Iot In Aerospace Defense Market Report

Published Date: 31 January 2026 | Report Code: iot-in-aerospace-defense

Iot In Aerospace Defense Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report analyzes the IoT in Aerospace Defense market, offering insights into market size, forecast growth, industry analysis, and regional assessments from 2023 to 2033.

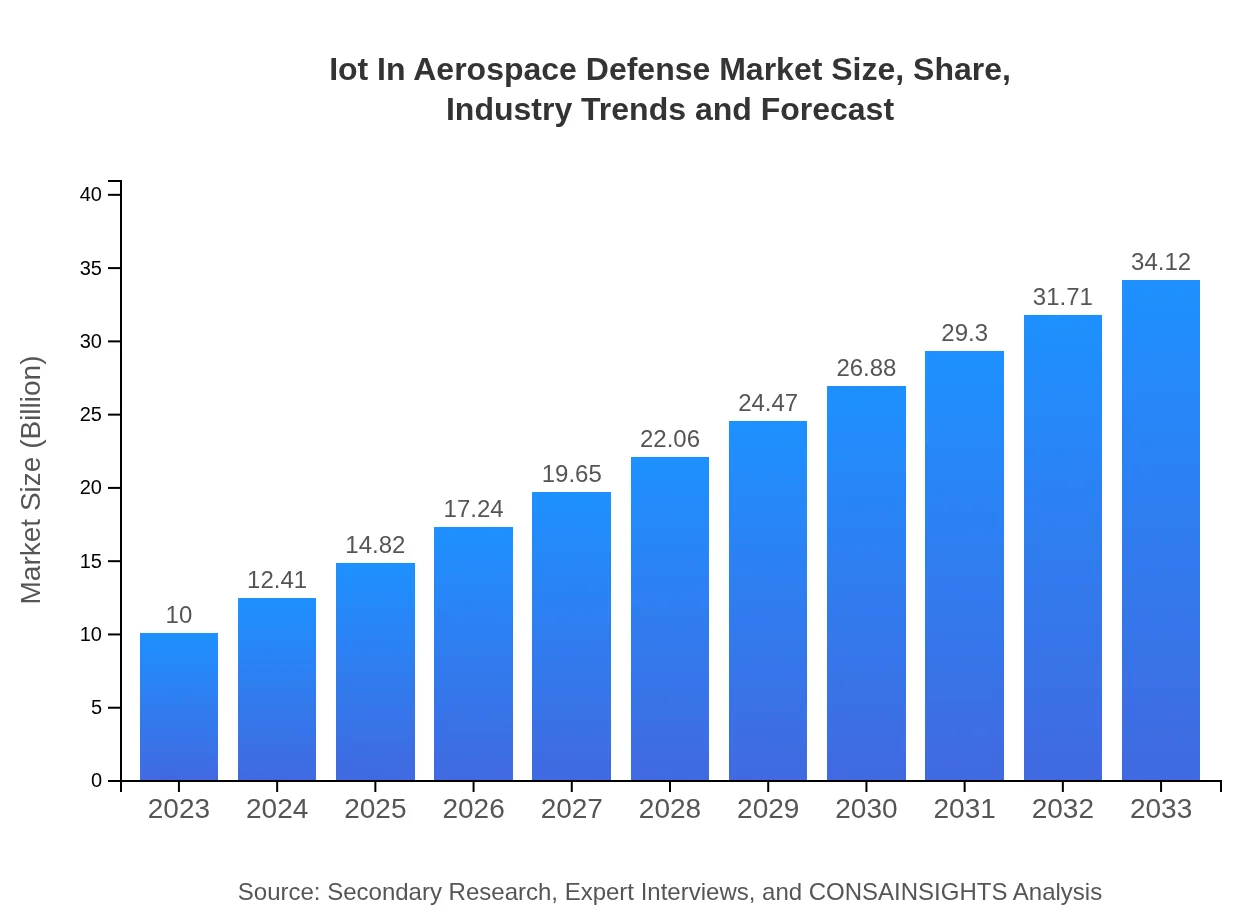

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 12.5% |

| 2033 Market Size | $34.12 Billion |

| Top Companies | Lockheed Martin, Raytheon Technologies, Boeing , Thales Group |

| Last Modified Date | 31 January 2026 |

IoT In Aerospace Defense Market Overview

Customize Iot In Aerospace Defense Market Report market research report

- ✔ Get in-depth analysis of Iot In Aerospace Defense market size, growth, and forecasts.

