It Staffing Market Report

Published Date: 31 January 2026 | Report Code: it-staffing

It Staffing Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the IT Staffing market, examining current trends, market size, growth projections, and regional insights for the forecast period of 2023 to 2033. It highlights key segments and competitive dynamics within the industry.

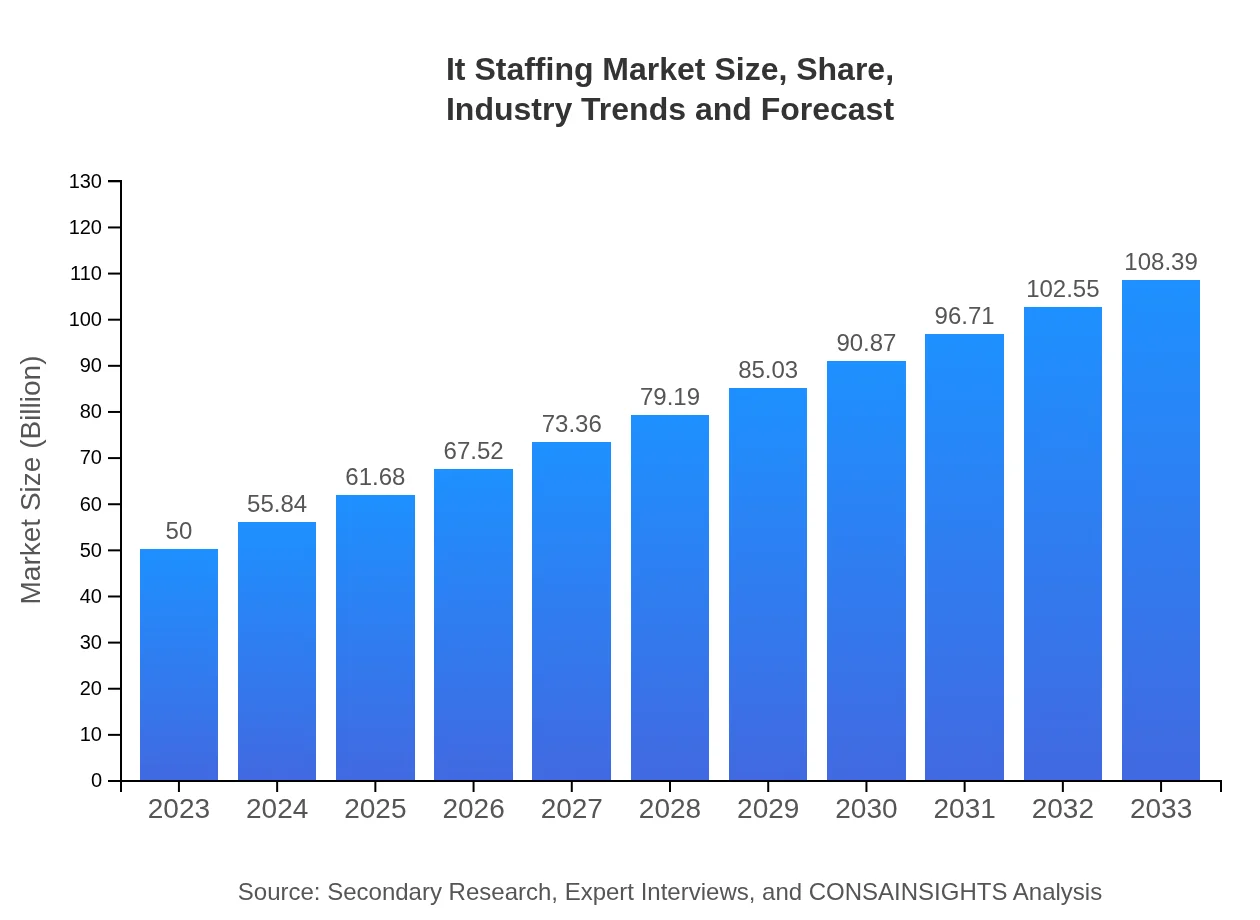

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $50.00 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $108.39 Billion |

| Top Companies | Robert Half, Kforce, TEKsystems, ManpowerGroup, Randstad |

| Last Modified Date | 31 January 2026 |

IT Staffing Market Overview

Customize It Staffing Market Report market research report

- ✔ Get in-depth analysis of It Staffing market size, growth, and forecasts.

