Iot Insurance Market Report

Published Date: 31 January 2026 | Report Code: iot-insurance

Iot Insurance Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the IoT Insurance market from 2023 to 2033, offering insights into market size, trends, regional dynamics, segmentation by product and application, and key players in the industry.

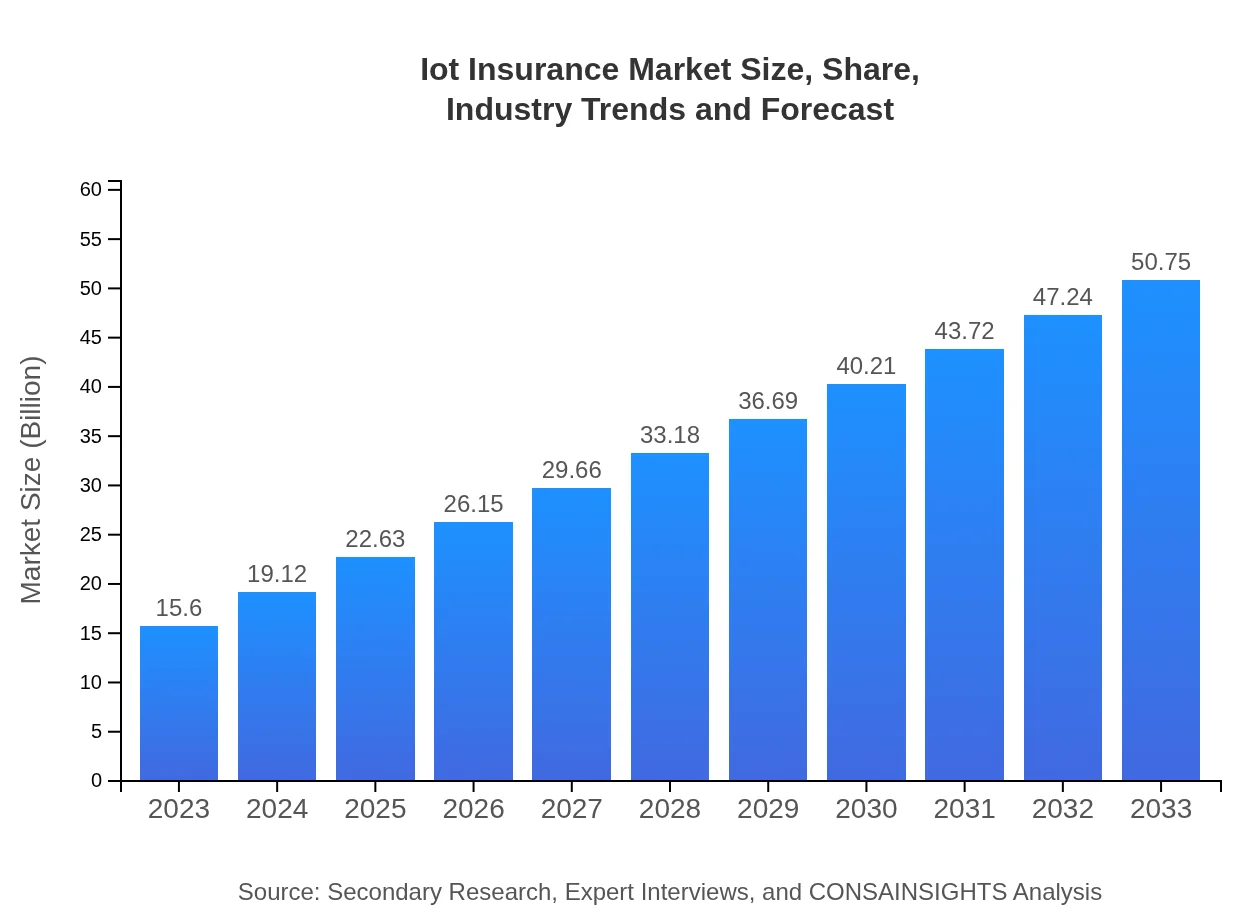

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 12% |

| 2033 Market Size | $50.75 Billion |

| Top Companies | IBM, Allianz, AXA |

| Last Modified Date | 31 January 2026 |

IoT Insurance Market Overview

Customize Iot Insurance Market Report market research report

- ✔ Get in-depth analysis of Iot Insurance market size, growth, and forecasts.

