It Services Market Report

Published Date: 31 January 2026 | Report Code: it-services

It Services Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the IT Services market from 2023 to 2033, covering insights on market size, industry analysis, regional dynamics, and technological trends, enabling stakeholders to make informed decisions.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

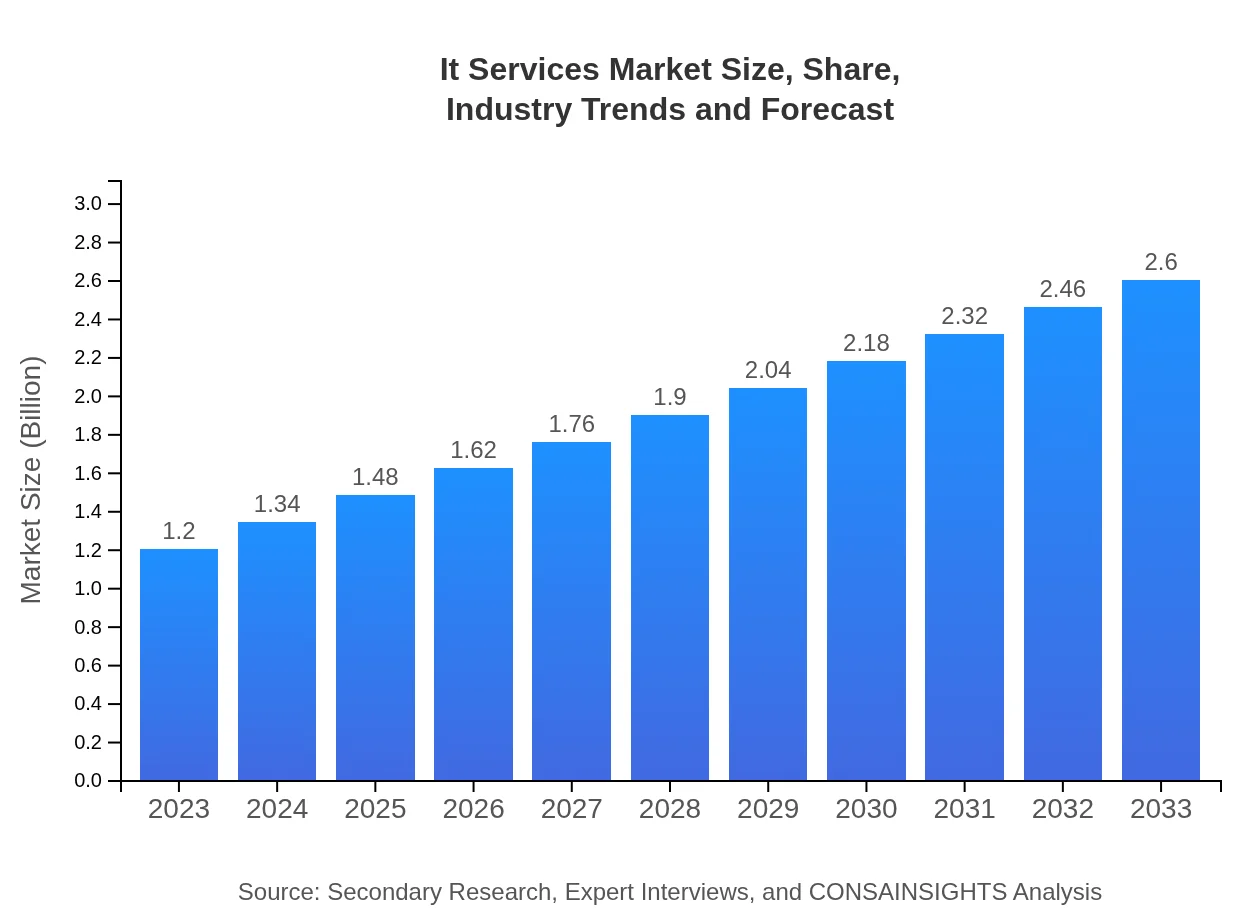

| 2023 Market Size | $1.20 Trillion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $2.60 Trillion |

| Top Companies | Accenture, IBM, Deloitte, Tata Consultancy Services (TCS), Cognizant |

| Last Modified Date | 31 January 2026 |

IT Services Market Overview

Customize It Services Market Report market research report

- ✔ Get in-depth analysis of It Services market size, growth, and forecasts.

