It In Real Estate Market Report

Published Date: 24 January 2026 | Report Code: it-in-real-estate

It In Real Estate Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the IT in Real Estate market from 2023-2033. It encompasses market size, industry trends, technological advancements, comprehensive regional insights, and future forecasts, offering valuable data for industry stakeholders.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

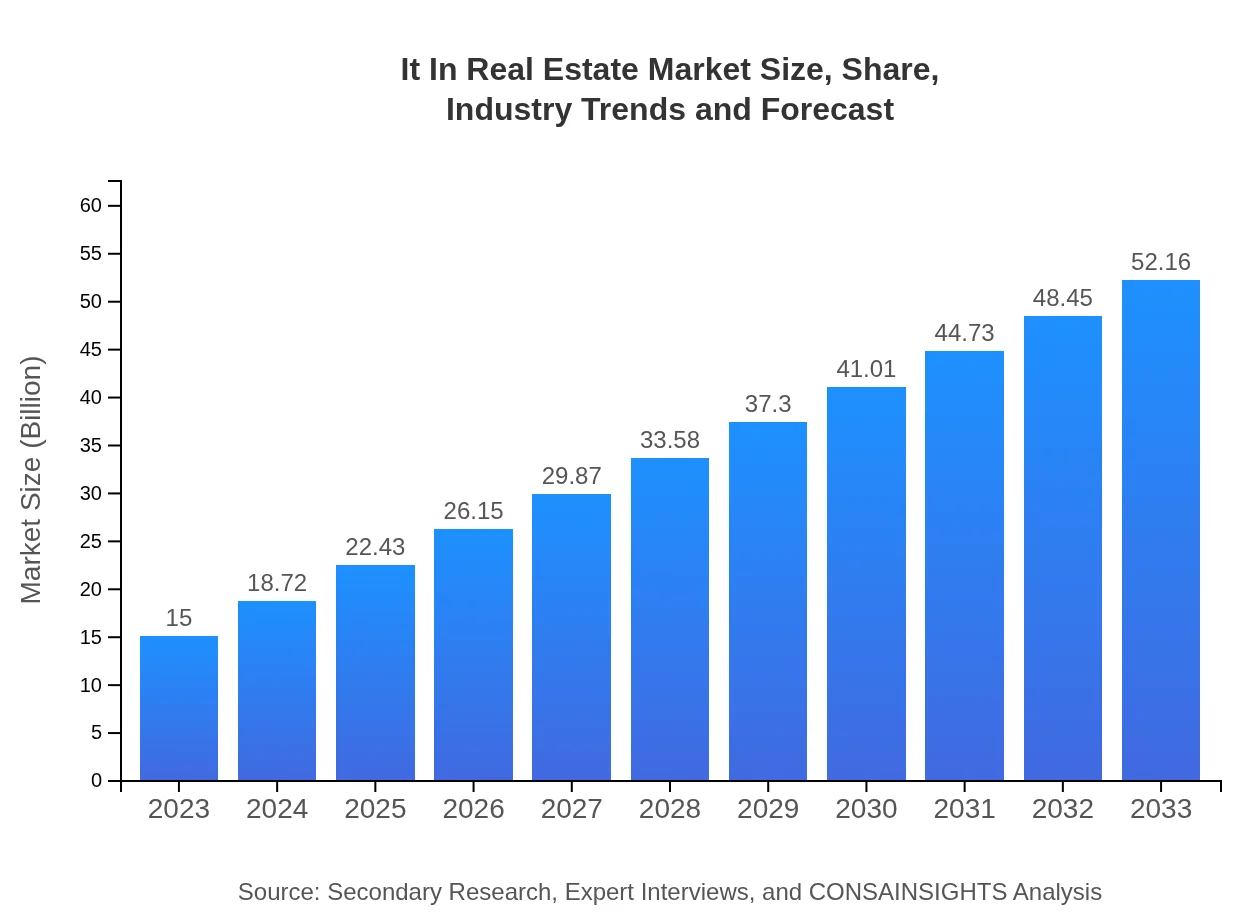

| 2023 Market Size | $15.00 Billion |

| CAGR (2023-2033) | 12.7% |

| 2033 Market Size | $52.16 Billion |

| Top Companies | Procore Technologies, Zillow Group, CoStar Group, Oracle |

| Last Modified Date | 24 January 2026 |

IT in Real Estate Market Overview

Customize It In Real Estate Market Report market research report

- ✔ Get in-depth analysis of It In Real Estate market size, growth, and forecasts.

