Ivd Market Report

Published Date: 31 January 2026 | Report Code: ivd

Ivd Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive overview of the In Vitro Diagnostics (IVD) market, emphasizing market trends, size, segments, and forecasts from 2023 to 2033, including regional insights and analysis of significant players.

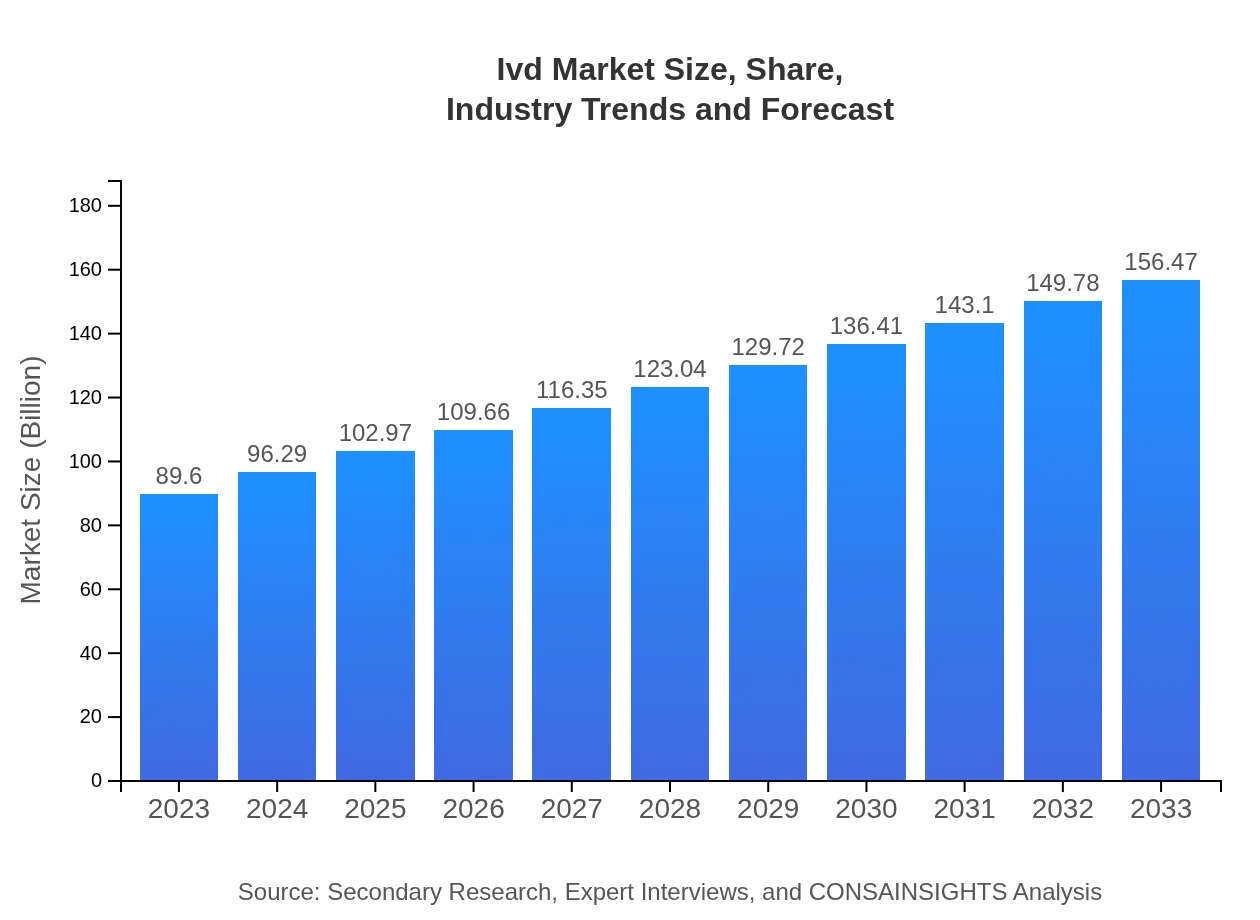

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $89.60 Billion |

| CAGR (2023-2033) | 5.6% |

| 2033 Market Size | $156.47 Billion |

| Top Companies | Roche Diagnostics, Abbott Laboratories, Siemens Healthineers, Thermo Fisher Scientific |

| Last Modified Date | 31 January 2026 |

IVD Market Overview

Customize Ivd Market Report market research report

- ✔ Get in-depth analysis of Ivd market size, growth, and forecasts.