- ✔ Understand It Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in It Services

What is the Market Size & CAGR of IT Services market in 2023 and 2033?

IT Services Industry Analysis

IT Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

IT Services Market Analysis Report by Region

Europe It Services Market Report:

Europe's IT Services market is forecasted to grow from $0.37 trillion in 2023 to nearly $0.79 trillion by 2033. The tightening regulations related to data privacy and security have led businesses to seek comprehensive IT solutions. Additionally, the emphasis on digital transformations across industries continues to bolster this market.Asia Pacific It Services Market Report:

In the Asia Pacific region, the IT Services market is projected to grow from $0.23 trillion in 2023 to approximately $0.49 trillion by 2033. The growth is fueled by rapid digital transformation initiatives, especially in countries like China and India, where technology adoption is on the rise. The need for managed services and cloud solutions is further enhancing market dynamics in this region.North America It Services Market Report:

North America remains the largest market for IT Services, with a projected increase from $0.43 trillion in 2023 to $0.94 trillion by 2033. This robust growth is driven by an entrenched IT infrastructure, high adoption of cloud-based services, and ongoing investments to enhance cybersecurity measures across various sectors.South America It Services Market Report:

South America is expected to see growth from $0.09 trillion in 2023 to about $0.19 trillion by 2033. Factors such as increasing internet penetration and growing IT infrastructure investments contribute to this growth. Local businesses are increasingly adopting IT services to optimize operations and stay competitive in the global market.Middle East & Africa It Services Market Report:

The Middle East and Africa region is anticipated to grow from $0.08 trillion in 2023 to about $0.18 trillion by 2033. This growth is driven by increased government investments in IT infrastructure and the private sector’s growing need for competitive technologies. The rise of mobile technologies and internet accessibility is also seen as a catalyst for expanding IT service offerings.Tell us your focus area and get a customized research report.

