Iot Node And Gateway Market Report

Published Date: 31 January 2026 | Report Code: iot-node-and-gateway

Iot Node And Gateway Market Size, Share, Industry Trends and Forecast to 2033

This market report provides a comprehensive analysis of the IoT Node and Gateway sector, covering market size, trends, and forecasts from 2023 to 2033. Insights include segmentation by region, technology, product types, and leading players in the industry.

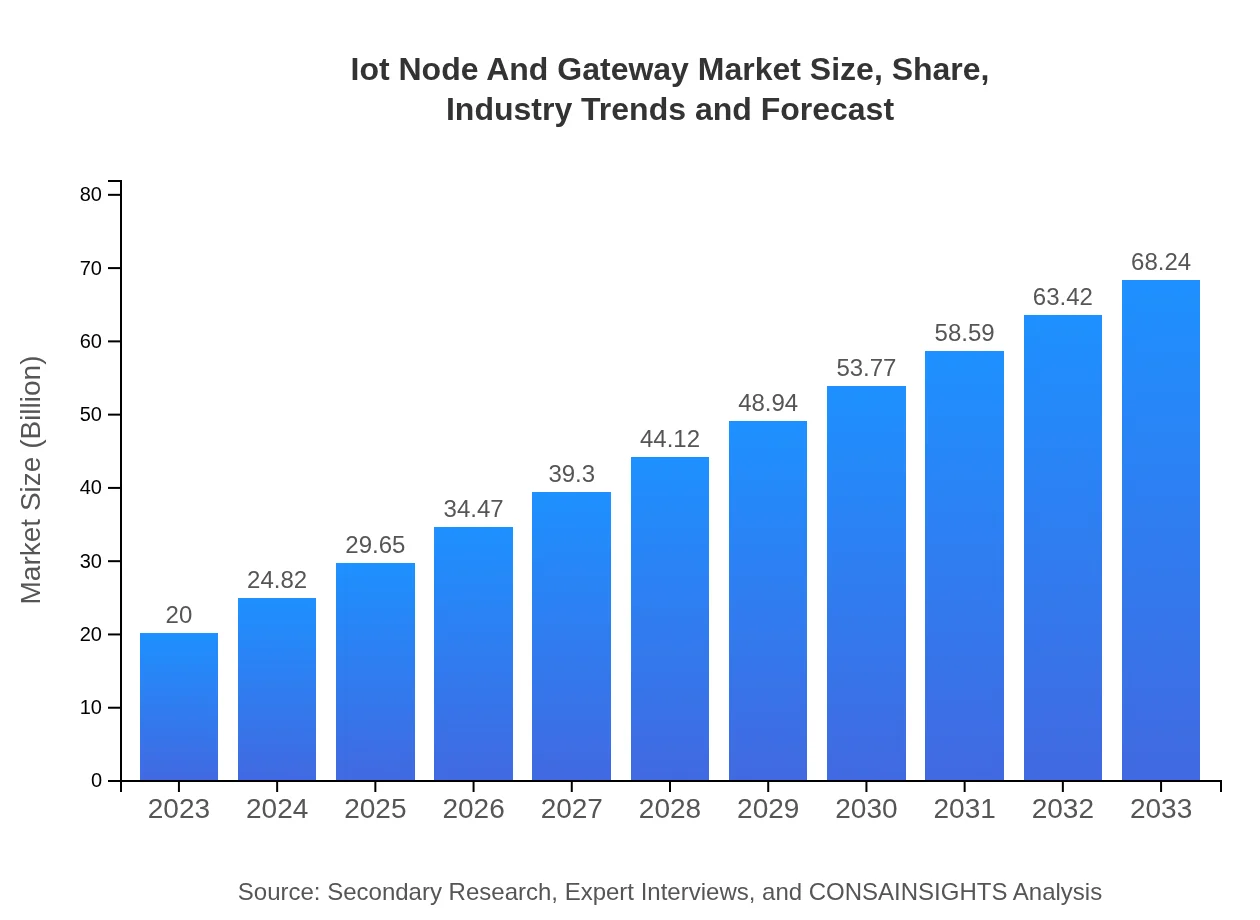

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $20.00 Billion |

| CAGR (2023-2033) | 12.5% |

| 2033 Market Size | $68.24 Billion |

| Top Companies | Cisco Systems, Inc., IBM Corporation, General Electric Company, Oracle Corporation, Siemens AG |

| Last Modified Date | 31 January 2026 |

Iot Node And Gateway Market Overview

Customize Iot Node And Gateway Market Report market research report

- ✔ Get in-depth analysis of Iot Node And Gateway market size, growth, and forecasts.