- ✔ Understand It In Real Estate's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in It In Real Estate

What is the Market Size & CAGR of the IT in Real Estate market in 2023?

IT in Real Estate Industry Analysis

IT in Real Estate Market Segmentation and Scope

Tell us your focus area and get a customized research report.

IT in Real Estate Market Analysis Report by Region

Europe It In Real Estate Market Report:

The European market size is expected to be $4.60 billion in 2023, rising to $16.01 billion by 2033. Factors such as stringent regulations and the need for sustainable practices are propelling technological adoption in real estate.Asia Pacific It In Real Estate Market Report:

In 2023, the market size in the Asia Pacific region is estimated at $3.03 billion, projected to grow to $10.55 billion by 2033, highlighting rapid urbanization and the growing adoption of technology in real estate processes.North America It In Real Estate Market Report:

North America currently leads the market with a size of $4.82 billion in 2023, projected to expand to $16.74 billion by 2033. This growth is supported by high technology penetration and ongoing innovation in real estate practices.South America It In Real Estate Market Report:

Latin America has a market size of approximately $1.23 billion in 2023, with expectations to reach $4.29 billion by 2033. The increasing investment in technology-driven solutions and digital platforms is fostering growth in this region.Middle East & Africa It In Real Estate Market Report:

The Middle East and Africa exhibit a market size of $1.31 billion in 2023, anticipated to grow to $4.57 billion by 2033. The incorporation of technology in urban development strategies boosts the need for IT solutions in real estate.Tell us your focus area and get a customized research report.

