Iot Integration Market Report

Published Date: 31 January 2026 | Report Code: iot-integration

Iot Integration Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the IoT Integration market, covering current trends, market sizes, growth rates, and forecasts from 2023 to 2033. Insights are provided on regional performances, technological advancements, key industry players, and future market dynamics.

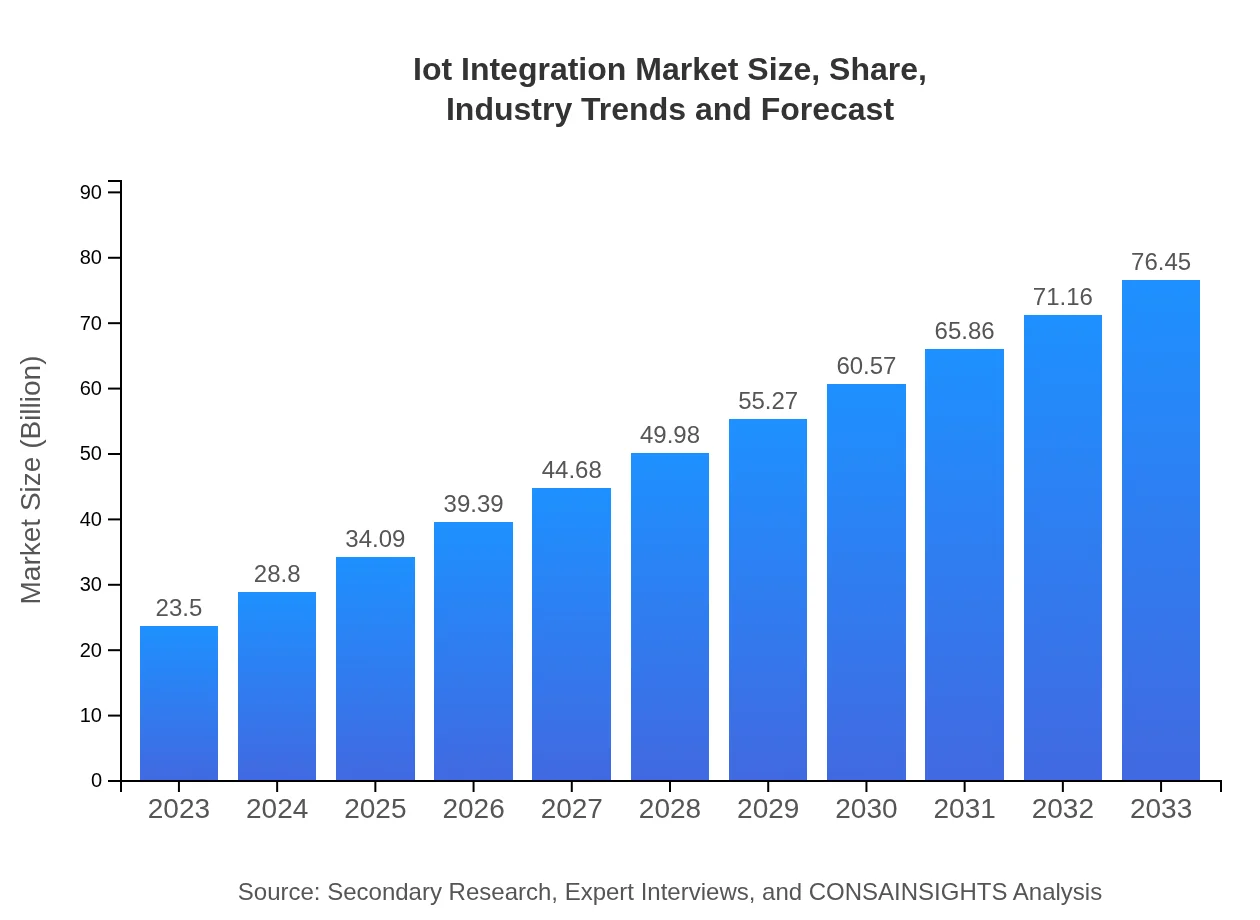

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $23.50 Billion |

| CAGR (2023-2033) | 12% |

| 2033 Market Size | $76.45 Billion |

| Top Companies | Cisco Systems, Inc., IBM Corporation, Microsoft Corporation, SAP SE, General Electric |

| Last Modified Date | 31 January 2026 |

IoT Integration Market Overview

Customize Iot Integration Market Report market research report

- ✔ Get in-depth analysis of Iot Integration market size, growth, and forecasts.

