Iv Equipment Market Report

Published Date: 31 January 2026 | Report Code: iv-equipment

Iv Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the IV Equipment market for the forecast period of 2023 to 2033. It covers market size, trends, regional insights, and segmentation, offering valuable data for industry stakeholders to strategize effectively.

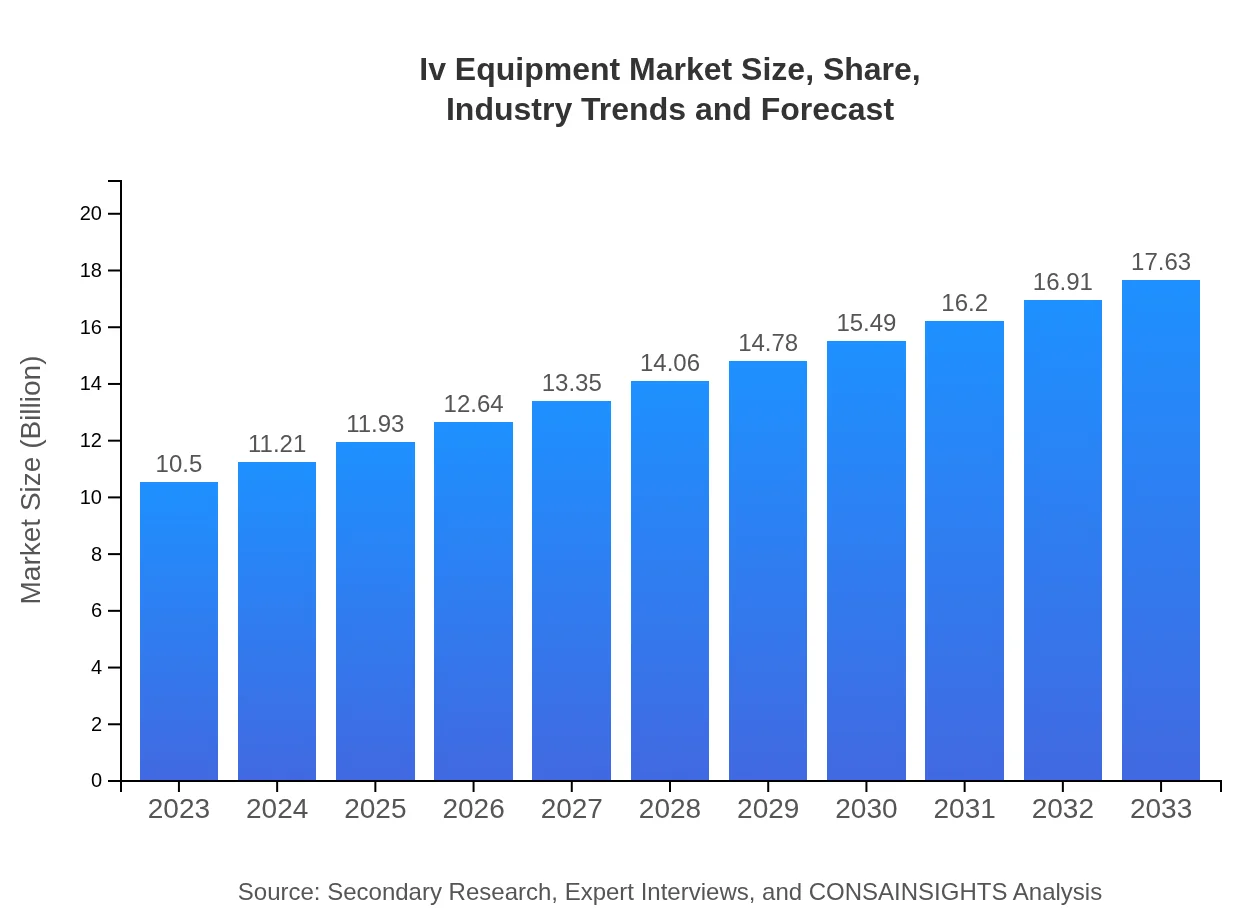

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $17.63 Billion |

| Top Companies | Baxter International, Medtronic , Fresenius Kabi, Smiths Medical |

| Last Modified Date | 31 January 2026 |

IV Equipment Market Overview

Customize Iv Equipment Market Report market research report

- ✔ Get in-depth analysis of Iv Equipment market size, growth, and forecasts.

