Isomaltulose Market Report

Published Date: 31 January 2026 | Report Code: isomaltulose

Isomaltulose Market Size, Share, Industry Trends and Forecast to 2033

This report explores the growth and trends in the Isomaltulose market from 2023 to 2033, offering key insights, regional analyses, market segmentation, and forecasts that highlight the industry’s future trajectory.

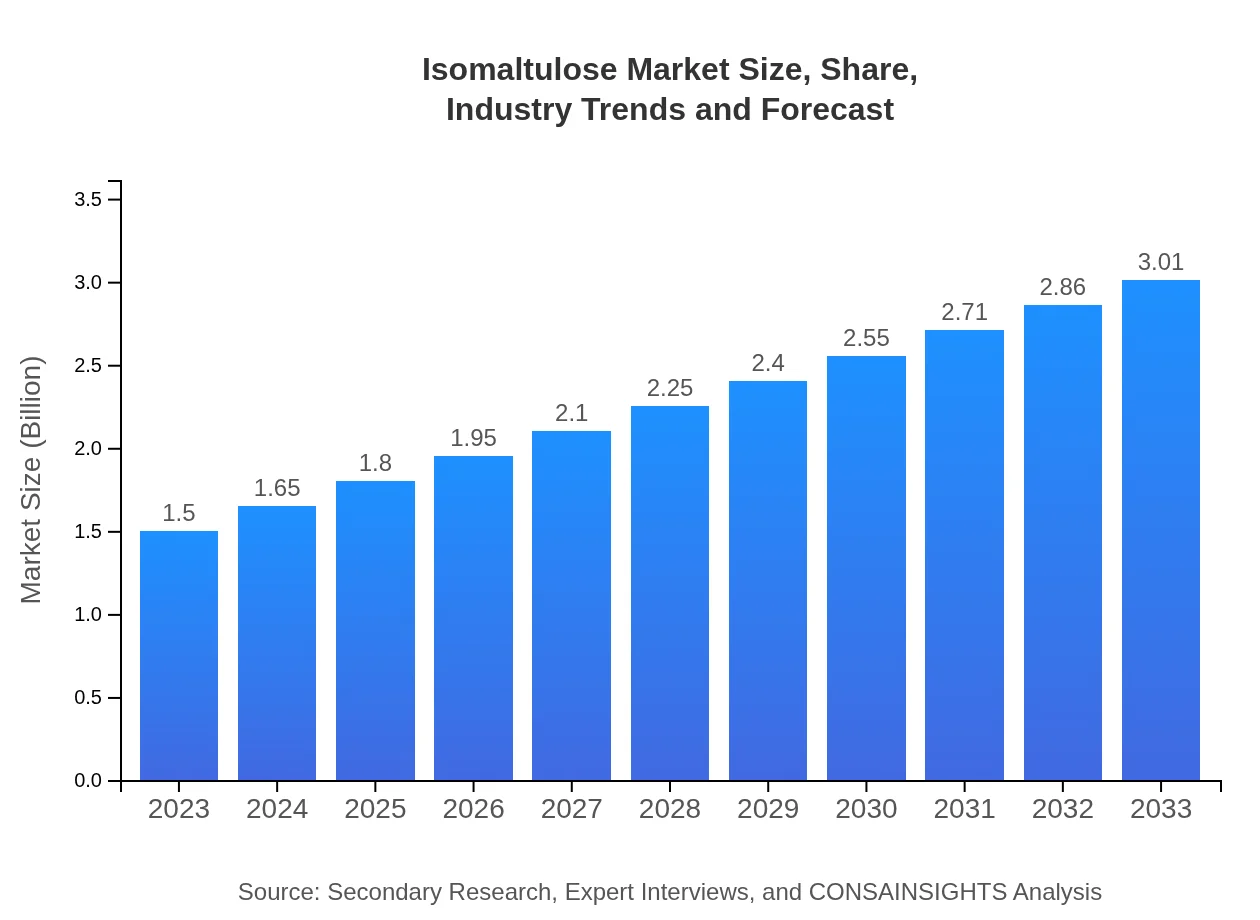

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 7.0% |

| 2033 Market Size | $3.01 Billion |

| Top Companies | Beneo GmbH, Matsutake Chemical Industry Co., Ltd., Shandong Longlive Bio-Technology Co., Ltd. |

| Last Modified Date | 31 January 2026 |

Isomaltulose Market Overview

Customize Isomaltulose Market Report market research report

- ✔ Get in-depth analysis of Isomaltulose market size, growth, and forecasts.