- ✔ Understand Iot In Aerospace Defense's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Iot In Aerospace Defense

What is the Market Size & CAGR of IoT In Aerospace Defense market in 2023 and 2033?

IoT In Aerospace Defense Industry Analysis

IoT In Aerospace Defense Market Segmentation and Scope

Tell us your focus area and get a customized research report.

IoT In Aerospace Defense Market Analysis Report by Region

Europe Iot In Aerospace Defense Market Report:

Europe's market is estimated to expand from $2.93 billion in 2023 to $10.00 billion by 2033. European nations are focusing on enhancing defense capabilities and interoperability among NATO forces, leading to increased investments in IoT solutions.Asia Pacific Iot In Aerospace Defense Market Report:

In the Asia Pacific region, the IoT in Aerospace Defense market is expected to grow from $2.03 billion in 2023 to $6.93 billion by 2033, indicating significant investment in aerospace technologies. Countries like China and India are increasing their defense budgets, propelling the adoption of IoT solutions for enhancing operational efficiency and security.North America Iot In Aerospace Defense Market Report:

North America, dominating the IoT in Aerospace Defense landscape, will see growth from $3.34 billion in 2023 to approximately $11.40 billion by 2033. The U.S. military's commitment to leveraging advanced technologies and leveraging public-private partnerships plays a crucial role in this escalation.South America Iot In Aerospace Defense Market Report:

South America's market is projected to grow from $0.70 billion in 2023 to $2.39 billion by 2033. The region is witnessing gradual adoption of IoT technologies driven by modernization efforts in aviation and defense sectors, although infrastructure challenges remain a hurdle.Middle East & Africa Iot In Aerospace Defense Market Report:

The Middle East and Africa market is projected to grow from $1.00 billion in 2023 to $3.40 billion by 2033. Investment in robust defense systems amidst regional security concerns will likely drive the adoption of IoT technologies in defense operations.Tell us your focus area and get a customized research report.

