Iot In Bfsi Market Report

Published Date: 31 January 2026 | Report Code: iot-in-bfsi

Iot In Bfsi Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the IoT in the BFSI sector, offering insights into market dynamics, trends, and forecasts from 2023 to 2033. It covers market size, growth metrics, regional analysis, and key player activities.

| Metric | Value |

|---|---|

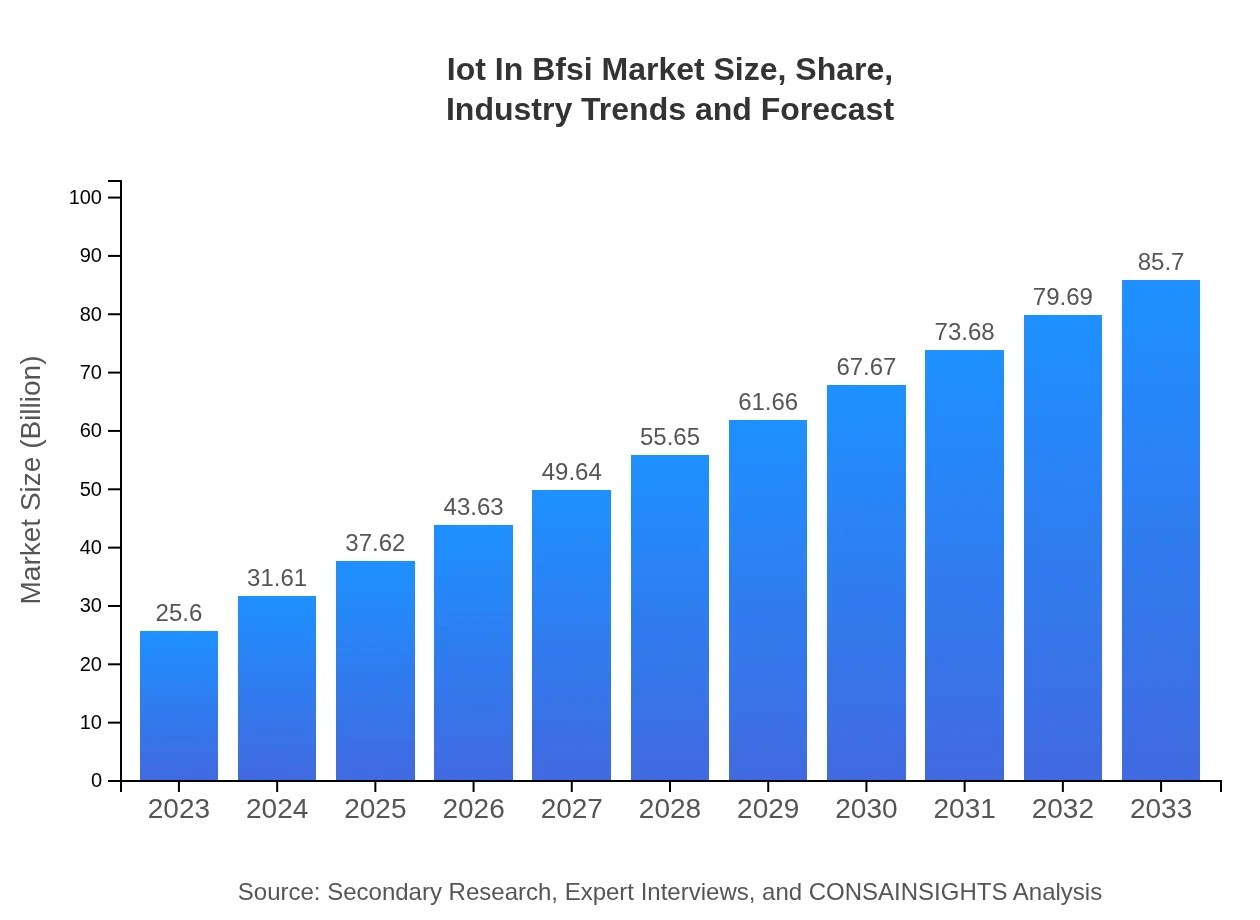

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.60 Billion |

| CAGR (2023-2033) | 12.3% |

| 2033 Market Size | $85.70 Billion |

| Top Companies | IBM, Microsoft, Cisco, SAP, Oracle |

| Last Modified Date | 31 January 2026 |

IoT In BFSI Market Overview

Customize Iot In Bfsi Market Report market research report

- ✔ Get in-depth analysis of Iot In Bfsi market size, growth, and forecasts.

- ✔ Understand Iot In Bfsi's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Iot In Bfsi

What is the Market Size & CAGR of IoT In BFSI market in 2023?

IoT In BFSI Industry Analysis

IoT In BFSI Market Segmentation and Scope

Tell us your focus area and get a customized research report.

