Ir And Thermal Imaging Systems Market Report

Published Date: 31 January 2026 | Report Code: ir-and-thermal-imaging-systems

Ir And Thermal Imaging Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Ir and Thermal Imaging Systems market, including trends, segmented insights, and regional forecasts from 2023 to 2033.

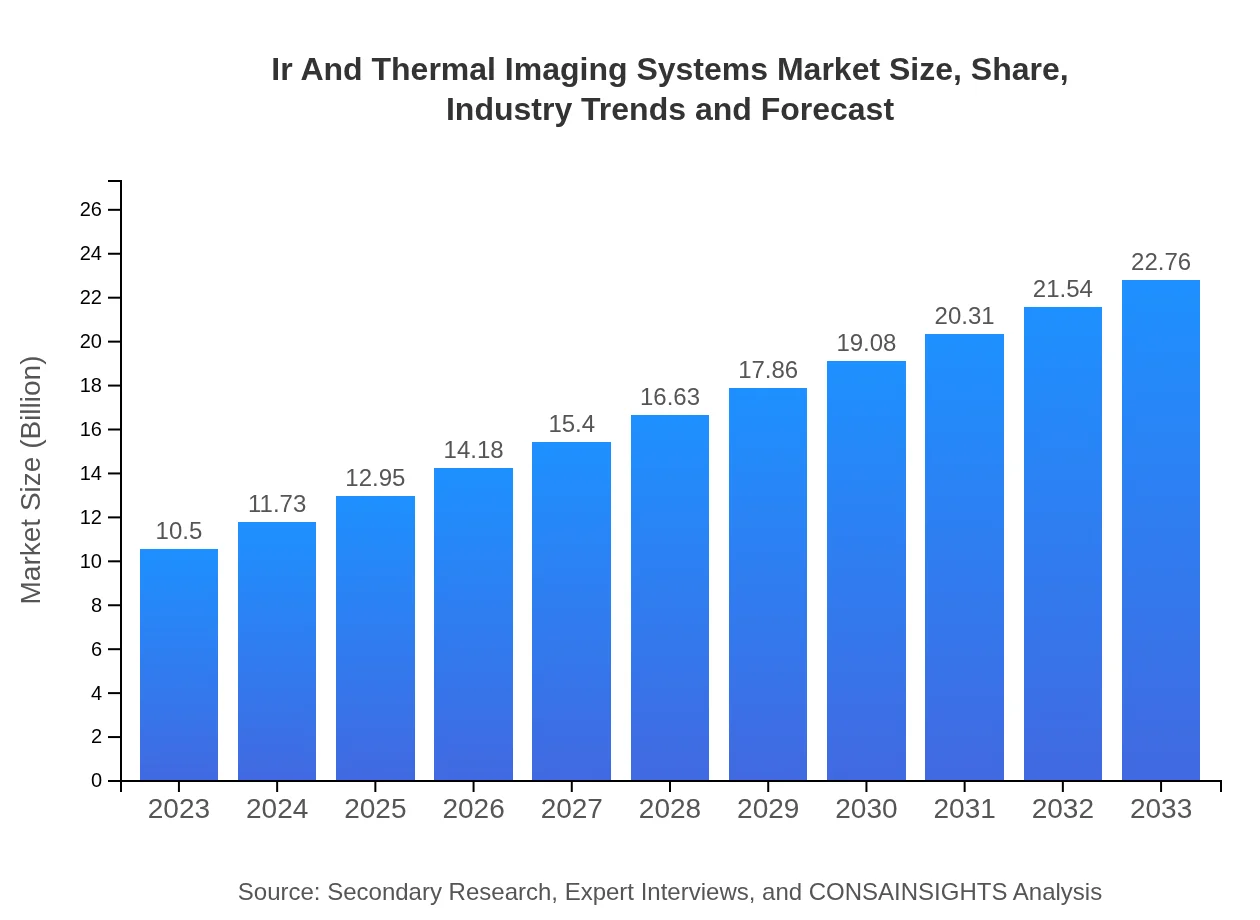

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $22.76 Billion |

| Top Companies | FLIR Systems, Leonardo, Raytheon Technologies, Hikvision |

| Last Modified Date | 31 January 2026 |

Ir And Thermal Imaging Systems Market Overview

Customize Ir And Thermal Imaging Systems Market Report market research report

- ✔ Get in-depth analysis of Ir And Thermal Imaging Systems market size, growth, and forecasts.

