Iot In Aviation Market Report

Published Date: 31 January 2026 | Report Code: iot-in-aviation

Iot In Aviation Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the IoT in aviation market from 2023 to 2033, including market size trends, segmentation, regional insights, key players, and future forecasts.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.50 Billion |

| CAGR (2023-2033) | 12% |

| 2033 Market Size | $50.43 Billion |

| Top Companies | Cisco Systems, Inc., Honeywell International Inc., Rockwell Collins, General Electric, Thales Group |

| Last Modified Date | 31 January 2026 |

IoT In Aviation Market Overview

Customize Iot In Aviation Market Report market research report

- ✔ Get in-depth analysis of Iot In Aviation market size, growth, and forecasts.

- ✔ Understand Iot In Aviation's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Iot In Aviation

What is the Market Size & CAGR of IoT In Aviation market in 2023?

IoT In Aviation Industry Analysis

IoT In Aviation Market Segmentation and Scope

Tell us your focus area and get a customized research report.

IoT In Aviation Market Analysis Report by Region

Europe Iot In Aviation Market Report:

In Europe, the market is expected to grow from $3.80 billion in 2023 to $12.35 billion by 2033, propelled by regulatory support and innovation in aviation IoT applications.Asia Pacific Iot In Aviation Market Report:

The Asia Pacific region is expected to see robust growth, with the market projected to escalate from $3.18 billion in 2023 to $10.33 billion by 2033. This growth is attributed to increasing air travel, expansion of airports, and significant investments in aviation technology.North America Iot In Aviation Market Report:

North America dominates the market with a value of $5.91 billion in 2023, projected to reach $19.21 billion by 2033. This growth is spurred by the presence of key players and substantial investments in IoT technologies for aviation.South America Iot In Aviation Market Report:

The South American market is anticipated to grow steadily, from $1.10 billion in 2023 to $3.59 billion by 2033, driven by infrastructural developments and growing airline industries in countries like Brazil.Middle East & Africa Iot In Aviation Market Report:

The Middle Eastern and African market is set to expand from $1.52 billion in 2023 to $4.94 billion by 2033, influenced by the region's burgeoning aviation sector and strategic connectivity enhancements.Tell us your focus area and get a customized research report.