IoT In BFSI Market Analysis Report by Region

Europe Iot In Bfsi Market Report:

The European market is projected at $6.91 billion in 2023, with an anticipated market size of $23.15 billion by 2033. Heightened regulatory standards and a growing focus on digital banking solutions are significant growth accelerators.Asia Pacific Iot In Bfsi Market Report:

In 2023, the IoT in BFSI market in the Asia Pacific region is valued at $4.87 billion, projected to rise to $16.31 billion by 2033. The rapid digitalization across major economies like India and China and rising investments in fintech innovations drive substantial growth in this region.North America Iot In Bfsi Market Report:

Dominating the global market, North America's IoT in BFSI market stands at $9.73 billion in 2023, expected to reach $32.58 billion by 2033, driven by high investments in IoT technologies and robust infrastructure in this sector.South America Iot In Bfsi Market Report:

The South American IoT in BFSI market is estimated at $1.26 billion in 2023, growing to $4.23 billion by 2033. Increased internet penetration and mobile device usage are key factors fostering market growth, alongside expanding financial inclusion initiatives.Middle East & Africa Iot In Bfsi Market Report:

In 2023, the IoT in BFSI market in the Middle East and Africa is estimated at $2.82 billion and is expected to rise to $9.44 billion by 2033. Increased focus on security and regulatory compliance initiatives drives market growth in this region.Tell us your focus area and get a customized research report.

Iot In Bfsi Market Analysis Digital_transformation

Global IoT in BFSI Market, By Digital Transformation (2023 - 2033)

Digital transformation is a major segment, accounting for $17.43 billion in 2023 and projected to soar to $58.36 billion by 2033, with a market share of approximately 68.1%. The push towards digital services and operational enhancements in BFSI sectors are critical for this growth.

Iot In Bfsi Market Analysis Regulatory_compliance

Global IoT in BFSI Market, By Regulatory Compliance (2023 - 2033)

This segment encompasses $6.92 billion in 2023, reaching $23.16 billion by 2033, maintaining a stable market share of 27.03%. Regulatory pressures and the need for compliance ensure elevated growth within this segment.

Iot In Bfsi Market Analysis Security_enhancements

Global IoT in BFSI Market, By Security Enhancements (2023 - 2033)

The demand for enhanced security ensures this segment, currently valued at $1.25 billion in 2023, grows to $4.17 billion by 2033. Security is imperative in the BFSI sector to safeguard against increasing cyber threats.

Iot In Bfsi Market Analysis Connectivity_and_sensor_technologies

Global IoT in BFSI Market, By Connectivity and Sensor Technologies (2023 - 2033)

In 2023, connectivity technologies contribute $17.43 billion, projected to rise to $58.36 billion by 2033. Sensor technologies bring in $6.92 billion in 2023, increasing to $23.16 billion by 2033, both playing crucial roles in operational efficiencies.

Iot In Bfsi Market Analysis Data_analytics

Global IoT in BFSI Market, By Data Analytics (2023 - 2033)

This segment is poised for growth, starting with $1.25 billion in 2023 and targeting $4.17 billion by 2033. The critical nature of data-driven insights in financial decision-making propels this market segment.

IoT In BFSI Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in IoT In BFSI Industry

IBM:

IBM leads with innovative IoT solutions tailored for the BFSI sector, enhancing data analytics and security.Microsoft:

Microsoft is a key player offering cloud-based IoT solutions, driving digital transformation in financial services.Cisco:

Cisco provides critical connectivity solutions for IoT implementations, aligning with BFSI's infrastructural needs.SAP:

SAP specializes in integrating data analytics with IoT to streamline operations and enhance regulatory compliance.Oracle:

Oracle's IoT cloud solutions empower financial institutions with real-time insights and operational efficiencies.We're grateful to work with incredible clients.

FAQs

What is the market size of iot In Bfsi?

The global IoT in BFSI market is valued at $25.6 billion in 2023, and it is projected to grow at a CAGR of 12.3%. This growth reflects the increasing adoption of IoT technologies across banking, financial services, and insurance sectors.

What are the key market players or companies in the iot In Bfsi industry?

Key players in the IoT in BFSI market include major tech firms such as IBM, SAP, Microsoft, and Cisco, alongside banking institutions like JPMorgan Chase and insurance entities such as Allianz, all integrating IoT solutions for enhanced operations.

What are the primary factors driving the growth in the iot In Bfsi industry?

The growth in the IoT in BFSI industry is driven by increasing demand for digital transformation, enhanced operational efficiencies, data analytics capabilities, regulatory compliance needs, and consumer demand for personalized financial services.

Which region is the fastest Growing in the iot In Bfsi?

The North America region is the fastest-growing for IoT in BFSI, expanding from $9.73 billion in 2023 to $32.58 billion by 2033. This growth is fueled by high technological adoption and significant investments in digital banking solutions.

Does ConsaInsights provide customized market report data for the iot In Bfsi industry?

Yes, ConsaInsights offers customized market report data for the IoT in BFSI industry, tailoring insights based on specific client needs, regional focuses, and segment analyses to ensure actionable intelligence.

What deliverables can I expect from this iot In Bfsi market research project?

Deliverables from the IoT in BFSI market research project typically include comprehensive market analysis, trend reports, competitive landscape assessments, region-specific data, and sector segmentation insights tailored to strategic decision-making.

What are the market trends of iot In Bfsi?

Current market trends in IoT in BFSI include a strong shift towards cloud-based solutions, increasing reliance on data analytics for customer insights, growing importance of security enhancements, and expanding adoption of smart banking technologies.