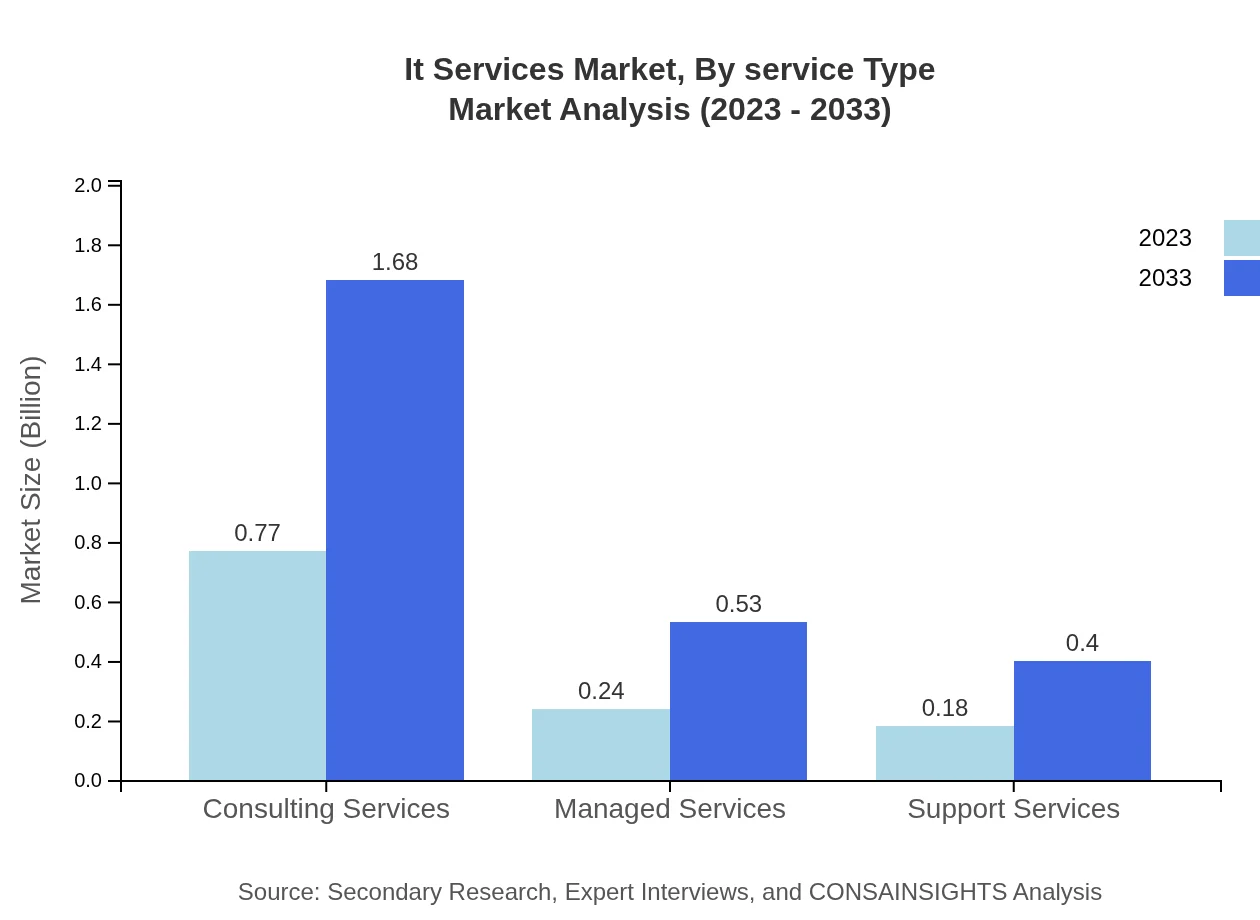

It Services Market Analysis By Service Type

IT Services are bifurcated into consulting, managed services, support services, and more. Consulting services dominate the market with a size of $0.77 trillion in 2023 and projected growth to $1.68 trillion by 2033, accounting for 64.4% market share. Managed services and support services are also significant contributors, projected to grow steadily with increasing demand for IT support.