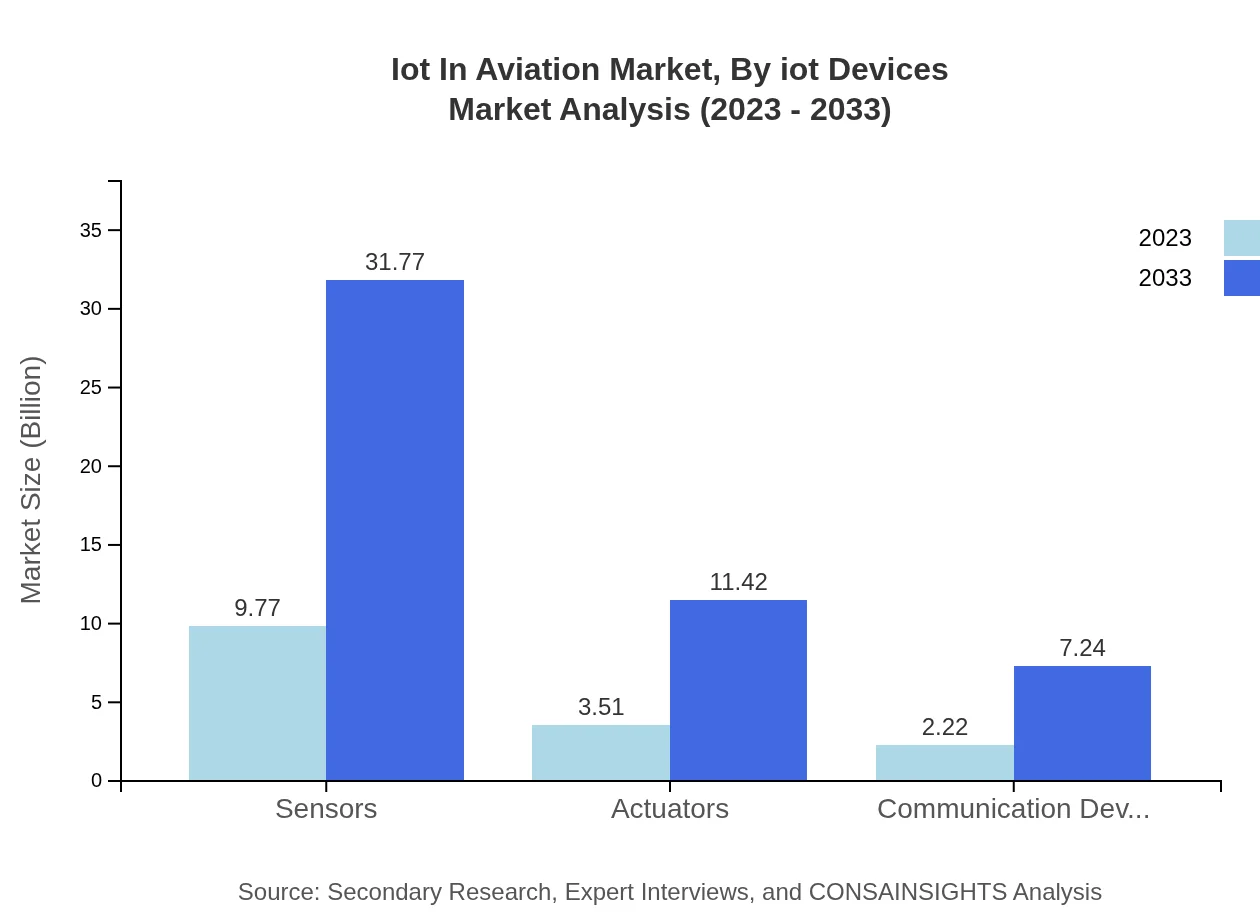

Iot In Aviation Market Analysis By Iot Devices

The segment of IoT devices in aviation comprises sensors, actuators, and communication devices which collectively enhance real-time data processing capabilities. The market is set to reflect strong growth, driven by advancements in wireless communication technologies and the demand for integrated sensors for aircraft monitoring.