- ✔ Understand Ir And Thermal Imaging Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ir And Thermal Imaging Systems

What is the Market Size & CAGR of Ir And Thermal Imaging Systems market in 2023?

Ir And Thermal Imaging Systems Industry Analysis

Ir And Thermal Imaging Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ir And Thermal Imaging Systems Market Analysis Report by Region

Europe Ir And Thermal Imaging Systems Market Report:

Europe's market is expected to grow from $2.59 billion in 2023 to $5.61 billion by 2033. The increase will be fueled by stringent regulations on safety and security, particularly in the industrial and automotive sectors, alongside a strong presence of key market players.Asia Pacific Ir And Thermal Imaging Systems Market Report:

The Asia Pacific market is anticipated to grow from $2.09 billion in 2023 to $4.52 billion in 2033. This growth is driven by increased defense expenditure and rising industrial automation in countries like China and India, fostering a suitable environment for thermal imaging technology adoption.North America Ir And Thermal Imaging Systems Market Report:

North America, the largest regional market, will see its value jump from $3.69 billion in 2023 to $7.99 billion by 2033. The growing demand from defense and security sectors, especially in the U.S., along with significant investments in research and development, are pivotal in this region’s growth trajectory.South America Ir And Thermal Imaging Systems Market Report:

In South America, the market is projected to expand from $0.72 billion in 2023 to $1.55 billion by 2033. The key growth drivers include increasing investments in infrastructure and security, particularly in Brazil and Argentina, alongside greater awareness of advanced imaging technologies in various applications.Middle East & Africa Ir And Thermal Imaging Systems Market Report:

The Middle East and Africa market is projected to jump from $1.43 billion in 2023 to $3.09 billion by 2033. Boosted by heightened security concerns and investments in critical infrastructure, countries such as UAE and Saudi Arabia are central to this market growth.Tell us your focus area and get a customized research report.