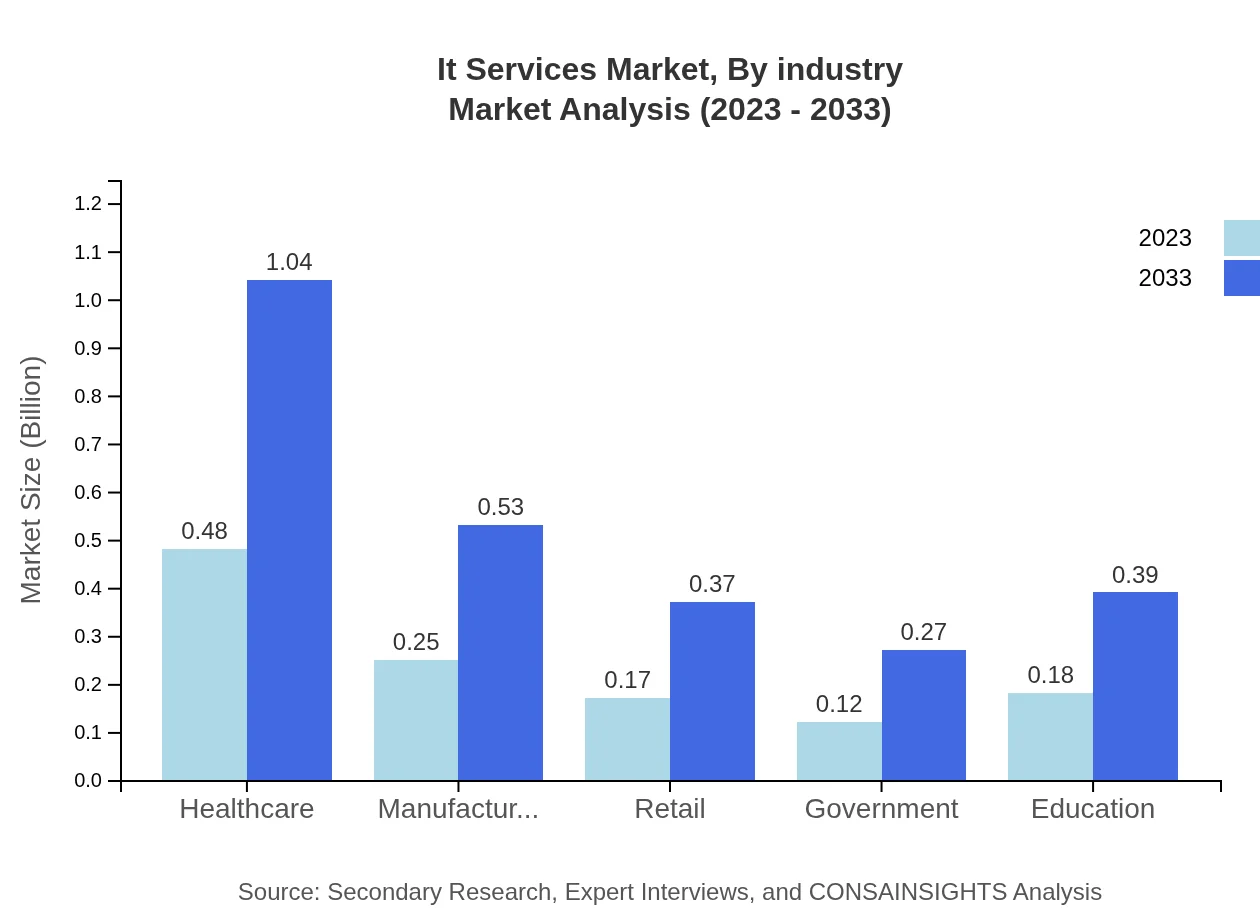

It Services Market Analysis By Industry

The healthcare sector leads with a market size expected to rise from $0.48 trillion in 2023 to $1.04 trillion by 2033, holding a steady 40.05% market share. Other key industries include manufacturing and retail, with sizes of $0.25 trillion (20.53% share) and $0.17 trillion (14.05% share) respectively in 2023.

