Iot Middleware Market Report

Published Date: 31 January 2026 | Report Code: iot-middleware

Iot Middleware Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the IoT Middleware market from 2023 to 2033, detailing market size, growth forecasts, technological trends, regional analysis, and key players shaping the industry.

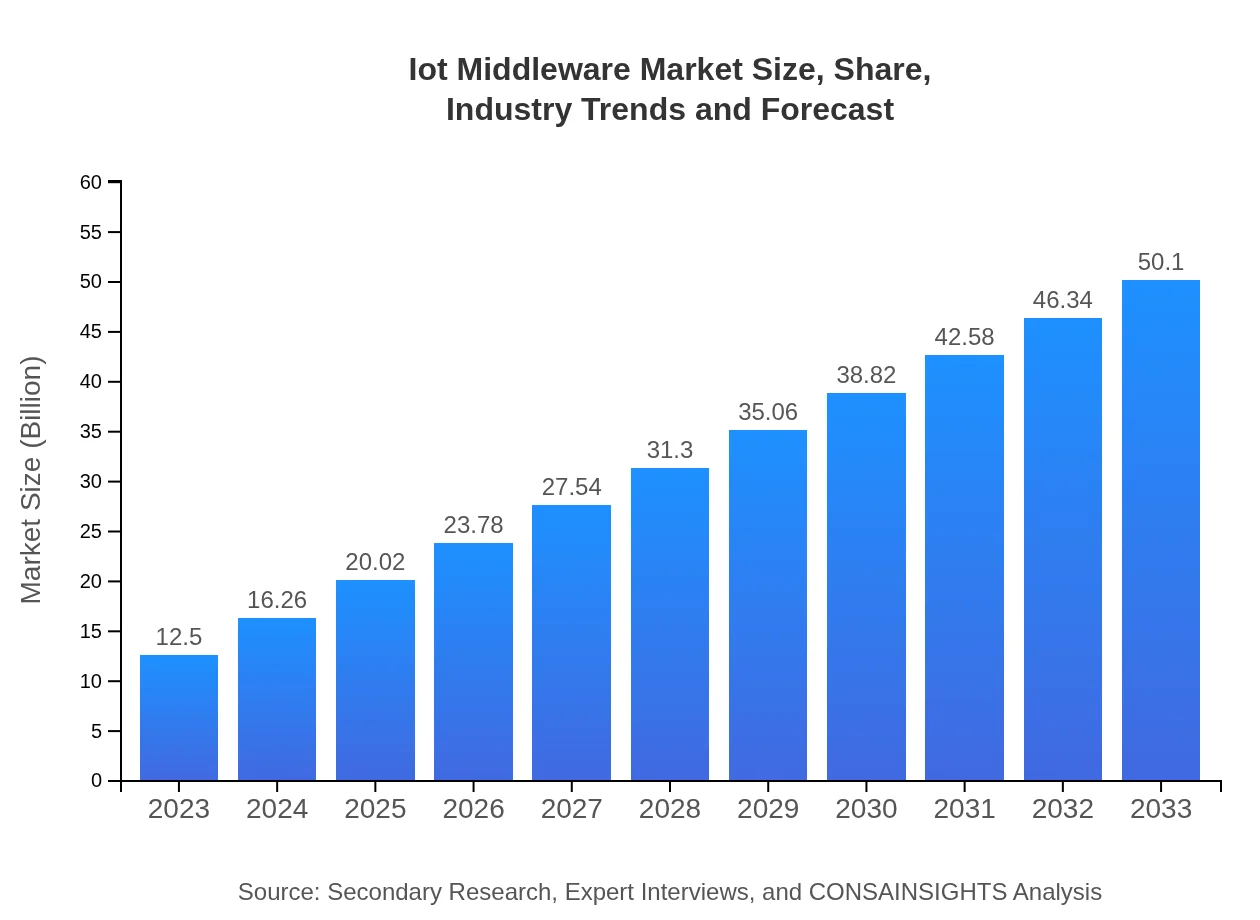

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 14.2% |

| 2033 Market Size | $50.10 Billion |

| Top Companies | PTC Inc., IBM Corporation, Cisco Systems, Inc., Microsoft Corporation, Amazon Web Services (AWS) |

| Last Modified Date | 31 January 2026 |

Iot Middleware Market Overview

Customize Iot Middleware Market Report market research report

- ✔ Get in-depth analysis of Iot Middleware market size, growth, and forecasts.