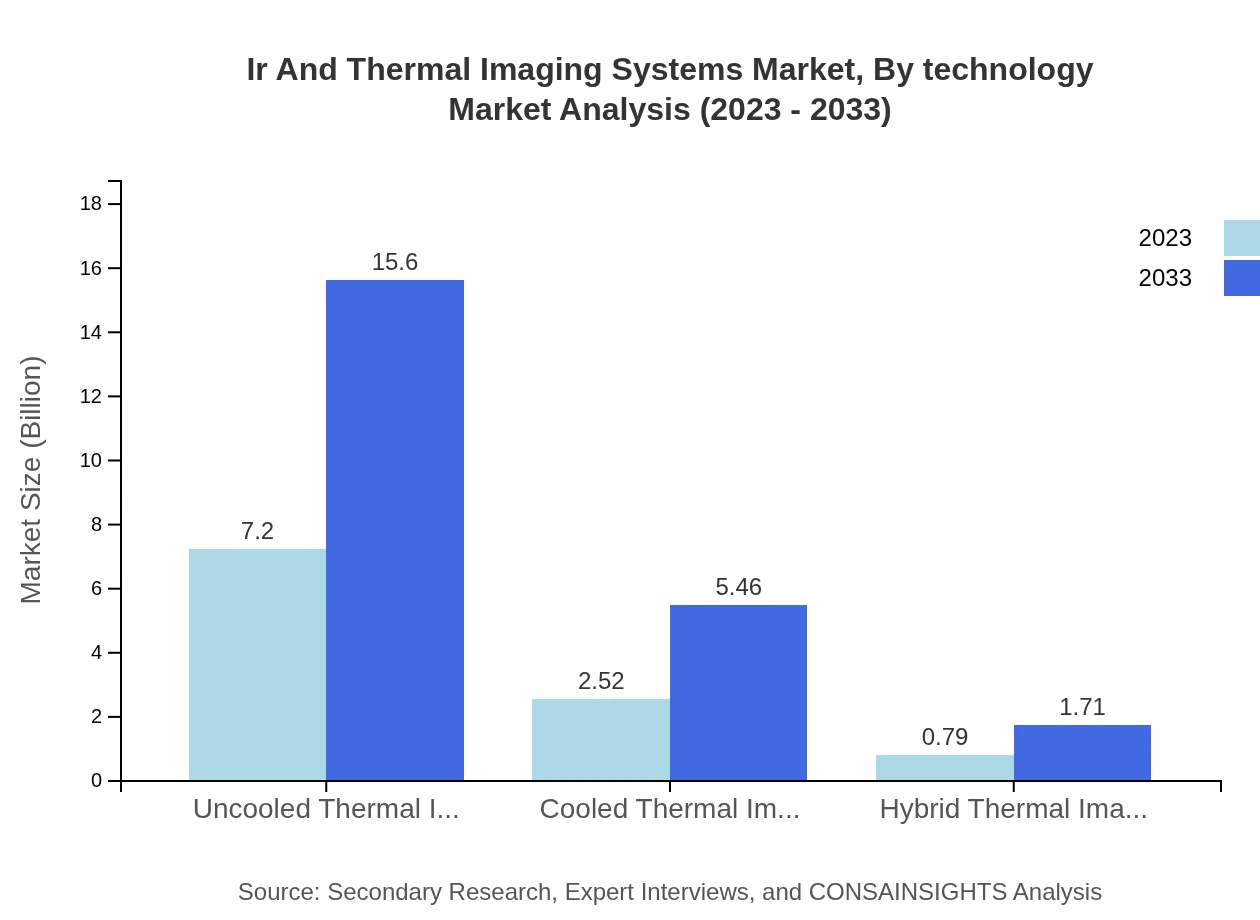

Ir And Thermal Imaging Systems Market Analysis By Technology

The market is primarily segmented into uncooled, cooled, and hybrid thermal imaging technologies. In 2023, uncooled thermal imaging leads in size at $7.20 billion, expected to grow to $15.60 billion by 2033. Cooled thermal imaging, with a 2023 market size of $2.52 billion, is forecasted to reach $5.46 billion by the end of the same period.

