It Asset Disposition Market Report

Published Date: 31 January 2026 | Report Code: it-asset-disposition

It Asset Disposition Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the It Asset Disposition market, focusing on current trends, growth forecasts, and market dynamics from 2023 to 2033. Insights on regional performance and sector segmentation are also included to support strategic decision-making.

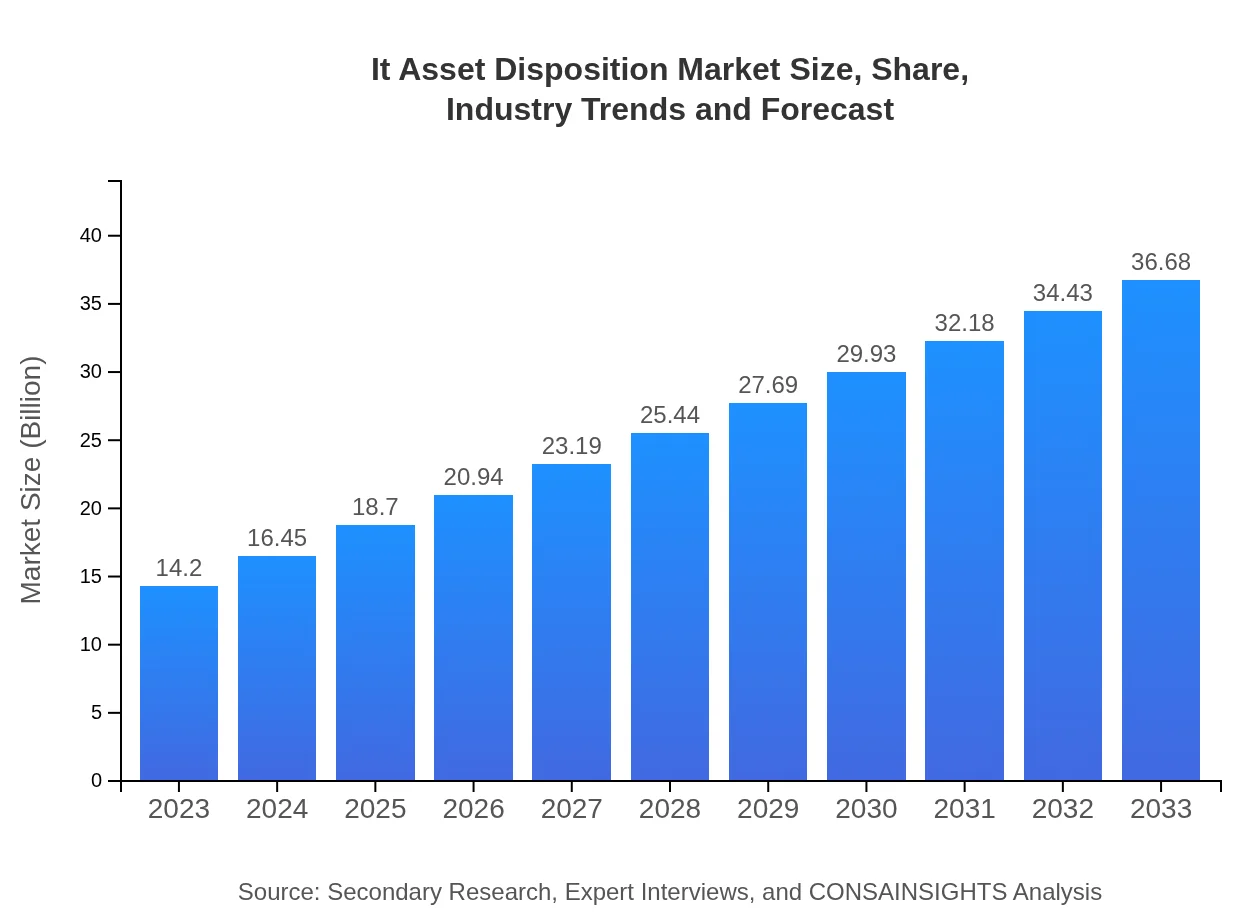

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $14.20 Billion |

| CAGR (2023-2033) | 9.6% |

| 2033 Market Size | $36.68 Billion |

| Top Companies | Iron Mountain Incorporated, Sims Recycling Solutions, About Recycling, Hewlett Packard Enterprise, Electronic Recyclers International |

| Last Modified Date | 31 January 2026 |

It Asset Disposition Market Overview

Customize It Asset Disposition Market Report market research report

- ✔ Get in-depth analysis of It Asset Disposition market size, growth, and forecasts.

