Investment Banking Market Report

Published Date: 24 January 2026 | Report Code: investment-banking

Investment Banking Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Investment Banking market from 2023 to 2033, including insights on market size, growth rates, industry trends, regional performance, key players, and forecasts.

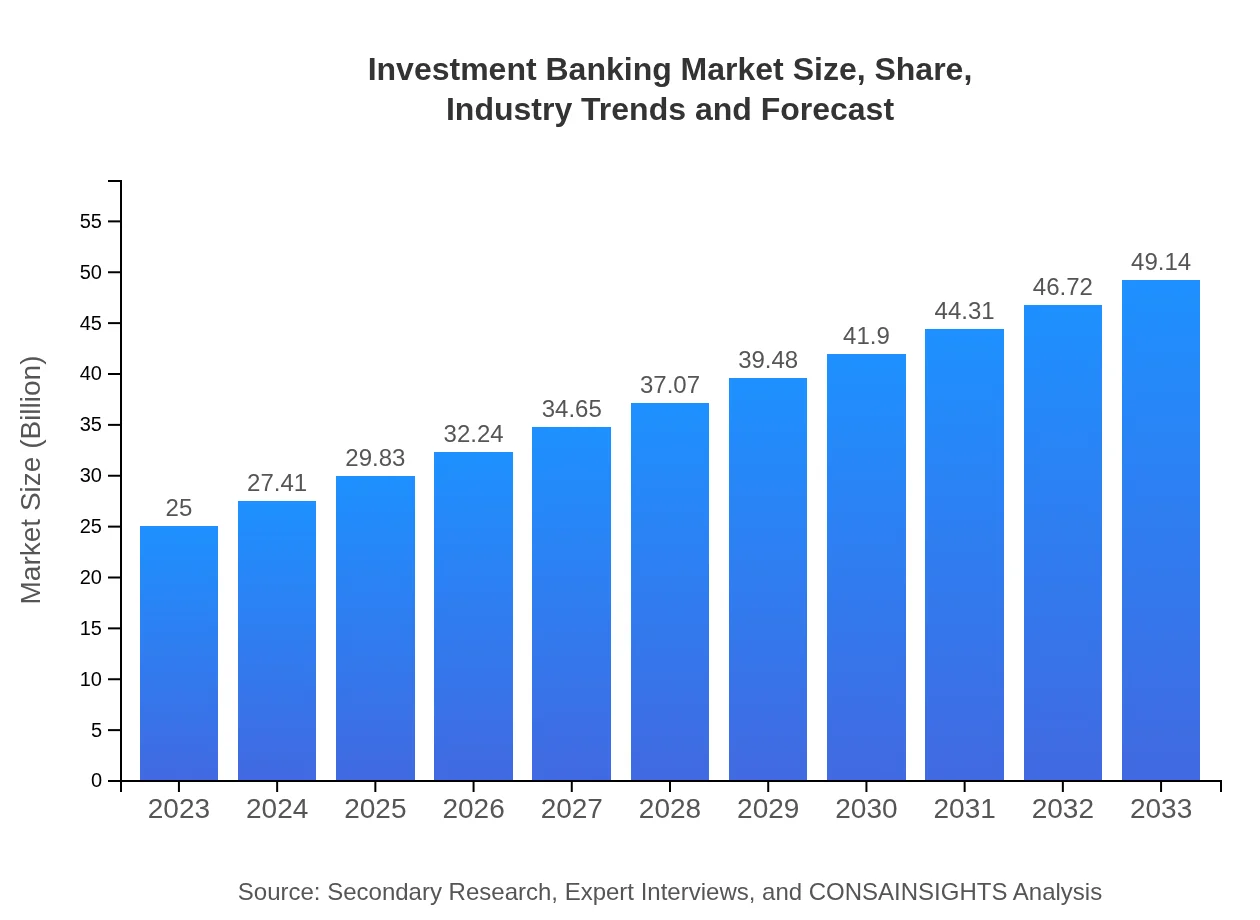

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $49.14 Billion |

| Top Companies | Goldman Sachs, Morgan Stanley, J.P. Morgan, Bank of America Merrill Lynch, Barclays |

| Last Modified Date | 24 January 2026 |

Investment Banking Market Overview

Customize Investment Banking Market Report market research report

- ✔ Get in-depth analysis of Investment Banking market size, growth, and forecasts.

