It Bfsi Market Report

Published Date: 31 January 2026 | Report Code: it-bfsi

It Bfsi Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the IT BFSI market, covering market size, growth forecasts, segmentation, regional insights, and key players within the industry. The analysis spans from 2023 to 2033, offering critical insights into future trends and opportunities.

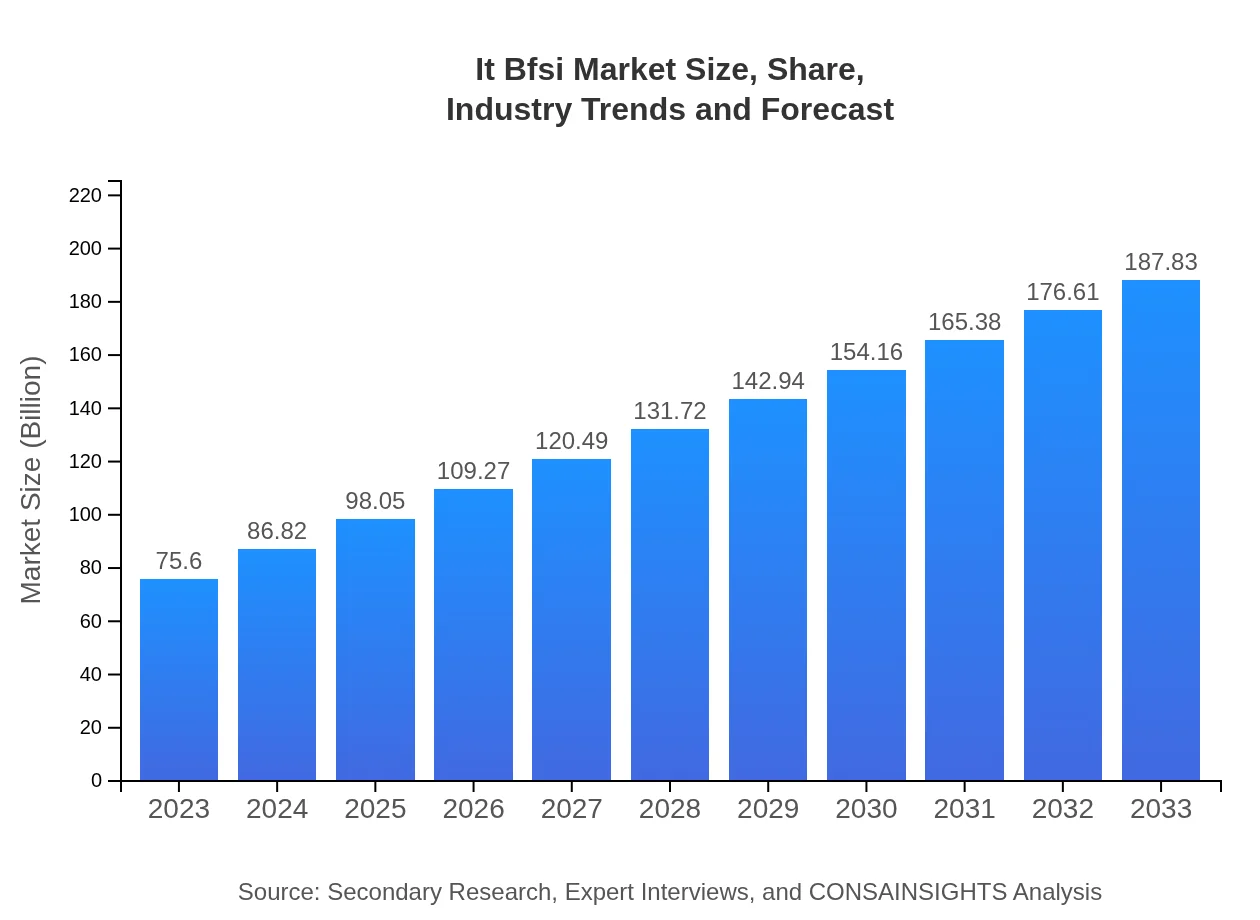

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $75.60 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $187.83 Billion |

| Top Companies | IBM, Oracle, SAP, FIS, Cerner |

| Last Modified Date | 31 January 2026 |

IT BFSI Market Overview

Customize It Bfsi Market Report market research report

- ✔ Get in-depth analysis of It Bfsi market size, growth, and forecasts.