- ✔ Understand Iot Insurance's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Iot Insurance

What is the Market Size & CAGR of IoT Insurance market in 2023?

IoT Insurance Industry Analysis

IoT Insurance Market Segmentation and Scope

Tell us your focus area and get a customized research report.

IoT Insurance Market Analysis Report by Region

Europe Iot Insurance Market Report:

Europe is projected to expand from $4.26 Billion in 2023 to $13.84 Billion by 2033. The market benefits from strong regulatory support, innovation in the fintech space, and a growing need for insurance models that incorporate data from IoT devices.Asia Pacific Iot Insurance Market Report:

The Asia Pacific region shows great promise in the IoT Insurance market, with a market size projected to grow from $3.23 Billion in 2023 to $10.51 Billion in 2033. The rapid development of smart technologies and increased internet connectivity in countries like China, India, and Japan is a major driver of this growth.North America Iot Insurance Market Report:

North America currently leads the IoT Insurance market with a size of $5.40 Billion in 2023, expected to reach $17.55 Billion by 2033. Key drivers include tech-savvy consumers, the prevalence of connected devices, and major insurance players investing heavily in IoT solutions.South America Iot Insurance Market Report:

In South America, the IoT Insurance market is estimated to expand from $1.19 Billion in 2023 to $3.89 Billion by 2033. The growth is attributed to increasing digitalization and evolving consumer preferences, although challenges like regulatory issues could slow progress.Middle East & Africa Iot Insurance Market Report:

The IoT Insurance market in the Middle East and Africa is on the rise, with growth forecasts set to increase from $1.52 Billion in 2023 to $4.95 Billion by 2033. The region's increasing investments in technology and digitalization efforts are expected to boost market development.Tell us your focus area and get a customized research report.