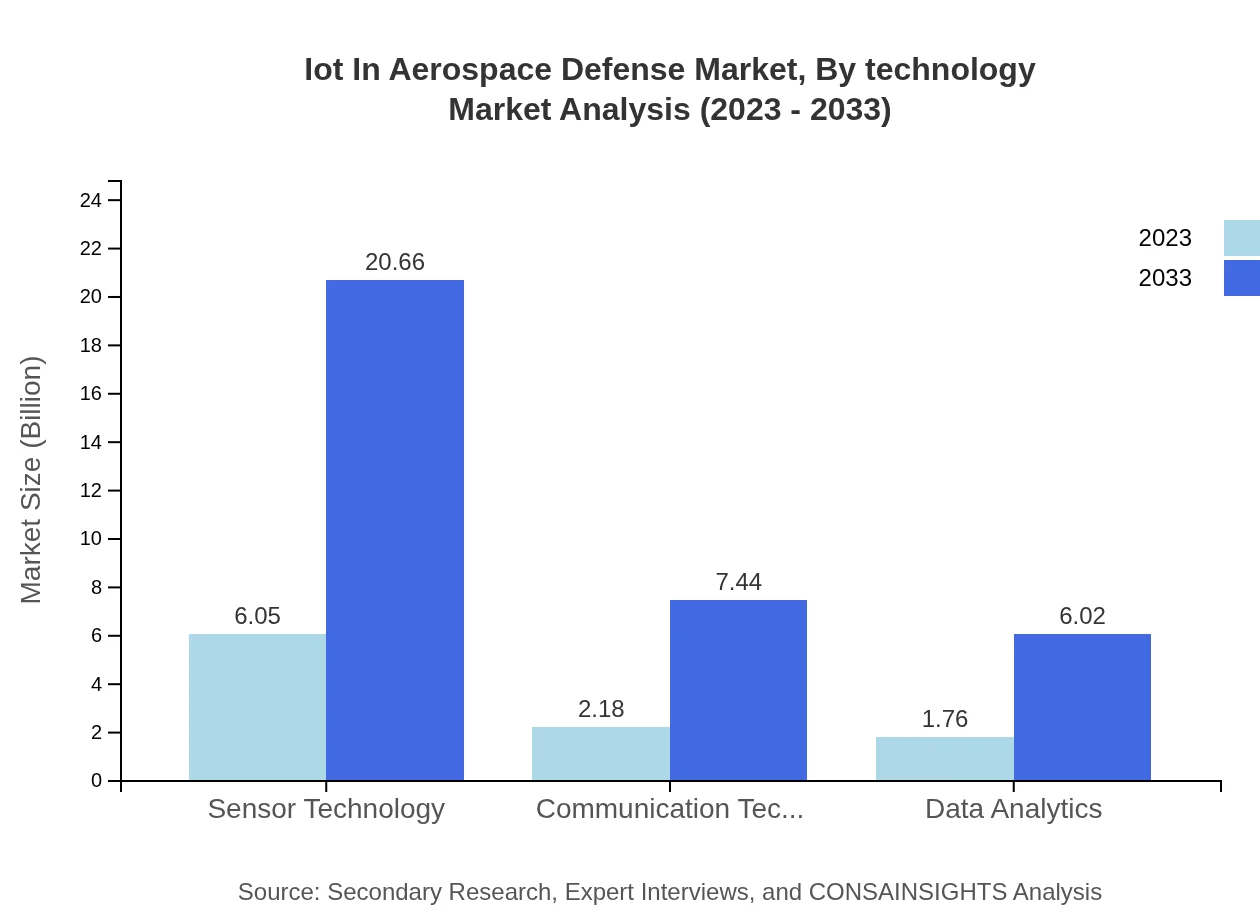

Iot In Aerospace Defense Market Analysis By Technology

The IoT in Aerospace & Defense market is characterized by various technologies such as Sensor Technology, Communication Technology, Cloud, and Data Analytics. These technologies facilitate real-time monitoring, data analysis, and operational efficiency, essential for modern aerospace missions.

