Ischemic Heart Disease Drugs Market Report

Published Date: 31 January 2026 | Report Code: ischemic-heart-disease-drugs

Ischemic Heart Disease Drugs Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Ischemic Heart Disease Drugs market, including insights into market size, trends, and forecasts from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

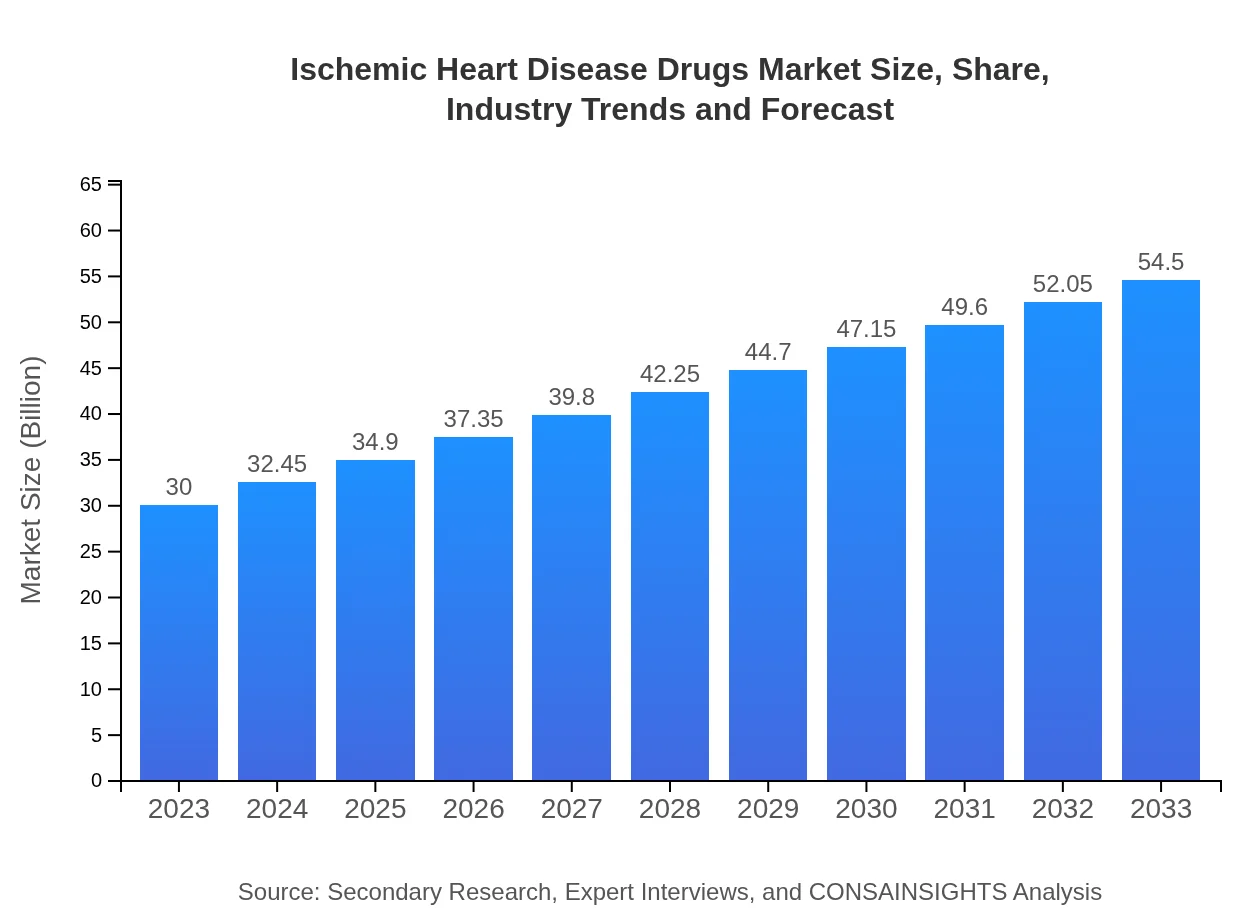

| 2023 Market Size | $30.00 Billion |

| CAGR (2023-2033) | 6% |

| 2033 Market Size | $54.50 Billion |

| Top Companies | Pfizer Inc., Bristol Myers Squibb, AstraZeneca, GlaxoSmithKline, Sanofi |

| Last Modified Date | 31 January 2026 |

Ischemic Heart Disease Drugs Market Overview

Customize Ischemic Heart Disease Drugs Market Report market research report

- ✔ Get in-depth analysis of Ischemic Heart Disease Drugs market size, growth, and forecasts.