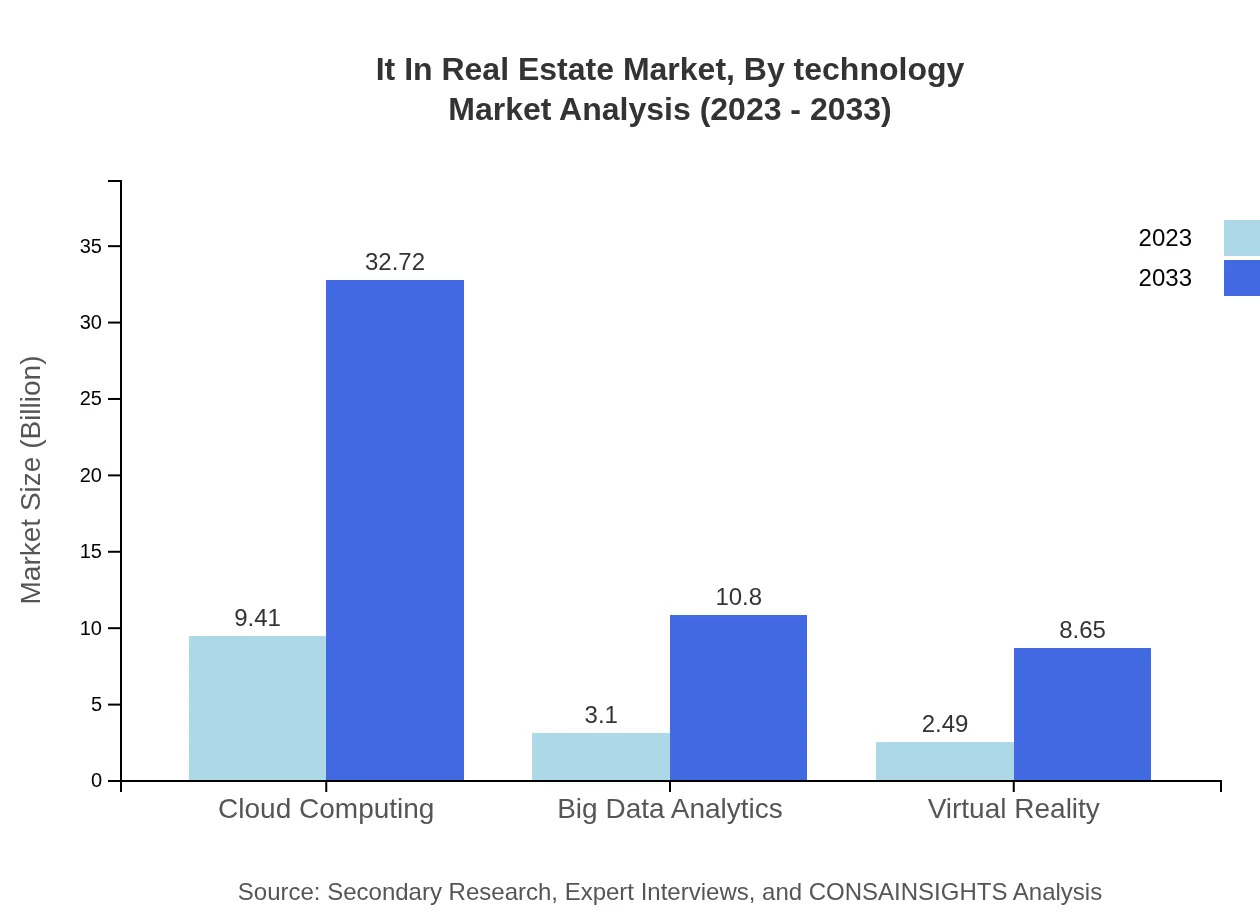

It In Real Estate Market Analysis By Technology

In the technology segment, Cloud Computing leads with a market size of $9.41 billion (2023), growing to $32.72 billion by 2033, maintaining a share of 62.72%. Big Data Analytics is also crucial, scaling from $3.10 billion to $10.80 billion, sustaining a notable share of 20.7%. Other technologies like Virtual Reality ($2.49 billion to $8.65 billion) and Property Management tools bolster the market, indicating robust demand across various technological applications.

