Iqf Fruits And Vegetables Market Report

Published Date: 31 January 2026 | Report Code: iqf-fruits-and-vegetables

Iqf Fruits And Vegetables Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the IQF Fruits and Vegetables market, covering key insights, market size, segment performance, and future trends from 2023 to 2033.

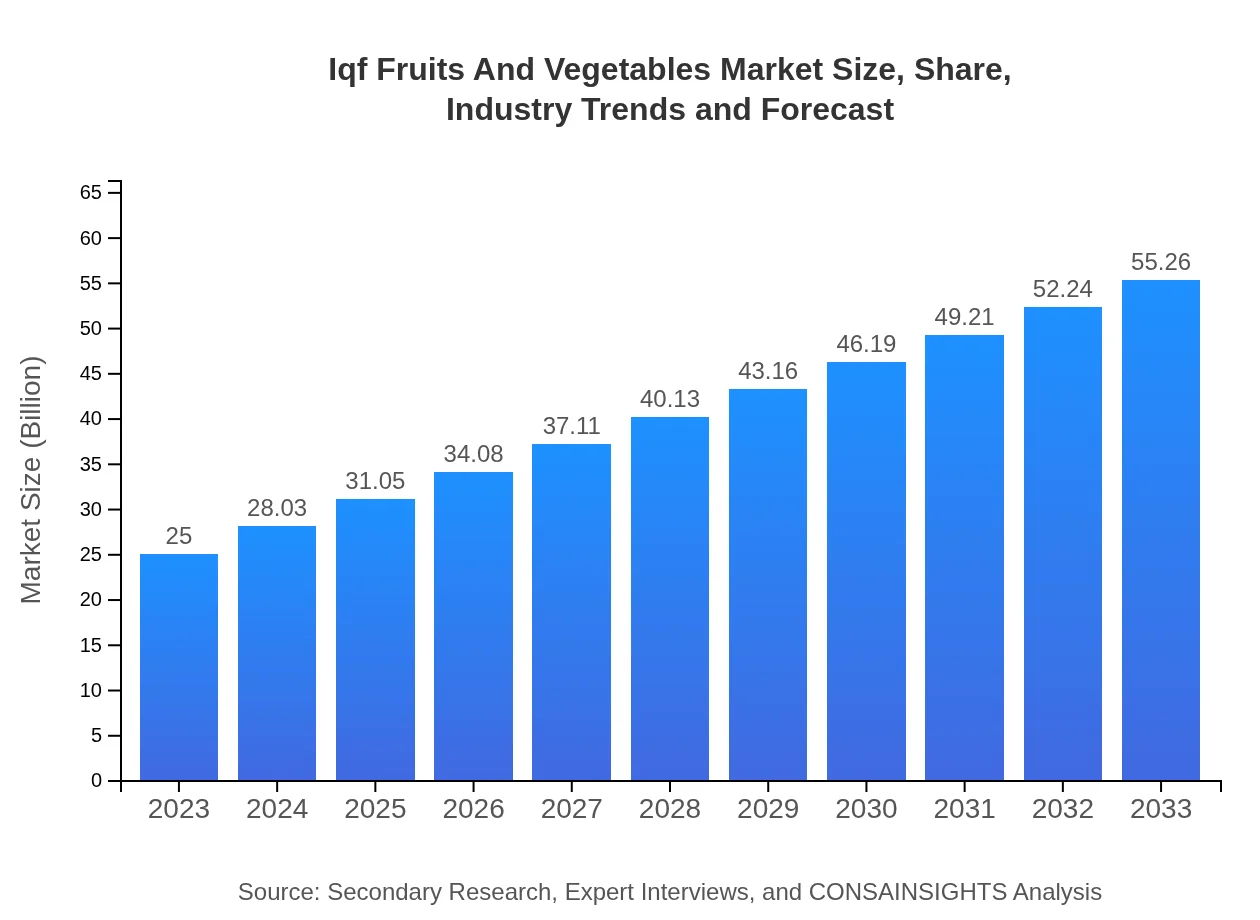

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.00 Billion |

| CAGR (2023-2033) | 8% |

| 2033 Market Size | $55.26 Billion |

| Top Companies | Bonduelle, Greenyard, Dole Food Company, McCain Foods |

| Last Modified Date | 31 January 2026 |

Iqf Fruits And Vegetables Market Overview

Customize Iqf Fruits And Vegetables Market Report market research report

- ✔ Get in-depth analysis of Iqf Fruits And Vegetables market size, growth, and forecasts.

