Islamic Finance Market Report

Published Date: 24 January 2026 | Report Code: islamic-finance

Islamic Finance Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Islamic Finance market, covering key aspects such as market size, segmentation, industry analysis, and regional performance from 2023 to 2033.

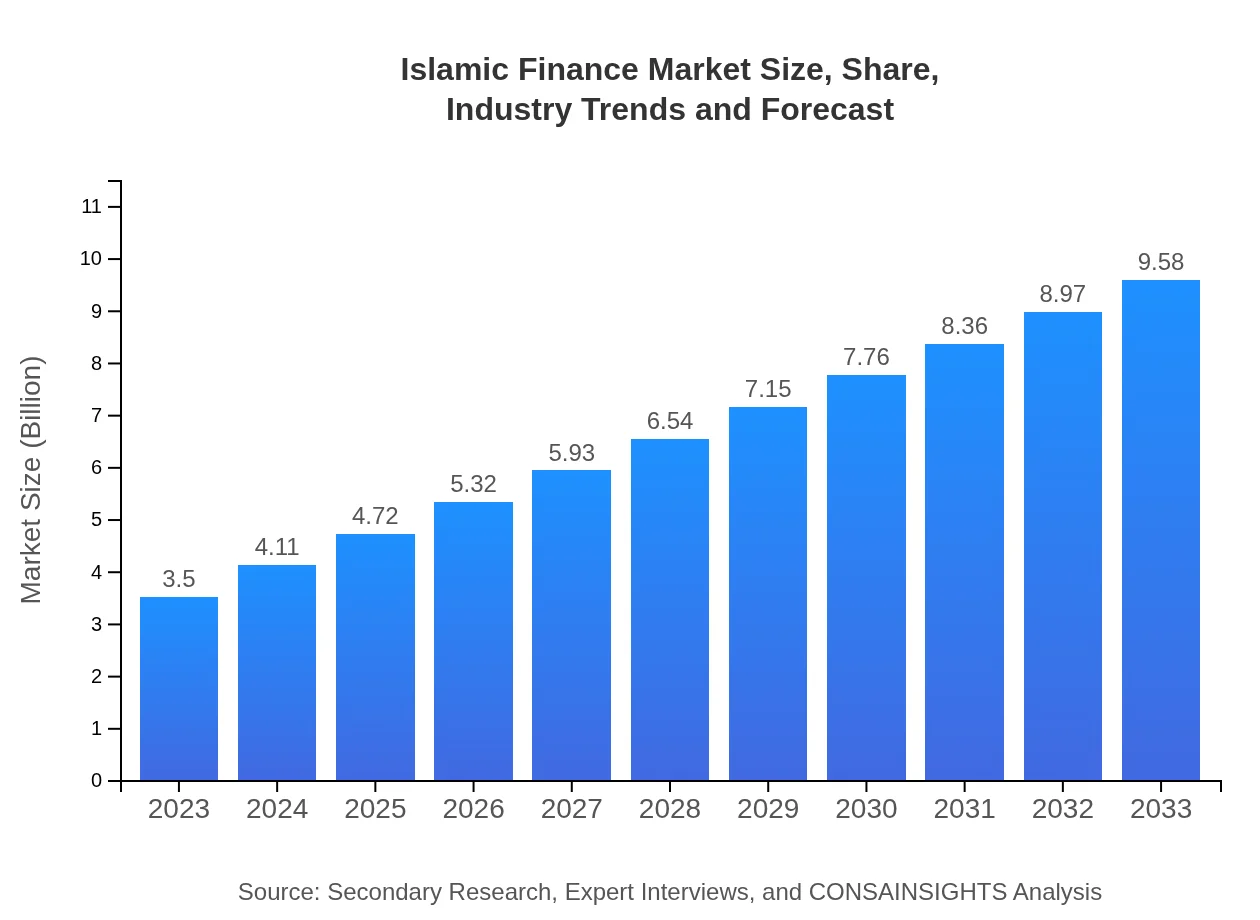

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Trillion |

| CAGR (2023-2033) | 10.2% |

| 2033 Market Size | $9.58 Trillion |

| Top Companies | Al Baraka Banking Group, DIB (Dubai Islamic Bank), Kuwait Finance House, Maybank Islamic, CIMB Islamic |

| Last Modified Date | 24 January 2026 |

Islamic Finance Market Overview

Customize Islamic Finance Market Report market research report

- ✔ Get in-depth analysis of Islamic Finance market size, growth, and forecasts.