- ✔ Understand Iv Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Iv Equipment

What is the Market Size & CAGR of IV Equipment market in 2023?

IV Equipment Industry Analysis

IV Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

IV Equipment Market Analysis Report by Region

Europe Iv Equipment Market Report:

In Europe, the market is valued at $2.78 billion in 2023, likely to grow to $4.66 billion by 2033. The region benefits from strong regulations ensuring safety and quality in healthcare products.Asia Pacific Iv Equipment Market Report:

In 2023, the IV Equipment market in Asia Pacific reached approximately $2.20 billion, forecasted to grow to $3.69 billion by 2033. The rise in healthcare investments and improved infrastructure in countries like India and China are significant growth drivers.North America Iv Equipment Market Report:

North America represents the largest market, currently valued at $3.49 billion in 2023, with projections of reaching $5.86 billion by 2033. High adoption rates of advanced healthcare technologies and a well-established healthcare system drive this demand.South America Iv Equipment Market Report:

The South American IV Equipment market is smaller but growing, valued at $0.74 billion in 2023, expected to rise to $1.23 billion by 2033. Increased healthcare expenditure and rising chronic diseases will contribute to this growth.Middle East & Africa Iv Equipment Market Report:

The market in the Middle East and Africa is estimated at $1.30 billion in 2023 and is expected to reach $2.18 billion by 2033. A shift towards improved healthcare systems and rising disposable incomes in these regions are pivotal in driving market expansion.Tell us your focus area and get a customized research report.

