Ip Multimedia Subsystem Ims Services Market Report

Published Date: 31 January 2026 | Report Code: ip-multimedia-subsystem-ims-services

Ip Multimedia Subsystem Ims Services Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Ip Multimedia Subsystem (IMS) services market, highlighting trends, size, growth forecasts, and consumer behaviors from 2023 to 2033.

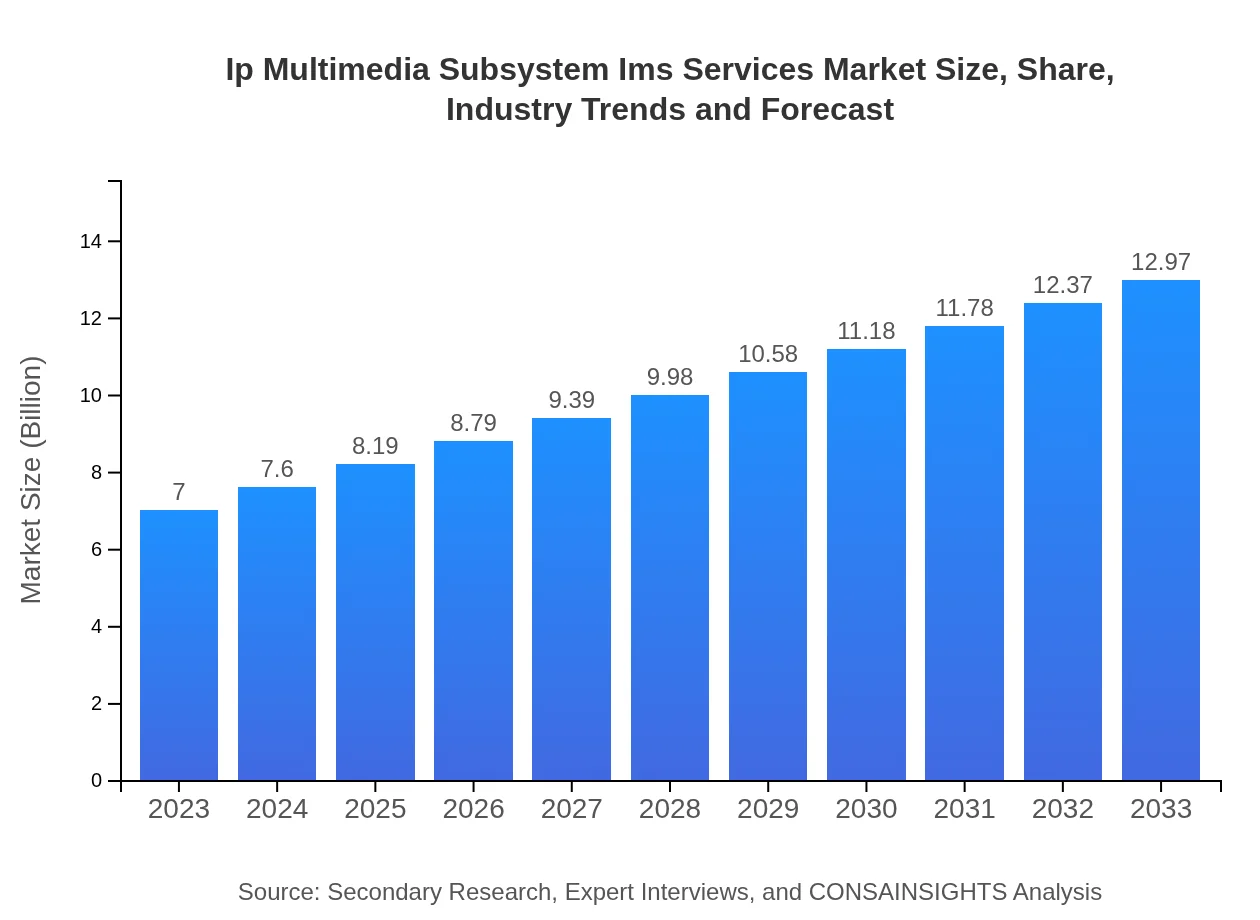

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $7.00 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $12.97 Billion |

| Top Companies | Cisco Systems, Inc., Ericsson , Nokia Corporation, Huawei Technologies Co., Ltd. |

| Last Modified Date | 31 January 2026 |

Ip Multimedia Subsystem Ims Services Market Overview

Customize Ip Multimedia Subsystem Ims Services Market Report market research report

- ✔ Get in-depth analysis of Ip Multimedia Subsystem Ims Services market size, growth, and forecasts.