- ✔ Understand Isomaltulose's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Isomaltulose

What is the Market Size & CAGR of Isomaltulose market in 2023?

Isomaltulose Industry Analysis

Isomaltulose Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Isomaltulose Market Analysis Report by Region

Europe Isomaltulose Market Report:

Europe is set to experience significant growth in the Isomaltulose market, with a size of $0.47 billion in 2023 expected to double to $0.93 billion by 2033. Regulatory support for healthier food options and rising consumer demand for natural sweeteners are fueling this growth.Asia Pacific Isomaltulose Market Report:

The Asia-Pacific region holds substantial market potential for Isomaltulose, driven by a robust food and beverage sector eager to adopt innovative sweeteners. The market size in 2023 is approximately $0.28 billion, projected to reach $0.56 billion by 2033, reflecting a CAGR of 7.5%. Increased health consciousness and dietary changes towards low-glycemic products are primary growth factors.North America Isomaltulose Market Report:

North America is poised to be a dominant player in the Isomaltulose market, valued at $0.56 billion in 2023 with projections to reach $1.13 billion by 2033, revealing a CAGR of 7.6%. The increasing incorporation of functional foods and the shift towards organic and health-oriented products are key growth drivers.South America Isomaltulose Market Report:

In South America, the Isomaltulose market is gaining momentum, with a market size of $0.08 billion in 2023, anticipated to grow to $0.17 billion by 2033. The region is witnessing a shift towards healthier alternatives in food and beverage consumption, driven by urbanization and an increase in lifestyle-related diseases.Middle East & Africa Isomaltulose Market Report:

In the Middle East and Africa, the Isomaltulose market is projected to grow from $0.11 billion in 2023 to $0.22 billion by 2033. Increasing awareness of health and dietary management, alongside the expanding food and beverage industry, will drive market growth in the region.Tell us your focus area and get a customized research report.