- ✔ Understand Ivd's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ivd

What is the Market Size & CAGR of IVD market in 2023 and 2033?

IVD Industry Analysis

IVD Market Segmentation and Scope

Tell us your focus area and get a customized research report.

IVD Market Analysis Report by Region

Europe Ivd Market Report:

In Europe, the IVD market's value was $22.78 billion in 2023, projected to grow to $39.78 billion by 2033. Key growth drivers include a well-established healthcare system, increasing prevalence of infectious diseases, and a growing focus on personalized medicine. European players lead in regulatory compliance and innovation.Asia Pacific Ivd Market Report:

In the Asia Pacific region, the IVD market was valued at approximately $18.62 billion in 2023, with projections indicating it will reach $32.51 billion by 2033. Market growth is driven by increasing healthcare investments, a growing elderly population, and rising awareness of preventive healthcare. Additionally, regional players are innovating to meet local healthcare needs, presenting opportunities for growth.North America Ivd Market Report:

North America remains a dominant region in the IVD market, valued at $29.63 billion in 2023, with expectations of reaching $51.75 billion by 2033. The growth is fueled by advanced healthcare infrastructure, high prevalence of chronic diseases, and significant investments in research and development. The U.S. leads the market with innovative diagnostic technologies.South America Ivd Market Report:

For South America, the IVD market is estimated to be around $8.03 billion in 2023, and it is expected to grow to $14.02 billion by 2033. Factors driving this market include rising incidences of chronic diseases and a push for improved healthcare infrastructure. The demand for cost-effective diagnostic solutions continues to rise in this region.Middle East & Africa Ivd Market Report:

The Middle East and Africa IVD market was valued at $10.55 billion in 2023 and is anticipated to grow to $18.42 billion by 2033. Factors such as rising awareness of healthcare testing and increasing investments in healthcare infrastructure fuel the market's progress, though regulatory challenges remain.Tell us your focus area and get a customized research report.