- ✔ Understand Investment Banking's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Investment Banking

What is the Market Size & CAGR of Investment Banking market in 2023?

Investment Banking Industry Analysis

Investment Banking Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Investment Banking Market Analysis Report by Region

Europe Investment Banking Market Report:

In Europe, the Investment Banking market will grow from $6.91 billion in 2023 to approximately $13.58 billion by 2033. Factors including increasing cross-border transaction volumes, evolving regulatory environments, and a focused approach towards sustainable finance are shaping this market's trajectory.Asia Pacific Investment Banking Market Report:

The Asia Pacific region is experiencing significant growth in the Investment Banking sector, with a market size of $5.50 billion in 2023 projected to reach $10.80 billion by 2033. The increasing number of IPOs and strategic M&As in China and India are major drivers. Furthermore, technology adoption for fintech solutions is reshaping traditional banking models across the region.North America Investment Banking Market Report:

North America continues to lead the Investment Banking market, which stands at $8.56 billion in 2023, projected to soar to $16.83 billion by 2033. The U.S. financial landscape is instrumental with vast corporate activities, high-value financing, and a vibrant IPO market. Additionally, innovative tech integrations enhance operational efficiency for major banks.South America Investment Banking Market Report:

In South America, the Investment Banking market is valued at $1.55 billion in 2023, expected to grow to $3.06 billion by 2033. Factors such as improved economic stability and government initiatives aiming to attract investments are pivotal in driving market expansion. Countries like Brazil and Argentina are significant players in this growth.Middle East & Africa Investment Banking Market Report:

The market in the Middle East and Africa stood at $2.48 billion in 2023, expected to rise to $4.87 billion by 2033. Increased foreign direct investment, significant infrastructure projects, and growing private equity activity are driving growth in the region.Tell us your focus area and get a customized research report.