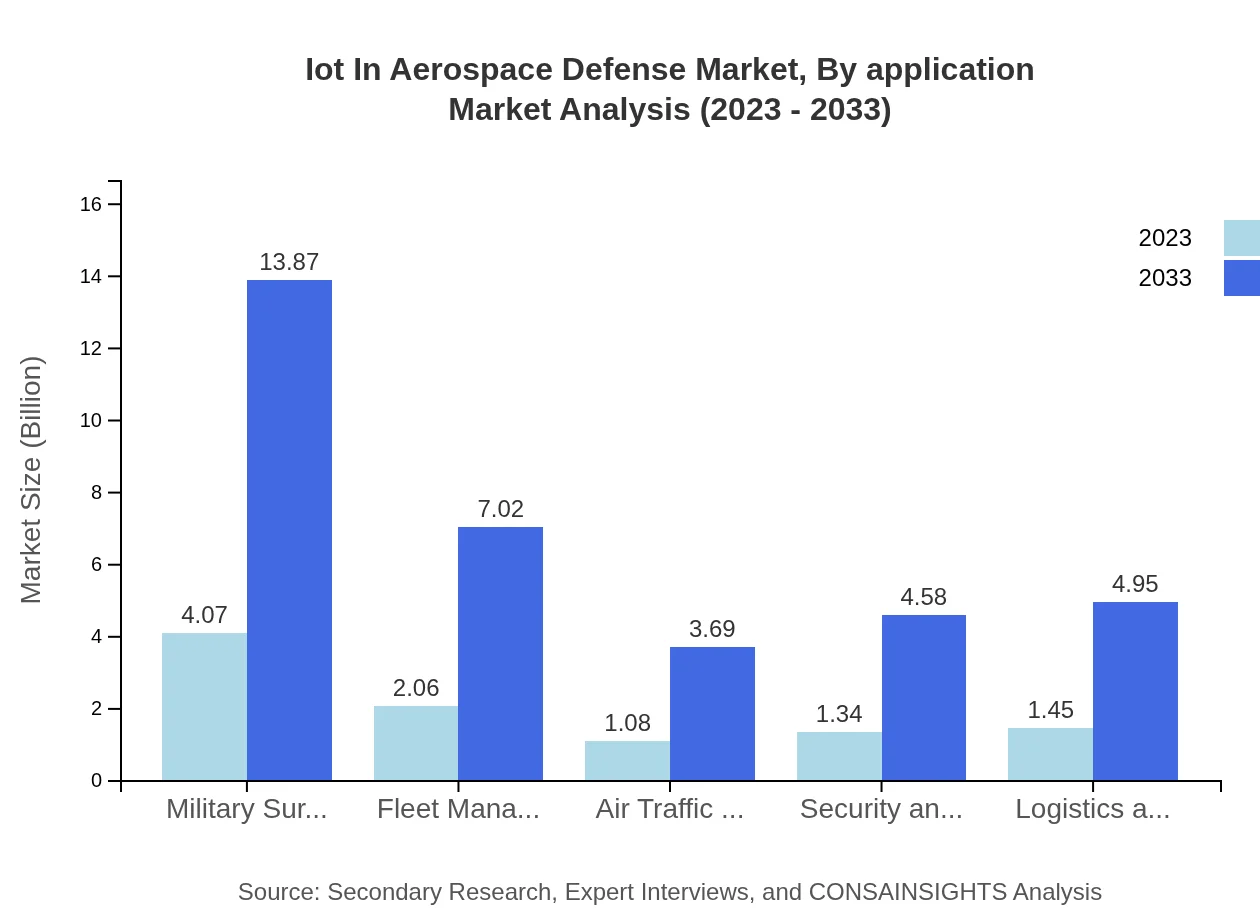

Iot In Aerospace Defense Market Analysis By Application

Key applications include Military Surveillance, Fleet Management, Air Traffic Management, and Security Monitoring. Each application addresses distinct operational needs, with military surveillance showing the highest growth due to the demand for advanced monitoring solutions.