- ✔ Understand Iqf Fruits And Vegetables's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Iqf Fruits And Vegetables

What is the Market Size & CAGR of Iqf Fruits And Vegetables market in 2023?

Iqf Fruits And Vegetables Industry Analysis

Iqf Fruits And Vegetables Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Iqf Fruits And Vegetables Market Analysis Report by Region

Europe Iqf Fruits And Vegetables Market Report:

Europe’s IQF Fruits and Vegetables market reached $8.68 billion in 2023, with expectations to grow to $19.19 billion by 2033. The growth is driven by increasing health awareness and the trend toward plant-based diets. Furthermore, stringent food quality regulations and the popularity of organic food products encourage investment in IQF technologies and distribution channels.Asia Pacific Iqf Fruits And Vegetables Market Report:

In 2023, the IQF Fruits and Vegetables market in Asia Pacific was valued at approximately $4.55 billion, with projections of reaching $10.06 billion by 2033. This significant growth is attributed to increasing urban populations and rising disposable income, leading to higher demand for frozen food products. Countries like China and India are driving the growth due to their large consumer bases and expanding retail networks. Technological advancements in IQF processes also contribute to enhancing the quality and appeal of frozen products.North America Iqf Fruits And Vegetables Market Report:

In North America, the market was valued at $8.53 billion in 2023 and is projected to reach $18.85 billion by 2033. The region's market is bolstered by busy lifestyles, which increase the demand for convenient meal solutions. The presence of key players and a well-developed cold chain logistics infrastructure further enhance market capabilities. In addition, health trends favoring frozen fruits and vegetables are solidifying their status among consumers.South America Iqf Fruits And Vegetables Market Report:

The South American IQF Fruits and Vegetables market was valued at $0.11 billion in 2023 and is expected to grow to $0.25 billion by 2033. The growth in this region is primarily driven by the increasing focus on food preservation methods and rising exports of frozen products. Additionally, an uptick in the food service sector in urban areas plays a key role in this expansion as consumers seek convenient and nutritious options.Middle East & Africa Iqf Fruits And Vegetables Market Report:

The IQF Fruits and Vegetables market in the Middle East and Africa was valued at $3.13 billion in 2023 and is anticipated to grow to $6.91 billion by 2033. Factors such as population growth, urbanization, and rising health consciousness contribute to this growth. The increasing availability of cold storage and logistics infrastructure is improving access to frozen products across the region.Tell us your focus area and get a customized research report.