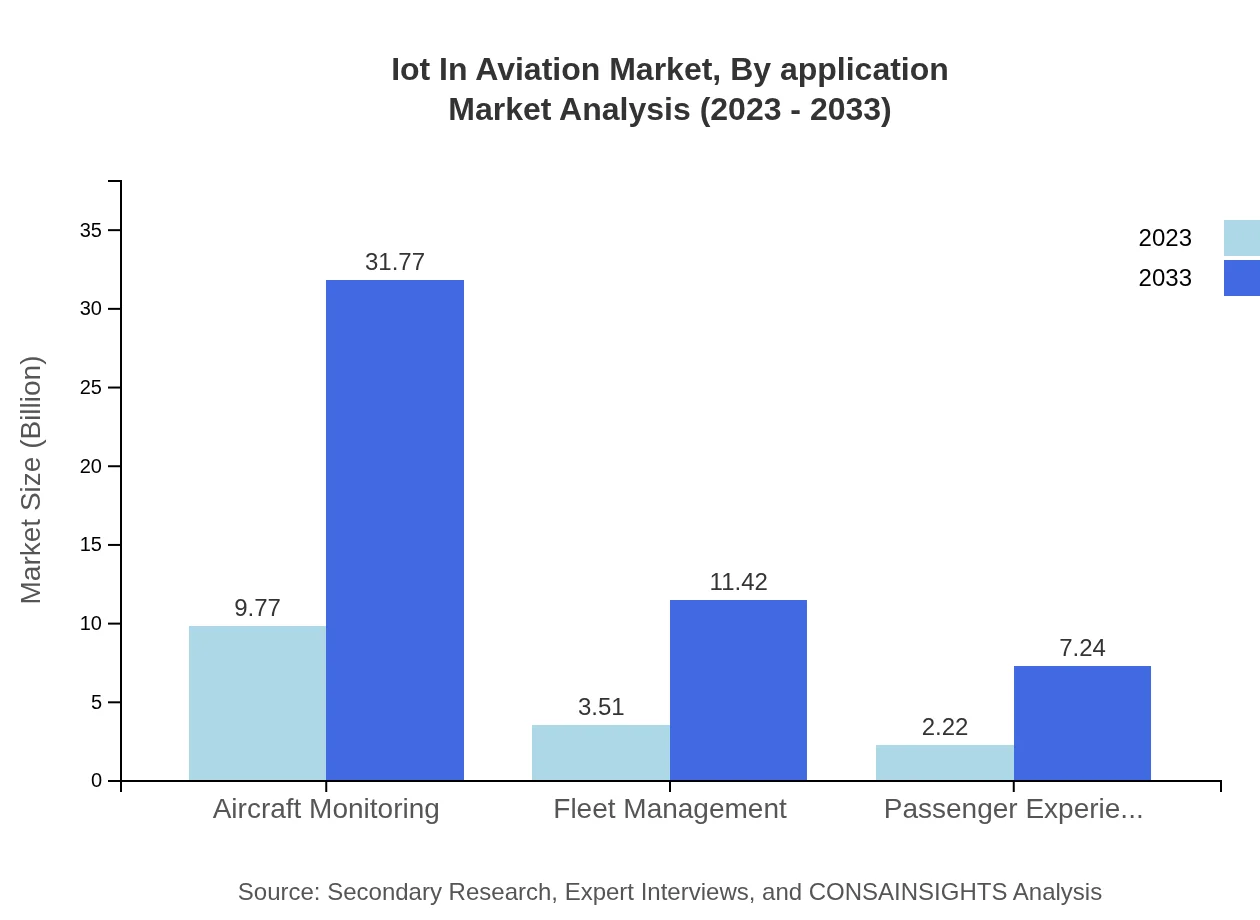

Iot In Aviation Market Analysis By Application

In the application segment, fleet management and predictive maintenance are key focus areas, projected to dominate market share. Enhanced passenger experience through real-time data access and in-flight connectivity solutions also plays a significant role in market progress.