- ✔ Understand Ip Multimedia Subsystem Ims Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ip Multimedia Subsystem Ims Services

What is the Market Size & CAGR of Ip Multimedia Subsystem Ims Services market in 2023?

Ip Multimedia Subsystem Ims Services Industry Analysis

Ip Multimedia Subsystem Ims Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ip Multimedia Subsystem Ims Services Market Analysis Report by Region

Europe Ip Multimedia Subsystem Ims Services Market Report:

The European IMS services market is expected to grow from $2.08 billion in 2023 to $3.86 billion by 2033. The emphasis on regulatory compliance and service innovation among telecom operators has accelerated the adoption of IMS solutions across the region. Integration of IMS in various sectors aims to improve operational efficiency and customer experience.Asia Pacific Ip Multimedia Subsystem Ims Services Market Report:

The Asia-Pacific region is witnessing a surge in the adoption of IMS services, anticipated to grow from $1.31 billion in 2023 to $2.43 billion by 2033. This growth is fueled by increasing internet penetration, mobile subscriptions, and the demand for enhanced multimedia services in countries like China and India, which are leading the demand for advanced communication solutions.North America Ip Multimedia Subsystem Ims Services Market Report:

North America is poised to remain a significant market, with IMS services projected to grow from $2.57 billion in 2023 to $4.76 billion by 2033. The dominance of major telecom players and a high demand for advanced multimedia services are significant contributors to this expansion. Additionally, substantial investments in 5G technology will enhance the scope for IMS services.South America Ip Multimedia Subsystem Ims Services Market Report:

In South America, the IMS services market is expected to increase from $0.25 billion in 2023 to $0.46 billion in 2033. Factors such as the gradual digitization of industries and enhancements in telecom infrastructures are driving this growth, as operators implement IMS to provide superior service quality and integrated solutions.Middle East & Africa Ip Multimedia Subsystem Ims Services Market Report:

In the Middle East and Africa, the IMS market is anticipated to grow from $0.79 billion in 2023 to $1.46 billion by 2033. There is a growing recognition of the importance of quality communication services as businesses increasingly adopt digital tools. Enhanced connectivity and infrastructure improvements will propel demand for IMS services in this region.Tell us your focus area and get a customized research report.