- ✔ Understand Ischemic Heart Disease Drugs's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ischemic Heart Disease Drugs

What is the Market Size & CAGR of Ischemic Heart Disease Drugs market in 2023?

Ischemic Heart Disease Drugs Industry Analysis

Ischemic Heart Disease Drugs Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ischemic Heart Disease Drugs Market Analysis Report by Region

Europe Ischemic Heart Disease Drugs Market Report:

Europe is expected to exhibit a market size increase from $7.73 billion in 2023 to $14.03 billion by 2033. The region benefits from a robust healthcare infrastructure and increasing investments in medical research.Asia Pacific Ischemic Heart Disease Drugs Market Report:

The Asia Pacific region represents a significant market for Ischemic Heart Disease Drugs, with an expected market size of $6.19 billion in 2023, projected to reach $11.25 billion by 2033. Rapid urbanization, lifestyle changes, and increasing healthcare expenditure are key drivers of this growth.North America Ischemic Heart Disease Drugs Market Report:

North America dominates the Ischemic Heart Disease Drugs market, forecasted to reach $18.22 billion by 2033, up from $10.03 billion in 2023. The high prevalence of cardiovascular diseases and strong reimbursement policies facilitate market expansion.South America Ischemic Heart Disease Drugs Market Report:

In South America, the market size is anticipated to grow from $2.31 billion in 2023 to $4.20 billion by 2033. The growth is propelled by rising awareness about heart health and the adoption of advanced treatment methodologies.Middle East & Africa Ischemic Heart Disease Drugs Market Report:

The Middle East and Africa are projected to witness market growth from $3.74 billion in 2023 to $6.79 billion by 2033. Enhancements in healthcare facilities and increased focus on chronic disease management are influencing market dynamics.Tell us your focus area and get a customized research report.