- ✔ Understand It Asset Disposition's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in It Asset Disposition

What is the Market Size & CAGR of It Asset Disposition market in 2023?

It Asset Disposition Industry Analysis

It Asset Disposition Market Segmentation and Scope

Tell us your focus area and get a customized research report.

It Asset Disposition Market Analysis Report by Region

Europe It Asset Disposition Market Report:

With a market size of $3.85 billion in 2023, Europe is set to expand to $9.94 billion by 2033. The region's growth is propelled by stringent environmental regulations regarding e-waste and a strong push towards sustainability. European companies are significantly investing in ITAD to ensure compliance while addressing the growing concerns surrounding data protection.Asia Pacific It Asset Disposition Market Report:

In 2023, the Asia Pacific region's It Asset Disposition market is valued at $3.04 billion, projected to reach $7.86 billion by 2033. The growth in this region is primarily driven by increasing technological adoption, urbanization, and stringent regulations on e-waste management. Additionally, the rising emphasis on data protection is propelling organizations towards outsourcing ITAD services.North America It Asset Disposition Market Report:

The North American It Asset Disposition market size is estimated at $4.85 billion in 2023 and is projected to escalate to $12.51 billion by 2033. The region represents a mature market owing to the high levels of e-waste generated, extensive regulation on data security, and well-established ITAD services. Advancements in recycling technologies are also enhancing the market outlook.South America It Asset Disposition Market Report:

The South American It Asset Disposition market was valued at $0.51 billion in 2023 and is expected to grow to $1.31 billion by 2033. The market's growth is supported by a rising middle class, growing adoption of digital technologies, and increased awareness regarding environmental sustainability and data security.Middle East & Africa It Asset Disposition Market Report:

The Middle East and Africa It Asset Disposition market is valued at $1.96 billion in 2023, with projections indicating growth to $5.05 billion by 2033. The key drivers include a surge in IT investments, coupled with increasing investments in data destruction services amid region-specific regulatory pressures, making ITAD a priority.Tell us your focus area and get a customized research report.