- ✔ Understand Iot Node And Gateway's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Iot Node And Gateway

What is the Market Size & CAGR of IoT Node And Gateway market in 2023?

IoT Node And Gateway Industry Analysis

IoT Node And Gateway Market Segmentation and Scope

Tell us your focus area and get a customized research report.

IoT Node And Gateway Market Analysis Report by Region

Europe Iot Node And Gateway Market Report:

Europe's market is estimated to grow from $6.28 billion in 2023 to $21.43 billion by 2033, driven by increasing government initiatives for digitalization and sustainability. Industries such as automotive, healthcare, and energy are expected to contribute significantly to IoT solutions adoption and gateway deployments.Asia Pacific Iot Node And Gateway Market Report:

In the Asia Pacific region, the IoT Node and Gateway market is expected to experience significant growth, with a market size projected to expand from $3.74 billion in 2023 to $12.75 billion by 2033. The growth is fueled by rapid industrialization, government initiatives supporting smart city projects, and the increasing adoption of IoT applications across various sectors such as agriculture and manufacturing.North America Iot Node And Gateway Market Report:

North America dominates the IoT Node and Gateway market, with a sizeable market size anticipated to rise from $7.56 billion in 2023 to $25.79 billion by 2033. The region is characterized by significant technological advancements, a strong presence of leading IoT solution providers, and extensive investment in smart infrastructure.South America Iot Node And Gateway Market Report:

The South American market is gradually gaining traction, projected to grow from $0.94 billion in 2023 to $3.22 billion by 2033. Economic development and the growing investment in digital transformation strategies are expected to drive this growth, alongside increasing demand for IoT solutions in agriculture and urban development.Middle East & Africa Iot Node And Gateway Market Report:

The Middle East and Africa market is projected to grow from $1.48 billion in 2023 to $5.04 billion by 2033. Increasing urbanization and investment in smart city developments are primary catalysts for this growth, alongside the infrastructural advancements in telecommunication networks.Tell us your focus area and get a customized research report.