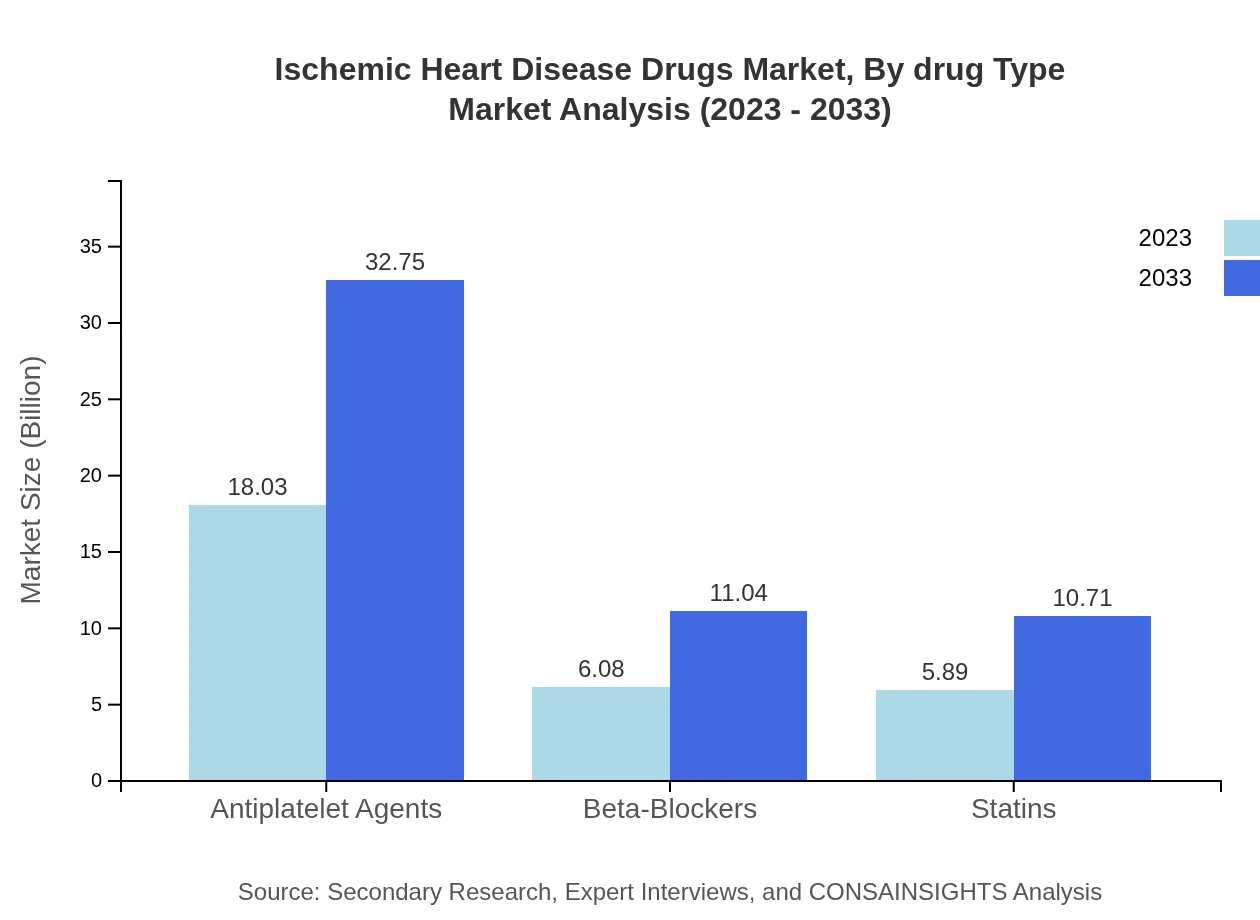

Ischemic Heart Disease Drugs Market Analysis By Drug Type

The drug type segment is dominated by Antiplatelet agents, which represented $18.03 billion in size in 2023, expected to grow to $32.75 billion by 2033, maintaining a 60.1% market share. Beta-blockers followed with $6.08 billion and projected to achieve $11.04 billion with a 20.25% share. Statins, Generic drugs, and Branded drugs also contribute significantly to the market, with projections reflecting steady growth.