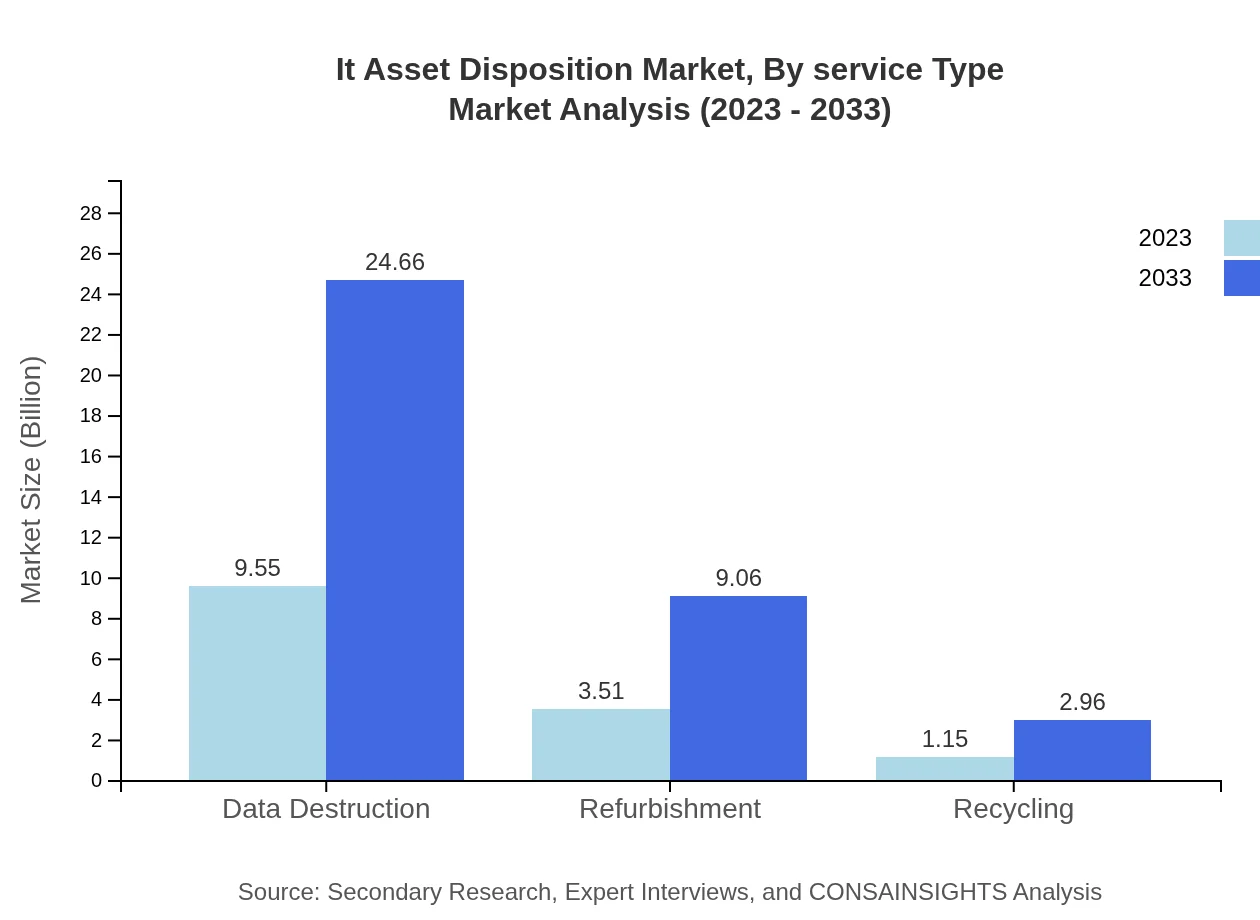

It Asset Disposition Market Analysis By Service Type

The service type segment in the IT Asset Disposition market focuses on service offerings such as data destruction, refurbishment, recycling, and resale. Data destruction leads the market with a significant share of 67.23% in 2023, growing to 67.23% in 2033, reflecting the increasing focus on data security. Refurbishment and resale services also hold considerable market value, emphasizing the trend toward maximizing asset recovery.