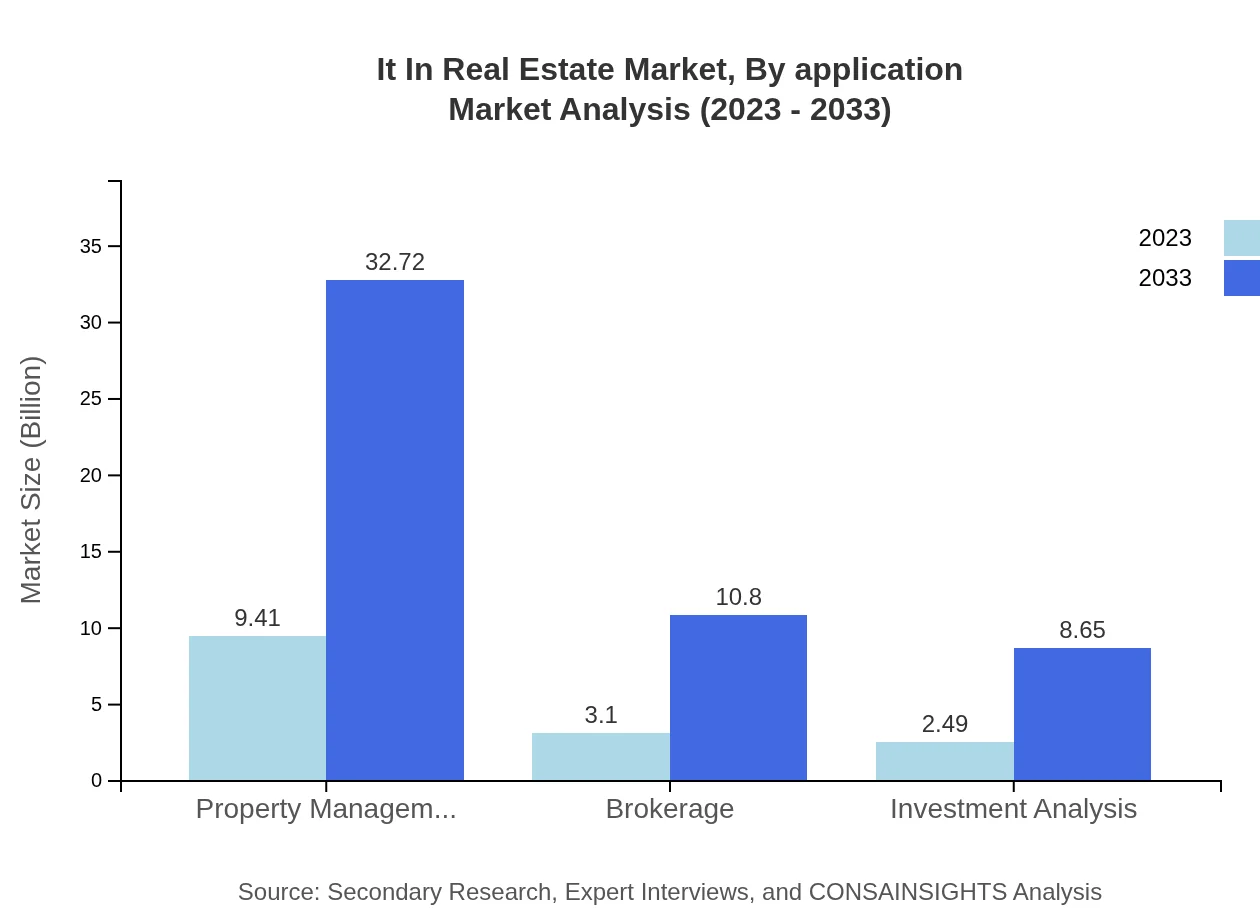

It In Real Estate Market Analysis By Application

Applications in the IT in Real Estate market include Brokerage, Investment Analysis, and Property Management. Brokerage services grow from $3.10 billion to $10.80 billion, while Investment Analysis increases from $2.49 billion to $8.65 billion by 2033. Property Management remains pivotal, starting at $9.41 billion and climbing to $32.72 billion, underscoring its importance in operational efficiency and tenant satisfaction.