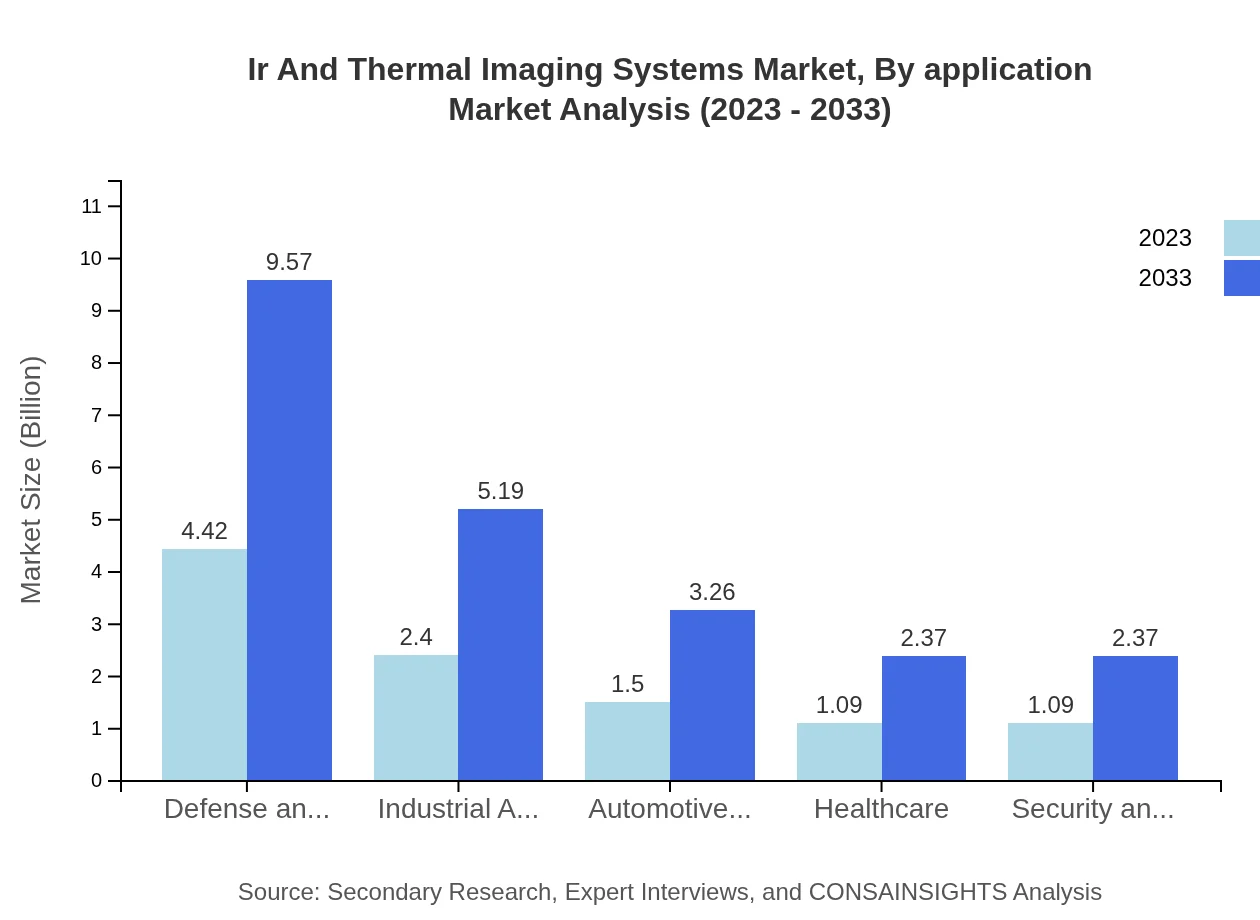

Ir And Thermal Imaging Systems Market Analysis By Application

Applications in sectors such as defense, healthcare, automotive, and manufacturing play critical roles. The defense application contributes significantly with a market size of $4.42 billion in 2023, projected to reach $9.57 billion in 2033, highlighting its importance.