- ✔ Understand Islamic Finance's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Islamic Finance

What is the Market Size & CAGR of Islamic Finance market in 2023?

Islamic Finance Industry Analysis

Islamic Finance Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Islamic Finance Market Analysis Report by Region

Europe Islamic Finance Market Report:

Europe presents one of the strongest markets for Islamic Finance, with a size of $1.18 trillion in 2023, predicted to reach $3.22 trillion by 2033. The region benefits from a mature banking infrastructure and a growing acceptance of Islamic finance principles among the general population.Asia Pacific Islamic Finance Market Report:

The Asia Pacific region is projected to show significant growth in the Islamic Finance market, with a size of $0.66 trillion in 2023 expected to grow to $1.79 trillion by 2033. Countries such as Malaysia and Indonesia are leading in Islamic banking growth due to governmental support and favorable regulatory environments.North America Islamic Finance Market Report:

In North America, the Islamic Finance market is estimated to have a size of $1.14 trillion in 2023, expected to expand to $3.13 trillion by 2033. Increased demand for ethical financial products among both Muslims and non-Muslims presents significant opportunities for growth.South America Islamic Finance Market Report:

The South American market for Islamic Finance is relatively nascent, with a size of $0.35 trillion in 2023 projected to rise to $0.95 trillion by 2033. The growing Muslim population and interest in ethical finance are driving gradual growth in this region.Middle East & Africa Islamic Finance Market Report:

The Middle East and Africa region showcases a robust Islamic Finance market, with a size of $0.18 trillion in 2023 projected to expand to $0.48 trillion by 2033. Home to many leading Islamic banks, this region is primarily driven by demand from local firms and governmental initiatives supporting Islamic finance.Tell us your focus area and get a customized research report.