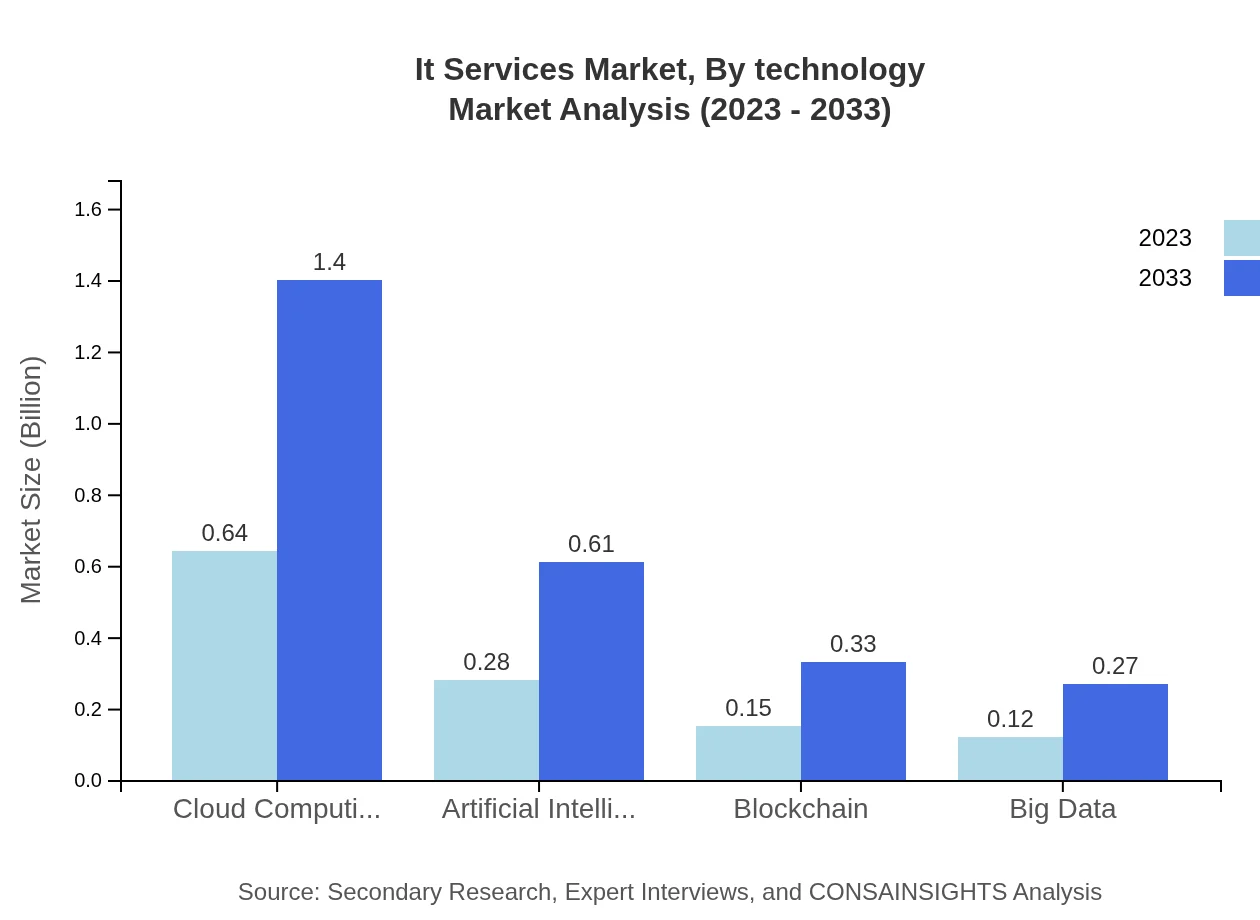

It Services Market Analysis By Technology

Cloud computing leads the way in IT Services technology trends, estimated at $0.64 trillion in 2023, expected to reach $1.40 trillion by 2033, representing 53.63% market share. Artificial Intelligence, Blockchain, and Big Data technologies are also significant, catering to the growing demand for innovative solutions.