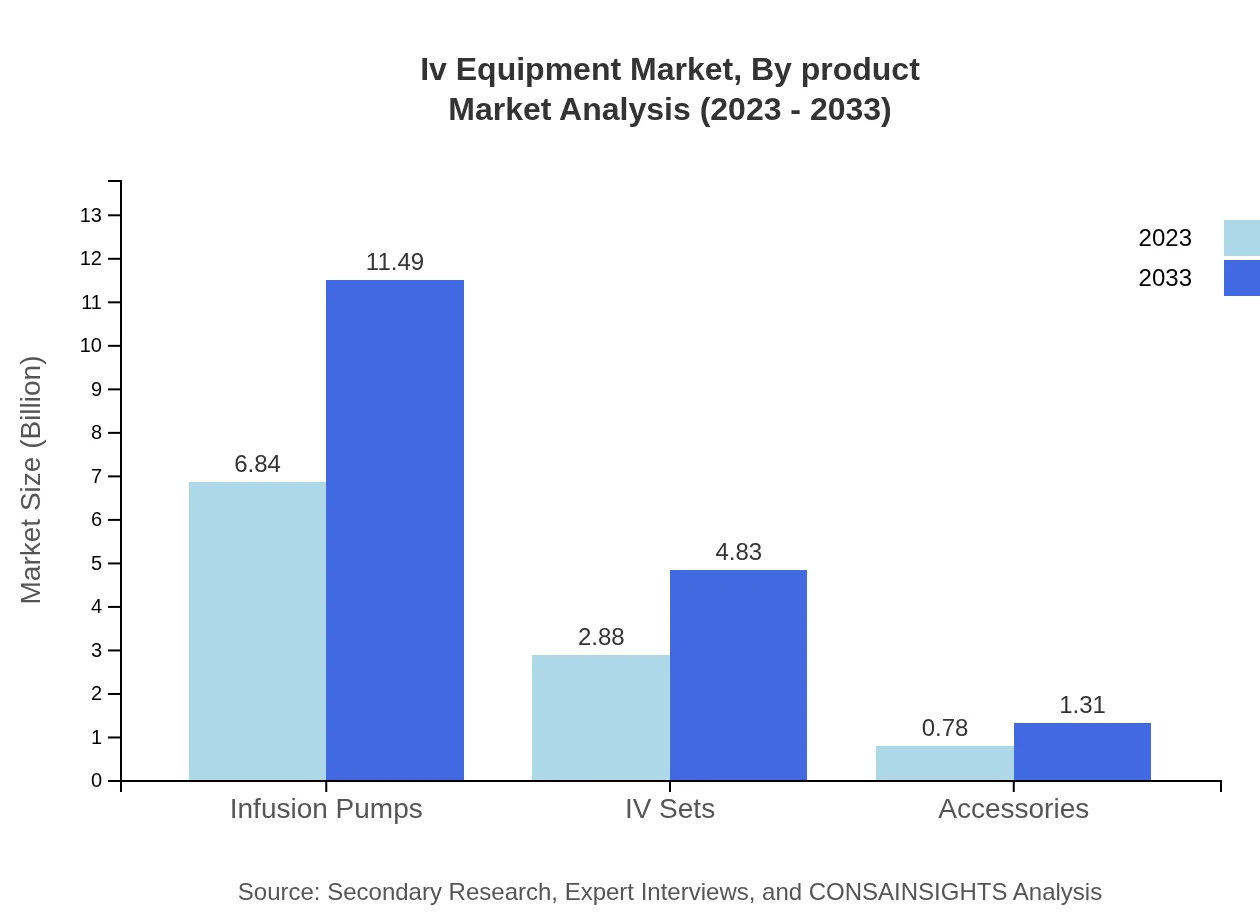

Iv Equipment Market Analysis By Product

The product segment of IV Equipment includes infusion pumps, IV sets, and accessories. Infusion pumps are the dominant product type with a market size of $6.84 billion in 2023, projected to grow to $11.49 billion by 2033, accounting for 65.16% of the market share. IV sets follow with a market size of $2.88 billion in 2023 and rising to $4.83 billion by 2033.