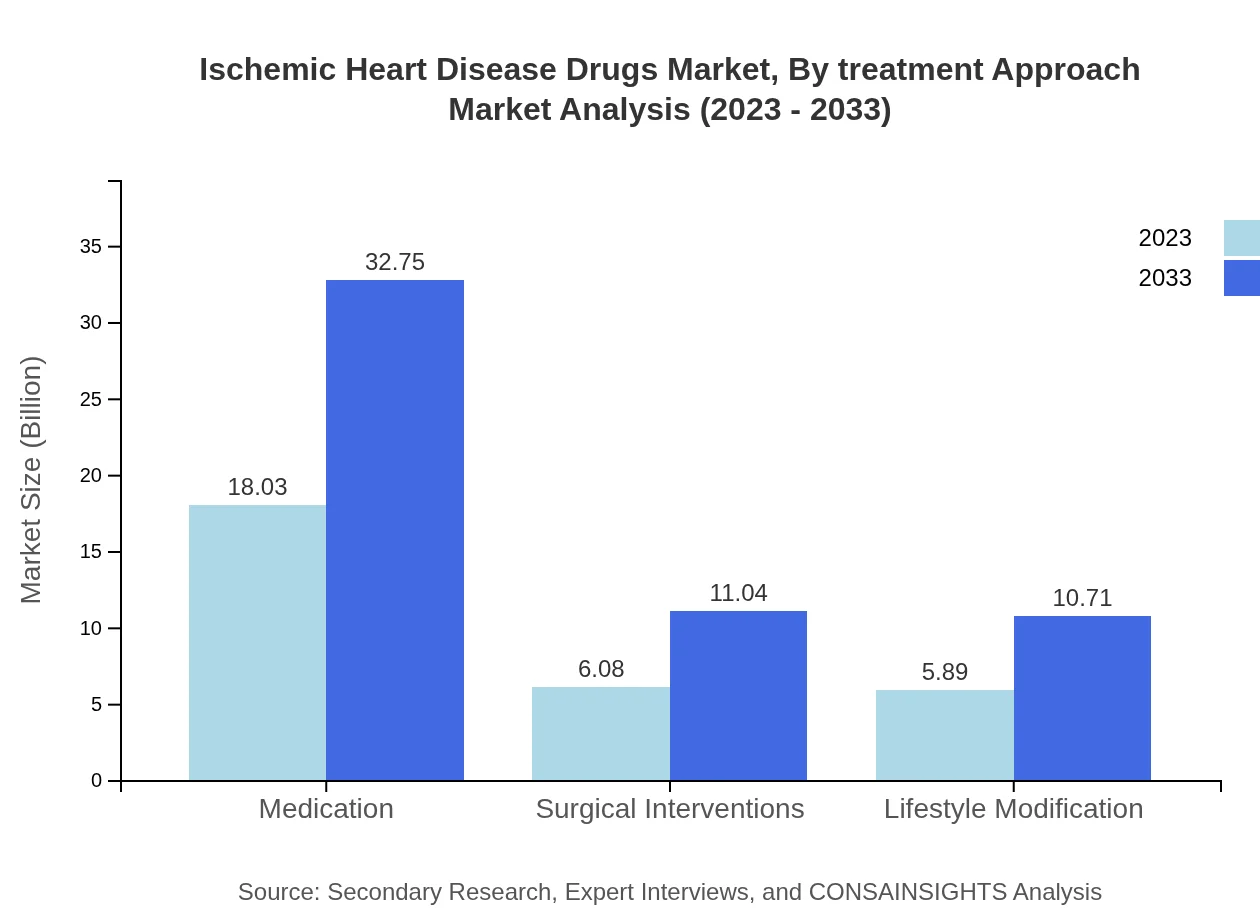

Ischemic Heart Disease Drugs Market Analysis By Treatment Approach

Treatment approaches include medication, surgical interventions, and lifestyle modifications. The medication segment is the largest contributor with anticipated growth from $18.03 billion in 2023 to $32.75 billion by 2033. Surgical interventions and lifestyle modifications are also essential components but contribute less to overall market size.