- ✔ Understand It Staffing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in It Staffing

What is the Market Size & CAGR of IT Staffing market in 2023?

IT Staffing Industry Analysis

IT Staffing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

IT Staffing Market Analysis Report by Region

Europe It Staffing Market Report:

Europe's IT Staffing market is valued at USD 14.01 billion in 2023 and expected to grow to USD 30.37 billion by 2033. The tightening labor markets and increasing adoption of advanced technologies across various sectors drive demand.Asia Pacific It Staffing Market Report:

The Asia Pacific IT Staffing market was valued at approximately USD 9.16 billion in 2023 and is expected to reach USD 19.87 billion by 2033. This growth is driven by rapid digitalization in countries like India and China, with a significant push towards technology innovation and increasing internet penetration.North America It Staffing Market Report:

North America remains the largest market, valued at USD 19.38 billion in 2023, forecasted to reach USD 42.00 billion by 2033. The presence of numerous tech firms and the highest expenditure on IT services significantly contribute to this growth.South America It Staffing Market Report:

In South America, the market stands at USD 1.27 billion in 2023, projected to grow to USD 2.76 billion by 2033. A young, tech-savvy population and government initiatives to encourage IT investments are pivotal for this growth.Middle East & Africa It Staffing Market Report:

The Middle East and Africa market, estimated at USD 6.17 billion in 2023, is anticipated to grow to USD 13.39 billion by 2033. Factors include increasing investments in IT infrastructure and a growing number of tech startups.Tell us your focus area and get a customized research report.