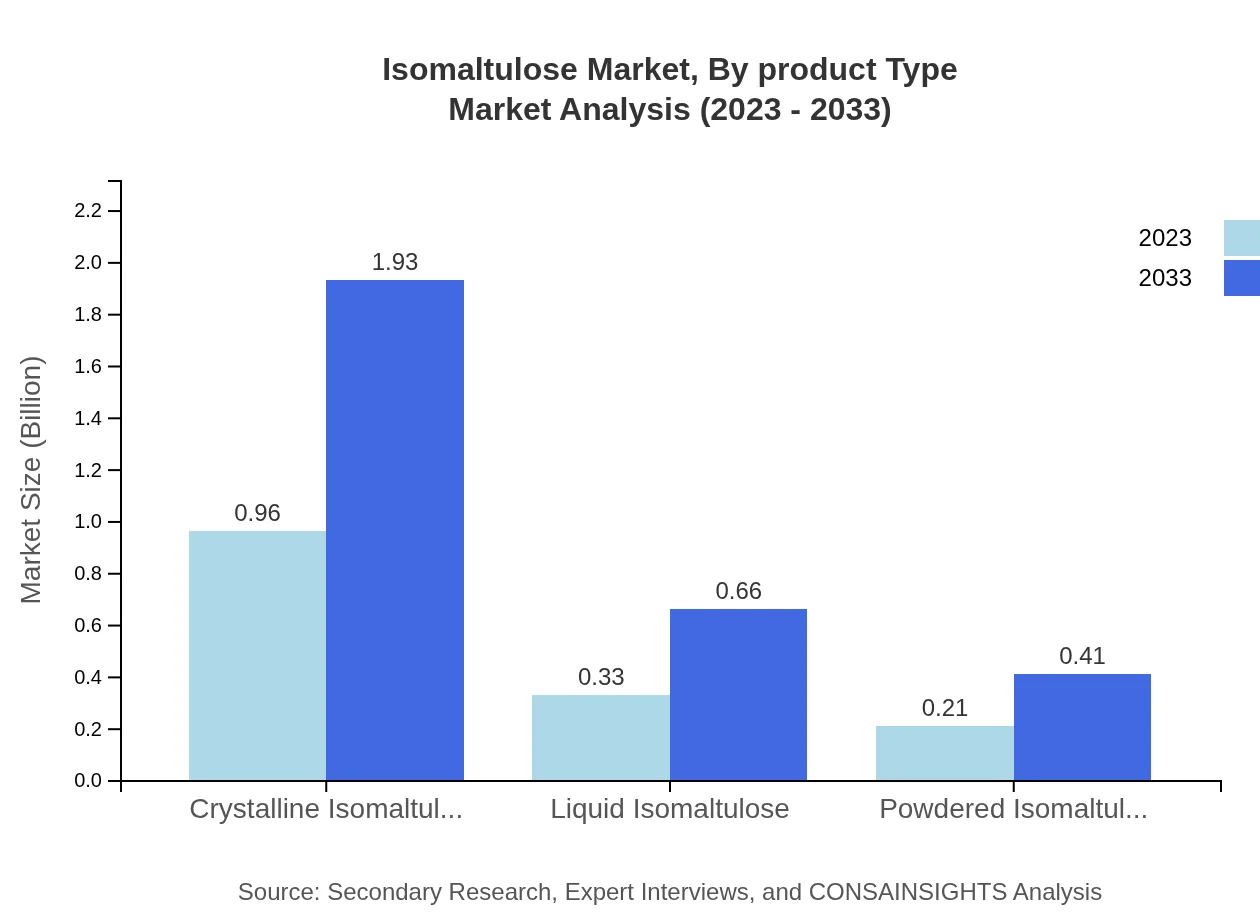

Isomaltulose Market Analysis By Product Type

The Isomaltulose market exhibits a varied landscape based on product types, with Crystalline Isomaltulose dominating the market with a size of $0.96 billion in 2023 and projected to reach $1.93 billion by 2033. Liquid and Powdered Isomaltulose segments also show promising growth, catering to specific applications in food and beverage formulations.