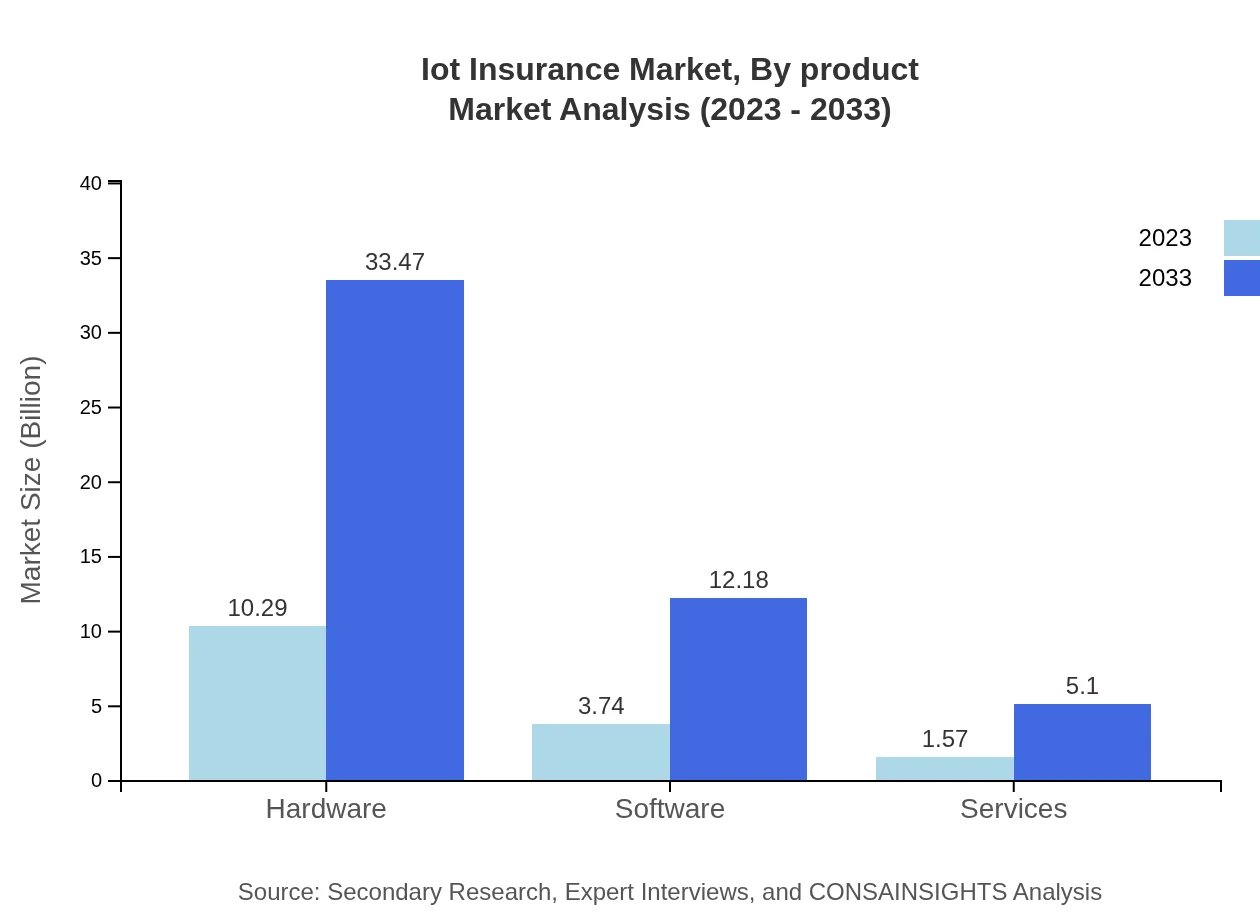

Iot Insurance Market Analysis By Product

The IoT Insurance market comprises hardware, software, and services. Hardware is the dominant segment with a market size of $10.29 Billion in 2023, expanding to $33.47 Billion by 2033. Software accounts for $3.74 Billion in 2023, projected to grow to $12.18 Billion. The services segment, starting at $1.57 Billion, is expected to rise to $5.10 Billion, reflecting the increasing need for specialized IoT insurance services and consulting.