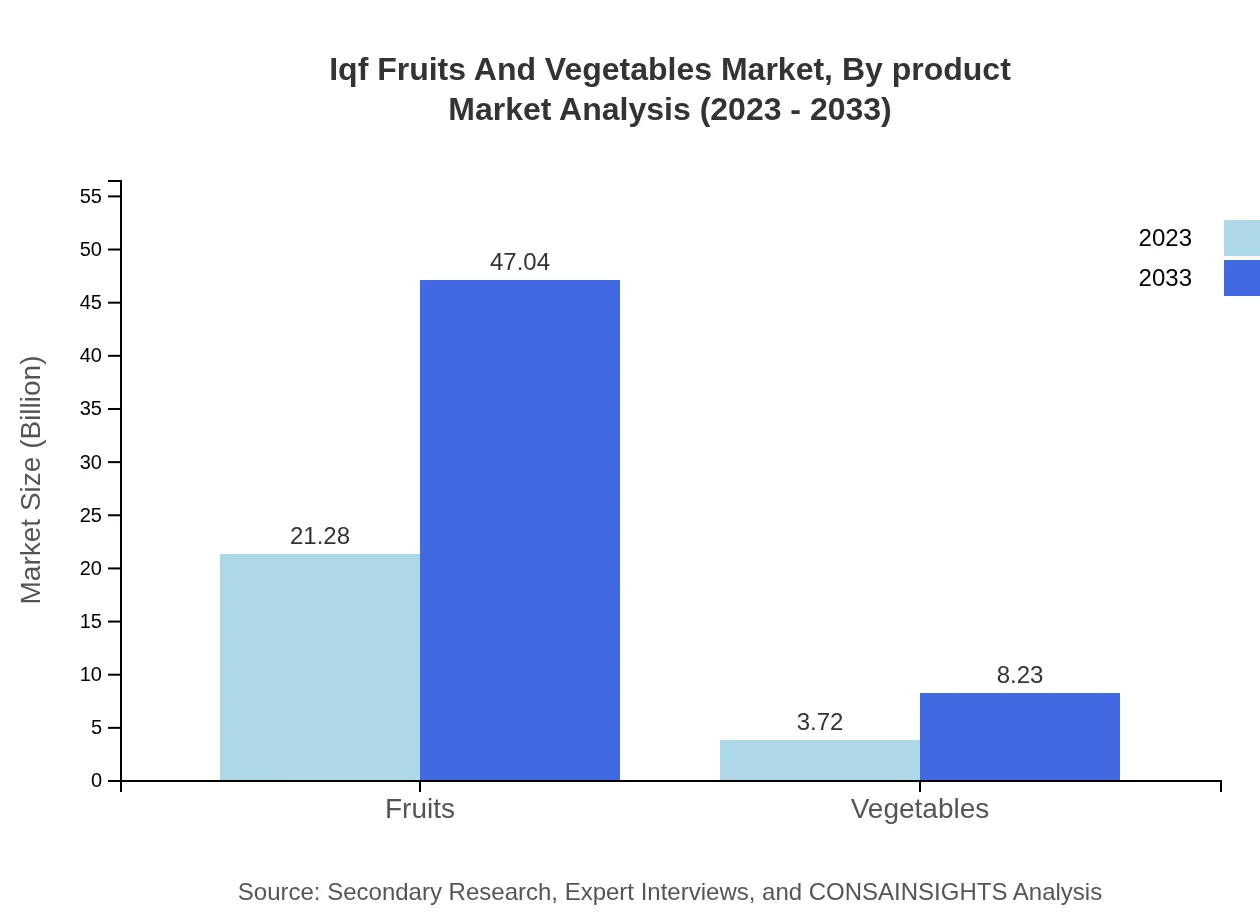

Iqf Fruits And Vegetables Market Analysis By Product

Within the IQF segment, fruits dominate the market, projected to grow from $21.28 billion in 2023 to $47.04 billion by 2033. This segment accounts for an 85.11% share, indicating strong consumer preference. Vegetables, though smaller, show considerable growth potential, increasing from $3.72 billion to $8.23 billion. Market dynamics suggest a focus on health and nutrition drives the popularity of IQF fruits propelled by their retention of taste and nutritional benefits.