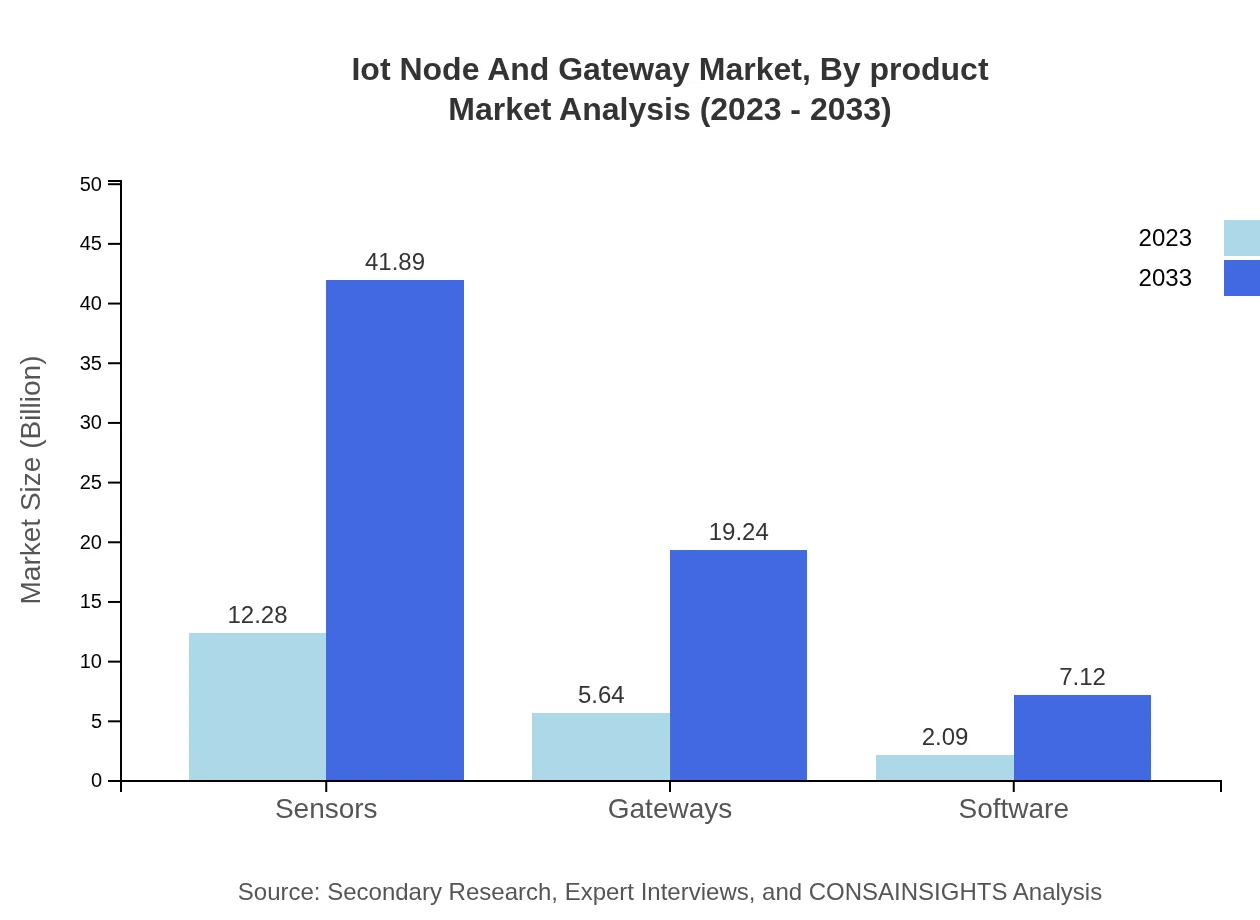

Iot Node And Gateway Market Analysis By Product

The IoT Node and Gateway market is dominated by sensor types, projected to grow from $12.28 billion in 2023 to $41.89 billion by 2033, holding a market share of 61.38%. Gateways are also significant, with a market size of $5.64 billion in 2023, expected to reach $19.24 billion by 2033, capturing 28.19% of the market. Software solutions hold a smaller share but are expected to grow substantially, from $2.09 billion to $7.12 billion, representing 10.43% market share.

