It Connector Market Report

Published Date: 31 January 2026 | Report Code: it-connector

It Connector Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the It Connector market, encompassing market size, trends, industry insights, and forecasts for the period from 2023 to 2033. Readers will gain valuable insights into the current status and future directions of this rapidly evolving sector.

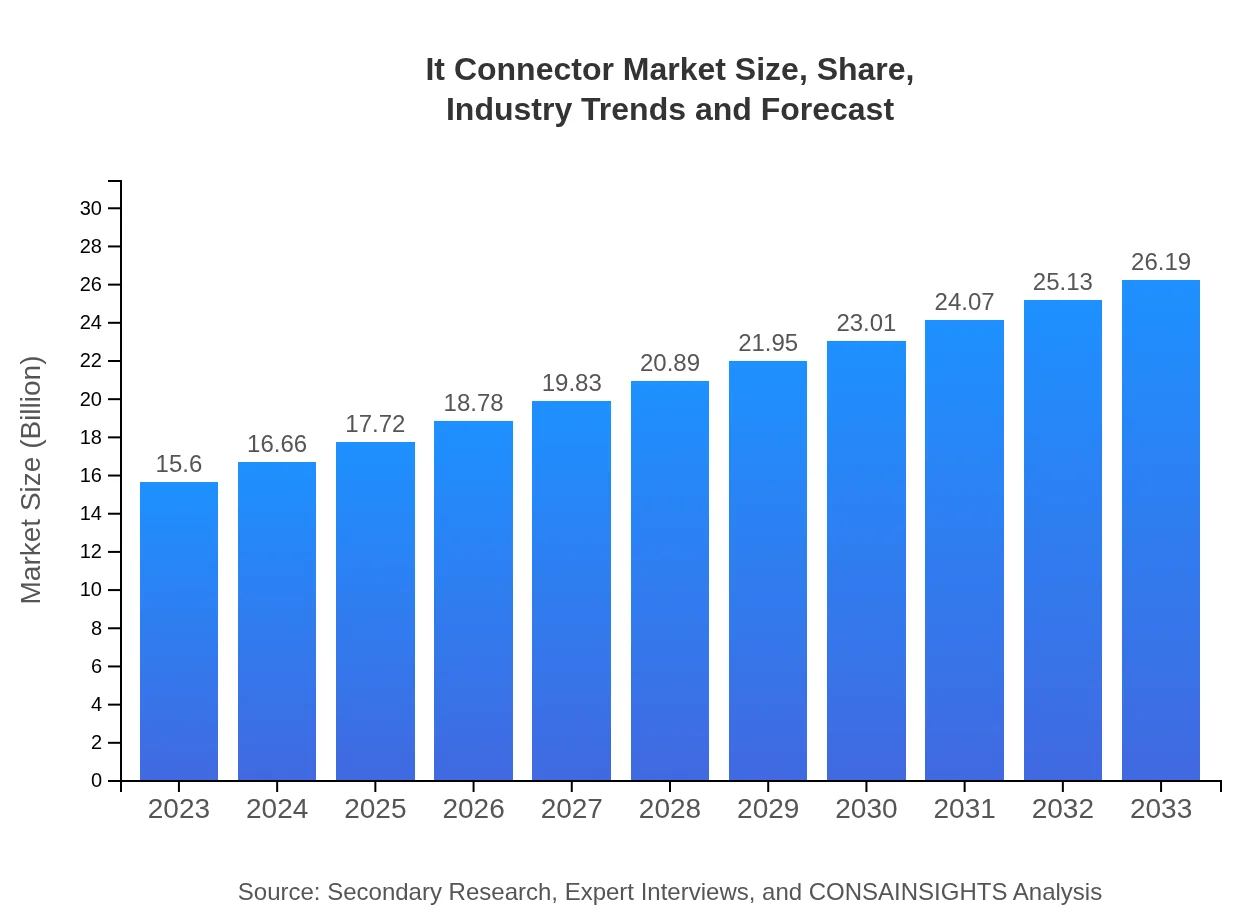

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $26.19 Billion |

| Top Companies | TE Connectivity, Molex, Amphenol Corporation, Belden |

| Last Modified Date | 31 January 2026 |

It Connector Market Overview

Customize It Connector Market Report market research report

- ✔ Get in-depth analysis of It Connector market size, growth, and forecasts.