- ✔ Understand It Bfsi's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in It Bfsi

What is the Market Size & CAGR of IT BFSI market in 2023?

IT BFSI Industry Analysis

IT BFSI Market Segmentation and Scope

Tell us your focus area and get a customized research report.

IT BFSI Market Analysis Report by Region

Europe It Bfsi Market Report:

The European market, currently valued at $23.89 billion, is projected to expand to $59.35 billion by 2033. The growth is attributed to stringent regulatory requirements precipitating technology upgrades, as well as the increasing adoption of open banking initiatives across the continent.Asia Pacific It Bfsi Market Report:

In the Asia Pacific region, the IT BFSI market is valued at $14.8 billion in 2023, projected to grow to $36.78 billion by 2033, reflecting the region's rapid digital adoption and investment in fintech solutions. Countries like India and China are leading this transformation due to favorable government initiatives and a growing technology-savvy populace.North America It Bfsi Market Report:

North America remains the largest market, estimated at $24.29 billion in 2023 and anticipated to reach $60.35 billion by 2033. The presence of major financial institutions, along with significant investments in cybersecurity and big data analytics, drive this market's dominance.South America It Bfsi Market Report:

South America showcases a developing IT BFSI market, starting at $2.83 billion in 2023 and expected to rise to $7.04 billion by 2033. The region witnesses growth driven by increased mobile banking penetration and a surge in local fintech startups responding to unmet consumer demands.Middle East & Africa It Bfsi Market Report:

The Middle East and Africa IT BFSI market, valued at $9.78 billion in 2023, is forecasted to grow to $24.31 billion by 2033. This growth is characterized by an increasing shift towards digital banking solutions, driven by a young population and the demand for enhanced customer service.Tell us your focus area and get a customized research report.