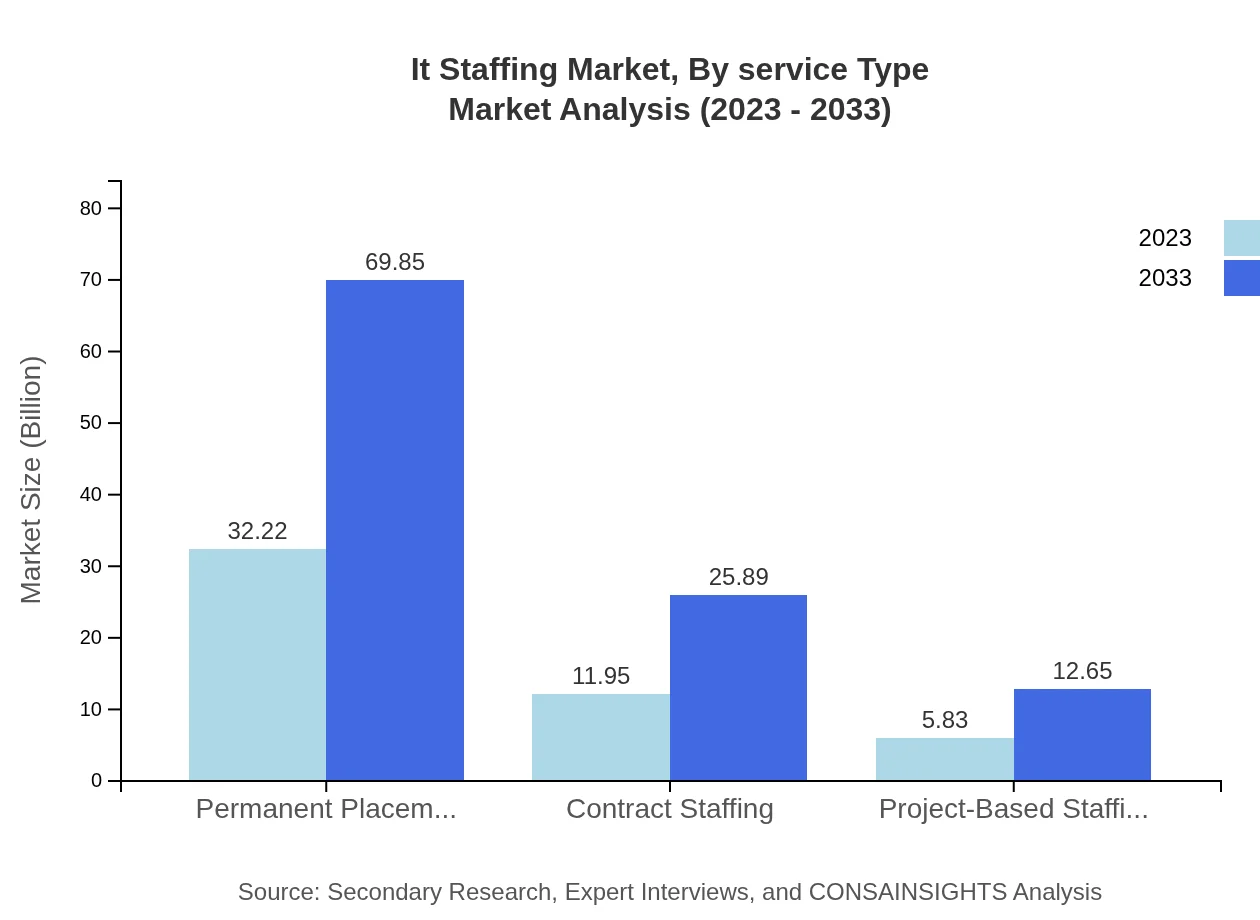

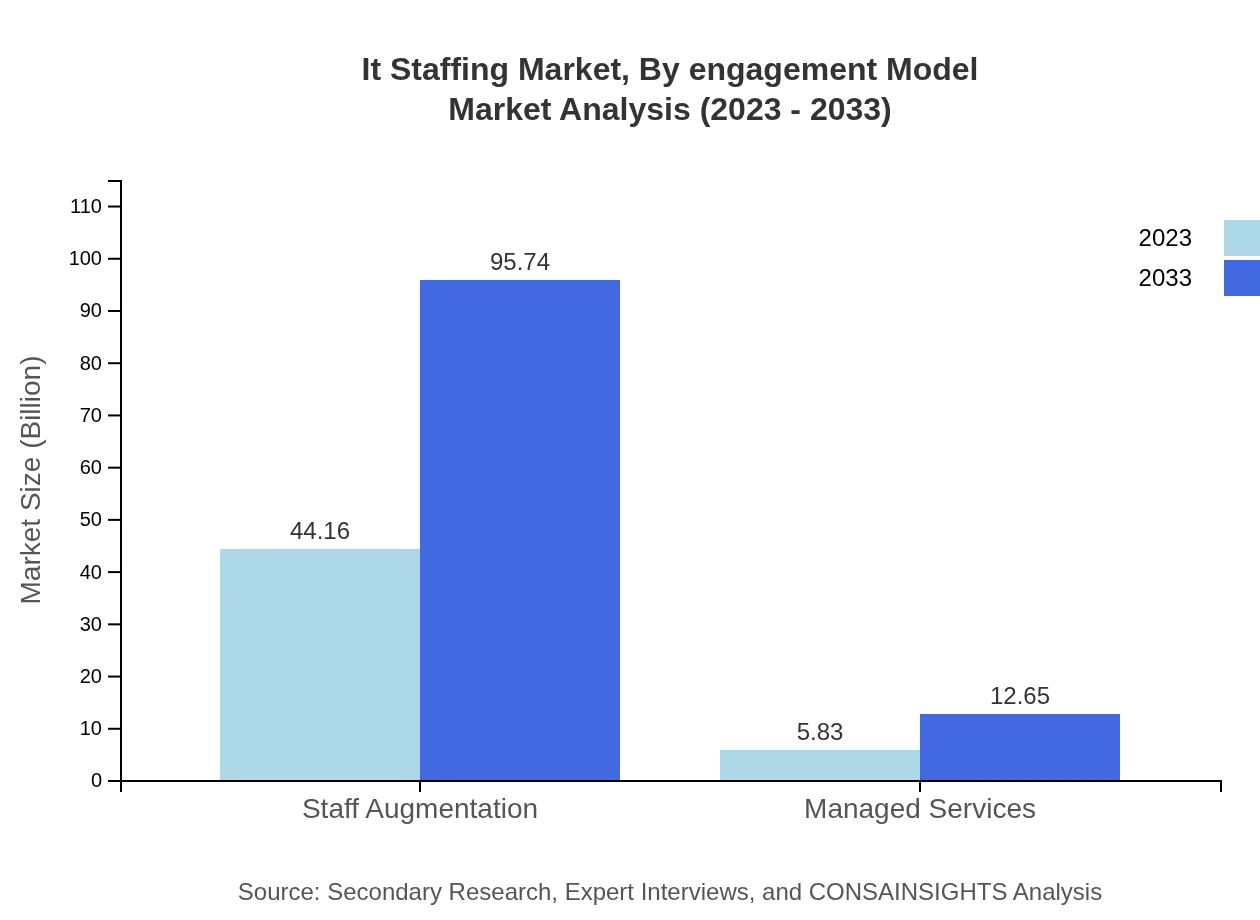

It Staffing Market Analysis By Service Type

The analysis of the IT Staffing market by service type shows that permanent placement is leading with a forecasted market size of USD 32.22 billion in 2023, growing to USD 69.85 billion by 2033. Contract staffing and project-based staffing follow with respective sizes of USD 11.95 billion to USD 25.89 billion and USD 5.83 billion to USD 12.65 billion. Staff augmentation leads the segment with a substantial size of USD 44.16 billion projected to reach USD 95.74 billion, showcasing the demand for flexible workforce solutions.