- ✔ Understand Iot Middleware's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Iot Middleware

What is the Market Size & CAGR of IoT Middleware market in 2023?

IoT Middleware Industry Analysis

IoT Middleware Market Segmentation and Scope

Tell us your focus area and get a customized research report.

IoT Middleware Market Analysis Report by Region

Europe Iot Middleware Market Report:

Europe’s IoT Middleware market stood at $3.41 billion in 2023, expected to expand to $13.66 billion by 2033. Key markets include Germany, France, and the UK, driven by stringent regulations on energy efficiency and sustainability. The European market is characterized by a focus on industrial IoT applications and strong connectivity standards but faces challenges related to data privacy and compliance.Asia Pacific Iot Middleware Market Report:

The Asia-Pacific region, with a market size of $2.68 billion in 2023, is projected to grow to $10.75 billion by 2033. The region is marked by rapid technological adoption and a burgeoning IoT ecosystem. Key markets include China and India, driven by substantial investments in smart city initiatives and industrial automation. However, challenges include varying regulatory frameworks and a need for standardized protocols.North America Iot Middleware Market Report:

North America holds a significant lead in the IoT Middleware market, starting at $4.38 billion in 2023 and forecasted to grow to $17.54 billion by 2033. The U.S. leads the region with robust investments in healthcare and smart home technologies, alongside strong government support for IoT initiatives. The region benefits from a mature technology landscape and high consumer awareness.South America Iot Middleware Market Report:

In South America, the IoT Middleware market is relatively nascent, valued at $0.32 billion in 2023, expected to reach $1.28 billion by 2033. Growth is primarily seen in Brazil and Argentina, propelled by increasing demand for smart agriculture and urban development solutions. Infrastructure challenges and slower adoption of advanced technologies remain notable hurdles.Middle East & Africa Iot Middleware Market Report:

The Middle East and Africa market is estimated to commence at $1.71 billion in 2023, growing to $6.87 billion by 2033. Significant growth drivers include smart city projects and investment in digital infrastructure across countries like UAE and South Africa. Nonetheless, the region is challenged by limited technological infrastructure and regional disparities in IoT adoption.Tell us your focus area and get a customized research report.