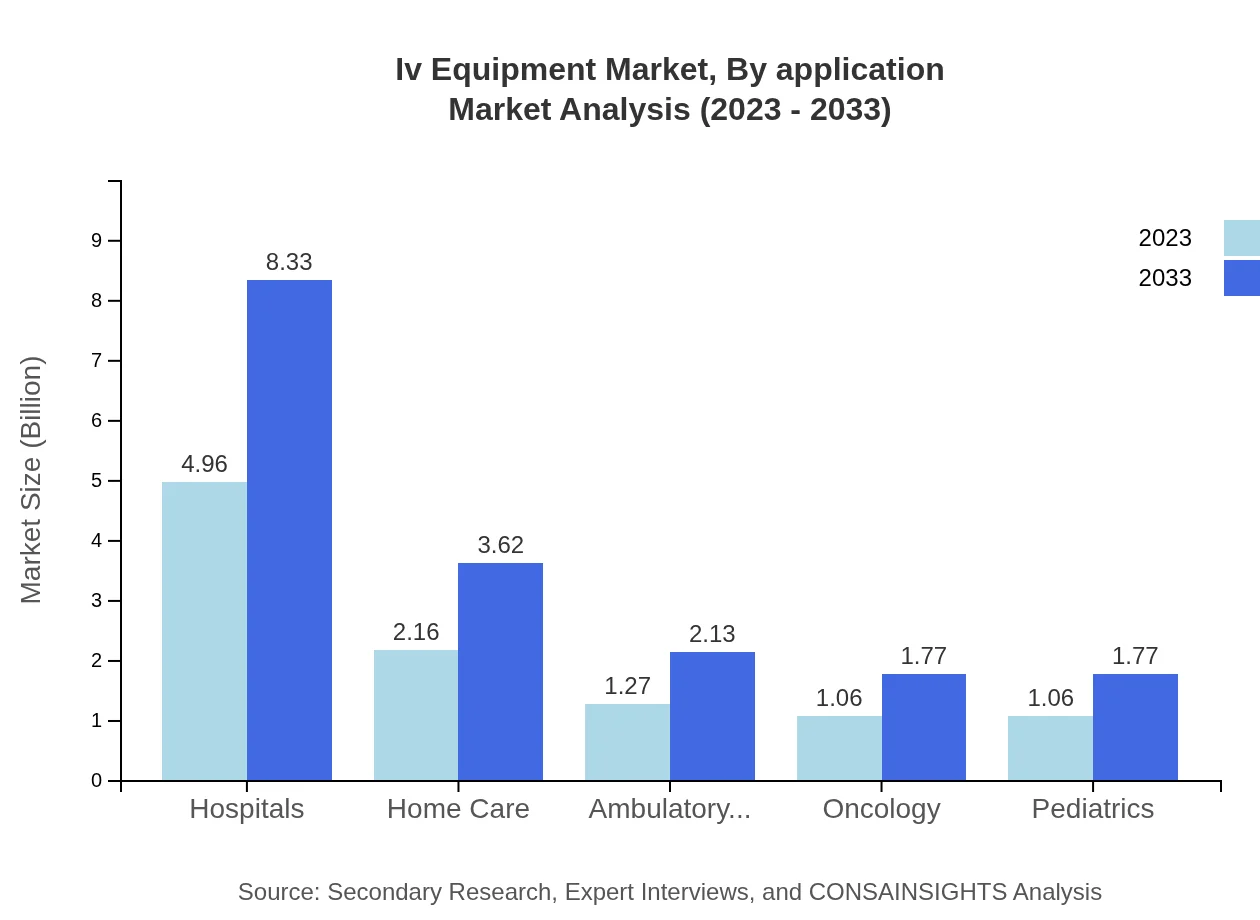

Iv Equipment Market Analysis By Application

Applications of IV Equipment span hospitals, which constitute the largest segment, valued at $4.96 billion in 2023, expanding to $8.33 billion by 2033. Other significant applications include home care, rehabilitation centers, and research institutes, demonstrating varied demands across the healthcare spectrum.