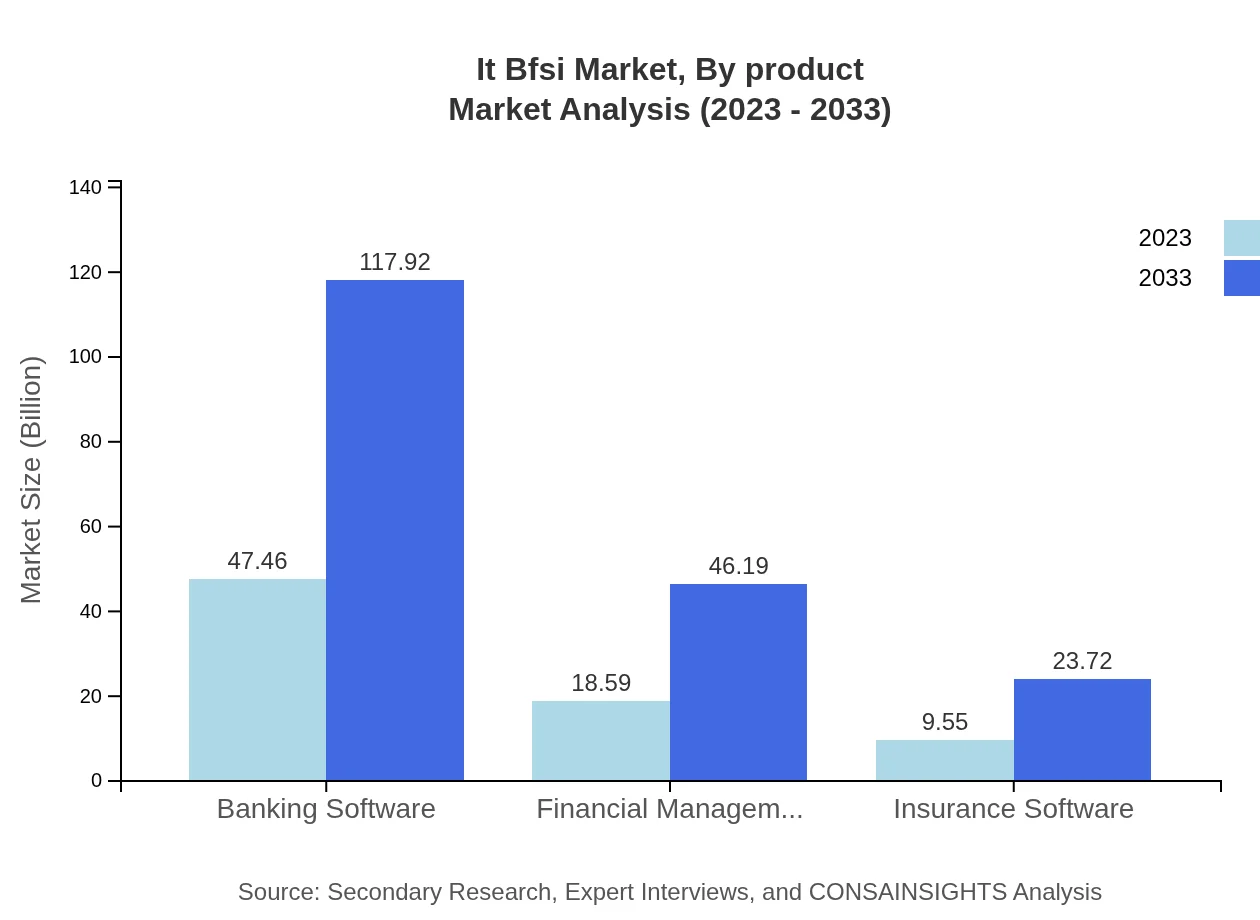

It Bfsi Market Analysis By Product

The Banking Software segment leads the market with a size of approximately $47.46 billion in 2023 and a projected growth to $117.92 billion by 2033. Financial Management Tools follow, starting at $18.59 billion in 2023, projected to reach $46.19 billion by 2033. Insurance Software also showcases growth, valued at $9.55 billion in 2023 and expanding to $23.72 billion by 2033.