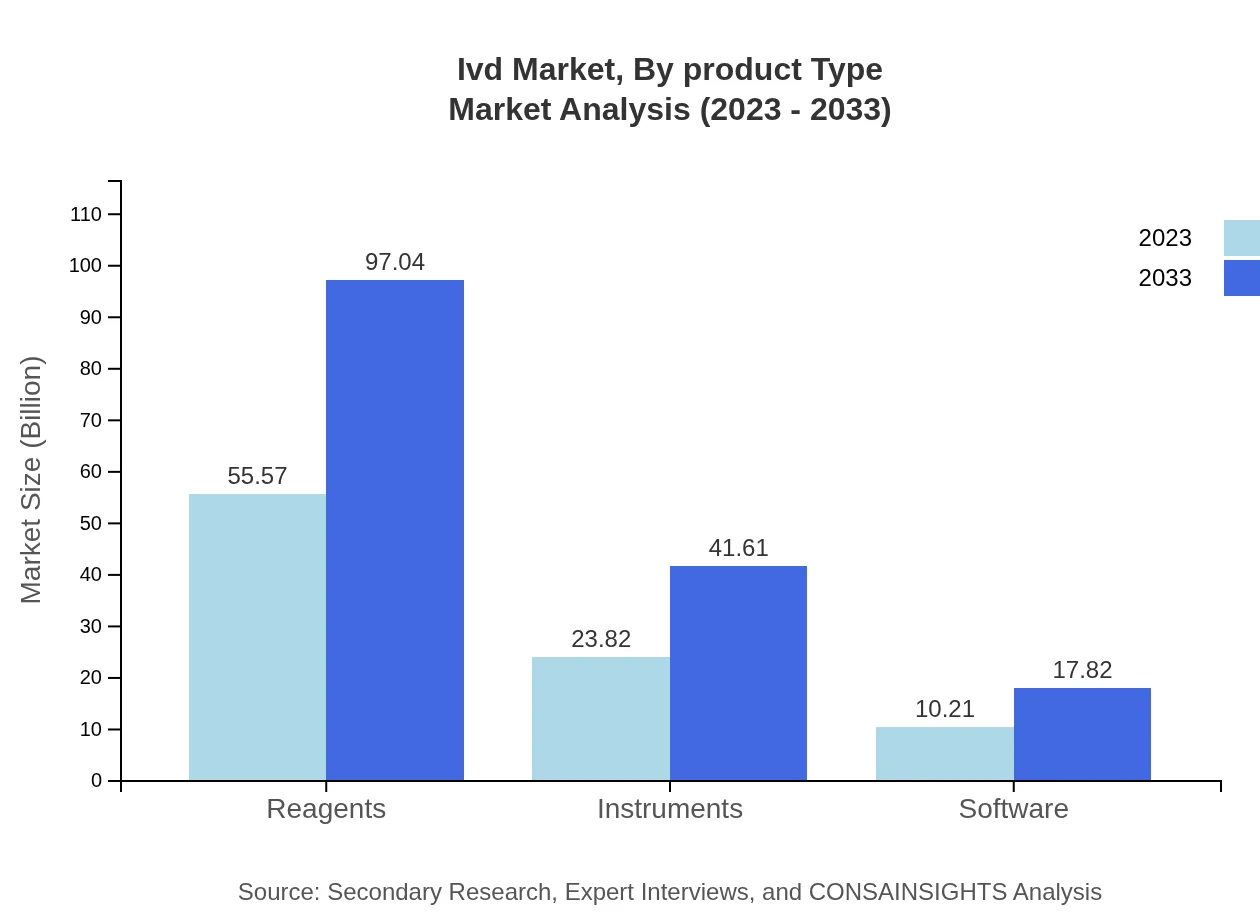

Ivd Market Analysis By Product Type

The IVD market, by product type, includes segments such as reagents, instruments, and software. Reagents dominate the market with a size of $55.57 billion in 2023 and projected growth to $97.04 billion by 2033, reflecting a strong CAGR. Instruments are expected to grow to $41.61 billion from $23.82 billion, while software solutions are also seeing an upward trend.