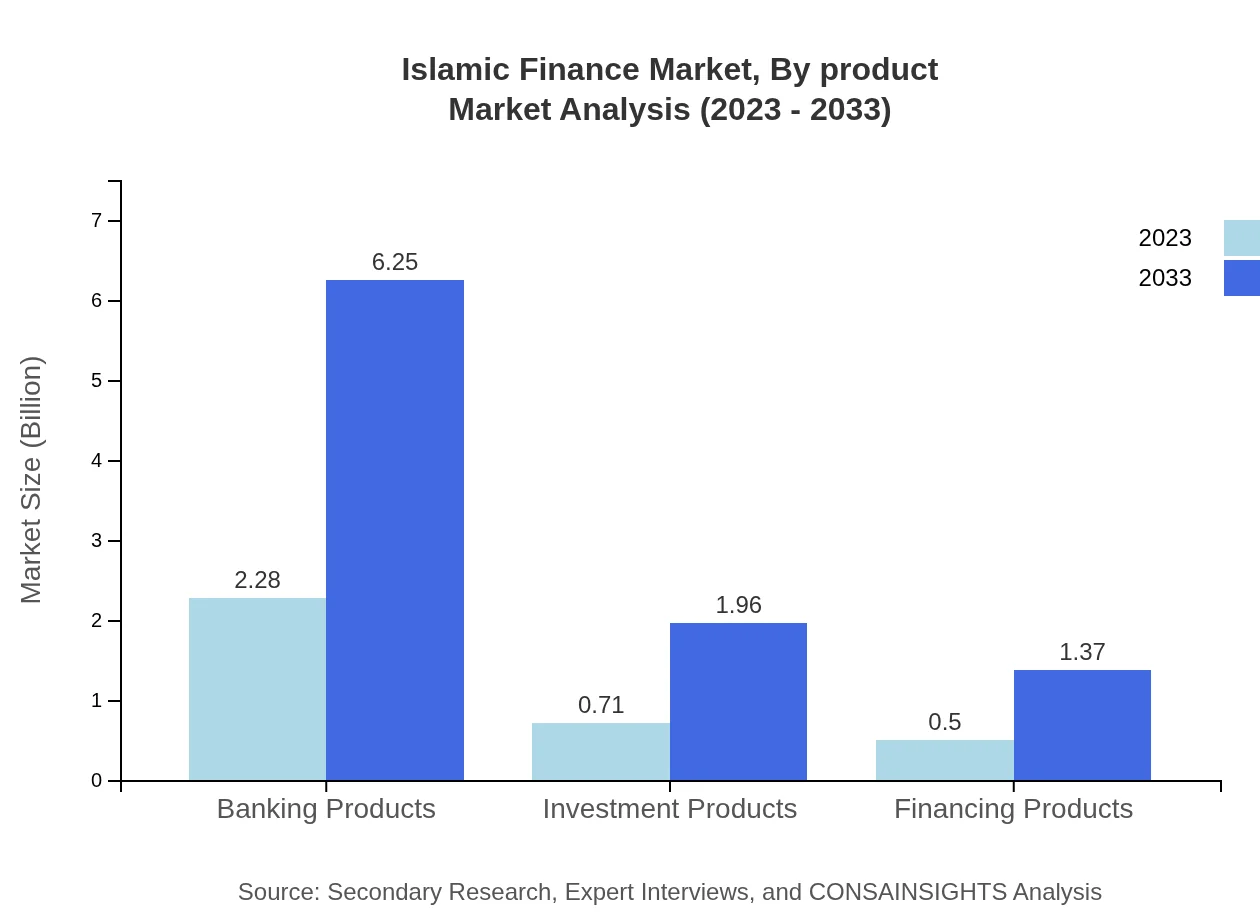

Islamic Finance Market Analysis By Product

The Banking Products segment leads the market, with a size of $2.28 trillion in 2023 projected to grow to $6.25 trillion by 2033, representing 65.28% of the market share. Investment Products follow with a size of $0.71 trillion growing to $1.96 trillion (20.42% share), and Financing Products expected to expand from $0.50 trillion to $1.37 trillion (14.3% share) over the same period.