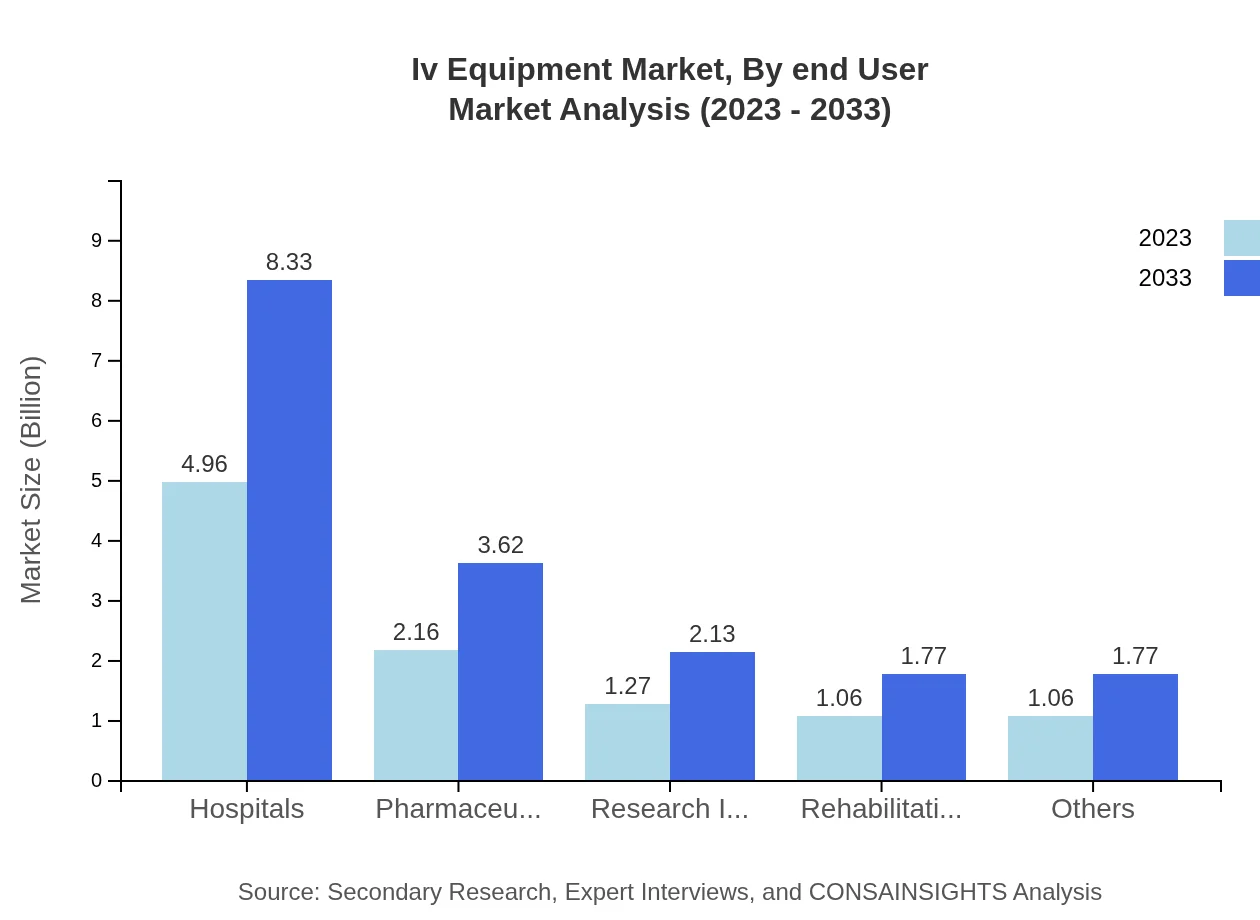

Iv Equipment Market Analysis By End User

End-users of IV Equipment include hospitals, pharmaceuticals, research institutes, and rehabilitation centers. Hospitals lead the segment with a share of 47.26% in 2023, driven by the need for advanced treatment solutions. Pharmaceuticals and home care services also portray significant demand for IV Equipment.