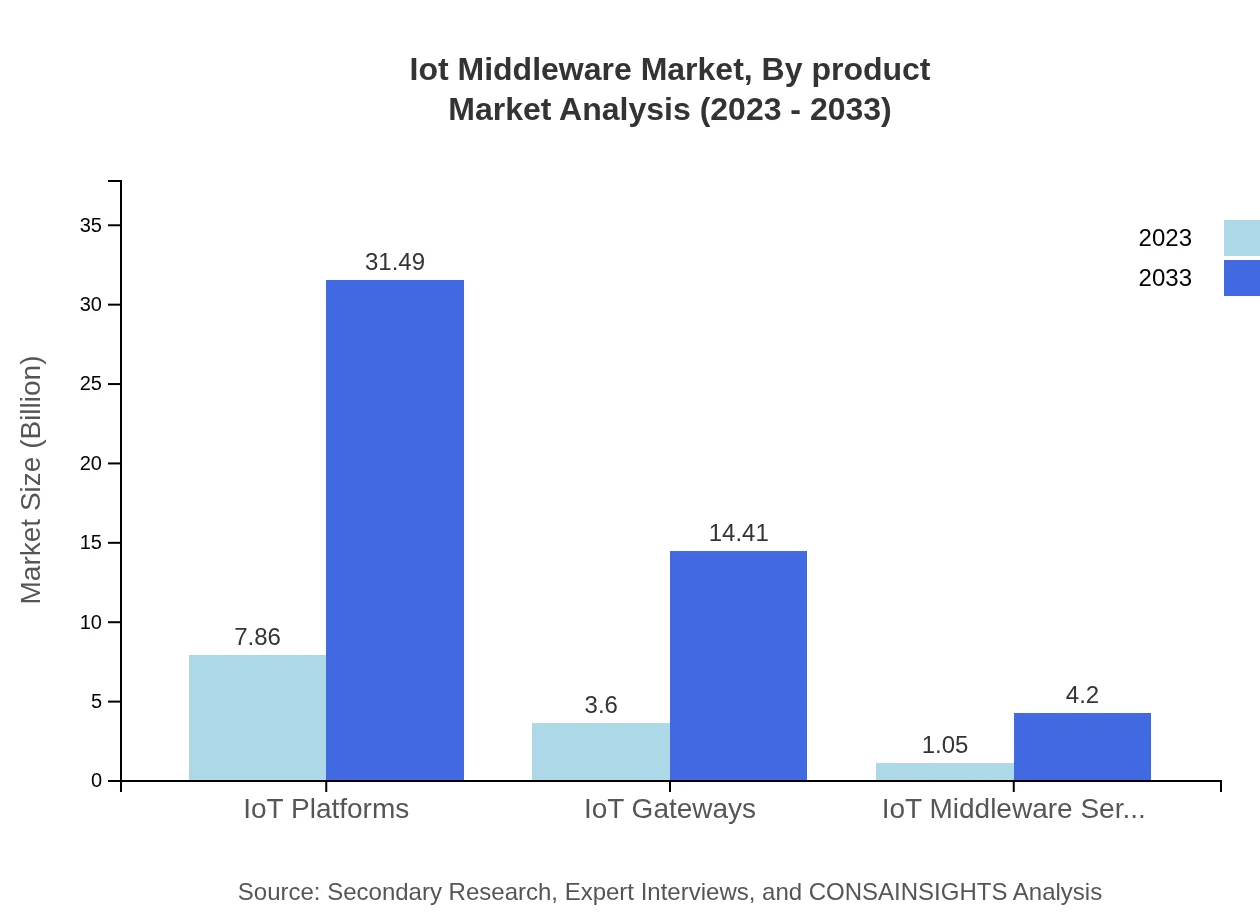

Iot Middleware Market Analysis By Product

The IoT Middleware market is dominated by various product types, with IoT platforms leading at a market size of $7.86 billion in 2023, projected to reach $31.49 billion by 2033. IoT gateways follow closely, projected to grow from $3.60 billion to $14.41 billion. Middleware services and monitoring tools, crucial for data flow management and analyzing performance, continue to expand, illustrating the necessity of adaptable infrastructure in the evolving digital landscape.