- ✔ Understand It Connector's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in It Connector

What is the Market Size & CAGR of It Connector market in 2023?

It Connector Industry Analysis

It Connector Market Segmentation and Scope

Tell us your focus area and get a customized research report.

It Connector Market Analysis Report by Region

Europe It Connector Market Report:

The European market for It Connectors is projected to see growth from $4.74 billion in 2023 to $7.96 billion by 2033. This growth trajectory is propelled by the increasing focus on sustainability, coupled with technological transitions towards renewable energy and smart grid applications.Asia Pacific It Connector Market Report:

The Asia Pacific It Connector market is poised for significant growth, with a market size projected to increase from $2.80 billion in 2023 to $4.70 billion by 2033. This growth is driven by rapid technological advancements, particularly in electronics manufacturing, and a growing middle-class population with rising disposable income fueling demand for consumer electronics.North America It Connector Market Report:

North America stands as a leader in the It Connector market, with an expected market size growth from $5.90 billion in 2023 to $9.90 billion in 2033. Factors driving this growth include robust demand for advanced connectivity solutions in enterprise IT, significant investments in R&D, and the proliferation of smart devices.South America It Connector Market Report:

In South America, the market for It Connectors is set to grow from $1.05 billion in 2023 to $1.76 billion by 2033. This region's growth is largely shaped by increasing investments in technology infrastructure, which is enhancing the need for efficient connectivity solutions across various sectors, including IT and telecommunications.Middle East & Africa It Connector Market Report:

The It Connector market in the Middle East and Africa is estimated to grow from $1.11 billion in 2023 to $1.86 billion by 2033. This growth is attributed to the region's ongoing digital transformation efforts, investments in smart city infrastructures, and rising mobile device penetration.Tell us your focus area and get a customized research report.