- ✔ Understand Iot Integration's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Iot Integration

What is the Market Size & CAGR of IoT Integration market in 2023?

IoT Integration Industry Analysis

IoT Integration Market Segmentation and Scope

Tell us your focus area and get a customized research report.

IoT Integration Market Analysis Report by Region

Europe Iot Integration Market Report:

Europe’s IoT Integration market is projected to expand from $6.95 billion in 2023 to $22.61 billion by 2033. Countries such as Germany and the UK are leading the charge, emphasizing regulations for data protection and sustainability in IoT solutions.Asia Pacific Iot Integration Market Report:

The Asia Pacific region is witnessing rapid adoption of IoT integration, with a market size of $4.41 billion in 2023, projected to reach $14.36 billion by 2033. Countries like China, India, and Japan lead in investments, driven by increasing smartphone penetration and government initiatives promoting smart city solutions.North America Iot Integration Market Report:

North America remains the largest market for IoT integration, with a size of $9.07 billion in 2023, forecasted to reach $29.51 billion by 2033. The region benefits from a strong technological infrastructure and high adoption rates across sectors like manufacturing and healthcare.South America Iot Integration Market Report:

In South America, the IoT Integration market was valued at $1.84 billion in 2023, expected to grow to $5.99 billion by 2033. The focus on enhancing infrastructure and urbanizing rural areas is propelling investments in IoT technologies, particularly in agriculture and logistics.Middle East & Africa Iot Integration Market Report:

The Middle East and Africa market, valued at $1.22 billion in 2023, is expected to grow to $3.98 billion by 2033. Investment in smart infrastructure and energy management systems is crucial in this region as governments push towards sustainable development and economic diversification.Tell us your focus area and get a customized research report.