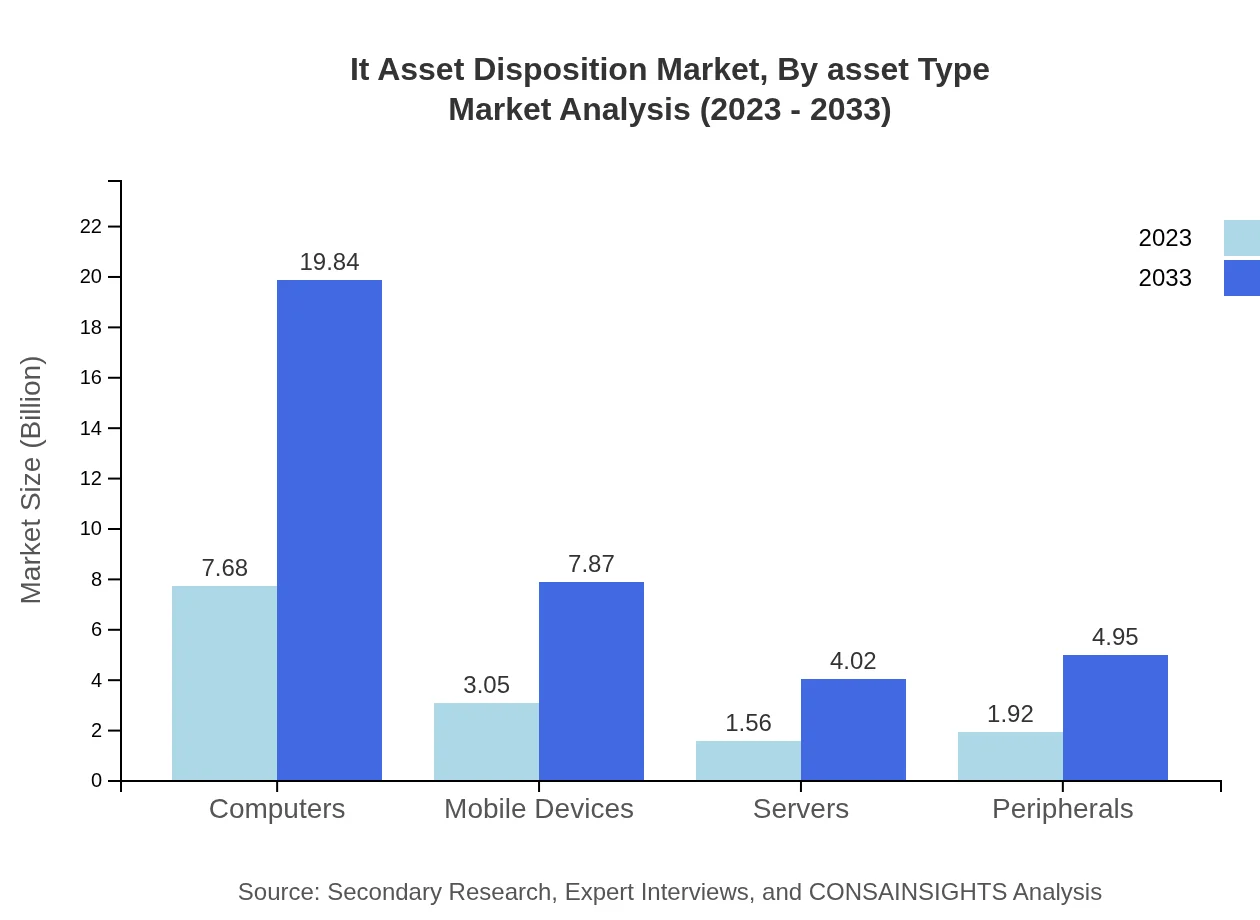

It Asset Disposition Market Analysis By Asset Type

The asset type segment includes computers, mobile devices, servers, and peripherals. In 2023, computers make up a substantial 54.09% of the market share, with a projected growth to 54.09% in 2033. Mobile devices are also significant, with a share of 21.45% in 2023, reflecting their growing usage and need for responsible disposal as technology evolves.