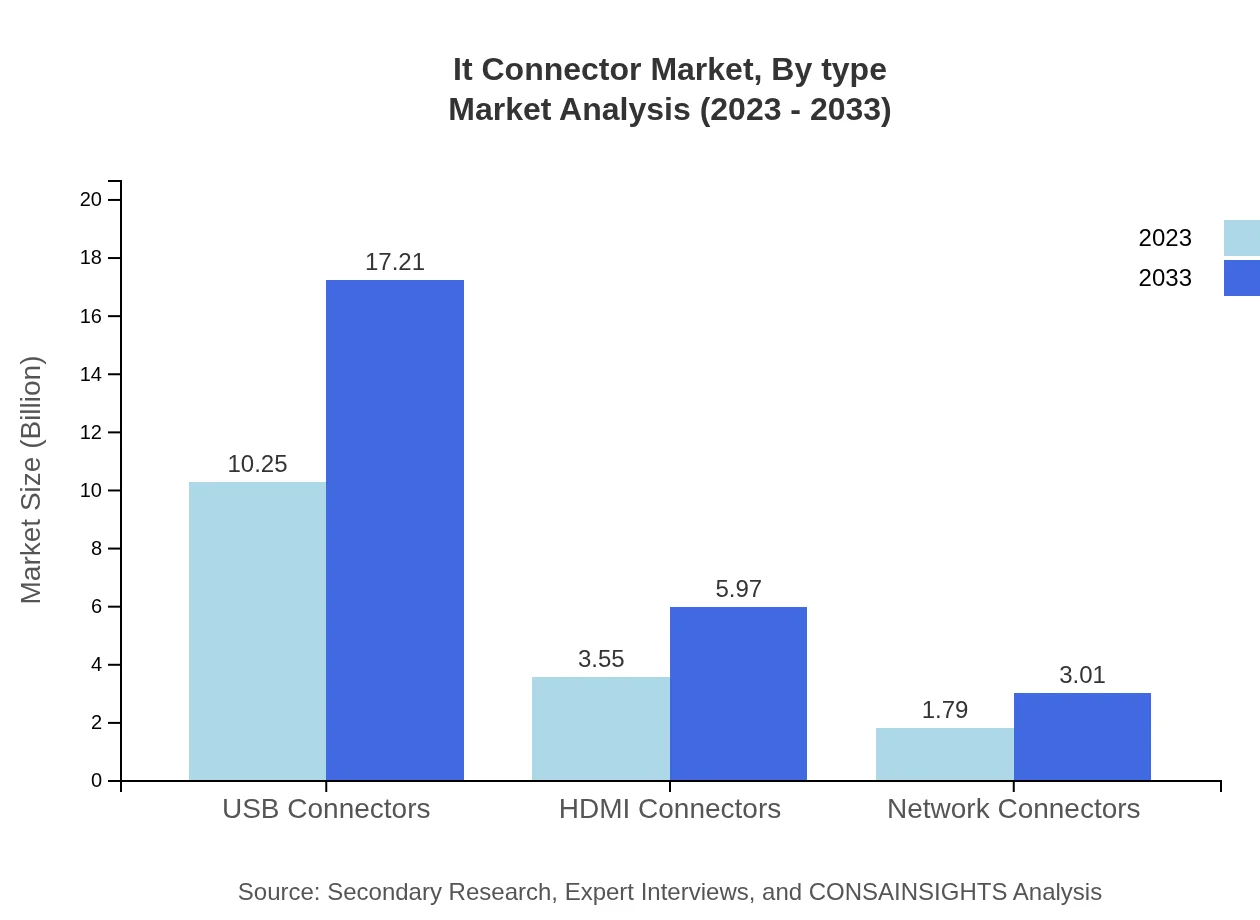

It Connector Market Analysis By Type

The It Connector market by type shows remarkable growth. USB connectors dominate the segment with a market size expected to increase from $10.25 billion in 2023 to $17.21 billion in 2033. HDMI connectors follow, growing from $3.55 billion in 2023 to $5.97 billion. Network connectors are also seeing growth, expanding from $1.79 billion in 2023 to $3.01 billion.

