It Outsourcing Market Report

Published Date: 31 January 2026 | Report Code: it-outsourcing

It Outsourcing Market Size, Share, Industry Trends and Forecast to 2033

This market report delves into the IT outsourcing sector, offering comprehensive insights on market trends, segmentation, and growth forecasts up to 2033. The analysis covers critical data, regional insights, industry leaders, and evolving technologies affecting the landscape of IT outsourcing.

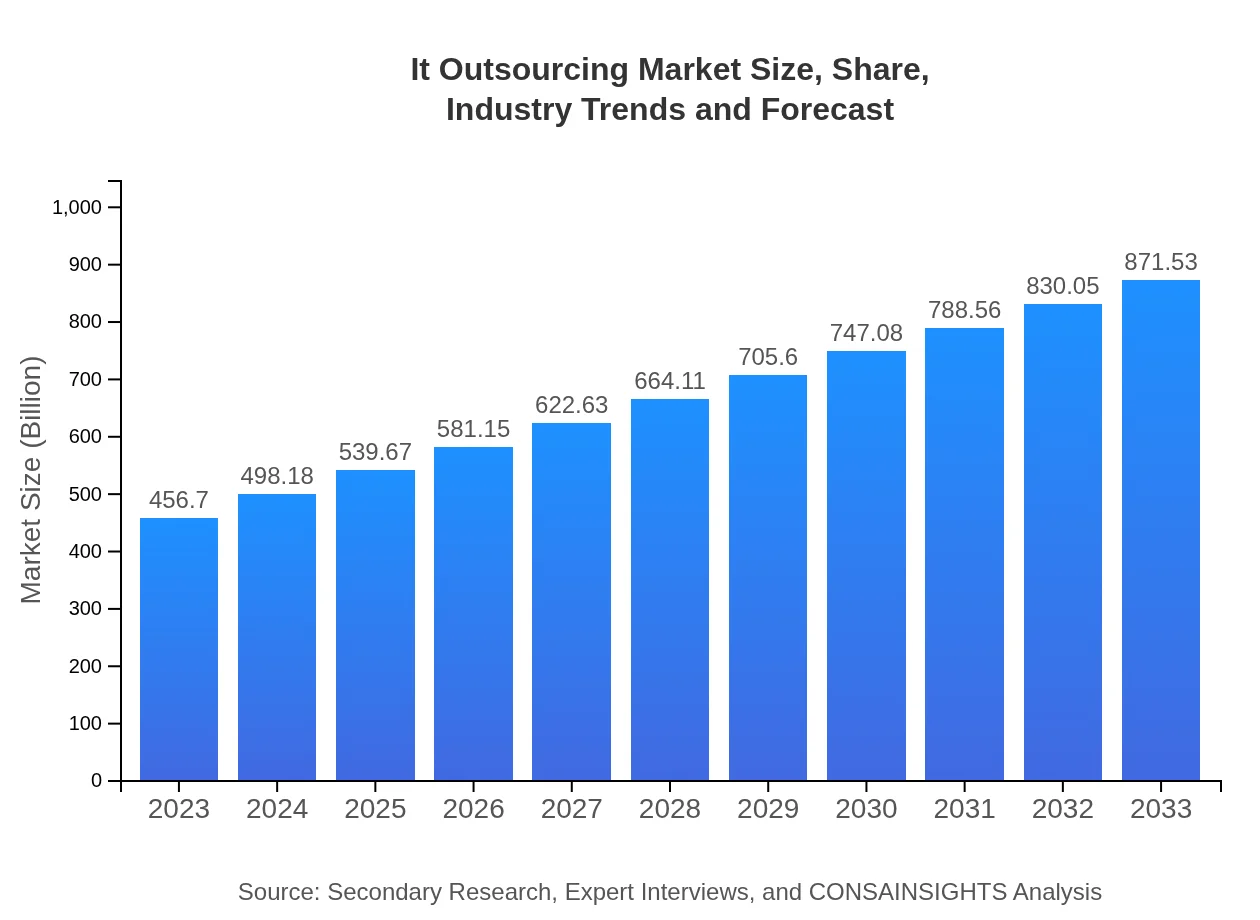

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $456.70 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $871.53 Billion |

| Top Companies | Accenture, Tata Consultancy Services (TCS), IBM |

| Last Modified Date | 31 January 2026 |

IT Outsourcing Market Overview

Customize It Outsourcing Market Report market research report

- ✔ Get in-depth analysis of It Outsourcing market size, growth, and forecasts.

