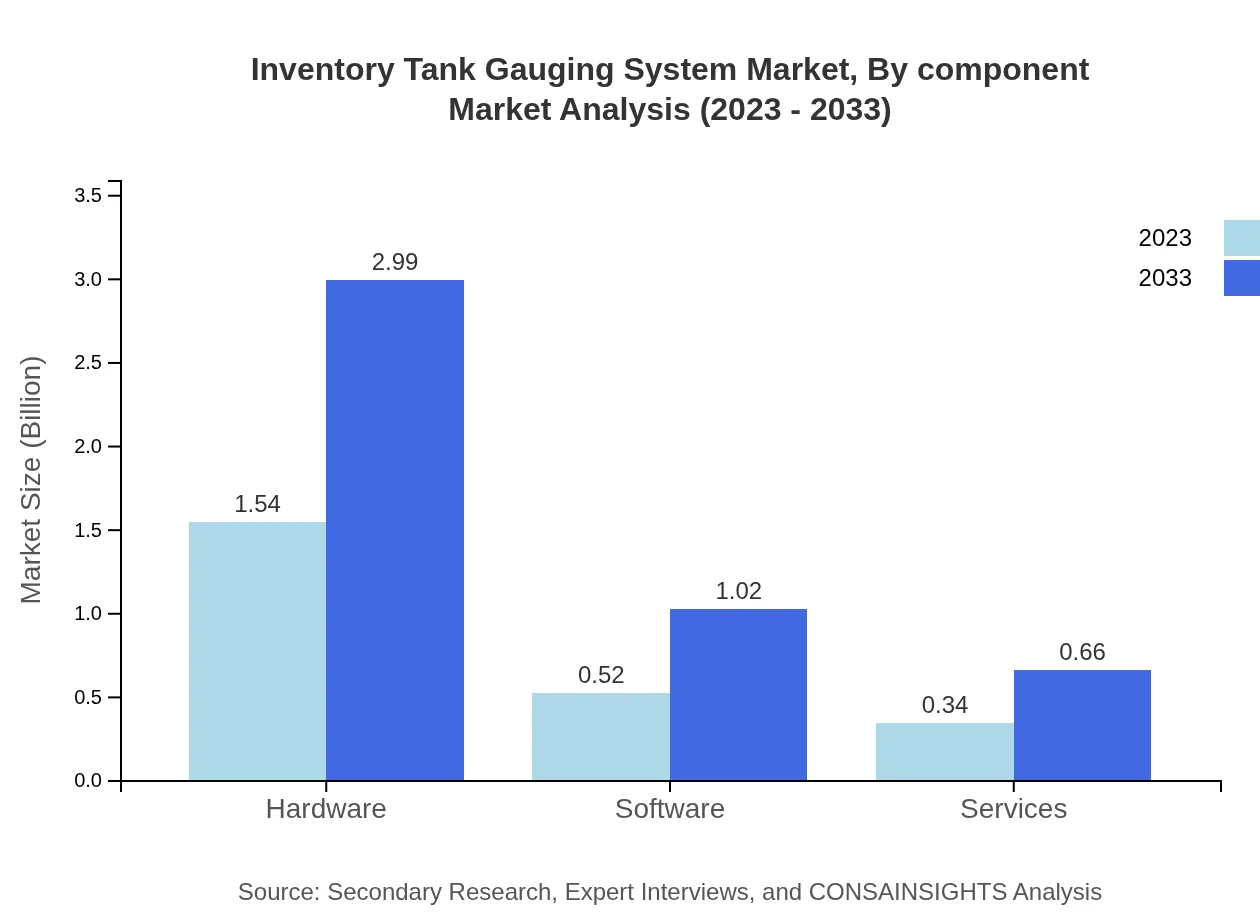

Inventory Tank Gauging System Market Analysis By Component

The inventory tank gauging systems comprise Hardware, Software, and Services. Hardware continues to dominate, forecasted to capture $1.54 billion in 2023 and expand to $2.99 billion by 2033, reflecting essential investments in physical assets required for tank gauging.