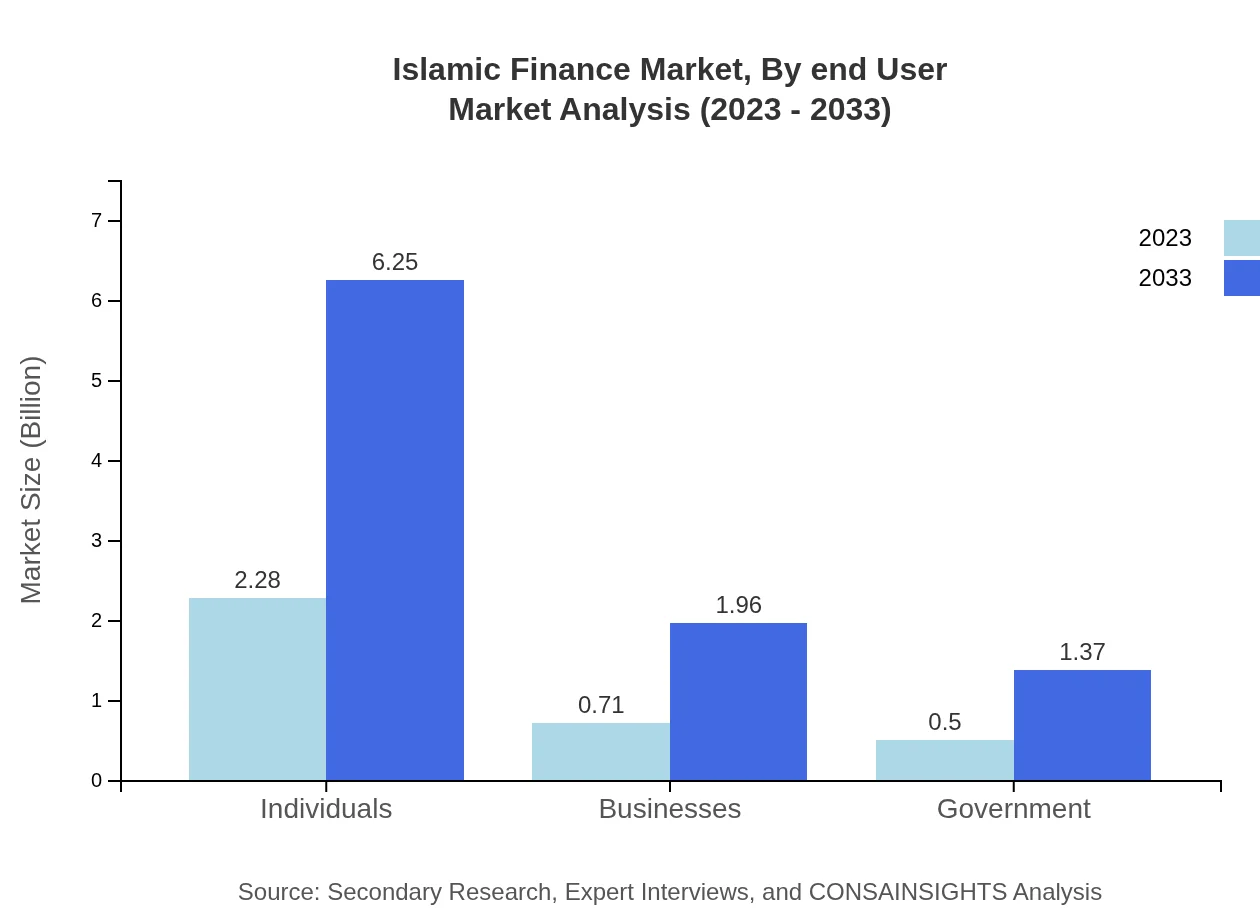

Islamic Finance Market Analysis By End User

Individuals make up the largest end-user segment with a size of $2.28 trillion in 2023 rising to $6.25 trillion by 2033 (65.28% share). Businesses comprise the next largest segment at $0.71 trillion with a projected size of $1.96 trillion, holding a 20.42% share. The Government segment, while smaller, is expected to grow from $0.50 trillion to $1.37 trillion (14.3% share).