- ✔ Understand It Outsourcing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in It Outsourcing

What is the Market Size & CAGR of IT Outsourcing market in 2023?

IT Outsourcing Industry Analysis

IT Outsourcing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

IT Outsourcing Market Analysis Report by Region

Europe It Outsourcing Market Report:

Europe's IT outsourcing market is projected to reach $299.63 billion by 2033, with firms increasingly outsourcing IT services to reduce costs and enhance operational efficiency. The region faces unique challenges like GDPR compliance, which influences the structuring of outsourcing contracts and collaborations.Asia Pacific It Outsourcing Market Report:

The Asia-Pacific region is witnessing robust growth in the IT outsourcing market, projected to reach $155.74 billion by 2033. Countries like India and China are leading in service provision, benefiting from a skilled workforce and lower operational costs, making them attractive destinations for outsourcing IT functions.North America It Outsourcing Market Report:

North America remains a significant player, with the market anticipated to grow to $288.65 billion by 2033. The U.S. is a hub for IT outsourcing due to its advanced tech landscape and requirement for innovative solutions, providing ample opportunities for both local and offshore providers.South America It Outsourcing Market Report:

The market in South America is expected to grow to $51.51 billion by 2033, driven by increasing digitalization and investments in technology. Key players in Brazil and Argentina are enhancing service offerings, catering to both local and international businesses seeking cost-effective solutions.Middle East & Africa It Outsourcing Market Report:

The Middle East and Africa are emerging markets for IT outsourcing, with expectations to grow to $76.00 billion by 2033. Countries like the UAE and South Africa are becoming attractive for outsourcing services, focusing on enhancing technology infrastructure to support business needs.Tell us your focus area and get a customized research report.