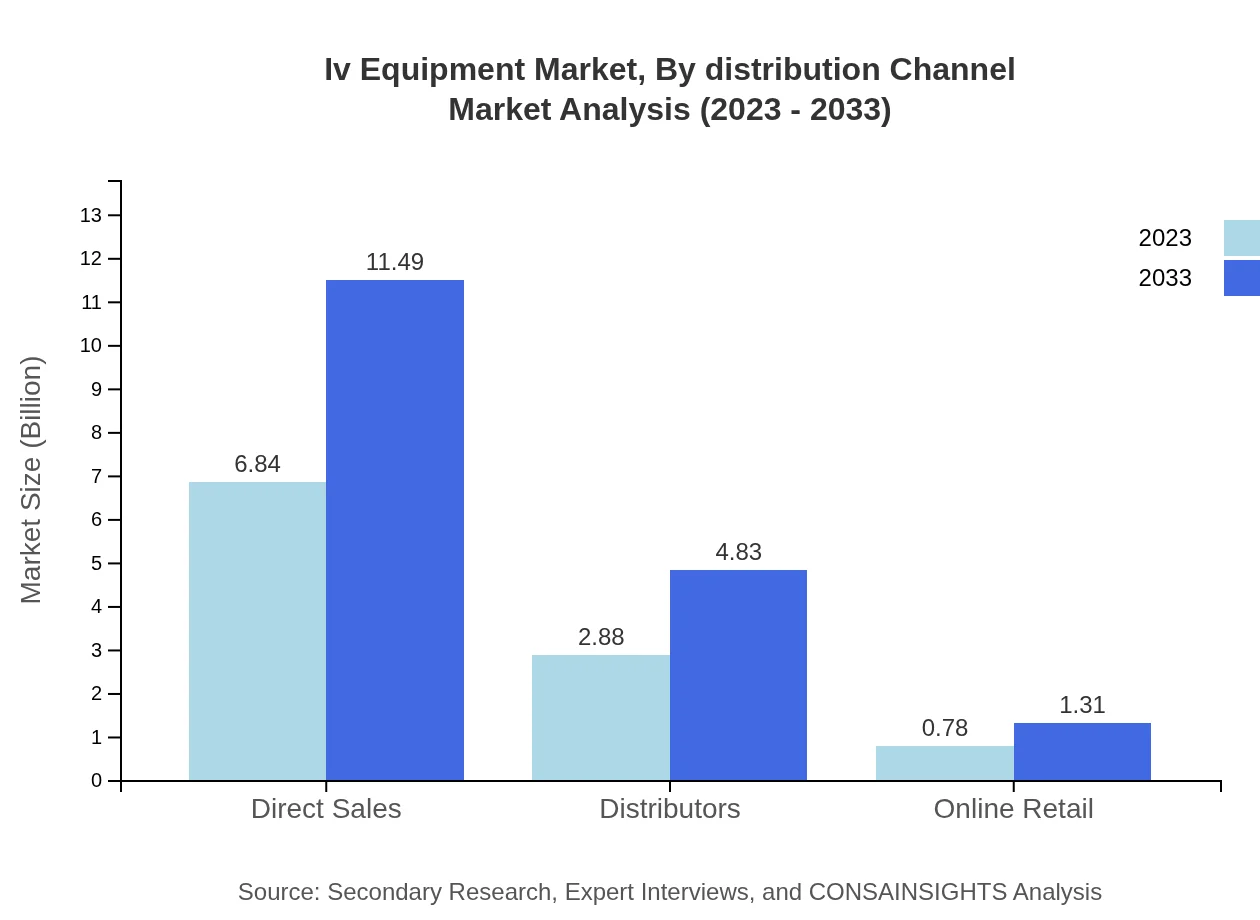

Iv Equipment Market Analysis By Distribution Channel

The distribution of IV Equipment is primarily through direct sales, accounting for 65.16% of the market share in 2023, showing a size of $6.84 billion. Distributors hold a 27.39% share, making up $2.88 billion, while online retail constitutes about 7.45% with a market size of $0.78 billion, reflecting a growing trend towards e-commerce.

IV Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in IV Equipment Industry

Baxter International:

Baxter International is a global healthcare company providing a comprehensive portfolio of IV solutions and equipment that enhance patient care through innovation.Medtronic :

Medtronic is a leader in medical technology, specializing in advanced infusion systems that improve patient safety and optimize clinical workflows.Fresenius Kabi:

Fresenius Kabi is known for its high-quality IV generic pharmaceuticals and infusion therapies designed for hospitals and home-care patients.Smiths Medical:

Smiths Medical focuses on patient monitoring, infusion delivery, and vascular access technologies, committing to improving the lives of patients and healthcare providers.We're grateful to work with incredible clients.

FAQs

What is the market size of IV equipment?

The IV equipment market is currently valued at approximately $10.5 billion and is expected to grow with a compound annual growth rate (CAGR) of 5.2%. This growth reflects increasing demand for intravenous therapy and related medical advancements.

What are the key market players or companies in this IV equipment industry?

The IV equipment industry is characterized by key players such as Becton, Dickinson and Company, Baxter International Inc., and Fresenius Kabi AG, among others. These companies lead the market through innovation and strategic partnerships.

What are the primary factors driving the growth in the IV equipment industry?

Market growth is primarily driven by an increase in chronic illnesses requiring intravenous therapies, technological advancements in infusion pumps, and a growing geriatric population. Additionally, rising healthcare expenditure bolsters market demand.

Which region is the fastest Growing in the IV equipment market?

The fastest-growing region in the IV equipment market is North America, projected to grow from $3.49 billion in 2023 to $5.86 billion by 2033. Europe and Asia Pacific are also significant, with growth in advanced healthcare infrastructures.

Does ConsaInsights provide customized market report data for the IV equipment industry?

Yes, ConsaInsights offers customized market report data for the IV equipment industry, enabling businesses to access tailored insights to effectively address their specific needs and challenges in the marketplace.

What deliverables can I expect from this IV equipment market research project?

Deliverables from the IV equipment market research project typically include comprehensive market analysis, detailed reports on competitive landscape, segmentation data, growth forecasts, and actionable insights for strategic decision-making.

What are the market trends of IV equipment?

Key trends in the IV equipment market include the rising adoption of smart infusion devices, increasing focus on patient safety, and a shift towards home healthcare solutions, as well as greater integration of technology to enhance treatment efficiency.