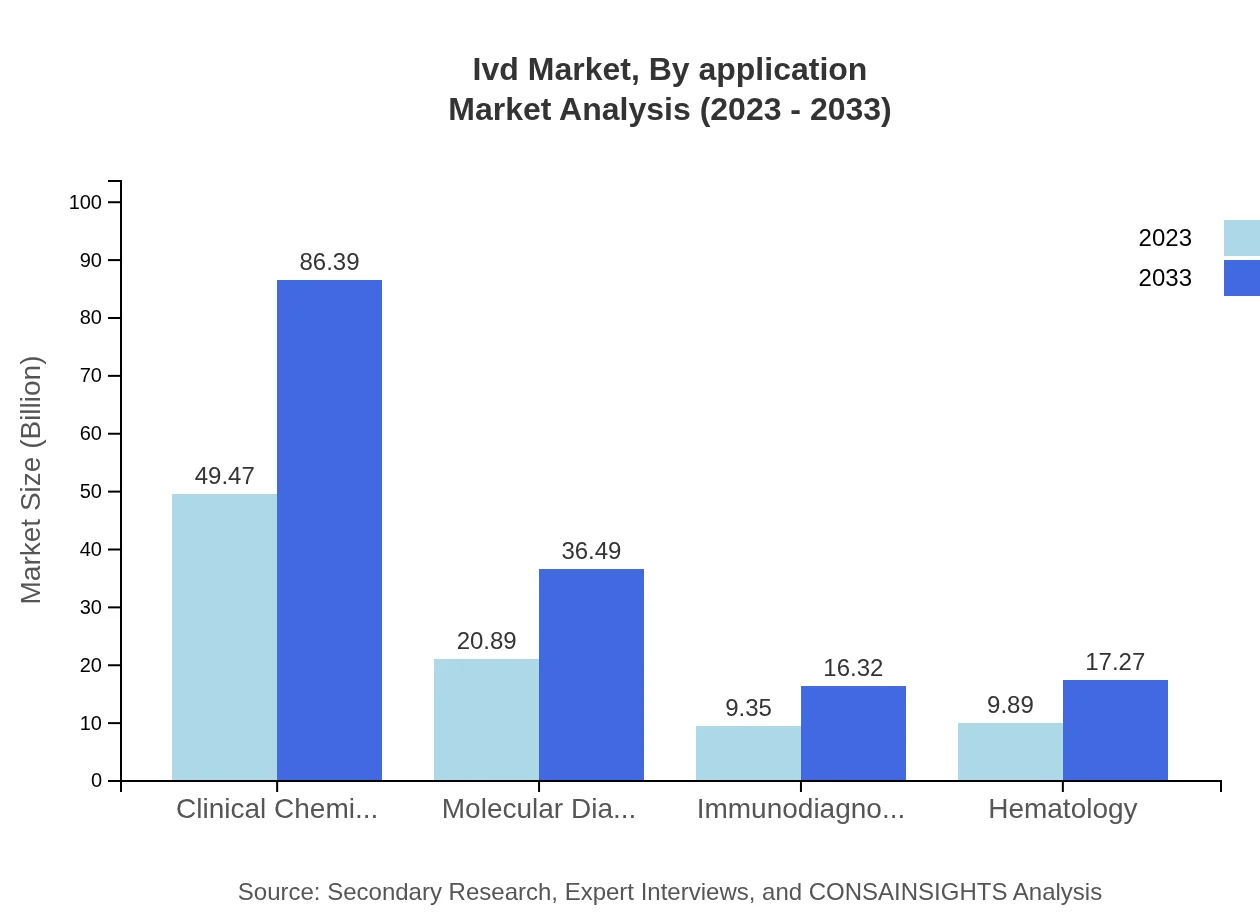

Ivd Market Analysis By Application

By application, the IVD market is segmented into infectious diseases, oncology, and clinical chemistry, among others. Clinical chemistry holds a substantial share with its market size reaching $49.47 billion in 2023 and projected to grow to $86.39 billion by 2033. The market share for molecular diagnostics and immunodiagnostics also reflects significant growth trends.