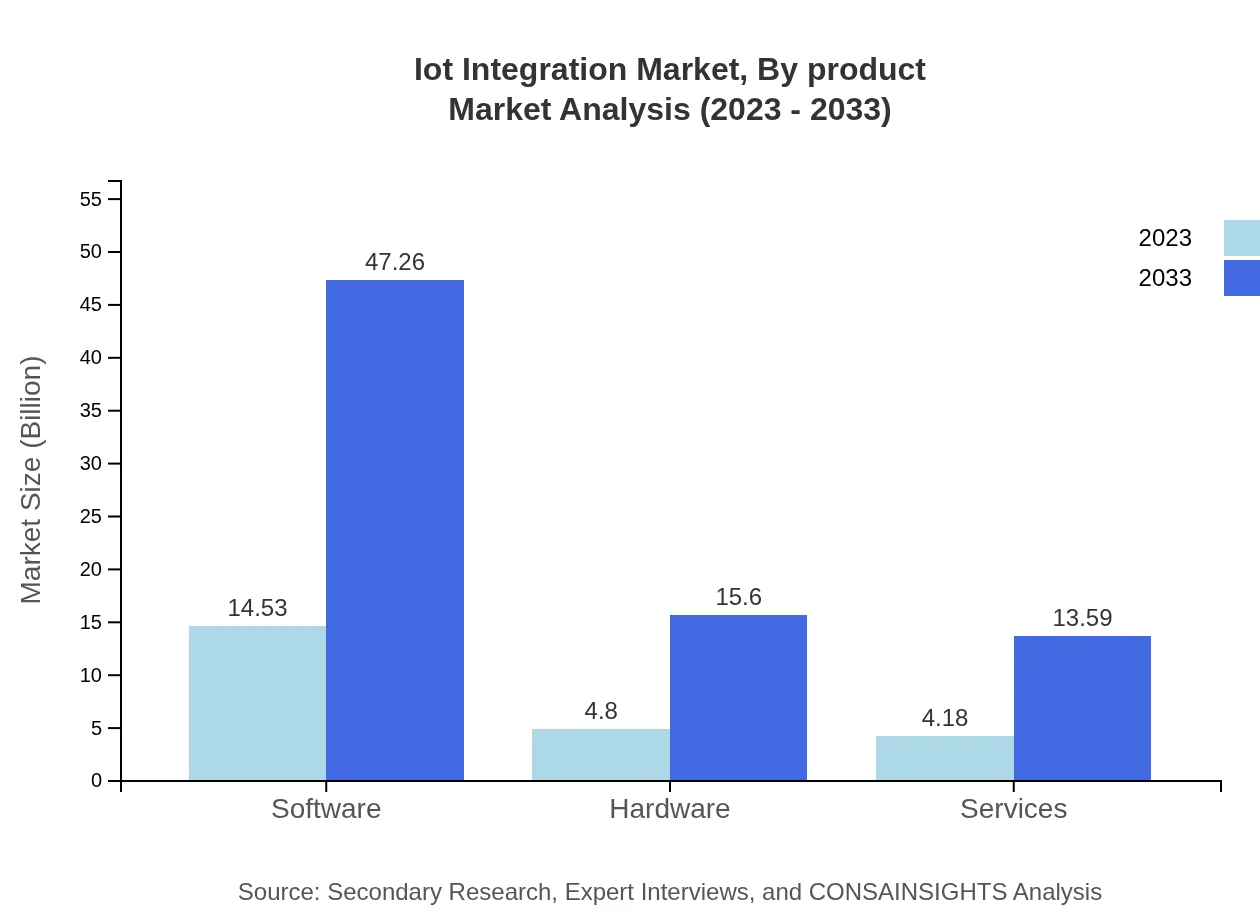

Iot Integration Market Analysis By Product

The software segment leads the IoT Integration market with a share of approximately 61.82% in 2023 and is projected to grow to $47.26 billion by 2033. This growth is significant due to the advancements in cloud computing and application development. Hardware and services, while smaller in market share, are equally crucial as they contribute to the overall ecosystem required for IoT functionalities.