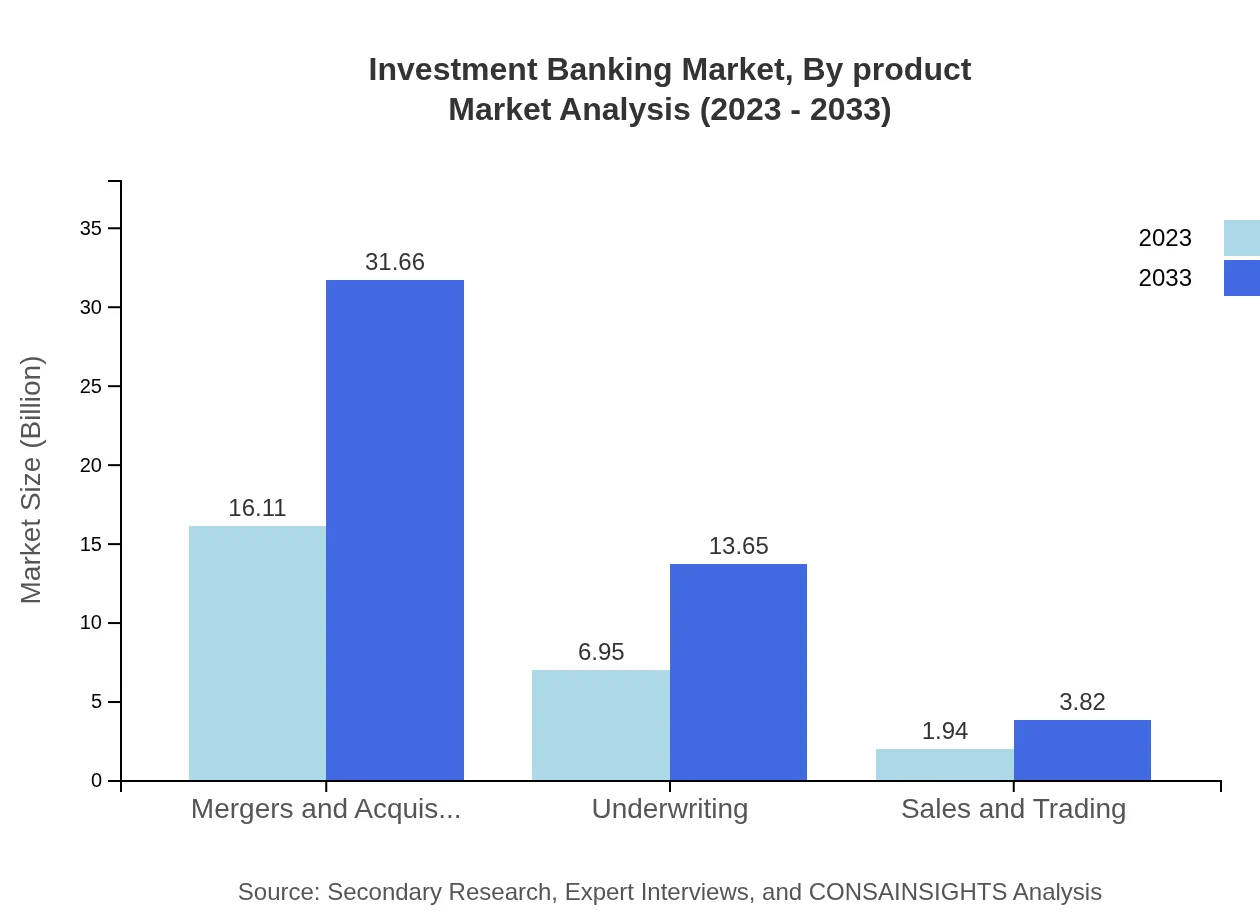

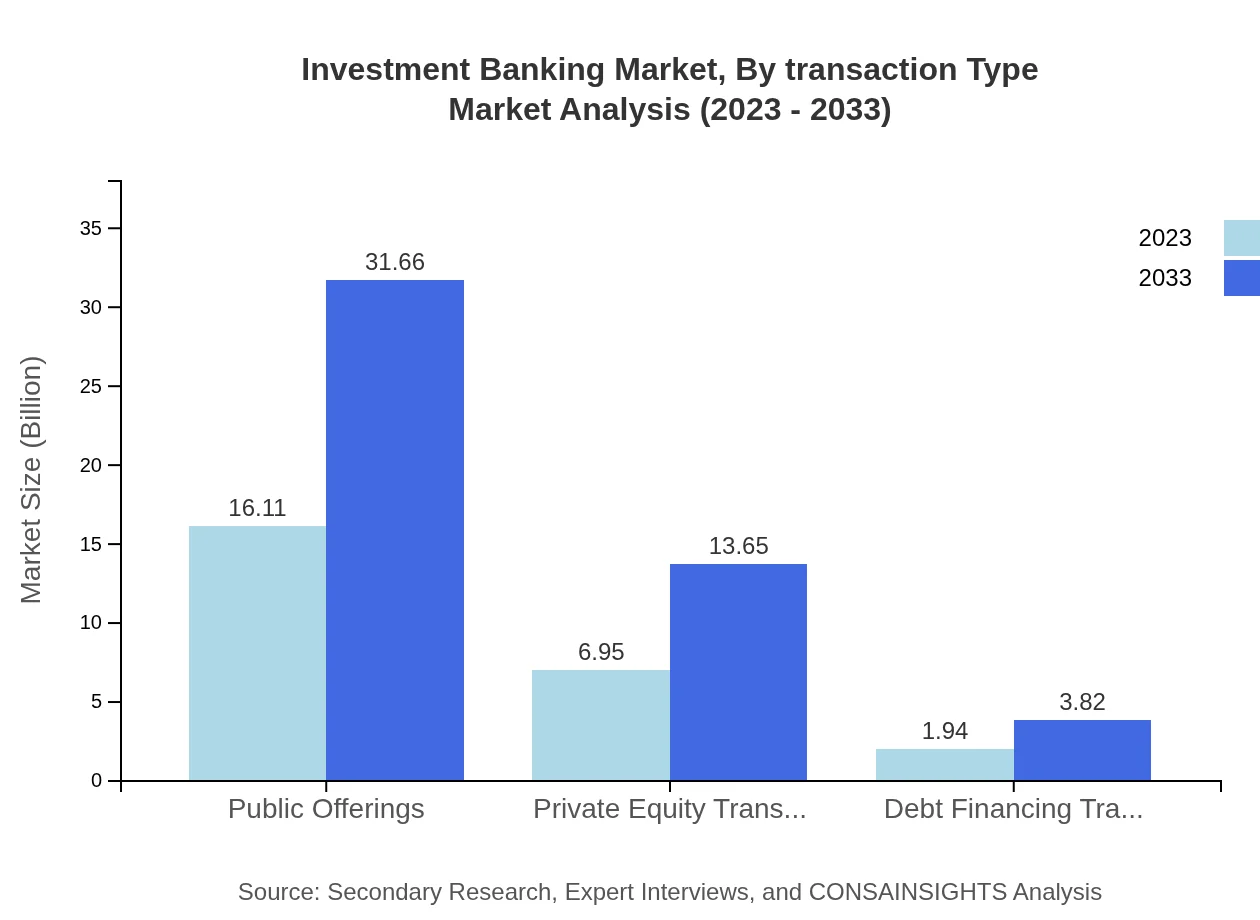

Investment Banking Market Analysis By Product

The Investment Banking market by product comprises various streams such as M&A advisory, underwriting services, sales and trading. M&A advisory remains the largest segment, projected to be valued at $16.11 billion in 2023 and $31.66 billion by 2033.