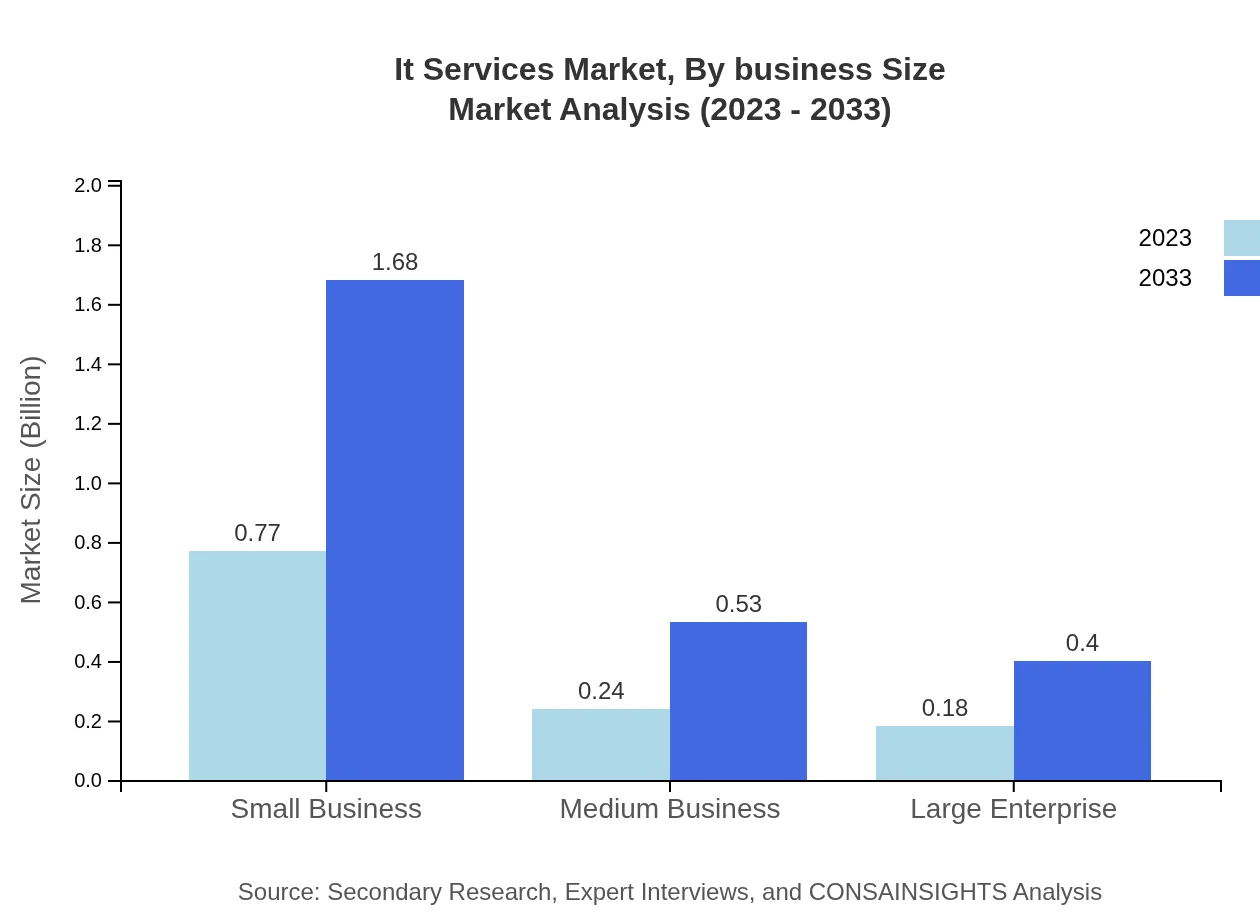

It Services Market Analysis By Business Size

The market is segmented into small, medium, and large enterprises. Small businesses are anticipated to command the largest segment, growing from $0.77 trillion in 2023 to $1.68 trillion by 2033, holding a 64.4% share. Medium and large enterprises also show notable market engagement with strategy-focused IT investments.