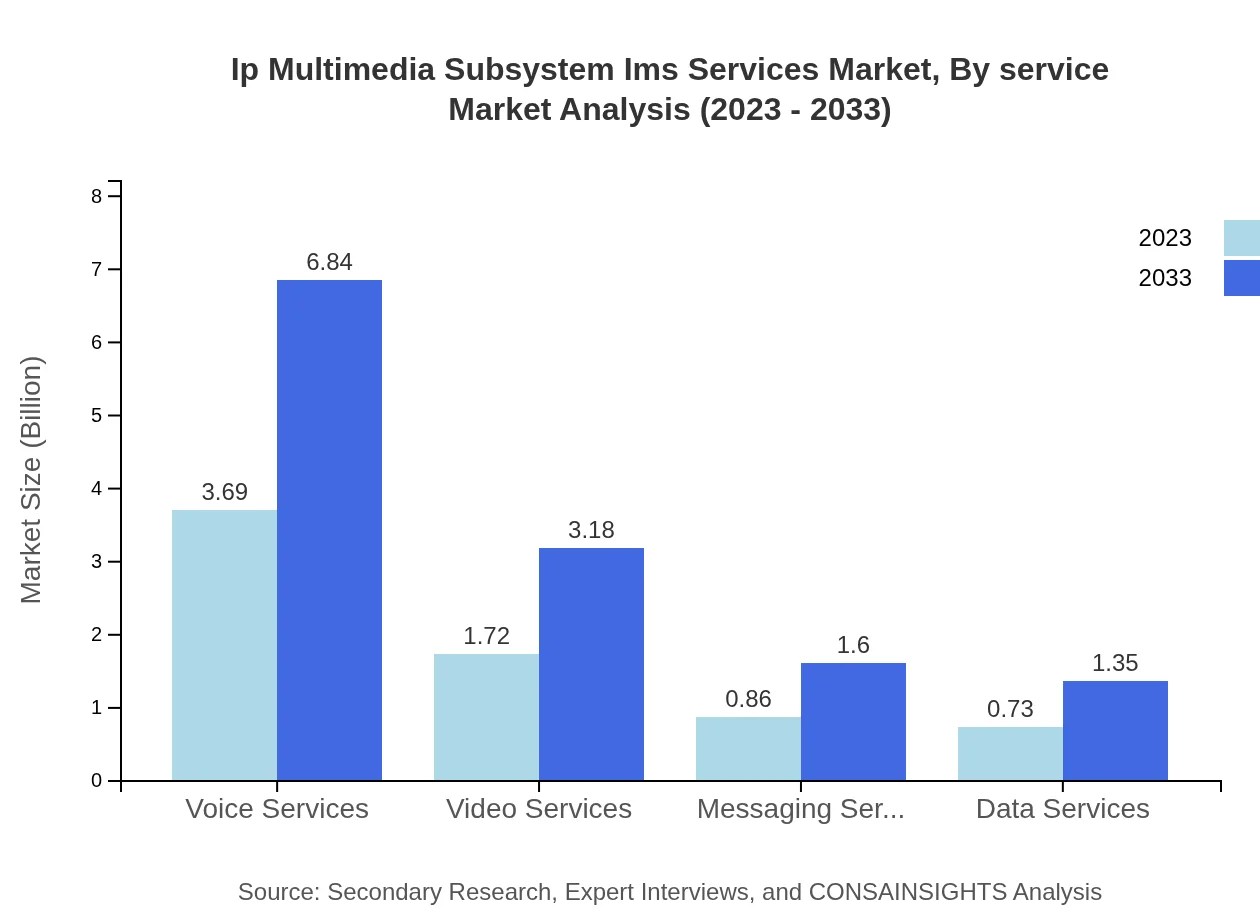

Ip Multimedia Subsystem Ims Services Market Analysis By Service

The services segment of the IMS market is largely driven by voice, video, and messaging services. In 2023, voice services dominate the market at $3.69 billion and are expected to reach $6.84 billion by 2033, maintaining a 52.73% market share throughout the decade. Video services, which currently represent $1.72 billion in 2023, are projected to double to $3.18 billion, while messaging services are forecasted to grow from $0.86 billion to $1.60 billion. The segment’s stability and growth highlight the continued significance of multimedia services in consumer and business communication.