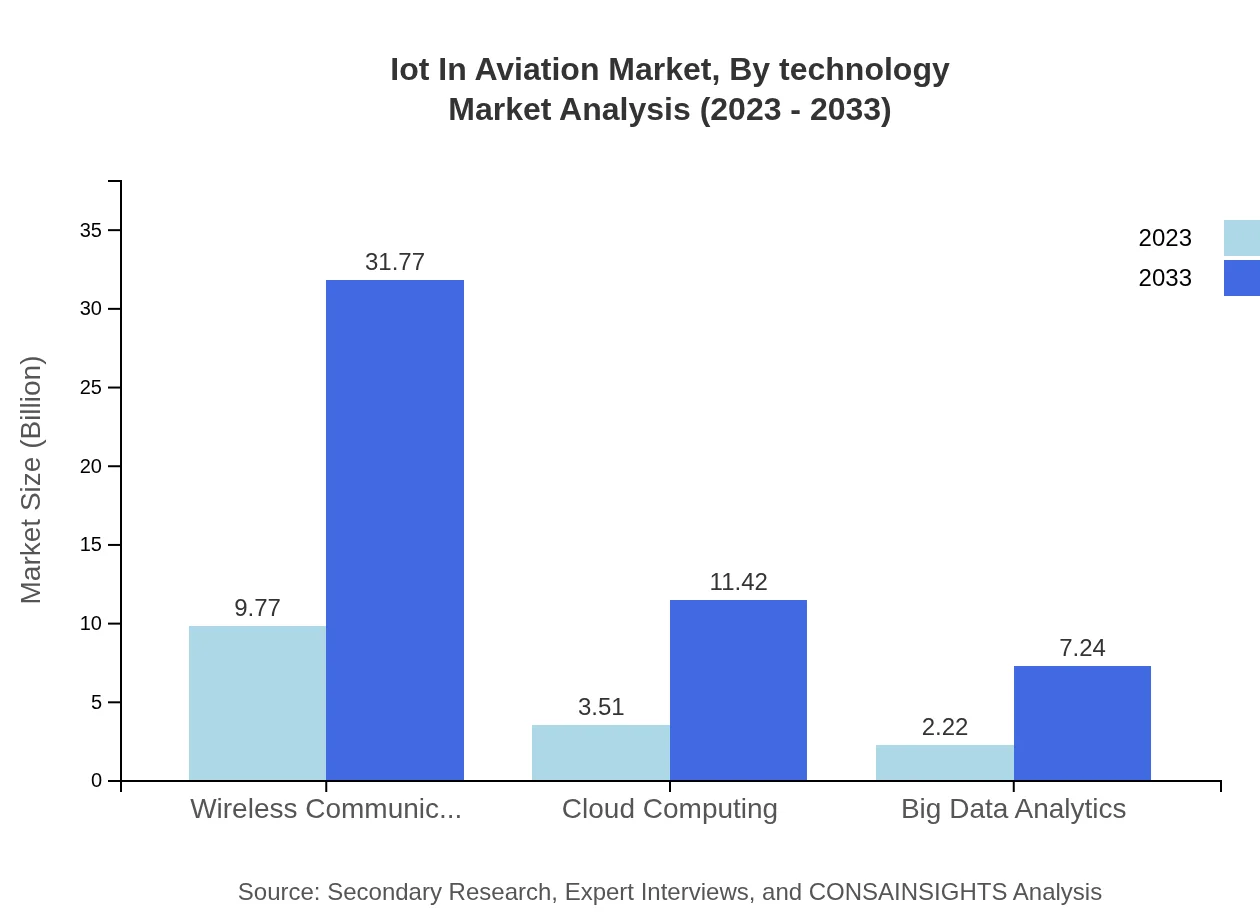

Iot In Aviation Market Analysis By Technology

The technological advancements in IoT frameworks, including cloud computing and big data analytics, form the backbone of data-driven decision-making in aviation. The effective utilization of data analytics leads to better operational strategies and improved customer satisfaction.