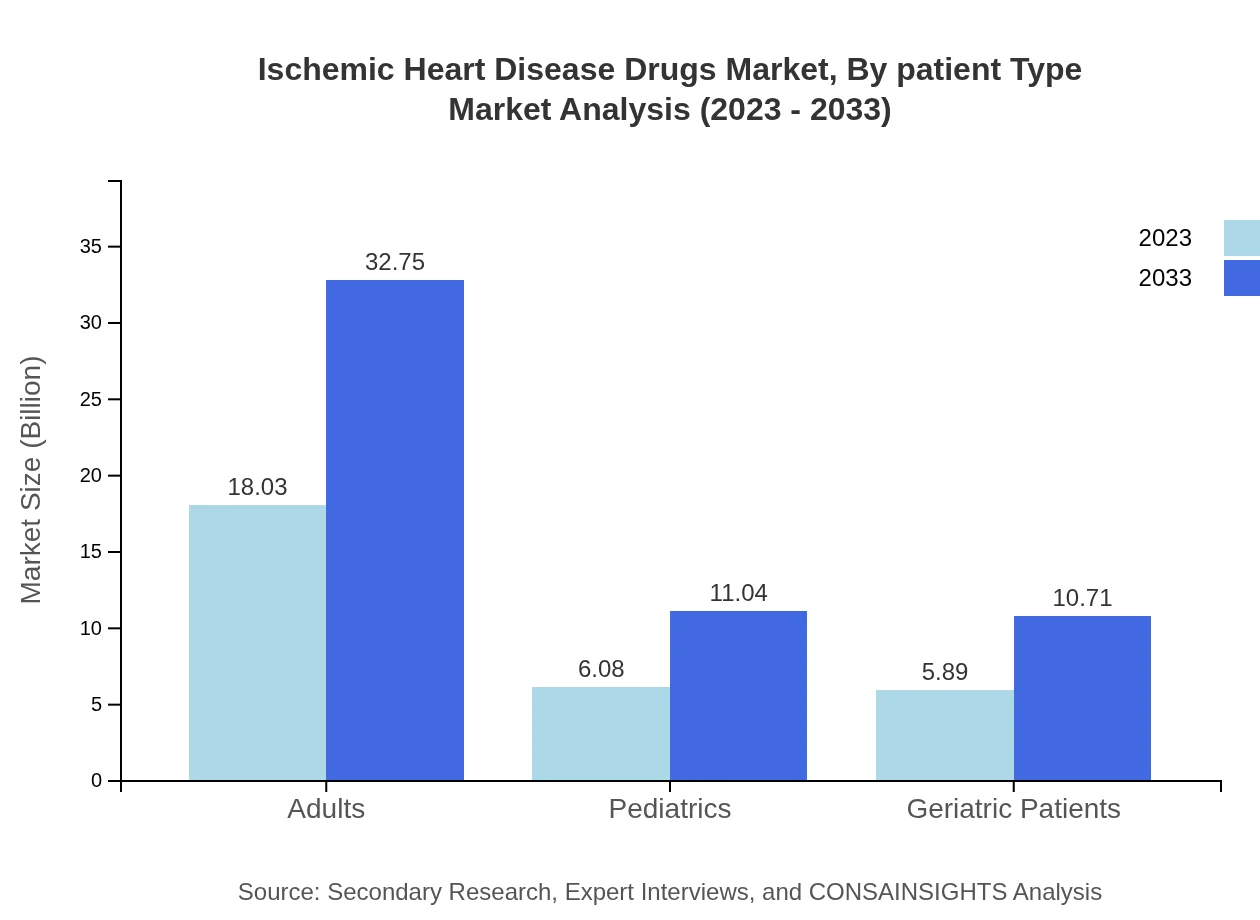

Ischemic Heart Disease Drugs Market Analysis By Patient Type

Market segmentation by patient type reveals that adults represent the largest share, expected to grow from $18.03 billion in 2023 to $32.75 billion by 2033. Geriatric patients and pediatrics also display growth potential, primarily due to rising incidences of heart disease across all age groups.