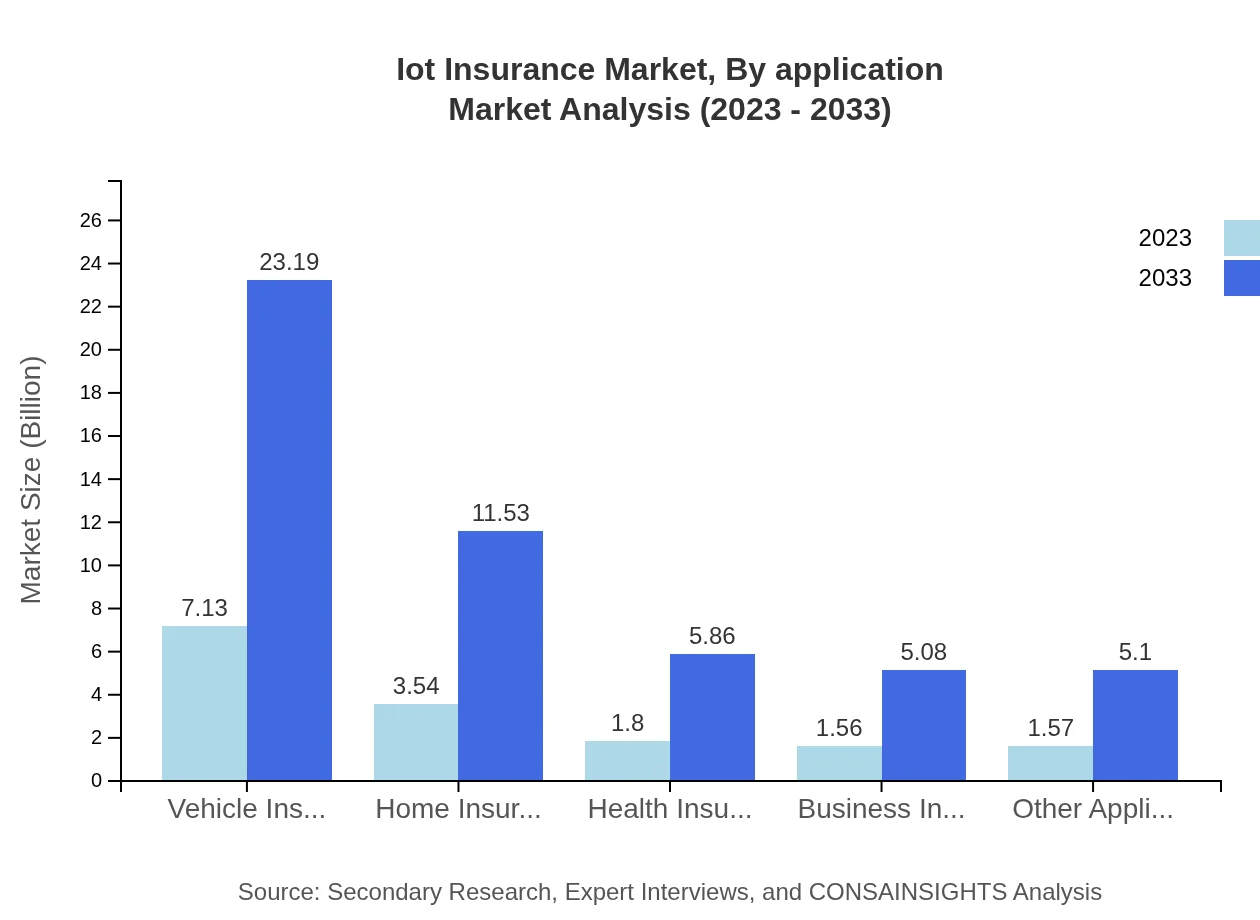

Iot Insurance Market Analysis By Application

The primary applications are vehicle, home, health, and business insurance. Vehicle insurance holds a significant share, valued at $7.13 Billion in 2023 and forecast to expand to $23.19 Billion. Home insurance will grow from $3.54 Billion to $11.53 Billion, while health insurance is anticipated to rise from $1.80 Billion to $5.86 Billion. Business insurance is also expanding with the same trajectory.