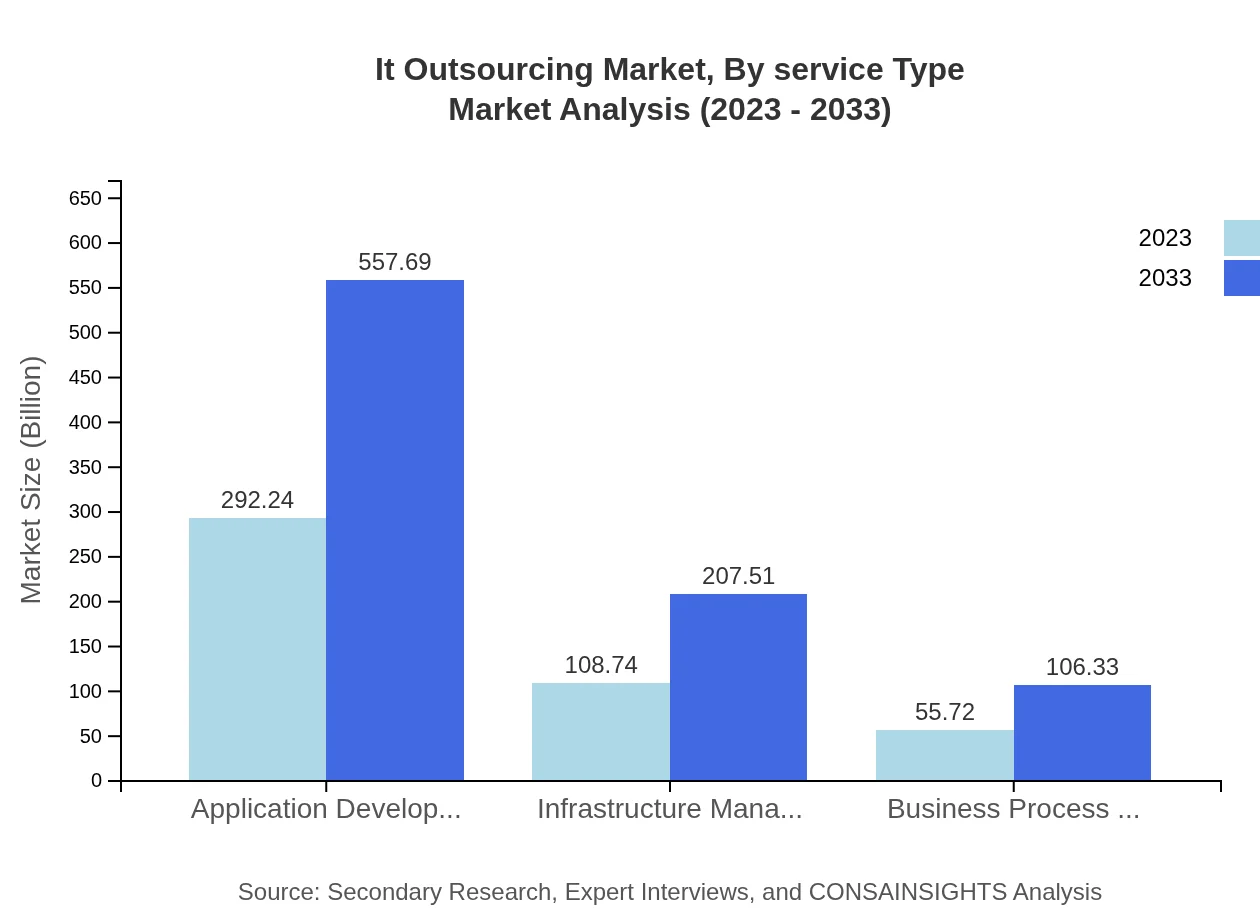

It Outsourcing Market Analysis By Service Type

The IT outsourcing market by service type is projected to expand from $215.84 billion in 2023 to $411.88 billion by 2033. Key service types include application development, which dominates the market due to high demand for custom software solutions, and infrastructure management, increasingly seen as critical for maintaining IT operations.