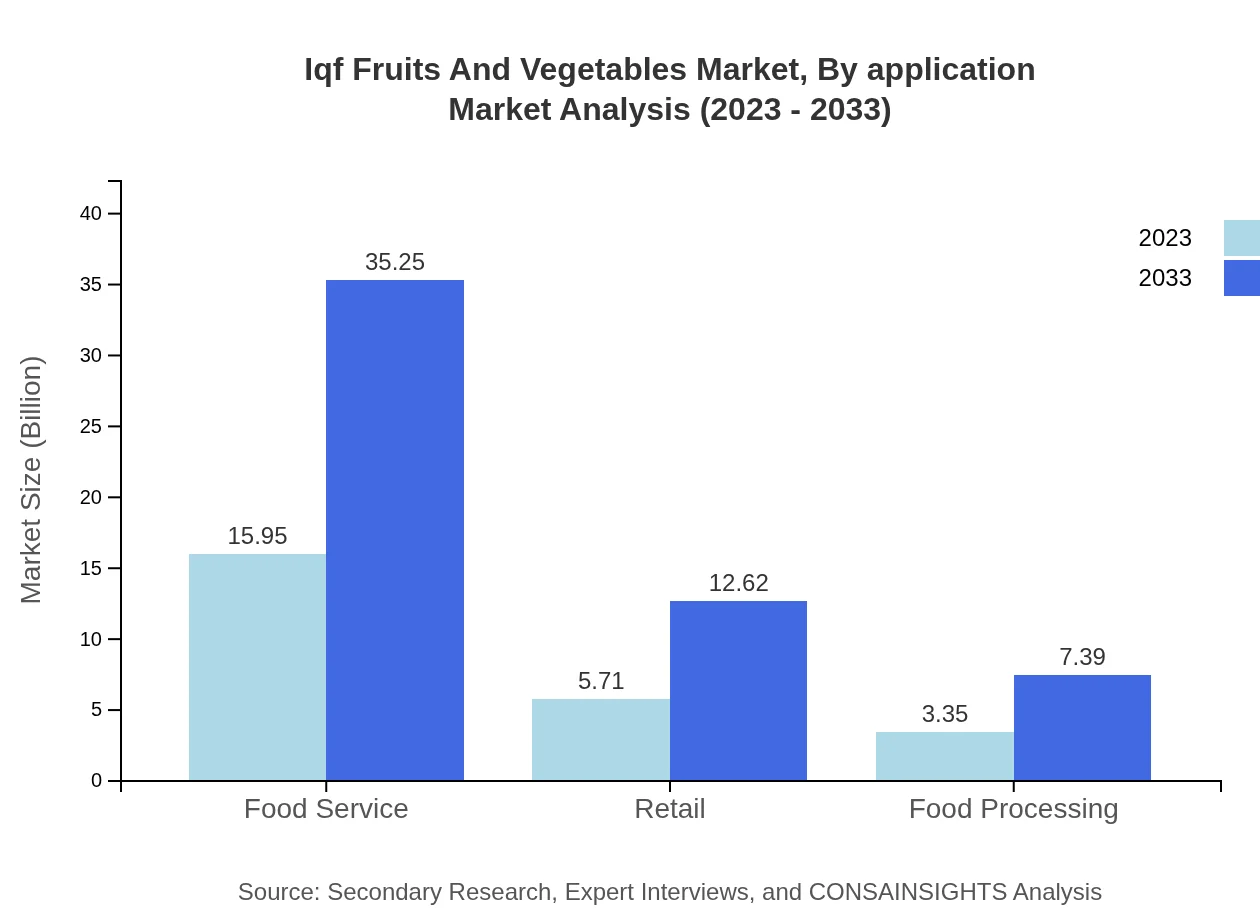

Iqf Fruits And Vegetables Market Analysis By Application

The application segment of IQF fruits and vegetables is diverse, with significant shares in food service and retail. Food service is expected to grow from $15.95 billion in 2023 to $35.25 billion by 2033, holding a 63.79% share. This reflects a broader consumer shift toward convenience in meal preparation. The household segment, albeit smaller, shows promise as more consumers lean towards pre-prepared meals.