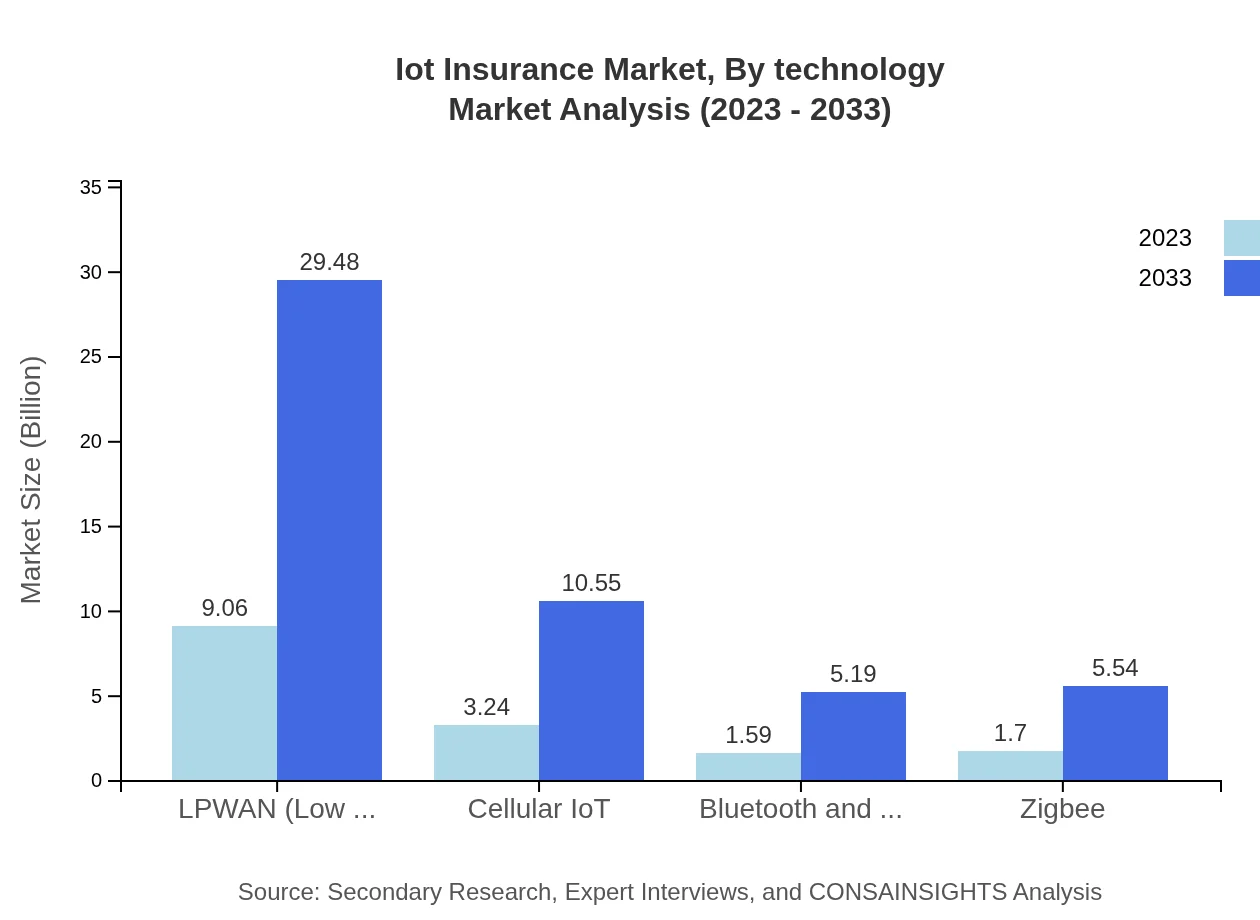

Iot Insurance Market Analysis By Technology

Key IoT technologies in the insurance sector include LPWAN, Cellular IoT, and Bluetooth/Wi-Fi. LPWAN is projected to maintain a significant share at $9.06 Billion in 2023 expanding to $29.48 Billion, while Cellular IoT will grow from $3.24 Billion to $10.55 Billion. Bluetooth and Wi-Fi also show growth from $1.59 Billion to $5.19 Billion, indicating a shift towards more connected and aware insurance services.

Iot Insurance Market Analysis By Region

Global IoT Insurance Market, By Region Market Analysis (2023 - 2033)

Regional analysis indicates robust growth with North America leading, followed by Europe and Asia Pacific, contributing to the majority of market growth. The supportive regulatory environment in Europe and increasing digital adoption in Asia Pacific are significant contributors to these regions' developments.