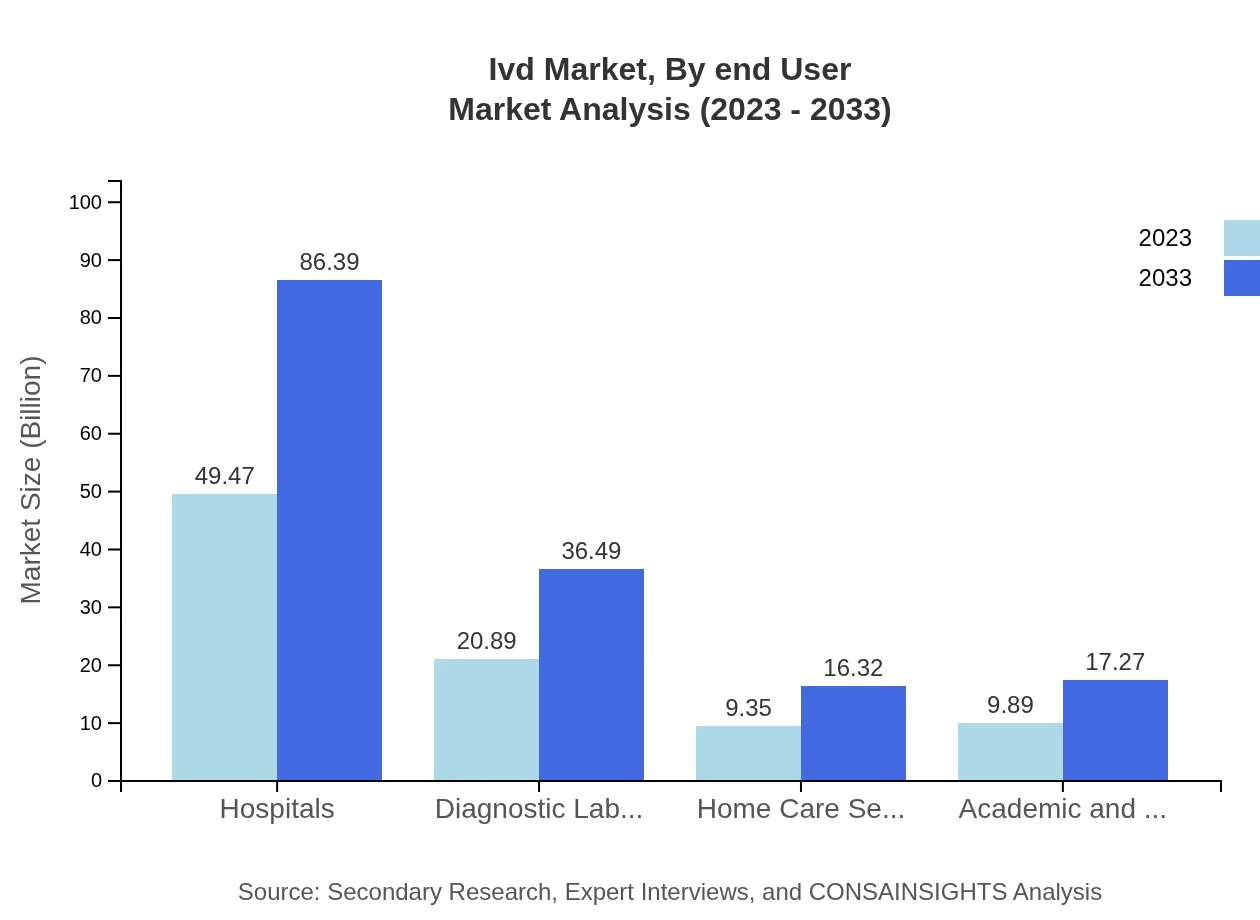

Ivd Market Analysis By End User

End-user segmentation breaks down into hospitals, diagnostic laboratories, home care settings, and academic institutions. Hospitals are the largest segment with a market size of $49.47 billion in 2023, expected to reach approximately $86.39 billion by 2033. Diagnostic laboratories and home care settings are also pivotal segments, driving innovation and market demand.