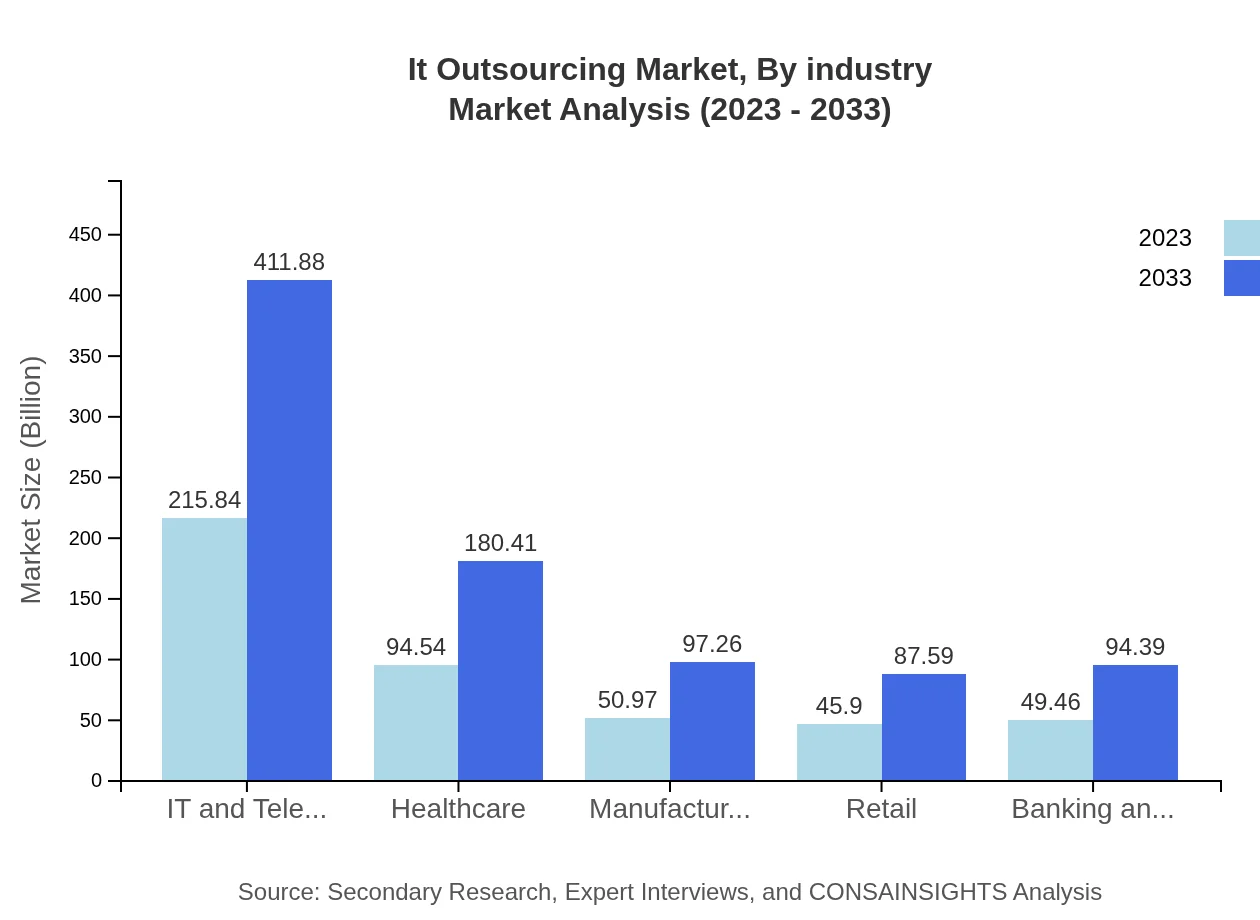

It Outsourcing Market Analysis By Industry

Healthcare is a significant sector for IT outsourcing, anticipated to grow from $94.54 billion in 2023 to $180.41 billion by 2033. The Banking and Financial Services sector also shows robust demand, expected to increase from $49.46 billion in 2023 to $94.39 billion by 2033 as institutions seek to enhance service delivery and security.