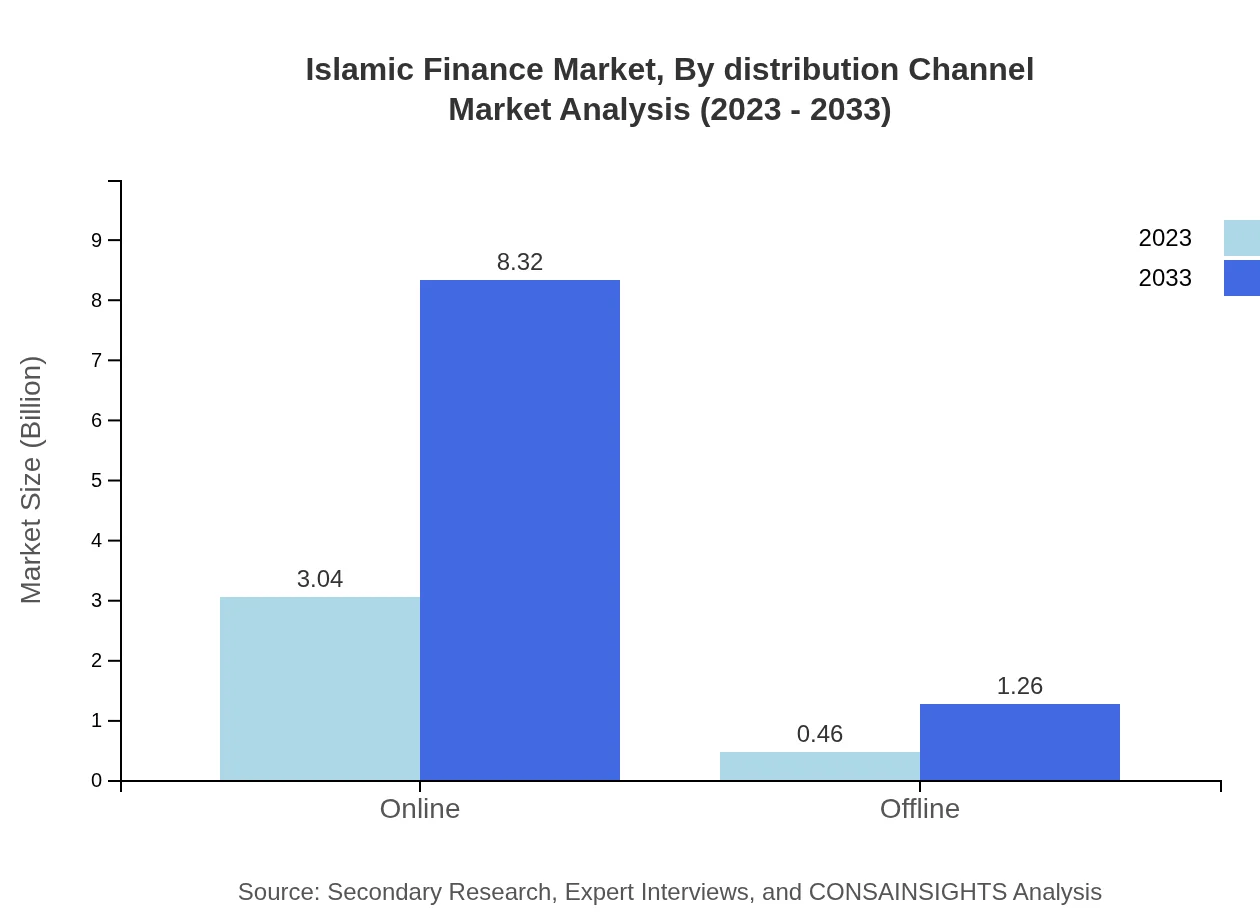

Islamic Finance Market Analysis By Distribution Channel

The online distribution channel dominates the market with a size of $3.04 trillion in 2023 growing to $8.32 trillion by 2033 (86.8% share), reflecting a significant shift towards digital banking and investment platforms in Islamic finance. The offline channel accounts for a smaller segment, growing from $0.46 trillion to $1.26 trillion (13.2% share).