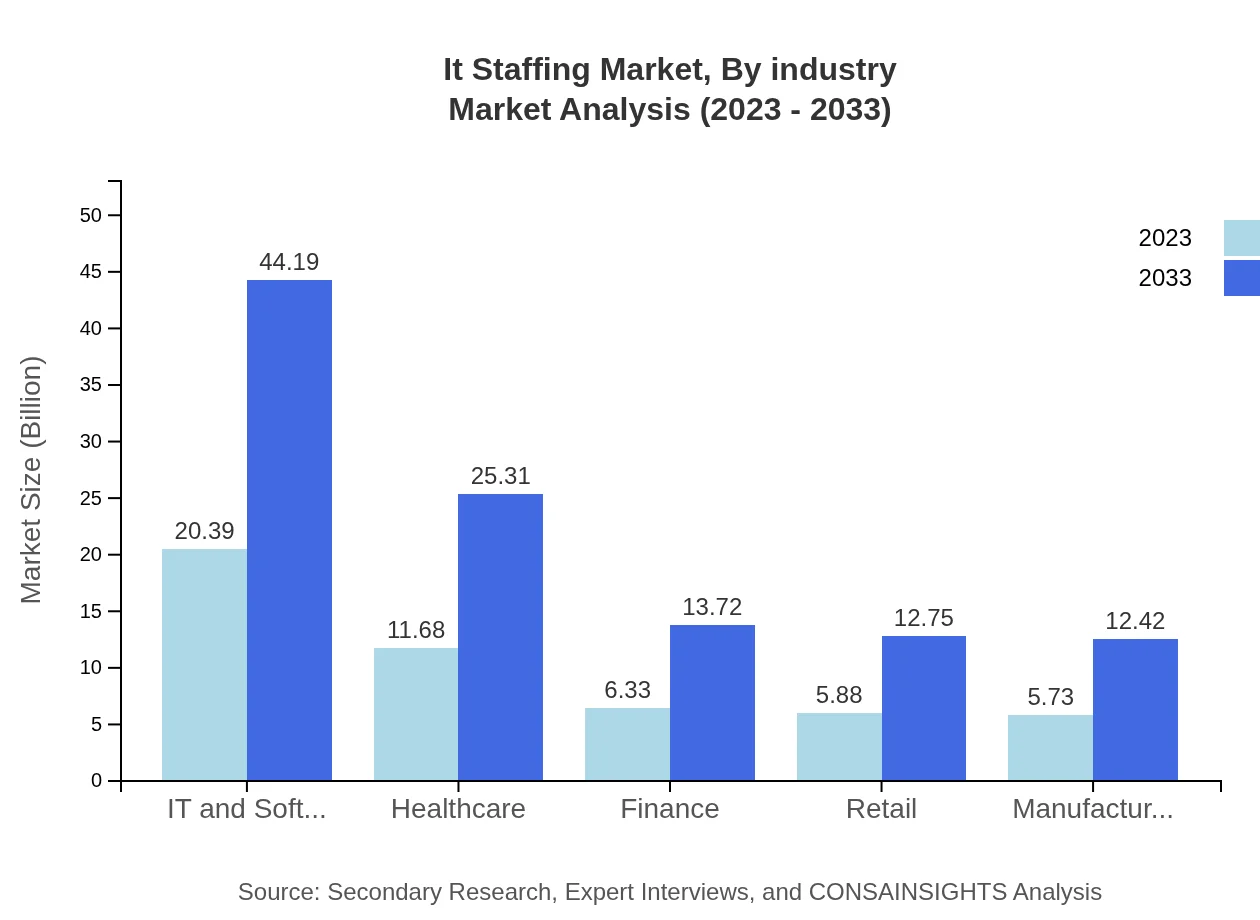

It Staffing Market Analysis By Industry

In analyzing by industry, IT and Software dominate with a substantial market size of USD 20.39 billion in 2023, set to increase to USD 44.19 billion by 2033. Healthcare is also significant, evolving from USD 11.68 billion to USD 25.31 billion. Other industries like finance and retail are expected to grow moderately, from USD 6.33 billion to USD 13.72 billion, and USD 5.88 billion to USD 12.75 billion, respectively, depicting diversity in industry demands.