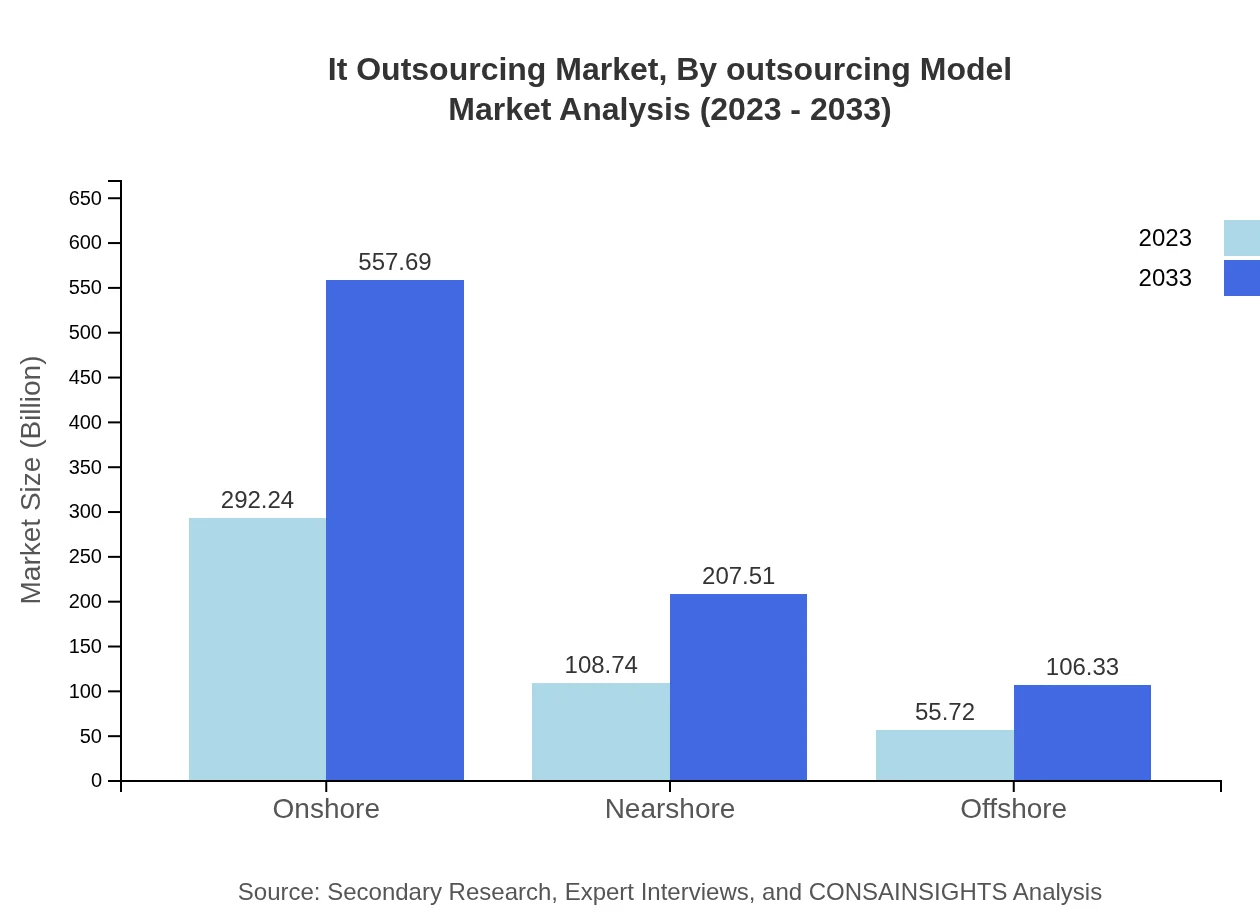

It Outsourcing Market Analysis By Outsourcing Model

The outsourcing model analysis reveals that offshore outsourcing, while significant, is seeing competition from nearshore options. Offshore is projected to grow from $55.72 billion in 2023 to $106.33 billion by 2033, while nearshore outsourcing captures a substantial market share due to benefits in collaboration and timeliness.