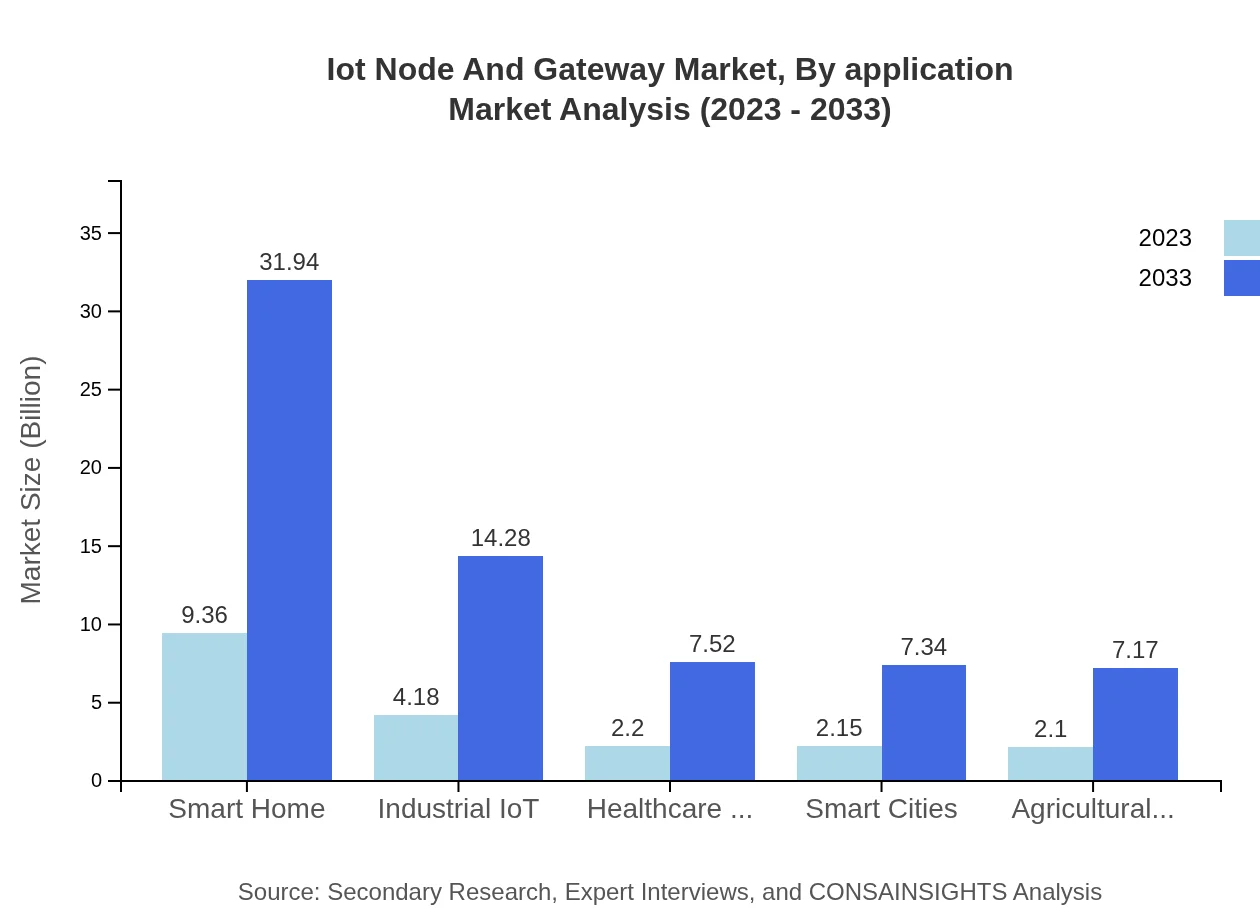

Iot Node And Gateway Market Analysis By Application

The industrial IoT segment captures a notable portion of the market, growing from $4.18 billion in 2023 to $14.28 billion by 2033, holding a 20.92% market share. Smart homes also represent a significant application area, with a market size expected to grow from $9.36 billion to $31.94 billion, accounting for 46.81% market share. Other key applications include transportation and logistics, healthcare IoT, and smart cities.