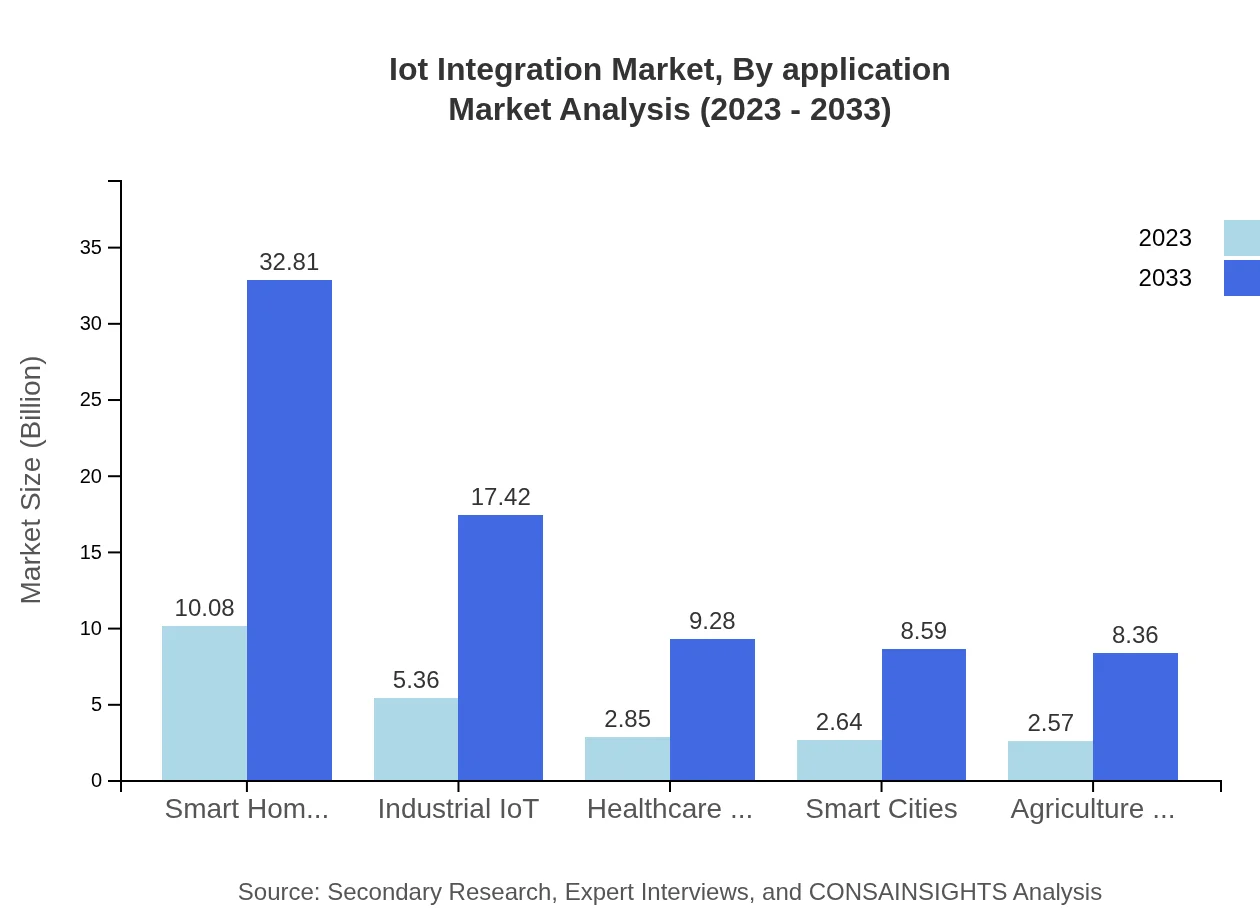

Iot Integration Market Analysis By Application

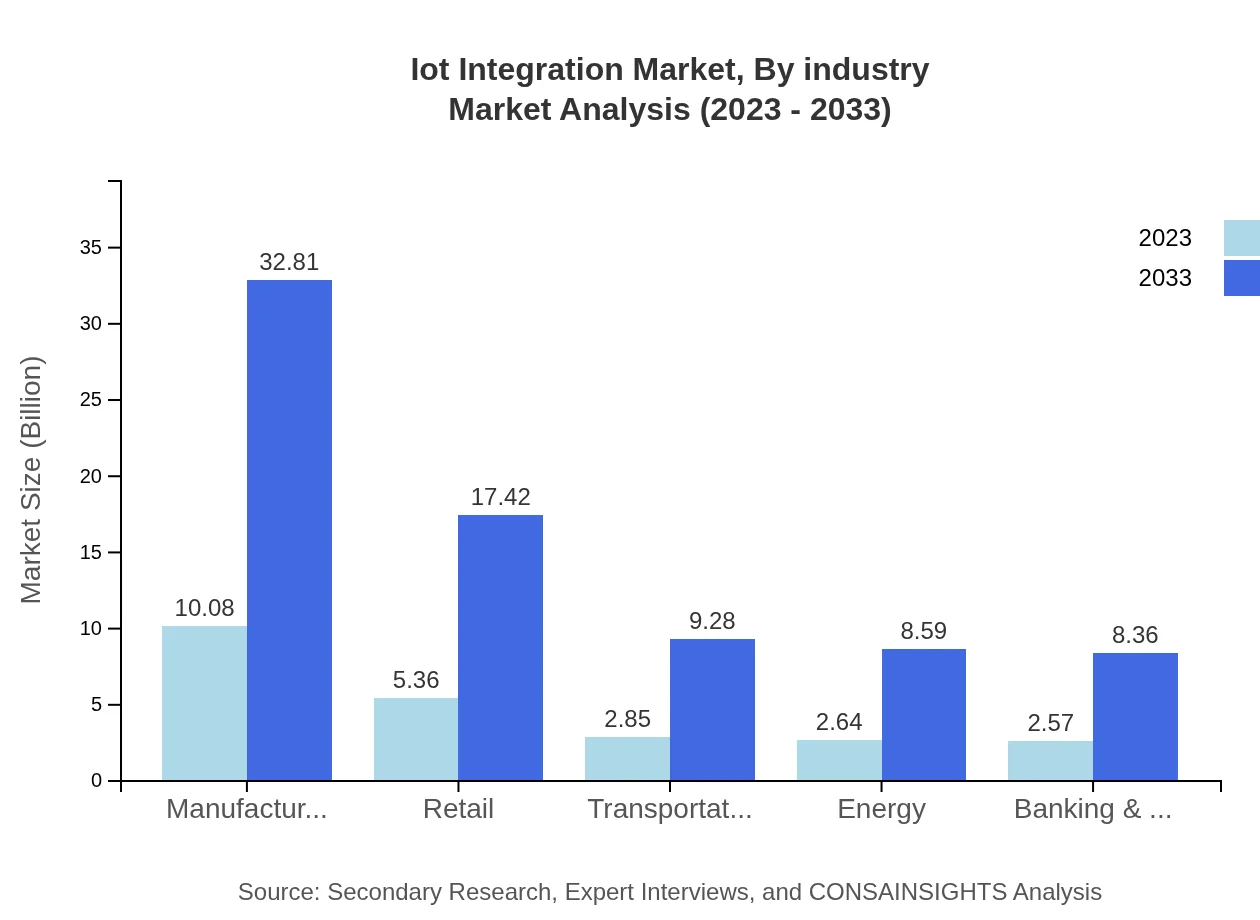

Manufacturing is the largest application segment, valued at $10.08 billion in 2023 with a share of 42.91%. Other significant applications include transportation, retail, and smart homes, which are all benefiting from efficiencies gained through IoT integration, such as improved supply chain management and enhanced customer interaction.