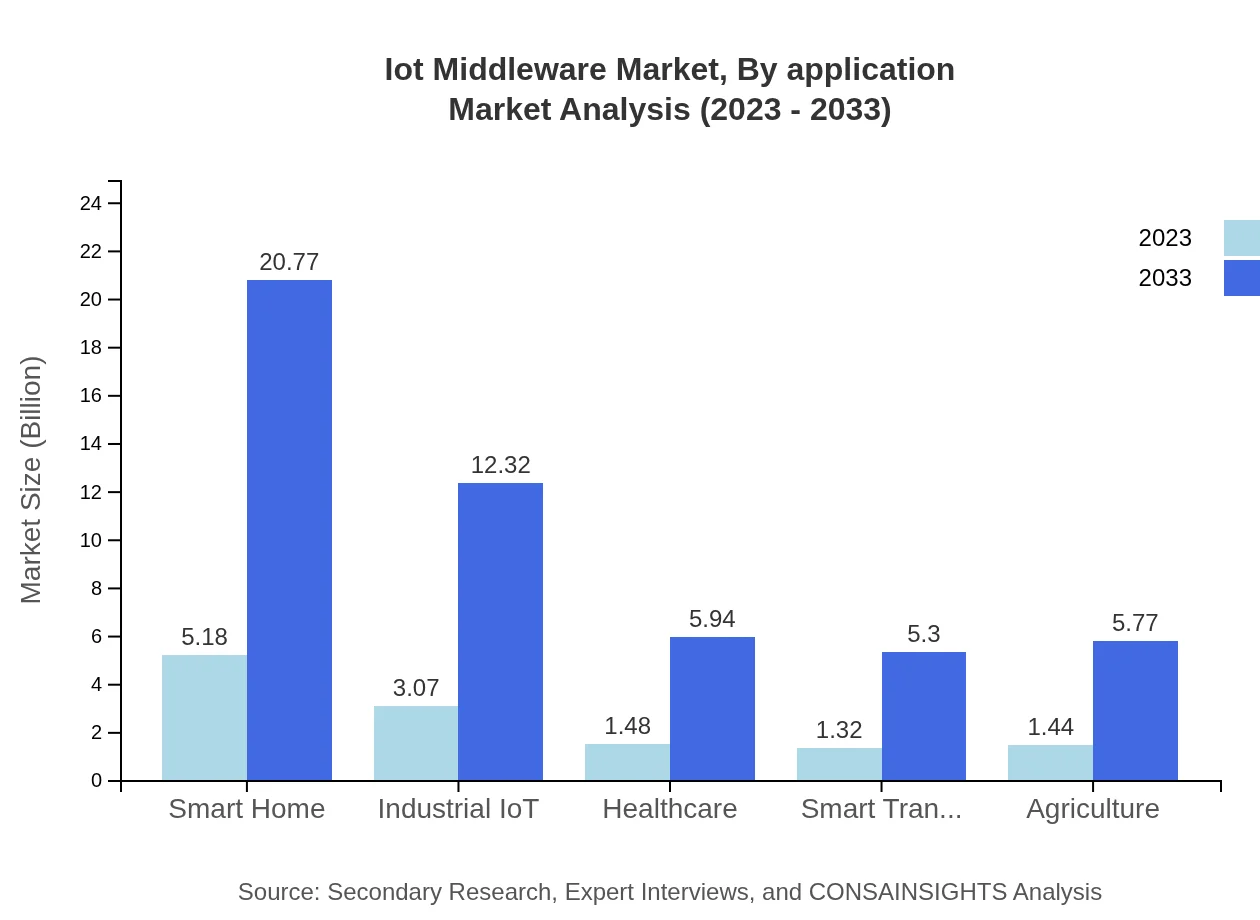

Iot Middleware Market Analysis By Application

Applications in sectors such as smart homes and industrial IoT contribute significantly to market growth. The smart home segment enjoys a robust market share of 41.46% in 2023, increasing to 41.46% by 2033. Industrial IoT applications are expected to see substantial growth fueled by advancements in automation and predictive maintenance, highlighting the need for effective middleware solutions to integrate IoT ecosystems.