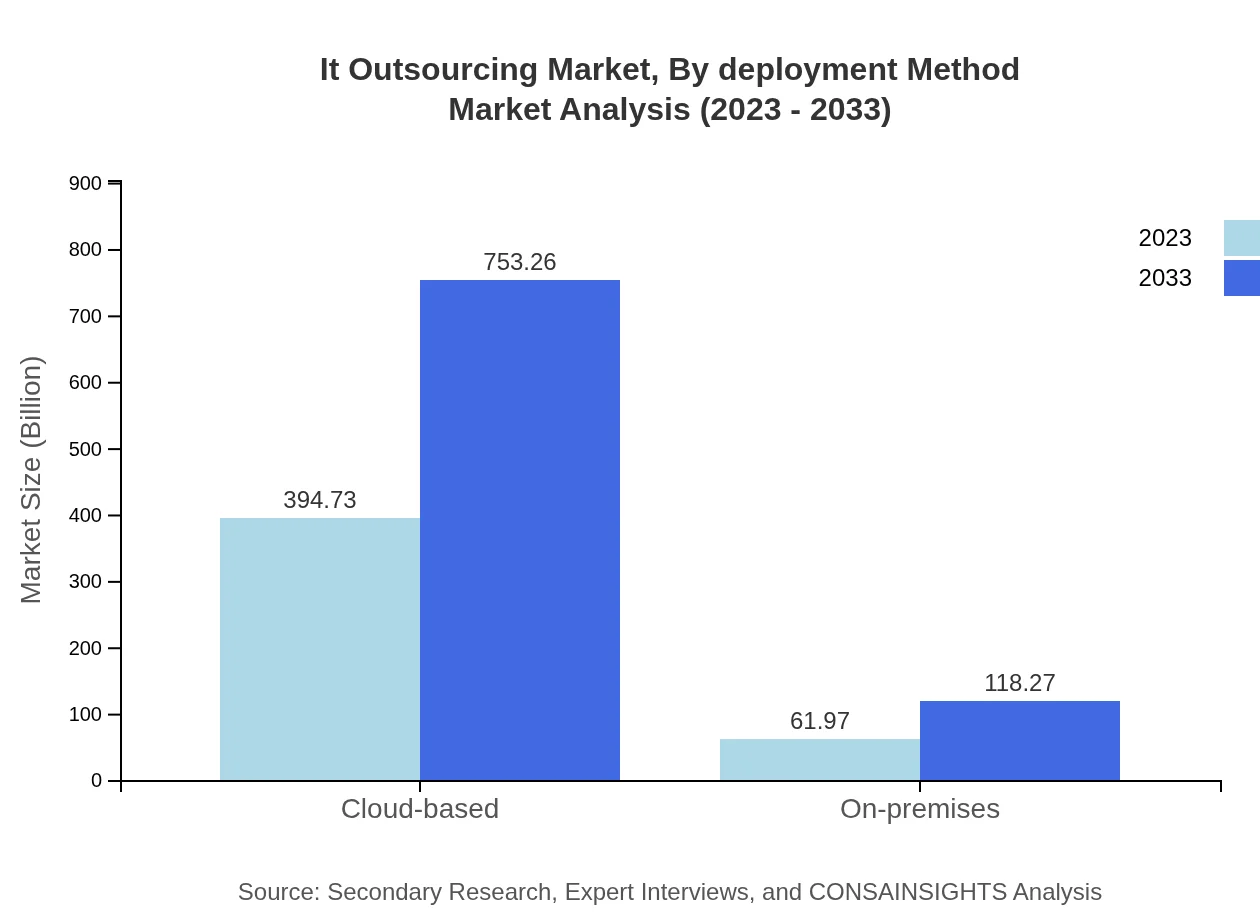

It Outsourcing Market Analysis By Deployment Method

The cloud-based deployment model is projected to dominate the IT outsourcing market with significant growth from $394.73 billion in 2023 to $753.26 billion by 2033. This surge is attributed to the increasing shift of businesses towards cloud infrastructure for flexibility and scalability, minimizing upfront capital expenditure.