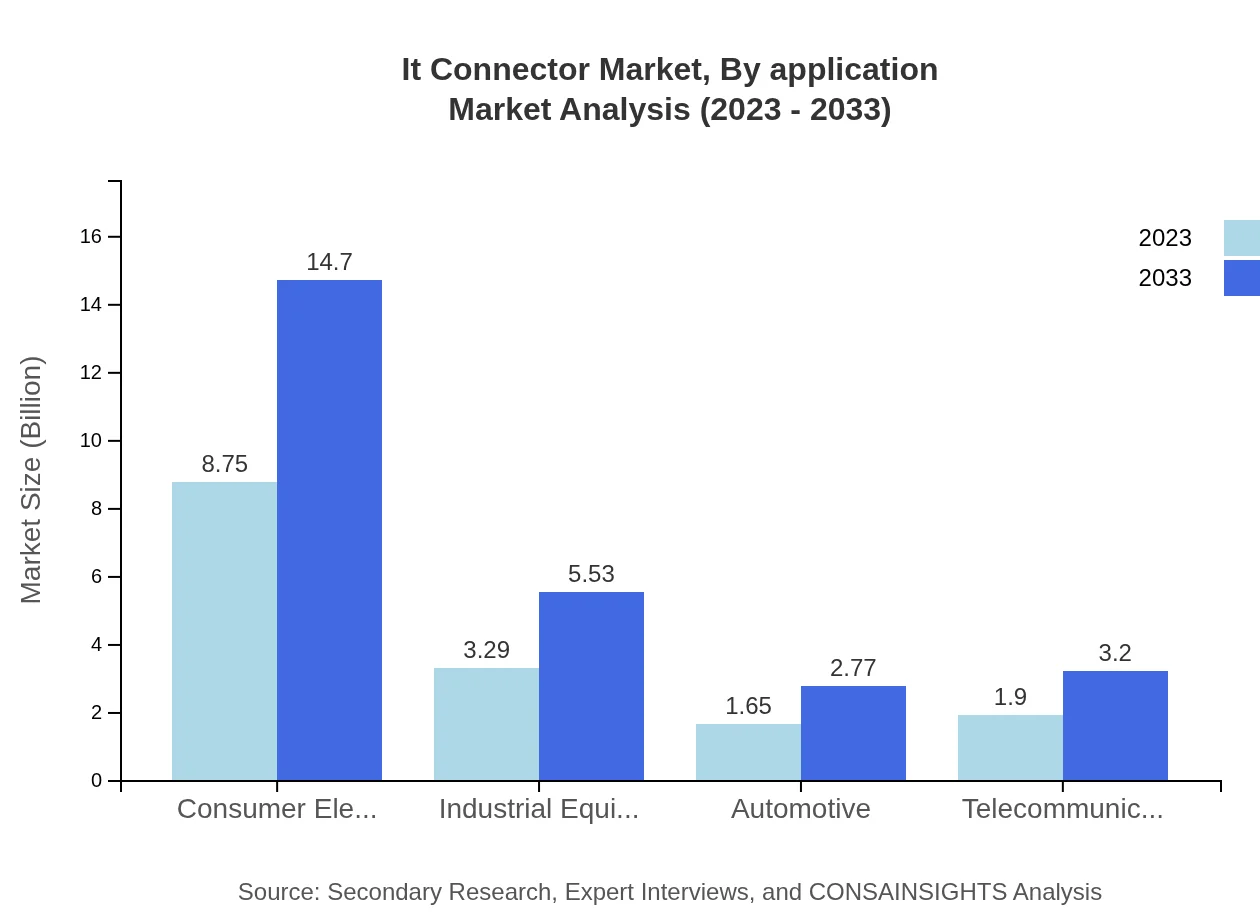

It Connector Market Analysis By Application

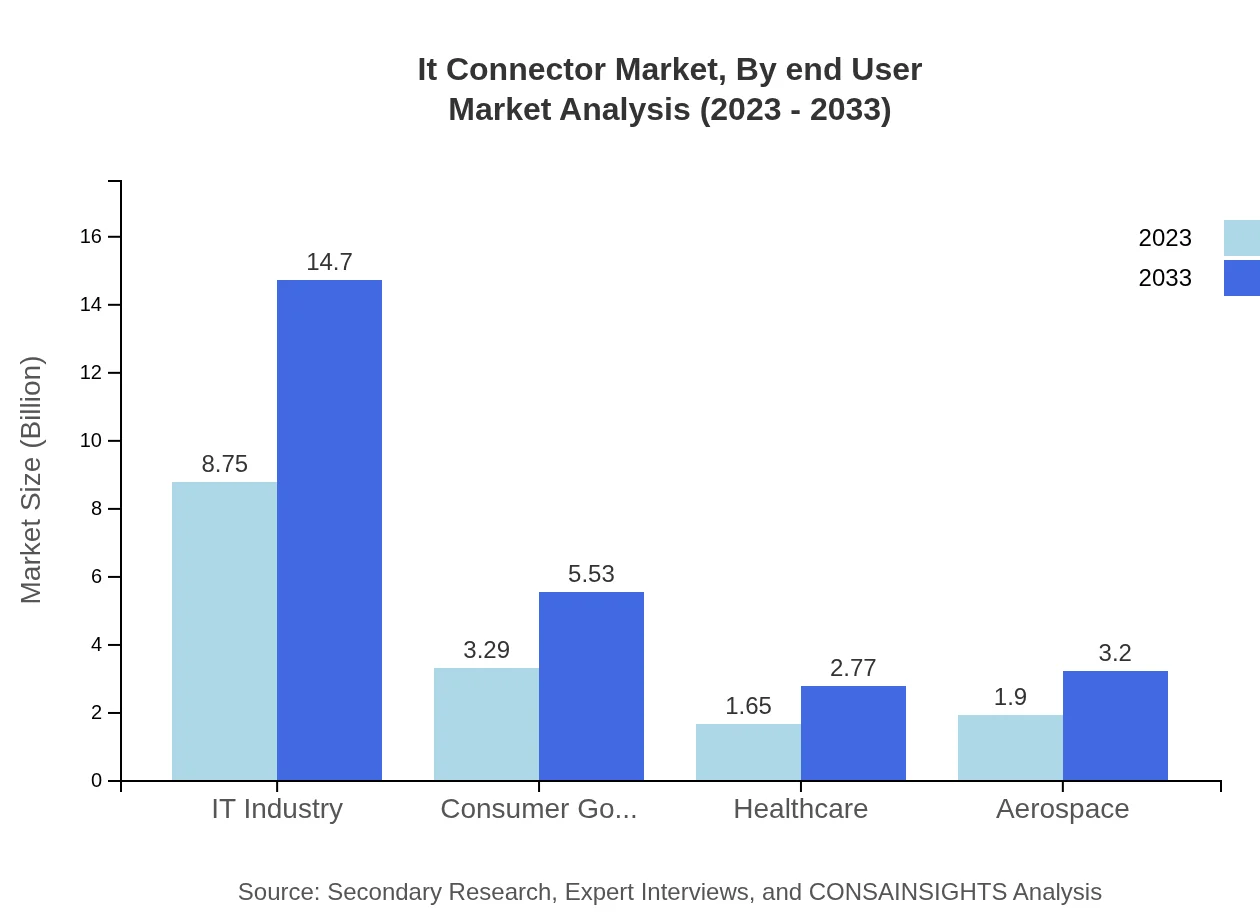

In the application segment, the IT sector shows a significant portion, with projections for a market size increase from $8.75 billion in 2023 to $14.70 billion by 2033. Consumer electronics and industrial equipment also represent vital sectors, growing steadily due to ongoing technological advancements and innovation.