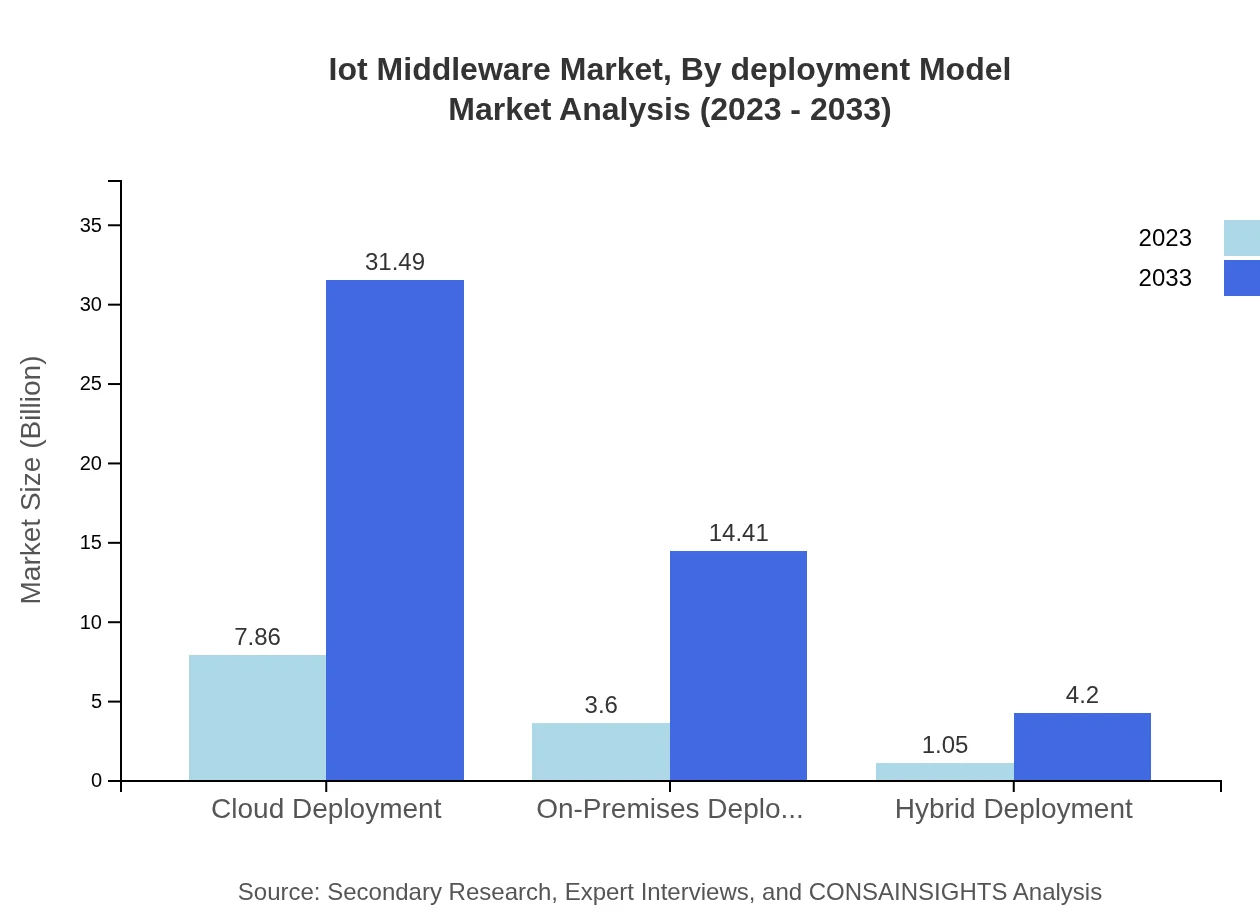

Iot Middleware Market Analysis By Deployment Model

The IoT Middleware deployment model comprises cloud, on-premises, and hybrid solutions. The cloud deployment model leads with a significant share of 62.86%, capitalizing on the flexibility and scalability it offers businesses. In contrast, on-premises solutions, though smaller at 28.76%, still appeal to organizations with stringent security requirements, while hybrid models are on the rise due to their balanced approach to accessibility and control.