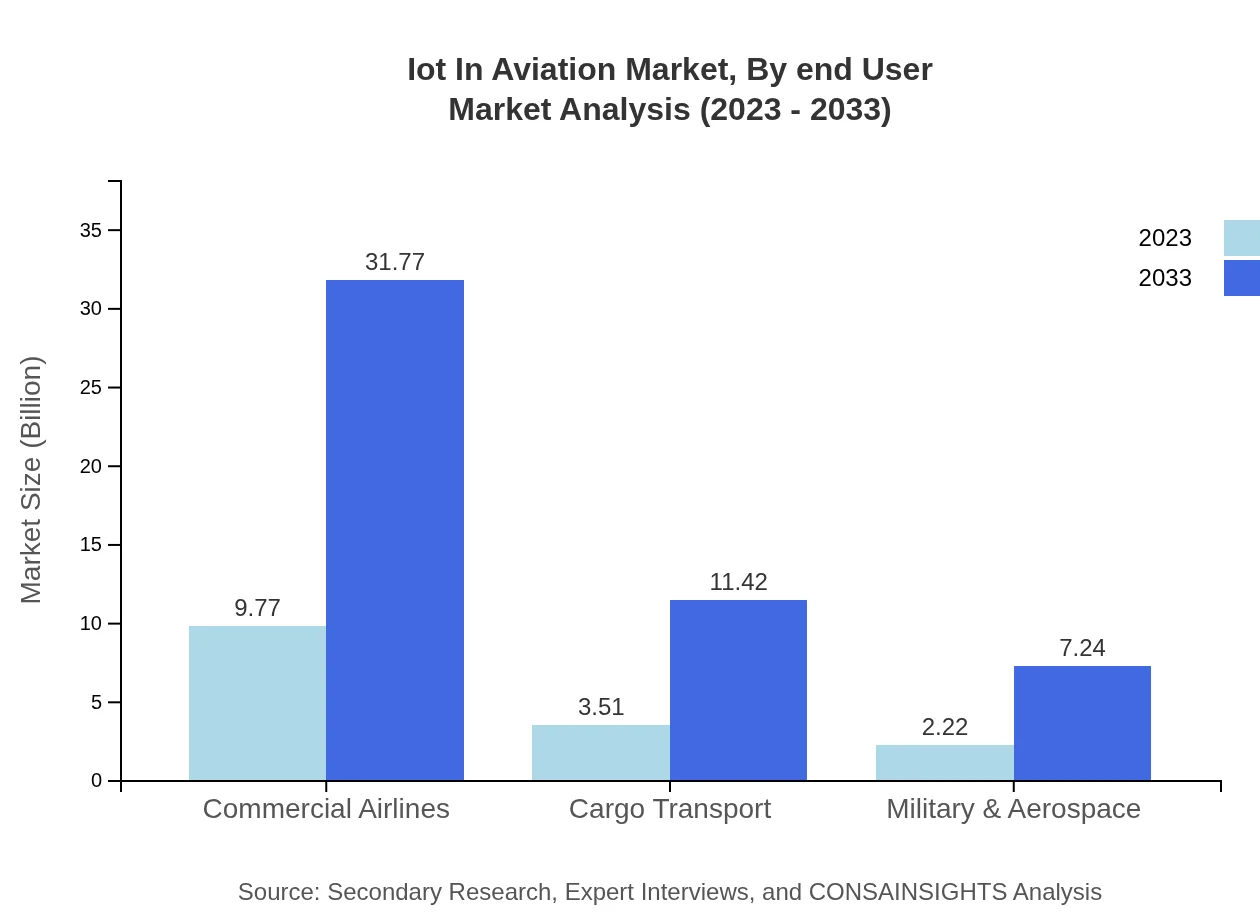

Iot In Aviation Market Analysis By End User

The end-user segment is primarily classified into commercial airlines, cargo transport, and military aerospace, with commercial airlines occupying the largest market share due to enhanced operational needs and a higher volume of data processing.