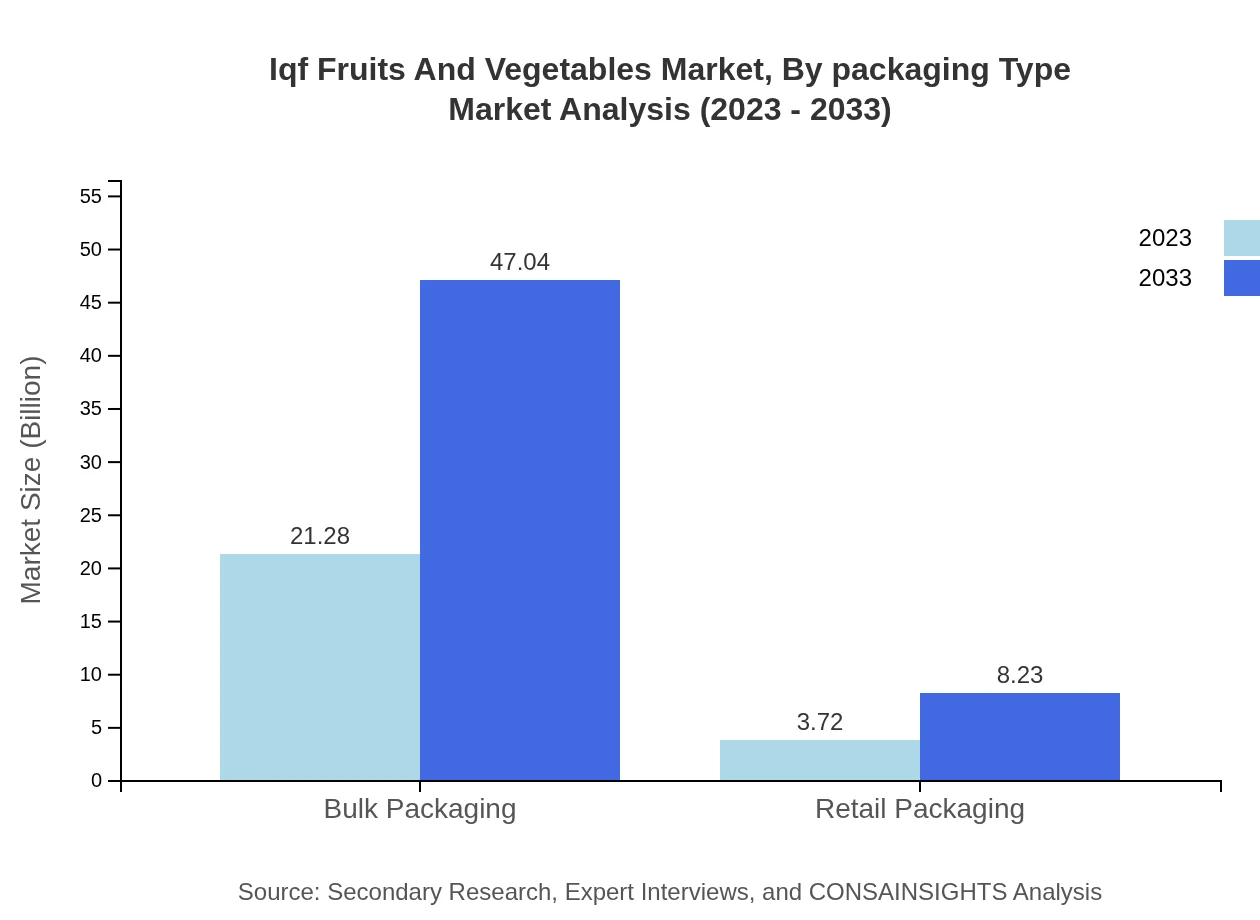

Iqf Fruits And Vegetables Market Analysis By Packaging Type

Bulk packaging is crucial in the IQF market, expected to grow from $21.28 billion to $47.04 billion, maintaining an 85.11% share. Retail packaging, while smaller, from $3.72 billion to $8.23 billion, addresses consumer convenience and on-the-go meal options effectively.