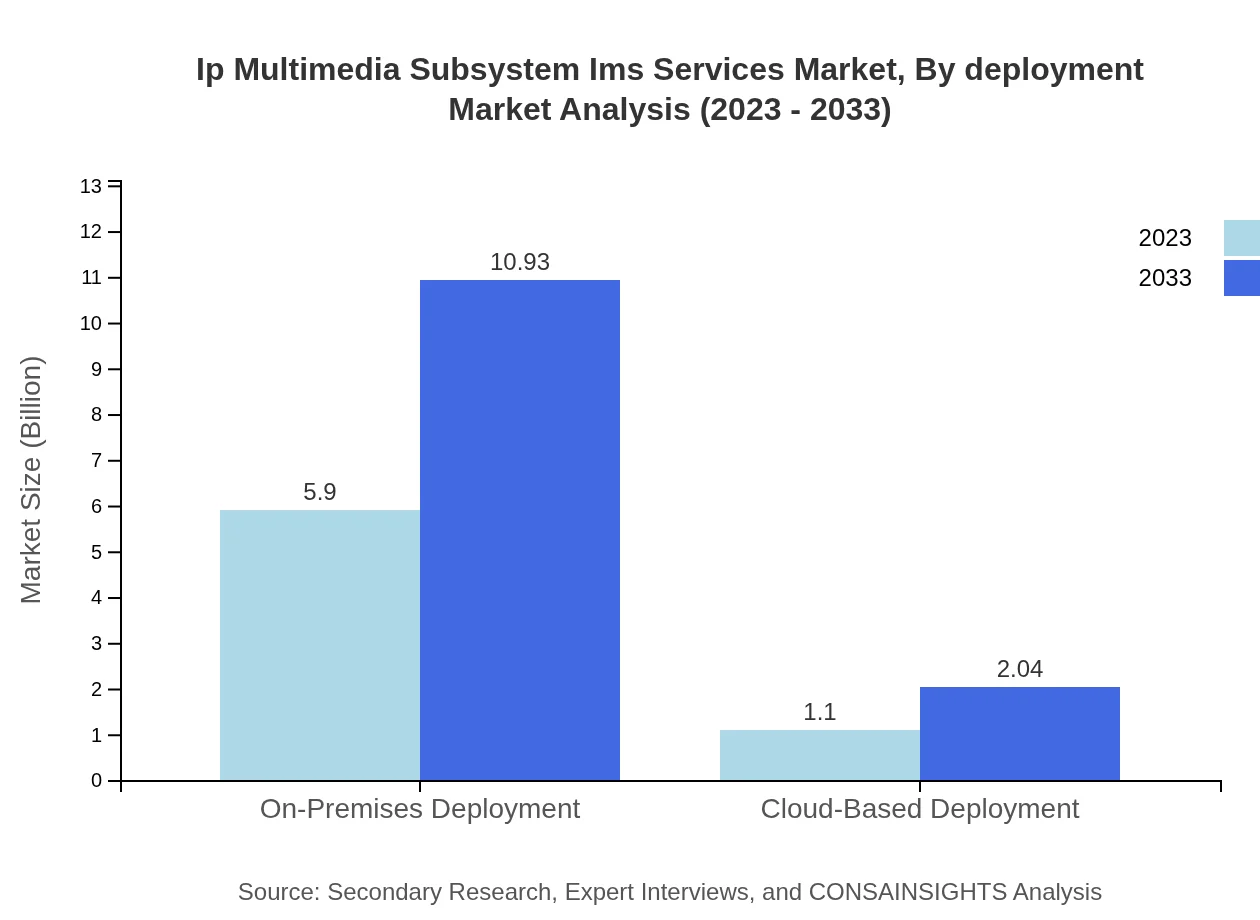

Ip Multimedia Subsystem Ims Services Market Analysis By Deployment

The deployment of IMS services can be categorized into on-premises and cloud-based solutions. In 2023, on-premises deployment leads with a market size of $5.90 billion, expected to expand to $10.93 billion by 2033, securing 84.24% market share. Cloud-based deployment, while smaller, is on the rise, projected to increase from $1.10 billion in 2023 to $2.04 billion, driven by the increased preference for flexible, scalable solutions among enterprises.