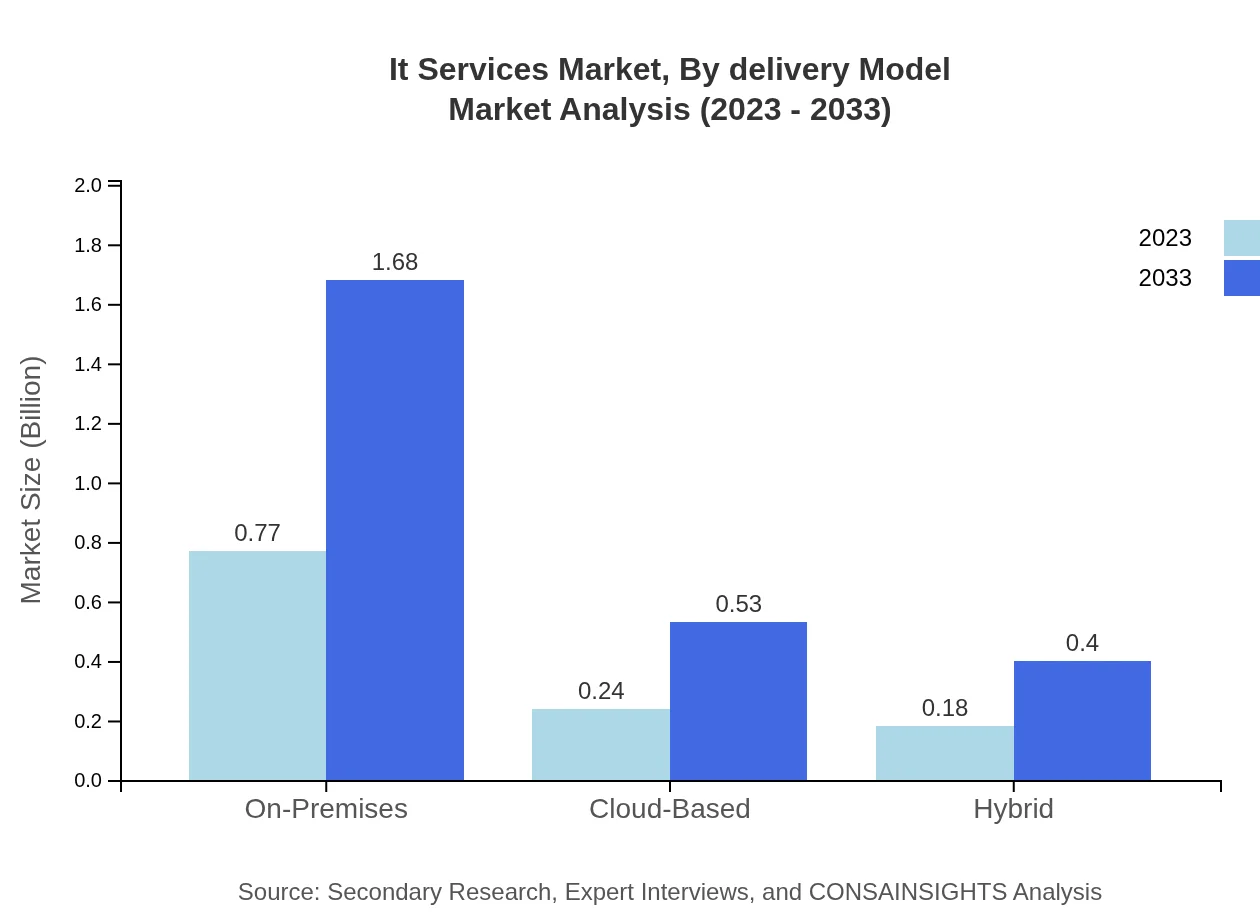

It Services Market Analysis By Delivery Model

Delivery models are categorized into on-premises, cloud-based, and hybrid approaches. The on-premises model holds significant market share with $0.77 trillion in 2023 while cloud-based solutions also show impressive growth potential, indicating a shift towards flexible, scalable solutions that align with modern business demands.

IT Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in IT Services Industry

Accenture:

Accenture is a global professional services company offering a wide range of services in strategy and consulting, digital transformation, technology, and operations. Its strong focus on innovation drives its leadership in IT Services.IBM:

IBM provides IT services across various domains, including cloud computing, AI, and cybersecurity. Known for its robust technology portfolio, IBM plays a vital role in shaping the IT Services landscape.Deloitte:

Deloitte is a leading global provider of audit, consulting, tax, and advisory services. The company offers an extensive range of IT services to help businesses navigate complex technology environments.Tata Consultancy Services (TCS):

TCS offers a comprehensive suite of IT services and solutions, focusing on digital transformation and consulting across multiple sectors.Cognizant:

Cognizant specializes in IT services and consulting, helping businesses adapt to the digital landscape through innovative technology solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of it Services?

The global IT Services market is projected to grow from $1.2 trillion in 2023 to unprecedented heights by 2033, with a CAGR of 7.8%. This growth reflects the increasing reliance on technology for business operations across various sectors.

What are the key market players or companies in the it Services industry?

Key players in the IT Services industry include well-established firms like IBM, Accenture, and Tata Consultancy Services, alongside tech giants such as Microsoft and Cisco. Their innovations drive service delivery and influence market trends significantly.

What are the primary factors driving the growth in the it Services industry?

Growth in the IT Services industry is driven by increasing digital transformation, rising demand for cloud services, and advancements in technologies like artificial intelligence and big data. Businesses strive for operational efficiency and competitive advantages, fueling this sector's expansion.

Which region is the fastest Growing in the it Services?

The fastest-growing region in the IT Services market is North America, projected to rise from $0.43 trillion in 2023 to $0.94 trillion by 2033. Asia Pacific also shows impressive growth, moving from $0.23 trillion in 2023 to $0.49 trillion.

Does ConsaInsights provide customized market report data for the it Services industry?

Yes, ConsaInsights specializes in providing customized market reports tailored to specific needs within the IT Services industry, empowering clients with insights that align with their strategic decision-making processes.

What deliverables can I expect from this it Services market research project?

From this IT Services market research project, expect comprehensive deliverables, including in-depth market analysis, segmentation data, detailed competitive landscape assessments, regional insights, and forecasts tailored to your strategic requirements.

What are the market trends of it Services?

Current trends in the IT Services market include a surge in cloud computing adoption, the integration of AI technologies, and a focus on cybersecurity. Additionally, there is an increasing demand for managed and consulting services as businesses adapt to digital challenges.