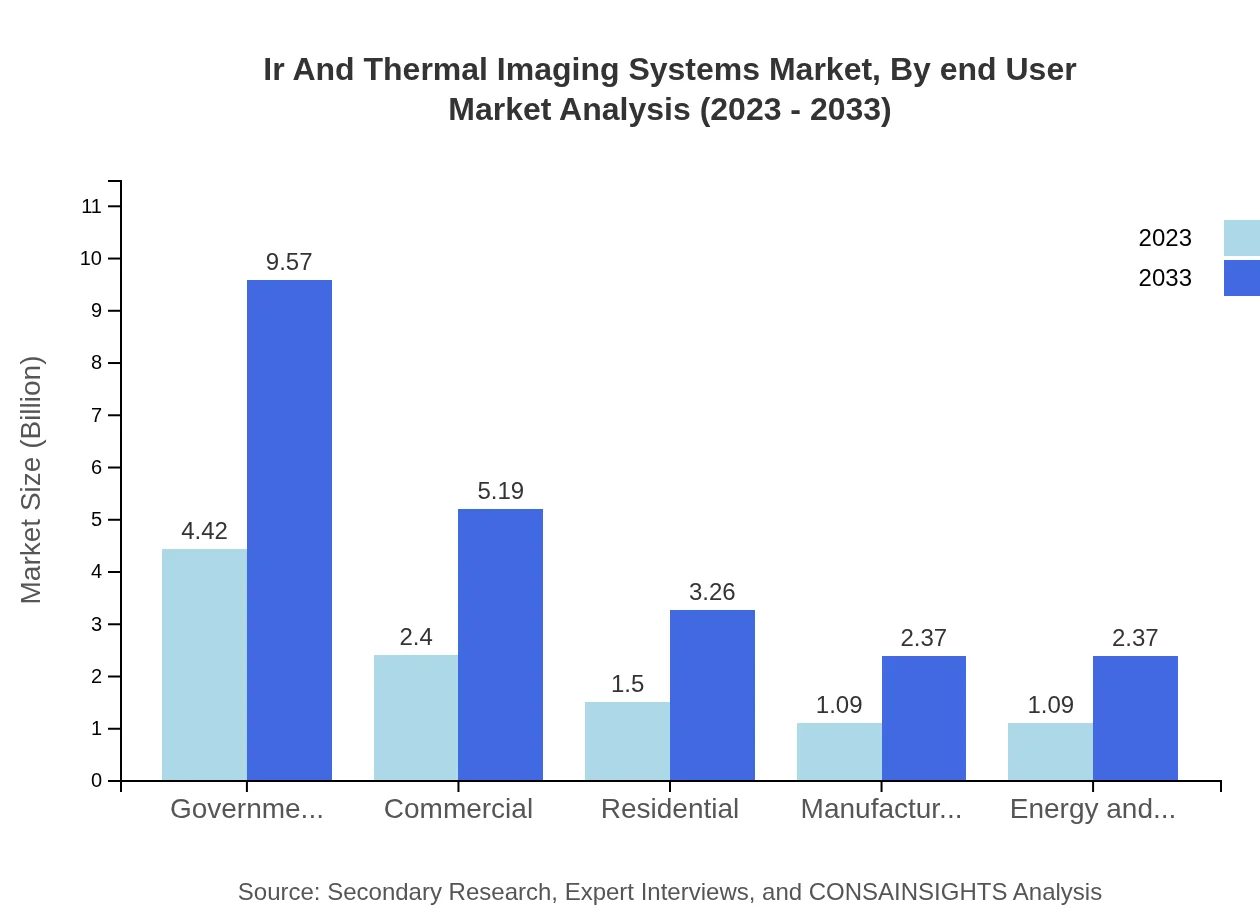

Ir And Thermal Imaging Systems Market Analysis By End User

Segments involving end-users such as government and defense, commercial, healthcare, energy and utilities are crucial. The government and defense segment accounted for $4.42 billion in 2023, with expectations to reach $9.57 billion by 2033, reflecting increasing military investments.