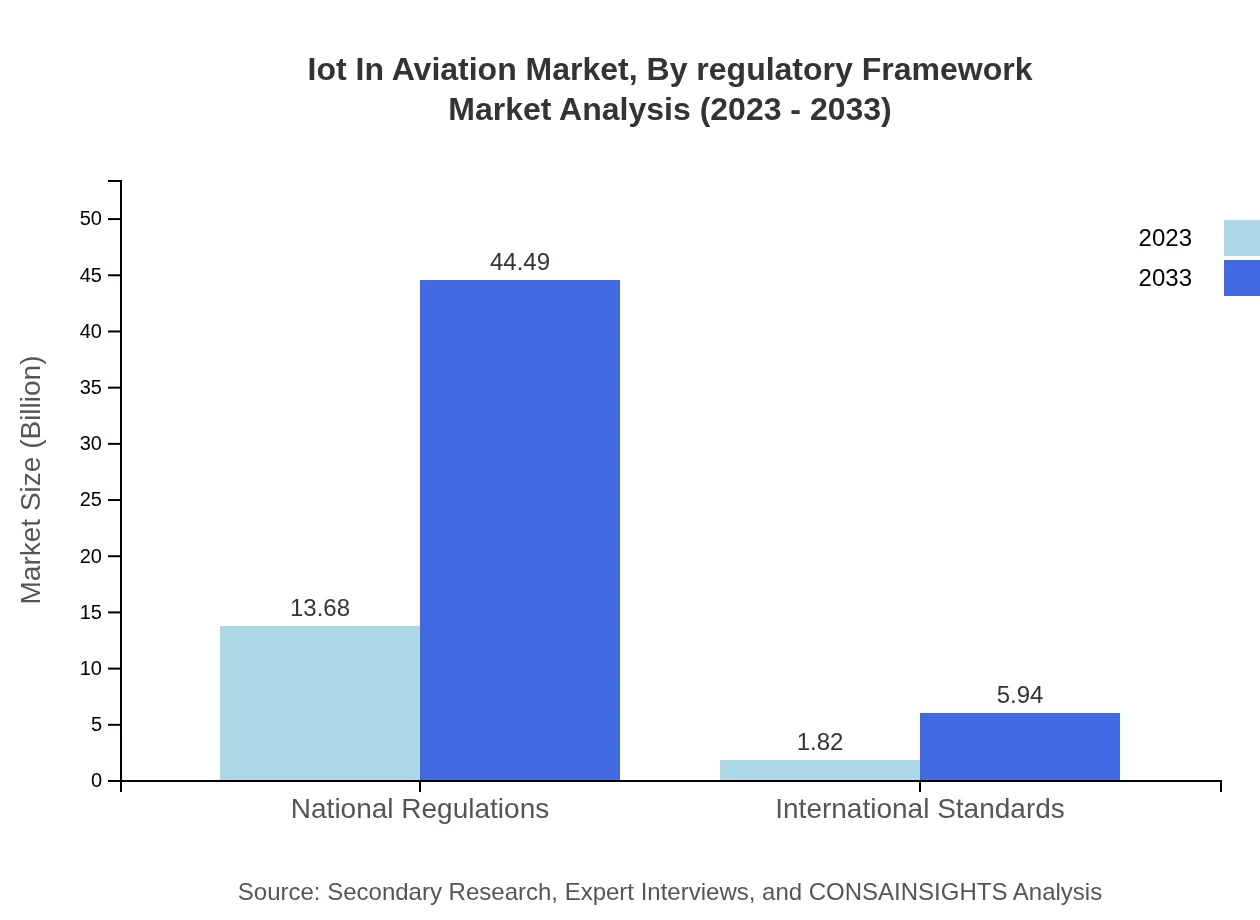

Iot In Aviation Market Analysis By Regulatory Framework

Regulatory frameworks have a significant impact on market dynamics, with national regulations and international standards shaping operational guidelines. Compliance with these regulations is essential for companies looking to leverage IoT solutions in aviation, encouraging technological advancements while prioritizing safety.

IoT In Aviation Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in IoT In Aviation Industry

Cisco Systems, Inc.:

Cisco provides IoT connectivity solutions for aviation, focusing on seamless data transmission and enhanced security across network systems.Honeywell International Inc.:

Honeywell develops integrated IoT solutions aimed at improving aircraft efficiency, safety, and passenger experience through advanced analytics and real-time monitoring.Rockwell Collins:

Rockwell Collins specializes in aviation electronics and communications, providing connected solutions that allow airlines to optimize operations and enhance in-flight experiences.General Electric:

GE plays a crucial role in the development of IoT applications for aviation, including predictive maintenance solutions that leverage big data analytics.Thales Group:

Thales offers sophisticated IoT solutions for air traffic management and in-flight connectivity, enhancing overall operational efficiency within the aviation sector.We're grateful to work with incredible clients.

FAQs

What is the market size of IoT in Aviation?

The IoT in Aviation market is valued at approximately $15.5 billion as of 2023, and it is projected to grow at a CAGR of 12% to reach significant heights by 2033.

What are the key market players or companies in the IoT in Aviation industry?

Key players in the IoT in Aviation industry include major aerospace manufacturers, software solution providers, and tech companies specializing in aviation technology and connectivity solutions, though specific names are proprietary to market research.

What are the primary factors driving the growth in the IoT in Aviation industry?

The growth in the IoT in Aviation industry is primarily driven by increasing demand for smart aircraft, advancements in data analytics, rising passenger awareness for safety, and the need for efficient fleet management solutions.

Which region is the fastest Growing in the IoT in Aviation market?

The fastest-growing region in the IoT in Aviation market is North America, predicted to grow from $5.91 billion in 2023 to $19.21 billion by 2033, owing to strong investment and technological innovation.

Does ConsaInsights provide customized market report data for the IoT in Aviation industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs and preferences within the IoT in Aviation industry, providing deep insights and analysis.

What deliverables can I expect from this IoT in Aviation market research project?

Deliverables from the IoT in Aviation market research project include comprehensive market reports, data segmentation, trend analysis, regional insights, and competitive landscape assessments.

What are the market trends of IoT in Aviation?

Key market trends in IoT in Aviation include rising connectivity solutions, integration of AI in operations, increasing focus on safety and aerodynamics, and deployments in passenger experience enhancement and fleet management.