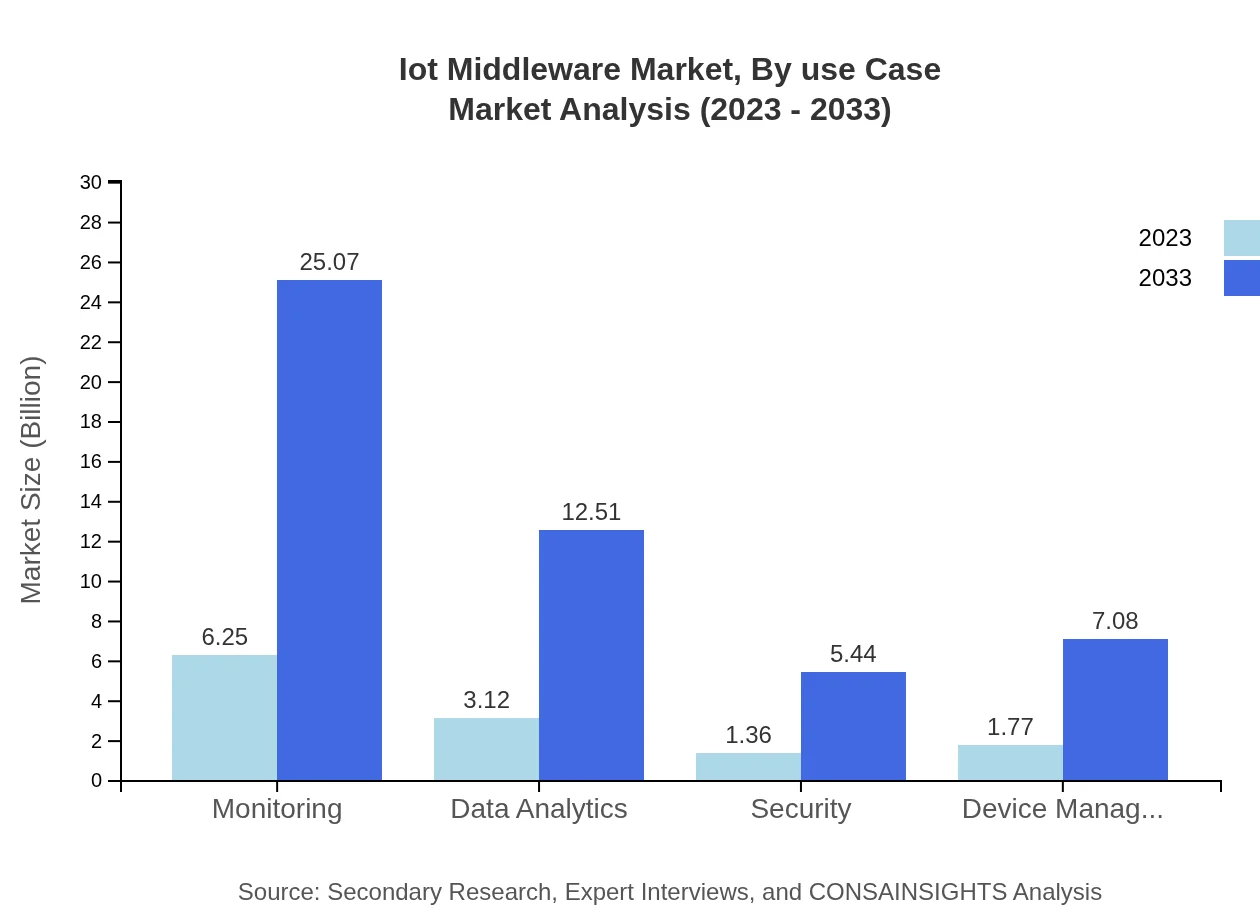

Iot Middleware Market Analysis By Use Case

Various use cases within the IoT Middleware ecosystem highlight specific demands across sectors. Monitoring use cases account for a sizeable portion of the market, reflecting critical needs in real-time data processing, while data analytics is also a fast-growing segment that facilitates decision-making. Security and device management use cases gain traction as organizations increasingly prioritize the safety and efficiency of their IoT deployments.