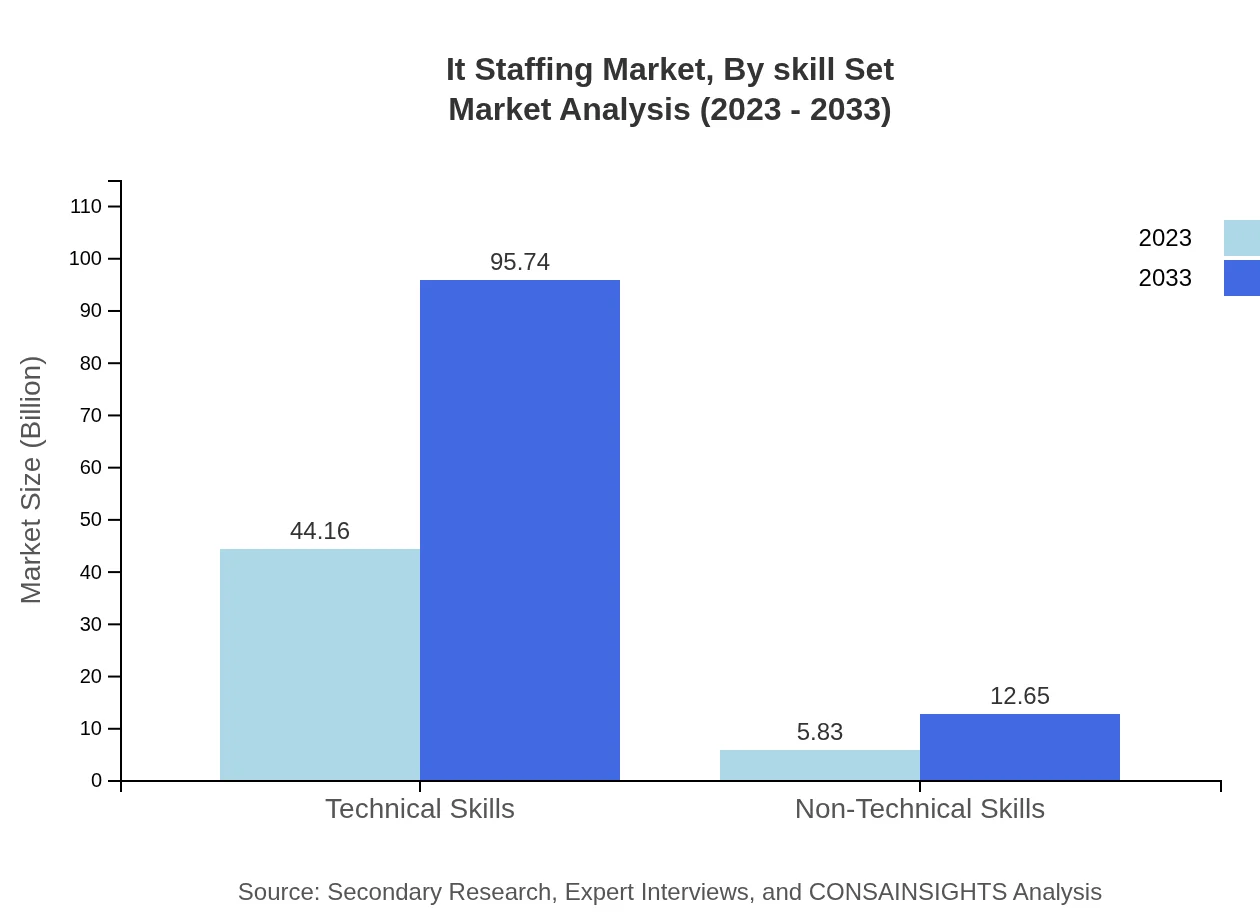

It Staffing Market Analysis By Skill Set

Technical skills hold a significant share of the market with a size expected to reach USD 44.16 billion in 2023 and USD 95.74 billion by 2033, underscoring the industry’s focus on hard technical capabilities. In contrast, non-technical skills account for only USD 5.83 billion and are projected to grow to USD 12.65 billion, reflecting the niche requirement for soft skills in a tech-driven world.