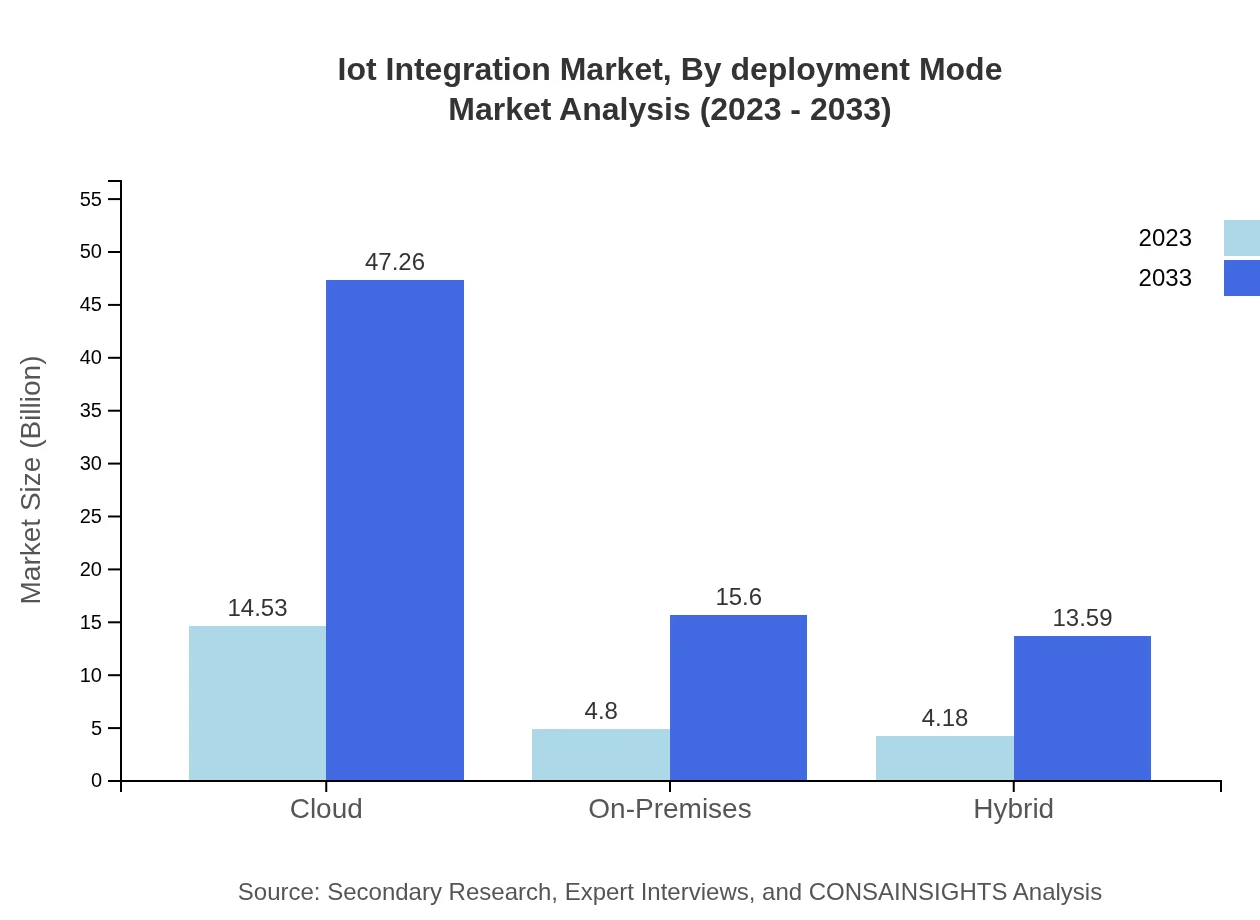

Iot Integration Market Analysis By Deployment Mode

Cloud deployment is increasingly favored for IoT integration due to its scalability and ease of management. This segment is projected to hold a market share of 61.82% by 2033, representing a strong preference for cloud solutions over on-premises and hybrid models, which cater to specific use-case requirements.

Iot Integration Market Analysis By Industry

The manufacturing industry is anticipated to dominate the segment with a market size of $32.81 billion by 2033. All sectors including healthcare and retail are seeing significant deployments of IoT technologies, particularly where efficiency and cost-effectiveness are paramount.