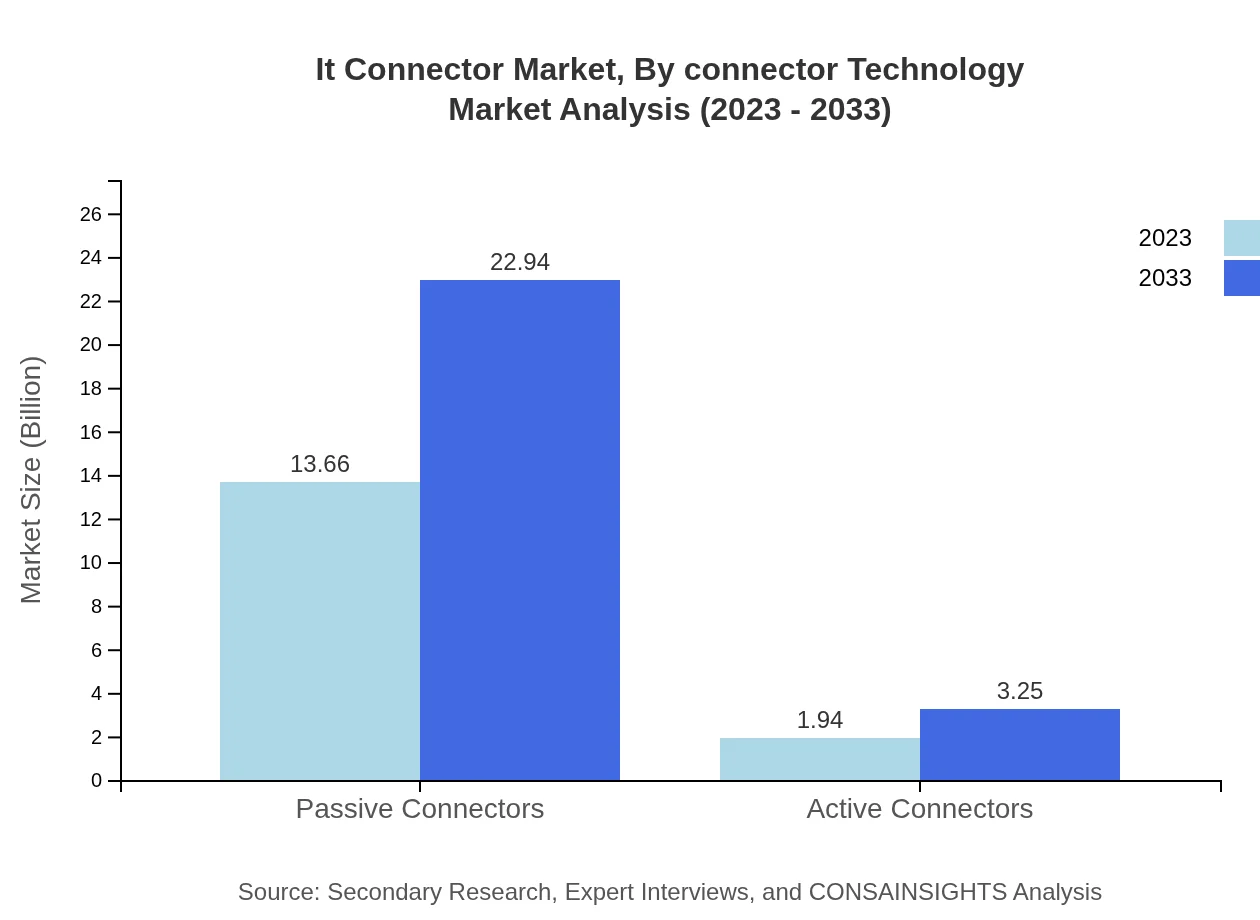

It Connector Market Analysis By Connector Technology

The market segmentation by connector technology shows a growing preference for passive connectors, which dominate the market with a size forecasted to rise from $13.66 billion in 2023 to $22.94 billion by 2033. Active connectors are also gaining traction, growing from $1.94 billion to $3.25 billion.