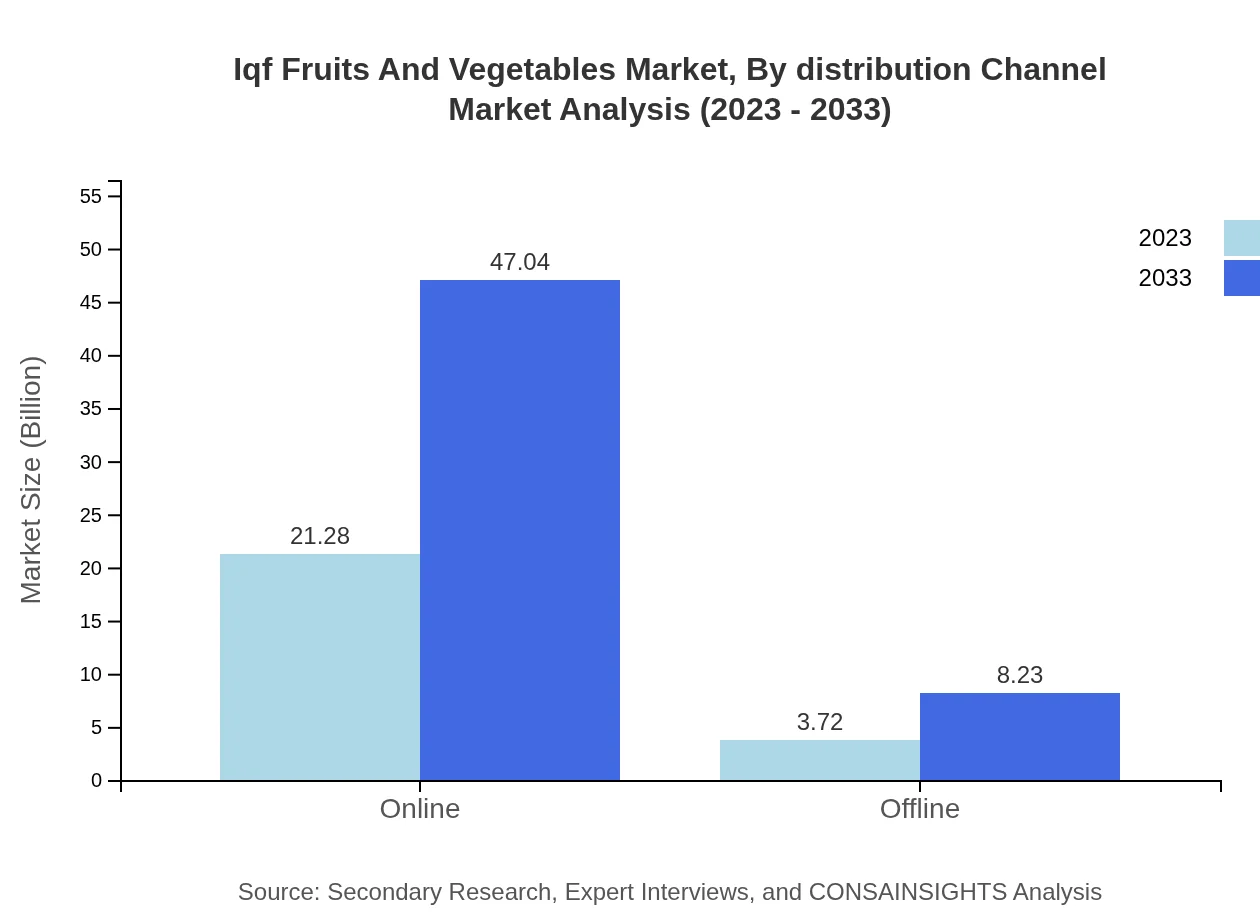

Iqf Fruits And Vegetables Market Analysis By Distribution Channel

The IQF market is increasingly influenced by online distribution channels. Online sales are anticipated to grow significantly from $21.28 billion to $47.04 billion, tapping into a consumer base gravitating towards e-commerce for groceries. Offline channels, while still relevant, are showing slower growth as consumers favor convenient online shopping methods.