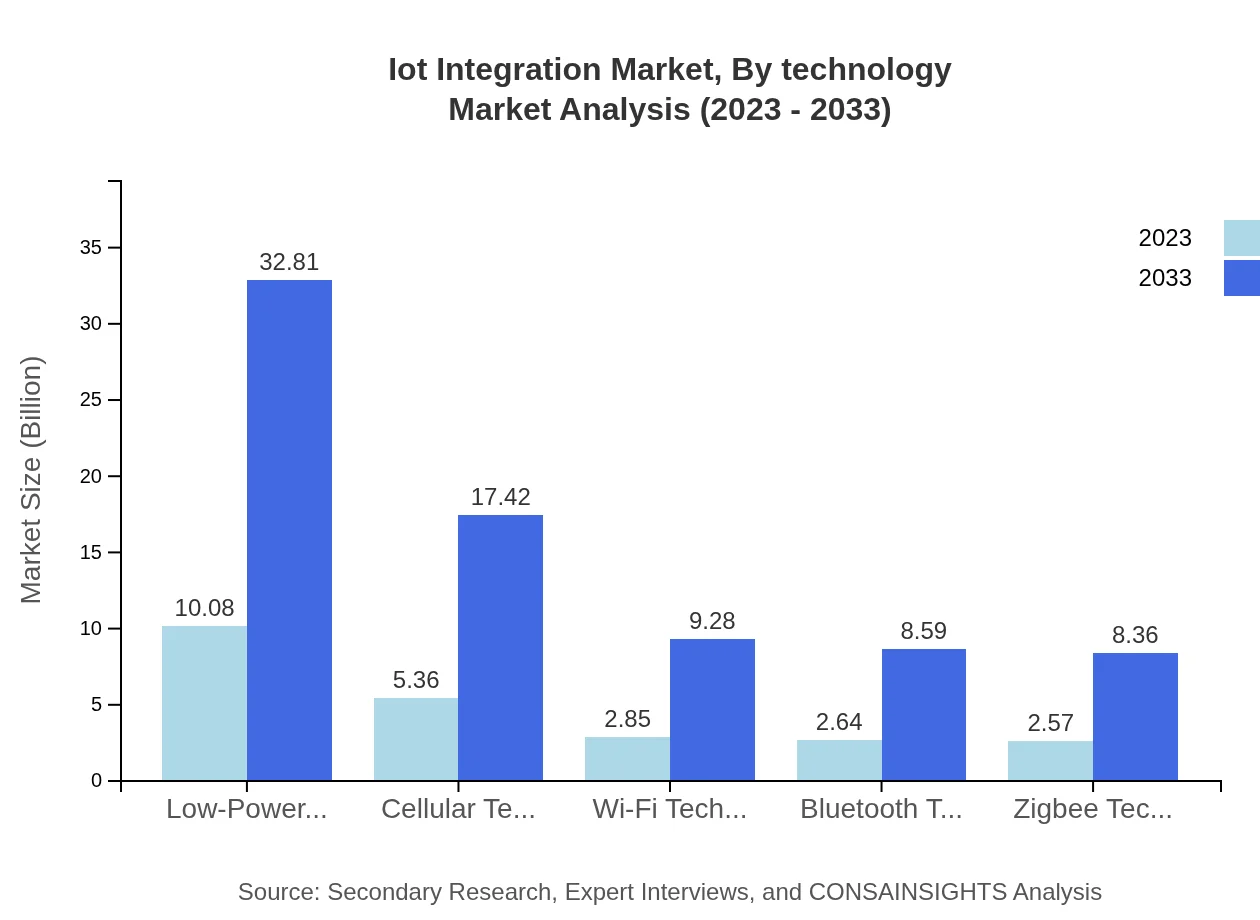

Iot Integration Market Analysis By Technology

Low-Power Wide-Area Networks (LPWANs) show the most promise, with a projected market value of $32.81 billion by 2033, reflecting the need for scalable and efficient connectivity solutions critical for IoT deployments.

IoT Integration Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in IoT Integration Industry

Cisco Systems, Inc.:

A global leader in IT and networking, Cisco offers comprehensive IoT solutions that help organizations enhance operational efficiencies through an interconnected framework.IBM Corporation:

IBM provides robust IoT integration services with a focus on analytics and cloud-based architecture, empowering industries to harness their data effectively.Microsoft Corporation:

Through its Azure IoT platform, Microsoft delivers state-of-the-art solutions for IoT integration, focusing on scalability and security for enterprises.SAP SE:

SAP specializes in enterprise software solutions and enables IoT integration in various business processes, optimizing resources and enhancing productivity.General Electric:

GE leverages its industrial IoT solutions to drive efficiencies across manufacturing and energy sectors, implementing IoT frameworks that enhance productivity.We're grateful to work with incredible clients.

FAQs

What is the market size of IoT Integration?

The IoT Integration market is projected to grow from $23.5 billion in 2023, with a robust CAGR of 12% leading to significant expansion by 2033. This growth is indicative of increasing adoption across various industries.

What are the key market players or companies in the IoT Integration industry?

Some key players in the IoT Integration market include Microsoft, IBM, Amazon Web Services, Google, Cisco, and Oracle. These companies offer various IoT solutions and are crucial in shaping market dynamics through innovation and strategic partnerships.

What are the primary factors driving the growth in the IoT Integration industry?

Key factors driving growth include rising demand for smart devices, increasing automation in industries, enhanced data analytics capabilities, and significant investment in IoT technology across sectors like healthcare, manufacturing, and smart cities.

Which region is the fastest Growing in the IoT Integration?

North America is currently the fastest-growing region in the IoT Integration market, projected to expand from $9.07 billion in 2023 to $29.51 billion by 2033, driven by technological advancements and investments in IoT infrastructure.

Does ConsaInsights provide customized market report data for the IoT Integration industry?

Yes, ConsaInsights offers tailored market research reports for the IoT Integration industry, designed to meet the specific needs of businesses. These customized reports provide insights on market trends, forecasts, and competitive landscapes.

What deliverables can I expect from this IoT Integration market research project?

The IoT Integration market research project will deliver comprehensive reports, data analytics, strategic recommendations, competitive analysis, and market forecasts to help businesses make informed decisions based on current and future trends.

What are the market trends of IoT Integration?

Current IoT Integration trends include increased adoption of cloud solutions, growth in edge computing, enhanced cybersecurity measures, and a shift toward sustainable IoT practices. The market shows significant potential in sectors like smart cities and healthcare IoT.