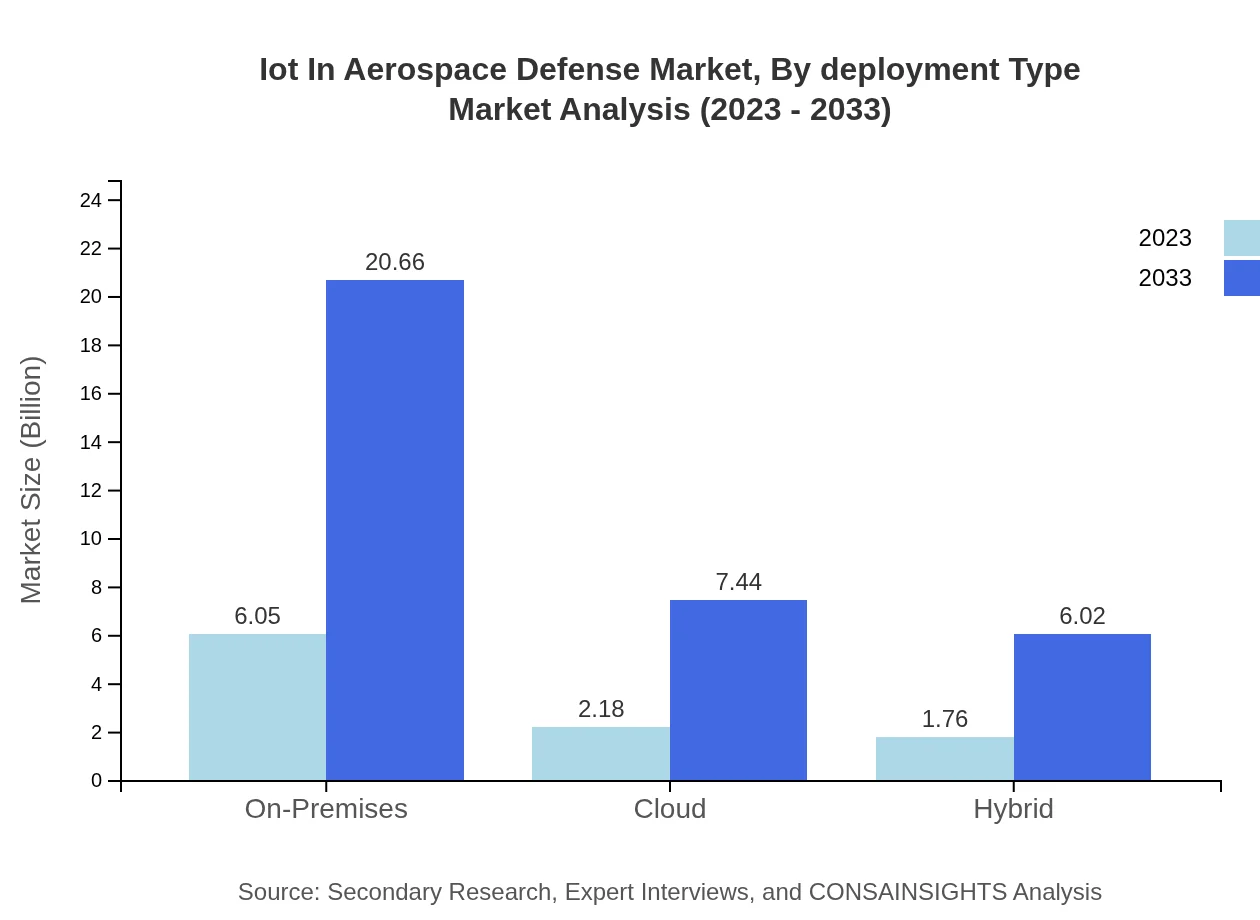

Iot In Aerospace Defense Market Analysis By Deployment Type

The market encompasses On-Premises, Cloud, and Hybrid deployment types, with On-Premises technology dominating due to stringent security needs, while Cloud solutions are gaining traction for their scalability and flexibility.