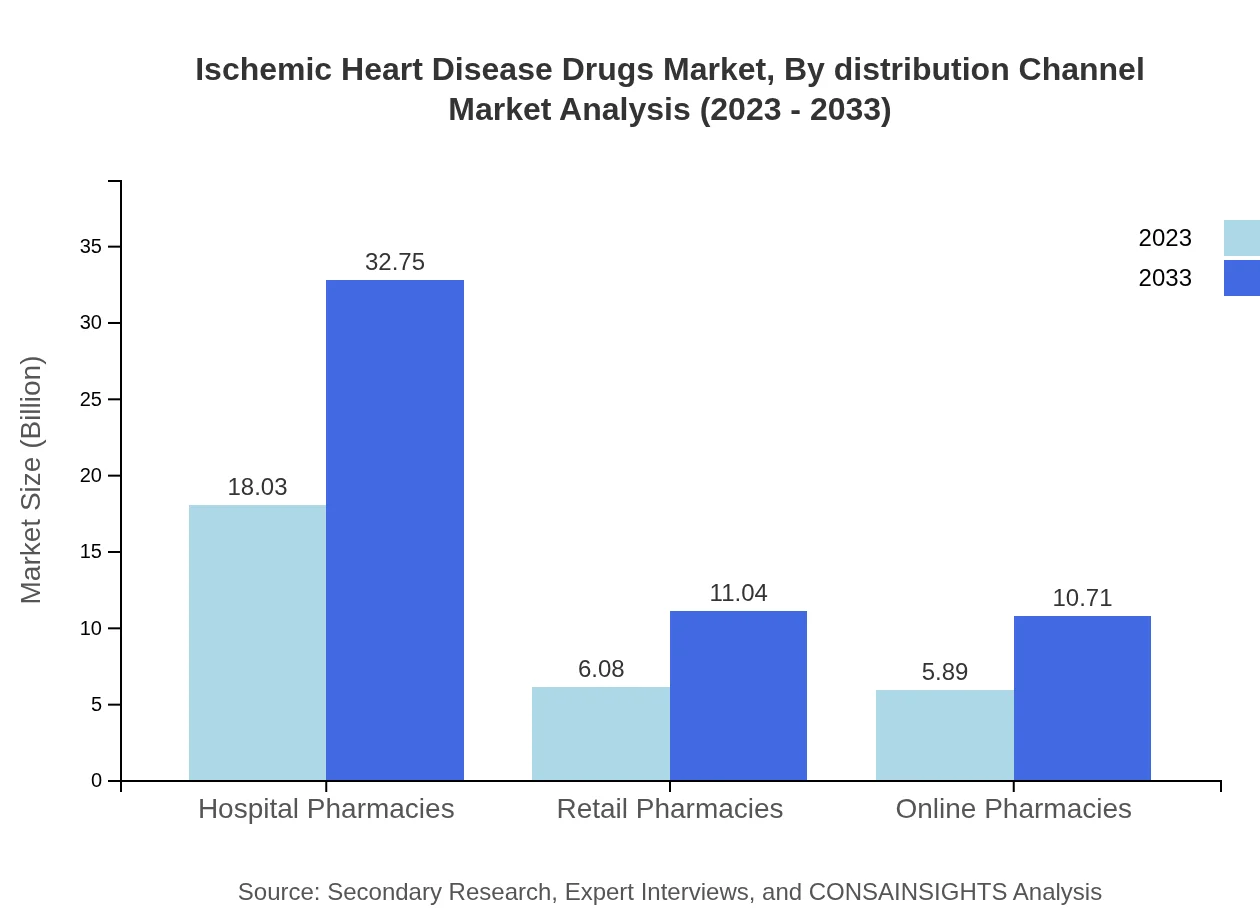

Ischemic Heart Disease Drugs Market Analysis By Distribution Channel

The market distribution is predominantly through hospital pharmacies, which account for $18.03 billion in size currently, with projections of reaching $32.75 billion. Retail and online pharmacies play a crucial role, serving the growing demand for accessibility to IHD drugs.