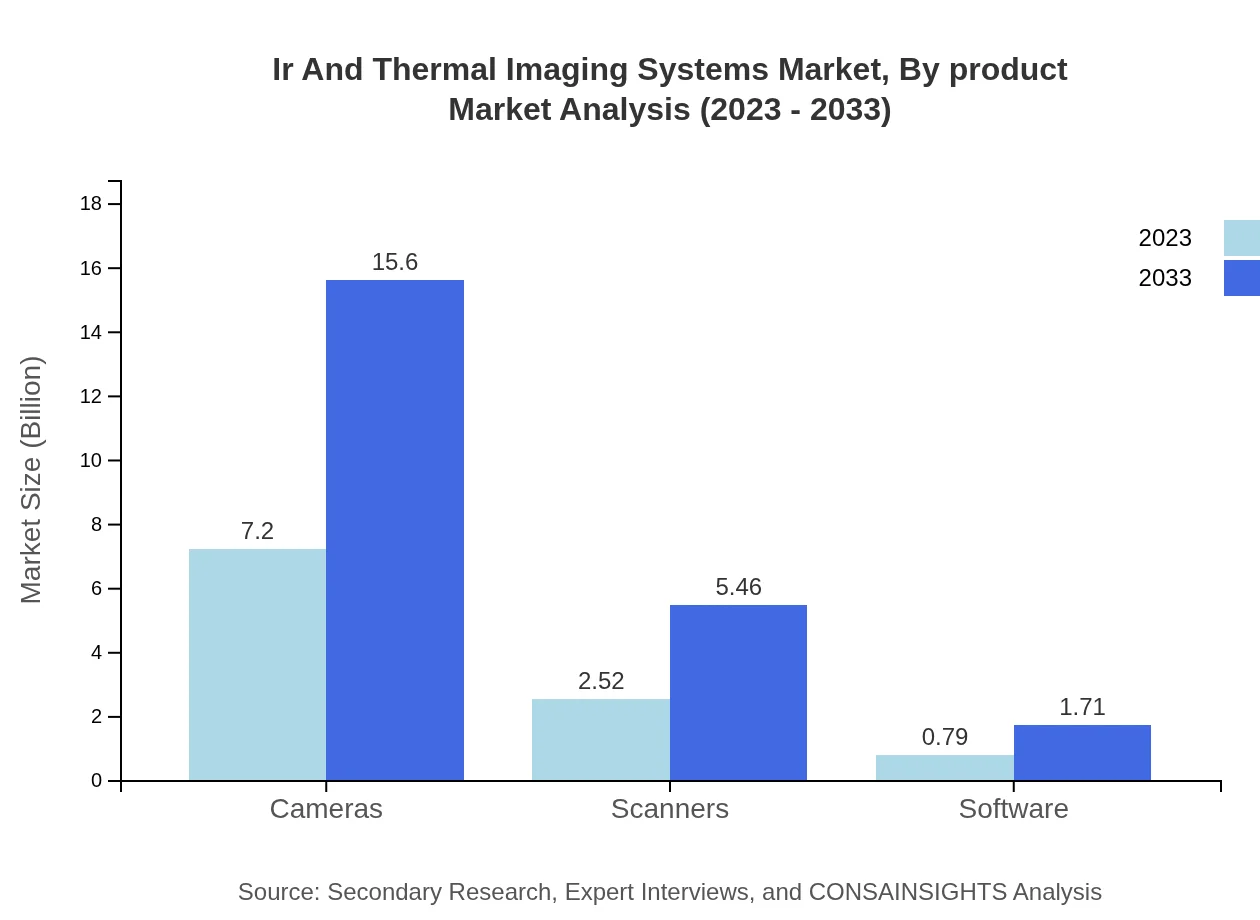

Ir And Thermal Imaging Systems Market Analysis By Product

Products like cameras, scanners, and software represent significant market shares. Cameras dominate, with a 2023 market size of $7.20 billion, projected to double by 2033. Scanners follow with a growing footprint, further illustrating the product diversity in this sector.

Ir And Thermal Imaging Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ir And Thermal Imaging Systems Industry

FLIR Systems:

A leading provider of thermal imaging cameras, offering innovative solutions across various industries including military, automotive, and firefighting.Leonardo:

This company specializes in defense and aerospace solutions, known for integrating advanced thermal imaging systems into its product offerings.Raytheon Technologies:

An aerospace and defense company with significant contributions to thermal imaging systems designed for military applications.Hikvision:

As a major player in video surveillance products, Hikvision also offers thermal cameras, enhancing security solutions across various sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of ir And Thermal Imaging Systems?

The global IR and Thermal Imaging Systems market size was valued at approximately $10.5 billion in 2023 and is projected to grow at a CAGR of 7.8%, reaching around $24.5 billion by 2033.

What are the key market players or companies in this ir And Thermal Imaging Systems industry?

Key players in the IR and Thermal Imaging Systems market include FLIR Systems, Inc., Teledyne Technologies, Raytheon Technologies, and Bosch Security Systems, contributing significantly to innovations and market expansion.

What are the primary factors driving the growth in the ir And Thermal Imaging Systems industry?

The growth of the IR and Thermal Imaging Systems market is driven by advancements in imaging technology, increased demand in defense applications, and rising applications across commercial and industrial sectors.

Which region is the fastest Growing in the ir And Thermal Imaging Systems?

The fastest-growing region in the IR and Thermal Imaging Systems market is North America, with the market expected to increase from $3.69 billion in 2023 to $7.99 billion by 2033.

Does ConsaInsights provide customized market report data for the ir And Thermal Imaging Systems industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the IR and Thermal Imaging Systems industry, providing relevant insights and strategic recommendations.

What deliverables can I expect from this ir And Thermal Imaging Systems market research project?

Expected deliverables include comprehensive market analysis reports, trend evaluations, competitor assessments, and tailored strategic recommendations suited to your business objectives.

What are the market trends of ir And Thermal Imaging Systems?

Current trends indicate a shift towards integration of AI in thermal imaging, expansion in healthcare and automotive applications, and increasing government investments in defense and surveillance technologies.