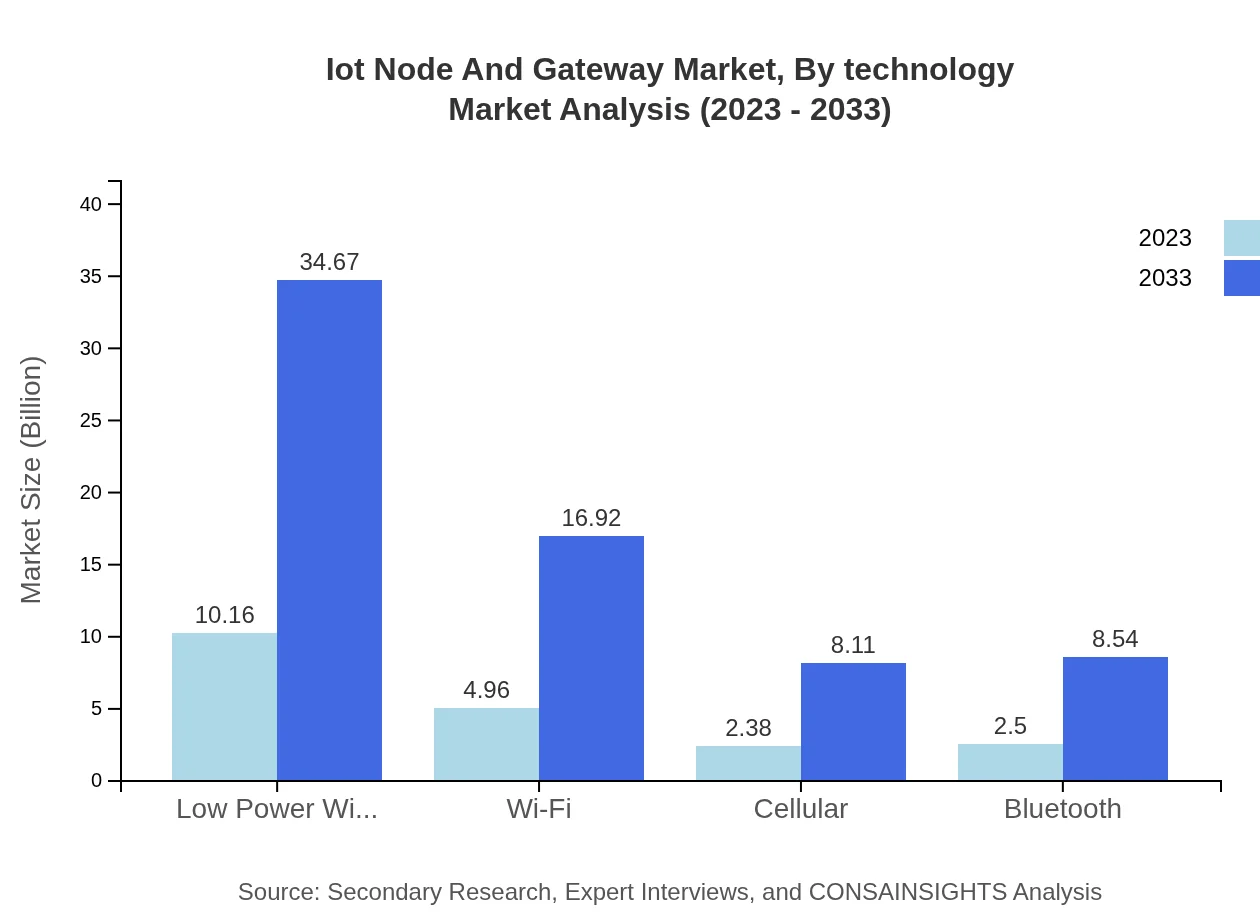

Iot Node And Gateway Market Analysis By Technology

Key technologies in the IoT Node and Gateway market include LPWAN, which holds the largest market size at $10.16 billion in 2023 with a growth projection to $34.67 billion by 2033 (50.8% market share). Wi-Fi technology also plays a major role, expanding from $4.96 billion to $16.92 billion, constituting a 24.8% market share. Emerging technologies like cellular and Bluetooth also hold significance, with projected shares of 11.89% and 12.51%, respectively.