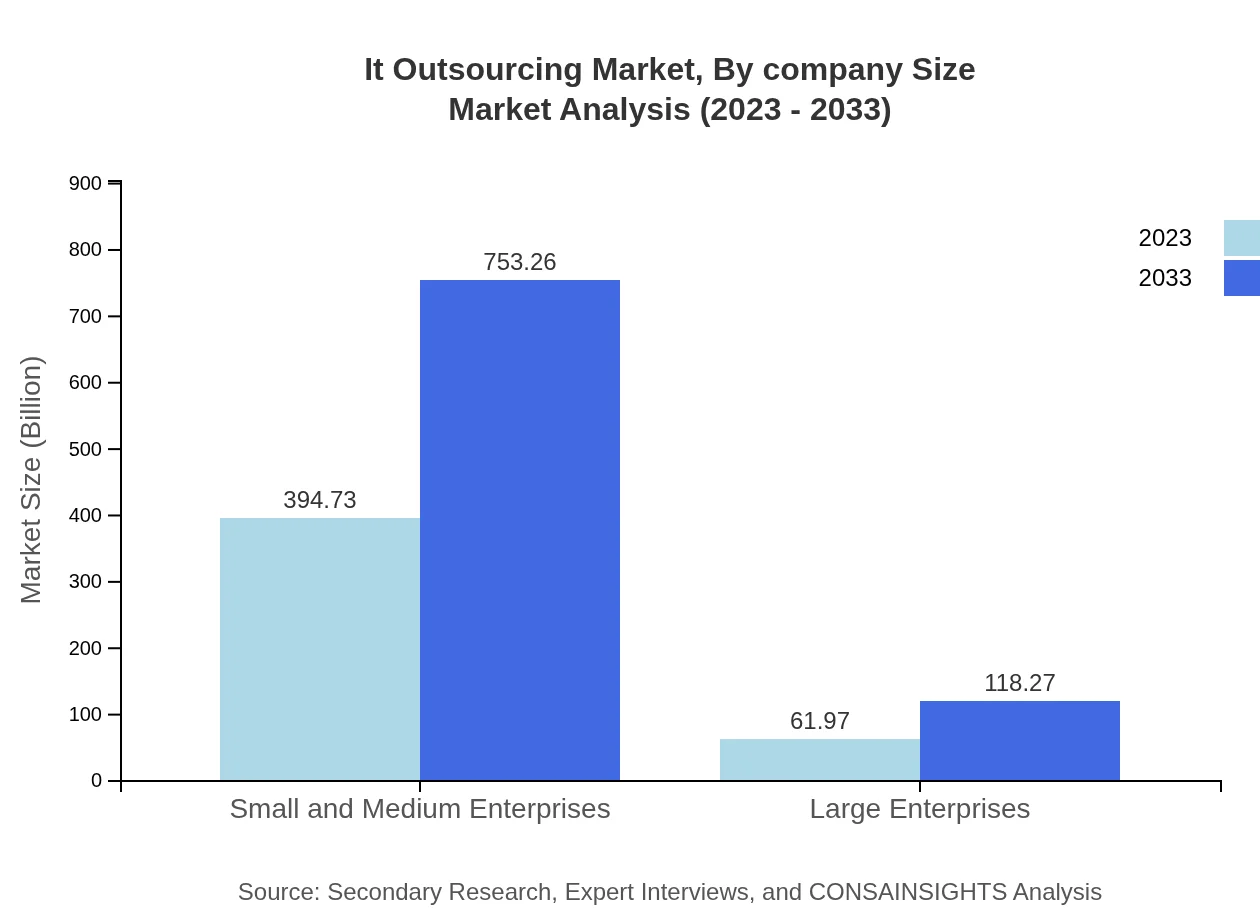

It Outsourcing Market Analysis By Company Size

Small and Medium Enterprises (SMEs) are major contributors to the IT outsourcing market, expected to grow from $394.73 billion in 2023 to $753.26 billion by 2033. Their increasing reliance on outsourcing for IT functions is driven by resource constraints and the need for technological advancements.

IT Outsourcing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in IT Outsourcing Industry

Accenture:

Accenture is a leading global professional services company that provides a broad range of services and solutions in strategy, consulting, digital, technology, and operations. Their IT outsourcing services are recognized for integrating advanced technologies with optimized processes.Tata Consultancy Services (TCS):

TCS is one of the largest IT services firms globally, headquartered in India. Their extensive range of IT outsourcing services caters to various industries, focusing on digital transformation and innovation to meet client needs.IBM:

IBM offers a wide array of outsourced IT services, including cloud computing, AI integration, and consulting, helping businesses to leverage technology for operational efficiency and strategic growth.We're grateful to work with incredible clients.

FAQs

What is the market size of IT Outsourcing?

The IT Outsourcing market is valued at approximately $456.7 billion in 2023, with a projected CAGR of 6.5%. This growth is attributed to the increasing demand for cost-effective IT solutions and the need for organizations to focus on core business functions.

What are the key market players or companies in the IT Outsourcing industry?

Key players in the IT Outsourcing market include industry giants such as Accenture, IBM, Tata Consultancy Services, Infosys, and Wipro. These companies are known for offering a wide range of IT services, including application development and infrastructure management.

What are the primary factors driving the growth in the IT Outsourcing industry?

Growth in the IT Outsourcing industry is driven by factors such as technological advancements, increased demand for cloud-based solutions, and the necessity for businesses to enhance operational efficiency while minimizing costs, leading to strategic outsourcing partnerships.

Which region is the fastest Growing in the IT Outsourcing?

The Asia Pacific region is the fastest-growing in the IT Outsourcing market, with a growth projection from $81.61 billion in 2023 to $155.74 billion by 2033, driven by rising adoption of technology and a skilled workforce.

Does ConsaInsights provide customized market report data for the IT Outsourcing industry?

Yes, ConsaInsights offers customized market report data for the IT Outsourcing industry to cater to specific business needs and strategies, ensuring clients receive tailored insights for informed decision-making.

What deliverables can I expect from this IT Outsourcing market research project?

Deliverables from the IT Outsourcing market research project typically include comprehensive market analysis reports, regional market insights, segmentation data, industry trends, and projections that guide strategic business planning.

What are the market trends of IT Outsourcing?

Current market trends in IT Outsourcing include a shift towards cloud-based solutions, increased use of automation and AI in service delivery, and a growing preference for onshore and nearshore outsourcing due to improved communication and collaboration.