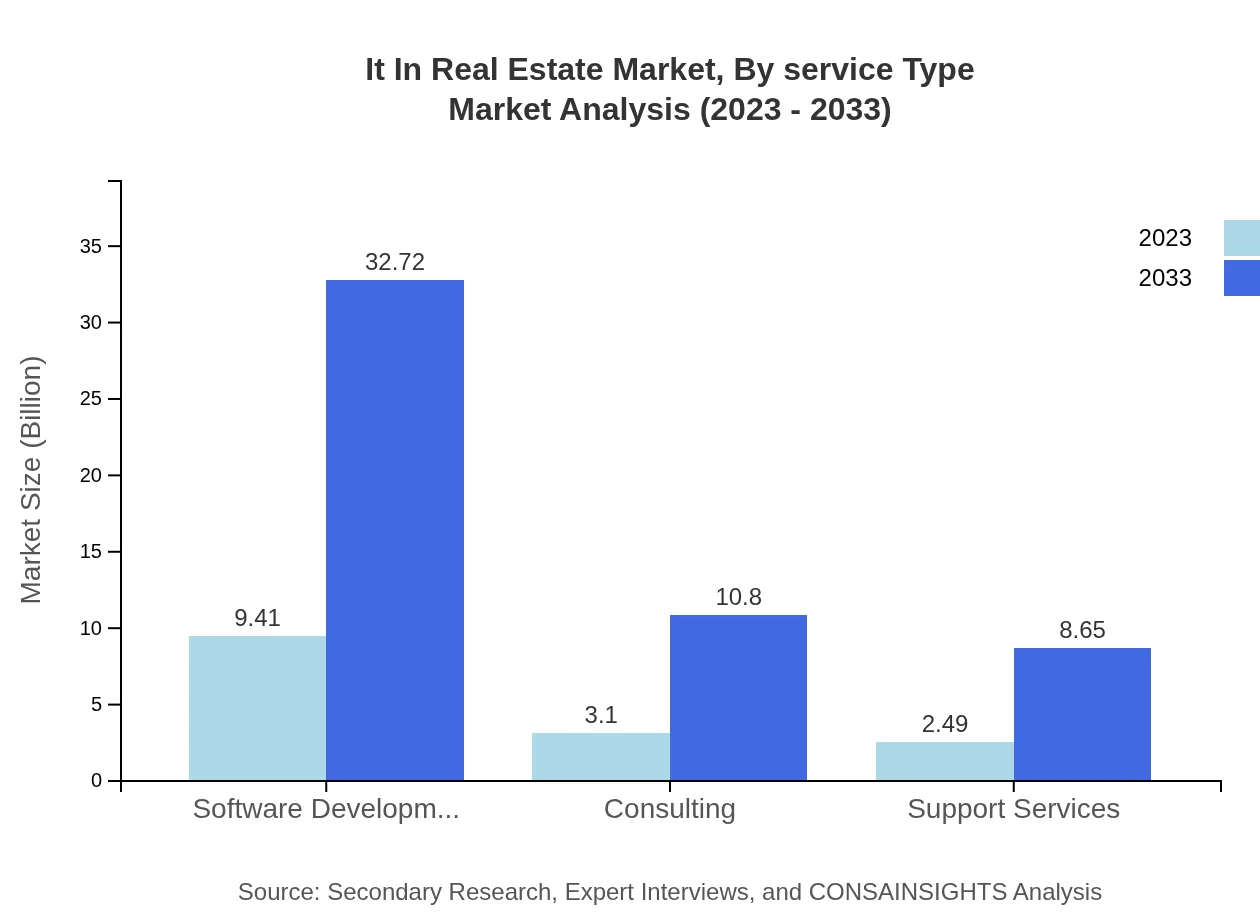

It In Real Estate Market Analysis By Service Type

Service types in the IT in Real Estate sector encompass Software Development, Consulting, and Support Services. Software Development is projected to grow significantly from $9.41 billion to $32.72 billion, highlighting its critical role in solution provision. Consulting and Support Services also display growth patterns, expanding from $3.10 billion to $10.80 billion, showcasing the need for strategic guidance in IT project implementations.