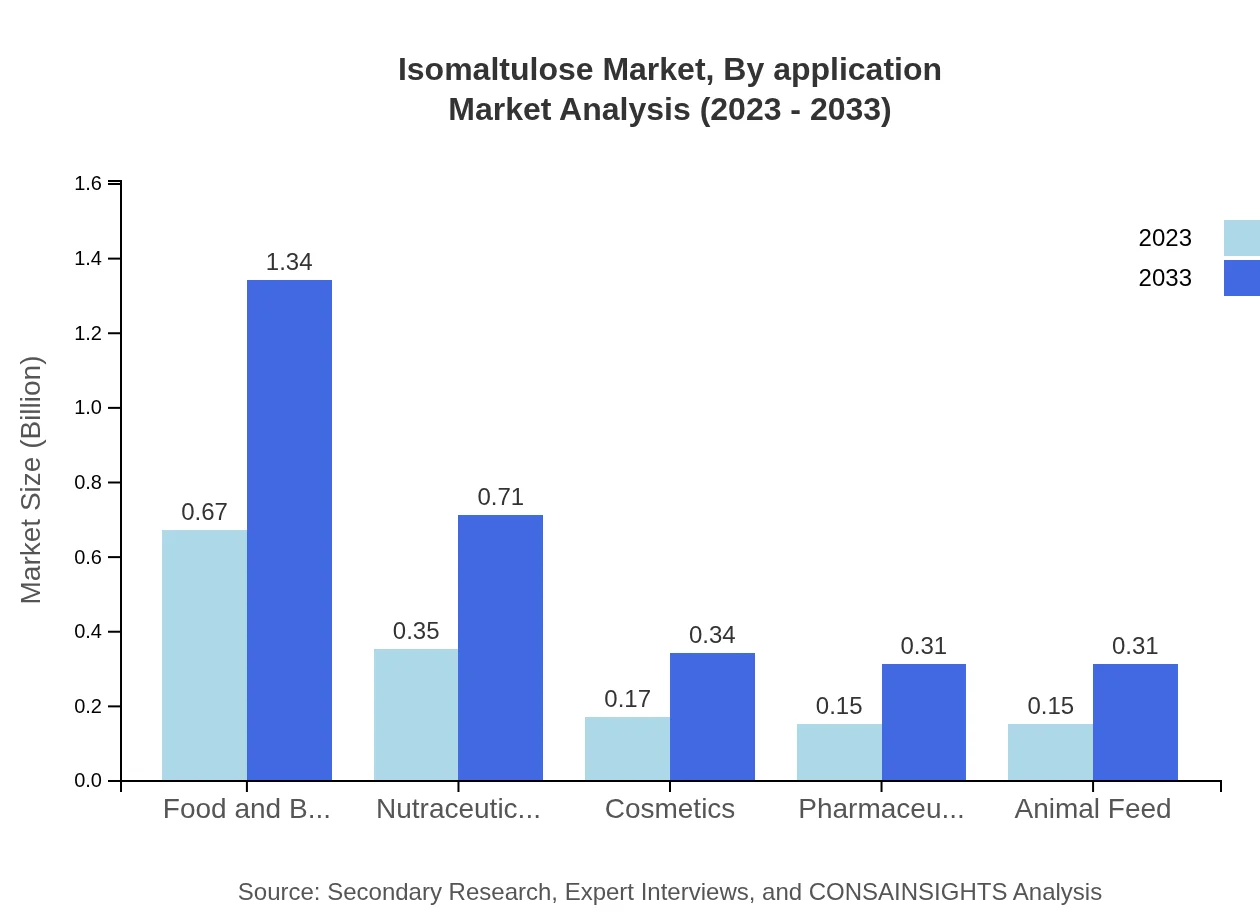

Isomaltulose Market Analysis By Application

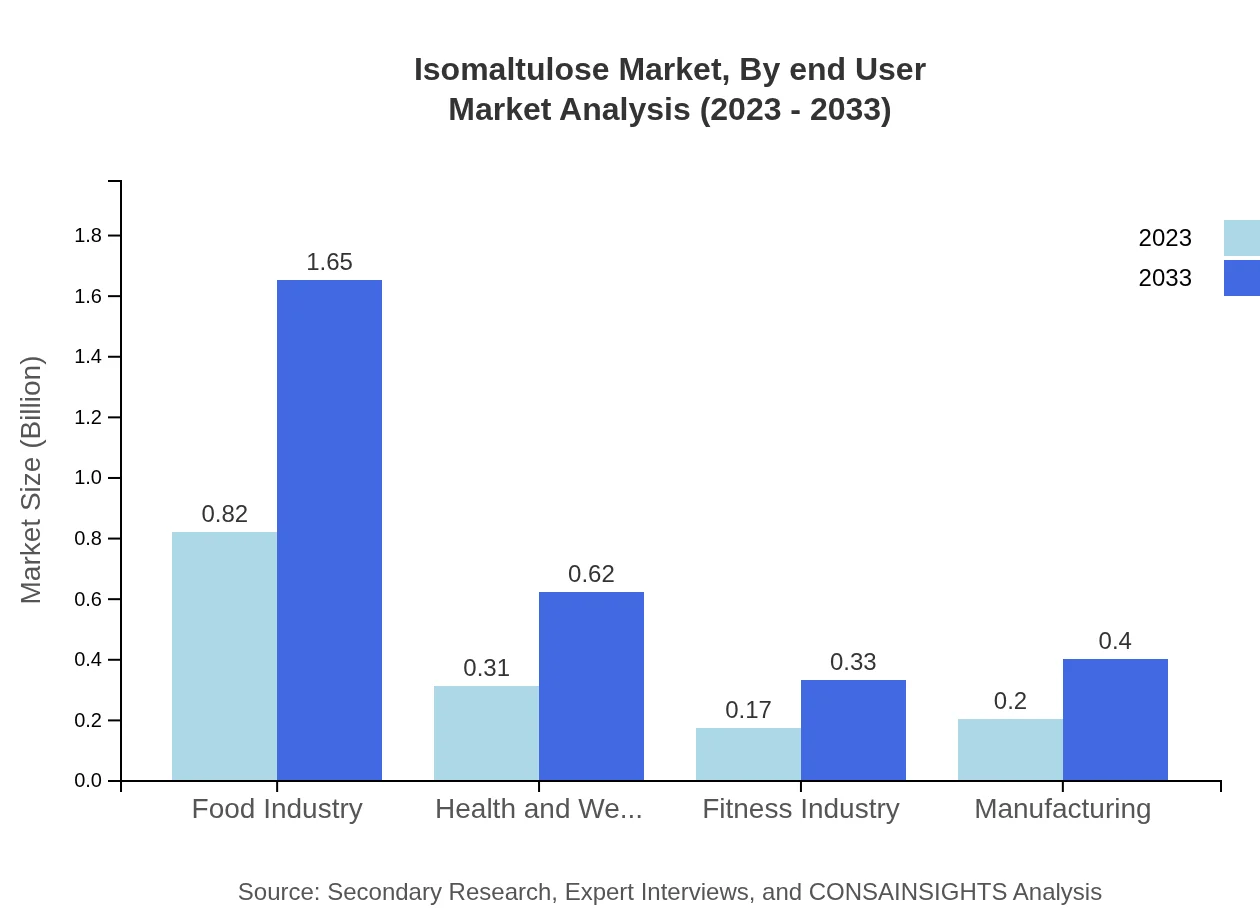

Application-wise, the Food Industry accounts for the largest share, estimated at $0.82 billion in 2023, and is projected to reach $1.65 billion by 2033. Other areas such as Nutraceuticals and Pharmaceuticals are also significant, driven by growing trends towards health and wellness.