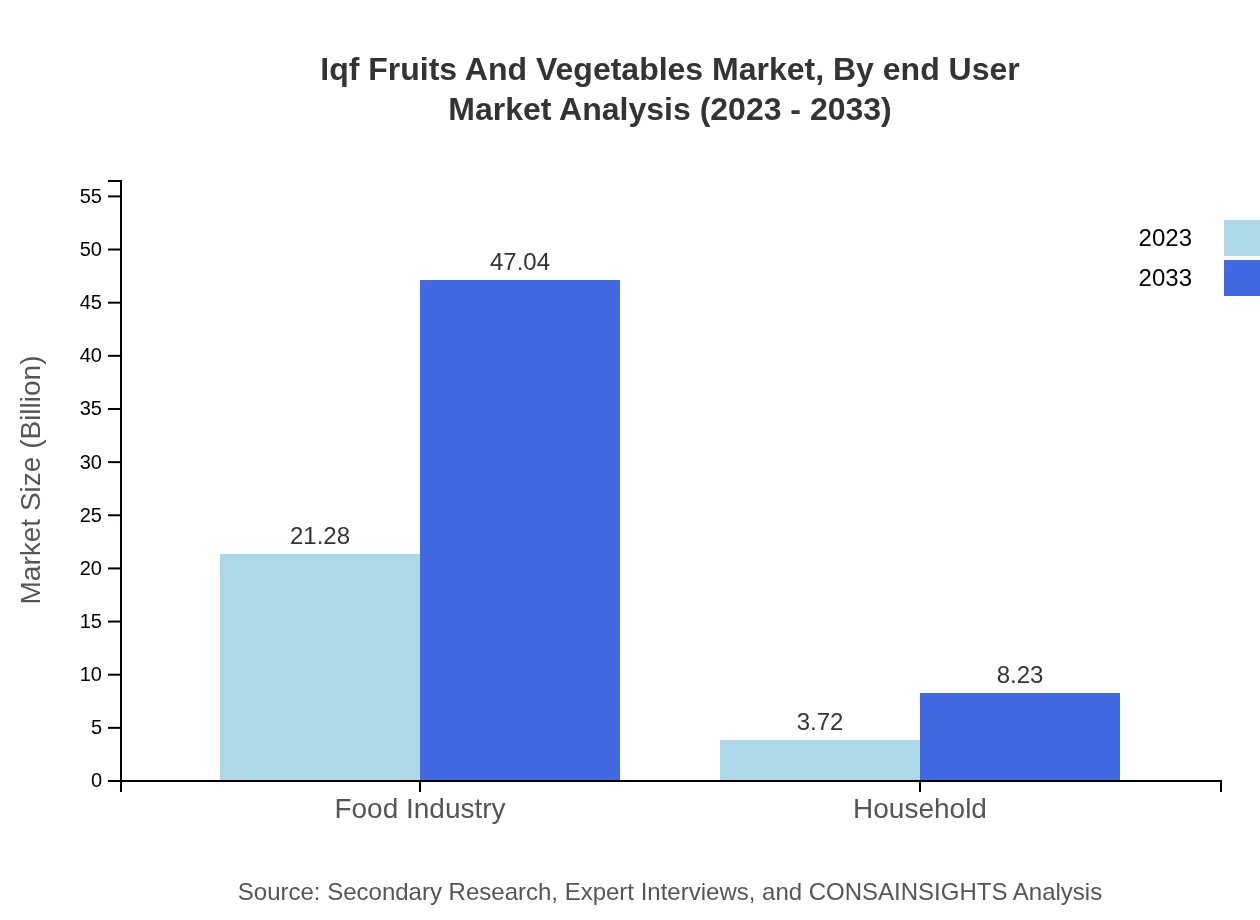

Iqf Fruits And Vegetables Market Analysis By End User

End-user segmentation highlights the significance of the food service industry, growing significantly due to the rise in dining out and demand for prepared meals. The retail sector is also crucial, shifting towards convenience-driven shopping habits among consumers. As health awareness rises, so will the demand among families and health-conscious individuals for high-quality frozen options.

Iqf Fruits And Vegetables Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in IQF Fruits And Vegetables Industry

Bonduelle:

Bonduelle is a leader in the global frozen food market, known for its diverse range of IQF fruits and vegetables that uphold quality and flavor. The company emphasizes sustainability and innovation in their sourcing and production practices.Greenyard:

Greenyard focuses on quality and innovation in the IQF sector, offering a wide range of frozen fruits and vegetables. Their commitment to sustainable practices and reliable supply chain management strengthens their market position.Dole Food Company:

Dole is a prominent name in the food industry, specializing in frozen fruits and vegetables. Their extensive product range and commitment to quality make them a prominent player in the IQF segment, satisfying consumer demand for healthy, convenient food options.McCain Foods:

McCain Foods is a leading player in frozen food, known for its innovative approach and a broad portfolio of IQF products. Their focus on quality and sustainability resonates well with health-conscious consumers worldwide.We're grateful to work with incredible clients.

FAQs

What is the market size of IQF Fruits and Vegetables?

The IQF Fruits and Vegetables market is currently valued at approximately $25 billion in 2023 and is projected to grow with a CAGR of 8%, indicating strong demand for high-quality frozen produce in the coming years.

What are the key market players or companies in the IQF Fruits and Vegetables industry?

Key players in the IQF Fruits and Vegetables market include major food processing companies and distributors that provide a range of frozen fruits and vegetables for retail and food service sectors, ensuring a robust supply chain.

What are the primary factors driving the growth in the IQF Fruits and Vegetables industry?

Growth in the IQF Fruits and Vegetables market is fueled by the increasing consumer preference for convenience foods, a rise in health consciousness, and the expanding use of frozen produce in diverse cuisines globally.

Which region is the fastest Growing in the IQF Fruits and Vegetables market?

The fastest-growing region in the IQF Fruits and Vegetables market is projected to be Europe, with the market increasing from $8.68 billion in 2023 to $19.19 billion by 2033, exhibiting strong demand in the coming decade.

Does ConsaInsights provide customized market report data for the IQF Fruits and Vegetables industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs, providing detailed insights into various segments and regional performances in the IQF Fruits and Vegetables industry.

What deliverables can I expect from this IQF Fruits and Vegetables market research project?

Deliverables from the IQF Fruits and Vegetables market research project include comprehensive reports, market forecasts, competitive analysis, segment breakdown, and insights on consumer trends, tailored to your requirements.

What are the market trends of IQF Fruits and Vegetables?

Current trends in the IQF Fruits and Vegetables market include increased innovation in packaging, a focus on organic and health-oriented frozen products, and expansion into online sales channels, reflecting changing consumer habits.