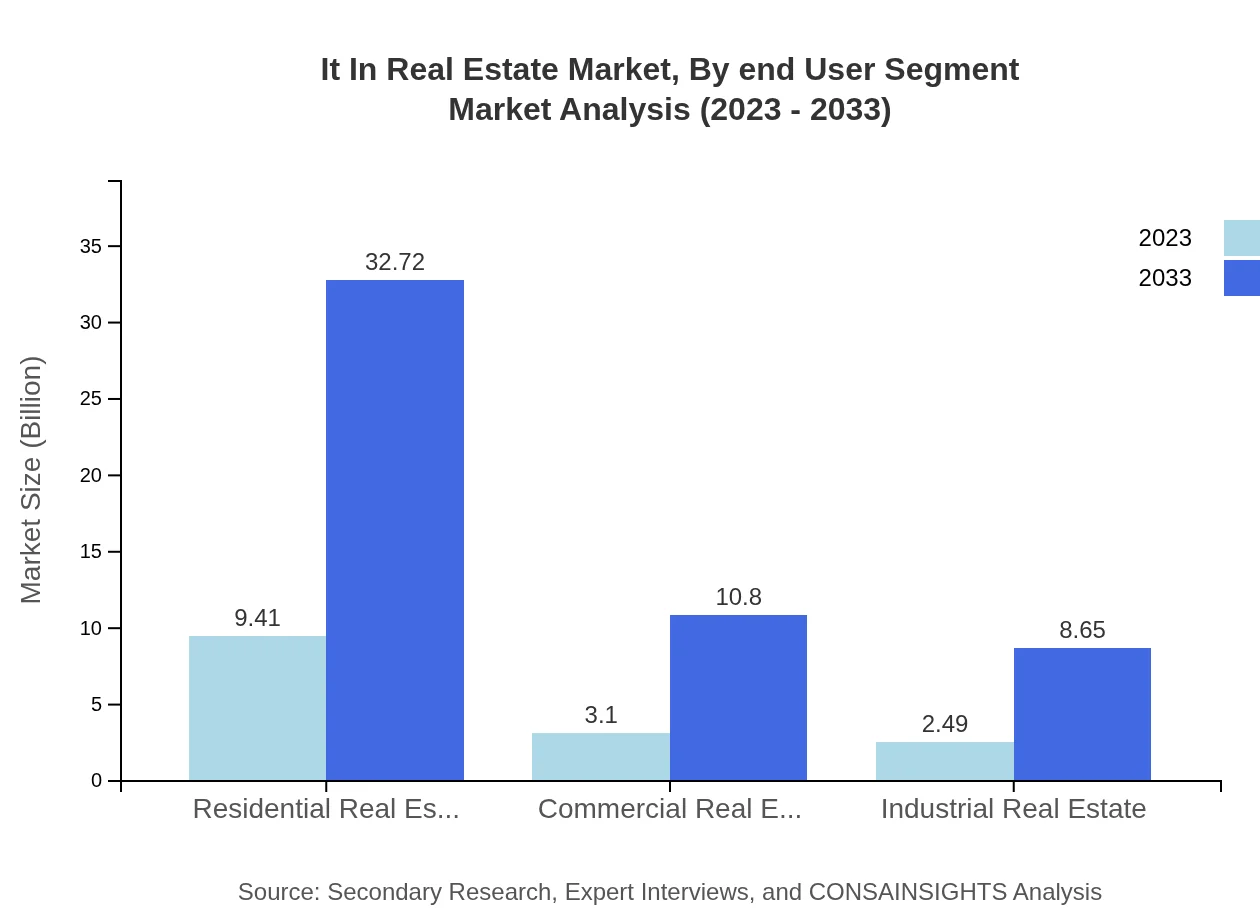

It In Real Estate Market Analysis By End User Segment

The end-user segment comprises Residential, Commercial, and Industrial Real Estate. Residential markets dominate, with sizes moving from $9.41 billion to $32.72 billion. Commercial Real Estate follows, growing from $3.10 billion to $10.80 billion, while Industrial Real Estate also sees growth from $2.49 billion to $8.65 billion, reflecting the diverse application of IT across different real estate sectors.

IT in Real Estate Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in the IT in Real Estate Industry

Procore Technologies:

Procore is a leading construction management software provider that offers solutions for project management, cost management, and financials in the real estate industry.Zillow Group:

Zillow operates a real estate and rental marketplace with comprehensive data analytics and technology solutions for consumers and real estate professionals.CoStar Group:

CoStar Group specializes in commercial real estate information and analytics, providing valuable insights that support strategic decisions in the industry.Oracle:

Oracle offers integrated cloud applications and platform services that help real estate firms enhance business processes and data management capabilities.We're grateful to work with incredible clients.

FAQs

What is the market size of IT in Real Estate?

As of 2023, the IT in Real Estate market is valued at approximately $15 billion, with a robust CAGR of 12.7%. This growth trajectory indicates a significant expansion expected in the coming years, reaching a potential market size of $35.56 billion by 2033.

What are the key market players or companies in the IT in Real Estate industry?

Key players in the IT in Real Estate market include top technology firms specializing in property management software, real estate analytics, and cloud-based solutions. Companies such as Zillow, CoStar Group, and IBM play crucial roles in driving innovation and integration within the sector.

What are the primary factors driving the growth in the IT in Real Estate industry?

The growth in the IT in Real Estate industry is driven by increased demand for data analytics, cloud solutions, and automation technologies. Enhanced efficiency in property management, along with the rise of smart buildings, contributes to the sector's expansion and innovation.

Which region is the fastest Growing in the IT in Real Estate?

The fastest-growing region in the IT in Real Estate market is expected to be North America, with a projected market size of $16.74 billion by 2033, up from $4.82 billion in 2023. Europe and Asia Pacific also show strong growth potential in this domain.

Does ConsaInsights provide customized market report data for the IT in Real Estate industry?

Yes, Consainsights offers customized market report data tailored to the IT in Real Estate industry. Clients can request specific insights and analyses based on their unique needs, enabling them to make informed strategic decisions.

What deliverables can I expect from this IT in Real Estate market research project?

Deliverables from the IT in Real Estate market research project typically include comprehensive market analysis reports, trend assessments, competitive landscape evaluations, and actionable insights. Visual aids such as graphs and charts also enhance understanding.

What are the market trends of IT in Real Estate?

Current market trends in IT in Real Estate include a growing emphasis on cloud computing, big data analytics, and virtual reality applications. As technology advances, integration of these elements is crucial for enhancing customer experiences and operational efficiencies.