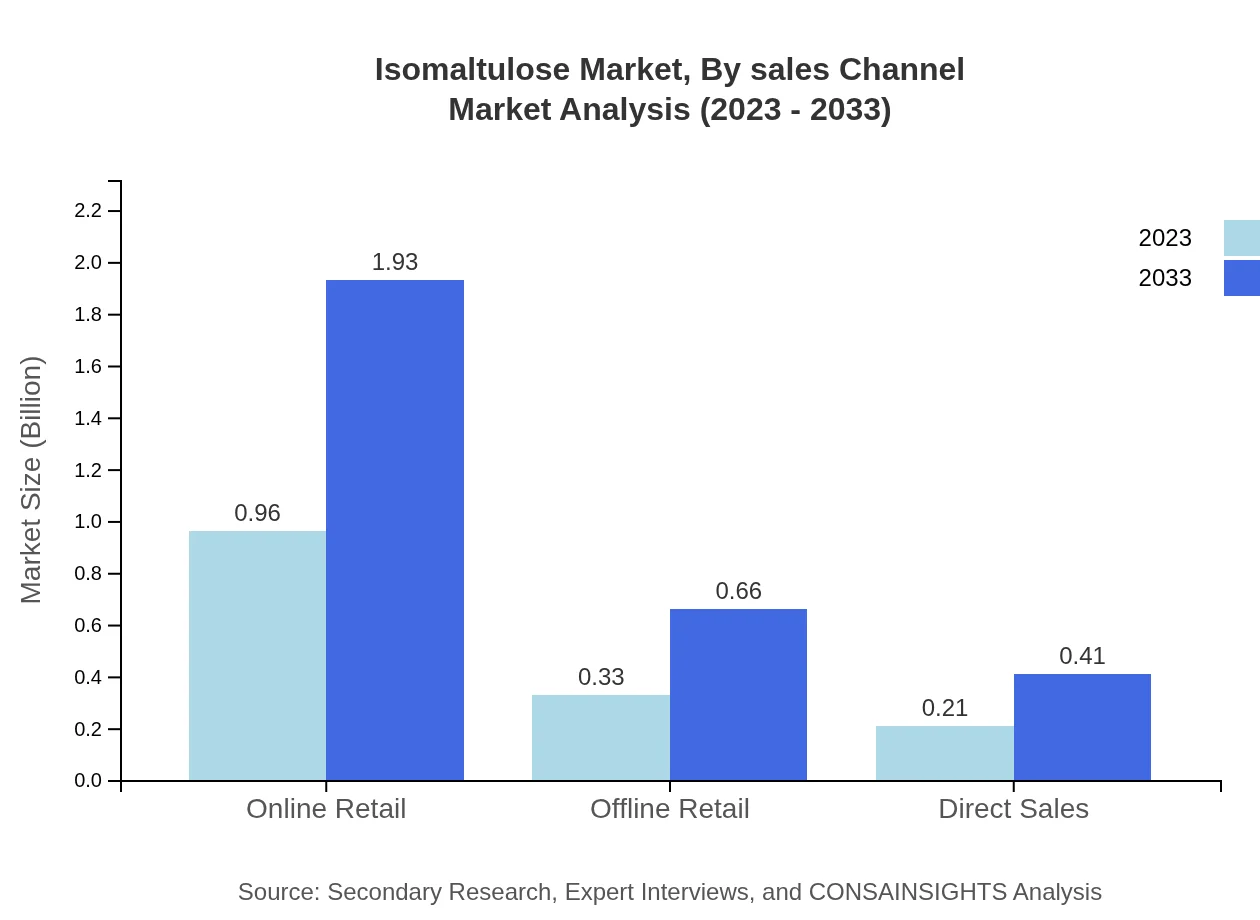

Isomaltulose Market Analysis By Sales Channel

Sales channels are crucial in the Isomaltulose market, with Online Retail leading with a market share of 64.32% in 2023. Offline channels including supermarkets and direct sales are also significant, but the trend leanings towards e-commerce reflect changing consumer buying patterns.