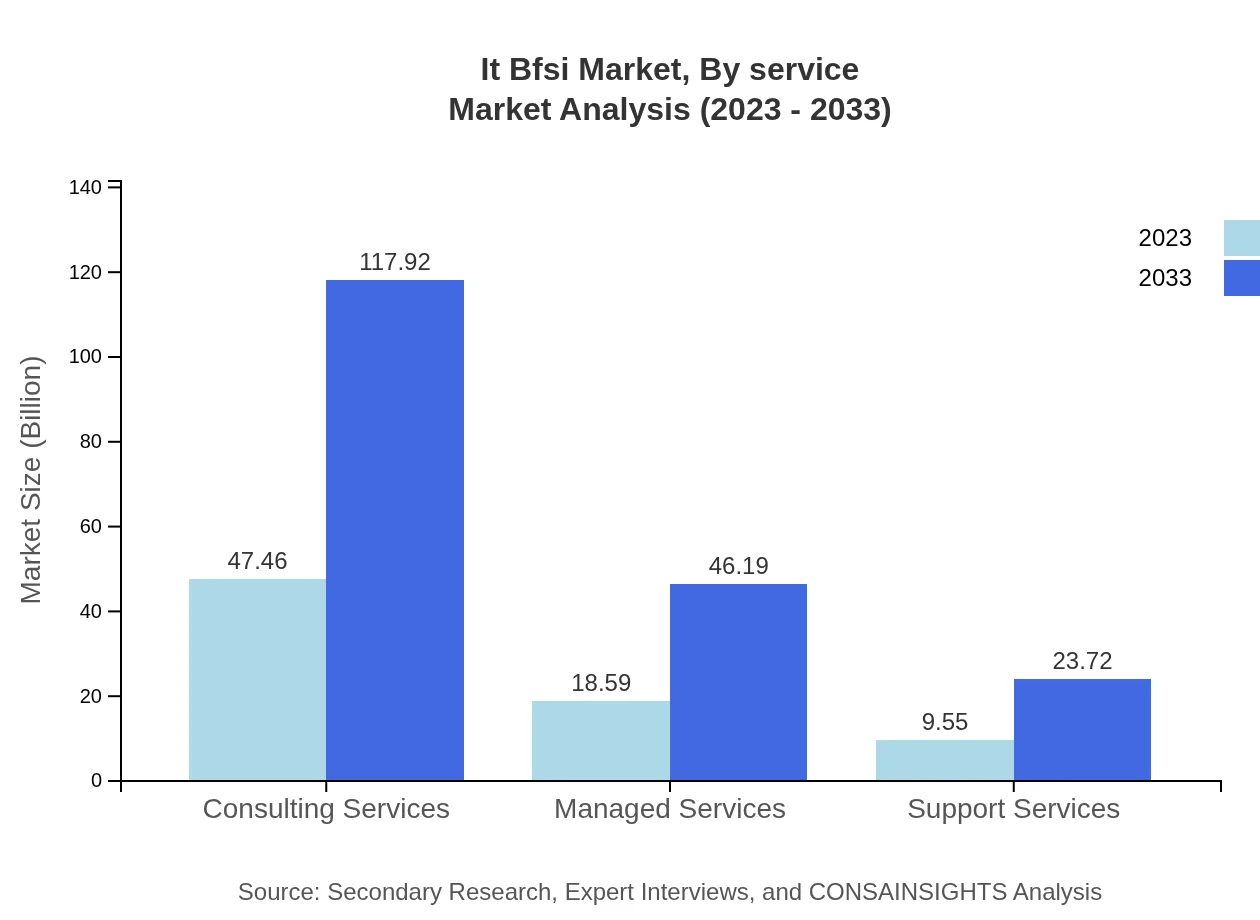

It Bfsi Market Analysis By Service

Consulting Services represent a significant market share with $47.46 billion in 2023 and expected to double by 2033. Managed Services and Support Services are also vital parts of the sector, with Managed Services starting at $18.59 billion and projected to reach $46.19 billion, while Support Services also reflects growth from $9.55 billion to $23.72 billion.