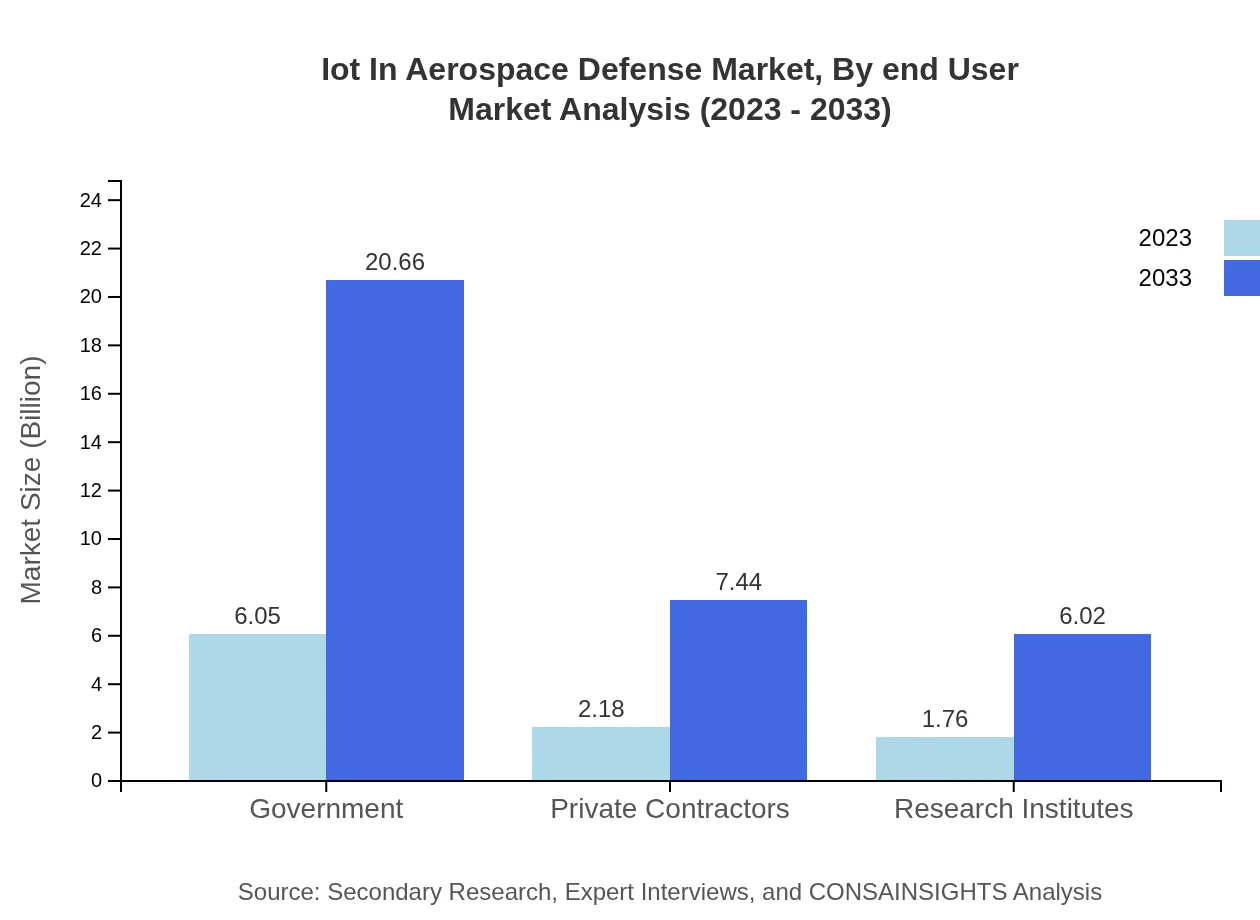

Iot In Aerospace Defense Market Analysis By End User

End-users include Government agencies, Private Contractors, Military branches, and Research Institutes, each with specific needs shaping the demand for IoT solutions in aerospace defense.