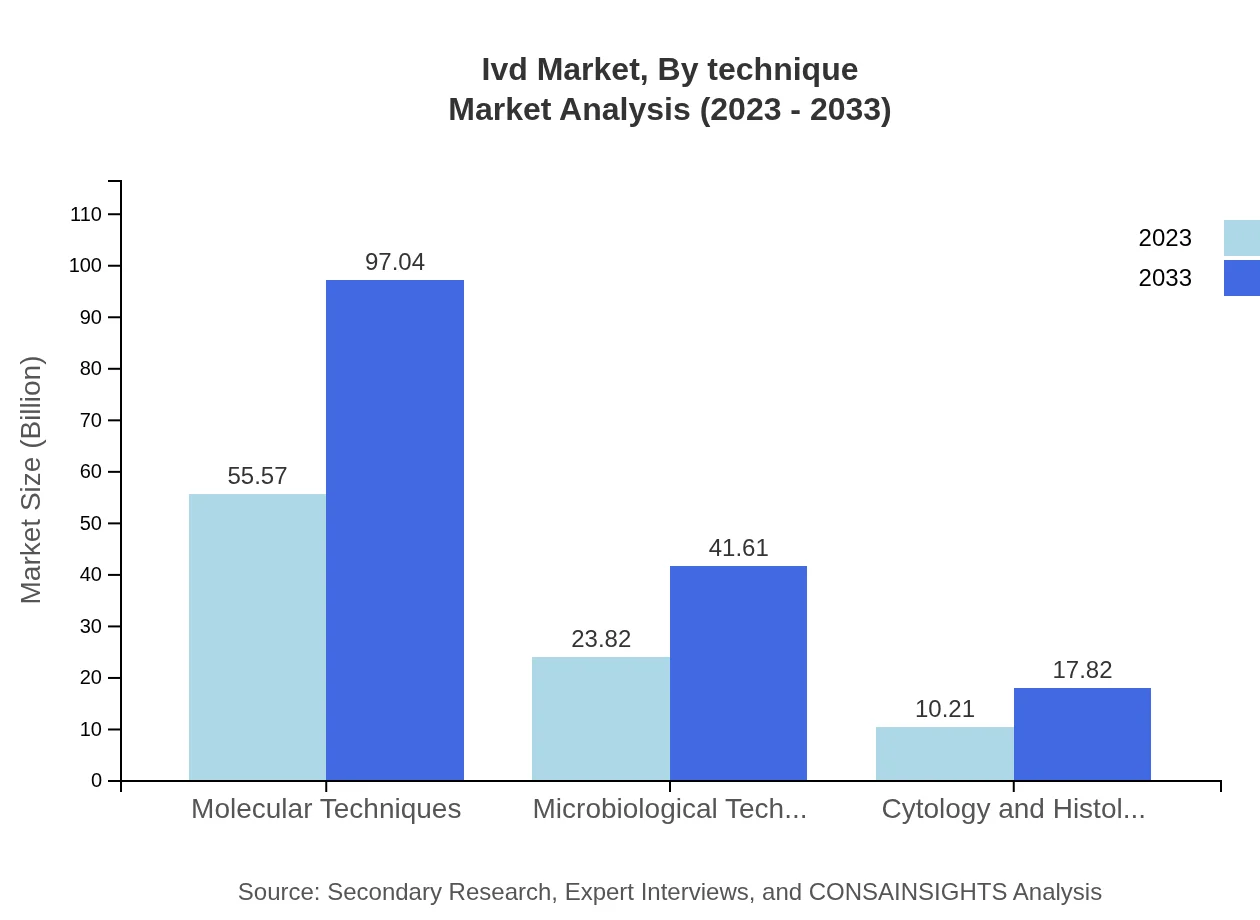

Ivd Market Analysis By Technique

Techniques such as molecular and microbiological diagnostics are critical in driving the IVD market. Molecular techniques are significant, with a size of $55.57 billion in 2023 set to grow to $97.04 billion by 2033. Microbiological techniques are also notable, expected to reach $41.61 billion from $23.82 billion, reflecting the demand for precise diagnostic tools.

IVD Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in IVD Industry

Roche Diagnostics:

A leading provider of IVD solutions, Roche Diagnostics specializes in molecular diagnostics and laboratory automation, focusing on enhancing patient care through innovation.Abbott Laboratories:

Known for its broad range of diagnostic platforms, Abbott Laboratories develops cutting-edge technology for infectious disease testing and continuous glucose monitoring.Siemens Healthineers:

Siemens Healthineers is recognized for its advanced imaging and laboratory diagnostics products, contributing to improved patient outcomes through digitalization.Thermo Fisher Scientific:

As a leading organization in the IVD industry, Thermo Fisher Scientific offers a diverse product portfolio, including reagents and instruments for various laboratory applications.We're grateful to work with incredible clients.

FAQs

What is the market size of IVD?

The global In Vitro Diagnostics (IVD) market size is estimated at $89.6 billion in 2023, with a projected CAGR of 5.6% from 2023 to 2033. This growth reflects advancements in diagnostic technology and increased demand for early disease detection.

What are the key market players or companies in this IVD industry?

Key market players in the IVD industry include Siemens Healthineers, Roche Diagnostics, Abbott Laboratories, and Thermo Fisher Scientific. These companies are recognized for their innovative products and significant market shares across various diagnostic sectors.

What are the primary factors driving the growth in the IVD industry?

The growth of the IVD industry is primarily driven by the rising prevalence of chronic diseases, increased demand for point-of-care testing, advancements in molecular diagnostics, and growing awareness regarding personalized medicine.

Which region is the fastest Growing in the IVD market?

North America is the fastest-growing region in the IVD market, expected to grow from $29.63 billion in 2023 to $51.75 billion by 2033. This region benefits from advanced healthcare infrastructure and high adoption of innovative diagnostics.

Does Consainsights provide customized market report data for the IVD industry?

Yes, Consainsights offers customized market report data tailored specifically for the IVD industry. Clients can obtain insights based on specific requirements, encompassing regional, segment-specific, and contextual data.

What deliverables can I expect from this IVD market research project?

Clients can expect comprehensive deliverables, including detailed market analysis reports, regional insights, segment breakdowns, and predictive analytics to aid decision-making processes in the IVD market.

What are the market trends of IVD?

IVD market trends include a shift towards automation in laboratories, increased utilization of point-of-care testing, growth in molecular diagnostics, and the adoption of artificial intelligence for enhanced diagnostic accuracy.