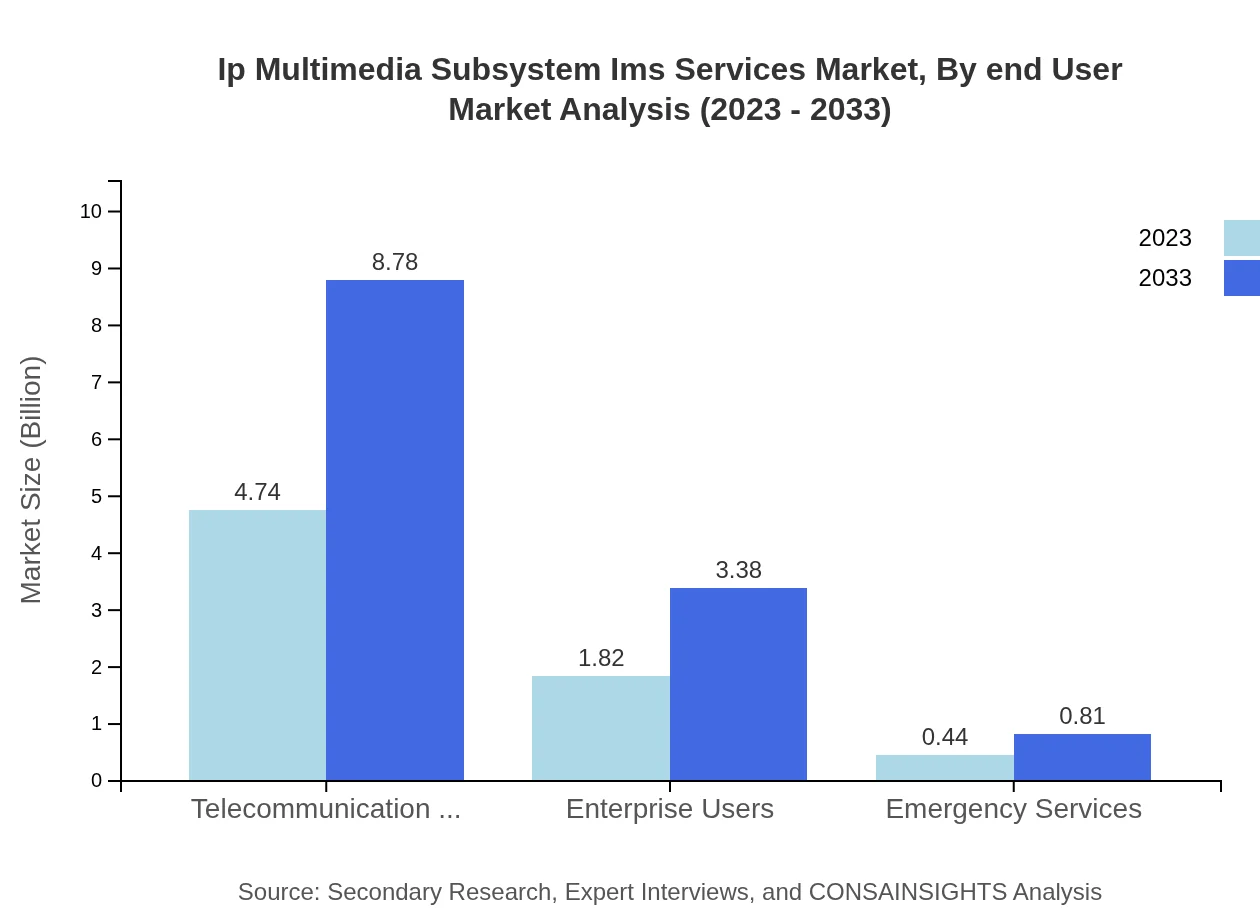

Ip Multimedia Subsystem Ims Services Market Analysis By End User

The end-user segment is largely divided into telecommunication operators, enterprises, and emergency services. Telecommunication operators hold the largest share at 67.67%, with a market size of $4.74 billion in 2023, growing to $8.78 billion in 2033. Enterprise users are also contributing significantly, growing from $1.82 billion to $3.38 billion, while emergency services remain a niche market growing from $0.44 to $0.81 billion. This segmentation underscores the critical role of IMS in enhancing service delivery across various sectors.