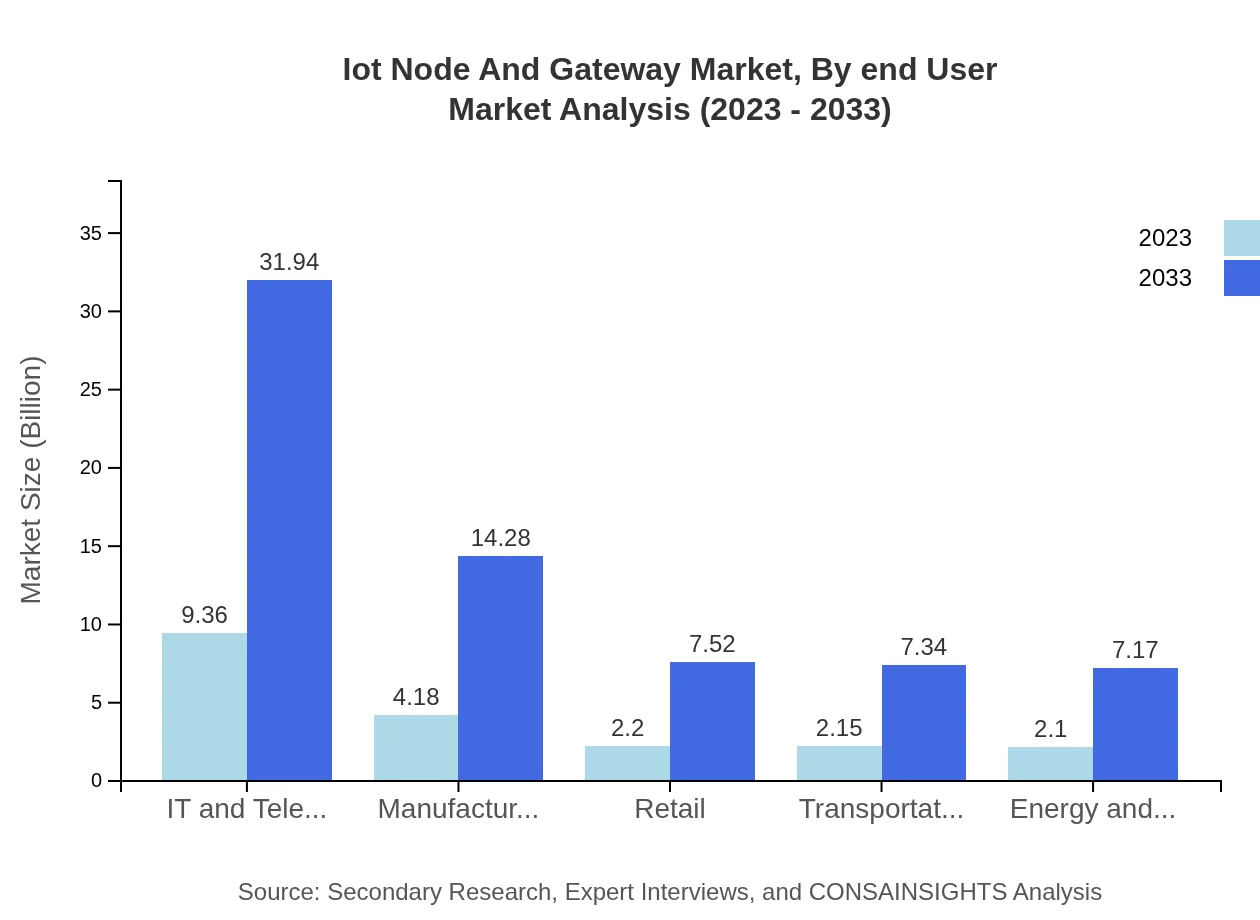

Iot Node And Gateway Market Analysis By End User

The IT and Telecom sector is the leading end-user, with a market size of $9.36 billion in 2023 and expected to grow to $31.94 billion by 2033 (46.81% market share). Manufacturing follows suit, with projected growth from $4.18 billion to $14.28 billion. Other notable sectors include smart cities and energy utilities.

IoT Node And Gateway Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in IoT Node And Gateway Industry

Cisco Systems, Inc.:

A leader in networking technology, Cisco provides comprehensive IoT connectivity, security, and data management solutions tailored for enterprise needs.IBM Corporation:

IBM focuses on cloud-based IoT solutions, offering advanced analytics and AI tools to enhance decision-making and operational efficiency across industries.General Electric Company:

GE leverages its industrial expertise to provide IoT solutions in sectors like energy and manufacturing, driving efficiency and optimization through data insights.Oracle Corporation:

Oracle offers robust cloud services and IoT applications, enabling organizations to integrate data from diverse sources and harness real-time analytics.Siemens AG:

Siemens provides end-to-end IoT solutions specifically for industries, enhancing automation, data analysis, and connectivity within manufacturing and infrastructure.We're grateful to work with incredible clients.

FAQs

What is the market size of IoT Node and Gateway?

The IoT Node and Gateway market is projected to grow to $20 billion by 2033, with a compound annual growth rate (CAGR) of 12.5%. This growth reflects the increasing demand for IoT solutions across various sectors.

What are the key market players or companies in this IoT Node and Gateway industry?

Key players include major technology firms such as Cisco Systems, IBM, Amazon Web Services, and Microsoft, which dominate the landscape through innovative IoT solutions and extensive market reach.

What are the primary factors driving the growth in the IoT Node and Gateway industry?

The primary drivers include the rising adoption of IoT devices in various sectors, increased demand for automation, enhanced connectivity solutions, and advancements in cloud computing technology facilitating better data processing.

Which region is the fastest Growing in the IoT Node and Gateway?

The fastest-growing region is expected to be North America, with a market projection of $25.79 billion by 2033, driven by technological advancements and significant investments in IoT infrastructure.

Does ConsaInsights provide customized market report data for the IoT Node and Gateway industry?

Yes, ConsaInsights offers customized market report data tailored to specific business needs within the IoT Node and Gateway industry, providing insights relevant to market dynamics and trends.

What deliverables can I expect from this IoT Node and Gateway market research project?

The deliverables include detailed market analysis reports, segment breakdowns, competitive landscape assessments, and forecasts, providing actionable insights to guide strategic decision-making.

What are the market trends of IoT Node and Gateway?

Market trends indicate a surge in demand for low-power connectivity solutions like LPWAN while focusing on security enhancements and integration of AI in IoT for improved data analytics.