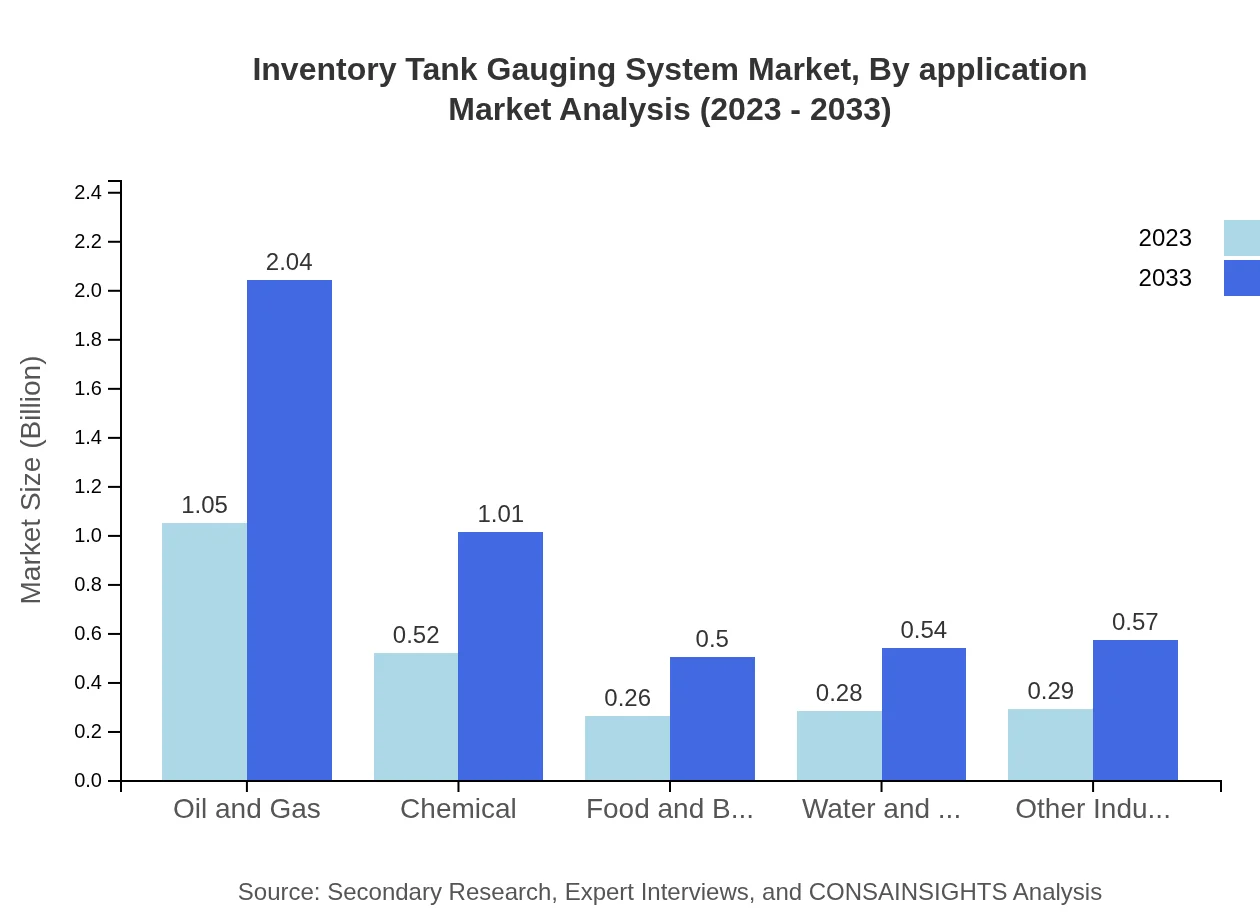

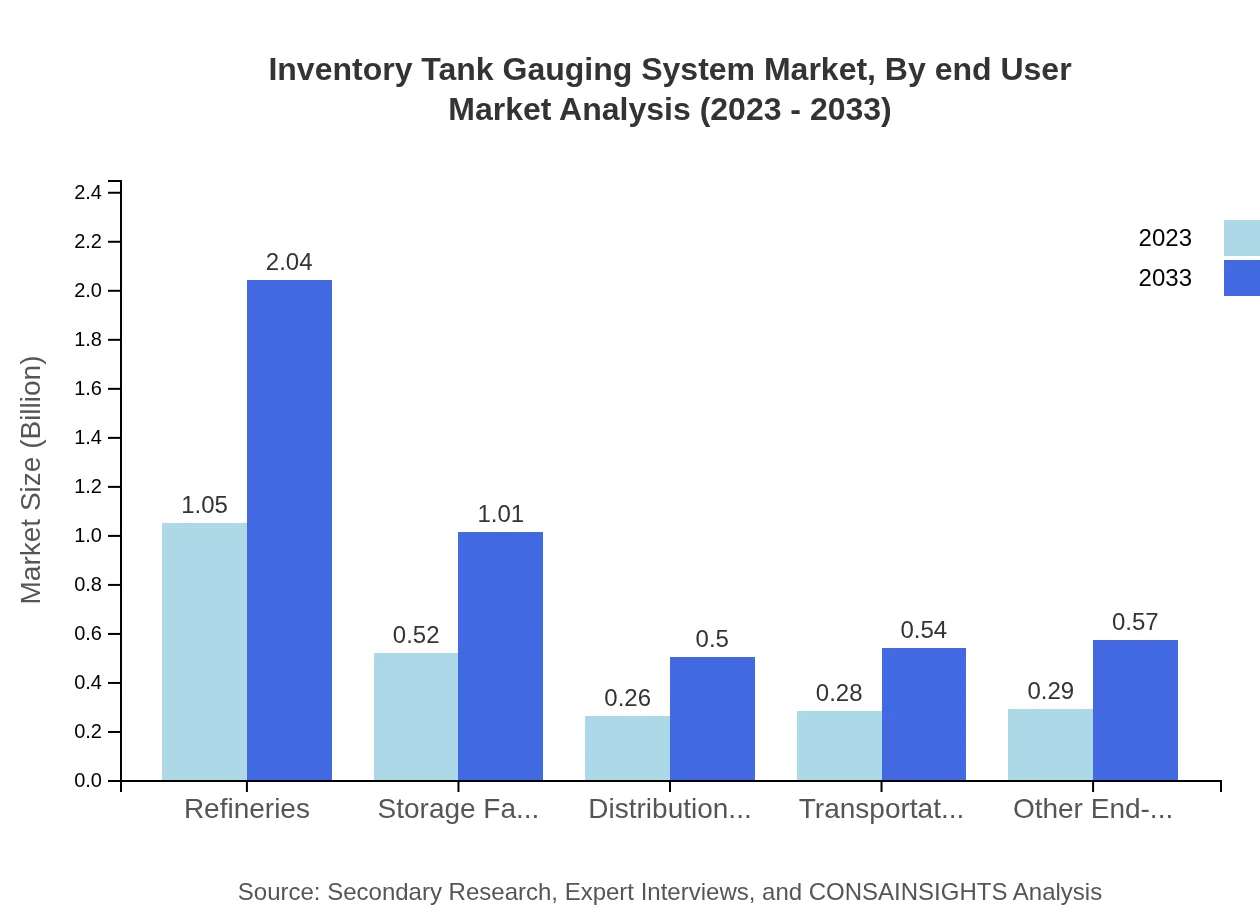

Inventory Tank Gauging System Market Analysis By End User

Key end-user industries include Oil and Gas, Chemical, Food and Beverage, and Water & Wastewater Management. The Oil and Gas sector commands a dominant share estimated at $1.05 billion in 2023 growing to $2.04 billion in 2033, indicating persistent demand for reliable gauging systems.

Inventory Tank Gauging System Market Analysis By Utility

Utilities include various functionalities such as Stock Management, Safety Compliance, Loss Prevention, and Predictive Maintenance. Each utility plays a vital role in enhancing operational efficiencies and ensuring regulatory compliance, indicating a growing need for sophisticated gauging systems across sectors.

Inventory Tank Gauging System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Inventory Tank Gauging System Industry

Emerson Electric Co.:

A key player offering advanced measuring instruments and inventory solutions, enhancing efficiency and accuracy in tank gauging systems.Honeywell International Inc.:

Provides innovative technology for industrial processes, specializing in inventory management and gauging system solutions.KROHNE Group:

Known for its high-quality gauging systems across multiple industries, contributing significantly to global market advancements.VEGA Grieshaber KG:

Focuses on reliable measurement technology, including state-of-the-art inventory gauging solutions utilized in various sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of Inventory Tank Gauging System?

The global inventory tank gauging system market is projected to reach $2.4 billion by 2033, growing at a robust CAGR of 6.7%. This growth reflects the increasing demand for precise and efficient gauging solutions across various industries.

What are the key market players or companies in this Inventory Tank Gauging System industry?