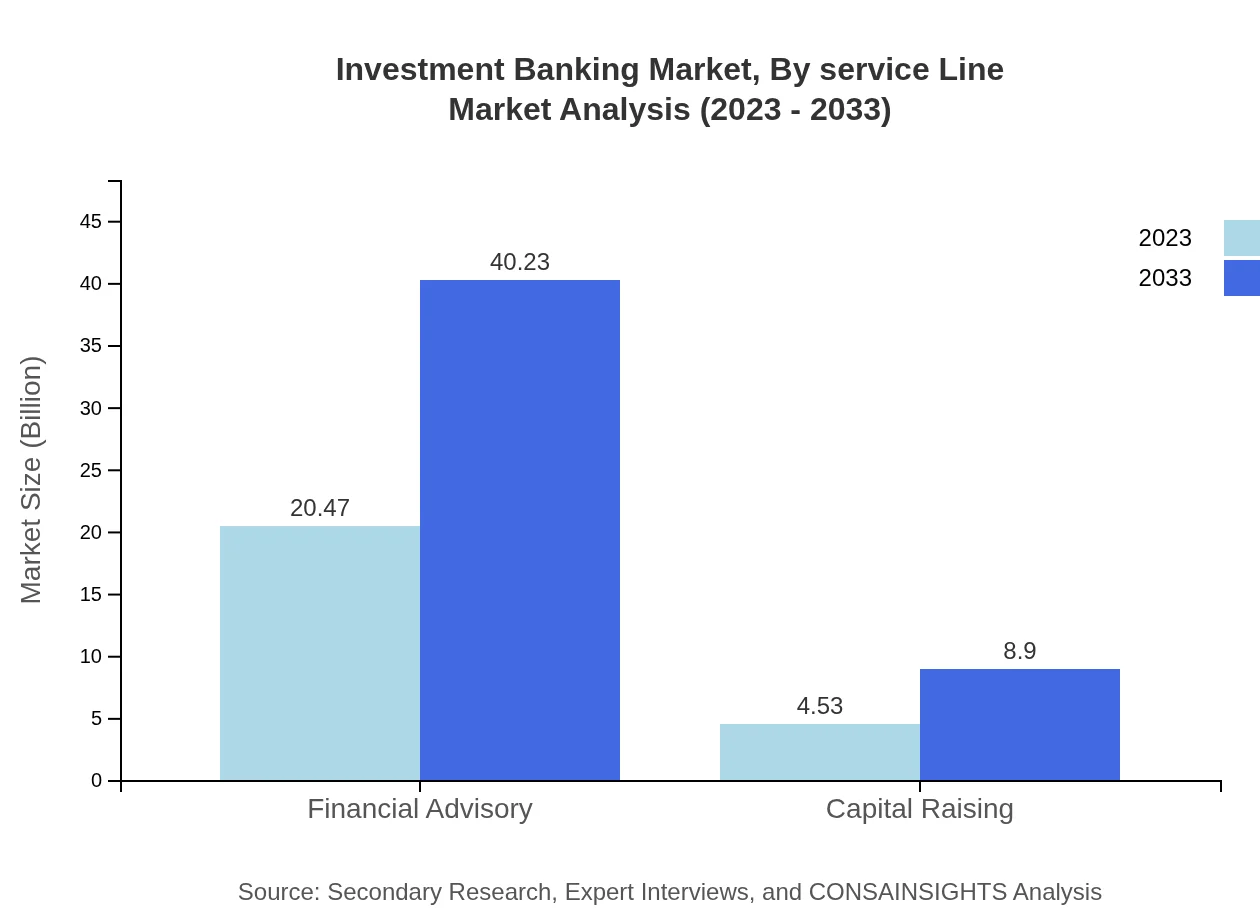

Investment Banking Market Analysis By Service Line

Segmentation by service line highlights M&A advisory as a dominant avenue, holding a market share of 64.44% in 2023. Underwriting services represent another core area, with a market size of $6.95 billion in 2023, expected to reach $13.65 billion by 2033.