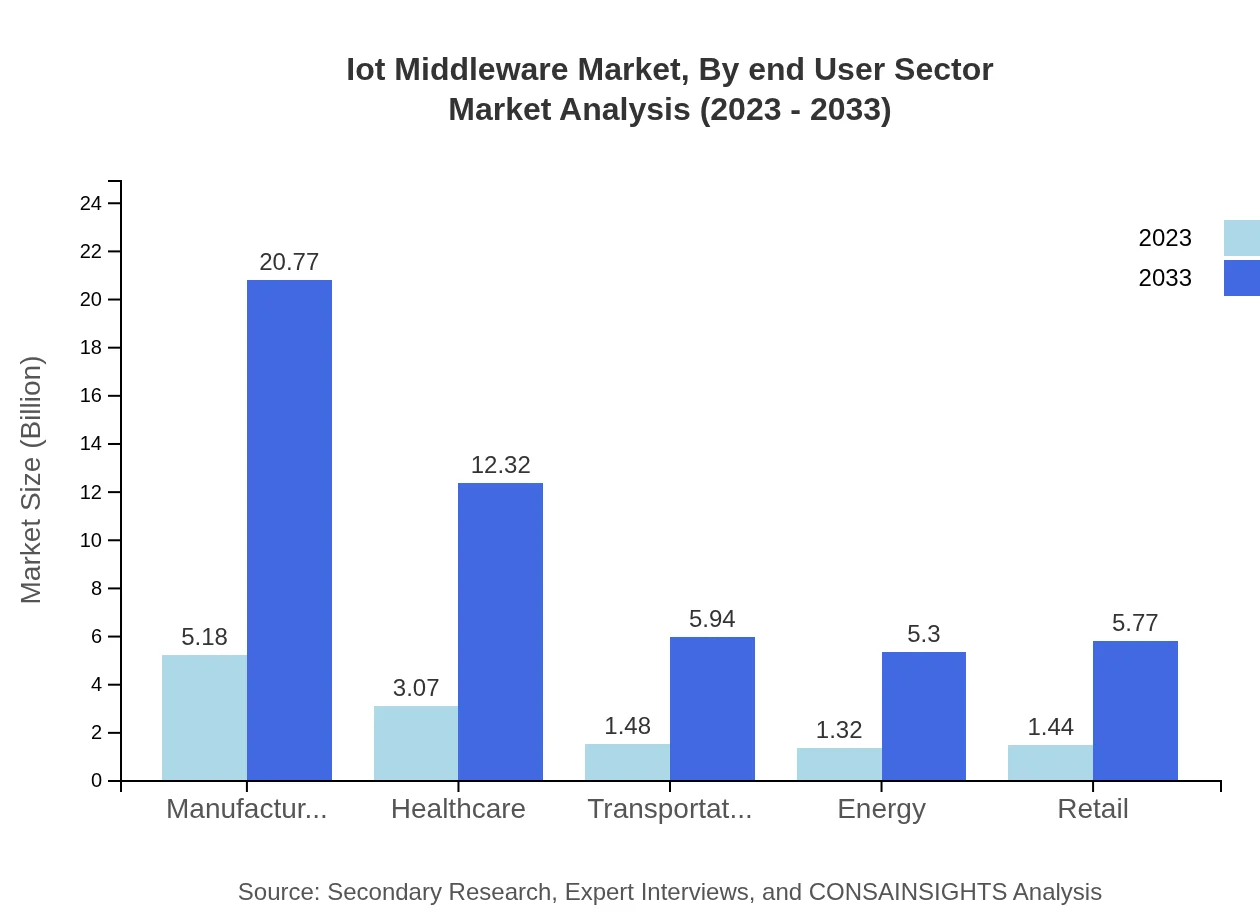

Iot Middleware Market Analysis By End User Sector

Key end-user sectors for the IoT Middleware market include healthcare, manufacturing, transportation, and retail. Manufacturing leads with a market share of 41.46% in 2023, continuously investing in IoT technologies for enhanced operational insights. The rise of smart retail solutions and adaptive healthcare governs shifts in market dynamics, necessitating tailored middleware solutions that align with sector-specific needs and regulations.

Iot Middleware Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in IoT Middleware Industry

PTC Inc.:

A leader in IoT platform solutions, PTC specializes in developing software to enhance industrial innovation and digital transformation strategies through IoT technologies.IBM Corporation:

IBM offers a robust suite of IoT Middleware solutions, including a widely recognized IoT platform leveraging AI and cloud technologies to optimize device interoperability and data management.Cisco Systems, Inc.:

Cisco provides a comprehensive IoT solution portfolio, focusing on secure connectivity and innovative IoT gateways designed to integrate seamlessly across various industries.Microsoft Corporation:

Through Azure IoT, Microsoft delivers a powerful cloud platform that allows businesses to effectively connect, manage, and analyze their IoT assets.Amazon Web Services (AWS):

AWS leads with its cloud services that support a plethora of applications, streamlining IoT ecosystem functionalities through scalable middleware solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of IoT Middleware?

The IoT Middleware market is projected to reach a size of approximately $12.5 billion by 2033, driven by a significant compound annual growth rate (CAGR) of 14.2%. This growth underscores the increasing demand for IoT applications across industries.

What are the key market players or companies in the IoT Middleware industry?

Key players in the IoT Middleware industry include established tech companies and startups focused on IoT solutions. These typically encompass firms that provide platforms for device management, data analytics, security solutions, and integration services that drive IoT innovation.

What are the primary factors driving the growth in the IoT Middleware industry?

Growth in the IoT Middleware industry is primarily driven by advancements in technology, increased adoption of IoT devices by various sectors, and the demand for efficient data management solutions. Businesses seek integrated middleware to enhance connectivity, data utilization, and operational efficiency.

Which region is the fastest Growing in the IoT Middleware?

The fastest-growing region in the IoT Middleware market is North America, projected to expand from $4.38 billion in 2023 to $17.54 billion by 2033. This growth is fueled by a robust technological ecosystem and significant investment in IoT infrastructure.

Does ConsaInsights provide customized market report data for the IoT Middleware industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the IoT Middleware industry. This includes comprehensive analysis, segmentation details, and forecasts that aid businesses in making informed strategic decisions.

What deliverables can I expect from this IoT Middleware market research project?

Deliverables from the IoT Middleware market research project include detailed market analysis reports, trend identification, growth forecasts, competitive landscape assessments, and tailored recommendations to support strategic planning and decision-making.

What are the market trends of IoT Middleware?

Key trends in the IoT Middleware market include the growing shift towards cloud-based solutions, increased security focus, and advancements in machine learning and data analytics technologies. Businesses are also exploring hybrid deployment models to enhance flexibility and scalability.