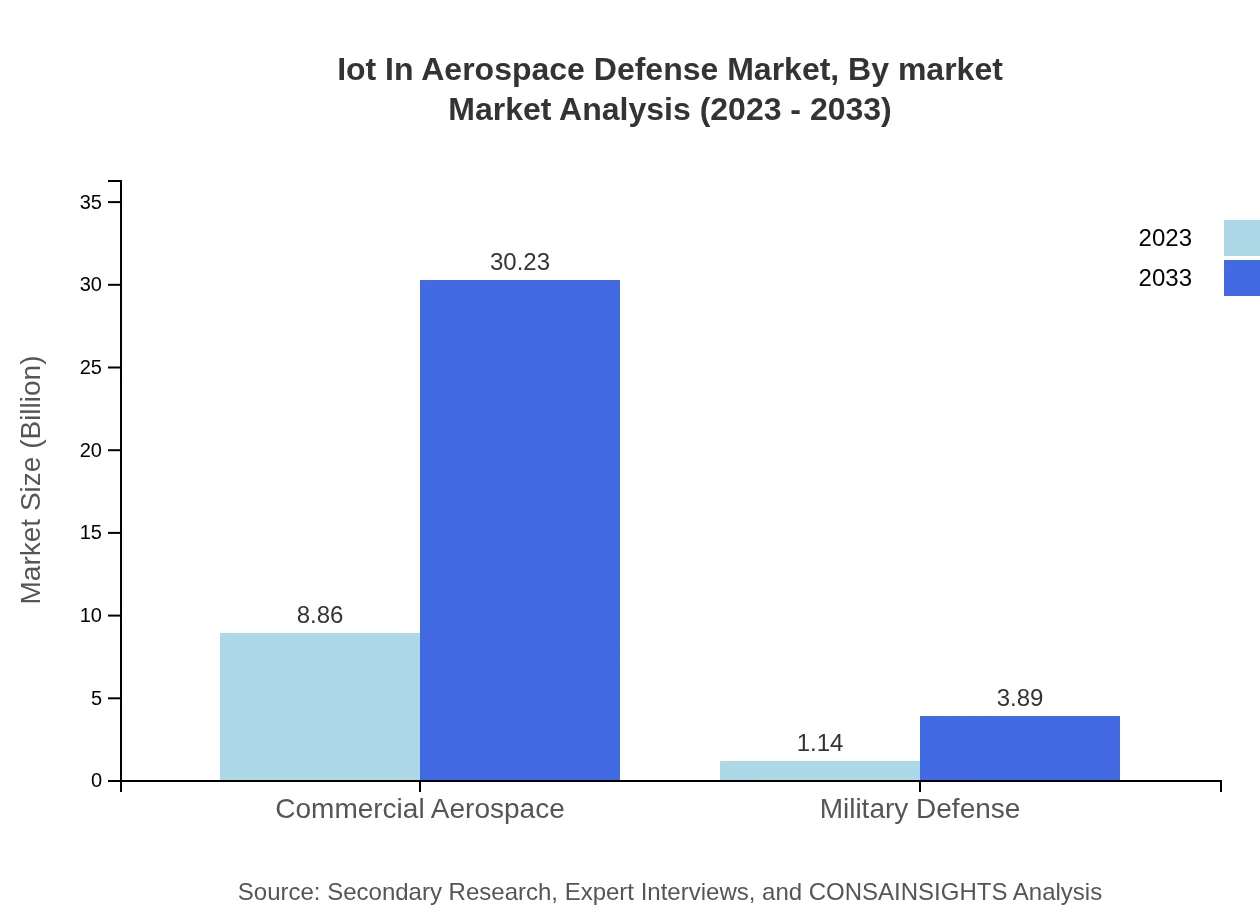

Iot In Aerospace Defense Market Analysis By Market

The market segments provided significant insights regarding its structure: Commercial Aerospace holds approximately 88.61% of the market share, Military Defense captures around 11.39%, showcasing the paramount focus on commercial applications.

IoT In Aerospace Defense Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in IoT In Aerospace Defense Industry

Lockheed Martin:

A leading aerospace and defense firm specializing in IoT technology for military applications, enhancing flight safety and mission capabilities.Raytheon Technologies:

Innovator in defense technology using IoT solutions for surveillance and reconnaissance, contributing to smarter military operations.Boeing :

Major player in commercial aerospace leveraging IoT for fleet management and operational efficiency.Thales Group:

Provides IoT-enabled solutions for security and defense, focusing on enhancing communication and situational awareness.We're grateful to work with incredible clients.

FAQs

What is the market size of IoT in Aerospace Defense?

The IoT in Aerospace Defense market is projected to reach $10 billion by 2033, growing at a CAGR of 12.5% from its current size of $10 billion in 2023.

What are the key market players or companies in this IoT in Aerospace Defense industry?

Key players in the IoT in Aerospace Defense market include industry giants like Boeing, Lockheed Martin, Airbus, Northrop Grumman, and Raytheon Technologies, which are instrumental in driving innovations in aerospace and defense technologies.

What are the primary factors driving the growth in the IoT in Aerospace Defense industry?

Growth in the IoT in Aerospace Defense industry is driven by advancements in sensor technology, increased defense spending, demand for enhanced security systems, and the need for operational efficiency and real-time data analytics in military operations.

Which region is the fastest Growing in the IoT in Aerospace Defense?

North America is the fastest-growing region for IoT in Aerospace Defense, projected to expand from $3.34 billion in 2023 to $11.40 billion by 2033, fueled by higher defense budgets and significant investments in technology upgrades.

Does ConsaInsights provide customized market report data for the IoT in Aerospace Defense industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the IoT in Aerospace Defense industry, ensuring comprehensive insights and analysis to support strategic decision-making.

What deliverables can I expect from this IoT in Aerospace Defense market research project?

Deliverables from the market research project include detailed market reports, segment analysis, growth forecasts, key player insights, and actionable recommendations tailored to the IoT in Aerospace Defense sector.

What are the market trends of IoT in Aerospace Defense?

Key trends in the IoT in Aerospace Defense market include increased automation, adoption of cloud computing, integration of AI for predictive maintenance, and the rising prominence of security measures to mitigate cyber-threats.