Key players in the inventory tank gauging system market include Emerson Electric Co., Honeywell International Inc., and Siemens AG, which dominate through innovative technologies and customer-focused solutions, catering to diverse client requirements.

What are the primary factors driving the growth in the Inventory Tank Gauging System industry?

Growth in the inventory tank gauging system market is driven by increased regulatory emphasis on safety, advancements in technology, and the rising need for efficient stock management solutions in sectors such as oil and gas, chemicals, and food production.

Which region is the fastest Growing in the Inventory Tank Gauging System?

The North American region is the fastest-growing market for inventory tank gauging systems, expected to expand from $0.79 billion in 2023 to $1.54 billion in 2033, fueled by high demand in oil and gas sectors.

Does ConsaInsights provide customized market report data for the Inventory Tank Gauging System industry?

Yes, ConsaInsights offers tailored market report data for the inventory tank gauging system industry, enabling clients to gain insights specific to their business needs and strategic objectives, ensuring relevant and actionable insights.

What deliverables can I expect from this Inventory Tank Gauging System market research project?

From the inventory tank gauging system market research project, you can expect comprehensive reports including market analysis, segment insights, competitive landscape, and regional data, providing valuable insights for strategic planning.

What are the market trends of Inventory Tank Gauging System?

Key trends in the inventory tank gauging system market include the adoption of smart technology, increased focus on safety compliance, the shift towards predictive maintenance, and a rise in integrated software solutions for enhanced operational efficiency.