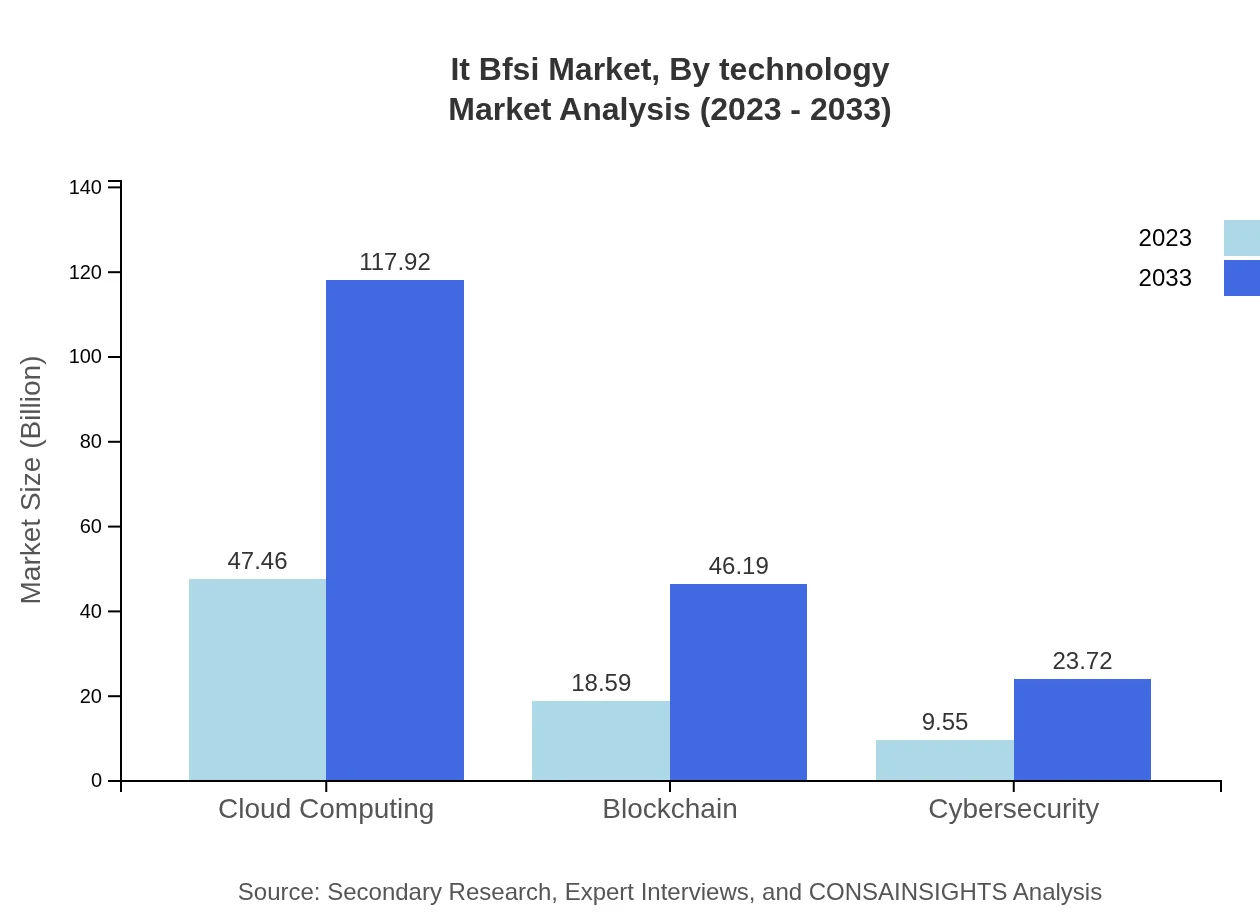

It Bfsi Market Analysis By Technology

Cloud Computing remains a dominant trend with a market size of $47.46 billion in 2023, expected to soar to $117.92 billion by 2033. The Blockchain segment follows with a starting value of $18.59 billion in 2023, anticipated to grow to $46.19 billion, alongside the Cybersecurity segment, projected to increase from $9.55 billion to $23.72 billion.