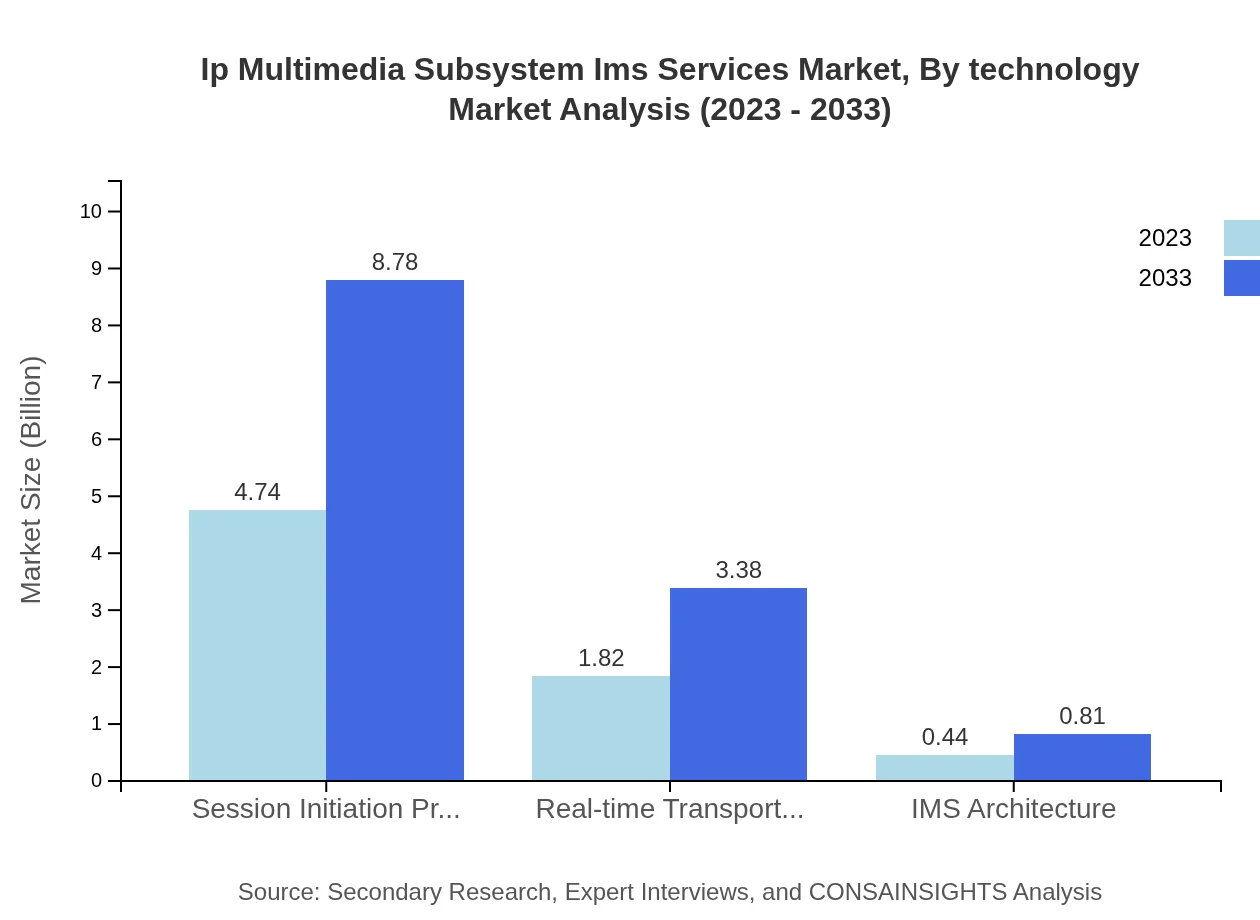

Ip Multimedia Subsystem Ims Services Market Analysis By Technology

Technologies driving the IMS market include Session Initiation Protocol (SIP) and Real-time Transport Protocol (RTP). SIP is projected to hold a market size of $4.74 billion in 2023, increasing to $8.78 billion by 2033. Meanwhile, RTP, significant for data transport, will grow from $1.82 billion to $3.38 billion. With enhanced protocol functionalities and greater integration capabilities, these technologies are pivotal for the efficient deployment and scalability of IMS services.

Ip Multimedia Subsystem Ims Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ip Multimedia Subsystem Ims Services Industry

Cisco Systems, Inc.:

Cisco is a global leader in networking and cybersecurity solutions, offering comprehensive IMS solutions that enhance the performance of telecom operators.Ericsson :

Ericsson is one of the foremost providers of cellular network infrastructure, leading the market in IMS services through innovative telecommunications technology.Nokia Corporation:

Nokia delivers advanced IMS portfolios aimed at enabling seamless multimedia communications across various sectors.Huawei Technologies Co., Ltd.:

Huawei is a multinational networking and telecommunications equipment company that significantly contributes to the IMS market with a wide range of solutions for service operators.We're grateful to work with incredible clients.

FAQs

What is the market size of ip Multimedia Subsystem Ims Services?

The IP Multimedia Subsystem (IMS) Services market is projected to reach approximately $7 billion by 2033, growing at a CAGR of 6.2% from its 2023 valuation. This expansion indicates increasing adoption and reliance on IMS technology across telecom networks.

What are the key market players or companies in this ip Multimedia Subsystem Ims Services industry?

Key players in the IMS Services market include major telecommunication companies, systems integrators, and technology providers such as Ericsson, Cisco, Nokia, and Huawei, which are at the forefront of driving innovation and service delivery.

What are the primary factors driving the growth in the ip Multimedia Subsystem Ims Services industry?

Growth in the IMS Services market is primarily driven by increasing demand for VoIP, video conferencing solutions, and enhanced multimedia experiences. Additionally, the transition to 5G networks significantly boosts the adoption of IMS services across industries.

Which region is the fastest Growing in the ip Multimedia Subsystem Ims Services?

The Asia Pacific region is the fastest-growing in the IMS Services market, expected to reach $2.43 billion by 2033, up from $1.31 billion in 2023, reflecting rapid technological advancements and investments in telecommunications infrastructure.

Does ConsaInsights provide customized market report data for the ip Multimedia Subsystem Ims Services industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients within the IMS Services industry, allowing them to obtain insights that align with their strategic objectives and market position.

What deliverables can I expect from this ip Multimedia Subsystem Ims Services market research project?

Deliverables from the IMS Services market research project include comprehensive market analysis reports, regional breakdowns, segment data, competitive landscape insights, and actionable strategic recommendations to guide decision-making processes.

What are the market trends of ip Multimedia Subsystem Ims Services?

Current trends in the IMS Services market include the rise of cloud-based deployment models, increasing integration of artificial intelligence for service optimization, and a shift towards enhancing user experiences through scalable and robust communication solutions.