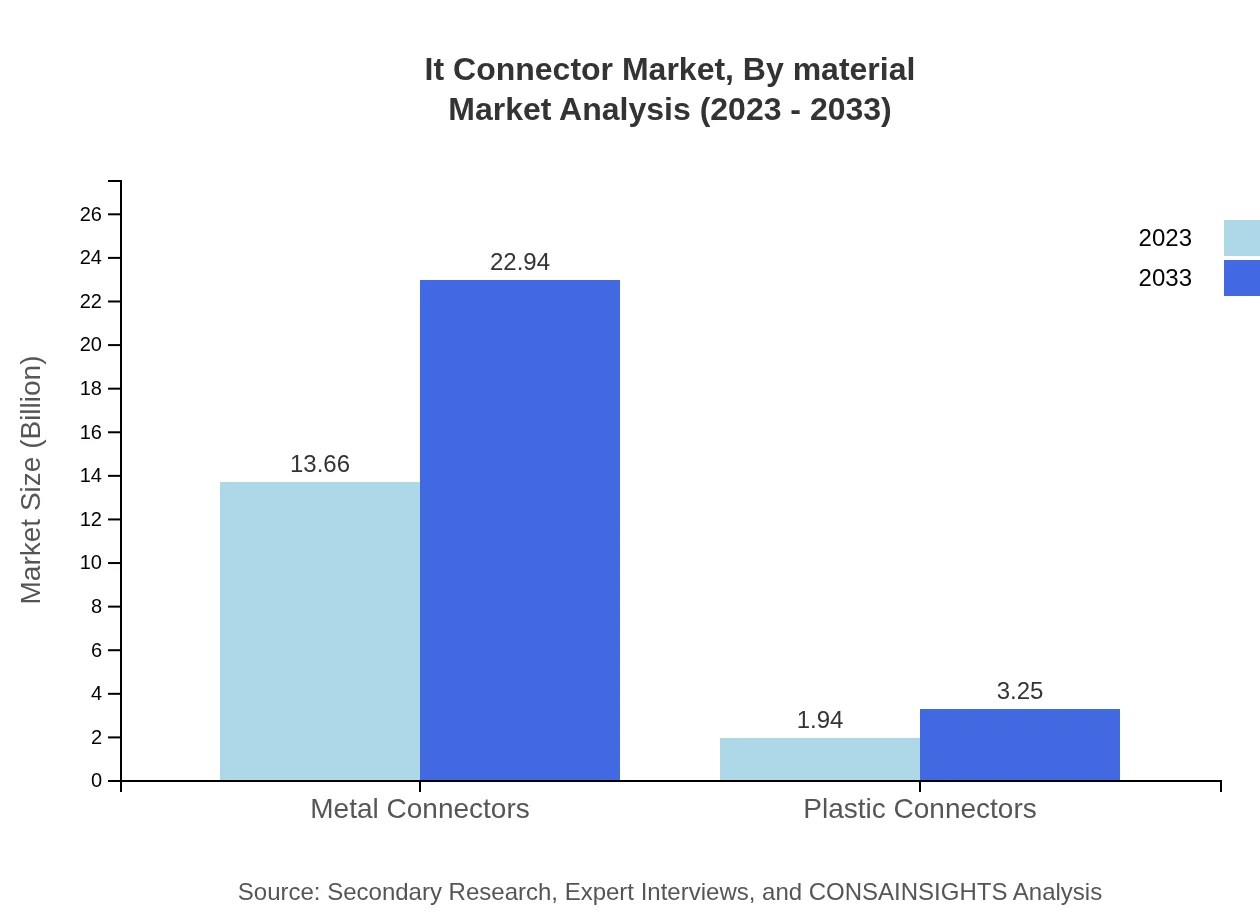

It Connector Market Analysis By Material

Analyzing the market by material, metal connectors are projected to show considerable growth from $13.66 billion in 2023 to $22.94 billion by 2033, while plastic connectors are expected to increase from $1.94 billion to $3.25 billion due to their lightweight and cost-effective nature.

It Connector Market Analysis By End User

End-user segmentation reveals the IT industry leading with a significant jump from $8.75 billion in 2023 to $14.70 billion by 2033. Consumer electronics also show a considerable presence, maintaining the same growth trajectory driven primarily by consumer demand for advanced technologies.

It Connector Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in It Connector Industry

TE Connectivity:

A leading player in the connector market, TE Connectivity focuses on developing innovative connector solutions that enhance connectivity in complex environments.Molex:

Molex specializes in advanced connectivity solutions, providing a broad range of products tailored to meet the diverse needs of various industries, including automotive and industrial automation.Amphenol Corporation:

Known for its comprehensive connector solutions, Amphenol Corporation serves multiple markets including telecommunications, aerospace, and military applications, focusing on high-performance standards.Belden:

Belden focuses on engineered network solutions, integrating connectors to ensure reliability and performance in data networks for the industrial and commercial sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of it Connector?

The global IT Connector market has a current size of 15.6 billion and is projected to grow at a CAGR of 5.2% through 2033.

What are the key market players or companies in this it Connector industry?

Key players in the IT Connector industry include global tech firms such as TE Connectivity, Amphenol, Molex, and JAE Electronics, driving innovation and supporting the growing demand in this market.

What are the primary factors driving the growth in the it Connector industry?

Growth in the IT Connector industry is driven by increasing connectivity demands, advancements in technology, and the growing deployment of 5G networks, which require enhanced interconnect solutions for devices.

Which region is the fastest Growing in the it Connector?

The Asia Pacific region is the fastest-growing market for IT Connectors, projected to increase from 2.80 billion in 2023 to 4.70 billion by 2033, showcasing significant development and technological adoption.

Does ConsaInsights provide customized market report data for the it Connector industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the IT Connector industry, enabling businesses to obtain relevant market insights and data.

What deliverables can I expect from this it Connector market research project?

Expected deliverables include comprehensive market analysis reports, trend forecasts, competitive landscape evaluations, and detailed segment breakdowns to inform strategic decision-making.

What are the market trends of it Connector?

Key trends include a move towards miniaturization of connectors, increased demand for high-speed transmission options, and a rising focus on eco-friendly materials in connector manufacturing.