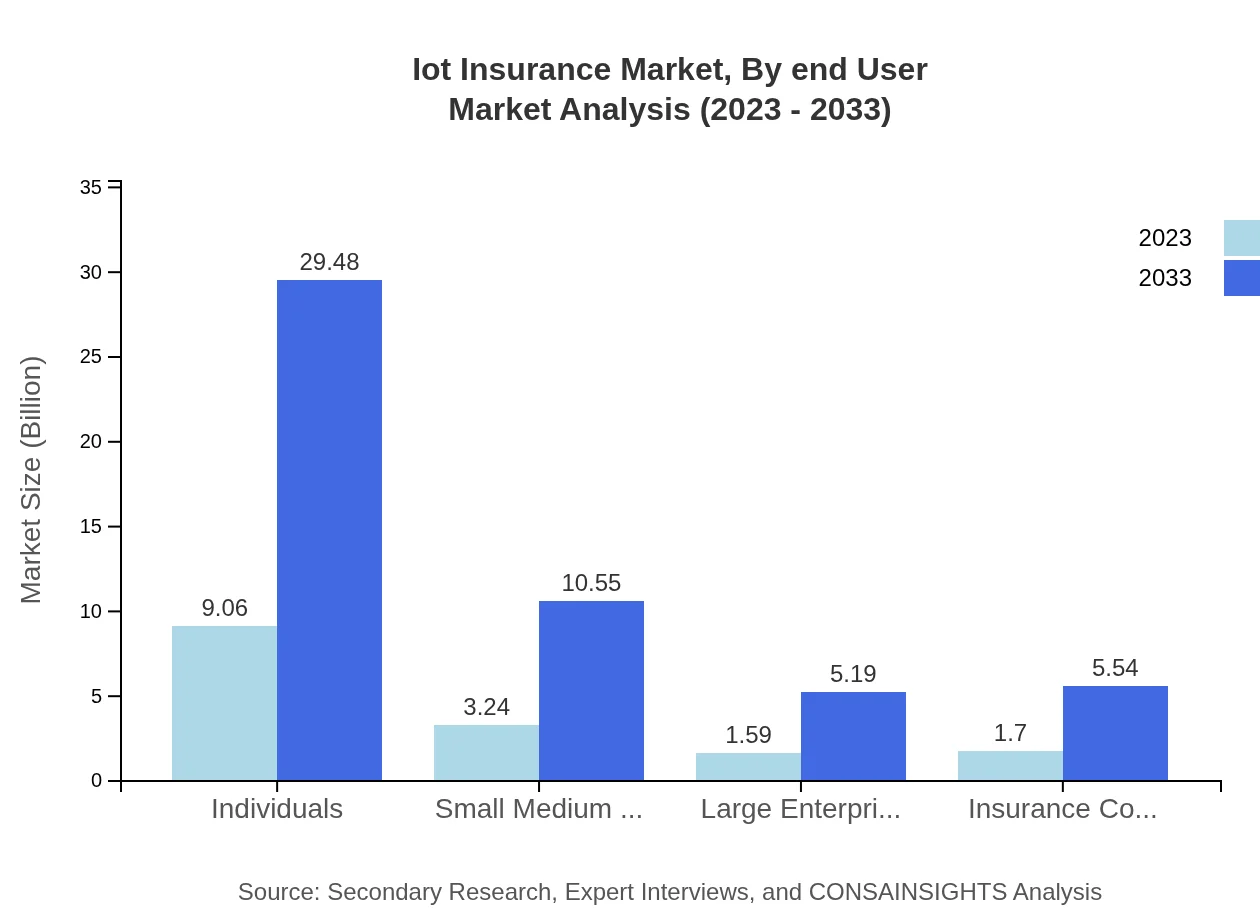

Iot Insurance Market Analysis By End User

The end users are segmented into individuals, SMEs, and large enterprises. Individuals dominate with a market size of $9.06 Billion, projected to reach $29.48 Billion. SMEs follow at $3.24 Billion, increasing to $10.55 Billion, and large enterprises grow from $1.59 Billion to $5.19 Billion, reflecting the market's broad appeal.

IoT Insurance Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in IoT Insurance Industry

IBM:

IBM integrates AI and IoT technologies to provide innovative insurance solutions, enhancing customer engagement and operational efficiency.Allianz:

Allianz leverages IoT devices to collect data for optimal risk assessment, offering personalized insurance plans tailored to consumer needs.AXA:

AXA focuses on smart home and health insurance products, utilizing IoT data to minimize risks and improve claims processing.We're grateful to work with incredible clients.

FAQs

What is the market size of IoT insurance?

The IoT insurance market is projected to grow from $15.6 billion in 2023 to significant heights by 2033, with a robust CAGR of 12%. This growth reflects the increasing adoption of IoT technologies across various sectors.

What are the key market players or companies in the IoT insurance industry?

Key players in the IoT insurance market include major insurance providers, technology firms focusing on IoT solutions, and startups innovating in risk assessment through IoT data analytics. Their strategic partnerships drive market advancements.

What are the primary factors driving the growth in the IoT insurance industry?

Driving growth in the IoT insurance sector are increased IoT device penetration, a growing focus on risk management using data analytics, and rising consumer demand for personalized insurance solutions tailored to individual needs.

Which region is the fastest Growing in the IoT insurance market?

North America is the fastest-growing region in the IoT insurance market, expected to rise from $5.40 billion in 2023 to $17.55 billion by 2033. Europe and Asia Pacific also show significant growth trajectories.

Does ConsaInsights provide customized market report data for the IoT insurance industry?

Yes, ConsaInsights offers customized market report data tailored to clients' specific requirements in the IoT insurance industry, providing insights that facilitate strategic decision-making and competitive advantage.

What deliverables can I expect from this IoT insurance market research project?

From the IoT insurance market research project, you can expect detailed reports including market size, forecasts, competitive analysis, regional insights, and key trends, ensuring comprehensive coverage of your information needs.

What are the market trends of IoT insurance?

Market trends in IoT insurance include an increase in personalized insurance products driven by IoT data analytics, greater regulatory focus on data privacy, and advancements in technology enhancing risk assessment capabilities.