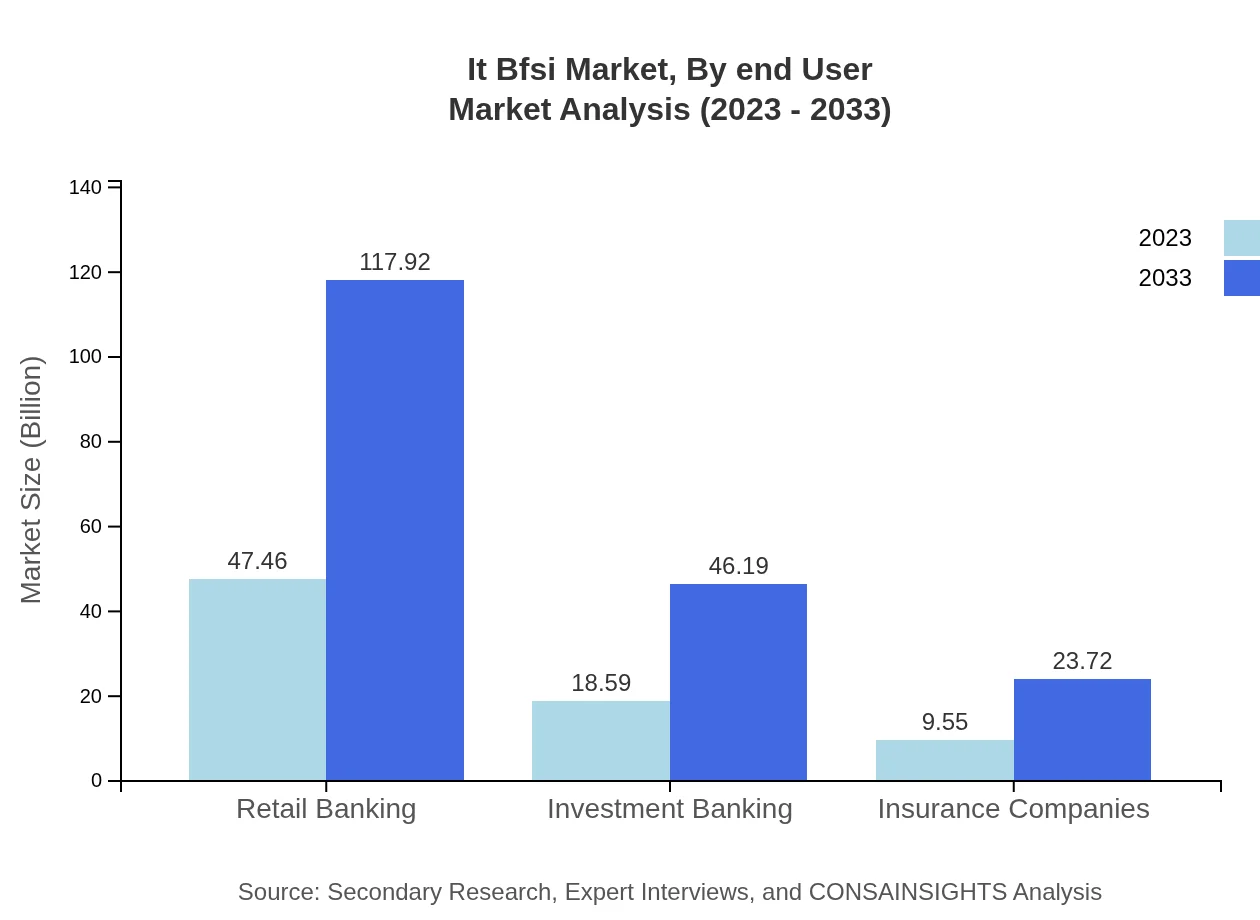

It Bfsi Market Analysis By End User

The Retail Banking sector commands the market with a size of $47.46 billion in 2023 and projected growth to $117.92 billion by 2033. Investment Banking stands at $18.59 billion in 2023, targeting $46.19 billion by 2033. The Insurance Companies segment also reflects resilience, starting at $9.55 billion and advancing to $23.72 billion by 2033.

IT BFSI Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in IT BFSI Industry

IBM:

IBM offers a suite of IT solutions tailored for the financial services sector, including artificial intelligence, cloud computing, and blockchain technology, enabling banks and insurers to innovate and enhance customer service.Oracle:

Oracle provides comprehensive software solutions for financial institutions, focusing on efficiency, data management, and regulatory compliance, supporting fintech innovations across the globe.SAP:

SAP designs ERP solutions specifically for the BFSI market, facilitating operational efficiency, real-time analytics, and strategic planning for businesses in the financial sector.FIS:

FIS is known for its leadership in banking and payments technology, offering services ranging from core banking systems to risk management solutions, thus enhancing the overall efficiency of financial institutions.Cerner:

Cerner focuses on health IT solutions but has ventured into integrating health data with financial data, tapping into the growing intersection of health and finance, particularly in insurance.We're grateful to work with incredible clients.

FAQs

What is the market size of IT-BFSI?

The IT-BFSI market size is projected to reach approximately $75.6 billion by 2033, with a compound annual growth rate (CAGR) of 9.2% during the forecast period. This growth reflects a strong demand for innovative financial technology solutions.

What are the key market players or companies in the IT-BFSI industry?

Key players in the IT-BFSI sector include major financial institutions and technology companies dedicated to transforming financial services through digital innovation, focusing on banking software, financial management tools, and cybersecurity solutions.

What are the primary factors driving the growth in the IT-BFSI industry?

The growth in the IT-BFSI industry is driven by the increasing demand for digital banking, the need for enhanced cybersecurity solutions, and the rapid adoption of financial technology, including cloud computing and blockchain technologies.

Which region is the fastest Growing in the IT-BFSI market?

The fastest-growing region in the IT-BFSI market is expected to be Asia Pacific, with market growth from $14.80 billion in 2023 to $36.78 billion by 2033, showcasing the region's rising economic development and technology adoption.

Does ConsaInsights provide customized market report data for the IT-BFSI industry?

Yes, ConsaInsights offers customized market report data tailored to client-specific needs within the IT-BFSI industry, enabling precise insights into market trends and forecasts for strategic decision-making.

What deliverables can I expect from this IT-BFSI market research project?

Deliverables from the IT-BFSI market research project typically include comprehensive reports, data analytics, regional market insights, segmented market analysis, and strategic recommendations tailored for stakeholders.

What are the market trends of IT-BFSI?

Key market trends in the IT-BFSI sector include the growth of digital banking, increased emphasis on cybersecurity, expansion of cloud services, and the continuous evolution of financial technologies such as blockchain and AI.