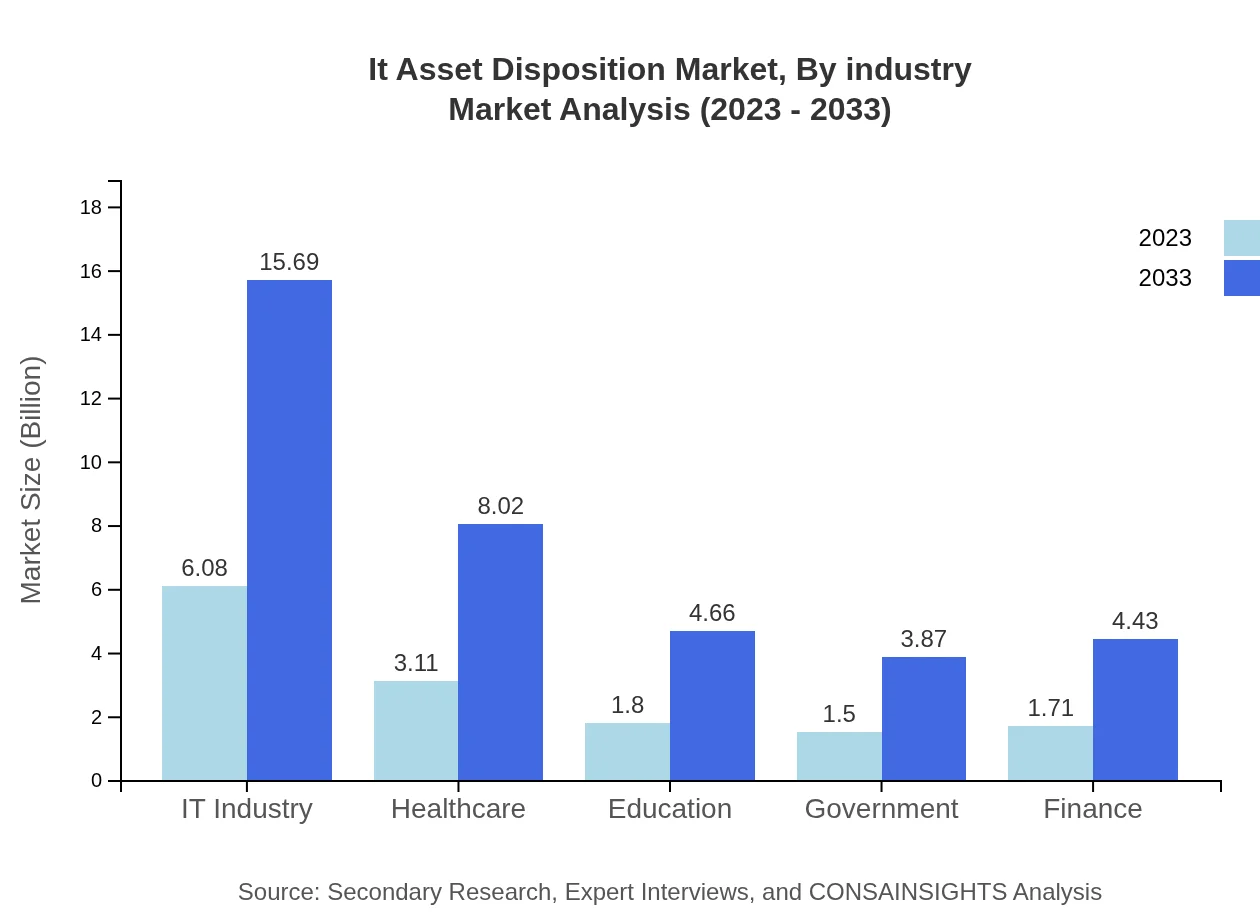

It Asset Disposition Market Analysis By Industry

The ITAD market is segmented by industry into IT, healthcare, education, government, and finance. The IT sector dominates with a size of $6.08 billion in 2023, projected to reach $15.69 billion in 2033, highlighting the critical nature of ITAD in tech-heavy industries. Healthcare and education also show solid market sizes of $3.11 billion and $1.80 billion respectively in 2023, emphasizing sector-specific needs for secure asset disposal.