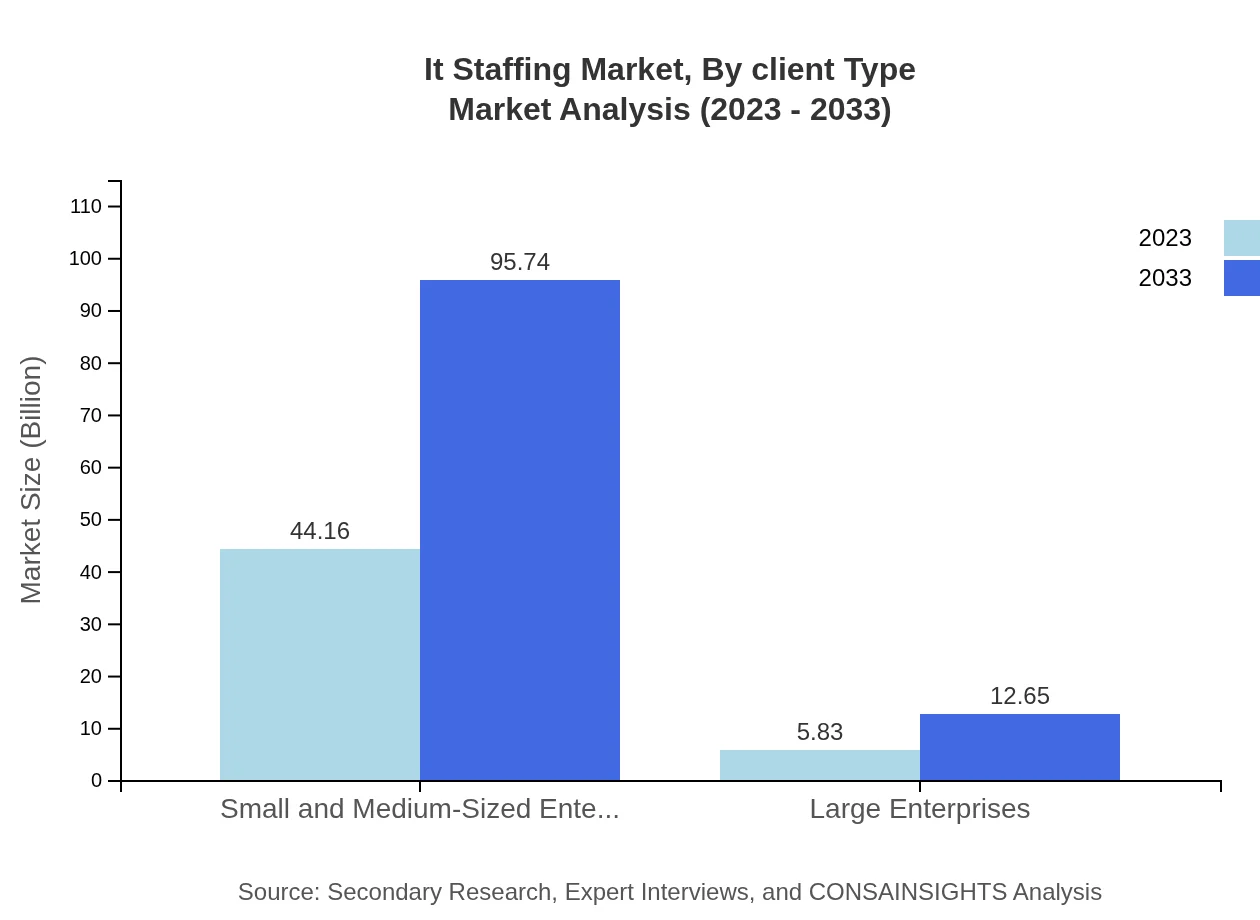

It Staffing Market Analysis By Client Type

Small and Medium-Sized Enterprises (SMEs) have the largest share in IT staffing, with a market size of USD 44.16 billion in 2023, expected to soar to USD 95.74 billion. This is indicative of SMEs' increasing reliance on external IT staffing to support their digital initiatives. Conversely, large enterprises, while significant, have smaller estimated growth from USD 5.83 billion to USD 12.65 billion due to their existing internal resources.

It Staffing Market Analysis By Engagement Model

Among engagement models, staff augmentation appears the most substantial with market growth from USD 44.16 billion in 2023 to USD 95.74 billion by 2033. Permanent placements are also notable, moving from USD 32.22 billion to USD 69.85 billion, reflecting an enduring preference for long-term employment solutions alongside flexible staffing arrangements.

IT Staffing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in IT Staffing Industry

Robert Half:

A global leader in staffing services, Robert Half specializes in placing highly skilled professionals in areas of accounting, finance, IT, and legal sectors.Kforce:

Kforce provides flexible staffing solutions, specializing in placing technology and finance professionals across various industries.TEKsystems:

TEKsystems is a leading provider of IT staffing and services, known for its vast network of tech talent and strong focus on customer satisfaction.ManpowerGroup:

With a strong presence worldwide, ManpowerGroup offers comprehensive workforce solutions including IT staffing across multiple sectors.Randstad:

Randstad specializes in flexible staffing and human resource services, with a robust portfolio in IT staffing solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of IT Staffing?

The global IT staffing market is valued at approximately $50 billion in 2023, with a CAGR of 7.8%. This growth trajectory suggests a significant expansion of staffing services tailored to the IT industry over the next decade.

What are the key market players or companies in this IT Staffing industry?

Key players in the IT staffing industry include companies like Adecco Group, ManpowerGroup, Randstad, Robert Half International, and Insight Global. These companies dominate through extensive networks and a robust understanding of technology staffing needs.

What are the primary factors driving the growth in the IT Staffing industry?

Growth in IT staffing is driven by digital transformation across industries, a surge in technology adoption, the need for specialized skill sets, and the increasing demand for flexible staffing solutions, all contributing to the industry's expansion.

Which region is the fastest Growing in the IT Staffing?

North America is the fastest-growing region in IT staffing, expecting growth from $19.38 billion in 2023 to $42.00 billion in 2033. Europe and Asia Pacific also show notable growth, reinforcing the demand for skilled IT professionals.

Does ConsaInsights provide customized market report data for the IT Staffing industry?

Yes, ConsaInsights provides customized market report data tailored to specific needs within the IT staffing industry. Clients can obtain detailed insights relevant to their operational context and strategic goals.

What deliverables can I expect from this IT Staffing market research project?

Deliverables from the IT staffing market research project include comprehensive market analysis, segmentation insights, competitive landscape assessments, and forecasts providing actionable insights for strategic decision-making.

What are the market trends of IT Staffing?

Current trends in the IT staffing market include an increasing reliance on remote staffing, growing demand for cloud and cyber security skills, emphasis on diversity hiring, and the rise of hybrid staffing solutions.