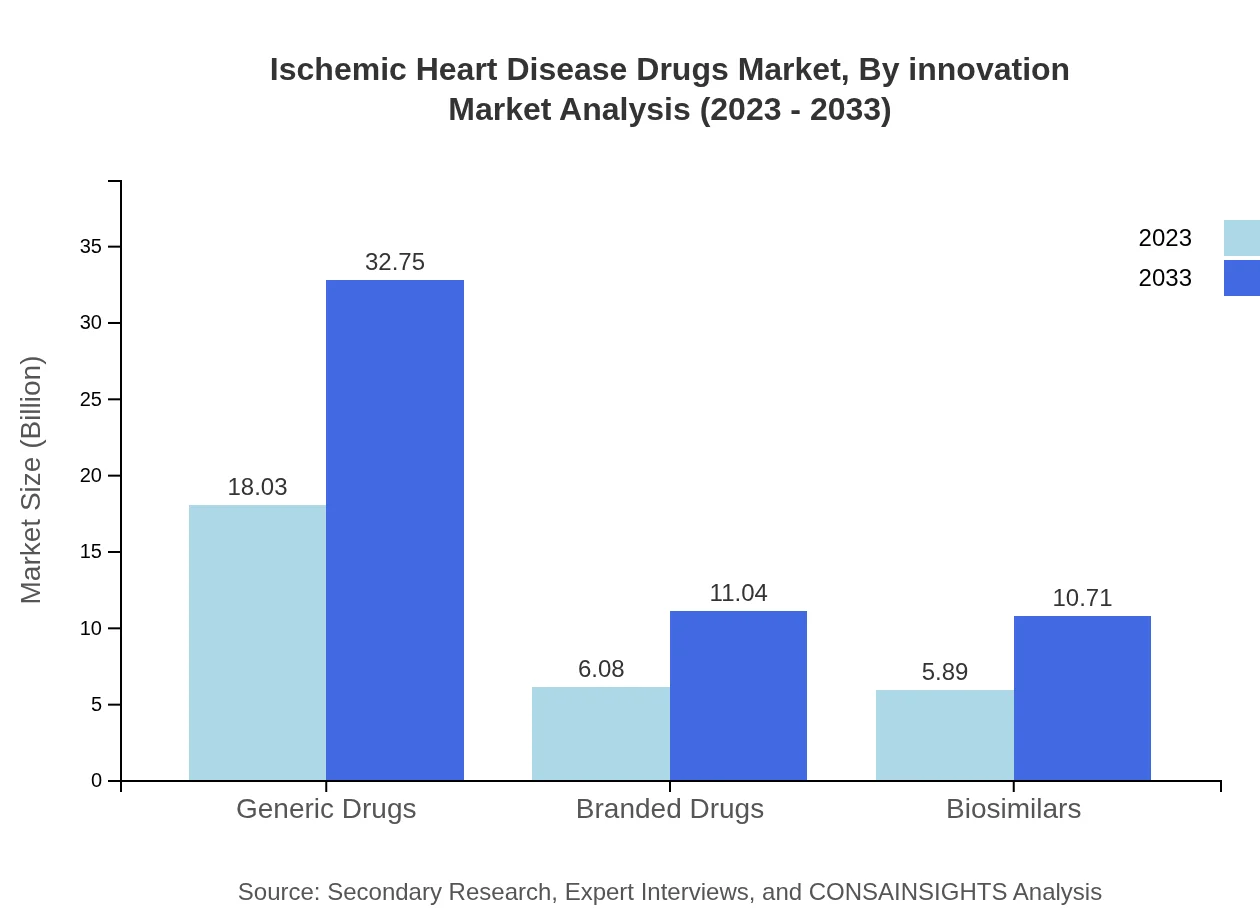

Ischemic Heart Disease Drugs Market Analysis By Innovation

Technological advancements in drug delivery systems and innovative formulations are driving the market forward. The trend of personalized medicine and the integration of AI in drug discovery are also influencing the industry's future, leading to better patient outcomes.

Ischemic Heart Disease Drugs Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ischemic Heart Disease Drugs Industry

Pfizer Inc.:

Pfizer leads in producing cardiovascular drugs, focusing on innovative therapies for ischemic heart diseases.Bristol Myers Squibb:

Known for its comprehensive portfolio of drugs, BMS invests in developing advanced therapies for heart conditions.AstraZeneca:

AstraZeneca is a key player in the cardiovascular market, dealing with drug classes that treat ischemic heart disease.GlaxoSmithKline:

GSK provides various heart disease drugs, emphasizing patient-centric product development and efficacy.Sanofi:

With significant investments in R&D, Sanofi is innovated in cardiovascular treatments to address ischemic heart diseases.We're grateful to work with incredible clients.

FAQs

What is the market size of ischemic Heart Disease Drugs?

The global ischemic heart disease drugs market is estimated to be valued at $30 billion in 2023, with a projected CAGR of 6% from 2023 to 2033, indicating significant growth opportunities in the coming decade.

What are the key market players or companies in the ischemic Heart Disease Drugs industry?

Key players in the ischemic heart disease drugs market include major pharmaceutical companies, such as Pfizer, AstraZeneca, and Novartis. These companies lead in product offerings of antiplatelet agents, beta-blockers, and statins among others.

What are the primary factors driving the growth in the ischemic Heart Disease Drugs industry?

The growth of the ischemic heart disease drugs market is driven by increasing prevalence of heart conditions, technological advancements in drug formulation, and heightened awareness regarding cardiovascular health, alongside preventive measures and effective treatments.

Which region is the fastest Growing in the ischemic Heart Disease Drugs?

The Asia Pacific region is projected to witness the fastest growth in the ischemic heart disease drugs market, with market growth from $6.19 billion in 2023 to $11.25 billion by 2033, reflecting increased healthcare investments.

Does ConsaInsights provide customized market report data for the ischemic Heart Disease Drugs industry?

Yes, ConsaInsights offers customized market report data tailored to the ischemic heart disease drugs industry, allowing businesses to gain insights specific to their needs and market conditions.

What deliverables can I expect from this ischemic Heart Disease Drugs market research project?

From the ischemic heart disease drugs market research project, you can expect comprehensive deliverables including detailed market analysis, segment-wise breakdowns, competitive landscape insights, and forecasts on market size and growth trends.

What are the market trends of ischemic Heart Disease Drugs?

Current trends in the ischemic heart disease drugs market include the rising adoption of generic drugs, increased focus on combination therapies, and developments in biosimilars, all contributing to a competitive market landscape.