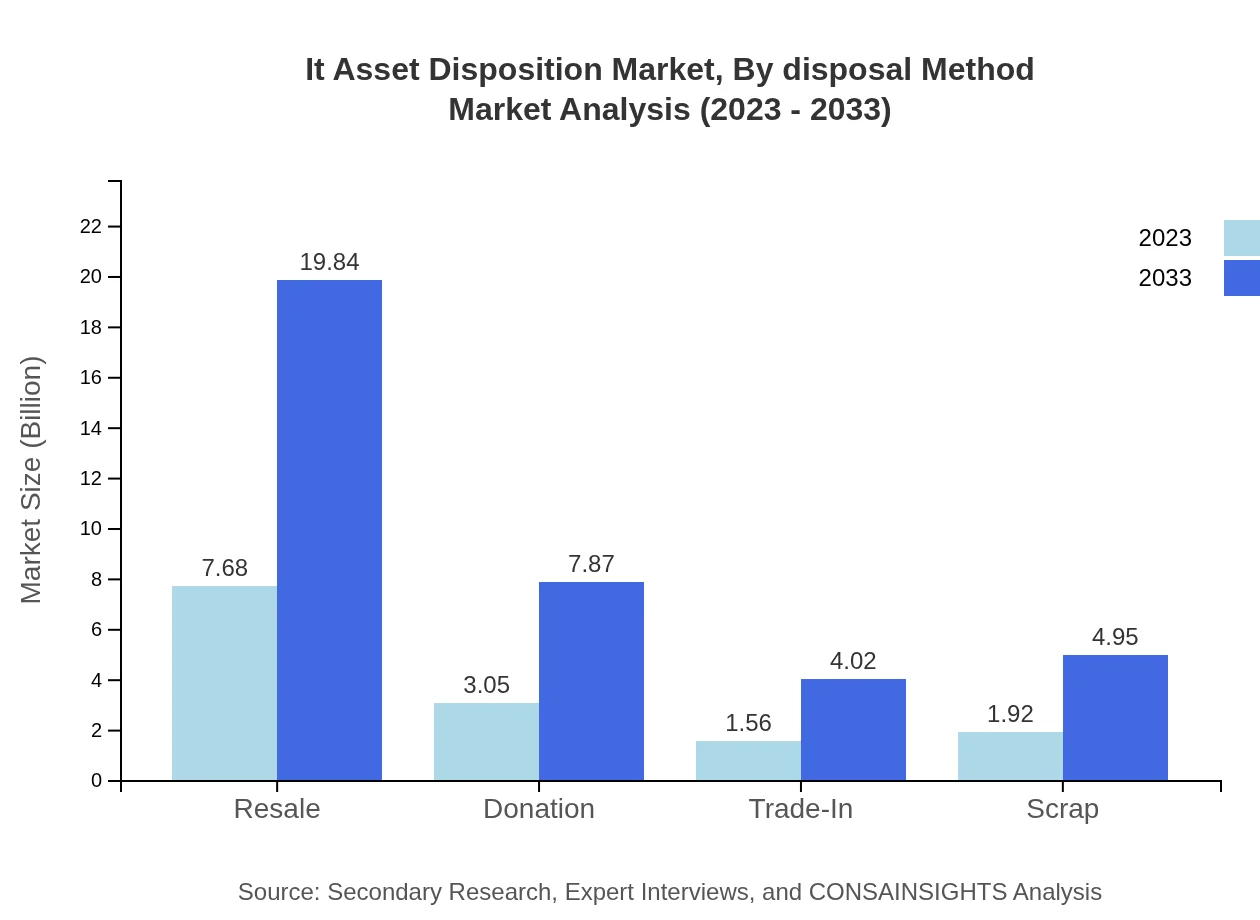

It Asset Disposition Market Analysis By Disposal Method

This segment includes methods of disposal such as recycling, trade-in, and donation. Resale remains the most effective outlet for recovered assets, featuring a $7.68 billion market size in 2023, expected to double in size to $19.84 billion by 2033. Similarly, data destruction services are forecasted to maintain their growth trajectory, reinforcing the industry's commitment to data security.

It Asset Disposition Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in It Asset Disposition Industry

Iron Mountain Incorporated:

Iron Mountain is a leading player providing secure IT asset disposition, data management, and storage solutions, known for its strong compliance and recycling initiatives worldwide.Sims Recycling Solutions:

Sims Recycling Solutions specializes in electronics recycling and asset recovery, offering solutions that minimize environmental impact and maximize value recovery from IT assets.About Recycling:

A Eco-Friendly recycling and IT asset disposition company emphasizing sustainability, offering services that create value from IT waste while ensuring compliance with environmental standards.Hewlett Packard Enterprise:

Hewlett Packard Enterprise provides HP's own IT asset disposition services, focusing on data security and environmental responsibility, including end-of-life management of IT equipment.Electronic Recyclers International:

Electronic Recyclers International is a leader in recycling electronics and providing asset recovery services while focusing on environmentally responsible disposal methods.We're grateful to work with incredible clients.

FAQs

What is the market size of IT Asset Disposition?

The IT Asset Disposition market is valued at $14.2 billion in 2023, with a projected CAGR of 9.6% reaching significant growth by 2033, thereby responding to the increasing demand for responsible electronic waste management.

What are the key market players or companies in the IT Asset Disposition industry?

Key players in the IT Asset Disposition industry include global firms specializing in e-waste management, data destruction, and refurbishment services. Companies like Iron Mountain, Sims Recycling Solutions, and Lakeland industry leaders push innovation and sustainable practices.

What are the primary factors driving the growth in the IT Asset Disposition industry?

Growth in the IT Asset Disposition industry is primarily driven by concerns over data security, the environmental impact of e-waste, stringent regulations governing electronic disposal, and the surge in IT equipment volumes needing sustainable disposition methods.

Which region is the fastest Growing in the IT Asset Disposition market?

North America is the fastest-growing region in the IT Asset Disposition market, projected to grow from $4.85 billion in 2023 to $12.51 billion by 2033. This rapid growth reflects robust technological infrastructure and regulatory frameworks.

Does ConsaInsights provide customized market report data for the IT Asset Disposition industry?

Yes, ConsaInsights offers customized market reports tailored to specific client needs within the IT Asset Disposition industry, providing comprehensive strategies based on unique business parameters and market trends.

What deliverables can I expect from this IT Asset Disposition market research project?

Deliverables from the IT Asset Disposition research project typically include detailed market analysis, segment insights, competitive landscape evaluation, forecasts, strategic recommendations, and data visualizations highlighting key trends.

What are the market trends of IT Asset Disposition?

Significant trends in the IT Asset Disposition market include increased focus on data privacy, rising adoption of sustainable practices, technological advancements in e-waste recycling, and growing consumer awareness surrounding the financial benefits of effective asset disposition.