Isomaltulose Market Analysis By End User

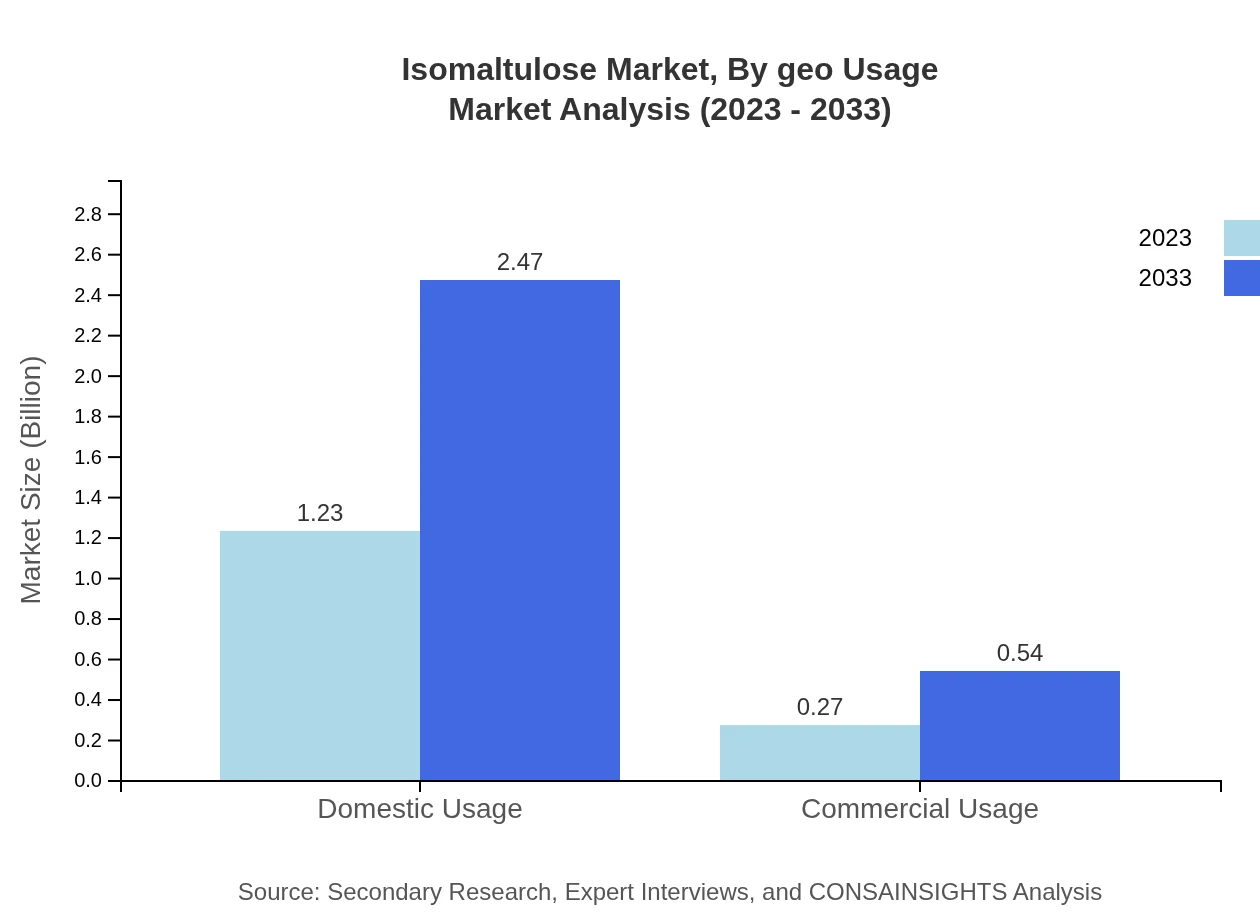

The Domestic Usage segment dominates with an impressive share of 82.16% in 2023. It highlights the growing consumer acceptance of Isomaltulose in households for healthier living. Commercial usage shows substantial growth as industries recognize the benefits of this sweetener.

Isomaltulose Market Analysis By Geo Usage

Regional dynamics illustrate varied adoption rates, with North America and Europe leading in usage per capita, driven by health trends and the presence of significant manufacturers. Asia-Pacific is catching up rapidly, supported by growing health consciousness.

Isomaltulose Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Isomaltulose Industry

Beneo GmbH:

A major player in the Isomaltulose market, Beneo GmbH focuses on developing functional ingredients, including Isomaltulose, aimed at promoting healthy lifestyles and nutritional benefits.Matsutake Chemical Industry Co., Ltd.:

Matsutake is known for its extensive portfolio in sweeteners and starches; it plays a notable role in the Isomaltulose market by providing innovative sweetening solutions.Shandong Longlive Bio-Technology Co., Ltd.:

Specializing in functional food additives, Shandong Longlive is committed to producing high-quality Isomaltulose, catering to evolving consumer needs in health-conscious markets.We're grateful to work with incredible clients.

FAQs

What is the market size of isomaltulose?

The isomaltulose market size was valued at approximately $1.5 billion in 2023, with projections showing a growth to $3.0 billion by 2033. The industry is expected to achieve a remarkable CAGR of 7.0% during this period.

What are the key market players or companies in the isomaltulose industry?

The isomaltulose industry comprises several key players including Linde AG, Cargill Inc., Ingredion Incorporated, and KSU Chemical Corporation. These companies dominate the market with their innovative products and significant market share.

What are the primary factors driving the growth in the isomaltulose industry?

Growth drivers for the isomaltulose market include rising health consciousness, demand for low glycemic index sweeteners, increased applications in the food and beverage industry, and growing awareness regarding the benefits of isomaltulose in energy management.

Which region is the fastest Growing in the isomaltulose market?

North America is anticipated to be the fastest-growing region in the isomaltulose market, expected to grow from $0.56 billion in 2023 to $1.13 billion by 2033. This region's significant health and wellness trends contribute to this growth.

Does ConsaInsights provide customized market report data for the isomaltulose industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the isomaltulose industry. Clients can request detailed insights and data specific to their segment or market focus.

What deliverables can I expect from this isomaltulose market research project?

Clients can expect detailed reports comprising market size analysis, growth trends, competitive landscape, consumer insights, and future forecasts. Additionally, customized dashboards and presentations will support strategic decision-making.

What are the market trends of isomaltulose?

Market trends indicate an increasing shift towards health-centric diets, growing demand for natural sweeteners, and expanded product availability across various segments such as food, beverages, and nutraceuticals. This trend points toward sustained growth in the isomaltulose market.