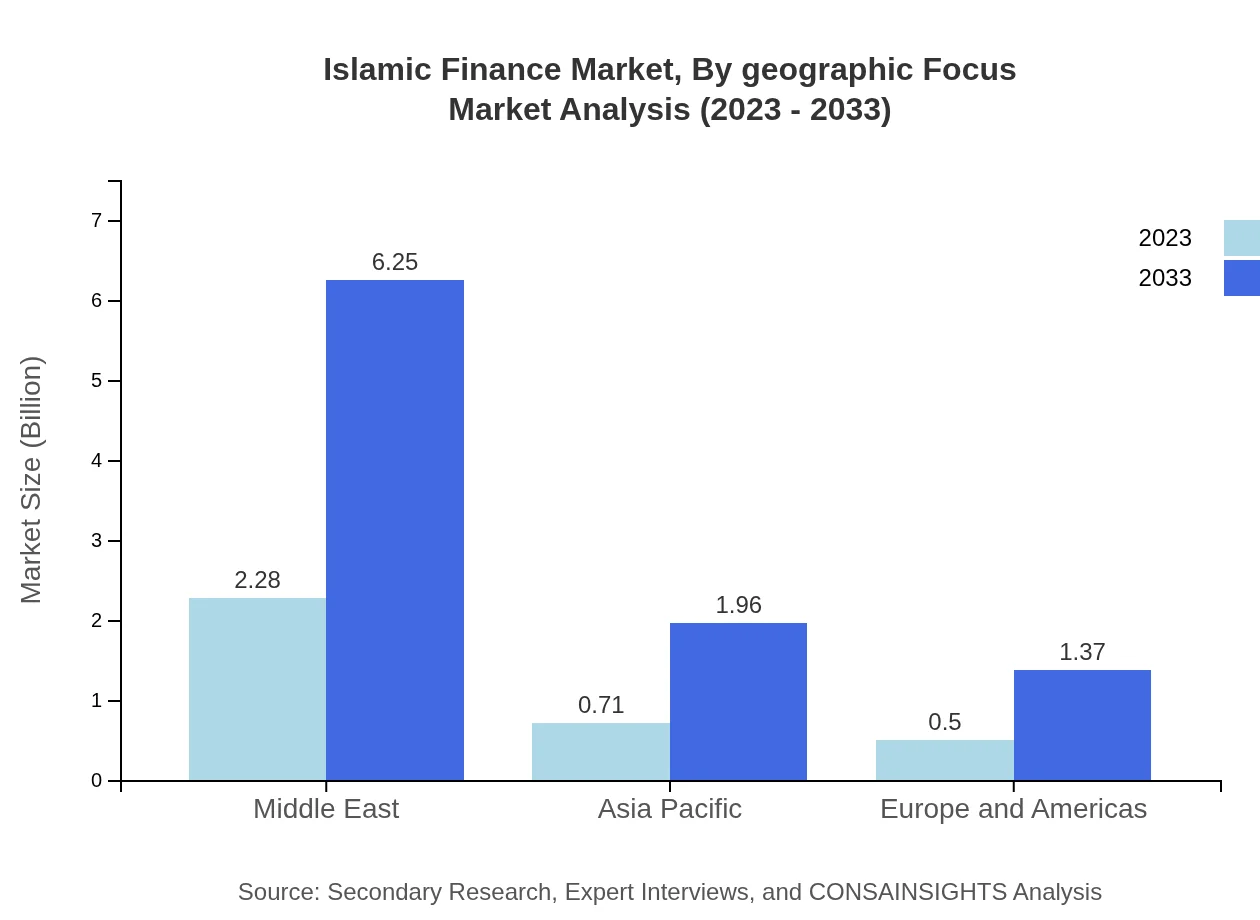

Islamic Finance Market Analysis By Geographic Focus

The Islamic Finance market is growing in geographic concentration, with a considerable focus on the Middle East, which maintains a size of $2.28 trillion in 2023 projected to expand to $6.25 trillion by 2033, comprising 65.28% of the total market. The Asia Pacific market is outlined with $0.71 trillion in 2023, expected to reach $1.96 trillion (20.42% share), while Europe and Americas collectively account for $0.50 trillion serving 14.3% of the market.

Islamic Finance Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Islamic Finance Industry

Al Baraka Banking Group:

A leading provider of Islamic banking services in various countries, Al Baraka is known for innovative products and extensive branch networks.DIB (Dubai Islamic Bank):

One of the largest Islamic banks globally, DIB offers a full suite of Sharia-compliant products catering to personal and corporate banking.Kuwait Finance House:

KFH is a prominent Islamic bank offering a wide range of financial services, emphasizing investment and real estate financing.Maybank Islamic:

Part of Maybank Group, offers comprehensive Islamic financing solutions, significantly impacting the Southeast Asia market.CIMB Islamic:

A leading Islamic financial services provider offering banking, investment, and insurance products across Southeast Asia.We're grateful to work with incredible clients.

FAQs

What is the market size of Islamic finance?

The global Islamic finance market is currently valued at approximately $3.5 trillion, with a remarkable CAGR of 10.2%. This growth reflects increasing demand for Sharia-compliant financial products and services, appealing to both individual and institutional investors worldwide.

What are the key market players or companies in the Islamic finance industry?

Key players in the Islamic finance industry include major banks like Al Baraka Banking Group and Dubai Islamic Bank, along with investment firms that specialize in Sharia-compliant portfolios. These entities are pivotal in driving market growth and expanding services.

What are the primary factors driving the growth in the Islamic finance industry?

Growth in the Islamic finance industry is driven by factors such as increasing awareness of Sharia-compliant financial products, high demand from Muslim populations, and rising investment opportunities in emerging markets, all contributing to a stronger market presence.

Which region is the fastest Growing in Islamic finance?

The fastest-growing region in the Islamic finance market is Europe, projected to grow from $1.18 trillion in 2023 to $3.22 trillion by 2033, reflecting a significant rise in Sharia-compliant financial demand across diverse demographics.

Does ConsaInsights provide customized market report data for the Islamic finance industry?

Yes, ConsaInsights offers customized market report data tailored to the needs of clients in the Islamic finance industry. This includes in-depth analysis on market trends, competitive landscape, and growth opportunities specific to various segments.

What deliverables can I expect from this Islamic finance market research project?

Deliverables from the Islamic finance market research project will include comprehensive reports, data visuals, market trend analysis, and actionable insights tailored to your specific needs and strategic goals within the industry.

What are the market trends of Islamic finance?

Current trends in the Islamic finance market highlight a shift towards digital transformation, increasing online services, and rising investment in sustainable finance initiatives. This evolution showcases how traditional finance is adapting to modern consumer preferences.