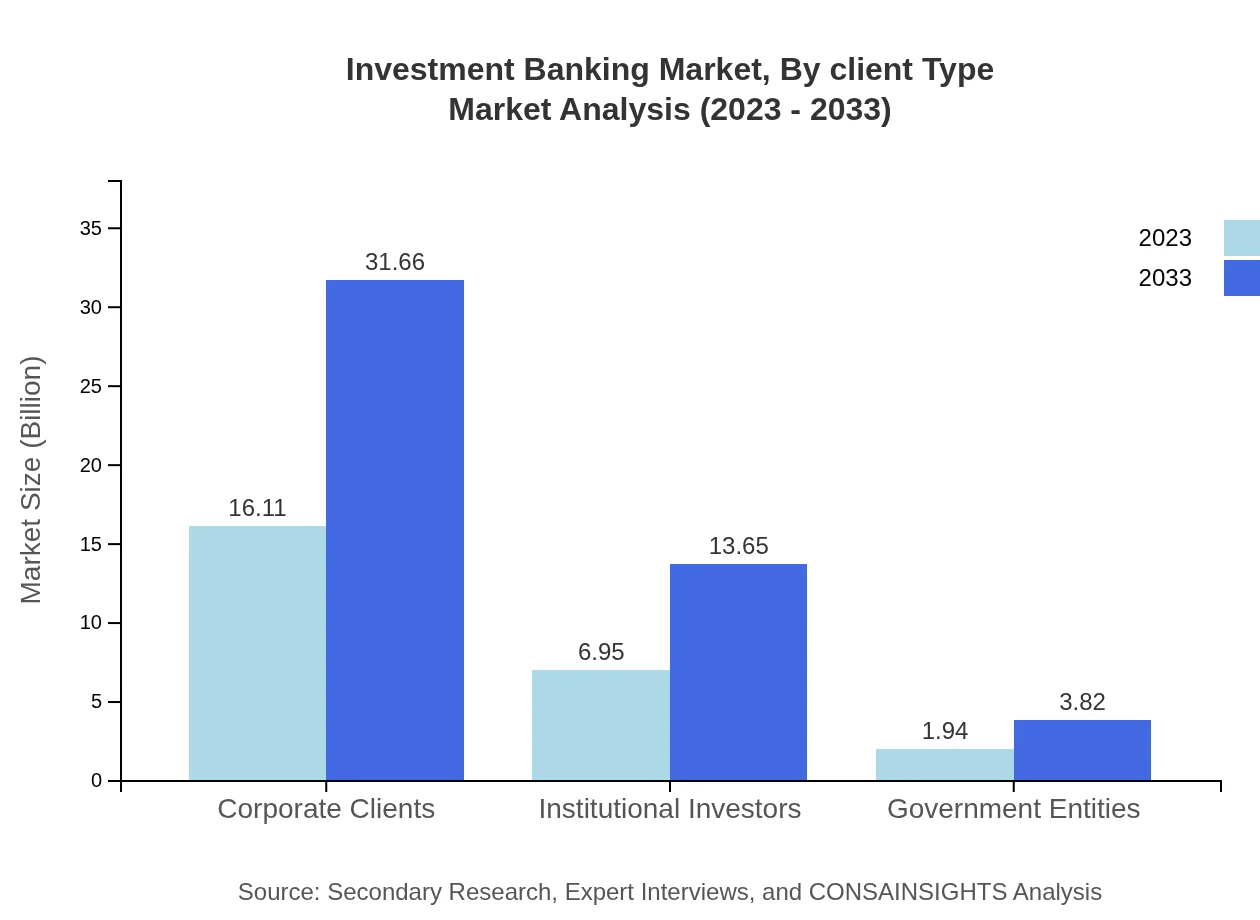

Investment Banking Market Analysis By Client Type

Client segmentation includes corporate clients, whose market size is around $16.11 billion in 2023 and projected to swell to $31.66 billion by 2033. Institutional investors and government entities also play vital roles in investment banking activities.

Investment Banking Market Analysis By Transaction Type

Transaction types reveal a diversification of activities with M&A deals witnessing significant activity. The market for private equity transactions is about $6.95 billion in 2023, expected to grow at a healthy rate through 2033, reflecting both general and market-specific factors.

Investment Banking Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Investment Banking Industry

Goldman Sachs:

One of the leading global investment banking, securities, and investment management firms worldwide, Goldman Sachs provides services in global markets, investment management, and securities.Morgan Stanley:

Morgan Stanley is a renowned financial services firm that offers a wide range of investment banking services, including corporate advisory, capital raising, and private equity investments.J.P. Morgan:

A global leader in investment banking, J.P. Morgan provides strategies and solutions for clients worldwide, covering diverse services aimed at entities of all sizes.Bank of America Merrill Lynch:

Offering a comprehensive suite of investment banking solutions, Bank of America supports clients with both advisory and capital raising services on a global scale.Barclays:

Barclays operates globally and provides investment banking services across sectors, focusing on advisory and financing to improve organizations’ financial standing.We're grateful to work with incredible clients.

FAQs

What is the market size of investment banking?

The investment banking market is estimated at $25 billion in 2023, with a projected CAGR of 6.8% through 2033. This growth reflects increasing demand for financial advisory services and capital raising activities in the global economy.

What are the key market players or companies in the investment banking industry?

Key players in investment banking include Goldman Sachs, Morgan Stanley, JPMorgan Chase, and Bank of America. These firms are recognized for their significant contributions to M&A, underwriting, and trading services, dominating the competitive landscape.

What are the primary factors driving the growth in the investment banking industry?

Growth drivers in investment banking include rising mergers and acquisitions, increased corporate financing needs, global market expansions, regulatory changes fostering innovation, and a growing emphasis on financial advisory services for private equity and institutional investors.

Which region is the fastest Growing in the investment banking market?

North America is the fastest-growing region in the investment banking market, projected to rise from $8.56 billion in 2023 to $16.83 billion by 2033. This growth can be attributed to a robust financial market infrastructure and high-volume transactions.

Does ConsaInsights provide customized market report data for the investment banking industry?

Yes, ConsaInsights offers customized market report data for the investment banking industry, tailored to specific client needs. This includes detailed analytics on market trends, player profiles, and forecasts based on various segments and regions.

What deliverables can I expect from this investment banking market research project?

Clients can expect comprehensive deliverables including detailed market analysis, growth forecasts, competitive assessments, regional insights, and segment-wise breakdowns. These materials assist in informed decision-making and strategic planning.

What are the market trends of investment banking?

Current market trends in investment banking highlight an increase in financial advisory demand, growing emphasis on technology adoption, integration of ESG factors, heightened competition, and evolving client expectations regarding service offerings.